Business Account Agreement and Disclosure (For Business Checking Accounts, Business Savings Accounts and Business Certificates)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

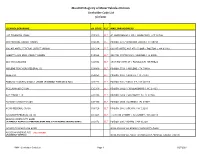

Esl Switch Support Reference List

ESL SWITCH SUPPORT REFERENCE LIST We know change can sometimes be a challenge. But not with ESL. We’re with you step by step to make the switching process clear and less complicated. For quick reference, use this form to help you keep track of information and prepare for a smooth transition. FOR PERSONAL USE; ALWAYS KEEP YOUR BANKING INFORMATION AND RECORDS CONFIDENTIAL. FORMER BANK INFORMATION Bank name Address Phone number ABA Routing Number Savings account number Checking account number Debit card number (last four digits only for your protection) Other account numbers (auto loan, mortgage, etc.) NEW ESL ACCOUNT INFORMATION ESL Branch address ESL Representative name ESL ABA Routing Number: 222371863 Member number Savings account number Checking account number Debit card number (last four digits only for your protection) Other information NOTE: For a short period, both your old bank account and your new ESL account should be active to ensure all payments and deposits are switched over correctly during the transition and enough money is available to cover outstanding bills. This guide is just one way to help you get organized to switch over to ESL. Our representatives are available to directly answer questions and assist as you go. 20 branches > 585.336.1000 > 800.848.2265 > esl.org > Live Chat Banking See reverse for more details. AUTOMATED/PREAUTHORIZED BILL PAYMENTS We suggest you review your past 3-4 banking statements for all bills paid automatically. Use this checklist as a guide for what you may need to transfer. Your ESL representative can help you identify automated payments on a statement from your former bank. -

Business Electronic Funds Transfer Disclosure Statement and Agreement

BUSINESS ELECTRONIC FUNDS TRANSFER DISCLOSURE STATEMENT AND AGREEMENT (for ESL Visa® Business Debit Card, TEL-E$L®, ESL Business Online Banking, ESL Business Mobile Banking and ESL Online Bill Pay) 1. INTRODUCTION This Agreement governs the following products/services offered by ESL Federal Credit Union (ESL): ESL Visa Business Debit Card The ESL Visa Business Debit Card allows you to access your ESL accounts at any ESL ATM as well as at other ATM and POS terminals displaying the NYCE or PLUS network logos across the country and worldwide. In addition, the ESL Visa Business Debit Card allows you to make electronic purchases directly from your designated ESL Business Checking Account. Visa purchases made with an ESL Visa Business Debit Card are directly debited from your designated ESL Business Checking Account. TEL-E$L (Automated Telephone Transaction Service) TEL-E$L is a computer assisted telephone self-service banking system that’s available 24 hours a day, seven days a week. You can complete transfers between accounts in your name and obtain important credit union or account information by following a series of computerized voice prompts. TEL-E$L requires the use of a pre-assigned Personal Identification Number (PIN). ESL Business Online Banking This service allows you to access all your ESL business accounts via the Internet 24 hours a day, seven days a week. You can transfer funds between accounts at ESL. In addition, you can view check images and receive your statements. ESL Business Mobile Banking This service is offered as a convenience and supplemental service to our ESL Business Online Banking services. -

Savings and Checking Discloure

SAVINGS AND CHECKING DISCLOSURE TERMS AND ACCOUNT AGREEMENT Welcome to ESL Federal Credit Union. Thank you for opening a new account with us. This Agreement describes the relationship between you and ESL Federal Credit Union. This is an important document. Please read it, and keep it in a safe place. You should ask us any questions you have about this Agreement. GENERAL TERMS AND CONDITIONS 1. This Agreement establishes your rights and responsibilities as a member of ESL Federal Credit Union and the obligations of ESL Federal Credit Union to you. In this Agreement, ESL Federal Credit Union may be referred to as “ESL”, “the credit union”, “we” or “us”. You may be referred to as “member”, “you” or “yours”. The word “account” means any one or more share or other accounts you have with ESL. This Agreement is a contract between ESL and you. It will, along with the credit union’s charter, by-laws and policies, govern all relationships between you and all other members of ESL and the credit union. Some accounts, for example loans, IRA, health savings accounts and trust accounts may have special rules which will be given to you separately. By signing a member account agreement, depositing money into your account or removing money out of your account, you indicate acceptance of the terms of this Agreement. All questions or communications to us should be sent to: ESL Federal Credit Union P.O. Box 92714 Rochester, NY 14692-8814 2. To join the credit union, you must complete payment of one share ($1.00) in your membership share account and have your application approved by an ESL authorized officer. -

