The Fraud Triangle and Tax Evasion

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sec. 1 Criminology Pages # Quest. I. Understanding Human Behavior ………………

Sec. 1 Criminology Pages # Quest. I. Understanding Human Behavior ………………. 2 9 II. Theories of Crime Causation... ……………..….. 4 18 III. White collar Crime ...……………….…………. ...9 18 IV. Organizational Crime ……………..…….……... 14 24 V. Occupational Crime ..…………………….......... .21 20 VI. Responsibility for Fraud Prevention...……….... 27 9 VII. Corporate Sentencing Guidelines ………........... 30 20 VIII. Fraud Prevention Policy .. ….………..………... .35 16 IX. Punishment ……....…………….……………......40 13 X. Criminal Justice System ……...………….....…...44 22 XI. Ethics for Fraud Examiners …...…...……...…...51 29 XII. ACFE Code of Ethics ………...…………….…...59 27 ______________________________________________________________________________ Sec. 1 - Criminology 0 / 66 I. Understanding Human Behavior_____________________________________ 1. Incentives programs and task-related bonuses are reinforcement strategies that can be successfully utilized in the workplace. A. True B. False When managers are faced with disgruntled employees, they can modify these emotional circumstances, not just with "image" work, but with adequate compensation and by recognizing workers' accomplishments. Incentives programs and task-related bonuses follow this principle, assuming that employees who feel challenged and rewarded by their jobs will produce more work at a higher quality, and are less likely to violate the law. 2. Criminological research has generally concluded that punishing a person for a crime helps deter that person from committing other crimes in the future. A. True B. False Behavioral studies, such as those conducted by Skinner, show that punishment is the least effective method of changing behavior. Punishing brings "a temporary suppression of the behavior," but only with constant supervision and application. In repeated experiments, Skinner found that punishment-either applying a negative stimulus, or taking away a positive one-effectively extinguished a subject's behavior, but that the behavior returned "when the punishment was discontinued and eventually all responses came out" again. -

PROCEEDINGS of the ACADEMIC WORKSHOP -J

If you have issues viewing or accessing this file, please contact us at NCJRS.gov. PROCEEDINGS of the ACADEMIC WORKSHOP "Definitional Dilemma: Can and Should There Be a Universal Definition of White Collar Crime?" -j 'II June 20-22 1996 Sponsored and Co-hosted by ~~ National White Collar Crime Center t~~1 and West Virginia University ~:*~~ PROCEEDINGS of the ACADEMIC WORKSHOP "Definitional Dilemma: Can and Should There Be a Universal Definition of White Collar Crime?. ~ii~i~,::,,,~ii!iiiiiiiiiiiiiiiiiiiiiiiiiii!! '~ @ O O O ® O @ Edited by James Helmkamp, Richard Ball and Kitty Townsend National White Collar Crime Center Training and Research Institute Morgantown, West Virginia prr.National Criminal Justice Reference Service - :' GOOO Rock~,il{e,k'iO 20850 © 1996 National White Collar Crime Center Training and Research Institute 11 Commerce Drive, Suite 200 Morgantown, West Virginia 26505 Permission is hereby given for this text to be reproduced, with proper attribution, by non-profit and public agencies engaged in research and training for criminal justice personnel. No resale or commercial use may be made of this document. Printed in the United States of America October, 1996 This project was supported by Grant No. 96-WC-CX-001 as awarded by the Bureau of Justice Assistance with the U.S. Office of Justice Programs. The opinions, findings, conclusions or recommendations expressed in this publication are those of the presenters and discussants and do not necessarily reflect the views of the National White Collar Crime Center or the U.S. Department of Justice. gi~il ~M~++ I ..................... 1"''1+:+ . , P(oo • '1"!. ..... , • i.. + ~ -.] .... :.. ~!;u. -

Chapter 8 a Brief History of the Underworld and Organized Crime, C. 1750–1950 Introduction

