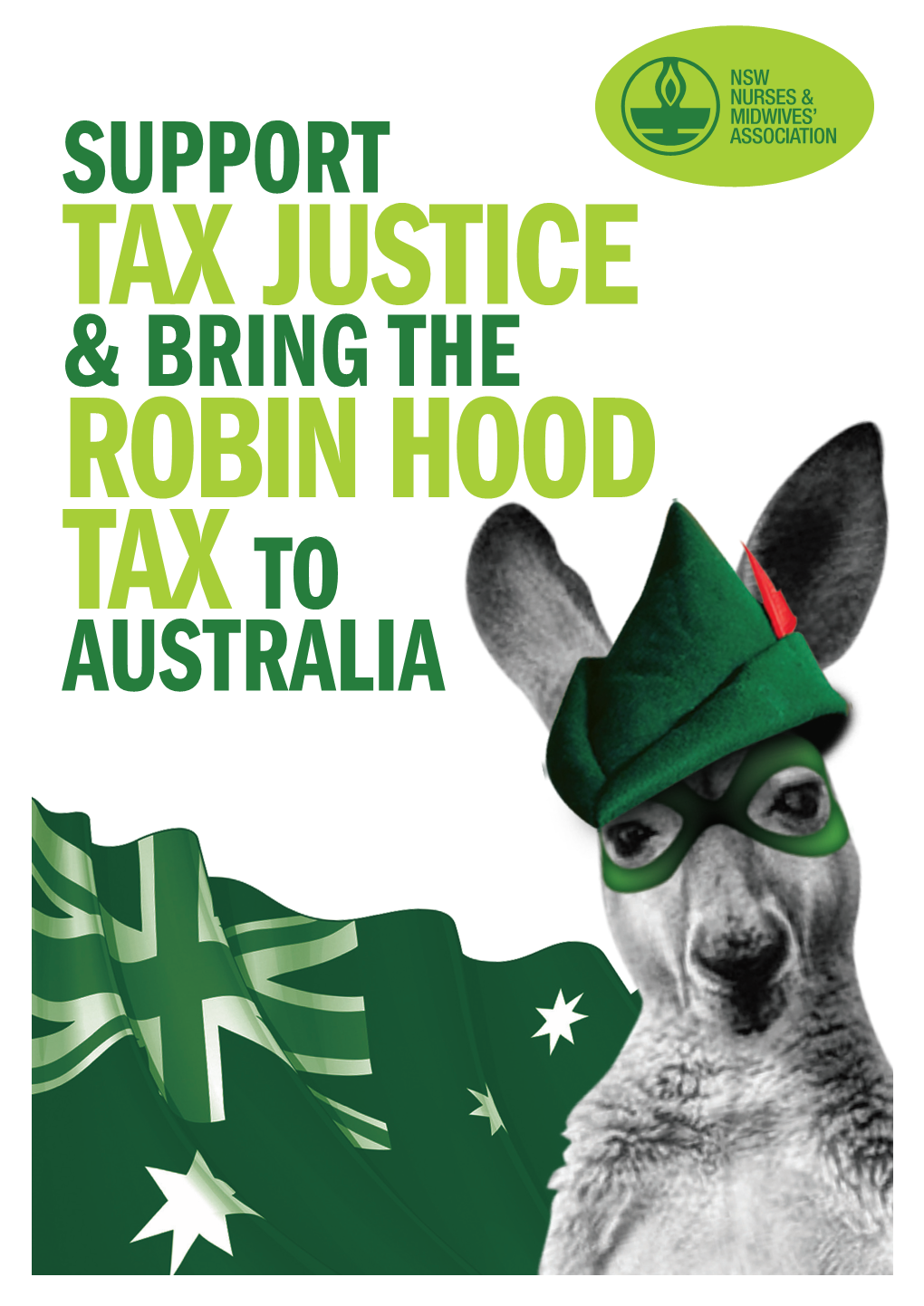

Support & Bring the Australia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

