Important Notice

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Logistics Capacity Assessment

LCA – Liberia Version 1.05 Logistics Capacity Assessment LIBERIA Country Name Liberia Official Name Republic of Liberia Assessment Assessment Dates: From 7th November 2009 To 3rd December 2009 Name of the Assessors Thierry Schweitzer assisted by Mårten Kihlström Title Consultant [email protected] & [email protected] Email contact GLCSC Rome: [email protected] 1//88 LCA – Liberia Version 1.05 1. Table of Contents 1. Table of Contents ...................................................................................................................................... 2 2. Country Profile .......................................................................................................................................... 3 2.1. Introduction & Background ................................................................................................................ 3 2.2. Humanitarian Background ................................................................................................................. 6 2.3. Contact List – NGO‟s ....................................................................................................................... 11 2.4. National Regulatory Departments ................................................................................................... 14 2.5. Customs Information ....................................................................................................................... 15 3. Logistics Infrastructure ........................................................................................................................... -

Minmap Region Du Littoral Synthese Des Donnees Sur La Base Des Informations Recueillies

MINMAP REGION DU LITTORAL SYNTHESE DES DONNEES SUR LA BASE DES INFORMATIONS RECUEILLIES Nbre de N° Désignation des MO/MOD Montant des Marchés N° page Marchés 1 Communauté Urbaine de de Douala 94 89 179 421 671 3 2 Communité Urbaine d'édéa 5 89 000 000 14 3 Communité Urbaine de Nkongsamba 6 198 774 344 15 4 Services déconcentrés Régionaux 17 718 555 000 16 Département du Moungo 5 Services déconcentrés départementaux 5 145 000 000 18 6 Commune de BARE BAKEM 2 57 000 000 18 7 Commune de BONALEA 3 85 500 000 19 8 Commune de DIBOMBARI 3 105 500 000 19 9 Commune de LOUM 16 445 395 149 19 10 Commune de MANJO 8 132 000 000 21 11 Commune de MBANGA 3 108 000 000 22 12 Commune de MELONG 12 173 500 000 22 13 Commune de NJOMBE PENJA 5 132 000 000 24 14 Commune d'EBONE 12 299 500 000 25 15 Commune de MOMBO 3 77 000 000 26 16 Commune de NKONGSAMBA I 1 27 000 000 26 17 Commune de NKONGSAMBA II 3 59 250 000 27 18 Commune de NKONGSAMBA III 2 87 000 000 27 TOTAL Département 78 1 933 645 149 Département du Nkam 19 Services déconcentrés départementaux 12 232 596 000 28 20 Commune de NKONDJOCK 16 258 623 000 29 21 Commune de YABASSI 14 221 000 000 31 22 Commune de YINGUI 4 53 500 000 33 23 Commune de NDOBIAN 17 345 418 000 33 TOTAL Département 63 1 111 137 000 Département de la Sanaga Maritime 24 Services déconcentrés départementaux 8 90 960 000 36 25 Commune de Dibamba 3 72 000 000 37 26 Commune de Dizangue 5 88 500 000 37 27 Commune de MASSOCK 4 233 230 000 38 28 Commune de MOUANKO 15 582 770 000 38 29 Commune de NDOM 12 339 237 000 40 Nbre de N° Désignation -

