Who Will Own the Streaming TV Future? Using AI to Predict the Winners and Losers in the Streaming Wars

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

February 26, 2021 Amazon Warehouse Workers In

February 26, 2021 Amazon warehouse workers in Bessemer, Alabama are voting to form a union with the Retail, Wholesale and Department Store Union (RWDSU). We are the writers of feature films and television series. All of our work is done under union contracts whether it appears on Amazon Prime, a different streaming service, or a television network. Unions protect workers with essential rights and benefits. Most importantly, a union gives employees a seat at the table to negotiate fair pay, scheduling and more workplace policies. Deadline Amazon accepts unions for entertainment workers, and we believe warehouse workers deserve the same respect in the workplace. We strongly urge all Amazon warehouse workers in Bessemer to VOTE UNION YES. In solidarity and support, Megan Abbott (DARE ME) Chris Abbott (LITTLE HOUSE ON THE PRAIRIE; CAGNEY AND LACEY; MAGNUM, PI; HIGH SIERRA SEARCH AND RESCUE; DR. QUINN, MEDICINE WOMAN; LEGACY; DIAGNOSIS, MURDER; BOLD AND THE BEAUTIFUL; YOUNG AND THE RESTLESS) Melanie Abdoun (BLACK MOVIE AWARDS; BET ABFF HONORS) John Aboud (HOME ECONOMICS; CLOSE ENOUGH; A FUTILE AND STUPID GESTURE; CHILDRENS HOSPITAL; PENGUINS OF MADAGASCAR; LEVERAGE) Jay Abramowitz (FULL HOUSE; GROWING PAINS; THE HOGAN FAMILY; THE PARKERS) David Abramowitz (HIGHLANDER; MACGYVER; CAGNEY AND LACEY; BUCK JAMES; JAKE AND THE FAT MAN; SPENSER FOR HIRE) Gayle Abrams (FRASIER; GILMORE GIRLS) 1 of 72 Jessica Abrams (WATCH OVER ME; PROFILER; KNOCKING ON DOORS) Kristen Acimovic (THE OPPOSITION WITH JORDAN KLEPPER) Nick Adams (NEW GIRL; BOJACK HORSEMAN; -

Television Academy Awards

2019 Primetime Emmy® Awards Ballot Outstanding Comedy Series A.P. Bio Abby's After Life American Housewife American Vandal Arrested Development Atypical Ballers Barry Better Things The Big Bang Theory The Bisexual Black Monday black-ish Bless This Mess Boomerang Broad City Brockmire Brooklyn Nine-Nine Camping Casual Catastrophe Champaign ILL Cobra Kai The Conners The Cool Kids Corporate Crashing Crazy Ex-Girlfriend Dead To Me Detroiters Easy Fam Fleabag Forever Fresh Off The Boat Friends From College Future Man Get Shorty GLOW The Goldbergs The Good Place Grace And Frankie grown-ish The Guest Book Happy! High Maintenance Huge In France I’m Sorry Insatiable Insecure It's Always Sunny in Philadelphia Jane The Virgin Kidding The Kids Are Alright The Kominsky Method Last Man Standing The Last O.G. Life In Pieces Loudermilk Lunatics Man With A Plan The Marvelous Mrs. Maisel Modern Family Mom Mr Inbetween Murphy Brown The Neighborhood No Activity Now Apocalypse On My Block One Day At A Time The Other Two PEN15 Queen America Ramy The Ranch Rel Russian Doll Sally4Ever Santa Clarita Diet Schitt's Creek Schooled Shameless She's Gotta Have It Shrill Sideswiped Single Parents SMILF Speechless Splitting Up Together Stan Against Evil Superstore Tacoma FD The Tick Trial & Error Turn Up Charlie Unbreakable Kimmy Schmidt Veep Vida Wayne Weird City What We Do in the Shadows Will & Grace You Me Her You're the Worst Young Sheldon Younger End of Category Outstanding Drama Series The Affair All American American Gods American Horror Story: Apocalypse American Soul Arrow Berlin Station Better Call Saul Billions Black Lightning Black Summer The Blacklist Blindspot Blue Bloods Bodyguard The Bold Type Bosch Bull Chambers Charmed The Chi Chicago Fire Chicago Med Chicago P.D. -