ESL Visa® Business Credit Card & Overdraft Line of Credit Application

Corporate Headquarters 225 Chestnut Street Rochester, NY 14604 ESL Visa® Business Credit Card & Overdraft Line of Credit Application 1. Borrower Information Name of Borrower: _________________________________________ Business Member Number: _______________________ (Legal Entity of Business Name or DBA Name) If Borrower is a DBA Owner’s Name: ________________________________________________ Tax ID (TIN/EIN): ___________________________ Email Address: ____________________________ Business Phone: _________________ Business Fax: ___________________ Business Entity: Sole Proprietor/DBA General Partnership Limited Partnership LLC/PLLC LLP Corporation (C-Corp) S-Corp Non-Profit Club/Association Nature/Purpose of Business: _____________________________________________ Number of Years in Business: ___________ Gross Annual Sales: $______________ State/County of Incorporation/Filing: __________________________________________ Business Type: Manufacturing Money Service Business Professional Real Estate Retail Transportation Other: ____________________________ Business Mailing Address: _________________________________________________________________________________ (If P.O. Box, please indicate actual street address below) City: ______________________________ State: ______ Zip: _____________ Business Street Address: __________________________________________________________________________________ (If different than mailing address) City: ______________________________ State: ______ Zip: _____________ 2. Select Products Business -

Short-Term Loan Application

ESL SHORT-TERM LOAN APPLICATION ESL SHORT-TERM LOAN PERSONAL > BUSINESS > WEALTH MANAGEMENT APPLICATION GET INSTANT CASH SUPPORT When sudden expenses happen, an ESL Short- ESL PRODUCTS & SERVICES Checking Visa® Prepaid Cards Term Loan provides quick cash, from $250 up to Money Maker Visa® Secured Credit Cards $1,000 based on credit evaluation, to help pay for Savings Visa® Check Cards Certificates Online Banking them. It’s also a practical option if you’re trying to IRAs Online Bill Pay establish or restore credit. Choose a 6-month term1 Health Savings Accounts In-Person Bill Pay Telephone Banking with a competitive fixed interest rate for manageable Mortgages Home Equity Loans ESL Chat Banking payments to keep you on course. and Lines of Credit ATM Network Vehicle and Personal Loans Mobile Banking Short-Term Loans Mobile Deposit The credit approval process can be conveniently Visa® Credit Cards completed in one visit and give you immediate access Ask about our full line of Business Banking and to your money once approved. We’ve included the Wealth Management products and services. qualifying requirements and application here to get you CONNECT WITH US: started. Corporate Headquarters 225 Chestnut Street > Rochester, NY 14604 EASY APPLICATION STEPS (Check esl.org for branch locations/hours) The application process is easy, straightforward Contact Center (Rochester, NY) 585.336.1000 > 800.848.2265 and immediately reviewed at any of our branch TDD Services locations. If approved, the funds will be made available 585.336.1399 > 800.243.6722 immediately. Just follow the steps below: Internet esl.org > ESL Chat Banking 1. -

Business Loan Application

Corporate Headquarters 225 Chestnut Street Rochester, NY 14604 Business Loan Application 1. Borrower Information Name of Borrower: _________________________________________ Business Member Number: _______________________ (Legal Entity of Business Name or DBA Name) If Borrower is a Sole Proprietor Owner’s Name: ________________________________________________ Tax ID (TIN/EIN): ___________________________ Email Address: ____________________________ Business Phone: _________________ Business Fax: ___________________ Business Entity: Sole Proprietor/DBA General Partnership Limited Partnership LLC/PLLC LLP Corporation (C-Corp) Business Individual Non-Profit Club/Association S-Corp Nature/Purpose of Business: _____________________________________________ Date Business Established: _____________ Prior Year Revenue: $______________ State/County of Incorporation/Filing: __________________________________________ Number of Employees: _____________ Number of jobs to be created with use of loan (if applicable): _________________________ Number of jobs that will be retained as a result of the loan that would have been lost otherwise (if applicable): ____________________ Is this business an existing franchise? Yes No Will funds be used to purchase a franchise? Yes No Franchise Name (if answer to either of the above questions is yes) : ____________________________________________________ Affiliates or Subsidiaries (if applicable): ________________________________________________________________________ If business is less than two years -