Shelter Cluster Dashboard NWSW052021

Shelter Cluster NW/SW Cameroon Key Figures Individuals Partners Subdivisions Cameroon 03 23,143 assisted 05 Individual Reached Trend Nigeria Furu Awa Ako Misaje Fungom DONGA MANTUNG MENCHUM Nkambe Bum NORD-OUEST Menchum Nwa Valley Wum Ndu Fundong Noni 11% BOYO Nkum Bafut Njinikom Oku Kumbo Belo BUI Mbven of yearly Target Njikwa Akwaya Jakiri MEZAM Babessi Tubah Reached MOMO Mbeggwi Ngie Bamenda 2 Bamenda 3 Ndop Widikum Bamenda 1 Menka NGO KETUNJIA Bali Balikumbat MANYU Santa Batibo Wabane Eyumodjock Upper Bayang LEBIALEM Mamfé Alou OUEST Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Fontem Nguti KOUPÉ HNO/HRP 2021 (NW/SW Regions) Toko MANENGOUBA Bangem Mundemba SUD-OUEST NDIAN Konye Tombel 1,351,318 Isangele Dikome value Kumba 2 Ekondo Titi Kombo Kombo PEOPLE OF CONCERN Abedimo Etindi MEME Number of PoC Reached per Subdivision Idabato Kumba 1 Bamuso 1 - 100 Kumba 3 101 - 2,000 LITTORAL 2,001 - 13,000 785,091 Mbongé Muyuka PEOPLE IN NEED West Coast Buéa FAKO Tiko Limbé 2 Limbé 1 221,642 Limbé 3 [ Kilometers PEOPLE TARGETED 0 15 30 *Note : Sources: HNO 2021 PiN includes IDP, Returnees and Host Communi�es The boundaries and names shown and the designations used on this map do not imply official endorsement or acceptance by the United Nations Key Achievement Indicators PoC Reached - AGD Breakdouwn 296 # of Households assisted with Children 27% 26% emergency shelter 1,480 Adults 21% 22% # of households assisted with core 3,769 Elderly 2% 2% relief items including prevention of COVID-19 21,618 female male 41 # of households assisted with cash for rental subsidies 41 Households Reached Individuals Reached Cartegories of beneficiaries reported People Reached by region Distribution of Shelter NFI kits integrated with COVID 19 KITS in Matoh town. -

CAMEROON Perspectives on Food Security October 2020 to May 2021 Food Security Improved in the Far North, but Worsened in the Northwest and Southwest

CAMEROON Perspectives on food security October 2020 to May 2021 Food security improved in the Far North, but worsened in the Northwest and Southwest KEY MESSAGES • Despite the recent surge in attacks by Boko Haram, and Current food security situation, October 2020 excessive rainfall leading to flooding in some locations in the Far North, ongoing new harvests have improved food security for many poor households that currently subsist on their own harvests. The harvest of rainfed grains from the primary agricultural campaign in 2020 is estimated to be average, due to favorable weather conditions. Slightly lower than average production is expected in the Logone-et-Chari, Mayo Sava, and Mayo Tsanga departments, where Boko Haram is most active, as well as in locations where harvests were lost to flooding. • Current prices at the primary markets in the Far North appear stable or are decreasing. Since July 2020, staple food prices have increased above typical levels. Sorghum and maize are selling at 46 to 60 percent, and 30 to 47 percent higher (respectively) than in July 2019. Although current prices are still above average, sorghum and groundnut prices have decreased by 17 percent and 18 percent as compared to the Source: FEWS NET previous three months. FEWS NET classification is IPC-compatible (Integrated Phase Classification). IPC-compatible analysis follows key IPC protocols but • In the Northwest and Southwest regions, where agricultural does not necessarily reflect the consensus of national food security production was lower than average for four consecutive years partners. due to ongoing socio-political conflicts, this year's harvests are running out earlier than usual. -

Results of Railway Privatization in Africa

36005 THE WORLD BANK GROUP WASHINGTON, D.C. TP-8 TRANSPORT PAPERS SEPTEMBER 2005 Public Disclosure Authorized Public Disclosure Authorized Results of Railway Privatization in Africa Richard Bullock. Public Disclosure Authorized Public Disclosure Authorized TRANSPORT SECTOR BOARD RESULTS OF RAILWAY PRIVATIZATION IN AFRICA Richard Bullock TRANSPORT THE WORLD BANK SECTOR Washington, D.C. BOARD © 2005 The International Bank for Reconstruction and Development/The World Bank 1818 H Street NW Washington, DC 20433 Telephone 202-473-1000 Internet www/worldbank.org Published September 2005 The findings, interpretations, and conclusions expressed here are those of the author and do not necessarily reflect the views of the Board of Executive Directors of the World Bank or the governments they represent. This paper has been produced with the financial assistance of a grant from TRISP, a partnership between the UK Department for International Development and the World Bank, for learning and sharing of knowledge in the fields of transport and rural infrastructure services. To order additional copies of this publication, please send an e-mail to the Transport Help Desk [email protected] Transport publications are available on-line at http://www.worldbank.org/transport/ RESULTS OF RAILWAY PRIVATIZATION IN AFRICA iii TABLE OF CONTENTS Preface .................................................................................................................................v Author’s Note ...................................................................................................................... -

