CLRG IQ Chaikin US Large Cap ETF Q1 Holdings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TOBAM Maximum Diversification USA USD

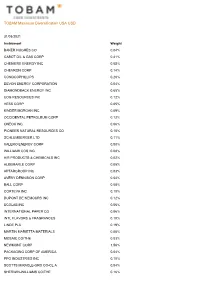

TOBAM Maximum Diversification USA USD 31/03/2021 Instrument Weight BAKER HUGHES CO 0.04% CABOT OIL & GAS CORP 0.41% CHENIERE ENERGY INC 0.05% CHEVRON CORP 0.14% CONOCOPHILLIPS 0.20% DEVON ENERGY CORPORATION 0.04% DIAMONDBACK ENERGY INC 0.65% EOG RESOURCES INC 0.12% HESS CORP 0.05% KINDER MORGAN INC 0.09% OCCIDENTAL PETROLEUM CORP 0.12% ONEOK INC 0.06% PIONEER NATURAL RESOURCES CO 0.10% SCHLUMBERGER LTD 0.11% VALERO ENERGY CORP 0.08% WILLIAMS COS INC 0.08% AIR PRODUCTS & CHEMICALS INC 0.02% ALBEMARLE CORP 0.05% APTARGROUP INC 0.03% AVERY DENNISON CORP 0.04% BALL CORP 0.08% CORTEVA INC 0.10% DUPONT DE NEMOURS INC 0.12% ECOLAB INC 0.06% INTERNATIONAL PAPER CO 0.06% INTL FLAVORS & FRAGRANCES 0.10% LINDE PLC 0.19% MARTIN MARIETTA MATERIALS 0.06% MOSAIC CO/THE 0.03% NEWMONT CORP 1.56% PACKAGING CORP OF AMERICA 0.04% PPG INDUSTRIES INC 0.10% SCOTTS MIRACLE-GRO CO-CL A 0.04% SHERWIN-WILLIAMS CO/THE 0.16% TOBAM Maximum Diversification USA USD 31/03/2021 Instrument Weight VULCAN MATERIALS CO 0.06% WESTROCK CO-WHEN ISSUED 0.03% 3M CO 0.31% ALLEGION PLC 0.03% AMERICAN AIRLINES GROUP INC 0.20% ARCONIC INC 0.04% AXON ENTERPRISE INC 0.03% C.H. ROBINSON WORLDWIDE INC 0.12% CARLISLE COS INC 0.02% CATERPILLAR INC 0.35% CLARIVATE ANALYTICS PLC 0.07% COPART INC 0.06% COSTAR GROUP INC 0.09% CUMMINS INC 0.11% DEERE & CO 0.11% DELTA AIR LINES INC 0.09% EMERSON ELECTRIC CO 0.15% EQUIFAX INC 0.06% EXPEDITORS INTL WASH INC 0.05% FASTENAL CO 0.08% FEDEX CORP 0.20% GENERAC HOLDINGS INC 0.06% GENERAL ELECTRIC CO 0.32% HEICO CORP-CLASS A 0.02% HUNT (JB) TRANSPRT SVCS -

LSV Asset Management LSV CONSERVATIVE VAL EQ FD LSVFNDRV As Of: 9/30/19 Base Currency: USD