Lienholder Code List 9/27/2021

MassDOT-Registry of Motor Vehicles Division Lienholder Code List 9/27/2021 LIENHOLDER NAME LH CODE ELT MAILING ADDRESS 1ST FINANCIAL BANK C50366 ELT 47 SHERMAN HILL RD / WOODBURY / CT 06798 360 FEDERAL CREDIT UNION C02166 ELT PO BOX 273 / WINDSOR LOCKS / CT 06096 600 ATLANTIC FEDERAL CREDIT UNION C01314 ELT 600 ATLANTIC AVE 4TH FLOOR / BOSTON / MA 02210 ABBOTT LABS EMPL CREDIT UNION C13286 ELT 325 TRI STATE PKWY / GURNEE / IL 60031 ABC BUS LEASING C41552 ELT 1506 NW 30TH ST / FARIBAULT/ MN 55021 ABILENE TEACHERS FEDERAL CU C06969 ELT PO BOX 5706 / ABILENE / TX 79608 ABLE INC C50051 ELT PO BOX 1907 / AUSTIN / TX 78767 ABOUND FEDERAL CREDIT UNION (FORMERLY FORT KNOX FCU) C02772 ELT PO BOX 900 / RADCLIFF / KY 40159 ACCLAIM FED CR UN C31308 ELT PO BOX 29527 / GREENSBORO / NC 27420 ACF FINCO 1 LP C42336 ELT PO BOX 2969 / SPRINGFIELD / IL 62708 ACHIEVA CREDIT UNION C34463 ELT PO BOX 1500 / DUNEDIN /FL 34697 ACMG FEDERAL CR UN C00716 ELT PO BOX 188 / SOLVAY / NY 13209 ACUSHNET FEDERAL CR UN C01006 ELT 112 MAIN STREET / ACUSHNET / MA 02743 ADAMS COMMUNITY BANK (FORMERLY ADAMS COOPERATIVE BANK AND SOUTH ADAMS SAVINGS BANK) C01872 ELT PO BOX 306 / ADAMS / MA 01220 ADAMS COOPERATIVE BANK NOW KNOWN AS ADAMS COMMUNITY BANK ADDISON AVENUE FCU (ALL TITLES) (FORMERLY HPEFCU) NOW KNOWN AS FIRST TECHNOLOGY FEDERAL CREDIT UNION RMV - Lienholder Code List Page 1 9/27/2021 MassDOT-Registry of Motor Vehicles Division Lienholder Code List 9/27/2021 LIENHOLDER NAME LH CODE ELT MAILING ADDRESS ADVANCIAL FEDERAL CREDIT UNION C40457 ELT PO BOX 276711 / SACRAMENTO -

Electronic Funds Transfer Disclosure Statement and Agreement

Electronic Funds Transfer Disclosure Statement and Agreement (for ESL ATM Card, ESL Visa® Debit Card, ESL Visa® Health Savings Account Card, TEL-E$L®, Automated Clearing House (ACH) Transactions, Electronic Check Conversion (ECK), ESL Online Banking, ESL Mobile Banking, ESL Online Bill Pay and ESL In-Person Bill Pay) 1. INTRODUCTION This agreement governs the following products/services offered by ESL Federal Credit Union (ESL): ESL ATM Card (ATM/POS Transactions) The ESL ATM Card allows you to access your ESL® accounts at any ESL ATM as well as at other ATM and POS terminals displaying the NYCE®, or PLUS® network logos across the country and worldwide. ESL Visa Debit Card The ESL Visa Debit Card provides you with all of the features listed for the ESL ATM Card, and in addition, allows you to make electronic purchases directly from your designated ESL Checking Account. Visa purchases made with an ESL Visa Debit Card are directly debited from your designated ESL Checking Account. ESL Visa Health Savings Account (HSA) Card The ESL Visa HSA Card provides you with all of the features listed for the ESL ATM Card, and in addition, allows you to make electronic purchases directly from your designated ESL HSA. TEL-E$L (Automated Telephone Transaction Service) TEL-E$L is a computer assisted telephone self-service banking system that's available 24 hours a day, seven days a week. You can complete transfers between accounts in your name and obtain important credit union or account information by following a series of computerized voice prompts. TEL-E$L requires the use of a pre-assigned Personal Identification Number (PIN). -

