What You May Not Know About T20 Cricket…

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Updatebro.Com

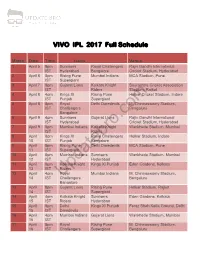

VIVO IPL 2017 Full Schedule Match Date Time Teams Venue 1 April 5 8pm Sunrisers Royal Challengers Rajiv Gandhi International IST Hyderabad Bangalore Cricket Stadium, Hyderabad 2 April 6 8pm Rising Pune Mumbai Indians MCA Stadium, Pune IST Supergiant 3 April 7 8pm Gujarat Lions Kolkata Knight Saurashtra Cricket Association IST Riders Stadium, Rajkot 4 April 8 4pm Kings XI Rising Pune Holkar Cricket Stadium, Indore IST Punjab Supergiant 5 April 8 8pm Royal Delhi Daredevils M. Chinnaswamy Stadium, IST Challengers Bengaluru Bangalore 6 April 9 4pm Sunrisers Gujarat Lions Rajiv Gandhi International IST Hyderabad Cricket Stadium, Hyderabad 7 April 9 8pm Mumbai Indians Kolkata Knight Wankhede Stadium, Mumbai IST Riders 8 April 8pm Kings XI Royal Challengers Holkar Stadium, Indore 10 IST Punjab Bangalore 9 April 8pm Rising Pune Delhi Daredevils MCA Stadium, Pune 11 IST Supergiant 10 April 8pm Mumbai Indians Sunrisers Wankhede Stadium, Mumbai 12 IST Hyderabad 11 April 8pm Kolkata Knight Kings XI Punjab Eden Gardens, Kolkata 13 IST Riders 12 April 4pm Royal Mumbai Indians M. Chinnaswamy Stadium, 14 IST ChallengersUpdatebro.com Bengaluru Bangalore 13 April 8pm Gujarat Lions Rising Pune Holkar Stadium, Rajkot 14 IST Supergiant 14 April 4pm Kolkata Knight Sunrisers Eden Gardens, Kolkata 15 IST Riders Hyderabad 15 April 8pm Delhi Kings XI Punjab Feroz Shah Kotla Ground, Delhi 15 IST Daredevils 16 April 4pm Mumbai Indians Gujarat Lions Wankhede Stadium, Mumbai 16 IST 17 April 8pm Royal Rising Pune M. Chinnaswamy Stadium, 16 IST Challengers Supergiant -

Delhi, Dhaka Agree on 22 Deals Vulnerable Tribes: Lost in A

follow us: april 9, 2017 Delhi City Edition thehindu.com 42 pages ț ₹15.00 facebook.com/thehindu twitter.com/the_hindu My govt is committed to Adityanath orders Uneasy calm prevails India clinches Davis farm loan waiver, says probe into sugar mill in Bhadrak after Cup tie against Amarinder Singh auction by Mayawati communal violence Uzbekistan page 7 page 11 page 9 page 19 Printed at . Chennai . Coimbatore . Bengaluru . Hyderabad . Madurai . Noida . Visakhapatnam . Thiruvananthapuram . Kochi . Vijayawada . Mangaluru . Tiruchirapalli . Kolkata . Hubballi . Mohali . Allahabad . Malappuram . Mumbai CCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCC NEARBY White harvest Vulnerable tribes: lost in a classiication trap Precise data crucial to ensure development initiatives Nitish lags of rally Shiv Sahay Singh on Yamuna bank Kolkata NEW DELHI A recent Anthropological Bihar Chief Minister Nitish Survey of India (AnSI) pub- Kumar lagged of a road lication has brought to the show and a rally here on fore startling revelations Saturday in what is intended about the Particularly Vul- to be the beginning of a move nerable Tribal Groups by the Janata Dal (United) (PVTGs) in the country inc- towards national expansion. luding the fact that no base The party plans to ield line surveys have been candidates from at least 100 conducted among more of the 272 wards that will be than half of such groups. going to the polls on April 23. “Our findings revealed Left out: A member of Onge tribe in Andamans (left), and a CITY Ī PAGE 2 Salt of the sea: The blazing sun doesn’t deter workers at a salt pan in Marakkanam, along the East Coast Road connecting Chennai shocking facts, of the 75 Toda woman from Tamil Nadu. -

