Public Document Pack

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Landscape Character of Brentwood Borough

4.0 LANDSCAPE CHARACTER OF BRENTWOOD BOROUGH 107 4.0 LANDSCAPE CHARACTER OF BRENTWOOD BOROUGH 4.1 General 4.1.1 This section of the report provides the detailed ‘profiles’ of Landscape Character Areas within Brentwood Borough, structured as follows: x Location of character area (map) x Boundaries of character area (map) x Photograph x Key characteristics x Overall character description x Visual characteristics x Historic land use x Ecological features x Key planning and land management issues x Sensitivities to change x Proposed landscape strategy objectives x Suggested landscape planning guidelines x Suggested land management guidelines The profiles should be read as a whole when used to inform decision making. Where Landscape Character Areas fall within two or more adjacent District/Borough areas, included in this Study report the same profile has been included within the respective section. In such instances, a cross-reference is noted in the respective Character Area profile(s). Reference should also be made to other studies for neighbouring authority areas including: x Thurrock Landscape Capacity Study 4.1.2 The following Landscape Character Types and Areas have been identified with Brentwood Borough (see Figure 4.1), and are described in the following sections: A - River Valley A11 - Roding River Valley F - Wooded Farmland F7 - Blackmore Wooded Farmland F8 - Doddinghurst Wooded Farmland F9 - Little Warley Wooded Farmland F10 - Heybridge Wooded Farmland F13 - Great Warley Wooded Farmland F14 - Ingrave and Herongate Wooded Farmland -

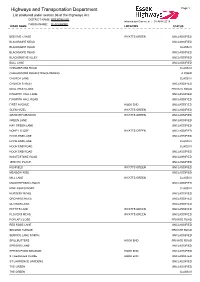

Highways and Transportation Department Page 1 List Produced Under Section 36 of the Highways Act

Highways and Transportation Department Page 1 List produced under section 36 of the Highways Act. DISTRICT NAME: BRENTWOOD Information Correct at : 01-APR-2017 PARISH NAME: BLACKMORE ROAD NAME LOCATION STATUS BEEHIVE CHASE WYATTS GREEN UNCLASSIFIED BLACKMORE MEAD UNCLASSIFIED BLACKMORE ROAD CLASS III BLACKMORE ROAD UNCLASSIFIED BLACKSMITHS ALLEY UNCLASSIFIED BULL LANE UNCLASSIFIED CHELMSFORD ROAD CLASS III CHELMSFORD ROAD STRAIGHTENING A ROAD CHURCH LANE CLASS III CHURCH STREET UNCLASSIFIED DEALTREE CLOSE PRIVATE ROAD FINGRITH HALL LANE UNCLASSIFIED FINGRITH HALL ROAD UNCLASSIFIED FIRST AVENUE HOOK END UNCLASSIFIED GLEN HAZEL WYATTS GREEN UNCLASSIFIED GRANARY MEADOW WYATTS GREEN UNCLASSIFIED GREEN LANE UNCLASSIFIED HAY GREEN LANE UNCLASSIFIED HONEY CLOSE WYATTS GREEN UNCLASSIFIED HOOK END LANE CLASS III HOOK END LANE UNCLASSIFIED HOOK END ROAD CLASS III HOOK END ROAD UNCLASSIFIED INGATESTONE ROAD UNCLASSIFIED JERICHO PLACE UNCLASSIFIED KILNFIELD WYATTS GREEN UNCLASSIFIED MEADOW RISE UNCLASSIFIED MILL LANE WYATTS GREEN CLASS III MOUNTNESSING ROAD UNCLASSIFIED NINE ASHES ROAD CLASS III NURSERY ROAD UNCLASSIFIED ORCHARD PIECE UNCLASSIFIED OUTINGS LANE UNCLASSIFIED PETTITS LANE WYATTS GREEN UNCLASSIFIED PLOVERS MEAD WYATTS GREEN UNCLASSIFIED POPLAR CLOSE PRIVATE ROAD RED ROSE LANE UNCLASSIFIED SECOND AVENUE PRIVATE ROAD SERVICE LANE NORTH UNCLASSIFIED SPILLBUTTERS HOOK END PRIVATE ROAD SPRIGGS LANE UNCLASSIFIED SPRING POND MEADOW HOOK END UNCLASSIFIED ST GEORGES CLOSE HOOK END UNCLASSIFIED ST LAWRENCE GARDENS UNCLASSIFIED THE GREEN UNCLASSIFIED -

