Rotary: an Essential Cog for RCS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SP's Airbuz 4 of 2010

SP’s RS: 100.00 (INDIA-BASED BUYER ONLY) An Exclusive Magazine on Civil A viation from India www.spsairbuz.net Issue: 4/2010 CORPORATE SPONSOR OF ATM-AIRPORTS-AIRLINES: INDIA INITIATIVE FOR INFRASTRUCTURE AIR TRAFFIC MANAGEMENT Deliberations INTERVIEW: S.R. RAGHAVENDRA RAO OF AAI AIR SPACE MANAGEMENT AN SP GUIDE PUBLICATION PLUS IGRUA: THE BEST FLYING TRAINING INSTITUTE INTERVIEW: TONY FERNANDES OF AIRASIA RNI NUMBER: DELENG/2008/24198 Innovative networked solutions are key to solving today’s – and tomorrow’s – challenges. As a trusted partner and integrator of complex technologies, ITT has the expertise to create sophisticated systems that work together seamlessly. From air traffic management and electronic warfare to tactical communications and night vision systems, ITT offers an array of capabilities to answer every need. All this adds up to one result – your mission’s success. For more information, visit ittdefenceindia.com. Air traffic management solutions for India. E L E C T R O N I C S Y S T E M S • G E O S P A T I A L S Y S T E M S • I N F O R M A T I O N S Y S T E M S ITT, the Engineered Blocks logo, and ENGINEERED FOR LIFE are registered trademarks of ITT Manufacturing Enterprises, Inc., and are used under license. ©2010, ITT Corporation. Table of Contents SP’s RS: 100.00 (INDIA-BASED BUYER ONLY) An Exclusive Magazine on Civil A viation from India www.spsairbuz.net Issue: 4/2010 Cover: CORPORATE SPONSOR OF ATM-AIRPORTS-AIRLINES: INDIA INITIATIVE FOR INFRASTRUCTURE With air travel having become less expensive, the problem of AIR air space management has TRAFFIC Lead Story MANAGEMENT acquired greater importance Deliberations INTERVIEW: S.R. -

Recent Trend in Indian Air Transport with Reference to Transport Economics and Logistic

© 2019 JETIR June 2019, Volume 6, Issue 6 www.jetir.org (ISSN-2349-5162) Recent Trend in Indian Air Transport with Reference to Transport Economics and Logistic Dr Vijay Kumar Mishra, Lecturer (Applied Economics), S.J.N.P.G College, Lucknow Air transport is the most modern means of transport which is unmatched by its speed, time- saving and long- distance operation. Air transport is the fastest mode of transport which has reduced distances and converted the world into one unit. But it is also the costliest mode of transport beyond the reach of many people. It is essential for a vast country like India where distances are large and the terrain and climatic conditions so diverse. Through it one can easily reach to remote and inaccessible areas like mountains, forests, deserts etc. It is very useful during the times of war and natural calamities like floods, earthquakes, famines, epidemics, hostility and collapse of law and order. The beginning of the air transport was made in 1911 with a 10 km air mail service between Allahabad and Naini. The real progress was achieved in 1920 when some aerodromes were constructed and the Tata Sons Ltd. started operating internal air services (1922). In 1927 Civil Aviation Department was set up on the recommendation of Air Transport Council. Flying clubs were opened in Delhi, Karachi, Calcutta (now Kolkata) and Bombay (now Mumbai) in 1928. In 1932 Tata Airways Limited introduced air services between Karachi and Lahore. In 1932, Air India began its journey under the aegis of Tata Airlines, a division of Tata Sons Ltd. -