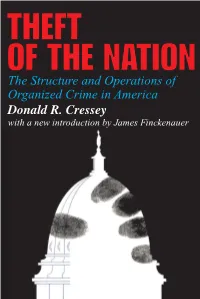

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Leeds Beckett Repository Chapter 8 A Brief History of the Underworld and Organized Crime, c. 1750–1950 Heather Shore Introduction In 1969, the American penologist and criminologist Donald R. Cressey invented an organized crime model for a modern audience (2008 [1969]). Two years before, he had been a consultant on organized crime for the President’s Commission on Law Enforcement and Administration of Justice convened by Lyndon Johnson to address the threat of organized crime in the United States. Cressey’s research, and his subsequent book, The Theft of the Nation, would inform U.S. government policies on organized crime for the following decades. In the 1960s Cressey spearheaded the movement of criminologists to attempt to formally define what organized crime was (Maltz, 1976). In doing so they looked back to the recent history of those North American cities in which crime groups were understood to have clawed their way into politics, economics, and society. History, and its impact on the present, was central to many of these attempts to define organized crime. As Attorney General Ramsey Clark remarked in an address to the National Emergency Committee of the National Council on Crime and Delinquency in New York in November 1967, “Many find it difficult to believe there is organized crime, but its existence is confirmed by history, experience and reason. It surfaced in the United States in the last decades of the nineteenth century and during the prohibition era” (U.S. Congress 1967, p. -

THEFT of the NATION the Structure and Operations of Organized

THEFT OF THE NATION Criminology Sociology American Studies THEFT OF THE NATION THEFT Th e Structure and Operations of Organized Crime in America Donald R. Cressey With a new introduction by James Finckenauer OF THE NATION Organized crime in America today is not the tough hoodlums familiar to moviegoers and TV watchers. It is more sophisticated, with many college graduates, gifted with organizational genius, all belonging to twenty-four tightly knit “families,” who have corrupted legitimate business and infi ltrated some of the highest levels of The Structure and Operations of local, state, and federal government. Th eir power reaches into Congress, into the executive and judicial branches, police agencies, and labor unions, and into such Organized Crime in America business enterprises as real estate, retail stores, restaurants, hotels, linen-supply houses, and garbage-collection routes. How does organized crime operate? How dangerous is it? What are the Donald R. Cressey implications for American society? How may we cope with it? In answering these questions, Cressey asserts that because organized crime provides illicit goods and services demanded by legitimate society, it has become part of legitimate society. with a new introduction by James Finckenauer Th is fascinating account reveals the parallels: the growth of specialization, “big- business practices” (pooling of capital and reinvestment of profi ts; fringe benefi ts like bail money), and government practices (negotiated settlements and peace treaties, defi ned territories, fair-trade agreements). For too long we have, as a society, concerned ourselves only with superfi cial questions about organized crime. Th eft of the Nation focuses on to a more profound and searching level. -

Sutherland, Edwin H.: Differential Association Theory and Differential Social Organization

Encyclopedia of Criminological Theory Sutherland, Edwin H.: Differential Association Theory and Differential Social Organization Contributors: Ross L. Matsueda Editors: Francis T. Cullen & Pamela Wilcox Book Title: Encyclopedia of Criminological Theory Chapter Title: "Sutherland, Edwin H.: Differential Association Theory and Differential Social Organization" Pub. Date: 2010 Access Date: September 12, 2014 Publishing Company: SAGE Publications, Inc. City: Thousand Oaks Print ISBN: 9781412959186 Online ISBN: 9781412959193 DOI: http://dx.doi.org/10.4135/9781412959193.n250 Print pages: 899-907 ©2010 SAGE Publications, Inc. All Rights Reserved. This PDF has been generated from SAGE knowledge. Please note that the pagination of the online version will vary from the pagination of the print book. SAGE ©2010 SAGE Publications, Inc. All Rights Reserved. SAGE knowledge http://dx.doi.org/10.4135/9781412959193.n250 Edwin Sutherland's development of differential association theory in 1947 marked a watershed in criminology. The theory, which dominated the discipline for decades, brought Chicago-style sociology to the forefront of criminology. It is well known that differential association explains individual criminality with a social psychological process of learning crime within interaction with social groups. Less well known is Sutherland's attempt to explain aggregate crime rates across groups and societies. Here, he specified the theory of differential social organization to explain rates of crime with an organizational process that implies group dynamics. This entry reviews Sutherland's theory of differential association, discusses attempts at revision, and assesses the empirical status of the theory. It also examines recent attempts to revisit and elaborate the concept of differential social organization as well as current areas of research in which it is being used. -

