Vornado Realty Trust 2012 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

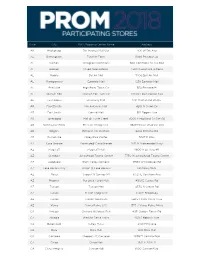

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

BOMA Bulletin Marble West Mcmillan Electric Co

SEPTEMBER/OCTOBER 2006 www.bomasf.org B OMA S a n F r a n c i s c o a d v a n c e s t h e c o m m e r c i a l r e a l e s t a t e i n d u s t r y t h r o u g h a d v o c a c y , p r o f e s s i o n a l d e v e l o p m e n t , a n d i n f o r m a t i o n e x c h a n g e Support our Associate Members: Buying BOMA Benefits Us All By Kathy Mattes, CPM, CCIM, Flynn Properties Inc. On the Inside good portion of our membership and involved with the local BOMAs there, has spent the past few months as well. If I’m doing business elsewhere working on their 2007 budgets. and don’t know the market but need some ELMER JOHNSON RECAP This process, arduous as it may seem, assistance, I know where to turn. And • •• 4 •• • reminds us where we spend our valuable that’s comforting. Adollars, and what expenditures give us the best return on investment. As a Principal Our Associate members are a great UILDING OUR 2006 B T BOMA member, I know the value received resource to BOMA San Francisco. • •• 6 •• • for my dues investment. I know that, as a Associate members contribute not only result of BOMA’s advocacy efforts, my dues and sponsorship support to our dues of approximately $0.01638 activities; they also actively CALENDAR per square foot per year saves serve on many committees that • •• 7 •• • 1.54 per square foot per year in do the work of our association. -

Mckesson HBOC, Inc. Securities Litigation 99-CV-20743-US District

US District Court Civil Docket as of February 8, 2013 Retrieved from the court on February 11, 2013 U.S. District Court California Northern District (San Jose) CIVIL DOCKET FOR CASE #: 5:99-cv-20743-RMW Aronson, et al v. McKesson HBOC, Inc., et al Date Filed: 04/28/1999 Assigned to: Judge Ronald M. Whyte Date Terminated: 03/26/2008 Referred to: Magistrate Judge Patricia V. Trumbull Jury Demand: Both Demand: $0 Nature of Suit: 850 Case in other court: Ninth Circuit, 06-15987 Securities/Commodities Cause: 15:78m(a) Securities Exchange Act Jurisdiction: Federal Question Plaintiff Andrew Aronson represented by D. Brian Hufford on behalf of himself and all others Pomerantz Haudek Block Grossman & similarly situated Gross LLP 100 Park Ave 26th Flr New York, NY 10017-5516 (212) 661-1100 LEAD ATTORNEY ATTORNEY TO BE NOTICED Daniel L. Berger Bernstein Litowitz Berger & Grossmann 1285 Avenue of the Americas 33rd Flr New York, NY 10019 (212) 554-1400 LEAD ATTORNEY ATTORNEY TO BE NOTICED Gerald J. Rodos Barrack Rodos & Bacine 2001 Market St 3300 Two Commerce Sq Philadelphia, PA 19103 (215) 963-0600 Email: [email protected] LEAD ATTORNEY ATTORNEY TO BE NOTICED Jeffrey W. Golan Barrack Rodos & Bacine 2001 Market St 3300 Two Commerce Sq Philadelphia, PA 19103 (215) 963-0600 LEAD ATTORNEY ATTORNEY TO BE NOTICED Joseph J. Tabacco , Jr. Berman DeValerio One California Street Suite 900 San Francisco, CA 94111 415-433-3200 Fax: 415-433-6382 Email: [email protected] LEAD ATTORNEY ATTORNEY TO BE NOTICED Leonard Barrack Barrack Rodos & Bacine 2001 Market St 3300 Two Commerce Sq Philadelphia, PA 19103 (215) 963-0600 Email: [email protected] LEAD ATTORNEY ATTORNEY TO BE NOTICED Max W. -

