Connectivity Secure Reliable

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Infrastructure Report 90-102 Regent Street Redfern, Wee Hur Student Housing

INFRASTRUCTURE REPORT 90-102 REGENT STREET REDFERN, WEE HUR STUDENT HOUSING 02 OCTOBER 2020 CONTACT KAKOLI DAS National Discipline Leader M 0428 981 326 Arcadis E [email protected] Level 16, 580 George Street Sydney NSW 2000 i WEE HUR GROUP WEE HUR STUDENT VILLAGE Infrastructure Report Author Benjamin Fogerty Checker Kakoli Das Approver Kakoli Das Report No F001 - 10036797 Date 25/09/2020 Revision Text 02 This report has been prepared for Wee Hur in accordance with the terms and conditions of appointment for Redfern Student Accommodation. Arcadis Australia Pacific Pty Limited (ABN 76 104 485 289) cannot accept any responsibility for any use of or reliance on the contents of this report by any third party. REVISIONS Approved Revision Date Description Prepared by by 01 25/09/2020 Draft Issue BF KD 02 02/10/2020 DA Submission BF KD iii CONTENTS 1 . EXECUTIVE SUMMARY ........................................................................................................ 1 1.1 Purpose ................................................................................................................................ 1 1.2 Authority ............................................................................................................................... 1 2 INTRODUCTION ...................................................................................................................... 2 2.1 Site Information ................................................................................................................... 2 2.2 Description -

ASX/Media Release

ASX/Media Release 29 March 2017 Sale of Investment in Macquarie Telecom Group Vocus Group Limited (ASX: VOC, ‘Vocus’) today announces that it has disposed of 3,358,511 shares representing ~16% relevant interest in the ordinary shares of Macquarie Telecom Group Limited (ASX: MAQ). The shares were held via a total return swap as described in the FY16 Vocus financial statements. Attached is the Form 605 Notice of ceasing to be a substantial holder. ENDS For further information please contact: Kelly Hibbins Investor Relations Debra Mansfield Corporate Communications P: +61 2 8316 9856 P: +61 3 9674 6569 M: +61 414 609 192 E: [email protected] E: [email protected] About Vocus: Vocus Group (ASX: VOC) is a vertically integrated telecommunications provider, operating in the Australian and New Zealand markets. The Company owns an extensive national infrastructure network of metro and back haul fibre connecting all capital cities and most regional centres across Australia and New Zealand. Vocus infrastructure now connects directly to more than 5,500 buildings. Vocus owns a portfolio of brands catering to corporate, small business, government and residential customers across Australia and New Zealand. Vocus also operates in the wholesale market providing high performance, high availability and highly scalable communications solutions which allow service providers to quickly and easily deploy new services for their own customer base. For more information please go to our website www.vocusgroup.com.au. VOCUSGROUP.COM.AU 605 page 1/2 15 July 2001 Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder To Company Name/Scheme ACN/ARSN 1. -

Good Morning, Please See Attached Notice of Decision for Block 1 Section 41 Suburb

Page 830 From: EPD, Customer Services Sent: Tuesday, 5 March 2019 10:35 AM To: '[email protected]' Cc: '[email protected]' Subject: NOTICE OF DECISION-201834545-1/41 LYNEHAM [SEC=UNCLASSIFIED] Attachments: NOTICE OF DECISION-201834545-SIGNED.PDF; 20190212 - Advice - Block 1 Section 41 Lyneham lease variation (A1884936....pdf; Icon Water Application Decision. Application - 174607. Lyneham - 1/41 Good Morning, Please see attached Notice of Decision for Block 1 Section 41 Suburb LYNEHAM Development Application No: 201834545 For further information please contact DA Coordinator on 6207 6383 or by email [email protected] Kind Regards Katherine Phone 6207 1923 [email protected] www.act.gov.au/accesscbr Access Canberra | ACT Government 16 Challis Street, Dickson| GPO Box 158 Canberra ACT 2601 Access Canberra is an ACT Government service that brings together customer and regulatory services, including the former Environment and Planning Directorates Customer Services Team. Access Canberra has been set up to make it easier for business, community organisations and individuals to work with ACT Government and deliver a more seamless experience. 1 Page 831 From: EPD, Customer Services Sent: Tuesday, 5 March 2019 10:36 AM To: EPSD DALeasingreferrals; '[email protected]'; HeritageReferrals; TCCS_PC DA; EPAPlanningLiaison; ORSRCS Subject: NOTICE OF DECISION-201834545-1/41 LYNEHAM [SEC=UNCLASSIFIED] Attachments: NOTICE OF DECISION-201834545-SIGNED.PDF; DISPATCHADVICECHECKLIST-201834545-01.doc Good Morning, Please see attached -