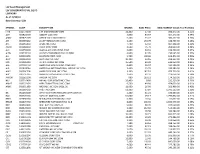

LSV Asset Management LSV CONSERVATIVE VAL EQ FD LSVFNDRV As of: 9/30/19 Base Currency: USD SYMBOL CUSIP DESCRIPTION SHARES BASE PRICE BASE MARKET VALUE% of Portfolio FITB 316773100 5TH 3RD BANCORP COM 14,400 27.38 394,272.00 0.51% ABT 002824100 ABBOTT LAB COM 3,600 83.67 301,212.00 0.39% ABBV 00287Y109 ABBVIE INC COM USD0.01 5,100 75.72 386,172.00 0.50% AYI 00508Y102 ACUITY BRANDS INC COM 1,400 134.79 188,706.00 0.24% AFL 001055102 AFLAC INC COM 7,400 52.32 387,168.00 0.50% AGCO 001084102 AGCO CORP COM 3,500 75.70 264,950.00 0.34% ALK 011659109 ALASKA AIR GROUP INC COM 3,000 64.91 194,730.00 0.25% ALSN 01973R101 ALLISON TRANSMISSION HOLDING 4,900 47.05 230,545.00 0.30% ALL 020002101 ALLSTATE CORP COM 5,700 108.68 619,476.00 0.80% ALLY 02005N100 ALLY FINL INC COM 10,200 33.16 338,232.00 0.44% MO 02209S103 ALTRIA GROUP INC COM 15,500 40.90 633,950.00 0.82% AAL 02376R102 AMERICAN AIRLINES INC COM USD1 6,800 26.97 183,396.00 0.24% AIG 026874784 AMERICAN INTERNATIONAL GROUP INC COM 3,400 55.70 189,380.00 0.24% AMP 03076C106 AMERIPRISE FINL INC COM 3,200 147.10 470,720.00 0.61% ABC 03073E105 AMERISOURCEBERGEN CORP COM 2,600 82.33 214,058.00 0.28% AMGN 031162100 AMGEN INC COM 900 193.51 174,159.00 0.22% NLY 035710409 ANNALY CAP MGMT INC COM 26,400 8.80 232,320.00 0.30% AMAT 038222105 APPLIED MATERIALS INC COM 9,500 49.90 474,050.00 0.61% ARNC 03965L100 ARCONIC INC COM USD1.00 11,900 26.00 309,400.00 0.40% T 00206R102 AT&T INC COM 51,300 37.84 1,941,192.00 2.50% BK 064058100 BANK NEW YORK MELLON CORP COM STK 4,300 45.21 194,403.00 0.25% BAC 060505104 -

United Airlines Holdings Annual Report 2021

United Airlines Holdings Annual Report 2021 Form 10-K (NASDAQ:UAL) Published: March 1st, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission Exact Name of Registrant as Specified in its Charter, State of I.R.S. Employer File Number Principal Executive Office Address and Telephone Incorporation Identification No. Number 001-06033 United Airlines Holdings, Inc. Delaware 36-2675207 233 South Wacker Chicago, Illinois Drive, 60606 (872) 825-4000 001-10323 United Airlines, Inc. Delaware 74-2099724 233 South Wacker Chicago, Illinois Drive, 60606 (872) 825-4000 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol Name of Each Exchange on Which Registered United Airlines Holdings, Inc. Common Stock, $0.01 par value UAL The Nasdaq Stock Market LLC Preferred Stock Purchase Rights The Nasdaq Stock Market LLC United Airlines, Inc. None None None Securities registered pursuant to Section 12(g) of the Act: United Airlines Holdings, Inc. None United Airlines, Inc. None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act United Airlines Holdings, Inc. Yes ☒ No ☐ United Airlines, Inc. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. -

Download All Holdings (PDF)