ESL VISA®Credit Card Application

October 9, 2013 IMB.lyt with BRM Env sample Layout: Business, 8 7/8 in (3.875" #9, 8.875") 3 7/8 x forArtwork x Envelope, IMPORTANT: DO NOT ENLARGE, REDUCE OR MOVE the FIM and barcodes. They are only valid as printed! October 9, 2013 IMB.lyt with BRM Env sample Layout: Business, 8 7/8 in (3.875" #9, 8.875") 3 7/8 for x Artwork x Envelope, IMPORTANT: DO NOT ENLARGE, REDUCE OR MOVE the FIM and barcodes. They are only valid as printed! to meet both USPS regulations and automation compatibility Special standards. care must be taken to ensure FIM and barcode are actual size AND placed properly on the mail piece to meet both USPS regulations and automation compatibility Special standards. care must be taken to ensure FIM and barcode are actual size AND placed properly on the mail piece ESL VISA® PERSONAL > BUSINESS > WEALTH MANAGEMENT CREDIT CARD APPLICATION ESL PRODUCTS & SERVICES Checking Rewards Visa Signature® Money Maker Credit Cards Savings Visa® Prepaid Cards Certificates Visa® Secured Credit Cards IRAs Visa® Check Cards Health Savings Accounts Online Banking FIRST-CLASS MAIL FIRST-CLASS MAIL Online Bill Pay BUSINESS REPLY MAIL REPLY BUSINESS BUSINESS REPLY MAIL REPLY BUSINESS Mortgages ROCHESTER NY 14692-9837 ROCHESTER 92714 PO BOX DEPT LOAN CONSUMER ATTN: FEDERAL CREDIT UNION ESL Home Equity Loans In-Person Bill Pay POSTAGE WILL ADDRESSEE BE PAID BY POSTAGE WILL ADDRESSEE BE PAID BY and Lines of Credit Telephone Banking Fold and seal outside edge with two pieces of tape before mailing. Vehicle and Personal Loans ESL Live Chat Banking Short-Term Loans ATM Network Visa® Credit Cards Mobile Banking Mobile Deposit PERMIT NO. -

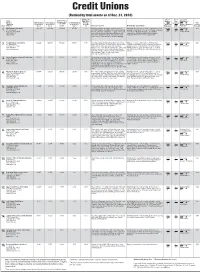

Credit Unions (Ranked by Total Assets As of Dec

Credit Unions (Ranked by total assets as of Dec. 31, 2010) Balance to No. of No. of Top Local Name Total in Share Open Basic Members Area Executive(s) Address Total Assets as Total Loans as Accounts as of Total Reserves as Savings Locations Year Telephone of 12/31/2010 of 12/31/2010 12/31/2010 of 12/31/2010 Account Total Local Board Chairman or Locally Rank Website ($000) ($000) ($000)1 ($000) ($) Services Provided2 Membership Requirements Employees ATMs President Founded ESL Federal Credit Union 3,932,967 2,051,943 2,427,899 467,456 1.00 Checking, savings, certificates, overdraft protection, Individuals who live, work, worship or attend school in the 300,000 19 David Fiedler 1920 1. 225 Chestnut St. IRAs, direct deposit, mortgages, home equity loans and geographic boundaries of the city of Rochester; employees Rochester, N.Y. 14604 lines of credit, Visa credit and check cards, vehicle and and retirees of Eastman Kodak Co., its subsidiary 627 40 Candy Obourn (585) 336-1000 personal loans, Internet banking and bill-pay service, organizations and their immediate family members; www.esl.org ATM cards, telephone banking, ATM network, online employees and retirees of select organizations chat service, investment services, business banking Summit Federal Credit Union 624,428 425,651 551,234 60,503 5.00 Checking, savings, holiday and vacation clubs, money Employees, retirees and volunteers of 500 member 59,600 9 Michael Vadala 1941 2. 100 Marina Drive market accounts, share certificates, direct deposit, IRAs, companies; individuals related to or sharing a permanent Rochester, N.Y. -