Domestic Transmission Capacity Service

Domestic Transmission Capacity Service An ACCC Draft Report on the review of the declaration for the Domestic Transmission Capacity Service December 2018 1 2 List of abbreviations ACCC Australian Competition and Consumer Commission AVC Access virtual circuit CAN Customer access network CBD Central business district CCA Competition and Consumer Act 2010 CSA Connectivity serving area CSP Carriage service provider CVC Connectivity virtual circuit DCS Data Carriage Service DSL Digital subscriber line DSLAM Digital subscriber line access multiplexer DTCS Domestic transmission capacity service ESA Exchange service area FAD Final access determination FSA Fibre serving area FTTB Fibre to the building FTTC Fibre to the curb FTTN Fibre to the node FTTP Fibre to the premises HFC Hybrid fibre coaxial Infrastructure RKR Audit of Telecommunications Infrastructure Assets – Record Keeping Rules IP Internet protocol LTIE Long-term interests of end-users Mbps Megabits per second MLL Managed leased line MNO Mobile network operator NBN National Broadband Network NBN Co NBN Co Limited 3 NNI Link product Virtual network-to-network interface link product currently being developed by NBN Co POI Point of interconnection POP Point of presence RKR Record keeping rules RSP Retail service provider SAM Service area module SAOs Standard access obligations SIOs Services in operation SSU Structural separation undertaking TC-1 NBN Co’s highest priority traffic class. It is suitable for applications such as voice. TC-2 An NBN traffic class that provides support for business type applications that require a committed information rate. TC-3 An NBN traffic class designed to give priority to transactional data such as business applications. -

Letter from the Chairman of Bigair 7 Letter from the Chairman of Superloop 9

The Australian St ock Ex change Limit ed Level 4, 20 Bridge Stre et SYDNEY NSW 2000 Attention: C ompany Announc ement Ofc er 28 Oct ober 2016 First Court Hearing and Scheme Booklet BigAir Group Limited (ASX:BGL) (“BigAir” or “Company”) is pleased to advise that the Federal Court of Australia (“Court”) has approved orders to convene meetings of the Company’s shareholders to consider and vote on the Scheme of Arrangement (“Scheme”) under which Superloop Limited will acquire all BigAir shares which it does not already own. A full copy of the Scheme Booklet is attached, as approved by the Court for dispatch to shareholders. The Scheme Booklet includes an Independent Expert Report prepared by Lonergan Edwards & Associates Limited. The Independent Expert has opined that the Scheme is fair and reasonable and in the best interests of BigAir shareholders, in the absence of a superior proposal. Indicative timetable The timetable steps for completion of the Scheme are: Scheme Meeting 11.00am on Wednesday, 7 December 2016 Second Court Date for approval of the Scheme Friday, 9 December 2016 Effective Date Friday, 9 December 2016 Court order lodged with ASIC BigAir Shares suspended from trading on ASX New Superloop shares commence trading on ASX on a deferred Monday, 12 December 2016 settlement basis Record Date for determining entitlement to the Scheme Wednesday, 14 December 2016 Consideration Implementation Date Wednesday, 21 December 2016 Payment of cash consideration and issue of New Superloop Shares Trading of New Superloop Shares commence on ASX on a normal By Thursday, 22 December 2016 settlement basis This timetable is indicative only and, among other things, is subject to the satisfaction of or, where applicable, waiver of the conditions precedent to the Scheme, and to all necessary shareholder and Court approvals. -

