Nzx Release Not for Distribution Or Release in the United States

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download PDF

Table of Contents Executive summary ............................................................................................... 2 What Auckland consumers have to say about electricity retail issues ........................... 3 The EAP has not fully met the requirements of the terms of reference ......................... 4 The big-5 incumbent retailers are to blame for residential price increases .................... 5 Sweet-heart deals with Tiwai Smelter are keeping prices artificially high ...................... 6 Stronger wholesale and retail competition needed to make electricity more affordable ... 8 Saves & Winbacks is making the two-tier retail market problem worse ...................... 11 Late payment penalties disadvantage vulnerable Kiwis unable to pay on time ............. 14 Prepayment arrangements exploit vulnerable consumers ......................................... 18 There are questions about compliance with the Vulnerable Consumer Guidelines and the objectives of the Guidelines .................................................................................. 19 Concluding remarks and recommendations ............................................................. 20 Appendix 1: Price increases over the last 18-years largely driven by retail (energy) .... 22 Appendix 2: Manipulation of pricing data can make it look like lines are to blame ........ 27 Appendix 3: The electricity retail and generation markets are highly “concentrated” .... 30 Appendix 4: Retail competition improvements driven by the last inquiry reforms -

New Zealand Broadband: Free TV's and Fridges - the Consumer Wins but Is It Sustainable?

MARKET PERSPECTIVE New Zealand Broadband: Free TV's and Fridges - The Consumer Wins but is it Sustainable? Peter Wise Shane Minogue Monica Collier Jefferson King Sponsored by Spark New Zealand Limited IDC OPINION The New Zealand telecommunications market is shifting; from a focus around better and faster connectivity, to service innovations and value. Consumers are enjoying better internet connectivity and a raft of competitive offers from more than 90 retailers. Retailers, however, are feeling the pinch of decreasing margins. Questions are starting to arise about the sustainability of such a competitive retail marketplace. Total telecommunications market revenues increased by 1.1% from NZ$5.361 billion in the year to December 2016 to NZ$5.421 billion in the year to December 2017. IDC forecasts that this growth will continue in future years with a Compound Annual Growth Rate (CAGR) of 1.4% to 2021. However, this growth disguises the true story of a market that is displaying extreme price pressure and competition in both fixed and mobile. Overall, ARPUs are either flat or declining in both broadband and mobile and in the broadband space Retail Service Providers (RSPs) continue to compete away any chance of strong, sustainable ARPU growth. New Zealand telecommunication's structural separation and national broadband plan have created new constructs and market dynamics. The UFB initiative has commoditised fibre in New Zealand. Consumer fibre plan prices have plummeted from averaging over NZ$200 per month in 2013 to around NZ$85 per month as at February 2018. Fibre is available to more than a million homes and premises, and over a third have made the switch. -

We're Making Life Better

Contact Energy Annual Limited Report 2019 WE’RE MAKING LIFE BETTER ANNUAL REPORT 2019 Contact is the human energy company with great ideas and smart solutions that make living easier for customers, now and in the future. This Annual Report is dated 12 August 2019 and is signed on behalf of the Board by: Robert McDonald Dame Therese Walsh Chair Chair, Audit Committee This report is printed on an environmentally responsible paper produced using Elemental Chlorine Free (ECF) FSC Certified pulp sourced from Sustainable & Legally Harvested Farmed Trees, and manufactured under the strict ISO14001 Environmental Management System. The inks used in printing this report have been manufactured from vegetable oils derived from renewable resources, and are biodegradable and mineral oil free. All liquid waste from the printing process has been collected, stored and subsequently disposed of through an accredited recycling company. CONTENTS This Year In Review ............................................................................................................................................................................... 5 Chair’s review .......................................................................................................................................................................................................................................................6 Chief Executive Officer’s review ..............................................................................................................................................................................................................7 -