Salmond's Grove, Ingrave, Essex Initial Landscape

Salmond’s Grove, Ingrave, Essex Initial Landscape and Green Belt Appraisal on behalf of Arebray Ltd Planning | March 2018 Status: Planning | Issue 01 Salmond’s Grove, Ingrave Initial Landscape and Green Belt Appraisal Contact: Simon Neesam Technical Director The Landscape Partnership The Granary, Sun Wharf Deben Road Woodbridge Suffolk, IP12 1AZ www.thelandscapepartnership.com The Landscape Partnership Ltd is a practice of Chartered Landscape Architects, Chartered Ecologists and Chartered Environmentalists, registered with the Landscape Institute and a member of the Institute of Environmental Management & Assessment and the Arboricultural Association. The Landscape Partnership Registered office Greenwood House 15a St Cuthberts Street Bedford MK40 3JG Registered in England No. 2709001 © The Landscape Partnership Page i March 2018 Status: Planning | Issue 01 Salmond’s Grove, Ingrave Initial Landscape and Green Belt Appraisal Contents 1 Introduction 2 Site context 3 Initial assessment of potential landscape and visual effects 4 Initial Green Belt Appraisal 5 Summary and Conclusion © The Landscape Partnership Page iii March 2018 Status: Planning | Issue 01 Salmond’s Grove, Ingrave Initial Landscape and Green Belt Appraisal 1 Introduction 1.1 Background to the project 1.1.1 In February 2018, The Landscape Partnership was commissioned by Arebray Ltd to undertake an initial landscape and Green Belt appraisal in support of the development of land at Salmond’s Grove, Ingrave for residential uses. The site consists of a pasture at Salmond’s Farm which is currently used to graze horses. It is located at the eastern edge of Ingrave, in the county of Essex. It is designated as Metropolitan Green Belt. 1.2 Proposed scheme 1.2.1 It is proposed that the site is redeveloped for residential uses. -

Newsletter Other Activities in Which the Nine Parish Councillors, Under the Chairmanship Of

Issue 8 May 2012 Parish Council News New Bus Service A new Sunday bus service for Herongate and Ingrave is due to start in May. The hail and stop return bus will run from Thorndon South, through the villages, down The Avenue past Thorndon North. It will then call at Brentwood Station, followed by Sainsburys , Ongar Road to the Brentwood Centre and, finally, Doddinghurst. The cost of a single journey fare will be £2.50 a person or a family ticket for two adults and two children will cost £5.00. The bus will run four times a day, twice in the morning and twice in the afternoon; the times will be confirmed by Brentwood Community Transport. The borough council will pay half the cost and the other half will be split between Herongate and Ingrave and Doddinghurst parish councils. Parish chairman Alan Marsh has spoken with the bus provider and offered £3,000 for this financial year and said the council would look at the possibility of paying an additional £1,000 in the next financial year. West Horndon parish council has since contacted Herongate and Ingrave with a view to joining this venture in the future. If the service is a success the borough council may consider an all-day service. A daily hail and stop return community bus service to Shenfield running via Herongate, Ingrave, Running Waters, Hanging Hill Lane then on to Shenfield Station is also in the early stages of negotiation. Plans are for the bus to run two to three times in the morning and two to three times in the afternoon. -

Planning Development Control Committee Following the Applicant’S Request for Time to Submit Revised Plans