AMG GW&K High Income Fund - Portfolio Holdings as of February 28, 2021 Name Sector Asset Class Country Currency Par/Shares Price ($) Market Value ($) % of Fund Starwood Property Trust Inc Fixed 4.75% Mar 2025 Corporate Bond US USD 262,000 102.22 $267,810 2.52% HCA Inc Fixed 5.38% Feb 2025 Corporate Bond US USD 236,000 112.25 $264,910 2.49% Delta Air Lines Inc Fixed 7.38% Jan 2026 Corporate Bond US USD 225,000 116.57 $262,274 2.47% United Airlines Holdings Inc Fixed 5.00% Feb 2024 Corporate Bond US USD 254,000 102.63 $260,668 2.45% Apache Corp Fixed 4.63% Nov 2025 Corporate Bond US USD 251,000 103.63 $260,099 2.45% General Electric Co Floating Perpetual Corporate Bond US USD 271,000 94.56 $256,255 2.41% Howmet Aerospace Inc Fixed 6.88% May 2025 Corporate Bond US USD 220,000 115.75 $254,639 2.39% Hudbay Minerals Inc Fixed 4.50% Apr 2026 144A Corporate Bond CA USD 250,000 101.38 $253,445 2.38% Service Properties Trust Fixed 7.50% Sep 2025 Corporate Bond US USD 223,000 113.47 $253,033 2.38% American Axle & Manufacturing Inc Fixed 6.25% Apr 2025 Corporate Bond US USD 243,000 103.01 $250,314 2.35% JPMorgan Chase & Co Floating Perpetual Corporate Bond US USD 245,000 102.00 $249,900 2.35% Penske Automotive Group Inc Fixed 3.50% Sep 2025 Corporate Bond US USD 243,000 101.75 $247,253 2.32% Ford Motor Co Fixed 4.35% Dec 2026 Corporate Bond US USD 231,000 106.57 $246,186 2.31% Sprint Corp Fixed 7.13% Jun 2024 Corporate Bond US USD 211,000 115.14 $242,956 2.28% Ovintiv Exploration Inc Fixed 5.63% Jul 2024 Corporate Bond US USD 206,000 109.65 $225,881 -

(SB #097802) [email protected]

Electronically FILED by Superior Court of California, County of Los Angeles on 12/04/2020 09:16 AM Sherri R. Carter, Executive Officer/Clerk of Court, by M. Mariscal,Deputy Clerk 20SMCV01866 Assigned for all purposes to: Santa Monica Courthouse, Judicial Officer: H. Ford III 1 DANIEL M. PETROCELLI (S.B. #097802) [email protected] 2 MOLLY M. LENS (S.B. #283867) [email protected] 3 O’MELVENY & MYERS LLP 1999 Avenue of the Stars, 8th Floor 4 Los Angeles, CA 90067-6035 Telephone: (310) 553-6700 5 Facsimile: (310) 246-6779 6 ERIC AMDURSKY (S.B. #180288) [email protected] 7 O'MELVENY & MYERS LLP 2765 Sand Hill Road 8 Menlo Park, California 94025 Telephone: (650) 473-2600 9 Facsimile: (650) 473-2601 10 Attorneys for Plaintiff ACTIVISION BLIZZARD, INC. 11 12 SUPERIOR COURT OF THE STATE OF CALIFORNIA 13 COUNTY OF LOS ANGELES, WEST DISTRICT 14 ACTIVISION BLIZZARD, INC., a Delaware Case No. Corporation, 15 Plaintiff, COMPLAINT FOR: 16 vs. (1) Intentional Interference with 17 Contract; NETFLIX, INC., a Delaware Corporation, and 18 DOES 1 through 25, inclusive, (2) Unfair Competition – Cal. Bus. & Prof. Code §§ Code 17200 et seq.; and 19 Defendants. (3) Aiding and Abetting Breach of 20 Fiduciary Duty 21 DEMAND FOR JURY TRIAL 22 23 24 25 26 27 28 COMPLAINT 1 Plaintiff Activision Blizzard, Inc. (“Plaintiff” or “Activision”), for its complaint against 2 Netflix, Inc. (“Netflix” or “Defendant”), alleges on knowledge as to itself and its own acts, and on 3 information and belief as to all other matters, as follows: 4 NATURE OF ACTION 5 1. -

