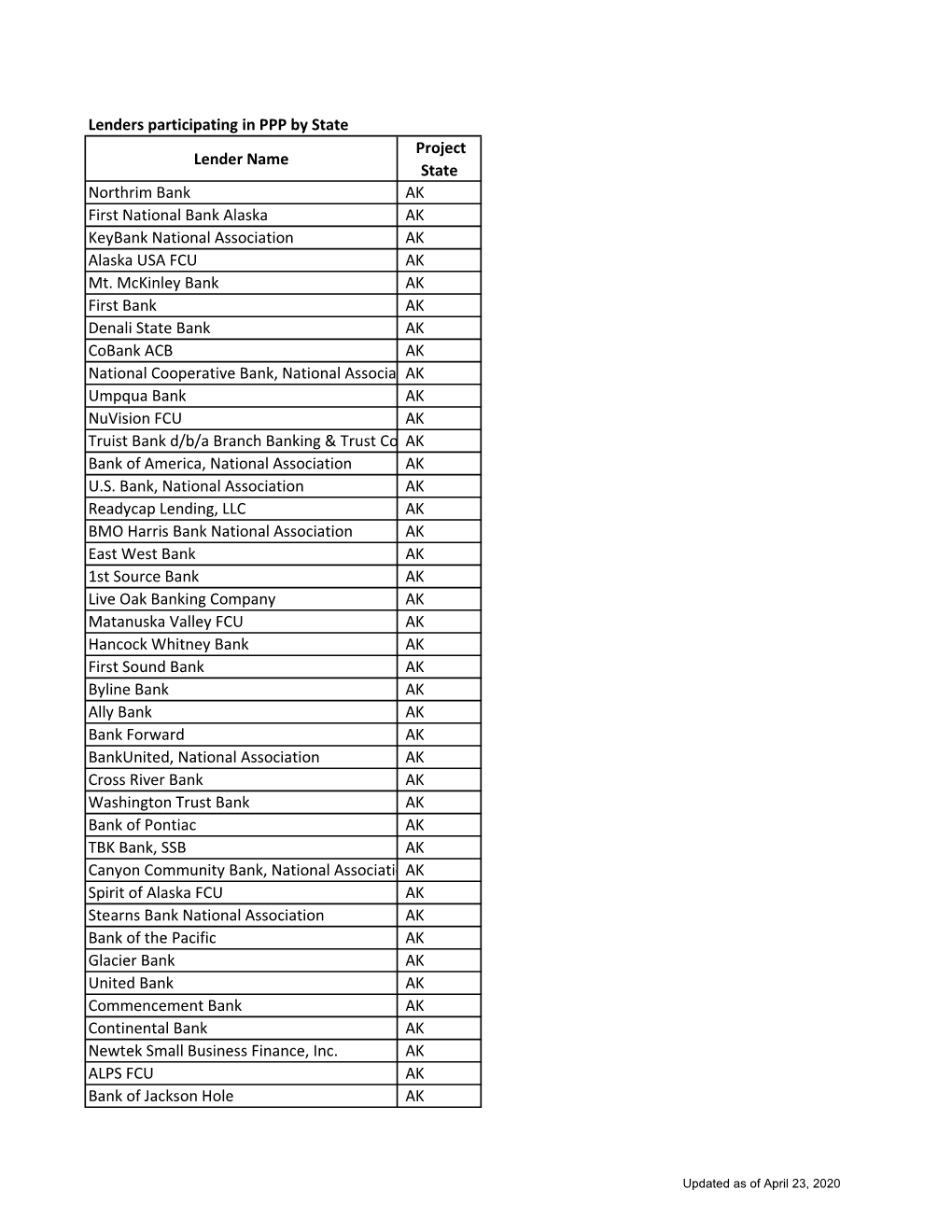

PPP Lender Activity Lookup.Xlsx

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Failed Financial Institution Litigation: Remember When*