Multicultural Social Cohesion in Veronica Mars

University of Wollongong Research Online Faculty of Law, Humanities and the Arts - Papers Faculty of Arts, Social Sciences & Humanities 2007 Over my dead body: Multicultural social cohesion in Veronica Mars Debra Dudek University of Wollongong, [email protected] Follow this and additional works at: https://ro.uow.edu.au/lhapapers Part of the Arts and Humanities Commons, and the Law Commons Recommended Citation Dudek, Debra, "Over my dead body: Multicultural social cohesion in Veronica Mars" (2007). Faculty of Law, Humanities and the Arts - Papers. 1392. https://ro.uow.edu.au/lhapapers/1392 Research Online is the open access institutional repository for the University of Wollongong. For further information contact the UOW Library: [email protected] Over my dead body: Multicultural social cohesion in Veronica Mars Abstract This paper argues that Veronica Mars foregrounds the notion that multiculturalism is a "field of accumulating whiteness," to borrow Ghassan Hage's phrase, and that multicultural cohesion exists primarily when Brown and Black bodies gain cultural and symbolic capital by accumulating Whiteness. Keywords mars, over, cohesion, veronica, social, body, multicultural, my, dead Disciplines Arts and Humanities | Law Publication Details Dudek, D. (2007). Over my dead body: Multicultural social cohesion in Veronica Mars. The Looking Glass: new perspectives in children's literature, 11 (1). This journal article is available at Research Online: https://ro.uow.edu.au/lhapapers/1392 Over My Dead Body: Multicultural Social Cohesion in Veronica Mars | D... http://www.lib.latrobe.edu.au/ojs/index.php/tlg/article/view/46/23 The Looking Glass : New Perspectives on Children's Literature, Vol 11, No 1 (2007) HOME ABOUT LOG IN REGISTER SEARCH CURRENT ARCHIVES ANNOUNCEMENTS Home > Vol 11, No 1 (2007) > Dudek Font Size: Over My Dead Body: Multicultural Social Cohesion in Veronica Mars Debra Dudek Debra Dudek received her PhD in literature from the University of Saskatchewan, Canada. -

Veronica Mars, Spinster...Old Maid

EXT. CAMELOT MOTEL - NIGHT Music cue: Air’s “La Femme D’Argent.” ANGLE on a rain-streaked, neon-reflecting motel window. Through gauzy curtains we see the SILHOUETTES OF LOVERS heaving toward climax with all the romantic finesse normally associated with Soviet farm equipment. VERONICA (V.O.) I’m never getting married. A middle-aged FAT MAN wearing a cheap, too-short, faux- Japanese robe and nothing else crosses through the frame carrying an ICE BUCKET. VERONICA (V.O.) (CONT'D) You want an absolute? A sure thing? Well, there it is. Veronica Mars, spinster...old maid. Carve it in stone. CRANE SHOT follows man down a flight of exterior motel steps. VERONICA (V.O.) (CONT’D) I mean, come on. What’s the point? Sure, there’s that initial primal drive...hormonal surge...whatever you want to call it. Ride it out. Better yet, ignore it... As the man reaches the ground floor level and heads toward the ICE MACHINE next to the motel office, shot widens and includes the wet blacktop of the parking lot and the flickering neon of the CAMELOT MOTEL sign. VERONICA (CONT'D) ...Sooner or later, the people you love betray you. As the man crosses back toward his room, CAMERA STOPS on the door to the first floor ROOM 8. As the CAMERA PUSHES IN on the keyhole... VERONICA (V.O.) (CONT’D) And here’s where it ends up -- fat men, cocktail waitresses, cheap motels on the wrong side of town. REVERSE ANGLE on a nondescript sedan parked on the street facing the motel. -

British Acting Heavyweights Michael Sheen and David Tennant Cast in Upcoming Amazon Original Comedy-Horror Good Omens

British acting heavyweights Michael Sheen and David Tennant cast in upcoming Amazon Original comedy-horror Good Omens August 15, 2017 Terry Pratchett and Neil Gaiman’s internationally best-selling novel will be brought to life by BBC Studios for Amazon Prime members globally; the 6-part drama will launch in 2019 Along with access to thousands of popular movies and TV episodes through Prime Video, Prime members across the UK benefit from unlimited One-Day Delivery, Prime Music, Prime Live Events, Prime Reading, Prime Photos, early access to Lightning Deals and more London, Tuesday 15 August 2017 – Amazon today announced that multi-award-winning actors Michael Sheen, OBE (Masters of Sex, Passengers) and David Tennant (Broadchurch, Doctor Who) are to star in Good Omens, the six-part humorous fantasy drama which will launch globally on Prime Video in 2019. It will launch in the UK on Prime Video before going on to BBC Two at a later date. The 6 x 1-hour equal parts comedy and horror series, which was greenlit in January 2017, is written by Neil Gaiman (American Gods), who will also serve as Showrunner. It is based on the well-loved and internationally bestselling novel ‘Good Omens’ by Terry Pratchett ( Hogfather) and Gaiman, and is being produced by BBC Studios, the BBC’s commercial production arm, Narrativa and The Blank Corporation, in association with BBC Worldwide. Sheen will star as the somewhat fussy angel and rare book dealer Aziraphale, and Tennant will play his opposite number, the fast living demon Crowley, both of whom have lived amongst Earth’s mortals since The Beginning and have grown rather fond of the lifestyle and of each other. -