November 23, 2004 Marlene H. Dortch, Secretary Federal

November 23, 2004 By ELECTRONIC FILING Marlene H. Dortch, Secretary Federal Communications Commission 445 Twelfth Street, S.W. Washington, D.C. 20554 Re: Written Ex Parte Presentation, Unbundled Access to Network Elements; Review ofthe Section 251 Unbundling Obligations ofIncumbent Local Exchange Carriers, WC Docket No. 04-313, CC Docket No. 01-338 Dear Ms. Dortch: On November 16, 2004, Verizon filed an ex parte letter in this docket, attaching a recent filing by MCI in a California state regulatory proceeding. As Verizon expressly acknowledges, MCI's pleading was submitted in response to a request by the California Public Utilities Commission "for comment on whether it should revise traditional retail regulation of ILECs.,,1 Verizon contends that this filing amounts to an admission by MCI "that the arguments it advanced in this proceeding no longer are valid,,2 - a claim that misstates the facts and ignores the context in which the California pleading was filed. Even a cursory review of the MCI submission shows that MCI did not contradict the facts or contentions that it has advanced in this proceeding concerning the state of intermodal competition. More fundamentally, the California proceeding and this Commission's pending Triennial Remand proceeding involve very different issues. The California Public Utilities Commission is examining in two concurrent proceedings the retail regulatory framework applicable to the state's foremost ILECs, and the application of intrastate switched access charges. In the instant proceeding, the FCC is charged with examining impairment in the absence ofthe availability of Letter from Dee May, Verizon, to Marlene H. Dortch, FCC, WC Docket No. -

Vornado Realty Trust

SECURITIES AND EXCHANGE COMMISSION FORM 8-K Current report filing Filing Date: 2017-06-05 | Period of Report: 2017-06-05 SEC Accession No. 0001104659-17-037358 (HTML Version on secdatabase.com) FILER VORNADO REALTY TRUST Mailing Address Business Address 888 SEVENTH AVE 888 SEVENTH AVE CIK:899689| IRS No.: 221657560 | State of Incorp.:MD | Fiscal Year End: 0317 NEW YORK NY 10019 NEW YORK NY 10019 Type: 8-K | Act: 34 | File No.: 001-11954 | Film No.: 17889956 212-894-7000 SIC: 6798 Real estate investment trusts VORNADO REALTY LP Mailing Address Business Address 888 SEVENTH AVE 210 ROUTE 4 EAST CIK:1040765| IRS No.: 133925979 | State of Incorp.:DE | Fiscal Year End: 1231 NEW YORK NY 10019 PARAMUS NJ 07652 Type: 8-K | Act: 34 | File No.: 001-34482 | Film No.: 17889957 212-894-7000 SIC: 6798 Real estate investment trusts Copyright © 2017 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 8-K CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of Report (Date of earliest event reported): June 5, 2017 VORNADO REALTY TRUST (Exact Name of Registrant as Specified in Charter) Maryland No. 001-11954 No. 22-1657560 (State or Other (Commission (IRS Employer Jurisdiction of File Number) Identification No.) Incorporation) VORNADO REALTY L.P. (Exact Name of Registrant as Specified in Charter) Delaware No. 001-34482 No. 13-3925979 (State or Other (Commission (IRS Employer Jurisdiction of -

Round-The-Clock Shopping Returns As Macy's Brings

December 18, 2013 Round-the-Clock Shopping Returns as Macy’s Brings Back Its Overnight Hours at Select Stores Extended Store Hours and 24-Hour Shopping Starts Friday, Dec. 20 NEW YORK--(BUSINESS WIRE)-- Last minute holiday shoppers receive their Christmas presents early this year with the gift of extra time as Macy’s brings back its seasonal tradition, 24-hour shopping. Beginning Friday, Dec. 20 at 7 a.m., 37 Macy’s stores in select cities across the country including Macy’s Herald Square in New York City; Union Square in San Francisco; and State Street in Chicago will stay open overnight for four days in a row of non-stop shopping until Christmas Eve on Tuesday, Dec. 24 at 6 p.m. With a shorter shopping season, Macy’s customers will be able to enjoy 107 hours of ‘round- the-clock shopping to ensure that everyone on the list receives the very best gift. A customer service initiative since 2006, Macy’s 24-hour shopping is a holiday tradition that makes the season less hectic with stores remaining open all-night during the homestretch of the Christmas season. Less holiday crowds and shorter lines are an added bonus as Macy’s makes sure that time is on everyone’s side. In addition to the 24-hour stores, mostly all stores nationwide, except furniture galleries and select locations, will offer extended hours each night until 2 a.m. thru Dec. 23, making Macy’s the go-to store for gifting. “Overnight shopping at Macy’s has become a holiday tradition that last minute gift-givers count on to get them through the time crunch of the season,” said Peter Sachse, chief stores officer, Macy’s, Inc. -