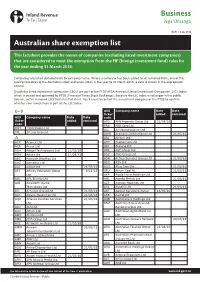

Australian Share Exemption List

Business Ngā Ūmanga IR871 | June 2016 Australian share exemption list This factsheet provides the names of companies (excluding listed investment companies) that are considered to meet the exemption from the FIF (foreign investment fund) rules for the year ending 31 March 2016. Companies are listed alphabetically by company name. Where a company has been added to, or removed from, one of the qualifying indices of the Australian stock exchange (ASX) in the year to 31 March 2016, a date is shown in the appropriate column. Qualifying listed investment companies (LICs) are part of the FTSE AFSA Australia Listed Investment Companies (LIC) Index which is owned and operated by FTSE (Financial Times Stock Exchange). Because the LIC index is no longer in the public domain, we’ve removed LICs from this factsheet. You’ll need to contact the investment company or the FTSE to confirm whether your investment is part of the LIC Index. 0–9 ASX Company name Date Date ticker added removed ASX Company name Date Date code ticker added removed APD APN Property Group Ltd 21/03/16 code ARB ARB Corp Ltd ONT 1300 Smiles Ltd ALL Aristocrat Leisure Ltd 3PL 3P Learning Ltd AWN Arowana International Ltd 21/03/16 A ARI Arrium Ltd ACX Aconex Ltd AHY Asaleo Care Ltd ACR Acrux Ltd AIO Asciano Ltd ADA Adacel Technologies Ltd 21/03/16 AFA ASF Group Ltd ADH Adairs Ltd 21/09/15 ASZ ASG Group Ltd ABC Adelaide Brighton Ltd ASH Ashley Services Group Ltd 21/03/16 AHZ Admedus Ltd ASX ASX Ltd ADJ Adslot Ltd 21/03/16 AGO Atlas Iron Ltd 21/03/16 AFJ Affinity Education Group 2/12/15 -

M2 Group Looks to New Zealand and Low-Cost Retail for Growth

TODAY'S PAPER VIDEOS INFOGRAPHICS MARKETS DATA LOGIN SUBSCRIBE search the AFR NEWS BUSINESS MARKETS STREET TALK REAL ESTATE OPINION TECHNOLOGY PERSONAL FINANCE LEADERSHIP LIFESTYLE ALL Home / Business / Telecommunications Jul 20 2015 at 12:15 AM | Updated Jul 20 2015 at 12:15 AM SAVE ARTICLE PRINT REPRINTS & PERMISSIONS | M2 Group looks to New Zealand and low-cost retail for growth RELATED ARTICLES Telstra tells Airbnb tagline doesn't 'Belong' in Oz 38 mins ago A handy step towards the connected car Vodafone Australia CEO slams Telstra's Asia strategy, service fees Murdoch sons get hefty salaries in new jobs Future of BBC up for grabs as UK government kicks off review Chief executive Geoff Horth, pictured, runs M2 Group's operations, while founder Vaughan Bowen keeps an eye on mergers and acquisitions – a vital station at the telco. James Alcock LATEST STORIES by David Ramli Workplace drug As the $1.56 billion takeover of iiNet by TPG Telecom looks close to a done deal, testing spreads to investors have begun to question whether the underbidder M2 Group can continue to white collar expand in a broadband market where it is a distant fourth behind Telstra, TPG and workers and executives Singtel-Optus. 3 mins ago M2, the Melbourne-based phone and internet reseller that is best known for its Insuring your subsidiary brands Dodo, iPrimus and Commander, has been a strong sharemarket SMSF's success performer. Its share price has risen almost 88 per cent over the past 12 months, 3 mins ago giving it a market value of about $2 billion. -

