8372 8899 Mr David Hawker MP Chair Standing Committee On

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Diachronic Study of Unparliamentary Language in the New Zealand Parliament, 1890-1950

WITHDRAW AND APOLOGISE: A DIACHRONIC STUDY OF UNPARLIAMENTARY LANGUAGE IN THE NEW ZEALAND PARLIAMENT, 1890-1950 BY RUTH GRAHAM A thesis submitted to the Victoria University of Wellington in fulfilment of the requirements for the degree of Doctor of Philosophy in Applied Linguistics Victoria University of Wellington 2016 ii “Parliament, after all, is not a Sunday school; it is a talking-shop; a place of debate”. (Barnard, 1943) iii Abstract This study presents a diachronic analysis of the language ruled to be unparliamentary in the New Zealand Parliament from 1890 to 1950. While unparliamentary language is sometimes referred to as ‘parliamentary insults’ (Ilie, 2001), this study has a wider definition: the language used in a legislative chamber is unparliamentary when it is ruled or signalled by the Speaker as out of order or likely to cause disorder. The user is required to articulate a statement of withdrawal and apology or risk further censure. The analysis uses the Communities of Practice theoretical framework, developed by Wenger (1998) and enhanced with linguistic impoliteness, as defined by Mills (2005) in order to contextualise the use of unparliamentary language within a highly regulated institutional setting. The study identifies and categorises the lexis of unparliamentary language, including a focus on examples that use New Zealand English or te reo Māori. Approximately 2600 examples of unparliamentary language, along with bibliographic, lexical, descriptive and contextual information, were entered into a custom designed relational database. The examples were categorised into three: ‘core concepts’, ‘personal reflections’ and the ‘political environment’, with a number of sub-categories. This revealed a previously unknown category of ‘situation dependent’ unparliamentary language and a creative use of ‘animal reflections’. -

2012 Annual Report.Pub

Field and Game Australia Annual Report 2011-12 guide to annual report This is the annual report of Field and Game Australia Inc, for the year ending June 30, 2012. The report provides information for the board, branches and stakeholders of Field and Game Australia about the organisation’s operations and performance. Field and Game Australia can not be held liable for any printing errors in this document. inside Part 1 contains an address from FGA Chairman Mr Bill Paterson and FGA contents CEO Mr Rod Drew. Part 2 gives a description of the organisation’s values, stakeholders, Chairman’s Address ...... 4 patrons, life members and management structure, as well as significant appointments and sub-committees. Part 3 details FGA’s membership statistics from this year and in CEO’s Address ...... 6 comparison to other years figures. Part 4 reports on the organisation’s achievements and performance and outlines the challenges that lay ahead. About FGA ...... 8 Part 5 recognises the achievements of various members and branches who have contributed to the overall success of the organisation. Membership ...... 11 Part 6 contains the audited financial report for the 2011-12 financial year. Part 7 reports on the game management sector, including game management, pest and vermin, and waterfowl count data. Partnerships ...... 12 Part 8 includes target participation figures and reports and results from the 2011 National Carnival. Part 9 reports on the progress of the WET Trust. Highlights ...... 13 acknowledgements FGA Awards ...... 15 Front cover image: Stockvault Contributors: Alison O’Connor, Shelley Gough, Tom Chick, Bill Paterson, Peter Rice, Noreen Sloan, Rod Drew, Rob Treble. -

Reps Front Template

The Parliament of the Commonwealth of Australia Report of the Australian Parliamentary Delegation to China and Mongolia 7-19 April 2005 October 2005 Canberra © Commonwealth of Australia 2005 ISBN 0 642 78716 6 Contents Membership of the Delegation............................................................................................................. v Introduction ..................................................................................................................1 Aims and objectives of the Delegation ........................................................................................ 1 Overview..................................................................................................................................... 2 Acknowledgments....................................................................................................................... 3 Bilateral visit to China..................................................................................................7 China at a glance ........................................................................................................................ 7 Background................................................................................................................................. 8 The National People’s Congress and State Council.................................................................. 10 Economic overview ................................................................................................................... 12 -

Ch 1 Elect Speaker

1 Debate on the election of Speaker Background — the Clerk’s ‘uncomfortable duty’ 1.1 Current standing order 11(g) does not permit debate to take place on the election of Speaker unless there is more than one candidate. This provision was the same in the former standing orders. 1.2 The first extract below from the Hansard of 12 February 2002 gives an example of an uncontested election of Speaker proceeding in accordance with the standing orders. The mover and seconder of the motion ‘That the honourable Member for Wakefield do take the Chair of this House as Speaker’ did not speak in support of their candidate. 1.3 The second extract from the Hansard of 16 November 2004, at the start of the current Parliament, shows events not proceeding in accordance with the standing orders. The mover on this occasion spoke in support of the candidate, prompting the following intervention from the Clerk: ‘It is my uncomfortable duty to remind the House that it is strictly not in order to speak in favour of the candidates unless the election is contested.’ 1.4 This advice was promptly ignored by the seconder, who proceeded to also speak in support of the candidate, although briefly. 1 2 DEBATE ON THE ELECTION OF SPEAKER Examples from last two elections of Speaker 1.5 The following extracts from Hansard show examples of where the standing orders were and were not followed. 1) Standing orders followed — 12 February 2002 SPEAKER Election The Clerk—Honourable members, the next business is the election of a Speaker. -