Activision Blizzard, Inc

Investment Club Presentation Activision Blizzard, Inc. (ATVI) Analyst: Niko Martinovic 5-Yr Stock Performance $90 $80 $70 $60 $50 $40 $30 Decline in stock primarily driven by analyst sentiment changes, missing expectations, CFO firings, $20 and most recently, Bungie games leaving ATVI $10 $0 1/15/20144/15/20147/15/201410/15/20141/15/20154/15/20157/15/201510/15/20151/15/20164/15/20167/15/201610/15/20161/15/20174/15/20177/15/201710/15/20171/15/20184/15/20187/15/201810/15/2018 Source: AIM/Martinovic 2018, Company Filings, S&P Capital IQ, and IBIS World 2 They’re Wrong Activision Blizzard has three meaningful and diverse revenue streams that can all grow in unique ways. E-Sports and Virtual Reality are the most exciting growth opportunities in this industry and ATVI is the best positioned to take advantage of it with the power of their brands, aggressive R&D spend, and patience. Source: 3 Note: Three Year Stock Performance ATVI has outperformed the S&P consistently since early 2017 while the Peer Set1 has reverted back. 160.00% 140.00% Stock Price $46.85 Shares Outstanding $762.41mm 120.00% Market Cap $36.08bn 52 Week Range $43.71-$84.68 100.00% Avg. Volume 7,550,000 EPS (TTM) $2.13 80.00% Past Month Performance -1.60% Past 1 Year -33.63% 60.00% Past 5 Year 170.36% 40.00% 20.00% 0.00% -20.00% -40.00% 1/15/2016 4/15/2016 7/15/2016 10/15/2016 1/15/2017 4/15/2017 7/15/2017 10/15/2017 1/15/2018 4/15/2018 7/15/2018 10/15/2018 S&P ATVI Peer Set Source: AIM/Martinovic 2018, Company Filings, S&P Capital IQ, and IBIS World 4 1Electronic Arts, Ubisoft, Take Two Interactive, Square Enix, and Zynga Company Overview & Monetization Activision Blizzard, Inc. -

Investment Report West Springfield

THE DE BURLO GROUP, INC. INVESTMENT ADVISORS • CAPITAL MANAGEMENT INVESTMENT REPORT WEST SPRINGFIELD MARCH 31, 2021 THE DE BURLO GROUP, INC. 50 FEDERAL STREET • 8th FL. • BOSTON • MASSACHUSETTS 02110 • PHONE 617.482.0275 • FAX 617.338.6077 West Springfield Retirement Board Investment Report for Quarter Ended March 31, 2021 For Meeting of April 27, 2021 The Economy Makes a Comeback, but it’s Far from Complete In late March, Fed Chair Jerome Powell once again credited the extraordinary efforts and “unprecedented” support of the central bank and Congress with the success of the economic recovery but was quick to state that the recovery was ongoing and “far from complete”. He went on to say, “…at the Fed, we will continue to provide the economy the support that it needs for as long as it takes.” The ambitious task of deploying an aggressive, effective, and equitable vaccination program coupled with renewed hiring aided by the scaffolding of supportive monetary and fiscal policy, is fueling America’s economic comeback and helping consumers to gain confidence. Analysts anticipate GDP growth to be 6.5% in 2022. More than 3 million vaccine doses are currently being administered daily in the U.S. Although these results are a sign of forward momentum, it is important to vaccinate 70% to 85% of the population in order to return to “normal”, according to experts. The pace of the vaccinations is also key as new variants continue to pose a threat to public health and to the economic recovery. Three Months Benchmarks* Ended 3/31/21 Dow Industrials 7.76% S&P 500 5.77% Russell 2000 12.44% NASDAQ Composite 2.78% MSCI Emerging Markets 1.95% MSCI EAFE Index 2.83% Crude Oil 21.93% Trade-weighted Dollar 2.85% Gold -10.04% 2 Year Treasury +4 basis points 10 Year Treasury +83 basis points Fed Funds Target Rate No Change * Please note the returns listed above refer to price changes only. -