White Collar Crime: the Proble:M and the Federal Response

If you have issues viewing or accessing this file, please contact us at NCJRS.gov. 95th congress} COMMITTEE PRINT 2d Session { No. 16 WHITE COLLAR CRIME: THE PROBLE:M AND THE FEDERAL RESPONSE SUBCOMMITTEE ON CRIME OF THE COMMITTEE ON THE JUDICIARY HOUSE OF REPRESENTATIVES NINETY-FIFTH CONGRESS SECOND SESSION JUNE 1978 or the use of the Committee on the Judiciary S. GOVERNMENT PRINTING OFFICID W ASIIINGTON : 1018 COMMI'ITEE ON THE JUDIOIARY PETER W. RODINO, JR., New Jetsey, Ohalrnl(1I" JACK BROOKS, Texas ROBERT McCLORY, Illinois ROBERT W. KASTENMllJIER, Wisconsin TOM RAILSBACK, Illinois DON EDWARDS, California CHARLES :m. WIGGINS, California JOHN CONYERS, JR., Michigan HAMILTON FISH, JR., New York JOSHUA EILBERG, Pennsylvania M. CALDWELL BUTLER, Virginia WALTER FLOWERS, Alabama WILLIAM S. COHEN, Maine JAMES R, MANN, South Carolina - CARLOS J. MOORHEAD, California JOHN F. SEIBERLING, Ohio JOHN M. ASHBROOK, Ohio GEORGE E. DANIELSON, California HENRY J. HYDE, Illinois ROBERT F. DRINAN, Massachusetts THOMAS N. KINDNESS. Ohio BARBARA JORDAN, Texas HAROLD S. SAWYER, Michigan ELIZABETH HOLTZMAN, New YGrk ROMANO L. M.A.ZZOLI. Kentucky WILLIAM J. HUGHES, New Jersey SAM B. HALu, JR., Texas LAMAR GUDGER, North Carolina HAROLD L. VOLKMER, Missouri HERBERT E. HARRIS II, Virginia JIM SANTINI, Nevada AuLEN E. ERTEL, Pennsylvania BILLY LEE EVANS, Georgia ANTHONY C. BEILENSON. California ALAN A. PAP'l{ER, General OouII3el GARNER J. CLINE, Staff Dlrectol' J!'RANKLIN G. POLK, ASBoclate Ooun8cl SUBCOMMITTEE ON CRIME JOHN CONYERS, JR., Michigan, Ohairman ELIZABETH HOLTZMAN, New York JOHN M. ASHBROOK, Ohio LAMAR GUDGER, North CarOlina TOllf RAILSBA.CK, Illinois HAROLD L. VOLKMER, Missouri ALLEN E. -

The Fraud Triangle and Tax Evasion

The Fraud Triangle and Tax Evasion Leandra Lederman Research Paper Number 398 Working Paper (2019) This paper can be downloaded without charge from the Social Science Research Network electronic library at: http://ssrn.com/abstract=3339558 Electronic copy available at: https://ssrn.com/abstract=3339558 Preliminary Draft The Fraud Triangle and Tax Evasion Leandra Lederman* ABSTRACT The “fraud triangle” is the preeminent framework for analyzing fraud in the accounting literature. It is a theory of why some people commit fraud, developed out of studies of individuals, including inmates convicted of criminal trust violations. The three components of the fraud triangle are generally considered to be (1) an incentive or pressure (usually financial), (2) opportunity, and (3) rationalization. There is a separate, extensive legal literature on tax compliance and evasion. Yet the fraud triangle is largely absent from this legal literature, although tax evasion is a type of fraud. This article rectifies that oversight, analyzing how the fraud triangle—and its expanded version, the “fraud diamond”—can inform the legal literature on tax compliance. The article argues that the fraud triangle can provide a frame that brings together distinct tax compliance theories discussed in the legal literature, the traditional economic (deterrence) model and behavioral theories focusing on such things as social norms or tax morale. TABLE OF CONTENTS INTRODUCTION ...............................................................................................................................