Annual Report for the As a Result of the National Financial Environment, Throughout 2009, US Congress Calendar Year 2009, Pursuant to Section 43 of the Banking Law

O R K Y S T W A E T E N 2009 B T A ANNUAL N N E K M REPORT I N T G R D E P A WWW.BANKING.STATE.NY.US 1-877-BANK NYS One State Street Plaza New York, NY 10004 (212) 709-3500 80 South Swan Street Albany, NY 12210 (518) 473-6160 333 East Washington Street Syracuse, NY 13202 (315) 428-4049 September 15, 2010 To the Honorable David A. Paterson and Members of the Legislature: I hereby submit the New York State Banking Department Annual Report for the As a result of the national financial environment, throughout 2009, US Congress calendar year 2009, pursuant to Section 43 of the Banking Law. debated financial regulatory reform legislation. While the regulatory debate developed on the national stage, the Banking Department forged ahead with In 2009, the New York State Banking Department regulated more than 2,700 developing and implementing new state legislation and regulations to address financial entities providing services in New York State, including both depository the immediate crisis and avoid a similar crisis in the future. and non-depository institutions. The total assets of the depository institutions supervised exceeded $2.2 trillion. State Regulation: During 2009, what began as a subprime mortgage crisis led to a global downturn As one of the first states to identify the mortgage crisis, New York was fast in economic activity, leading to decreased employment, decreased borrowing to act on developing solutions. Building on efforts from 2008, in December and spending, and a general contraction in the financial industry as a whole. -

Crystal Reports

CALENDAR YEAR 2020 L-2-LIST ALPHABETICAL LISTING BY REPRESENTED ENTITIES DATE REPRESENTED ENTITY GOVERNMENTAL AFFAIRS AGENT COMPENSATION 02/16/2021 14-16 BURMA ROAD INDUSTRIAL LLC DBA SAK STRUCTURES LLC GENOVA BURNS LLC 0.00 02/11/2021 3M FOY PUBLIC AFFAIRS GROUP 50,000.00 02/16/20217-ELEVEN INC MBI GLUCKSHAW 65,000.10 02/04/2021 A PLACE FOR MOM PRINCETON PUBLIC AFFAIRS GROUP INC 60,000.00 02/02/2021 A PLACE FOR ROVER MERCURY PUBLIC AFFAIRS 90,000.00 02/16/2021AAA CLUBS OF NJ CAPITAL IMPACT GROUP 60,000.00 02/16/2021 ABBOTT LABORATORIES KOMJATHY & KEAN LLC 45,000.00 02/16/2021 ACCESS NJ MBI GLUCKSHAW 38,750.00 02/16/2021ACRA TURF CLUB LLC RIKER DANZIG SCHERER HYLAND & PERRETTI LLP 0.00 02/16/2021 ACREAGE HOLDINGS OPTIMUS PARTNERS LLC 184,086.00 02/23/2021 ACTIVE ACQUISITIONS MBI GLUCKSHAW 35,000.00 02/16/2021ACTIVE HOURS INC DBA EARNIN PRINCETON PUBLIC AFFAIRS GROUP INC 53,448.00 02/16/2021 ADOBE SYSTEMS INCORPORATED PRINCETON PUBLIC AFFAIRS GROUP INC 60,000.00 02/11/2021 ADT LLC DBA ADT SECURITY SERVICES PUBLIC STRATEGIES IMPACT LLC 33,000.00 02/12/2021ADTALEM GLOBAL EDUCATION VAN WAGNER GOVERNMENT AFFAIRS LLC 48,000.00 02/04/2021 ADVANCED BIOTECH CLB PARTNERS INC 88,000.00 02/16/2021 ADVOCATES FOR NJ HISTORY MBI GLUCKSHAW 3,500.00 02/16/2021AECOM MBI GLUCKSHAW 66,000.00 02/05/2021 ALLEGRO DEVELOPMENT COMPANY LLC ARCHER PUBLIC AFFAIRS LLC 1,980.00 02/11/2021 ALLIANCE OF BOYS & GIRLS CLUBS IN NJ PUBLIC STRATEGIES IMPACT LLC 37,624.98 02/10/2021ALLIANCE TO PREVENT LEGIONNAIRES DISEASE LEACH POLICY MANAGEMENT LLC 60,000.00 02/16/2021 ALTUS NJ LLC ADVOCACY & MANAGEMENT GROUP 19,500.00 This summary data reflects the information as reported on the Annual Lobbying reports covering calendar year 2020, received as of 5:00 p.m. -