AM General V. Activision Blizzard

Case 1:17-cv-08644-GBD-JLC Document 218 Filed 03/31/20 Page 1 of 29 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORI( -- -- ----- -- -- ------------------------- --x AM GENERAL LLC, Plaintiff, MEMORANDUM DECISION -against- AND ORDER ACTIVISION BLIZZARD, INC., ACTIVISION 17 Civ. 8644 (GBD) PUBLISHING, INC., and MAJOR LEAGUE GAMING CORP., Defendants. --------- -- --- -- --------- -- -- -- ---- -- - --x GEORGE B. DANIELS, United States District Judge: Plaintiff AM General LLC ("AMG") brings this action against Defendants Activision Blizzard, Inc. and Activision Publishing, Inc. (collectively, "Activision") and Major League Gaming Corp. ("MLG") for trademark infringement, trade dress infringement, unfair competition, false designation of origin, false advertising, and dilution under the Lanham Act, 15 U.S.C. §§ 1114, 1125, and 1125(c), respectively. (Compl., ECF No. 1, ~~ 82-147.) AMG also raises pendant New York state law claims for trademark infringement, unfair competition, false designation of origin, trade dress infringement, false advertising, and dilution. (Jd. ~~ 148-81.) On May 31, 2019, Defendants moved for summaty judgment on all of AMG's claims pursuant to Federal Rule of Civil Procedure 56. (Defs. Activision and MLG's Notice of Mot. for Summ. J., ECF No. 131.) On the same day, Plaintiff moved for partial summaty judgment on Defendants' laches claim pursuant to Federal Rule of Civil Procedure 56(a). (PI. AMG's Notice of Mot. for Partial Summ. J., ECF No. 138.) Subsequently, Defendants filed a motion to strike (1) certain portions of Plaintiffs Rule 56.1 statement of material facts and (2) the "experiment" contained in the rebuttal report of Plaintiff s expeli, Dr. Y oran Wind ("MTS I"). -

Starbucks to Grow in Yunnan Percent of the IPO Proceeds Chemchina Currently to Expand and Upgrade Its Has Four Overseas Subsidiar- European Plants and Another Ies

10 businesscompanies SATURDAY, NOVEMBER 13, 2010 CHINA DAILY Bluestar Adisseo seeks $1.56 billion in HK IPO BEIJING — Bluestar Adisseo Nutrition Group, the French animal-nutrition company backed by China National Chemical Corp (ChemChina), is seeking In all of our compa- HK$12.08 billion ($1.56 bil- nies we show respect lion) in a Hong for diff erent cultures, RETAIL Kong initial public ‘‘ offering, accord- which I believe is the ing to a term sheet sent to key to success.” investors. REN JIANXIN Bluestar Adisseo is off er- PRESIDENT, CHEMCHINA ing 2.3 billion shares, or 25 percent of the company, at HK$3.50 to HK$5.25. pany would take advantage Pricing the stock at the of its rich resources in the ARIANA LINDQUIST / BLOOMBERG top end of the range would country to help Bluestar Howard Schultz (center), chairman, president and chief executive offi cer of Starbucks Corp, speaks at a news conference after a signing ceremony for a Memorandum give the company a market Adisseo to achieve further of Understanding (MOU) between Starbucks Corp, the Yunnan Academy of Agricultural Science and the People’s Government of Pu’er city, in Kunming, Yunnan capitalization of about development. province, on Friday. Starbucks Corp, the world’s biggest coff ee chain, will set up a farm and processing facilities in China’s southern Yunnan province. $6.23 billion. Deutsche “In all of our companies Bank AG and Morgan we show respect for diff er- Stanley are managing the ent cultures, which I believe sale. is the key to success,” said The company will use 40 Ren. -

Esports – Who Are the Big Players and the Likely

Esports – Who are the big players and the likely winners Millennial driven esports continues to grow rapidly. The number of esports enthusiasts worldwide was estimated to be ~165 million in 2018, and for total global viewers, the forecast is ~453 million in 2019. Esports global revenue is forecast to pass US$1b in 2019 and by 2022 the global eSports market revenue is forecast to reach US$1.79 billion growing at a CAGR of 22.3%. The big players in esports Activision Blizzard Inc. (NASDAQ: ATVI) Activision Blizzard owns the popular Overwatch League as well as World of Warcraft, StarCraft, Diablo, and Hearthstone. In 2018 Activision Blizzard signed a multiyear deal with Walt Disney to broadcast the Overwatch League. As of March 2018, it was the largest game company in the Americas and Europe in terms of revenue and market capitalization. Activision Blizzard has several business units: Activision Publishing, Blizzard Entertainment, King, Major League Gaming,and Activision Blizzard Studios. Alphabet Inc. (NASDAQ: GOOGL) Alphabet (Google) has a new cloud gaming platform called Stadia. It operates games hosted on remote servers and then streams video content to connected devices, including smartphones, tablets, computers and TVs. Other competitors in the streaming space include Amazon (Twitch), Facebook, Twitter, Microsoft, Tencent, and Alibaba. Amazon (NASDAQ: AMZN) Amazon’s Twitch leads the online USA streaming market. Amazon acquired Twitch for nearly $1 billion in 2014. Twitch is only a very small percentage of Amazon’s massive revenue. Electronic Arts Inc. (NASDAQ: EA) Electronic Arts is an American video game company headquartered in California. It is the second-largest gaming company in the Americas and Europe by revenue and market capitalization. -