\\server05\productn\N\NYB\5-1\NYB101.txt unknown Seq: 1 27-APR-09 15:14 FAILED FINANCIAL INSTITUTION LITIGATION: REMEMBER WHEN* RICHARD D. BERNSTEIN JOHN R. OLLER JESSICA L. MATELIS** INTRODUCTION As the global economic crisis continues, the effect of the credit crisis and fair value accounting will create a likely up- surge in litigation, reminiscent of the wave of lawsuits spawned by the Savings and Loan crisis of 1988-1994 (“S&L crisis”). The body of law developed during the S&L crisis provides a ready starting point for this new round of failed financial institution litigation. Moreover, new developments since the S&L crisis will also be tested in the coming years. The Federal Deposit Insurance Corporation (“FDIC”) and the Resolution Trust Corporation (“RTC”), in their capac- ity as receivers,1 and the Office of Thrift Supervision (“OTS”), in its regulatory capacity, spearheaded much of the S&L litiga- tion. The FDIC, RTC, and OTS aggressively pursued officers and directors of failed banks and thrifts, as well as various third parties, including audit firms, law firms, and a then-major in- vestment bank, that provided services to the failed institutions. At the height of the S&L crisis, the combined direct and indi- rect payments by the FDIC and the RTC to outside counsel in 1991 reached over $700 million. The collapse of Washington Mutual in September 2008 represented the largest bank failure in U.S. history;2 added to IndyMac’s collapse in July 2008 and the failure of a number of * “We lived and learned, life threw curves/There was joy, there was hurt/Remember when.” Remember When, lyrics by Alan Jackson. -

Dartmouth Law Journal Vol. 12.2 Fall 2014

BAEZ PROSECUTORIAL DISCRETION ADVISED: ANALYZING THE PROPER ROLE OF “ECONOMIC CONSEQUENCES” AS A FACTOR IN FEDERAL PROSECUTORIAL DECISIONS NOT TO SEEK CRIMINAL CHARGES LUIS BAEZ** The 2008 housing and financial crisis produced numerous books, documentaries, and legal works around the term “Too Big to Jail.” Though the United States Justice Department claimed that the term’s applicability to the financial crisis was mostly conjecture, the past few years has indicated it is—for the most part—true. While other legal and scholarly works have discussed the term and its validity, this article argues that prosecutors should be entirely barred from considering “economic consequences” of their decisions whether or not to bring criminal charges against a person or other legal entity in order to uphold justice within the criminal system. ! INTRODUCTION ............................................................................................. 2 I. THE SOURCE OF FEDERAL PROSECUTORIAL DISCRETION ..................... 4 A. The Decision to Charge ................................................................ 5 B. Selecting the Charge ..................................................................... 5 II. RULES THAT GOVERN PROSECUTORIAL DISCRETION ............................ 6 III. THE HANDLING OF PAST CORPORATE CRIMES ...................................... 9 A. The Great Depression ................................................................... 9 B. Savings & Loan Crisis ................................................................. -

Results 2020 4Q20 #Youarethevaccine

Results 2020 4Q20 #YouAreTheVaccine We address the challenges faced by banks with a sound CET1 fully-loaded (*) LCR / NSFR capital and liquidity position reinforced by the sale agreement of our subsidiary in the United States 14.58% 149% / 127% (*) Pro-forma: including the positive impact from the sale of BBVA USA. We support the community to protect We use technology to promote the health and wellbeing of all new ways of working Hybrid model more exible M +€35 +€11M Donated for the ght Donated by customers against the pandemic and employees Onsite Remote working 123,174 working employees We oer nancial support to to our customers to relief We rely on employees committed with our Purpose, their nancial burden and to help them in their recovery to bring the age of opportunities to everyone, and with our values Deferrals and repayment exibility More funding and liquidity and loans with government support Customer We think We are Continuous drive of digital channels comes rst big one team € We have digital advisory tools to help our customers to We help our clients transition improve their nancial health toward a sustainable future Pledge 2025 To mobilize €100 Billion Companies Individual customers Mobilized Lo €50,000M approx. We help our customers in cumulated since 2018 their lives and in their businesses Digital Mobile Digital customers customers sales 63% 59% 64% Another milestone in our (% penetration) (% penetration) (% of total unit sold) commitment to sustainability We face 2021 with an unparalleled position of strength to invest -