Impact Assessment on By-Catch Artisanal Fisheries: Sea Turtles And

quac d A ul n tu a r e s e J i o r u e r h n Ayissi and Jiofack, Fish Aquac J 2014, 5:3 s i a F l Fisheries and Aquaculture Journal DOI: 10.4172/ 2150-3508.1000099 ISSN: 2150-3508 Research Article Open Access Impact Assessment on By-catch Artisanal Fisheries: Sea Turtles and Mammals in Cameroon, West Africa Ayissi I1,2,3,4,* and Jiofack TJE5 1University of Abdelmalek Essaâdi, Department of Biology, Faculty of Science, Tetouan 2121, Morocco 2Cameroon Marine Biology Association, Morocco 3Specialized Research Center for Marine Ecosystems in Kribi-Cameroon, Cameroon 4Institute of Fisheries and Aquatic Sciences (ISH) at Yabassi, University of Douala, PO Box 2701, Douala, Cameroon 5 Sub-Regional School and Postdoctoral Water Development and Integrated Management of Forests and Tropical Territories, Kinshasa, RDC, Congo *Corresponding author: Ayissi I, University of Abdelmalek Essaâdi, Department of Biology, Faculty of Science, Tetouan 2121, Morocco, Tel: +237 97350175; E-mail: [email protected] Received date: January 20, 2014; Accepted date: July 09, 2014; Published date: July 16, 2014 Copyright: © 2014 Ayissi I, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. Abstract The by-catch assessment has been carried out along Cameroon coastline to map artisanal fishing effort and quantify impact of by-catch on sea turtles and marine mammals during three months from June to September 2011 and specific objectives include: - To interview fishermen in various fishing villages or ports in Cameroon regarding fishing effort and catch. -

2.3M 1.4M 679K 204K 58.1K

CAMEROON: North-West and South-West Situation Report No. 19 As of 31 May 2020 This report is produced by OCHA Cameroon in collaboration with humanitarian partners. It covers 1 – 31 May 2020. The next report will be issued in July 2020. MAY 2020 HIGHLIGHTS • An estimated 83,557 pupils and students are eligible to sit for end of cycle exams in 2020. • 16 out of the 37 health districts in the North-West and South-West (NWSW) have confirmed cases of COVID-19. • A cholera outbreak is reported in Tiko and Limbe health districts in the South West. • UNICEF supported the establishment of ten in-patient facilities in NWSW for the management of severe acute malnutrition (SAM) cases with complications. • UNHCR and partner have acquired land to build temporal IDP shelter in some locations in the SW. • OCHA and UNICEF supported a joint cluster led training of 81 front- line NGO staff on transmission, signs, symptoms and prevention of COVID-19 in the NW Region. Source: OCHA • IRC constructed 5 boreholes, rehabilitated 20 water distribution The boundaries and names shown and the designations used on systems and constructed 18 tank bases and tap stands, resulting in this map do not imply official endorsement or acceptance by the an 82.4% increase in water supply coverage compared to April. United Nations. 2.3M 1.4M 679K 204K 58.1K affected people targeted for internally displaced (IDP) Returnees (former Cameroonian assistance IDP) Refugees and Asylum seekers in Nigeria Sources: Sources: Sources: Sources: Sources: Humanitarian Need Humanitarian MSNA in -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L. -

206 Villages Burnt in the North West and South West Regions

CHRDA Email: [email protected] Website: www.chrda.org Cameroon: The Anglophone Crisis 206 Villages burnt in the North West and South West Regions April 2019 SUMMARY The Center for Human Rights and Democracy in Africa (CHRDA) has analyzed data from local sources and identified 206 villages that have been partially, or completely burnt since the beginning of the immediate crisis in the Anglophone regions. Cameroon is a nation sliding into civil war in Africa. In 2016, English- speaking lawyers, teachers, students and civil society expressed “This act of burning legitimate grievances to the Cameroonian government. Peaceful protests villages is in breach of subsequently turned deadly following governments actions to prevent classical common the expression of speech and assembly. Government forces shot peaceful article 3 to the Four protesters, wounded many and killed several. Geneva Convention 1949 and the To the dismay of the national, regional and international communities, Additional Protocol II the Cameroon government began arresting activists and leaders to the same including CHRDA’s Founder and CEO, Barrister Agbor Balla, the then Convention dealing President of the now banned Anglophone Consortium. Internet was shut with the non- down for three months and all forms of dissent were stifled, forcing international conflicts. hundreds into exile. Also, the burning of In August 2017, President Paul Biya of Cameroon ordered the release of villages is in breach of several detainees, but avoided dialogue, prompting mass protests in national and September 2017 with an estimated 500,000 people on the streets of international human various cities, towns and villages. The government’s response was a rights norms and the brutal crackdown which led to a declaration of independence on October host of other laws” 1, 2017. -