The-Recitals-October-2020-Vajiram.Pdf

PERSONALCOPY NOT FOR SALE OR CIRCULATION VAJIRAM & RAVI The Recitals Explore Current Affairs Through Q&A (October 2020) VAJIRAM & RAVI (INSTITUTE FOR IAS EXAMINATION) (A unit of Vajiram & Ravi IAS Study Centre LLP) 9-B, Bada Bazar Marg, OLD RAJINDER NAGAR NEWDELHI-110060 Ph.: (011) 41007400, (011) 41007500 Visitusat: www.vajiramandravi.com No part of this publication may be reproduced or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, or stored in any retrieval system of any nature without the written permission of the copyright holder and the publisher, application for which shall be made to the publisher. © VAJIRAM & RAVI IAS STUDY CENTRE LLP VAJIRAM & RAVI (INSTITUTE FOR IAS EXAMINATION) (A unit of Vajiram & Ravi IAS Study Centre LLP) 9-B, Bada Bazar Marg, Old Rajinder Nagar, New Delhi 110060 Phone No: (011) 41007400, (011) 41007500 Visitusat: www.vajiramandravi.com Printed at: SURYA GROUP Ph.:7503040594 Email: [email protected] INDEX Message From The Desk Of Director 1 1. Feature Article 2-11 a. Corporatisation of Ordnance Factory Board b. Labour Laws 2. Mains Q&A 12-29 3. Prelims Q&A 30-74 4. Bridging Gaps 75-137 1. Narco And Polygraph Tests 2. Target Rating Point (TRP) 3. SVAMITVA Scheme 4. Tech For Tribals 5. Star Campaigner 6. Election Symbols 7. Committee on Candidate Election Expenditure 8. New Land Laws For Jammu And Kashmir 9. General Consent To CBI 10. DAY-NRLM in J&K 11. Cost Of A Plate Of Food Report 12. Leaves for Single Male Parent VAJIRAM AND RAVI The Recitals (October 2020) 13. -

Chapter 3 1 2

Cover Page The handle http://hdl.handle.net/1887/44409 holds various files of this Leiden University dissertation Author: George, Moses Title: Legal implications of airport privatization in India Issue Date: 2016-11-24 Chapter 3.1.2 Chapter 3 Topic I: Monopoly and Privatization Research Paper 3 Public Monopoly to Private Monopoly - A Case Study of Greenfield Airport Privatization in India – Part II Published in Issues in Air Law and Policy, Volume 9, Spring 2010, No 2 55 Chapter 3.1.2 Public Monopoly to Private Monopoly – A Case Study of Greenfield Airport Privatization in India – Part II by Moses George Introduction The first two privatization ventures in the airport infrastructure sector in India were greenfield airports in Bangalore and Hyderabad. Consequent to the opening of these new airports, the existing airports in these cities (HAL Airport in Bangalore, Begumpet Airport in Hyderabad) were closed in accordance with conditions set forth in the concession agreements between the Government of India (GoI) and the new airport operators. In this context, this article examines various legal and commercial issues related to closing of the old airports in Bangalore and Hyderabad and the monopoly created thereby. This article consists of two parts. Part I, which discussed issues related to the legal and policy framework, the concession agreements, the Airports Authority of India Act 1994,1 and the notification regarding closure of the old airports, appeared in the previous issue of this journal.2 Part II deals with issues related to other aviation laws, the Constitution of India, competition law, the public interest, and other factors. -

List of Indian Aviation Disasters with Loss of 20 Or More Lives

WORST AVIATION ACCIDENTS INVOLVING INDIA AND INDIA-BASED AIRCRAFT All accidents resulting in 20 or more deaths Date Location Aircraft Deaths Remarks Cause 11-12-1996 Haryana state Saudia B 747, 349 Incl 312 on B 747 Mid-air collision. Kazakh crew Kazakh IL-76 and 37 on IL-76 blamed. Insufficient facilities at Delhi airport. 23-06-1985 Atlantic, off Air India B 747 329 Bomb explosion. Errors in Ireland baggage checking. 2 killed in related incident in Tokyo. 01-01-1978 Off Mumbai Air India B 747 213 Instrument failure and pilot error just after takeoff. 22-05-2010 Mangalore Air India Exp B 737 158 8 surv. Overshot due to pilot error. 19-10-1988 Ahmedabad IA B 737 133 2 surv. Undershot due to pilot error. 24-01-1966 Mont Blanc, Air India B 707 117 Navigation error while landing France at Geneva. Dr Homi Bhabha among dead. 07-02-1968 Himachal IAF AN-12 98 Hit mountain in snowstorm. Pradesh Wreckage found in 2003. 13-10-1976 Mumbai IA Caravelle 95 Engine fire just after takeoff. Maintenance blamed, also crew did not cope correctly. 07-07-1962 NE of Alitalia DC-8 94 Crashed on high ground, Mumbai pilot error while approaching Mumbai. 14-02-1990 Bangalore IA A320 92 54 surv. Failure of controls, pilots blamed for reacting wrongly. 14-06-1972 Near Delhi JAL DC-8 90 Incl 4 on ground, Approached too low, pilot 3 surv. error. 19-11-1978 Leh IAF AN-12 78 Incl 1 on ground Flaps failure on approach. -