The Climate Risk of New Zealand Equities

The Climate Risk of New Zealand Equities Hamish Kennett Ivan Diaz-Rainey Pallab Biswas Introduction/Overview ØExamine the Climate Risk exposure of New Zealand Equities, specifically NZX50 companies ØMeasuring company Transition Risk through collating firm emission data ØCompany Survey and Emission Descriptives ØPredicting Emission Disclosure ØHypothetical Carbon Liabilities 2 Measuring Transition Risk ØTransition Risk through collating firm emissions ØAimed to collate emissions for all the constituents of the NZX50. ØUnique as our dataset consists of Scope 1, Scope 2, and Scope 3 emissions, ESG scores and Emission Intensities for each firm. ØCarbon Disclosure Project (CDP) reports, Thomson Reuters Asset4, Annual reports, Sustainability reports and Certified Emissions Measurement and Reduction Scheme (CEMAR) reports. Ø86% of the market capitilisation of the NZX50. 9 ØScope 1: Classified as direct GHG emissions from sources that are owned or controlled by the company. ØScope 2: Classified as indirect emissions occurring from the generation of purchased electricity. ØScope 3: Classified as other indirect GHG emissions occurring from the activities of the company, but not from sources owned or controlled by the company. (-./01 23-./014) Ø Emission Intensity = 6789 :1;1<=1 4 Company Survey Responses Did not Email No Response to Email Responded to Email Response Company Company Company Air New Zealand Ltd. The a2 Milk Company Ltd. Arvida Group Ltd. Do not report ANZ Group Ltd. EBOS Ltd. Heartland Group Holdings Ltd. Do not report Argosy Property Ltd. Goodman Property Ltd. Metro Performance Glass Ltd. Do not report Chorus Ltd. Infratil Ltd. Pushpay Holdings Ltd. Do not report Contact Energy Ltd. Investore Property Ltd. -

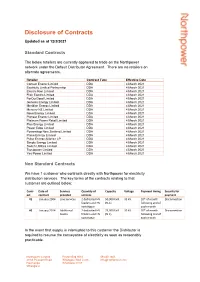

Disclosure of Contracts

Disclosure of Contracts Updated as at 12/3/2021 Standard Contracts The below retailers are currently approved to trade on the Northpower network under the Default Distributor Agreement. There are no retailers on alternate agreements. Retailer Contract Type Effective Date Contact Energy Limited DDA 4 March 2021 Ecotricity Limited Partnership DDA 4 March 2021 Electric Kiwi Limited DDA 4 March 2021 Flick Electric Limited DDA 4 March 2021 ForOurGood Limited DDA 4 March 2021 Genesis Energy Limited DDA 4 March 2021 Meridian Energy Limited DDA 4 March 2021 Mercury NZ Limited DDA 4 March 2021 Nova Energy Limited DDA 4 March 2021 Pioneer Energy Limited DDA 4 March 2021 Platinum Power Retail Limited DDA 4 March 2021 Plus Energy Limited DDA 4 March 2021 Power Edge Limited DDA 4 March 2021 Powershop New Zealand Limited DDA 4 March 2021 Prime Energy Limited DDA 4 March 2021 Pulse Energy Alliance LP DDA 4 March 2021 Simply Energy Limited DDA 4 March 2021 Switch Utilities Limited DDA 4 March 2021 Trustpower Limited DDA 4 March 2021 Yes Power Limited DDA 4 March 2021 Non Standard Contracts We have 1 customer who contracts directly with Northpower for electricity distribution services. The key terms of the contracts relating to that customer are outlined below: Contr Date of Services Quantity of Capacity Voltage Payment timing Security for act contract provided services payment #1 January 2004 Line Services 2 dedicated HV 50,000 kVA 33 kV 20th of month Disconnection feeders and HV (N-1) following end of switchgear each month #2 January 2014 Additional 2 dedicated HV 25,000 kVA 33 kV 20th of month Disconnection Assets feeders and HV (N-1) following end of switchgear each month In the event that supply is interrupted to this customer the Distributor is required to resume the conveyance of electricity as soon as reasonably practicable. -