ESL Consumer Loan Application

IMPORTANT: DO NOT ENLARGE, REDUCE OR MOVE the FIM and barcodes. They are only valid as printed! IMPORTANT: Special care must DO NOTbe taken ENLARGE, to ensure REDUCE FIM and barcodeOR MOVE are theactual FIM size and AND barcodes. placed They properly are only on the valid mail as piece printed! Specialto meet careboth mustUSPS be regulations taken to ensure and automation FIM and barcode compatibility are actual standards. size AND placed properly on the mail piece to meet both USPS regulations and automation compatibility standards. CONSUMER LOAN CONSUMER APPLICATION NO POSTAGE NONECESSARY POSTAGE NECESSARYIF MAILED IFIN MAILED THE UNITEDIN THE STATES UNITED STATES BUSINESS REPLY MAIL FIRST-CLASSBUSINESS MAIL PERMIT REPLY NO. 559 ROCHESTER MAIL NY FIRST-CLASS MAIL PERMIT NO. 559 ROCHESTER NY POSTAGE WILL BE PAID BY ADDRESSEE POSTAGE WILL BE PAID BY ADDRESSEE ESL FEDERAL CREDIT UNION ATTN: CONSUMER LOAN DEPT PO BOX 92714 ROCHESTER NY 14692-9837 Artwork for Envelope, Business, #9, 3 7/8 x 8 7/8 in (3.875" x 8.875") Produced by DAZzle, Version 12.2.02 ArtworkLayout: samplefor Envelope, BRM Env Business, with IMB.lyt #9, 3 7/8 x 8 7/8 in (3.875" x 8.875") Produced(c) 1993-2012, by DAZzle, DYMO Version Endicia, 12.2.02 www.Endicia.com OctoberLayout: sample 9, 2013 BRM Env with IMB.lyt Authorized(c) 1993-2012, User, DYMO Serial Endicia, # www.Endicia.com October 9, 2013 Authorized User, Serial # Fold and seal outside edge with two pieces of tape before mailing. ESL CONSUMER LOAN APPLICATION Type of Loan Requested PERSONAL > BUSINESS > WEALTH -

ESL VISA® SECURED Credit Card Application

ESL VISA® SECURED CREDIT CARD APPLICATION ESL VISA® SECURED PERSONAL > BUSINESS > WEALTH MANAGEMENT CREDIT CARD APPLICATION SIMPLE STEPS TO GET YOUR CARD APPLICATION REQUIREMENTS Choose from 2 easy options—meet with an ESL Please read closely. If you do not meet all of the ESL PRODUCTS & SERVICES Checking Visa® Prepaid Cards Representative in branch or talk to us by phone at requirements, we may not be able to approve your Money Maker Visa® Secured Credit Cards 585.336.1000, then: ESL Visa® Secured Credit Card application. Each Savings Visa® Check Cards Certificates Online Banking applicant must meet all of the requirements. 1. Complete the attached application (see IRAs Online Bill Pay Application Requirements). Health Savings Accounts In-Person Bill Pay q A member in good standing with a savings Telephone Banking 2. Deposit money equal to your requested Mortgages account at ESL Federal Credit Union. ESL Live Chat Banking credit line into an ESL Secured Credit Card Home Equity Loans q At least 18 years old. and Lines of Credit ATM Network Savings Account. q Currently not the primary owner of an ESL Visa Vehicle and Personal Loans Mobile Banking In branch—deposit with cash, check or transfer Secured Credit Card. (This applies to primary Short-Term Loans Mobile Deposit from another ESL account. applicant only.) Visa® Credit Cards By phone—deposit with transfer from another q Positive balances in all ESL Savings or Checking ESL account or check by mail. Ask about our full line of Business Banking and Accounts. Wealth Management products and services. 3. Get instant approval.