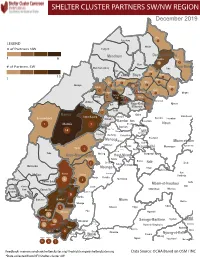

NW SW Presence Map Complete Copy

SHELTER CLUSTER PARTNERS SW/NWMap creation da tREGIONe: 06/12/2018 December 2019 Ako Furu-Awa 1 LEGEND Misaje # of Partners NW Fungom Menchum Donga-Mantung 1 6 Nkambe Nwa 3 1 Bum # of Partners SW Menchum-Valley Ndu Mayo-Banyo Wum Noni 1 Fundong Nkum 15 Boyo 1 1 Njinikom Kumbo Oku 1 Bafut 1 Belo Akwaya 1 3 1 Njikwa Bui Mbven 1 2 Mezam 2 Jakiri Mbengwi Babessi 1 Magba Bamenda Tubah 2 2 Bamenda Ndop Momo 6b 3 4 2 3 Bangourain Widikum Ngie Bamenda Bali 1 Ngo-Ketunjia Njimom Balikumbat Batibo Santa 2 Manyu Galim Upper Bayang Babadjou Malentouen Eyumodjock Wabane Koutaba Foumban Bambo7 tos Kouoptamo 1 Mamfe 7 Lebialem M ouda Noun Batcham Bafoussam Alou Fongo-Tongo 2e 14 Nkong-Ni BafouMssamif 1eir Fontem Dschang Penka-Michel Bamendjou Poumougne Foumbot MenouaFokoué Mbam-et-Kim Baham Djebem Santchou Bandja Batié Massangam Ngambé-Tikar Nguti Koung-Khi 1 Banka Bangou Kekem Toko Kupe-Manenguba Melong Haut-Nkam Bangangté Bafang Bana Bangem Banwa Bazou Baré-Bakem Ndé 1 Bakou Deuk Mundemba Nord-Makombé Moungo Tonga Makénéné Konye Nkongsamba 1er Kon Ndian Tombel Yambetta Manjo Nlonako Isangele 5 1 Nkondjock Dikome Balue Bafia Kumba Mbam-et-Inoubou Kombo Loum Kiiki Kombo Itindi Ekondo Titi Ndikiniméki Nitoukou Abedimo Meme Njombé-Penja 9 Mombo Idabato Bamusso Kumba 1 Nkam Bokito Kumba Mbanga 1 Yabassi Yingui Ndom Mbonge Muyuka Fiko Ngambé 6 Nyanon Lekié West-Coast Sanaga-Maritime Monatélé 5 Fako Dibombari Douala 55 Buea 5e Massock-Songloulou Evodoula Tiko Nguibassal Limbe1 Douala 4e Edéa 2e Okola Limbe 2 6 Douala Dibamba Limbe 3 Douala 6e Wou3rei Pouma Nyong-et-Kellé Douala 6e Dibang Limbe 1 Limbe 2 Limbe 3 Dizangué Ngwei Ngog-Mapubi Matomb Lobo 13 54 1 Feedback: [email protected]/ [email protected] Data Source: OCHA Based on OSM / INC *Data collected from NFI/Shelter cluster 4W. -