Solar Pv and Batteries in New Zealand – Consumer Centric Electricity

SOLAR PV AND BATTERIES IN NEW ZEALAND – CONSUMER CENTRIC ELECTRICITY November 2016 ITP Renewables Australia Benefits of Distributed PV in NZ- Draft Report About IT Power The IT Power Group, formed in 1981, is a specialist renewable energy, energy efficiency and carbon markets consulting company. The group has offices and projects throughout the world. IT Power (Australia) Pty Ltd (ITP) was established in 2003 and has undertaken a wide range of projects, including designing grid-connected renewable power systems, providing advice for government policy, feasibility studies for large, off-grid power systems, developing micro-finance models for community-owned power systems in developing countries and modelling large-scale power systems for industrial use. The staff at ITP have backgrounds in renewable energy and energy efficiency, research, development and implementation, managing and reviewing government incentive programs, high level policy analysis and research, including carbon markets, engineering design and project management. ITP/A0215 – November 2016 Benefits of Distributed PV in NZ – Draft Report Document Control Record Document prepared by: IT Power (Australia) Pty Limited Level 1, 19-23 Moore St, Turner, ACT, 2612, Australia PO Box 6127, O’Connor, ACT, 2602, Australia Tel. +61 2 6257 3511 Fax. +61 2 6257 3611 E-mail: [email protected] http://www.itpau.com.au Document Control Proposal title Benefits of Distributed PV in NZ Client RFP No. NA ITP Project Number A0215 Client SEANZ Client Contact Brendan Winitana Rev Date Status Author/s Project Manager Approved Rob Passey, Annie Ngo, Muriel Watt, 1 4 Nov 2016 Draft Rob Passey Muriel Watt Graham Henricksen 2 11 Nov 2016 Final Rob Passey, Annie Ngo, Muriel Watt, Muriel Watt Rob Passey Graham Henricksen A person or organisation choosing to use documents prepared by IT Power (Australia) Pty Ltd accepts the following: a) Conclusions and figures presented in draft documents are subject to change. -

Annual Report 2013 ANNUAL REPORT Contact 2013

here Annual Report 2013 ANNUAL REPORT Contact 2013 ...is where we do our best work. CONTENTS Contact 2013 At Contact… We keep the lights burning, We are one of New Zealand’s largest listed companies but we operate with the same genuine concern for our the hot water flowing and the customers and communities as the smallest. We are BBQ fired up for around 566,000 integral to our customers’ lives – and our customers customers across the country. are integral to us. OUR BEST WORK 4 CASE STUDIES 30 CONTACT AT A GLANCE 12 HOW WE OPERATE 40 OUR BUSINESS MODEL 14 GOVERNANCE 56 WHERE WE OPERATE 16 REMUNERATION REPORT 62 KEY PERFORMANCE INDICATORS 18 STATUTORY DISCLOSURES 65 CHAIRMAN & CEO’S REVIEW 20 FINANCIAL STATEMENTS 69 OUR BOARD 26 INDEPENDENT AUDITOR’S REPORT 99 OUR LEADERSHIP TEAM 28 CORPORATE DIRECTORY 100 This Annual Report is dated 5 September 2013 and is signed on behalf of the Board by: Grant King Sue Sheldon Follow us at facebook.com/contactenergy Chairman Director OUR BEST WORK Contact 2013 “The kids think there’s always money on the card – they think nothing of a 30 minute shower.” Contact customer research Everyone in the family has unique habits when it comes to energy use. That can make it tough for households to manage their energy costs. We’ve created an easy-to-use online tool, called HEAT, to help our customers manage their energy and identify practical ways to save money on their energy bills. 4 Contact Energy LIMITED Annual Report 2013 Contact Energy LIMITED Annual Report 2013 5 OUR BEST WORK Contact 2013 “I’ll come home on a sunny day and she’ll have the dryer on for half an hour to do her bra and knickers.” Contact customer research Household energy costs vary from month to month as energy use fluctuates. -

Infratil Limited and Vodafone New Zealand Limited

PUBLIC VERSION NOTICE SEEKING CLEARANCE FOR A BUSINESS ACQUISITION UNDER SECTION 66 OF THE COMMERCE ACT 1986 17 May 2019 The Registrar Competition Branch Commerce Commission PO Box 2351 Wellington New Zealand [email protected] Pursuant to section 66(1) of the Commerce Act 1986, notice is hereby given seeking clearance of a proposed business acquisition. BF\59029236\1 | Page 1 PUBLIC VERSION Pursuant to section 66(1) of the Commerce Act 1986, notice is hereby given seeking clearance of a proposed business acquisition (the transaction) in which: (a) Infratil Limited (Infratil) and/or any of its interconnected bodies corporate will acquire shares in a special purpose vehicle (SPV), such shareholding not to exceed 50%; and (b) the SPV and/or any of its interconnected bodies corporate will acquire up to 100% of the shares in Vodafone New Zealand Limited (Vodafone). EXECUTIVE SUMMARY AND INTRODUCTION 1. This proposed transaction will result in Infratil having an up to 50% interest in Vodafone, in addition to its existing 51% interest in Trustpower Limited (Trustpower). 2. Vodafone provides telecommunications services in New Zealand. 3. Trustpower has historically been primarily a retailer of electricity and gas. In recent years, Trustpower has repositioned itself as a multi-utility retailer. It now also sells fixed broadband and voice services in bundles with its electricity and gas products, with approximately 96,000 broadband connections. Trustpower also recently entered into an arrangement with Spark to offer wireless broadband and mobile services. If Vodafone and Trustpower merged, there would therefore be some limited aggregation in fixed line broadband and voice markets and potentially (in the future) the mobile phone services market. -