As Writers of Film and Television and Members of the Writers Guild Of

July 20, 2021 As writers of film and television and members of the Writers Guild of America, East and Writers Guild of America West, we understand the critical importance of a union contract. We are proud to stand in support of the editorial staff at MSNBC who have chosen to organize with the Writers Guild of America, East. We welcome you to the Guild and the labor movement. We encourage everyone to vote YES in the upcoming election so you can get to the bargaining table to have a say in your future. We work in scripted television and film, including many projects produced by NBC Universal. Through our union membership we have been able to negotiate fair compensation, excellent benefits, and basic fairness at work—all of which are enshrined in our union contract. We are ready to support you in your effort to do the same. We’re all in this together. Vote Union YES! In solidarity and support, Megan Abbott (THE DEUCE) John Aboud (HOME ECONOMICS) Daniel Abraham (THE EXPANSE) David Abramowitz (CAGNEY AND LACEY; HIGHLANDER; DAUGHTER OF THE STREETS) Jay Abramowitz (FULL HOUSE; MR. BELVEDERE; THE PARKERS) Gayle Abrams (FASIER; GILMORE GIRLS; 8 SIMPLE RULES) Kristen Acimovic (THE OPPOSITION WITH JORDAN KLEEPER) Peter Ackerman (THINGS YOU SHOULDN'T SAY PAST MIDNIGHT; ICE AGE; THE AMERICANS) Joan Ackermann (ARLISS) 1 Ilunga Adell (SANFORD & SON; WATCH YOUR MOUTH; MY BROTHER & ME) Dayo Adesokan (SUPERSTORE; YOUNG & HUNGRY; DOWNWARD DOG) Jonathan Adler (THE TONIGHT SHOW STARRING JIMMY FALLON) Erik Agard (THE CHASE) Zaike Airey (SWEET TOOTH) Rory Albanese (THE DAILY SHOW WITH JON STEWART; THE NIGHTLY SHOW WITH LARRY WILMORE) Chris Albers (LATE NIGHT WITH CONAN O'BRIEN; BORGIA) Lisa Albert (MAD MEN; HALT AND CATCH FIRE; UNREAL) Jerome Albrecht (THE LOVE BOAT) Georgianna Aldaco (MIRACLE WORKERS) Robert Alden (STREETWALKIN') Richard Alfieri (SIX DANCE LESSONS IN SIX WEEKS) Stephanie Allain (DEAR WHITE PEOPLE) A.C. -

TCA: Buzz Trumps Ratings for Amazon

TCA: Buzz Trumps Ratings For Amazon 08.03.2015 ​After a downright jovial series of TCA panels showing off Amazon's wares, during which the executives could be seen snapping selfies, the mood shifted to serious with Roy Price, head of Amazon Studios, Morgan Wandell, head of drama, and Joe Lewis, head of comedy. Fresh off the news that the streaming service has signed Woody Allen to create his first TV series and that Amazon has brought Top Gear's erstwhile (and controversial) trio Jeremy Clarkson, Richard Hammond and James May for a new car series, Price fielded many questions from critics concerned about Woody's past and the inappropriate behavior that led to Top Gear's ignominious end. Price only discussed Allen's filmmaking credentials and updated the project. The scripts for season one are just about done, and Price expects Allen to begin shooting at the end of the year, or the beginning of 2016, with an eye toward a premiere in the second half of 2016. Price refused to discuss the parameters of the deal with Clarkson and company, and merely stated, "We're bullish about the show and think it will turn out well." But how does Amazon define well in a land without ratings? While Price left the possibility of releasing some sort of numbers or rankings from time to time, it's clear that the number of viewers doesn't concern Amazon. "Internally we talk about the quality of the shows more than the numbers," Lewis said. "Viewership numbers can be distracting," Price said. -