Shri Ved Prakash & Shri R. K. Bahuguna Elected As

ISSUE 64, MARCH-APRIL, 2017 CELEBRATING (10th April, 2017 - 16th April, 2017) HON’BLE PRESIDENT TO ADDRESS THE 8TH PUBLIC SECTOR DAY ON 11TH APRIL, 2017 Shri Ved Prakash & Shri R. K. Bahuguna Elected as Chairman & Vice Chairman of SCOPE Shri Ved Prakash Shri R. K. Bahuguna CMD, MMTC Ltd. CMD, RAILTEL Corp. MARCH-APRIL, 2017 SCOPE NEWS Shri Ved Prakash & Shri R. K. Bahuguna Elected as Chairman & Vice Chairman of SCOPE Shri Ved Prakash Shri R. K. Bahuguna CMD, MMTC Ltd. CMD, RAILTEL Corp. allot papers received from Constituent PSEs for the SCOPE Mr. Deepak Kumar Hota, CMD, BEML; Mr. D.R. Sarin, CMD, ALIMCO; BElections 2017-19 for Chairman, Vice-Chairman and Members of Mr. Ravi P. Singh, Director (Personnel), Power Grid Corporation; Mr. the SCOPE Executive Board were counted and results were declared Saptarshi Roy, Director (HR), NTPC; Mr. D.D. Misra, Director (HR), ONGC; on 28th March 2017 in the presence of authorized representatives Mr. Rajeev Bhardwaj, Director (HR), SECI; Mr. R.K. Gupta, CMD, WAPCOS from PSEs and Contestants. Limited; Mr. R.K. Sinha, Director (HR), NTC; Mr. Deependra Singh, CMD, IREL; Mr. Kishor Rungta, Director (Finance), ECIL; Dr. Sanjay Kumar, Dr. U.D. Choubey, Director General, SCOPE and Returning Officer Director (HR), WCL; Dr. B.P. Sharma, CMD, Pawan Hans Limited; Cmde declared the results. A.N. Sonsale, CMD, NEPA Ltd.; Dr. H. Purushotham, CMD, NRDC; Following are the results: Mr. D.S. Sudhakar Ramaiah, Director (Finance) & CMD, PDIL; and Chairman: Mr. Ved Prakash, CMD, MMTC Ltd. Mr. Anupam Anand, Director (Personnel), Hindustan Copper Limited. -