Energy Complaints Scheme – Accepted Deadlocked Complaints Report for the Period 1 April 2020 - 31 March 2021

Energy Complaints Scheme – accepted deadlocked complaints report for the period 1 April 2020 - 31 March 2021 Accepted deadlocked complaints The tables below show the number of deadlocked complaints that were accepted for consideration, and the relevant provider. Not all providers in the Energy Complaints Scheme had an accepted deadlocked complaint in this period. A full provider list is available on our website: www.utilitiesdisputes.co.nz The tables also show each providers’ market share, which is calculated by the number of installation control points (ICPs) or equivalent. Total ICPs (or equivalent) were calculated on 28 February 2021 from ICPs on the electricity and gas registries, and customer numbers obtained from providers. Distributors Distributor Accepted Share of Total ICPs Market share deadlocked accepted (or of ICPs (or complaints deadlocked equivalent) equivalent) complaints Alpine Energy 1 1.8% 33,113 1.3% Aurora Energy 7 12.7% 92,584 3.7% Counties Power 2 3.6% 44,978 1.8% Electra 1 1.8% 45,697 1.8% ElectroNet Services * 1 1.8% 0 0.0% Horizon Networks 1 1.8% 24,940 1.0% MainPower 1 1.8% 41,494 1.6% Northpower 3 5.5% 60,326 2.4% Orion 1 1.8% 208,259 8.2% Powerco 6 10.9% 447,295 17.7% The Lines Company (TLC) 3 5.5% 23,716 0.9% Top Energy 4 7.3% 33,049 1.3% Unison 4 7.3% 113,586 4.5% Vector 17 30.9% 699,786 27.7% WEL Networks 3 5.5% 95,851 3.8% Total 55 100% 1,964,674 77.8% Total ICPs (or equivalent) for all electricity and gas distributors: 2,524,362 Key: *Subsidiary of Westpower. -

Download Financial Statements

About These Financial Statements Statement of Comprehensive Income FOR THE SIX MONTHS ENDED 31 DECEMBER 2019 FOR THE SIX MONTHS ENDED 31 DECEMBER 2019 These interim Financial Statements are for Contact, a group made up of Contact Energy Limited, the entities over which it has control or joint control and its associate. Unaudited Unaudited Audited 6 months ended 6 months ended Year ended Contact Energy Limited is registered in New Zealand under the Companies Act 1993. It is listed on the New Zealand Stock Exchange $m Note 31 Dec 2019 31 Dec 2018 30 June 2019 (NZX) and the Australian Securities Exchange (ASX) and has bonds listed on the NZX debt market. Contact is an FMC reporting entity Revenue and other income A2 1,110 1,304 2,460 under the Financial Markets Conduct Act 2013. Operating expenses A2 (889) (1,026) (1,955) Contact’s interim Financial Statements for the six months ended 31 December 2019 provide a summary of Contact’s performance Significant items A2 2 5 9 for the period and outline significant changes to information reported in the Financial Statements for the year ended 30 June 2019 Depreciation and amortisation C2 (110) (102) (205) (2019 Annual Report). The Financial Statements should be read with the 2019 Annual Report. Net interest expense B4 (28) (39) (70) The Financial Statements have been prepared: Profit before tax 85 142 239 in millions of New Zealand dollars (NZD) unless otherwise stated in accordance with New Zealand generally accepted accounting practice (GAAP) and comply with NZ IAS 34 Interim Financial Tax expense (26) (43) (69) Reporting Profit from continuing operations 59 99 170 using the same accounting policies and significant estimates and critical judgments disclosed in the 2019 Annual Report, Discontinued operation except as disclosed in note C2 with certain comparative amounts reclassified to conform to the current period’s presentation. -