The Humor and Freshness of VERONICA MARS Arrive to HBO

The humor and freshness of VERONICA MARS arrive to HBO Starring Kristen Bell, the fourth season of this fan-favorite series premieres on June 5th, exclusively on HBO and HBO GO MIAMI, FL. May 6th, 2020 – With the fresh and sarcastic humor that characterize her, VERONICA MARS arrives to HBO and HBO GO. Starring Kristen Bell and created by writer Rob Thomas, the fourth season of this series about the clever detective premieres on June 5th. Times per country: Hbocaribbean.com In the fictional coastal community of Neptune, the rich and powerful make the rules and desperately seek to hide their dirty little secrets. Unfortunately for them, Veronica Mars, a brave and intelligent private investigator, is dedicated to solving the most complicated mysteries of this town. Season four begins when young vacationers are killed during spring break, impacting the city's tourism industry, and Mars Investigations is hired by the parents of one of the victims to find the killer. The story will follow Veronica's investigations, which are shrouded in an epic mystery that will lead her to face the powerful elites of the city. The fourth season of VERONICA MARS stars Kristen Bell, alongside Enrico Colantoni and Jason Dohring. The executive producers are Rob Thomas, Diane Ruggiero-Wright, Dan Etheridge, and Kristen Bell. The series is produced by Spondoolie Productions, in association with Warner Bros. Television. Enjoy the fourth season of VERONICA MARS exclusively on HBO and HBO GO starting on June 5th. Posted on 2020/05/06 on hbomaxlapress.com. -

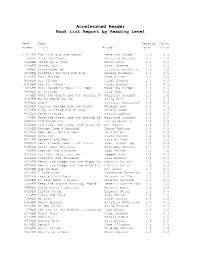

Accelerated Reader Book List Report by Reading Level

Accelerated Reader Book List Report by Reading Level Test Book Reading Point Number Title Author Level Value -------------------------------------------------------------------------- 27212EN The Lion and the Mouse Beverley Randell 1.0 0.5 330EN Nate the Great Marjorie Sharmat 1.1 1.0 6648EN Sheep in a Jeep Nancy Shaw 1.1 0.5 9338EN Shine, Sun! Carol Greene 1.2 0.5 345EN Sunny-Side Up Patricia Reilly Gi 1.2 1.0 6059EN Clifford the Big Red Dog Norman Bridwell 1.3 0.5 9454EN Farm Noises Jane Miller 1.3 0.5 9314EN Hi, Clouds Carol Greene 1.3 0.5 9318EN Ice Is...Whee! Carol Greene 1.3 0.5 27205EN Mrs. Spider's Beautiful Web Beverley Randell 1.3 0.5 9464EN My Friends Taro Gomi 1.3 0.5 678EN Nate the Great and the Musical N Marjorie Sharmat 1.3 1.0 9467EN Watch Where You Go Sally Noll 1.3 0.5 9306EN Bugs! Patricia McKissack 1.4 0.5 6110EN Curious George and the Pizza Margret Rey 1.4 0.5 6116EN Frog and Toad Are Friends Arnold Lobel 1.4 0.5 9312EN Go-With Words Bonnie Dobkin 1.4 0.5 430EN Nate the Great and the Boring Be Marjorie Sharmat 1.4 1.0 6080EN Old Black Fly Jim Aylesworth 1.4 0.5 9042EN One Fish, Two Fish, Red Fish, Bl Dr. Seuss 1.4 0.5 6136EN Possum Come a-Knockin' Nancy VanLaan 1.4 0.5 6137EN Red Leaf, Yellow Leaf Lois Ehlert 1.4 0.5 9340EN Snow Joe Carol Greene 1.4 0.5 9342EN Spiders and Webs Carolyn Lunn 1.4 0.5 9564EN Best Friends Wear Pink Tutus Sheri Brownrigg 1.5 0.5 9305EN Bonk! Goes the Ball Philippa Stevens 1.5 0.5 408EN Cookies and Crutches Judy Delton 1.5 1.0 9310EN Eat Your Peas, Louise! Pegeen Snow 1.5 0.5 6114EN Fievel's Big Showdown Gail Herman 1.5 0.5 6119EN Henry and Mudge and the Happy Ca Cynthia Rylant 1.5 0.5 9477EN Henry and Mudge and the Wild Win Cynthia Rylant 1.5 0.5 9023EN Hop on Pop Dr. -