COMMITTEE: PLANNING PLACE: COUNCIL DEVELOPMENT CONTROL CHAMBER DATE: WEDNESDAY CO-ORDINATOR: MS L JONES 14 FEBRUARY 2007 Committee Co-ordinator TIME: 7.00 pm (Ext. 2691) N.B. This meeting will be subject to a Webcast broadcast live on the Internet TO: Crs: Miss Monnickendam (Chairman), Ms Golding (Vice-Chairman), Mrs Brehaut, Brown, Mrs Coe, Good, Mrs Holmes, Mrs Hubbard, MacLellan, Minns, Mrs Monnickendam, Myers, Parker, Mrs Pound and Mrs Sheehan. Nominated Substitutes: Crs: Elphick, Faragher, Hardy and Mrs McGinley. Co-opted Representatives: Mr Afteni (Mountnessing PC), Mrs Dicker (Doddinghurst PC), Mr Bland (Stondon Massey PC), Mr Day (Ingatestone and Fryerning PC), Mr Jardine (Kelvedon Hatch PC), Mrs Smith (Blackmore, Hook End & Wyatts Green PC), Mrs Savill (Navestock PC), Mr Bayless (Herongate & Ingrave PC) and Mr Crowley (West Horndon PC). MEMBERS ARE RESPECTFULLY SUMMONED TO ATTEND THE ABOVE MEETING TO TRANSACT THE BUSINESS SET OUT BELOW. Chief Executive & Town Clerk AGENDA PART ONE (Items which, in the opinion of the Chief Executive & Town Clerk, will be considered with the public present at the meeting. Details of Background Documents relied upon in the reports before the Committee are attached as an appendix to this Agenda.) 1 1. APOLOGIES FOR ABSENCE 2. MINUTES OF THE PLANNING COMMITTEE MEETING HELD ON 17.1.2007 Members are requested to bring with them to the meeting their Minutes folder. The Committee is invited to approve the Minutes of the Planning Committee held on 17.1.2007. 3. PLANNING APPLICATIONS AND MATTERS The Committee -

Highways and Transportation Department Page 1 List Produced Under Section 36 of the Highways Act

Highways and Transportation Department Page 1 List produced under section 36 of the Highways Act. DISTRICT NAME: BRENTWOOD Information Correct at : 01-APR-2018 PARISH NAME: BLACKMORE ROAD NAME LOCATION STATUS BEEHIVE CHASE WYATTS GREEN UNCLASSIFIED BLACKMORE MEAD UNCLASSIFIED BLACKMORE ROAD CLASS III BLACKMORE ROAD UNCLASSIFIED BLACKSMITHS ALLEY UNCLASSIFIED BULL LANE UNCLASSIFIED CHELMSFORD ROAD CLASS III CHELMSFORD ROAD STRAIGHTENING A ROAD CHURCH LANE CLASS III CHURCH STREET UNCLASSIFIED DEALTREE CLOSE PRIVATE ROAD FINGRITH HALL LANE UNCLASSIFIED FINGRITH HALL ROAD UNCLASSIFIED FIRST AVENUE HOOK END UNCLASSIFIED GLEN HAZEL WYATTS GREEN UNCLASSIFIED GRANARY MEADOW WYATTS GREEN UNCLASSIFIED GREEN LANE UNCLASSIFIED HAY GREEN LANE UNCLASSIFIED HONEY CLOSE WYATTS GREEN UNCLASSIFIED HOOK END LANE UNCLASSIFIED HOOK END LANE CLASS III HOOK END ROAD CLASS III HOOK END ROAD UNCLASSIFIED INGATESTONE ROAD UNCLASSIFIED JERICHO PLACE UNCLASSIFIED KILNFIELD WYATTS GREEN UNCLASSIFIED MEADOW RISE UNCLASSIFIED MILL LANE WYATTS GREEN CLASS III MOUNTNESSING ROAD UNCLASSIFIED NINE ASHES ROAD CLASS III NURSERY ROAD UNCLASSIFIED ORCHARD PIECE UNCLASSIFIED OUTINGS LANE UNCLASSIFIED PETTITS LANE WYATTS GREEN UNCLASSIFIED PLOVERS MEAD WYATTS GREEN UNCLASSIFIED POPLAR CLOSE PRIVATE ROAD RED ROSE LANE UNCLASSIFIED SECOND AVENUE PRIVATE ROAD SERVICE LANE NORTH UNCLASSIFIED SPILLBUTTERS HOOK END PRIVATE ROAD SPRIGGS LANE UNCLASSIFIED SPRING POND MEADOW HOOK END UNCLASSIFIED ST GEORGES CLOSE HOOK END UNCLASSIFIED ST LAWRENCE GARDENS UNCLASSIFIED THE GREEN UNCLASSIFIED -