JOHN HANCOCK INVESTMENT TRUST II Form

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-03-31 | Period of Report: 2021-01-31 SEC Accession No. 0001145549-21-019758 (HTML Version on secdatabase.com) FILER JOHN HANCOCK INVESTMENT TRUST II Mailing Address Business Address C/O JOHN HANCOCK FUNDSC/O JOHN HANCOCK FUNDS CIK:743861| IRS No.: 000000000 | State of Incorp.:MA | Fiscal Year End: 1031 200 BERKELEY STREET 200 BERKELEY STREET Type: NPORT-P | Act: 40 | File No.: 811-03999 | Film No.: 21791427 BOSTON MA 02116 BOSTON MA 02116 617-663-3000 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document John Hancock Regional Bank Fund Quarterly portfolio holdings 1/31/2021 Fund’s investments As of 1-31-21 (unaudited) Shares Value Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Common stocks 99.2% $1,002,534,917 (Cost $577,539,623) Financials 99.2% 1,002,534,917 Banks 94.8% 1st Source Corp. 157,918 6,214,073 Altabancorp 18,406 592,857 American Business Bank (A) 144,317 4,841,835 American River Bankshares 139,590 1,803,503 Ameris Bancorp 363,746 14,226,106 Atlantic Capital Bancshares, Inc. (A) 332,013 5,939,713 Atlantic Union Bankshares Corp. 394,323 12,949,567 Bank of America Corp. 858,343 25,449,870 Bank of Commerce Holdings 318,827 3,229,718 Bank of Marin Bancorp 171,486 6,368,990 Bar Harbor Bankshares 209,204 4,499,978 BayCom Corp. (A) 266,008 3,910,318 Berkshire Hills Bancorp, Inc. -

San Antonio Sports Hall of Fame Auction Items

SAN ANTONIO SPORTS HALL OF FAME TRIBUTE AUCTION FEBRUARY 10, 2005 Instructions for the Auction: 1. Please follow the instructions on the Bid Sheets for the silent auction. 2. Minimum Bid is the Starting Bid. 3. Incremental Increases should be followed or your Bid will be deleted unless it is higher than required. 4. Please note all Gift Certificates have expiration dates. 5. Check out will begin after all the Inductees have been presented. 6. Visa, MasterCard or American Express, Cash and Checks are accepted. 7. Live Auction will be paid for immediately by successful bidder. Bid High & Good Luck! Page 1 Live Auction 1……….Mexican Fiesta Party at Rio Plaza Courtyard Party for up to 75 friends at Rio Plaza on the Riverwalk; Mexican Buffet and 'Tex Mex' drinks to include Margaritas, Wine and Beer accompanied by light entertainment. Book Soon! Based on Availability. Value $2,500 Donated by Rio Plaza and Weston Events 2……….Wine Lovers Extravaganza Explore the Napa Valley with a Weekend for Two at Trinchero Estates Bed & Breakfast known for their world class wines and located in the heart of the wine country with gourmet Breakfasts, Tour & Tasting. Additionally Two Nights-Stay in San Francisco at the Marriott Airport San Francisco. Airfare for Two included. Donated by Trinchero Winery and Airfare Courtesy of The Miner Corporation 3……….Vacation on the Beach Manzanillo Villa for 8. One-week stay in a 4-Bedroom/4-Bath villa located on a cliffside overlooking the Pacific Ocean. Swimming pool. Cook/Housekeeper for hire. Santiago Country Club Membership. Fishing options. -