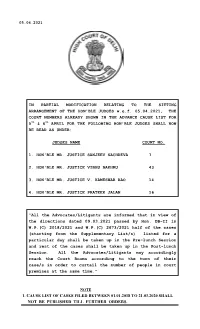

1. Cause List of Cases Filed Between 01.01.2018 to 21.03.2020 Shall Not Be Published Till Further Orders

05.04.2021 IN PARTIAL MODIFICATION RELATING TO THE SITTING ARRANGEMENT OF THE HON'BLE JUDGES w.e.f. 05.04.2021, THE COURT NUMBERS ALREADY SHOWN IN THE ADVANCE CAUSE LIST FOR 5th & 6th APRIL FOR THE FOLLOWING HON'BLE JUDGES SHALL NOW BE READ AS UNDER: JUDGES NAME COURT NO. 1. HON'BLE MR. JUSTICE SANJEEV SACHDEVA 7 2. HON'BLE MR. JUSTICE VIBHU BAKHRU 43 3. HON'BLE MR. JUSTICE V. KAMESWAR RAO 14 4. HON'BLE MR. JUSTICE PRATEEK JALAN 16 “All the Advocates/Litigants are informed that in view of the directions dated 09.03.2021 passed by Hon. DB-II in W.P.(C) 2018/2021 and W.P.(C) 2673/2021 half of the cases (starting from the Supplementary List/s) listed for a particular day shall be taken up in the Pre-lunch Session and rest of the cases shall be taken up in the Post-lunch Session. All the Advocates/Litigants may accordingly reach the Court Rooms according to the turn of their case/s in order to curtail the number of people in court premises at the same time.” NOTE 1. CAUSE LIST OF CASES FILED BETWEEN 01.01.2018 TO 21.03.2020 SHALL NOT BE PUBLISHED TILL FURTHER ORDERS. HIGH COURT OF DELHI: NEW DELHI No. 384/RG/DHC/2020 DATED: 19.3.2021 OFFICE ORDER HON'BLE ADMINISTRATIVE AND GENERAL SUPERVISION COMMITTEE IN ITS MEETING HELD ON 19.03.2021 HAS BEEN PLEASED TO RESOLVE THAT HENCEFORTH THIS COURT SHALL PERMIT HYBRID/VIDEO CONFERENCE HEARING WHERE A REQUEST TO THIS EFFECT IS MADE BY ANY OF THE PARTIES AND/OR THEIR COUNSEL. -

Tender Statistics for the Month of August

Tender Statistics for the Month of August - 2019 (Organisations Using their Own eProcurement Systems , Non NIC eProcurement Solutions) Tender Information of Current Month Cumulative Details(From Inception) Sl # Value # Cancelled # # Awards Awarded # Tenders Value # Awards Awarded Organization No. Tenders(Incl. (in Rs. cr) Corrigendums Value (in Rs. cr) Value Cancelled) (in Rs. cr) (in Rs. cr) 1 Ministry of Railways 35785 15965.56 0 0 0 0 1940430 611108.57 48438 13853.22 2 Central Public Works 2572 1296.85 61 268 2 0.04 252833 67581.68 1248 0.33 Department (CPWD) 3 Hindustan Petroleum 1306 0 0 170 355 165.04 57043 0 46541 33477.24 Corporation Limited 4 Bharat Petroleum 1157 0 0 181 49 139.35 59949 2183.7 6074 232600.37 Corporation Limited 5 Directorate of Purchase and 845 0 0 0 0 0 19855 0 0 0 Stores, DAE 6 NTPC Limited 813 2.22 0 1 0 0 106493 1976.97 72849 96715.72 7 Nuclear Power Corporation 506 2459.56 0 0 139 1179.94 60210 7216.99 34468 8545.35 of India Ltd 8 BHEL Bhopal 494 0 0 17 0 0 4128 0 0 0 9 Steel Authority of India Ltd 462 0 3 50 0 0 5088 0 0 0 10 Bharat Heavy Electricals 320 0 0 19 0 0 24258 130.27 0 0 Limited, Hyderabad 11 Neyveli Lignite Corporation 259 0 0 2 230 17.6 20901 0 16396 2175.17 Limited 12 Oil and Natural Gas 209 0 0 0 0 0 17317 0 0 0 Corporation Limited 13 GAIL India Limited 158 0 0 15 24 238.04 9122 0 2670 11809.89 14 Heavy Electrical Equipment 154 0 0 0 0 0 2099 0 0 0 Plant 15 Balmer Lawrie and Company 154 0 1 26 0 0 12631 0 413 69.64 Limited 16 High Pressure Boiler plant, 148 45.99 0 5 0 0 1516 2990.42 0 0 -

We Want to Continue Innovating, Finding Newer Ways to Delight Our Customers and Redefine Air Travel.” — LESLIE THNG, CHIEF EXECUTIVE OFFICER, VISTARA