Report Template

Formal Council Tax (Brentwood Borough Council and Parishes) Resolution 2018/19 1. That it be noted that on 7 December 2017 under delegated authority, the Section 151 Officer approved the calculation of the following amounts as the Council’s Tax Base for 2018/19 in accordance with the Local Authorities (Calculation of Council Tax Base) (England) Regulations 2012: a) for the whole Council area as 32,592.60 (item “T” in the formula in section 33(1) of the Local Government Finance Act 1992, as amended (“the Act”)), and b) for dwellings in those parts of its area to which a Parish precept relates as follows Parish Taxbase Blackmore 1,460.80 Doddinghurst 1,186.10 Herongate and Ingrave 1,065.80 Ingatestone and Fryerning 2,388.70 Kelvedon Hatch 1,074.10 Mountnessing 491.30 Navestock 240.90 Stondon Massey 330.50 West Horndon 677.80 2. That the Council Tax requirement for the Council’s own purposes for 2018/19 (excluding Parish precepts) be calculated as £5,969,009. 3. That the following amounts be calculated for the year 2018/19 in accordance with Sections 32 to 36 of the Act: a) £35,506,589 being the aggregate of the amounts which the Council estimates for the items set out in Section 32(2) of the Act taking into account all precepts issued to it by Parish Councils. b) £29,020,934 being the aggregate of the amounts which the Council estimates for the items set out in Section 32(3) of the Act. c) £6,485,655 being the amount by which the aggregate at 3a) above exceeds the aggregate at 3b) above, calculated by the Council in accordance with Section 32(4) of the Act as its Council Tax requirement for the year (item “R” in the formula in Section 33(1) of the Act). -

Highways and Transportation Department Page 1 List Produced Under Section 36 of the Highways Act

Highways and Transportation Department Page 1 List produced under section 36 of the Highways Act. DISTRICT NAME: BRENTWOOD Information Correct at : 01-APR-2019 PARISH NAME: BLACKMORE ROAD NAME LOCATION STATUS BEEHIVE CHASE WYATTS GREEN UNCLASSIFIED BLACKMORE MEAD UNCLASSIFIED BLACKMORE ROAD CLASS III BLACKMORE ROAD UNCLASSIFIED BLACKSMITHS ALLEY UNCLASSIFIED BULL LANE UNCLASSIFIED CHELMSFORD ROAD CLASS III CHELMSFORD ROAD STRAIGHTENING A ROAD CHURCH LANE CLASS III CHURCH STREET UNCLASSIFIED DEALTREE CLOSE PRIVATE ROAD FINGRITH HALL LANE UNCLASSIFIED FINGRITH HALL ROAD UNCLASSIFIED FIRST AVENUE HOOK END UNCLASSIFIED GLEN HAZEL WYATTS GREEN UNCLASSIFIED GRANARY MEADOW WYATTS GREEN UNCLASSIFIED GREEN LANE UNCLASSIFIED HAY GREEN LANE UNCLASSIFIED HONEY CLOSE WYATTS GREEN UNCLASSIFIED HOOK END LANE UNCLASSIFIED HOOK END LANE CLASS III HOOK END ROAD CLASS III HOOK END ROAD UNCLASSIFIED INGATESTONE ROAD UNCLASSIFIED JERICHO PLACE UNCLASSIFIED KILNFIELD WYATTS GREEN UNCLASSIFIED MEADOW RISE UNCLASSIFIED MILL LANE WYATTS GREEN CLASS III MOUNTNESSING ROAD UNCLASSIFIED NINE ASHES ROAD CLASS III NURSERY ROAD UNCLASSIFIED ORCHARD PIECE UNCLASSIFIED OUTINGS LANE UNCLASSIFIED PETTITS LANE WYATTS GREEN UNCLASSIFIED PLOVERS MEAD WYATTS GREEN UNCLASSIFIED POPLAR CLOSE PRIVATE ROAD RED ROSE LANE UNCLASSIFIED SECOND AVENUE PRIVATE ROAD SERVICE LANE NORTH UNCLASSIFIED SPILLBUTTERS HOOK END PRIVATE ROAD SPRIGGS LANE UNCLASSIFIED SPRING POND MEADOW HOOK END UNCLASSIFIED ST GEORGES CLOSE HOOK END UNCLASSIFIED ST LAWRENCE GARDENS UNCLASSIFIED THE GREEN UNCLASSIFIED -