St Mark's News

St Mark’s NEWSISSUE MARCH 2015 THE UNIVERSITIES OF ADELAIDE, PENNINGTON TERRACE NORTH ADELAIDE East Wing Opening Completing the Vision Academic and Sporting Success The College Library in the 1990s In this Issue From the Master .............................................................................................................. 3 The East Wing Project ..................................................................................................... 4 Scholarships and Academic Results ............................................................................... 6 Hawker Scholarship ......................................................................................................... 7 Cowan Grants .................................................................................................................. 7 College Club Committee ................................................................................................. 8 Students Dhow a Committment to Social Justice .......................................................... 9 About St Mark’s Sporting Success ........................................................................................................... 10 Around the College ........................................................................................................ 12 College Paralympic Hopeful Gives Back to Charity .................................................................... 14 Founded in 1925 as the first Honorary Degrees ......................................................................................................... -

Upholding the Australian Constitution Volume Twenty-Four

Upholding the Australian Constitution Volume Twenty-four Proceedings of the Twenty-fourth Conference of The Samuel Griffith Society Traders Hotel Brisbane, 159 Roma Street, Hobart — August 2012 © Copyright 2014 by The Samuel Griffith Society. All rights reserved. Contents Introduction Julian Leeser The Fourth Sir Harry Gibbs Memorial Oration Senator the Honourable George Brandis In Defence of Freedom of Speech Chapter One The Honourable Ian Callinan Defamation, Privacy, the Finkelstein Report and the Regulation of the Media Chapter Two Michael Sexton Flights of Fancy: The Implied Freedom of Political Communication 20 Years On Chapter Three The Honourable Justice J. D. Heydon Sir Samuel Griffith and the Making of the Australian Constitution Chapter Four The Honourable Christian Porter Federal-State Relations and the Changing Economy Chapter Five The Honourable Richard Court A Federalist Agenda for Coast to Coast Liberal (or Labor) Governments Chapter Six Keith Kendall The Case for a State Income Tax Chapter Seven Josephine Kelly The Constitutionality of the Environmental Protection and Biodiversity Conservation Act i Chapter Eight The Honourable Gary Johns Native Title 20 Years On: Beyond the Hyperbole Chapter Nine Lorraine Finlay Indigenous Recognition – Some Issues Chapter Ten J. B. Paul Speaker of the House Contributors ii Introduction Julian Leeser The 24th Conference of The Samuel Griffith Society was held in Brisbane during the weekend of 17-19 August 2012. It marked the 20th anniversary of the Society’s birth. 1992 was undoubtedly a momentous year in Australia’s constitutional history. On 2 January 1992 the perspicacious John and Nancy Stone decided to incorporate the Samuel Griffith Society thirteen days after Paul Keating was appointed Prime Minister. -

Political Exchange Program

POlitical EXCHANGE PROgram Since its creation, JCIE has worked to promote closer relations between Japan’s leaders and their overseas counterparts through political exchange. The Political Exchange Program dates back to 1968, when the first US-Japan Parliamentary Exchange brought eight Congressional members to Tokyo for an unprecedented program of meetings and discus- sions with leading Japanese political and social figures. In the ensuing years, JCIE broadened its programs, establish- ing additional exchange programs for young political lead- ers from Japan and the United States (1973), for senior US Congressional staff (1982), and for young Australian and Japanese political leaders (1991). More than 1,000 individual political leaders have taken part in one or more of these ex- change programs. While the initial emphasis of the exchanges was generally on deepening mutual understanding and building bilateral networks of leaders, dramatic changes in the international and domestic environment have encouraged JCIE to in- creasingly stress the objective of offering political leaders the opportunity for dialogue on common challenges such as global warming or energy security. This evolution has been accompanied by a significant expansion in the role of Japanese politicians in policymaking that has made political exchange even more meaningful, and in response, JCIE has expanded its programs to include frequent study meetings for Diet members on issues relating to international affairs, often with the participation of visiting foreign leaders and other experts. JCIE has also increasingly drawn on the strong network of political leaders it has developed through this program to involve them in study and dialogue projects on key policy issues of critical concern. -