Appendix 4D and Half Year FY17 Result FEB 22, 2017 Download

22 FEBRUARY 2017 THE MANAGER COMPANY ANNOUNCEMENTS OFFICE AUSTRALIAN SECURITIES EXCHANGE 4TH FLOOR, 20 BRIDGE ST SYDNEY NSW 2000 ELECTRONIC LODGEMENT DEAR SIR/MADAM, FY17 HALF YEAR RESULTS Vocus Group (ASX: VOC) today releases its financial results for the half year ended 31 December 2016. Please find attached an Appendix 4D half year report. The Company will conduct an investor briefing commencing at 9.30am this morning. The briefing will be webcast and can be accessed through the Company’s website at www.vocusgroup.com.au. The investor briefing pack is attached to this announcement. YOURS FAITHFULLY, ASHE-LEE JEGATHESAN GROUP GENERAL COUNSEL & COMPANY SECRETARY Vocus Group | vocusgroup.com.au 1 Vocus Group Limited Appendix 4D Half-year report 1. Company details Name of entity: Vocus Group Limited ABN: 96 084 115 499 Reporting period: For the half-year ended 31 December 2016 Previous period: For the half-year ended 31 December 2015 2. Results for announcement to the market $'000 Revenues from ordinary activities up 403.9% to 888,241 Underlying EBITDA * up 200.8% to 187,248 Profit from ordinary activities after tax attributable to the owners of Vocus Group Limited up 94.9% to 47,181 Profit for the half-year attributable to the owners of Vocus Group Limited up 94.9% to 47,181 Underlying net profit after tax ** up 235.6% to 91,854 31 Dec 2016 31 Dec 2015 Cents Cents Basic earnings per share 7.72 10.58 Diluted earnings per share 7.71 10.56 Underlying diluted earnings per share *** 15.01 11.94 Basic and diluted earnings per share for the half-year ended 31 December 2016 includes the impact of significant items after tax of $44,673,000 (31 December 2015: $3,163,000). -

Telecommunications Provider Locator

Telecommunications Provider Locator Industry Analysis & Technology Division Wireline Competition Bureau January 2010 This report is available for reference in the FCC’s Information Center at 445 12th Street, S.W., Courtyard Level. Copies may be purchased by contacting Best Copy and Printing, Inc., Portals II, 445 12th Street S.W., Room CY-B402, Washington, D.C. 20554, telephone 800-378-3160, facsimile 202-488-5563, or via e-mail at [email protected]. This report can be downloaded and interactively searched on the Wireline Competition Bureau Statistical Reports Internet site located at www.fcc.gov/wcb/iatd/locator.html. Telecommunications Provider Locator This report lists the contact information, primary telecommunications business and service(s) offered by 6,493 telecommunications providers. The last report was released March 13, 2009.1 The information in this report is drawn from providers’ Telecommunications Reporting Worksheets (FCC Form 499-A). It can be used by customers to identify and locate telecommunications providers, by telecommunications providers to identify and locate others in the industry, and by equipment vendors to identify potential customers. Virtually all providers of telecommunications must file FCC Form 499-A each year.2 These forms are not filed with the FCC but rather with the Universal Service Administrative Company (USAC), which serves as the data collection agent. The pool of filers contained in this edition consists of companies that operated and collected revenue during 2007, as well as new companies that file the form to fulfill the Commission’s registration requirement.3 Information from filings received by USAC after October 13, 2008, and from filings that were incomplete has been excluded from this report. -