KKR Is the IPL's Most Valuable Brand, Despite Missing out on Title

Press Release: For Immediate Release KKR is the IPL’s Most Valuable Brand, Despite Missing Out on Title Kolkata Knight Riders is the IPL’s most valuable brand, worth US$58.6 million Mumbai Indians has the most powerful brand Royal Challengers Bangalore’s is the only brand to fall in rank The business value of the IPL system grows 9% to US$3.8 billion Since 2009, leading valuation and strategy consultancy Brand Finance has calculated both the business value of the Indian Premier League system and the brand values of each individual franchise team, providing a deep understanding of the opportunities and challenges facing the teams and the IPL system as a whole. View the ranking of the IPL's most valuable team brands here With a brand value of US$58.6 million and the fastest growth year to year of 24%, Kolkata Knight Riders (KKR) top the Brand Finance IPL league table for the second year in a row. Despite missing out on the title, KKR has continues to consistent qualify for the playoff stages. The team has displayed strong leadership skills, team bonding, and a clear approach to composition and winning tactics. This year, however, surprising player choices in the playoffs did not pay off as KKR lost to Mumbai Indians in the second qualifier. KKR has its owner Shakh Rukh Khan to thank for a larger part of its popular appeal. The Bollywood superstar attracts incredible media attention and fan following, acting as an icon for the entire franchise. Depending heavily on Khan’s personal brand equity and connections, KKR lands a host of local and national sponsorships and has been one of the first to introduce an effective merchandising strategy. -

Current Affairs Pdf – April 2016

Search DayTodayGK in Google Playstore and get our free app. Practice DayTodayGK’s Unlimited Quizzes with our APP. Follow us on Facebook & Get all the Updates. Our Facebook Page – www.facebook.com/daytodaygk Join our whatsapp group and get all the important GK Updates. Send a Whatsapp message to +919629987566 All The Success for your Examination. For More Study Materials, Please Logon to www.daytodaygk.com. Prepare Well & Always Stay Focused. CURRENT AFFAIRS QUICK RECAP – APRIL 2016 INDIAN AFFAIRS • Union Government launched Inclusiveness and Accessibility Index for Persons with Disabilities • Union Government launched Startup India Portal and Mobile App • Kachhabali Becomes 1st Liquor-free village in Rajasthan • Mumbai to get its first Arbitration Centre • Government Unveils new building bye laws in New Delhi • BHEL commissions 250 Mw unit at Nabinagar plant in Bihar • Telangana Road Transport Authority’s Mobile App M-Wallet launched • India becomes fourth largest spender on defence • India's fastest train to hit tracks on April 5 • Delhi roads to be vacuum cleaned from today • Maharashtra first state to join national cancer grid • Haryana fixes qualification for urban body polls • Free helmets for two-wheeler riders in Kerala • 2 Andhra Pradesh villages to run on solar power • Madhya Pradesh to create Department of Happiness • Bihar imposes complete liquor ban from 5 th april • India’s fastest train Gatimaan Express launched • Mumbai gets it’s first-ever AC local train • Odisha to Launch Model Schools in 14 Districts • Dubai’s United -