29Th April 2012 NEWS RELEASE CARDINAL O

29th April 2012 NEWS RELEASE CARDINAL O’BRIEN BRANDS CAMERON’S OPPOSITION TO THE ROBIN HOOD TAX ‘SHAMEFUL’ The UK’s most senior Catholic, Cardinal Keith O’Brien, has branded David Cameron and his government’s opposition to a tiny tax on banks and the financial sector to help combat poverty as ‘shameful’. In a letter to the Prime Minister the Cardinal outlined his support for the Robin Hood Tax campaign, which calls for the UK Government to put in place a 0.05% tax on financial transactions such as bonds, stocks and derivatives. If implemented, it could raise £20 billion annually in the UK to be spent on poverty alleviation at home and overseas, and support communities affected by climate change. The Cardinal highlighted that thousands of SCIAF supporters across Scotland have signed up to the campaign, adding their voices to a widespread movement across Scotland, the UK and internationally, amid growing political support for such a tax. Cardinal O’Brien said: “At this difficult economic time more needs to be done to help the poor, both at home and abroad, as they are the ones hit the hardest by the fall-out of the global financial crisis. The banks and financial sector, which caused the problem, have a clear responsibility to pay their fair share. It is shameful that David Cameron is currently protecting his wealthy friends in the City by his opposition to this simple, fair and sustainable financial transactions tax.” In his letter to David Cameron (full text below) Cardinal O’Brien said: “The economy must be judged by what it achieves for the common good. -

Robin Hood in a Time of Austerity · LRB 18 February 2016

8/30/2016 James Meek · Robin Hood in a Time of Austerity · LRB 18 February 2016 Back to article page Robin Hood in a Time of Austerity James Meek 00:00 81:58 Myth is a story that can be retold by anyone, with infinite variation, and still be recognisable as itself. The outline of surviving myth is rerecognised in the lives of each generation. It’s an instrument by which people simplify, rationalise and retell social complexities. It’s a means to haul the abstract, the global and the relative into the realm of the concrete, the local and the absolute. It’s a way to lay claim to faith in certain values. If those who attempt to interpret the world do so only through the prism of professional thinkers, and ignore the persistence of myth in everyday thought and speech, the interpretations will be deficient. This is the importance of the Robin Hood myth. It’s the first and often the only political economic fable we learn. It’s not a children’s story, although it is childlike. It contains the three essential ingredients of grownup narrative – love, death and money – without being a love story, a tragedy or a comedy. It doesn’t tell of the founding of a people. It’s not a fairy story or a religious myth; it has no monsters, gods or wizards in it, only human beings. It’s not a parable. In place of a moral, it has a plan of action. What does Robin Hood do? We all know. -

Kieler Studien

Institut für Weltwirtschaft The Kiel Institute for World Economics Annual Report 2003 Contents I. The Institute in 2003: An Overview 3 II. Research and Advisory Activities 6 1. Main Areas of Research 6 2. President’s Department 7 3. Growth, Structural Change, and the International Division of Labor (Research Department I) 10 4. Environmental and Resource Economics (Research Department II) 21 5. Regional Economics (Research Department III) 27 6. Development Economics and Global Integration (Research Department IV) 35 7. Business Cycles (Research Department V) 43 8. Interdepartmental Research 53 9. Cooperation with Researchers and Research Organizations 53 10. Advisory Activities and Participation in Organizations 61 11. Commissioned Expert Reports and Research Projects 64 III. Documentation Services 72 1. The Library 72 2. The Economic Archives 75 IV. Teaching and Lecturing 77 1. Universities and Colleges 77 2. Advanced Studies Program 77 3. Guest Lectures and Seminars at Universities 79 V. Conferences 80 1. Conferences Organized by the Institute 80 2. External Conferences 84 VI. Publications 96 1. In-House Publications 96 2. Out-of-House Publications 103 VII. Appendix 114 1. Recipients of the Bernhard Harms Prize, the Bernhard Harms Medal, and the Bernhard Harms Prize for Young Economists 114 2. Staff (as of January 1, 2004) 116 3. Organization Chart 121 I. The Institute in 2003: An Overview The Kiel Institute for World Economics at the University of Kiel (IfW) is one of the world’s major centers for international economic policy research and documentation. The Institute’s main activities are economic research, economic policy consulting, and the documentation and provision of information about international economic relations. -