Herongate and Ingrave Parish Council

Herongate and Ingrave Parish Council Clerk to the Council: Mrs. Theresa Grainger 34a Common Road Ingrave Brentwood Essex CM13 3QL Tel: 07548 743248 Email: [email protected] NEW WEBSITE: www.herongateandingravepc.org.uk Minutes of the Parish Council Meeting held at St. Nicholas Church Hall on Tuesday, 28th January 2014 at 7.15pm In the Chair: Cllr A. Kingsford Present: Cllr A. Bayless, Cllr. D. Harman (Vice Chairman), Cllr P. Hawkins, Cllr K. Pegram and Cllr S. Theobald Officers: Mrs T. Grainger (Clerk) Members of the public: Five 13/14.127 Public participation session with respect to items on the agenda and other matters that are of mutual interest A resident of School Lane raised the problem of dangerous potholes along this lane and asked if the Parish Council could do anything about the situation. The resident felt that the houses in School Lane were not responsible for repairs. This is a private lane and not adopted by the Borough. Discussion took place regarding the possibility of the Parish Council organising a load of aggregate for the residents to spread to fill the holes but this was dismissed as the aggregate would soon wash away. It was suggested that the Clerk write to St. Nicholas Church to establish who is responsible for repairs. Members of the Public expressed their appreciation of the beautiful Christmas tree this year. At this point the Chairman thanked all involved in the Christmas tree celebrations. 13/14.128 Apologies for absence Apologies were received from Cllr S. Murphy, Cllr F. O’Connor and Cllr R. -

BRENTWOOD Information Correct at : 01-APR-2020 PARISH NAME: BLACKMORE ROAD NAME LOCATION STATUS

Highways and Transportation Department Page 1 List produced under section 36 of the Highways Act. DISTRICT NAME: BRENTWOOD Information Correct at : 01-APR-2020 PARISH NAME: BLACKMORE ROAD NAME LOCATION STATUS BEEHIVE CHASE WYATTS GREEN UNCLASSIFIED BLACKMORE MEAD UNCLASSIFIED BLACKMORE ROAD CLASS III BLACKMORE ROAD UNCLASSIFIED BLACKSMITHS ALLEY UNCLASSIFIED BULL LANE UNCLASSIFIED CHELMSFORD ROAD CLASS III CHELMSFORD ROAD STRAIGHTENING A ROAD CHURCH LANE CLASS III CHURCH STREET UNCLASSIFIED DEALTREE CLOSE PRIVATE ROAD FINGRITH HALL LANE UNCLASSIFIED FINGRITH HALL ROAD UNCLASSIFIED FIRST AVENUE HOOK END UNCLASSIFIED GLEN HAZEL WYATTS GREEN UNCLASSIFIED GRANARY MEADOW WYATTS GREEN UNCLASSIFIED GREEN LANE UNCLASSIFIED HAY GREEN LANE UNCLASSIFIED HONEY CLOSE WYATTS GREEN UNCLASSIFIED HOOK END LANE UNCLASSIFIED HOOK END LANE CLASS III HOOK END ROAD CLASS III HOOK END ROAD UNCLASSIFIED INGATESTONE ROAD UNCLASSIFIED JERICHO PLACE UNCLASSIFIED KILNFIELD WYATTS GREEN UNCLASSIFIED MEADOW RISE UNCLASSIFIED MILL LANE WYATTS GREEN CLASS III MOUNTNESSING ROAD UNCLASSIFIED NINE ASHES ROAD CLASS III NURSERY ROAD UNCLASSIFIED ORCHARD PIECE UNCLASSIFIED OUTINGS LANE UNCLASSIFIED PETTITS LANE WYATTS GREEN UNCLASSIFIED PLOVERS MEAD WYATTS GREEN UNCLASSIFIED POPLAR CLOSE PRIVATE ROAD RED ROSE LANE UNCLASSIFIED SECOND AVENUE PRIVATE ROAD SERVICE LANE NORTH UNCLASSIFIED SPILLBUTTERS HOOK END PRIVATE ROAD SPRIGGS LANE UNCLASSIFIED SPRING POND MEADOW HOOK END UNCLASSIFIED ST GEORGES CLOSE HOOK END UNCLASSIFIED ST LAWRENCE GARDENS UNCLASSIFIED THE GREEN UNCLASSIFIED -