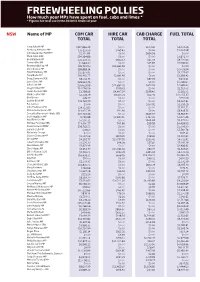

Freewheeling Pollies How Much Your Mps Have Spent on Fuel, Cabs and Limos * * Figures for Total Use in the 2010/11 Financial Year

FREEWHEELING POLLIES How much your MPs have spent on fuel, cabs and limos * * Figures for total use in the 2010/11 financial year NSW Name of MP COM CAR HIRE CAR CAB CHARGE FUEL TOTAL TOTAL TOTAL TOTAL Tony Abbott MP $217,866.39 $0.00 $103.42 $4,559.36 Anthony Albanese MP $35,123.59 $265.43 $0.00 $1,394.98 John Alexander OAM MP $2,110.84 $0.00 $694.56 $0.00 Mark Arbib SEN $34,164.86 $0.00 $0.00 $2,806.77 Bob Baldwin MP $23,132.73 $942.53 $65.59 $9,731.63 Sharon Bird MP $1,964.30 $0.00 $25.83 $3,596.90 Bronwyn Bishop MP $26,723.90 $33,665.56 $0.00 $0.00 Chris Bowen MP $38,883.14 $0.00 $0.00 $2,059.94 David Bradbury MP $15,877.95 $0.00 $0.00 $4,275.67 Tony Burke MP $40,360.77 $2,691.97 $0.00 $2,358.42 Doug Cameron SEN $8,014.75 $0.00 $87.29 $404.41 Jason Clare MP $28,324.76 $0.00 $0.00 $1,298.60 John Cobb MP $26,629.98 $11,887.29 $674.93 $4,682.20 Greg Combet MP $14,596.56 $749.41 $0.00 $1,519.02 Helen Coonan SEN $1,798.96 $4,407.54 $199.40 $1,182.71 Mark Coulton MP $2,358.79 $8,175.71 $62.06 $12,255.37 Bob Debus $49.77 $0.00 $0.00 $550.09 Justine Elliot MP $21,762.79 $0.00 $0.00 $4,207.81 Pat Farmer $0.00 $0.00 $177.91 $1,258.29 John Faulkner SEN $14,717.83 $0.00 $0.00 $2,350.51 Mr Laurie Ferguson MP $14,055.39 $90.91 $0.00 $3,419.75 Concetta Fierravanti-Wells SEN $20,722.46 $0.00 $649.97 $3,912.97 Joel Fitzgibbon MP 9,792.88 $7,847.45 $367.41 $2,675.46 Paul Fletcher MP $7,590.31 $0.00 $464.68 $2,475.50 Michael Forshaw SEN $13,490.77 $95.86 $98.99 $4,428.99 Peter Garrett AM MP $39,762.55 $0.00 $0.00 $1,009.30 Joanna Gash MP $78.60 $0.00 -

Adelaidean | June 2005

FREE Publication Adelaidean NEWS FROM THE UNIVERSITY OF ADELAIDE Volume 14 • Number 4 • June 2005 inside this issue 3 The future is eye-tech Keeping our trees streets ahead 8 New $8m music facilities hit the right note 10 Revecca responds to child disease challenge 13 Anne’s perfect strands: knitting and writing 5 Hawker scholars’ double success A hoverfl y and a computer chip Physiology seeing eye to eye 7 Photo by David O’Carroll David’s high-energy stargazing Can the humble fl y help us to see engineers led by Dr O’Carroll, and a powerful sense of structure in the better? known as the Visual Physiology world.” Group, studying the brains and eyes Unlike the popular stereotype, fl y The Visual Physiology Group has 11 of fl ies to develop artifi cial vision eyes do not form thousands of little already studied how fl ies perceive this systems – computer chips that can NASA astronaut to launch images – instead, they perceive one visual motion, and copied the whole Japanese conference see – that one day may provide the very fuzzy image of the world process onto a tiny computer chip. basis for a bionic eye. around it. Dr Karin Nordstrom, a post-doctoral “As all animals move, the world Yet, with a brain the size of a grain fellow in the Discipline of Physiology 16 moves past and so even stationary of rice and only this fuzzy image to and a member of the Visual objects generate patterns of motion Helping our sports stars strive go on, how do fl ies see well enough Physiology Group, said this is done for excellence on our retina,” he said. -