Press Release Third Annual National Speakers

PRESS RELEASE CONTACT: Veronica S. Laurel CHRISTUS Santa Rosa Foundation 210.704.3645 office; 210.722-5325 mobile THIRD ANNUAL NATIONAL SPEAKERS LUNCHEON HONORED TOM FROST AND FEATURED CAPTAIN“SULLY” SULLENBERGER Proceeds from the Luncheon benefit the Friends of CHRISTUS Santa Rosa Foundation SAN ANTONIO – (April, 3, 2013) Today, the Friends of CHRISTUS Santa Rosa Foundation held its Third Annual National Speakers Luncheon to honor Tom C. Frost, Jr. with the Beacon Award for his passionate service to the community, and featured Captain Chesley B. “Sully” Sullenberger, III as the keynote speaker. Proceeds from the event will benefit programs supported by the Foundation. The Friends of CHRISTUS Santa Rosa Foundation supports the health and wellness of adults throughout south and central Texas by raising money for innovative programs and equipment for four general hospitals and regional health and wellness outreach programs in the San Antonio Medical Center, Westover Hills, Alamo Heights and New Braunfels. The National Speakers Luncheon celebrates the contributions of Frost by honoring him with the Friends of CHRISTUS Santa Rosa Beacon Award. Frost is chairman emeritus of Frost Bank and is the fourth generation of his family to oversee the bank founded by his great grandfather, Colonel T.C. Frost in 1868. He has a long history of community service, having served on the Board of Trustees for the San Antonio Medical Foundation, the Texas Research and Technology Foundation and Southwest Research Institute. He has served on executive committees, boards and initiatives for the San Antonio Livestock Exposition, the McNay Art Museum, the Free Trade Alliance and the YMCA, to name just a few. -

Cadence Bancorporation (Exact Name of Registrant As Specified in Its Charter)

Section 1: 10-K (10-K) UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-38058 Cadence Bancorporation (Exact name of registrant as specified in its charter) Delaware 47-1329858 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 2800 Post Oak Boulevard, Suite 3800, Houston, Texas 77056 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (713) 871-4000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange on which registered Class A Common Stock CADE New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Annual Report

2011 Corporate Responsibility Annual Report This is BBVA Compass’ fourth Corporate Responsibility annual report, and it contains information on the organization’s related performance during calendar year 2011. This report, as was the case in both 2010 and 2009, includes only BBVA Compass content — which is in contrast to the 2008 report’s inclusion of significant amounts of data introducing the BBVA Group. Its focus is on issues deemed significant by our stakeholders in light of the current global economic environment. Our approach transparently displays the nature of BBVA Compass’ main commitments and operations, both as a financial services institution in the United States and as a member of the BBVA Group (BBVA), a premier global financial services institution. This report has been prepared at Global Reporting Initiative G3 (GRI) Application level B and was also independently reviewed to achieve level B+. The 2011 report is available as a single electronic document to reduce paper consumption and to be aligned with the environmental initiative of the bank. A printed Executive Summary of this report is available upon request. 2011 BBVA Compass Corporate Responsibility Annual Report Contents 3 Contents and Introduction 4 Letter from the U.S. Country Manager and BBVA Compass President and CEO 5 Profile 8 Stakeholder Engagement 10 Corporate Responsibility Principles and Policy 13 Financial Inclusion 17 Responsible Finance 20 Responsible Banking 31 Responsible Management of Human Resources 41 Responsible Procurement 44 Environmental Management -