History of the Brentwood Borough Parishes

History of the Brentwood Borough Parishes Please select from the list below: • Blackmore, Hook End and Wyatts Green • Doddinghurst • Herongate and Ingrave • Ingatestone and Fryerning • Kelvedon Hatch • Mountnessing • Navestock • Stondon Massey • West Horndon Blackmore, Hook End and Wyatts Green First recorded in the Domesday book as 'Phingaria' (Fingrith), the Latinised form of an Anglo Saxon name meaning 'the stream of the people of Fin'. The use of the name Blackmore, meaning 'Black Marsh' or 'Black Swamp' would seem to have been generally accepted by the end of the Middle Ages. Blackmore, which is one of the more attractive Essex villages, is in the centre of the Parish. To the South, on a moated site, is the church of St Laurence, which is all that remains of an Augustine Priory of Blackmore, founded in the 12th century. After the dissolution of the Priory in 1525, the chancel of its church was demolished, but the rest of the building was retained as the parish church. The 15th century timber bell tower is one of the finest in England. Adjoining the churchyard is Jericho Priory. The main block of this imposing building is red brick, three storeys high, with four bays and square angle turrets. As this house is on the same moated site as the church, and both were partly walled, especially in the west, it is reasonably thought that it may be on the site of an early, 16th century, house, either built after the dissolution of the Priory, or adopted from its buildings. Legend has it that the original house was a country retreat of Henry VIII and that it was the birthplace, in 1520, of his natural son, Henry Fitzroy, Duke of Richmond. -

Braintree, Brentwood, Chelmsford, Maldon and Uttlesford Landscape Character Assessments

BRAINTREE, BRENTWOOD, CHELMSFORD, MALDON AND UTTLESFORD LANDSCAPE CHARACTER ASSESSMENTS September 2006 CHRIS BLANDFORD ASSOCIATES Environment Landscape Planning CONTENTS Preface Executive Summary 1.0 INTRODUCTION 1.1 Background and Study Area 1.2 Study Aims and Objectives 1.3 The Importance of Landscape Character 1.4 Planning Policy Framework 1.5 Approach and Methodology 1.6 Structure of the Report 2.0 OVERVIEW OF THE STUDY AREA 2.1 General 2.2 Physical Influences on the Shaping of the Landscape 2.3 Historical Influences on the Landscape 2.4 Key Forces for Change in the Landscape 2.5 Landscape Character in The Study Area – An Overview 3.0 LANDSCAPE CHARACTER OF BRAINTREE DISTRICT 3.1 General 3.2 River Valley Landscapes 3.3 Farmland Plateau Landscapes 3.4 Wooded Farmland Landscapes 4.0 LANDSCAPE CHARACTER OF BRENTWOOD BOROUGH 4.1 General 4.2 River Valley Landscapes 4.3 Wooded Farmland Landscapes 4.4 Fenland Landscapes 5.0 LANDSCAPE CHARACTER OF CHELMSFORD BOROUGH 5.1 General 5.2 River Valley Landscapes 5.3 Farmland Plateau Landscapes 5.4 Drained Estuarine Marsh Landscapes 5.5 Wooded Farmland Landscapes 6.0 LANDSCAPE CHARACTER OF MALDON DISTRICT 6.1 General 6.2 River Valley Landscapes 6.3 Farmland Plateau Landscapes 6.4 Estuarine Marsh/Mudflat Landscapes 6.5 Drained Estuarine Marsh Landscapes 6.6 Coastal Farmland Landscapes 6.7 Wooded Farmland Landscapes 7.0 LANDSCAPE CHARACTER OF UTTLESFORD DISTRICT 7.1 General 7.2 River Valley Landscapes 7.3 Farmland Plateau Landscapes 7.4 Chalk Upland Landscapes 11100101R Final LCAs_09-06 Contents 8.0 RECOMMENDATIONS 8.1 General 8.2 Key Applications of the Landscape Character Assessments 8.3 Incorporating Landscape Character into Local Development Frameworks 8.4 Monitoring Landscape Change 8.5 Enhancing the Character Evidence Base APPENDICES A.