02, Jun 2016 the Lions Show in Saurashtra IPL Debutant Gujarat

02, Jun 2016 The Lions show in Saurashtra IPL debutant Gujarat Lions almost scripted a fairy tale, they lost in the virtual semifinal, but they won many hearts not only in Rajkot but everywhere they played, but undoubtedly the foundation was laid at the Saurashtra Cricket Association (SCA) Stadium in Khanderi. A look at all their five matches which they played in one of the most magnificent stadium in the world… Match No 1 Lions off to a great start The home team started their campaign in Rajkot with a crushing seven-wicket win against Rising Pune Supergiants. It was billed as the match between MS Dhoni versus his boys as most of the Gujarat Lions players this year are former Dhoni’s team mates when he was leading the now disbanded Chennai Super Kings team. Batting first Supergiants looked set for a score in excess of 180, but a superb display of defensive bowling towards the end turned the contest in Lions' favour. Aaron Finch and Brendon McCullum then effectively killed the game by pillaging 62 in the Powerplay, during their chase of 164. MS Dhoni had pulled back some momentum for Supergiants by contributing to a 20-run last over in the first innings, but his bowlers threw it all away. Loose deliveries stacked up, and the Lions openers duly dispatched them. Four fours and two sixes off the seamers, RP Singh and Ishant Sharma, meant Dhoni turned to M Ashwin in the last over of the Powerplay, but Finch took the legspinner for four fours in a 19-run over. -

IPL 2016 Schedule

IPL 2016 Schedule TIME DATE MATCH VENUE (LOCAL) 09/04/2016 Mumbai Indian vs Wankhede Stadium, Mumbai 8:00 pm Saturday Rising Pune Supergiants Match 1 10/04/2016 Kolakata knight Riders Eden Gardens, Kolkata 8:00 pm Sunday vs Delhi Daredevils Match 2 11/04/2016 Kings XI Punjab vs Punjab Cricket Association 8:00 pm Monday Gujarat Lions Stadium, Mohali Match 3 12/04/2016 Royal Challengers M. Chinnaswamy Stadium, 8:00 pm Tuesday Bangalore VS Sunrisers Bengaluru Match 4 Hyderabad 13/04/2016 Kolkata Knight Riders Eden Gardens, Kolkata 8:00 pm Wednesday VS Mumbai Indians Match 5 14/04/2016 Gujarat Lions VS Rising Saurashtra Cricket 8:00 pm Thursday Pune Supergiants Association Stadium, Rajkot Match 6 15/04/2016 Delhi Daredevils VS Ferozeshah Kotla, Delhi 8:00 pm Friday Kings XI Punjab Match 7 16/04/2016 Sunrisers Hyderabad VS Rajiv Gandhi International 4:00 pm Saturday Kolkata Knight Riders Cricket Stadium, Hyderabad Match 8 IPL 2016 Schedule TIME DATE MATCH VENUE (LOCAL) 16/04/2016 Mumbai Indians VS Wankhede Stadium, Mumbai 8:00 pm Saturday Gujarat Lions Match 9 17/04/2016 Kings XI Punjab VS Punjab Cricket Association 4:00 pm Sunday Rising Pune Supergiants Stadium, Mohali Match 10 17/04/2016 Royal Challengers M. Chinnaswamy Stadium, 8:00 pm Sunday Bangalore VS Delhi Bengaluru Match 11 Daredevils 18/04/2016 Sunrisers Hyderabad VS Rajiv Gandhi International 8:00 pm Monday Mumbai Indians Cricket Stadium, Hyderabad Match 12 19/04/2016 Kings XI Punjab VS Punjab Cricket Association 8:00 pm Tuesday Kolkata Knight Riders Stadium, Mohali Match 13 20/04/2016 -