Consumer Privacy Policy

Rev. April 2018 WHAT DOES BANK OF THE WEST FACTS DO WITH YOUR PERSONAL INFORMATION? Financial companies choose how they share your personal information. Federal law gives Why? consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. The types of personal information we collect and share depend on the product or service you What? have with us. This information can include: ■ Social Security number and income ■ transaction history and account balances ■ credit history and employment information All financial companies need to share customers’ personal information to run their everyday How? business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Bank of the West chooses to share; and whether you can limit this sharing. Does Bank oF the Reasons we can share your personal inFormation Can you limit this sharing? West share? For our everyday business purposes— such as to process your transactions, maintain your Yes No account(s), respond to court orders and legal investigations, or report to credit bureaus For our marketing purposes— Yes No to offer our products and services to you For joint marketing with other Financial companies Yes No For our aFFiliates’ everyday business purposes— Yes No information about your transactions and experiences For our aFFiliates’ everyday business purposes— Yes Yes information about your creditworthiness For our aFFiliates to market to you Yes Yes For nonaFFiliates to market to you No We don’t share To limit ■ Call 1-800-676-BEAR (2327)—our menu will prompt you through your choice(s) ■ TTY users may call 1-800-659-5495 our sharing Please note: If you are a new customer, we can begin sharing your information 60 days from the date we sent this notice. -

Printmgr File

ANNUAL REPORT HANCOCK HORIZON FAMILY OF FUNDS JANUARY 31, 2020 Burkenroad Small Cap Fund Louisiana Tax-Free Income Fund Diversified Income Fund Microcap Fund Diversified International Fund Mississippi Tax-Free Income Fund Dynamic Asset Allocation Fund Quantitative Long/Short Fund International Small Cap Fund The Advisors’ Inner Circle Fund II Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary, or, if you are a direct investor, by calling 1-800-990-2434. You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Funds, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-990-2434. -

PUBLIC SECTION BNP Paribas 165(D)

PUBLIC SECTION OCTOBER 1, 2014 PUBLIC SECTION BNP Paribas 165(d) Resolution Plan Bank of the West IDI Resolution Plan This document contains forward-looking statements. BNPP may also make forward-looking statements in its audited annual financial statements, in its interim financial statements, in press releases and in other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about BNPP’s beliefs and expectations, are forward-looking statements. These statements are based on current plans, estimates and projections, and therefore undue reliance should not be placed on them. Forward-looking statements speak only as of the date they are made, and BNPP undertakes no obligation to update publicly any of them in light of new information or future events. CTOBER O 1, 2014 PUBLIC SECTION TABLE OF CONTENTS 1. Introduction ........................................................................................................................4 1.1 Overview of BNP Paribas ....................................................................................... 4 1.1.1 Retail Banking ....................................................................................... 5 1.1.2 Corporate and Investment Banking ....................................................... 5 1.1.3 Investment Solutions ............................................................................. 6 1.2 Overview of BNPP’s US Presence ........................................................................ -

City of Tyler City Council Communication

CITY OF TYLER CITY COUNCIL COMMUNICATION Agenda Number: C-A-3 Date: August 25, 2021 Subject: Request that the City Council consider reviewing and accepting the Investment Report for the quarter ending June 30, 2021. Page: Page 1 of Item Reference: The City of Tyler Investment Portfolio Summary includes all of the core information required under the Public Funds Investment Act plus some additional supporting information that has been prepared to assist the City Council in the quarterly review process. Please reference the attachment labeled as Investments held on June 30. RECOMMENDATION: It is recommended that the City Council consider reviewing and accepting the Investment Report for the quarter ending June 30, 2021. ATTACHMENTS: Investment Portfolio 2021 06 30 Federal Reserve Bank of Dallas 2nd Quarter Investments_held_on_June_30 Drafted/Recommended By: Department Leader Keidric Trimble, CFO Edited/Submitted By: City Manager 1 INVESTMENT PORTFOLIO SUMMARY For the Quarter Ended June 30, 2021 Prepared by Valley View Consulting, L.L.C. The investment portfolio of the City of Tyler is in compliance with the Public Funds Investment Act and the Investment Policy. Chief Financial Officer Accounting Manager Treasury Manager Disclaimer: These reports were compiled using information provided by the City. No procedures were performed to test the accuracy or completeness of this information. The market values included in these reports were obtained by Valley View Consulting, L.L.C. from sources believed to be accurate and represent proprietary valuation. Due to market fluctuations these levels are not necessarily reflective of current liquidation values. Yield calculations are not determined using standard performance formulas, are not representative of total return yields and do not account for investment advisor fees.