2016 Hawker Daniel Coulthurst Release 2

MEDIA RELEASE May 5th 2016 St Ignatius’ College student awarded prestigious C.A.S. Hawker Scholarship Former St Ignatius’ College Riverview student Daniel Coulthurst from Wagga Wagga has been recognised with a national scholarship that will assist him to complete his Bachelor of Agribusiness degree at Marcus Oldham College at Geelong. Daniel was educated at Riverina Anglican College (2003 – 2005) and St Ignatius’ College Riverview (2006 – 2007). Former Governor-General Major General The Hon Michael Jeffery, AC, AO (Mil), CVO, MC (Retd) presented five new Charles Hawker Scholars with their scholarship certificates this morning at a ceremony held at Burgmann College at the ANU in Canberra. Since 1990, the Trustees have awarded more than five million dollars to 114 young Australians, including a significant number from regional areas. The five successful candidates for 2016 were awarded Hawker Scholarships from a strong field of 187 applicants. The Charles Hawker Scholarship was established by Mrs. Lilias Needham in memory of her brother Charles Allan Seymour Hawker. Today the scholarship is valued at up to $50,000.00 over three years and is one of the most generous privately funded residential scholarships available to undergraduate and postgraduate students in Australia. The five new scholars are studying Agribusiness, Law, International Relations, Commerce and Journalism. The 2016 scholars have studied in Urana (NSW), Adelaide (SA), Albany (WA), Geelong (VIC), Melbourne (VIC), Renmark (SA) and Wagga Wagga (NSW). Forty friends and family, college representatives, current scholars and Trustees of the C.A.S. Hawker Scholarship attended the function at Burgmann College. Other students awarded C.A.S. -

From the Careers Centre

CAREER MAILBOX Wednesday 15th September 2015 DATES TO DIARISE Reminder: VTAC 2015 Key Dates Timely applications through VTAC Wednesday 30 September 2015 SEAS applications close Tuesday 6 October 2015 Reminder:Scholarships throughVTAC 2016 VTAC Keyclose Dates Friday 16 October 2015 Also, students applying for courses that have extra requirements (i.e. submitting a folio, a pre-selection kit, arranging an interview, etc.) are reminded that failure to meet the deadline date for these means students may no longer be eligible for selection into their desired course. Students eligible to apply for SEAS are also reminded that you cannot apply for SEAS and VTAC Scholarships until you have made your VTAC application, so putting your VTAC application in soon would be to your advantage! The VTAC website is www.vtac.edu.au. GGS CAREER EVENTS for TERM 4 Tuesday 13th October Monash University Cook Theatre 1.15- 1.55pm USEFUL LINKS FOR YEAR 12’s www.vtac.edu.au Victorian Tertiary Admission Centre for all Year 12 applicants How to register a VTAC user account : Registering for VTAC Course application demo: VATC Course Application Demo SEAS application demo: Demo for Special Entry Access Scheme http://vtac-prod-vtactier-18g6isvzq3ums-1597879423.ap-southeast- 2.elb.amazonaws.com/applying/scholarships.html: Applying for Scholarships Through VTAC VCE REVISION SESSIONS News from Victoria University Free VCE Lecture Series Victoria University is offering a series of free VCE revision lectures, designed to assist Year 12 students prepare for their exams. Each session is delivered by VCE qualified assessors and teachers, and runs between 3.5 and 4.5 hours and all commencing at 10.00am. -

Field & Game Australia

FIELD & GAME AUSTRALIA ANNUAL REPORT 2015–16 Field & Game Australia ANNUAL REPORT 2015–16 1 CONTENTS Field & Game Australia ..............3 Board and Staff .....................4 Appointments ......................5 Milestones .........................6 Chairman’s Report ..................7 General Manager’s Report ...........9 2015–16 Financial Report ........... 11 Membership ......................14 Our Changing Face ................15 Wetlands Environmental Taskforce. 17 Hunting and Game Management ....19 Simulated Field ....................21 2015 Member Service Awards. 24 CONTACT US In person: 65 Anzac Avenue, Seymour By post: PO Box 464, Seymour 3661 Email: [email protected] Phone: (03) 5799 0960 Web: www.fieldandgame.com.au Twitter: @fieldandgame Facebook: Field and Game Australia 2 ANNUAL REPORT 2015–16 Field & Game Australia Guide to the Annual Report This is the annual report of Field & Game Australia (FGA) Inc. for the financial year ending June 30, 2016. The report provides information from the Board, branches and stakeholders of FGA about the organisation’s operations and performance; and is presented at the Association’s Annual General Meeting (AGM). FGA cannot be held liable for any printing errors in this document. Acknowledgements CONTRIBUTORS: Rachel Berry; Ian Gould; David Hawker, AO; Peter Hawker; Darren Linton; David McNabb; Bill Paterson; Daryl Snowdon; Robert Treble. PRINTED BY: Willprint, Shepparton. FEEDBACK: We welcome your comments regarding this report. Send your feedback through to [email protected], or phone (03) 5799 0960. Field & Game Australia ANNUAL REPORT 2015–16 3 FIELD & GAME AUSTRALIA Our Mission Our Patrons To be the most effective organisation in the Professor Grahame Webb, BSc (Hons), PhD. promotion of hunting, recreational shooting, The Honourable David Hawker, AO.