Net Neutrality and Game Development Back in 2007 … FCC Goal

Net Neutrality and Game Development Back in 2007 … FCC Goal “[W]e seek to preserve the open, safe, and secure Internet and to promote and protect the legitimate business needs of broadband Internet access service providers and broader public interests such as innovation, investment, research and development, competition, consumer protection, speech, and democratic engagement.” Open Internet NPRM (October 2009) The Core Distinction Telecommunications services The offering of telecommunications for a fee directly to the public. “Telecommunications” is the transmission of information of the user’s choosing, without change in the form or content of the information as sent and received. Information services The offering of a capability for generating, acquiring, storing, transforming, processing, retrieving, utilizing, or making available information via telecommunications. FCC Classification Decisions Conclusion: Broadband Internet Access Service is an information service. The transmission element is not a separate component that must be offered to others. “Telecommunications service” obligations do not apply. 2005 FCC Policy Statement Consumers are entitled to access the lawful Internet content of their choice; Consumers are entitled to run applications and use services of their choice, subject to the needs of law enforcement; Consumers are entitled to connect their choice of legal devices that do not harm the network; and Consumers are entitled to competition among network providers, application and service providers, and content -

AMERICAN CENTURY INVESTMENT TRUST Form NPORT-P Filed 2021

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-08-24 | Period of Report: 2021-06-30 SEC Accession No. 0001145549-21-048495 (HTML Version on secdatabase.com) FILER AMERICAN CENTURY INVESTMENT TRUST Mailing Address Business Address 4500 MAIN STREET 4500 MAIN STREET CIK:908406| IRS No.: 000000000 | State of Incorp.:MA | Fiscal Year End: 0331 KANSAS CITY MO 64111 KANSAS CITY MO 64111 Type: NPORT-P | Act: 40 | File No.: 811-07822 | Film No.: 211201694 816-531-5575 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document American Century Investments® Quarterly Portfolio Holdings High-Yield Fund June 30, 2021 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document High-Yield - Schedule of Investments JUNE 30, 2021 (UNAUDITED) Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Shares/ Principal Amount ($) Value ($) CORPORATE BONDS — 86.4% Aerospace and Defense — 2.0% Bombardier, Inc., 6.00%, 10/15/22(1) 96,000 96,316 Bombardier, Inc., 7.50%, 3/15/25(1)(2) 305,000 314,341 Howmet Aerospace, Inc., 5.125%, 10/1/24 175,000 193,590 Rolls-Royce plc, 5.75%, 10/15/27(1) 250,000 275,695 TransDigm, Inc., 6.25%, 3/15/26(1) 1,000,000 1,056,250 TransDigm, Inc., 6.375%, 6/15/26 520,000 539,354 TransDigm, Inc., 4.625%, 1/15/29(1) 500,000 501,645 2,977,191 Airlines — 1.2% American Airlines, Inc. / AAdvantage Loyalty IP Ltd., 5.50%, 4/20/26(1) 504,000 534,240 United Airlines Holdings, Inc., 5.00%, 2/1/24(2) 555,000 577,930 United Airlines Pass Through Trust, 4.875%, 7/15/27 235,832 250,458 United Airlines, Inc., 4.625%, 4/15/29(1) 373,000 386,521 1,749,149 Auto Components — 0.7% Goodyear Tire & Rubber Co.