Audit Committee Quarterly II/2018: Geschäftsmodell

Audit Committee Quarterly II / 2018 DAS MAGAZIN FÜR CORPORATE GOVERNANCE Gefördert durch Audit Committee Institute e.V. GESCHÄFTSMODELL EDITORIAL Deutschland – Zeit für digitale Geschäftsmodelle Die vierte Revolution der Industrialisierung ist in vollem Gange. Im Gegensatz zu den vorhergehenden industri- ellen Revolutionen mit ihren konkreten Treibern Dampf- maschine, Fließband und Computer ist dieses Zeitalter der sog. Digitalisierung schwer einzugrenzen. Eine Er- kenntnis hat sich trotz allem mittlerweile in den deut- schen Vorstandsetagen durchgesetzt: Digitale Trans- formation ist heute keine Option mehr, sondern Not- wendigkeit. Dennoch betrachten einige Unternehmen die Digitalisierung aufgrund von Erfolgen aus der Ver- gangenheit noch immer durch eine reine Technologie- brille. So sind deutsche Unternehmen gut darin, ihre bestehenden Produkte und Prozesse durch inkremen- telle Innovationen an neue Technologien anzupassen oder sie mithilfe neuer Technologien etwas schneller, besser, effizienter zu gestalten. Doch reicht das? Deutschland ist ein Land zahlreicher Weltmarktführer klassischer Wirtschaftszweige, in denen innovative Geschäftsmodelle das Potenzial haben, industriever- ändernde Umwälzungen auszulösen. Marktbeherr- schende Digitalriesen wie die GAFAs (Google, Amazon, Facebook und Apple) sucht man hierzulande vergeb- lich. Und auch wenn sich Berlin als deutsches Start- up-Mekka rühmt, so kann es sich mit Hubs wie dem Silicon Valley, Tel Aviv oder der aufstrebenden Szene im asiatischen Raum nicht messen. Während Berlin bisher -

Financial Transactions Are So Mobile That an FTT in One Country Is Unenforceable and Will Simply Result in Trading Moving Overseas

FACTS & MYTHS ABOUT A FINANCIAL TRANSACTION TAX Updated May 2013 What is a financial transaction tax (FTT)? The FTT (also known as a financial speculation tax , Wall Street trading tax, or Robin Hood tax) is a tiny fee – at rates of a fraction of a percent – on Wall Street trading of financial instruments such as stocks, bonds, derivatives, futures, options, and credit default swaps. What are the key facts about the FTT? • An FTT would raise at least tens of billions of dollars per year in badly needed revenue. This is a substantial amount, skimming the fat off of a sector of the economy that can afford to pay it. Some other revenue-raising options being discussed (such as a value-added tax) would fall much more on the middle class. • An FTT would reduce dangerous financial market speculation. Since it would hit high-volume, high-speed trading the hardest, the FTT would serve to discourage short-term speculation in financial markets as well as the proliferation of ever more complex derivatives. • An FTT would encourage longer-term productive investment. By reducing the volume and profitability of short-term trading that serves no productive purpose, the FTT would encourage Wall Street to find new ways to make money from longer-term productive investments. • An FTT would put Wall Street to work for Main Street. Reckless Wall Street gambling cost Americans trillions in bailouts, lost jobs and wealth, and cost states billions in lost revenue. The FTT would help put Wall Street to work rebuilding Main Street with revenue to create potentially hundreds of thousands of jobs and support critical public services and infrastructure. -

GETTING STARTED a Robin Hood Tax on the Banks Has the Power to Raise Hundreds of Billions Every Year Globally

ROBIN HOOD TAX: GETTING STARTED A Robin Hood Tax on the banks has the power to raise hundreds of billions every year globally. Money that could protect public services in the UK, help the poorest people at home and abroad and tackle climate change. ROBIN HOOD TAX AND WHAT WE WANT TO SEE: INTERNATIONAL DEVELOPMENT: A BANK TAX THAT WOULD MAKE ROBIN WHY IT MATTERS. 3 PROUD. The effects of the banking crisis on developing countries We know that the Government could introduce didn’t get a huge amount of coverage in the UK. greater taxation on the financial sector to the tune Understandably enough, the focus was on the impact of £20bn a year. here, as the actions of a small minority wreaked havoc on the UK economy. But, unsurprisingly, a fire fuelled in wealthy countries also burnt millions of poor people – and MONEY FROM A ROBIN HOOD TAX GOING 3 TO THOSE WHO NEED IT. continues to do so. We suggest this money should be split: 50% to There are the inevitable pitfalls of globalisation, for starters. Spending falls in the UK. People buy fewer UK | 25% to Climate Change | 25% to International clothes. Shops order fewer clothes. Orders fall in factories Development. in poor countries. People are laid off and can’t find alternative work. And suddenly the global economic crisis THE UK BEING AN INTERNATIONAL 3 LEADER hits the market stall holder who used to sell lunches to the people in factories. And so on and so on. So we can help push for Europe-wide taxes on the The crisis also had a profound effect on poor countries financial sector. -