Kernel NZ 20 Fund for the Month Ended 30 April 2021

Kernel NZ 20 Fund For the month ended 30 April 2021 Fund overview What does the fund invest in? The Fund provides investors with a diversified exposure across Sector mix a range of sectors including utilities, real estate, This shows the sectors that the fund currently invests in: telecommunication and healthcare to 20 of the largest companies listed in New Zealand. Large and liquid, many of Health Care 30.1% these companies export globally and collectively account for Utilities 21.1% over 80% of the value of the entire investable NZ stockmarket. Industrials 16.9% Communication Services 10.7% Key information Real Estate 6.0% • Index tracked: S&P/NZX 20 Index Materials 5.8% • Number of constituents: 20 Consumer Staples 5.5% • Distribution frequency: Quarterly Consumer Discretionary 2.6% Energy 1.3% • Management fee: 0.39% Cash 0.0% • Inception: 28th August 2019 • Indicative yield: 2.02% How to use Kernel NZ 20 Fund The NZ 20 fund can be used in a variety of investment Top 10 investments strategies, for example: % of fund’s Company • A core allocation to NZ equities net asset value • A tactical exposure to NZ blue-chips Fisher & Paykel Healthcare 17.95% • A low cost alternative to other active managers Auckland International Airport 8.81% Spark 7.83% Performance Meridian Energy 6.43% Fund after Index Net tracking Mainfreight 5.88% fees difference Fletcher Building 5.76% 1 month 1.17% 1.20% -0.03% Ryman Healthcare 5.66% 3 months -4.20% -4.11% -0.09% Contact Energy 5.54% 6 months 4.19% 4.43% -0.24% The a2 Milk Company 5.46% 1 year 17.25% 17.34% -0.09% Infratil 4.96% 3 years 17.51% Current cash & equivalents = 0.01% 5 years 15.60% 10 years 16.43% Further information Fund returns before tax and assuming distributions reinvested. -

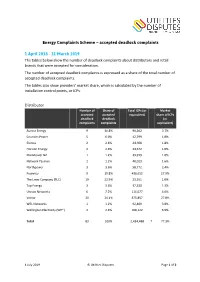

Energy Complaints Scheme – Accepted Deadlock Complaints 1

Energy Complaints Scheme – accepted deadlock complaints 1 April 2018 - 31 March 2019 The tables below show the number of deadlock complaints about distributors and retail brands that were accepted for consideration. The number of accepted deadlock complaints is expressed as a share of the total number of accepted deadlock complaints. The tables also show providers’ market share, which is calculated by the number of installation control points, or ICPs. Distributor Number of Share of Total ICPs (or Market accepted accepted equivalent) share of ICPs deadlock deadlock (or complaints complaints equivalent) Aurora Energy 9 10.8% 90,262 3.7% Counties Power 5 6.0% 42,799 1.8% Electra 2 2.4% 44,908 1.8% Horizon Energy 2 2.4% 24,672 1.0% MainPower NZ 1 1.2% 39,919 1.6% Network Tasman 1 1.2% 40,023 1.6% Northpower 3 3.6% 58,772 2.4% Powerco 9 10.8% 436,652 17.9% The Lines Company (TLC) 19 22.9% 23,551 1.0% Top Energy 3 3.6% 32,330 1.3% Unison Networks 6 7.2% 111,577 4.6% Vector 20 24.1% 675,857 27.8% WEL Networks 1 1.2% 92,400 3.8% Wellington Electricity (WE*) 2 2.4% 168,122 6.9% Total 83 100% 2,434,488 † 77.3% 4 July 2019 © Utilities Disputes Page 1 of 2 Retail brand Number of Share of Total ICPs (or Market accepted accepted equivalent) share of ICPs deadlock deadlock (or complaints complaints equivalent) Contact 11 8.3% 478,525 18.3% Ecotricity 5 3.8% 5,640 0.2% Electric Kiwi 4 3.0% 36,132 1.4% Elgas 7 5.3% 31,314 1.2% Energy Online 3 2.3% 106,576 4.1% Flick Electric Co 4 3.0% 20,702 0.8% Genesis Energy * 20 15.0% 566,276 21.6% GLOBUG 4 3.0%