Globaler Airline-Newsletter Von Berlinspotter.De

Globaler Airline-Newsletter von Berlinspotter.de Sehr geehrte Leser, Hiermit erhalten Sie als PDF die europäischen und globalen Airline-News aus dem Bearbeitungszeitraum 2. bis 15. April – unterteilt in die Update-Blöcke der Premium- Version (ein Wechsel ist jederzeit möglich). Ich danke Ihnen für die Unterstützung des einzigen deutschsprachigen Luftfahrt- Newsletter. Mit freundlichen Grüßen Oliver Pritzkow Webmaster Berlinspotter.de --- 5.4. --- EUROPA Aegean Airlines stellte eine 737-300 (SX-BGW, msn 29264) außer Dienst. Sie ging an Deutsche Structured Finance zurück. Im Gegenzug übernahm man einen werksneuen Airbus A320-200 (SX-DVM, msn 3439). Air Baltic erhielt eine ex-Air Berlin 737-300 (YL-BBJ, msn 30333) per Leasing von Boullioun Aviation Services. Air Berlin bekommt einen neuen Großaktionär. Access Industries wird den Anteil der Vatas-Tochter Haarlem One in Höhe von 18,56 % übernehmen. Vatas war erst im Januar 2008 bei Air Berlin eingestiegen und hatte ihren Anteil rasch erhöht. Allerdings liegt das Aktienpaket derzeit bei der NordLB. Diese hatte vom Pfandrecht Gebrauch gemacht und sich als Sicherheit für geplatzte Aktiengeschäfte mit Vatas dieses Paket geholt. Access Industries gehört dem russischstämmigen US-Milliardär Leonard Blawatnik. Weitere Beteiligungen sind der british-russische Ölförderer TNK- BP sowie der russische Aluminiumkonzern Rusal. Die Air Berlin-Aktie legte zunächst um fast 10 5 % zu, nachdem sie erst wenige Tage zuvor aufgrund einer gesenkten Gewinnprognose einbrach. Als die Pfändung des Aktienpakets bekannt wurde, sank sie auf 5 %. Air France nahm am 1. April die erste Route unter dem neuen USA-Europa- OpenSky-Abkommen auf. Vom Flughafen London Heathrow hob man in Kooperation mit Partner Delta Air Lines zum ersten Direktflug nach Los Angeles ab. -

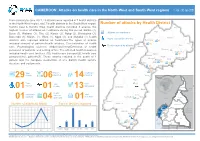

SSA Infographic

CAMEROON: Attacks on health care in the North-West and South-West regions 1 Jan - 30 Jun 2021 From January to June 2021, 29 attacks were reported in 7 health districts in the North-West region, and 7 health districts in the South West region. Number of attacks by Health District Kumbo East & Kumbo West health districts recorded 6 attacks, the Ako highest number of attacks on healthcare during this period. Batibo (4), Wum Buea (3), Wabane (3), Tiko (2), Konye (2), Ndop (2), Benakuma (2), Attacks on healthcare Bamenda (1), Mamfe (1), Wum (1), Nguti (1), and Muyuka (1) health Injury caused by attacks Nkambe districts also reported attacks on healthcare.The types of attacks Benakuma 01 included removal of patients/health workers, Criminalization of health 02 Nwa Death caused by attacks Ndu care, Psychological violence, Abduction/Arrest/Detention of health Akwaya personnel or patients, and setting of fire. The affected health resources Fundong Oku Kumbo West included health care facilities (10), health care transport(2), health care Bafut 06 Njikwa personnel(16), patients(7). These attacks resulted in the death of 1 Tubah Kumbo East Mbengwi patient and the complete destruction of one district health service Bamenda Ndop 01 Batibo Bali 02 structure and equipments. Mamfe 04 Santa 01 Eyumojock Wabane 03 Total Patient Healthcare 29 Attacks 06 impacted 14 impacted Fontem Nguti Total Total Total 01 Injured Deaths Kidnapping EXTRÊME-NORD Mundemba FAR-NORTH CHAD 01 01 13 Bangem Health Total Ambulance services Konye impacted Detention Kumba North Tombel NONORDRTH 01 04 destroyed 01 02 NIGERIA Bakassi Ekondo Titi Number of attacks by Month Type of facilities impacted AADAMAOUADAMAOUA NORTH- 14 13 NORD-OUESTWEST Kumba South CENTRAL 12 WOUESTEST AFRICAN Mbonge SOUTH- SUD-OUEST REPUBLIC 10 WEST Muyuka CCENTREENTRE 8 01 LLITITTORALTORAL EASESTT 6 5 4 4 Buea 4 03 Tiko 2 Limbe Atlantic SSUDOUTH 1 02 Ocean 2 EQ.