STATEMENTS of SUPPORT for a FINANCIAL TRANSACTION TAX (FTT) Updated July 2013

STATEMENTS OF SUPPORT FOR A FINANCIAL TRANSACTION TAX (FTT) Updated July 2013 Religious and Opinion Leaders Kofi Annan, former Secretary-General of the United Nations I support innovative financing solutions, such as a fair maritime bunker fuel tax, a levy on airline tickets, or the Financial 1 Transaction Tax. Boston Globe editorial board As Obama and other policymakers contemplate far-reaching changes to entitlements such as Medicare and Social Security, a financial transaction tax — which would simultaneously raise money and deter another crisis — has to be part 2 of the discussion. Al Gore, former U.S. Vice President We need policy changes, we need a tax on carbon and we need a tax on global transactions.3 Bob Herbert, former columnist at The New York Times While the fees would be a trivial expense for what the general public tends to think of as ordinary traders – people investing in stocks, bonds or other assets for some reasonable period of time – they would amount to a much heavier lift 4 for speculators, the folks who bring a manic quality to the markets, who treat it like a casino. Van Jones, author and President of Rebuild the Dream The Wall Street Tax… is common sense… Congress is about to face a telling choice. Will they vote to tax Wall Street gamblers in the 1%, or cut the Social Security checks of senior citizens in the 99%?5 Nicholas Kristof, columnist at The New York Times Impose a financial transactions tax. This would be a modest tax on financial trades, modeled on the suggestions of James Tobin, an American economist who won a Nobel Prize. -

TJF 2-1 On-Screen

TAX JUSTICE FOCUS the quarterly newsletter of the first quarter 2006 volume 2 number 1 Pulp reality,tax fiction Trade issue The building of a huge pulp factory in Uruguay by Finnish company Botnia not only Letter from Davos 2 represents a threat to the environment. Thanks to the various tax exemptions the Letter from Bamako 3 company has secured, the Botnia investment will bring little real benefit to the country’s economy,writes Jorma Penttinen. Campaigns and TJN news 4 The supply side of corrupt he benefits of foreign direct invest- and according to the calculations pro- the pulp mills on environmental grounds. practices 7 ment are more or less taken for duced by Botnia, the factory would in- According to an opinion poll carried out T Media roundup 7 granted. The transfers of technology, crease the country’s GDP by 1.6 per in August 2005, just over half of Uru- employment opportunities, direct cent. guayans opposed the pulp mills. The is- The WTO and taxation 10 money flows, and revenues for local and sue will be referred to International state government are seen to benefit Botnia’s investment is explained by lower Court of Justice by Argentina, and the Mind the tax gap 11 the host country. costs: fast growing eucalyptus trees and presidents of both countries will meet in cheap labour mean that production costs the near future to discuss the two pulp The hidden face of corporate It was no surprise then that Uruguay are half of those in Finland. The pulp is mills. corruption - unmasked 12 was more than keen to accept the not destined for South American mar- building of huge pulp factories on the kets; it will be transported to Europe As well as the environmental concerns, Reviews and new research 13 banks of river Uruguay, on the other and China. -

FINANCIAL TRANSACTION TAXES in THEORY and PRACTICE Leonard E

FINANCIAL TRANSACTION TAXES IN THEORY AND PRACTICE Leonard E. Burman, William G. Gale, Sarah Gault, Bryan Kim, Jim Nunns, and Steve Rosenthal June 2015 DISCUSSION DRAFT - COMMENTS WELCOME CONTENTS Acknowledgments 1 Section 1: Introduction 2 Section 2: Background 5 FTT Defined 5 History of FTTs in the United States 5 Experience in Other Countries 6 Proposed FTTs 10 Other Taxes on the Financial Sector 12 Section 3: Design Issues 14 Section 4: The Financial Sector and Market Failure 19 Size of the Financial Sector 19 Systemic Risk 21 High-Frequency Trading and Flash Trading 22 Noise Trading 23 Section 5: Effects of an FTT 24 Trading Volume and Speculation 24 Liquidity 26 Price Discovery 27 Asset Price Volatility 28 Asset Prices and the Cost of Capital 29 Cascading and Intersectoral Distortions 30 Administrative and Compliance Costs 32 Section 6: New Revenue and Distributional Estimates 33 Modeling Issues 33 Revenue Effects 34 Distributional Effects 36 Section 7: Conclusion 39 Appendix A 40 References 43 ACKNOWLEDGMENTS Burman, Gault, Nunns, and Rosenthal: Urban Institute; Gale and Kim: Brookings Institution. Please send comments to [email protected] or [email protected]. We thank Donald Marron and Thornton Matheson for helpful comments and discussions, Elaine Eldridge and Elizabeth Forney for editorial assistance, Lydia Austin and Joanna Teitelbaum for preparing the document for publication, and the Laura and John Arnold Foundation for funding this work. The findings and conclusions contained within are solely the responsibility of the authors and do not necessarily reflect positions or policies of the Tax Policy Center, the Urban Institute, the Brookings Institution, or their funders. -