Wayne Towne Center

WAYNE TOWNE CENTER WAYNE, NEW JERSEY Managed by Urban Edge Properties OPPORTUNITY AA VV AA II LL AA BB LL EE THE SPACE AVAILABLE LEVEL 2 23,426 SF POSSIBLE EXPANSION APPROX 4,000 SF AVAILABLE LEVEL 1 19,309 SF Wayne Towne Center is Northern NJ’s preeminent value-oriented lifestyle center boasting a lineup of today’s sought-after retailers. Popular dining complements the retail destination appeal and continued investment drives some of the highest repeat shopper visits in the market.* THE WAYNE, NEW JERSEY 295,294 5 MILE POPULATION ZIP CODE (07470) BOASTS Wayne Towne Center abuts Willowbrook Mall and is quickly accessed via heavily trafficked Routes 80, 23 and 46. 308,536 $4 BILLION 5 MILE DAYTIME POPULATION IN ANNUAL RETAIL SALES Shoppers across a 100+ square mile trade area $151,202 choose Wayne Towne Center because it’s easy to 3 MILE HHI get to, easy to park, has what they need, and keeps getting better. With a loyal customer base generating sales estimated to exceed $300M annually, your brand has nothing but opportunity at Wayne Towne Center. $4B retail sales within 5 miles, expenditure, demographic, traffic and visitation data sourced: SitesUSA, ESRI, Placer.ai respectively. WAYNE TOWNE CENTER 80 Route 23, Wayne, NJ 07470 URBAN EDGE PROPERTY WAYNE TOWNE CENTER OTHER TOTOWA 23 COMMONS WEST FALLS ® PLAZA 80 80 46 46 PLAZA SQUARE 23 WILLOWBROOK MALL WEST BELT PLAZA SUPERIOR ROADWAY ACCESS V V 13,925 As a top performing lifestyle offering, Wayne Towne Center offers ease of access from all major roadways and superior customer parking. -

Y\5$ in History

THE GARGOYLES OF SAN FRANCISCO: MEDIEVALIST ARCHITECTURE IN NORTHERN CALIFORNIA 1900-1940 A thesis submitted to the faculty of San Francisco State University A5 In partial fulfillment of The Requirements for The Degree Mi ST Master of Arts . Y\5$ In History by James Harvey Mitchell, Jr. San Francisco, California May, 2016 Copyright by James Harvey Mitchell, Jr. 2016 CERTIFICATION OF APPROVAL I certify that I have read The Gargoyles of San Francisco: Medievalist Architecture in Northern California 1900-1940 by James Harvey Mitchell, Jr., and that in my opinion this work meets the criteria for approving a thesis submitted in partial fulfillment of the requirements for the degree Master of Arts in History at San Francisco State University. <2 . d. rbel Rodriguez, lessor of History Philip Dreyfus Professor of History THE GARGOYLES OF SAN FRANCISCO: MEDIEVALIST ARCHITECTURE IN NORTHERN CALIFORNIA 1900-1940 James Harvey Mitchell, Jr. San Francisco, California 2016 After the fire and earthquake of 1906, the reconstruction of San Francisco initiated a profusion of neo-Gothic churches, public buildings and residential architecture. This thesis examines the development from the novel perspective of medievalism—the study of the Middle Ages as an imaginative construct in western society after their actual demise. It offers a selection of the best known neo-Gothic artifacts in the city, describes the technological innovations which distinguish them from the medievalist architecture of the nineteenth century, and shows the motivation for their creation. The significance of the California Arts and Crafts movement is explained, and profiles are offered of the two leading medievalist architects of the period, Bernard Maybeck and Julia Morgan. -