FIRST BIOFUEL CIVIL AIRCRAFT SHOW POWERED FLIGHT MANUFACTURING REPORT: IN INDIA IN INDIA FIA 2018 P 11 P 16 P 22 AUGUST-SEPTEMBER 2018 `100.00 (INDIA-BASED BUYER ONLY) VOLUME 11 • ISSUE 4 WWW.SPSAIRBUZ.COM ANAIRBUZ EXCLUSIVE MAGAZINE ON CIVIL AVIATION FROM INDIA EXCLUSIVE PAGE 8 “we wANT TO CONTINUE INNOVATING, FINDING NEWER WAYS TO DELIGHT OUR CUSTOMERS AND REDEFINE AIR TRAvel.” — LESLIE THNG, CHIEF EXECUTIVE OFFICER, VISTARA AN SP GUIDE PUBLICATION RNI NUMBER: DELENG/2008/24198 TABLE OF CONTENTS EXCLUSIVE COVER STORY / INTERVIEW P8 “we’re not chasing the COMPETITION, BUT CREATING A Cover: FIRST BIOFUEL CIVIL AIRCRAFT SHOW “Vistara has naturally inherited POWERED FLIGHT MANUFACTURING REPORT: IN INDIA IN INDIA FIA 2018 UNIQUE SPACE FOR OURSELVES IN P 11 P 16 P 22 very strong values and stands the market” AUGUST-SEPTEMBER 2018 `100.00 (INDIA-BASED BUYER ONLY) VOLUME 11 • ISSUE 4 committed to delivering WWW.SPSAIRBUZ.COM ANAIRBUZ EXCLUSIVE MAGAZINE ON CIVIL AVIATION FROM INDIA EXCLUSIVE In an exclusive interview with Jayant customer-centricity at every PAGE 8 “WE WANT touchpoint,”says Leslie Thng, TO CONTINUE Baranwal, Editor-in-Chief of SP’s INNOVATING, FINDING CEO, Vistara, in an exclusive NEWER WAYS AirBuz, Leslie Thng, Chief Executive TO DELIGHT OUR CUSTOMERS with SP’s AirBuz. AND REDEFINE AIR TRAVEL.” Officer of Vistara shares his optimism — LESLIE THNG, CHIEF EXECUTIVE OFFICER, Cover Photograph: VISTARA AN SP GUIDE PUBLICATION and outlines his vision and plans for Vistara RNI NUMBER: DELENG/2008/24198 the future growth of the airlines. SP's AirBuz Cover 4-2018.indd 1 18/09/18 4:43 PM POLICY / AIR INDIA P14 AIR INDIA DISINVESTMENT Debate on Air India disinvestment though, has been on for over two decades and the failed attempt at disinvestment earlier this year, was an anticlimactic episode in the ongoing saga. -

CAA WEEK 4 October, 2020.Indd

Disclaimer The current affairs articles are segregated from prelims and mains perspective, such separation is maintained in terms of structure of articles. Mains articles have more focus on analysis and prelims articles have more focus on facts. However, this doesn’t mean that Mains articles don’t cover facts and PT articles can’t have analysis. You are suggested to read all of them for all stages of examination. CURRENT AFFAIRS ANALYST WEEK- 4 (OCTOBER, 2020) CONTENTS Section - A: MAINS CURRENT AFFAIRS Area of GS Topics in News Page No. Bangladesh’s economic rise & its implications on India 02 ECONOMY Is transparent taxation the panacea for tax terrorism? 04 Potholes on the digital payment superhighway 06 ETHICS Ethos of Justice and Its Adversaries 08 INTERNATIONAL India-US Defence Deals 10 RELATIONS Section - B: PRELIMS CURRENT AFFAIRS Area of GS Topics in News Page No. BIODIVERSITY Zoological Survey of India lists 62 species of skinks 14 Global Hunger Index 2020 15 ECONOMY IFSCA releases framework for regulatory sandbox 16 India’s fi rst seaplane service to begin 31 October 17 Aldabra’s coral reefs recovered faster from bleaching, 18 ENVIRONMENT fi nds new research Conservation of the world’s seagrasses 20 GEOGRAPHY Hyderabad rainiest place in India 22 China Passes Export Law To Protect National Security, 23 Technology INTERNATIONAL RELATIONS Israel and Bahrain establish formal diplomatic relations 25 Pakistan, China re-elected to UNHRC 25 ********** SECTION: A (MAINS) CURRENT AFFAIRS CURRENT AFFAIRS WEEK - 4 (OCTOBER, 2020) WEEKLY BANGLADESH’S ECONOMIC RISE & ITS IMPLICATIONS ON INDIA CONTEXT (C-DAC), Mohali at Guru AngadDev Veterinary University (GADVASU), Ludhiana. -