Iplinfo-IPL Schedule2016

IPL2016 Sr. No. Match Venue Date & Time Mumbai Indians Sat 8:00 PM VS Mumbai 01 09-April-2016 Rising Pune Supergiants Kolkata Knight Riders Sun 8:00 PM VS Kolkata 02 10-April-2016 Delhi Daredevils Kings XI Punjab Mon 8:00 PM VS Mohali 03 11-April-2016 Gujarat Lions Royal Challengers Bangalore Tue 8:00 PM VS Bengaluru 04 12-April-2016 Sunrisers Hyderabad Kolkata Knight Riders Wed 8:00 PM VS Kolkata 05 13-April-2016 Mumbai Indians Gujarat Lions Thu 8:00 PM VS Rajkot 06 14-April-2016 Rising Pune Supergiants Delhi Daredevils Fri 8:00 PM VS Delhi 07 15-April-2016 Kings XI Punjab Sunrisers Hyderabad Sat 4:00 PM VS Hyderabad 08 16-April-2016 Kolkata Knight Riders Mumbai Indians Sat 8:00 PM VS Mumbai 09 16-April-2016 Gujarat Lions Kings XI Punjab Sun 4:00 PM VS Mohali 10 17-April-2016 Rising Pune Supergiants Royal Challengers Bangalore Sun 8:00 PM VS Bengaluru 11 17-April-2016 Delhi Daredevils Sunrisers Hyderabad Mon 8:00 PM VS Hyderabad 12 18-April-2016 Mumbai Indians Kings XI Punjab Tue 8:00 PM VS Mohali 13 19-April-2016 Kolkata Knight Riders Mumbai Indians Wed 8:00 PM VS Mumbai 14 20-April-2016 Royal Challengers Bangalore Gujarat Lions Thu 8:00 PM VS Rajkot 15 21-April-2016 Sunrisers Hyderabad Rising Pune Supergiants Fri 8:00 PM VS Pune 16 22-April-2016 Royal Challengers Bangalore Delhi Daredevils Sat 4:00 PM VS Delhi 17 23-April-2016 Mumbai Indians Sunrisers Hyderabad Sat 8:00 PM VS Hyderabad 18 23-April-2016 Kings XI Punjab Gujarat Lions Sun 4:00 PM VS Rajkot 19 24-April-2016 Royal Challengers Bangalore Rising Pune Supergiants Sun 8:00 PM -

IPL 2021 Schedule Fixture and Time Table

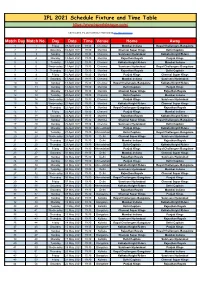

IPL 2021 Schedule Fixture and Time Table https://www.isportsleague.com/ Check Latest IPL 2021 Schedule Now only at IPL 2021 Schedule Match Day Match No. Day Date Time Venue Home Away 1 1 Friday 09 April 2021 19:30 Chennai Mumbai Indians Royal Challengers Bangalore 2 2 Saturday 10 April 2021 19:30 Mumbai Chennai Super Kings Delhi Capitals 3 3 Sunday 11 April 2021 19:30 Chennai Sunrisers Hyderabad Kolkata Knight Riders 4 4 Monday 12 April 2021 19:30 Mumbai Rajasthan Royals Punjab Kings 5 5 Tuesday 13 April 2021 19:30 Chennai Kolkata Knight Riders Mumbai Indians 6 6 Wednesday 14 April 2021 19:30 Chennai Sunrisers Hyderabad Royal Challengers Bangalore 7 7 Thursday 15 April 2021 19:30 Mumbai Rajasthan Royals Delhi Capitals 8 8 Friday 16 April 2021 19:30 Mumbai Punjab Kings Chennai Super Kings 9 9 Saturday 17 April 2021 19:30 Chennai Mumbai Indians Sunrisers Hyderabad 10 10 Sunday 18 April 2021 15:30 Chennai Royal Challengers Bangalore Kolkata Knight Riders 10 11 Sunday 18 April 2021 19:30 Mumbai Delhi Capitals Punjab Kings 11 12 Monday 19 April 2021 19:30 Mumbai Chennai Super Kings Rajasthan Royals 12 13 Tuesday 20 April 2021 19:30 Chennai Delhi Capitals Mumbai Indians 13 14 Wednesday 21 April 2021 15:30 Chennai Punjab Kings Sunrisers Hyderabad 13 15 Wednesday 21 April 2021 19:30 Mumbai Kolkata Knight Riders Chennai Super Kings 14 16 Thursday 22 April 2021 19:30 Mumbai Royal Challengers Bangalore Rajasthan Royals 15 17 Friday 23 April 2021 19:30 Chennai Punjab Kings Mumbai Indians 16 18 Saturday 24 April 2021 19:30 Mumbai Rajasthan Royals -