De Financiële Lobby Op Haar Knieën Na De Financiële

DE FINANCIËLE LOBBY OP HAAR KNIEËN NA DE FINANCIËLE CRISIS? DIACHRONISCHE COMPARATIEVE CASESTUDIE: DE IMPACT VAN SALIENCE OP FINANCIËLE LOBBYSTRATEGIEËN INZAKE DE EUROPESE FINANCIËLE TRANSACTIETAKS Wetenschappelijke verhandeling Aantal woorden: 26491 Nele Debyser Stamnummer: 01614280 Promotor: Prof. dr. Ferdi De Ville Commissaris: Prof. dr. Niels Gheyle Masterproef voorgelegd voor het behalen van de graad master in de richting EU-Studies Academiejaar: 2019-2020 Inhoudsopgave VOORWOORD .................................................................................................................................................. 4 ABSTRACT ........................................................................................................................................................ 5 AFKORTINGEN ................................................................................................................................................. 6 INLEIDING ........................................................................................................................................................ 7 1. LITERATUUROVERZICHT ............................................................................................................................ 11 1.1. Definities ............................................................................................................................................ 11 1.1.1. (Financiële) lobby ....................................................................................................................... -

Is the Financial Transaction Tax (FTT) a Good Idea?

Is the Financial Transaction Tax (FTT) a Good Idea? Nobel Prize Winner, James Tobin, proposed a tax on foreign exchange (forex) transactions in order to throw ‘sand into the wheels’ of finance. He believed that there was excessive, socially unuseful, trading and that too many bright young people were becoming forex traders. Advocation of taxing a wider range of financial transactions, a Financial Transactions Tax (FTT), has grown as financial transactions have proliferated over the years and Lord Adair Turner, Chairman of the Financial Services Authority (FSA), has echoed Tobin in alleging much of the trading in financial markets to be socially useless. In 2011, the EU proposed the imposition of an FTT in the EU. The City of London is strongly opposed and the Prime Minister, David Cameron, has vowed to protect the City from vindictive EU regulation and the FTT in the interests of the UK economy. Is he right to do so? The City and the wider financial sector, clearly does contribute considerable tax revenue to the UK and yet the government is committed to ‘rebalancing’ the economy to reduce dependence on the City in the wake of the Global Finance crisis. Further, 52% of City buildings are now owned by overseas interests, many in the EU. More importantly, the share of the City financial markets controlled by UK banks and other financial institutions is much smaller than that of European institutions and those for the US and Asian countries. The City is pre-eminently an international financial centre, and the largest one in Europe. The European Union countries thus have a vested interest in it competitiveness and a right to assure it is properly regulated to underpin financial stability, and the City benefits from UK’s membership of the EU. -

Sozialalmanach Schwerpunkt: Steiergerechtegkeet

2015 Sozialalmanach Schwerpunkt: Steiergerechtegkeet 2015 Sozialalmanach Schwerpunkt: Steiergerechtegkeet Sozialalmanach 2015 Sous la direction de Nathalie Georges, Danielle Schronen et Robert Urbé Caritas Luxembourg 29, rue Michel Welter L-2730 Luxembourg Tél. +352 40 21 31 200 Fax +352 40 21 31 209 www.caritas.lu Tous droits réservés. © Caritas Luxembourg Par cette publication, Caritas Luxembourg n’entend pas prendre à son compte les opinions émises dans cet ouvrage qui devront être considérées comme étant propres aux auteurs. Conception graphique et impression : saint-paul luxembourg Photo : © Claudine Bosseler, Studio C ; avec nos remerciements à l’Amicale et Mutuelle des Universitaires en Sciences Economiques Asbl, organisatrice du séminaire « Comment réussir ma déclaration d’impôts ? » du 12 février 2015 Imprimé sur papier 100% recyclé Avril 2015 ISBN: 978-2-919974-18-4 Inhalt Vorwort .............................................................. 11 Introduction........................................................... 13 1. Teil Zur sozialen Lage Luxemburgs 2014-2015 Robert Urbé...........................................................................17 1. D’Ried zur Lag vun der Natioun den 2. Abrëll 2014 ..............................19 2. Rückblick auf das Sozialjahr 2014-2015 ..........................................25 3. Luxembourg 2020 : le semestre européen et le Programme National de Réforme ..53 4. Die Lage der Nation am Vorabend des 5. Mai 2015 ...............................83 Etudes sélectionnées du service Caritas