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT of NEW YORK Chapter 11 in Re

20-12097-scc Doc 393 Filed 12/28/20 Entered 12/28/20 14:40:51 Main Document Pg 1 of 6 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK Chapter 11 In re CENTURY 21 DEPARTMENT STORES LLC, Case No. 20-12097 (SCC) et al., Debtors.1 (Jointly Administered) ORDER APPROVING THE REJECTION OF CONTRACTS AND LEASES AND ABANDONMENT OF PROPERTY IN CONNECTION THEREWITH Pursuant to and in accordance with the Order Establishing Procedures for the Rejection of Executory Contracts and Unexpired Leases [Dkt. No. 97] (the “Rejection Procedures Order”);2 and the Court having jurisdiction over this matter pursuant to 28 U.S.C. §157 and 1334; and it appearing that this matter is a core proceeding pursuant to 28 U.S.C. § 157(b)(2); and it appearing that venue of these cases and this matter is proper pursuant to 28 U.S.C. §§ 1408 and 1409; and the Debtors having properly filed and served a “Sixth Notice of Rejection of Executory Contracts and/or Unexpired Leases” [Dkt. No. 311] (the “ Sixth Rejection Notice”) in accordance with the terms of the Rejection Procedures Order in respect of the rejection of the executory contracts (the “Contracts”) and/or unexpired leases (the “Leases”) set forth on Exhibit 1 hereto; and no timely objections having been filed to the rejection of the Contracts and Leases; and it appearing that due and adequate notice of the Rejection Procedures Order and the 1 The Debtors in these chapter 11 cases (the “Chapter 11 Cases”), along with the last four digits of each Debtor’s federal tax identification number, as applicable, are Century 21 Department Stores LLC (4073), L.I. -

Optiplus New York State Provider List 11

Sheet1 ALBANY BRONX KINGS Albany Bronx Brooklyn Sterling Optical Sterling Optical Cohen's Fashion Optical Crossgates Mall 2168 White Plains Road 189 Montague Street 120 Washington Avenue Ext. (718) 931-0500 (718) 855-2333 (518) 456-4151 BERGEN BRONX KINGS Paramus Bronx Brooklyn Lens Lab Express of Paramus Vision Quest Optical Lens Lab Express 193 Route 17 South 880 White Plains Road 482 86th St (201) 368 -1916 (718) 239-9389 (718) 921-5488 BERGEN BRONX KINGS Bergenfield Bronx Brooklyn New Jersey Eye Center Cohen's Fashion Optical Lens Lab Express of Flatbush 1 North Washington Ave. 3416 Jerome Avenue 972 Flatbush Avenue (201) 384-7333 (718) 325-3160 (718) 826-0005 BRONX BRONX KINGS Bronx Bronx Brooklyn General Vision of Lincoln Optic Zone Lens Lab Express of Graham Avenue Hospital 2882 Third Avenue 28 Graham Ave 234 East 149th Street (718) 402-8300 (718) 486-0117 Room 2-A3 (718) 665-0611 BRONX BRONX KINGS Bronx Bronx Brooklyn Bronx Eyecare Bronx Eye Care Family Vision Center 2374 Grand Concourse 5571 Broadway 1023 Church Avenue (718) 365-6300 (718) 543-2020 (718) 826-1234 BRONX KINGS KINGS Bronx Brooklyn Brooklyn Bronx Eyecare General Vision of Flatbush Vogue Optical 2075 Bartow Avenue 2504 Flatbush Ave 3723 Nostrand Ave (718) 671-5666 (718) 253-7700 (718) 646-6200 BRONX KINGS KINGS Bronx Brooklyn Brooklyn Bronx Eyecare General Vision of Court Street Fulton Vision Center 940 Southern Boulevard 66 Court Street 519 Fulton Street (718) 328-7137 (718) 625-0025 (718) 852-7906 KINGS CAMDEN ESSEX Brooklyn Haddon Heights Irvington Mega Vision Center Dr.