Australiaʼs Specialist Fibre and Network Solutions Provider

Vocus Group Vocus AUSTRALIAʼS SPECIALIST FIBRE | Annual Report 2019 AND NETWORK SOLUTIONS PROVIDER Annual Report 2019 VOCUS GROUP Annual Report 2019 ABOUT THIS REPORT The Annual Report 2019 is a summary of Vocus operations, activities and financial position for the 12 month period to 30 June 2019. Vocus Group Limited is the parent company of the Vocus group of companies. In this report, unless otherwise stated, references to “Vocus”, “the Group”, “the Company”, “we”, “our” and “us” refer to Vocus Group Limited and its controlled entities. In this report, references to the financial year refer to the period 1 July to 30 June unless otherwise stated. All dollar figures are expressed in Australian dollars, unless otherwise stated. Our Corporate Governance Statement, detailing our compliance with the ASX Corporate Governance Council’s “Corporate Governance Principles & Recommendations – 3rd Edition” can be found online at our website via http://vocusgroup.com.au/ about-us/corporate-governance/. REPORT OBJECTIVES This report meets our governance and compliance requirements and has been written to provide shareholders and interested parties with clear, easy to understand information on the Company and its performance in FY19. ADDITIONAL INFORMATION This report can also be found online via http://vocusgroup.com.au/investors/ company-performance/annual-reports/ A full copy of our Sustainability Report, reviewing our environmental, social and economic impact, can be found online via http://vocusgroup.com.au/sustainability/ sustainability-report/. KEY DATES Financial Year End – 30 June 2019 Annual General Meeting – 29 October 2019 The 2019 Annual General Meeting will be held at the Warrane Theatre at the Museum of Sydney. -

VOC.AX: Vocus/M2 Completes Fixed Telco 'Big Four'

8 April 2016 Asia Pacific/Australia Equity Research Alternative Carriers Vocus Communications (VOC.AX / VOC AU) Rating OUTPERFORM Price (08-Apr,A$) 8.58 INCREASE TARGET PRICE Target Price (A$) (from 8.0) 9.2 Target price ESG risk (%) 0.0 Market cap (A$mn) 4,565.9 Vocus/M2 completes fixed telco 'big four' Yr avg. mthly trading (A$mn) 204.8 Projected return: ■ Enlarged Vocus can become a major telco: Vocus has been transformed Capital gain (%) 7.2 following the recent mergers with Amcom and M2. The enlarged Vocus now Dividend yield (net %) 2.4 has national network capability, a strong data/internet product set, scale Total return (%) 9.6 presence in all key customer segments (medium/large corporate, wholesale, *Stock ratings are relative to the relevant country benchmark. ¹Target price is for 12 months. SME and consumer), and an enhanced national sales and dealer network to Research Analysts sell its products. The merged group has the footprint and capabilities that it Fraser McLeish needs to win share in all its key markets and to grow into a major telco over 61 2 8205 4069 [email protected] time. Execution will now be the main factor determining success. In this Lucas Goode report we undertake a detailed review of Vocus' operations and key drivers. 61 2 8205 4431 [email protected] ■ Market share gains to accelerate: The enlarged Vocus is expanding its sales force and investing in marketing, which we expect to drive continued growth in market share as corporate/business customers re-assess their telcom requirements as they transition to an IP/cloud environment. -

How TPG's David Teoh Snared His Prey Iinet

Home / Business / Telecommunications Sep 5 2015 at 12:15 AM Updated Sep 5 2015 at 2:55 PM How TPG's David Teoh snared his prey iiNet Rob Homer by David Ramli It takes a special kind of businessman to stalk his prey for four long years. But in a market where money lives quarter to quarter, that's exactly what the reclusive billionaire and TPG Telecom executive chairman, David Teoh, did in his patient hunt for internet service provider iiNet. In February 2011, as Sydney's skies turned grey with summer rain, Teoh invited iiNet chair Michael Smith and founder Michael Malone to breakfast at the Bambini Wine Room in the city across from Hyde Park. As they ate among the wood-grained panels beneath a wall of pinot noir, Teoh insisted he was merely an investor chasing a bargain. In March 2015, four silent years later, Smith's phone buzzed with a second invitation to breakfast. Teoh decided now was time to strike and offered an all-cash deal the chairman felt he couldn't refuse. TPG's $1.56 billion takeover of iiNet, which was finalised in the Federal Court late last month, has been a gruelling and controversial process amid claims the sale was bungled, and undervalued both the telco and the market – points the company strongly deny. But what is indisputable is the quiet power skilfully amassed by TPG's Malaysian-born executive chairman in a relatively short time. Between the first fateful breakfast and September 3, TPG's market capitalisation has grown from $1.1 billion to over $7 billion.