Corporate Plan

Pawan Hans Limited Corporate Plan 2015 Pawan Hans Tower, C-14, Sec -1, Noida, U.P. Corporate Planning & Management System Corporate Planning & Management System Preface India’s civil aviation market is among the fastest growing in the world, but helicopter use remains very limited. From the time, the first civil helicopter flown in India in November 1953 and up to year 1986 the commercial use of helicopters in India remains limited to small aviation activity involved in communication and crop spraying. The formation of the Pawan Hans Limited in 1986 provided the first boost to the civil helicopter industry in India, which now holds and operates the largest fleet in the country with a defined mandate “To become a market leader in Helicopters and Sea Plane services, to provide regional connectivity through small fixed Wing Aircrafts operations and provide repair/ overhaul services at par with international standards.” Today, there are approximately 277 civil registered helicopters in the country, out of which only about 92 helicopters are in commercial business. However, these numbers are woefully inadequate when compared with the world population of civil helicopters. As per the HAI statistics, out of a total world civil helicopter population of 35,000 India accounts for less than one per cent. In fact, India currently has fewer civil helicopters than even Switzerland. Brazil – a developing country like ours – the city of Sao Paulo (similar to Bombay and Delhi) itself has about 750 helicopters. Despite of these above statistics, the market and industry remains optimistic about the Indian Civil helicopter Industry. Accordingly, Pawan Hans has developed a Corporate Plan as strategic vision document–2020 to meet the challenges in all facets of organizational growth led to business expansion in terms of fleet size; improve productivity, increase prosperity, skill development and development of Heliports under Heli-Hubs concept. -

Global Vectra AR-2011.P65

BOARD OF DIRECTORS Lt.Gen.(Retd.) SJS Saighal (Chairman) Mr. Ravinder Kumar Rishi (Non-Executive Director) Mr. P. Raj Kumar Menon (Whole-time Director) Mr. R.S.S.L.N. Bhaskarudu (Independent Director) Dr. Gautam Sen (Independent Director) Maj.Gen.(Retd.) Gurdial Singh Hundal (Independent Director) Dr. Chandrathil Gouri Krishnadas Nair (Independent Director) COMPANY SECRETARY Mr.Raakesh D.Soni AUDITORS B S R & Co. Chartered Accountants BANKERS The Royal Bank of Scotland N.V. Axis Bank Limited Standard Chartered Bank HDFC Bank Limited REGISTERED OFFICE A-54, Kailash Colony, New Delhi – 110 048 Tel. No.:-91-11-2923 5035 Fax No.:-91-11-2923 5033 CORPORATE OFFICE CONTENTS Hanger No. C-He / Hf, Airports Authority of India, Notice 01 Civil Aerodrome, Juhu, Directors’ Report 04 Mumbai – 400 054 Tel. No.:-91-22-6140 9200 Management Discussion 06 Fax No.:-91-22-6140 9253 and Analysis Report REGISTRAR & TRANSFER AGENTS Report on Corporate Governance 09 Report of the Auditors 17 Link Intime India Private Limited C-13, Pannalal Silk Mills Compound, Balance Sheet 20 L.B.S. Marg, Bhandup (W), Mumbai – 400 078 Profit and Loss Account 21 Tel No.:-91-22-2596 3838 Cash Flow Statement 22 Accounting Policies 24 Schedules Forming Parts of the Accounts 27 Balance Sheet Abstract and Company’s 44 General Business Profile 111333th Annual Report 2010-2011 Global Vectra Helicorp Limited NOTICE notwithstanding the fact that such remuneration is in excess of the statutory ceiling specified in this regard The Thirteen ANNUAL GENERAL MEETING of the Global as in force and amended from time to time and Vectra Helicorp Limited will be held on the Friday, 23rd day necessary approval of the Central Government will be of September, 2011 at 1.30 p.