2018 DGA Episodic Director Diversity Report (By SIGNATORY COMPANY)

2018 DGA Episodic Director Diversity Report (by SIGNATORY COMPANY) Combined # Episodes # Episodes # Episodes # Episodes Combined Total # of Female + Directed by Male Directed by Male Directed by Female Directed by Female Male Male Female Female Signatory Company Title Female + Network Episodes Minority Male Caucasian % Male Minority % Female Caucasian % Female Minority % Unknown Unknown % Unknown Unknown % Minority % Episodes Caucasian Minority Caucasian Minority 40 North Productions, LLC Looming Tower, The 10 0 0% 10 100% 0 0% 0 0% 0 0% 0 0% 0 0% Hulu ABC Signature Studios, Inc. SMILF 8 8 100% 0 0% 0 0% 8 100% 0 0% 0 0% 0 0% Showtime ABC Studios American Housewife 24 13 54% 9 38% 2 8% 11 46% 0 0% 2 8% 0 0% ABC ABC Studios BlacK-ish 24 18 75% 6 25% 11 46% 3 13% 4 17% 0 0% 0 0% ABC ABC Studios Code BlacK 13 6 46% 7 54% 3 23% 2 15% 1 8% 0 0% 0 0% CBS ABC Studios Criminal Minds 22 10 45% 12 55% 4 18% 4 18% 2 9% 0 0% 0 0% CBS ABC Studios For The People 9 4 44% 5 56% 0 0% 2 22% 2 22% 0 0% 0 0% ABC ABC Studios Grey's Anatomy 24 16 67% 8 33% 4 17% 3 13% 9 38% 0 0% 0 0% ABC ABC Studios Grown-ish 13 11 85% 2 15% 7 54% 2 15% 2 15% 0 0% 0 0% Freeform ABC Studios How To Get Away With 15 11 73% 4 27% 2 13% 2 13% 7 47% 0 0% 0 0% ABC Murder ABC Studios Kevin (Probably) Saves the 15 6 40% 9 60% 2 13% 4 27% 0 0% 0 0% 0 0% ABC World ABC Studios Marvel's Agents of 22 11 50% 11 50% 5 23% 4 18% 2 9% 0 0% 0 0% ABC S.H.I.E.L.D. -

DARK CITY HIGH the High School Noir of Brick and Veronica Mars Jason A

DARK CITY HIGH THE HIGH SCHOOL NOIR OF BRICK AND VERONICA MARS Jason A. Ney ackstabbing, adultery, blackmail, robbery, corruption, and murder—you’ll find them all here, in a place where no vice is in short supply. You want drugs? Done. Dames? They’re a dime a dozen. But stay on your toes because they’ll take you for all you’re worth. Everyone is work- ing an angle, looking out for number one. Your friend could become your enemy, and if the circumstances are right, your enemy could just as easily become your friend. Alliances are as unpredictable and shifty as a career criminal’s moral compass. Is all this the world of 1940’s and 50’s film noir? Absolutely. But, tures like the Glenn Ford vehicle The Blackboard Jungle (1955) and Bas two recent works—the television show Veronica Mars (2004- melodramas like James Dean’s first feature,Rebel Without a Cause 2007) and the filmBrick (2005)—convincingly argue, it is also the (1955). But a noir film from the years of the typically accepted noir world of the contemporary American high school. cycle (1940-1958) populated primarily by teenagers and set inside a That film noir didn’t extend its seductive, deadly reach into the high school simply does not exist. Perhaps noir didn’t make it all the high schools of the forties and fifties is somewhat surprising, given way into the halls of adolescent learning because adults still wanted how much filmmakers danced around the edges of what we now to believe that the teens of their time retained an element of their call noir when crafting darker stories about teens gone bad. -

The Ruderman White Paper on Employment of Actors With

THE RUDERMAN WHITE PAPER ON EMPLOYMENT OF ACTORS WITH DISABILIITES IN TELEVISION Danny Woodburn Kristina Kopić July 2016 White Paper – Disability Television – Contents TABLE OF CONTENTS: Executive Summary _______________________________________________________________________________ 1 Sections: 1. Introduction _______________________________________________________________________________ 3 2. Evidence Overview _______________________________________________________________________ 7 3. Evidence Analysis ________________________________________________________________________ 19 4. Anecdotal Evidence by Danny Woodburn _____________________________________________ 27 5. Best Practices ____________________________________________________________________________ 35 THE RUDERMAN FAMILY FOUNDATION One of our goals at the Ruderman Family Foundation is to change the public’s awareness of people with disabilities. More specifically we make the argument that full inclusion of people with disabilities is not a matter of charity, but of civil rights. We researched this White Paper in order to further the awareness around this civil rights movement. We believe that the results we found will meaningfully contribute to the conversation of diversity in entertainment as a civil rights issue that needs to be addressed more systematically by the media and entertainment industry. Our Mission The Ruderman Family Foundation believes that inclusion and understanding of all people is essential to a fair and flourishing community. Guided by our Jewish values,