Govt. Junks Border Wall Plan Remarks by Moots 24X7 Seamless Virtual Fence with Sensors to Stop Iniltration from Pakistan Army Chief

follow us: saturday, february 18, 2017 Delhi City Edition thehindu.com 24 pages ț ₹10.00 facebook.com/thehindu twitter.com/the_hindu Printed at . Chennai . Coimbatore . Bengaluru . Hyderabad . Madurai . Noida . Visakhapatnam . Thiruvananthapuram . Kochi . Vijayawada . Mangaluru . Tiruchirapalli . Kolkata . Hubballi . Mohali . Allahabad . Malappuram . Mumbai NEARBY CCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCC Centre backs Skyfall Govt. junks border wall plan remarks by Moots 24x7 seamless virtual fence with sensors to stop iniltration from Pakistan Army chief Vijaita Singh of the Army, 541 violations Special Correspondent New Delhi were reported during the NEW DELHI The Centre has given up its same period. In these viola- The government on Friday PM outsider to U.P., proposal to build a wall tions, 57 locals and 26 secur- came out in support of says Priyanka along the Pakistan border in ity personnel were killed. Army chief General Bipin Lucknow Jammu, originally envisaged The Home Ministry is now Rawat for his remarks Making her much-awaited as a barrier to cross-border working on a Comprehens- about local residents com- debut in the campaign for the terror. ive Integrated Border Man- ing in the way of counter- Assembly elections in Uttar Pradesh, Priyanka Gandhi The raised embankment, agement System (CIBMS) for insurgency operations in Vadra joined her brother and initiated by the UPA govern- 24X7 surveillance. the Kashmir Valley. Congress vice-president ment in 2013 after the twin Minister of State in the Rahul Gandhi on Friday in attacks in the Hiranagar/ Pilot project under way Prime Minister’s Office attacking Prime Minister Samba sector, was to come “Currently a pilot project is (PMO) Jitendra Singh said Narenda Modi for his claim of up along 179 km of the Inter- under way, where an integ- General Rawat had not being the “adopted son” of national Border in Jammu. -

Page16sports.Qxd (Page 1)

SATURDAY, MARCH 25, 2017 (PAGE 16) DAILY EXCELSIOR, JAMMU India under pressure, Kohli Release funds to state bodies for holding matches: SC to BCCI highly doubtful for fourth Test NEW DELHI, Mar 24: commitments postulated in the DHARAMSALA, Mar 24: unless his replacement Shreyas will take a call later tonight or contract so that there is no The Supreme Court today impediments in holding the test Iyer fires big time. tomorrow before the game. We asked the Committee of Indian captain Virat Kohli Kohli did bat at the nets today will have to give it that much time match," it said. was rendered a highly doubtful Administrators (CoA) appointed but admitted that a call can only more to make a call with the The direction came when starter for the fourth and final by it to run the BCCI to release be taken by physio Patrick physiotherapist." Additional Solicitor General cricket Test against Australia, a funds to state cricket associa- Farhart in the evening. The India Teams (from): Tushar Mehta, appearing for scenario that has put the hosts tions, including HPCA, which is camp probably doesn't want to India: Virat Kohli (captain), Himachal Pradseh Cricket under immense pressure on the holding the last India-Australia give away any psychological KL Rahul, Murali Vijay, Association (HPCA), said the eve of the decider of the bitterly Cheteshwar Pujara, Ajinkya test, for organising matches. CoA is not releasing Rs 2.5 crore fought series. advantage to the opposition ahead A bench headed by Justice of the decider. Perhaps that was Rahane, Karun Nair, Wriddhiman required for conducting the last With the high-voltage rubber Saha (wk), Ravichandran Dipak Misra also considered the test match beginning tomorrow also the reason that the skipper, locked at 1-1, things couldn't Ashwin, Ravindra Jadeja, Ishant plea of Maharashtra, Karnataka in Dharamshala. -

IPL 2016 Schedule PDF

IPL 2016 Schedule PDF Matc Date & h Time Teams Venue Type Result April 9, Mumbai Indians Vs Wankhede Stadium, Leag Rising Pune 2016, Rising Pune Mumbai ue Supergiant Won 8:00 PM Supergiant by 9 Wicket(s) IST April 10, Delhi Capitals Vs Eden Gardens, Kolkata Leag Kolkata Knight 2016, Kolkata Knight ue Riders Won by 8:00 PM Riders 9 Wicket(s) IST April 11, Kings XI Punjab Vs Punjab Cricket Leag Gujarat Lions 2016, Gujarat Lions Association IS Bindra ue Won by 5 8:00 PM Stadium, Mohali, Wicket(s) IST Chandigarh April 12, Royal Challengers M Chinnaswamy Leag Royal 2016, Bangalore Vs Stadium, Bangalore ue Challengers 8:00 PM Sunrisers Bangalore Won IST Hyderabad by 45 Run(s) April 13, Kolkata Knight Eden Gardens, Kolkata Leag Mumbai Indians 2016, Riders Vs Mumbai ue Won by 6 8:00 PM Indians Wicket(s) IST April 14, Rising Pune Saurashtra Cricket Leag Gujarat Lions 2016, Supergiant Vs Association Stadium, ue Won by 7 8:00 PM Gujarat Lions Rajkot Wicket(s) IST April 15, Kings XI Punjab Vs Feroz Shah Kotla, Delhi Leag Delhi Capitals 2016, Delhi Capitals ue Won by 8 8:00 PM Wicket(s) IST IPL schedule data published at @ IPL Cricket Match April 16, Mumbai Indians Vs Wankhede Stadium, Leag Gujarat Lions 2016, Gujarat Lions Mumbai ue Won by 3 4:00 PM Wicket(s) IST April 16, Sunrisers Rajiv Gandhi Leag Kolkata Knight 2016, Hyderabad Vs International Stadium, ue Riders Won by 8:00 PM Kolkata Knight Uppal, Hyderabad 8 Wicket(s) IST Riders April 17, Rising Pune Punjab Cricket Leag Kings XI Punjab 2016, Supergiant Vs Association IS Bindra ue Won by 6 -

English-Grammar-Std-12

Oscar English Grammar According to new paper style for board exam Standard – 12 Functional English grammar and Textbook and Lapwing Answers of all the exercises are given in a separate book - Suresh Mangukiya hild is Sp C ec y i er al v " E " O R S C A Since -2008 Excellent English by Suresh Mangukiya 1 Oscar English Grammar Annual Exam SECTION : A (Objective – 17 marks) • Tick mark True or False against the following statements : [04] • Find and write the nearest meaning : [03] • Select the most appropriate language function given in the bracket and write against the sentence : [03] • Select the most appropriate response : (M.C.Q.) [04] • Select the most appropriate question to get the underlined word / phrase as answer: (M.C.Q.) [03] SECTION : B (Reading comprehension - 19 marks) • Read the extract and answer the questions : [10] • Fill in the blanks with the appropriate words given in the brackets : [03] • Write a short note focusing on the questions : [06] SECTION : C (Reading comprehension 20 marks • Read the following passages and answer the questions given below it : [05] • Summary writing. [05] • Read the news clipping and answer the questions : [05] • Read the stanza and answer the questions : [05] SECTION : D (Functions : 20 Marks) • Transformation [04] • Reported speech [04] • Complete the sentence using the functions given in the brackets : [05] • Synthesis [03] • Editiing [04] SECTION : E (Writing : 24 Marks) • Information transfer [05] • Paragraph writing [08] • Application writing or Speech writing [06] • Email writing or Report writing (Either is asked) [05] Excellent English by Suresh Mangukiya 2 Oscar English Grammar Section - A Write whether the sentences are True or False: (1) Customer was technically powerful.