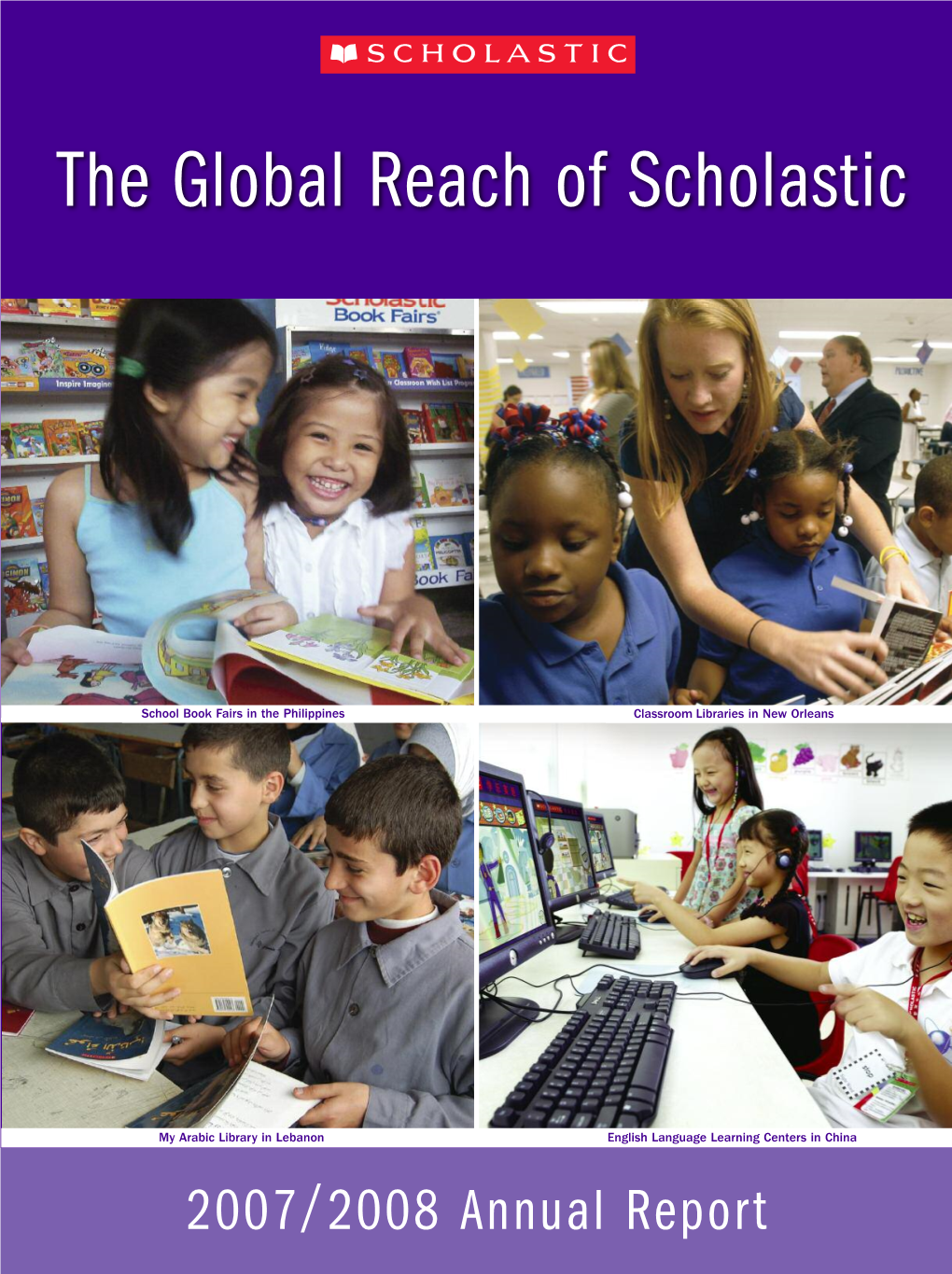

The Global Reach of Scholastic

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Photoshop CS4 - New Features 4 What’S New for Tablet Users? 66 Photoshop in 3D 20 Camera Raw 14 CONTENTS

Photoshop CS4 - New Features 4 What’s new for Tablet Users? 66 Photoshop in 3D 20 Camera Raw 14 CONTENTS Flash CS4 - New Features 26 What’s a GPU? 13 Illustrator CS4- New Features 30 Indesign CS4- New Features 48 Dreamweaver CS4- New Features 42 Fireworks CS4- New Features 52 Premiere CS4- New Features 55 After Effects CS4- New Features 60 Bridge CS4- New Features 64 WELCOME WELCOME TO THIS CS4 SUPERGUIDE CONTRIBUTORS This was a very ambitious project to cover all the David Blater & Anne-Marie Conception: David Blatner and Anne-Marie Concepción are regarded as the top InDesign experts and have authored a ton of book and spoken at many events. Together they new CS4 products. While we didn’t manage to cover run the top InDesign Resource and magazine InDesignSecrets.com every application, we got really close. There have been Jeff Foster: Jeff Foster has been producing and training for traditional and digital images, photography, many sleepless nights and favor-calling to make this a illustration, motion graphics and special effects for DV and Film for over 20 years. He has authored several books and reality. I have managed to assemble a very elite group spoken at big Industry events. PixelPainter.com of people, some of the smartest minds in the business. Chris Georgeness: Chris spent six years as Director of Creative Development for Soup2nuts and Each contributer is an expert (In many cases the top art-directed many animated TV shows including Home Movies (Cartoon Network). Chris runs Mudbubble.com and Keyframer.com. In recent years, Chris Georgenes has created high profile projects for Adobe, Yahoo!, Digitas, expert) in their chosen application. -

Scholastic Corporation Notice Of

Scholastic 557 Broadway, New York, NY 10012-3999 (212) 343-6100 www.scholastic.com SCHOLASTIC CORPORATION NOTICE OF ANNUAL MEETING OF STOCKHOLDERS To Holders of Class A Stock and Common Stock: The Annual Meeting of Stockholders of Scholastic Corporation (the “Company”) will be held at the Company’s corporate headquarters located at 557 Broadway, New York, New York on Wednesday, September 21, 2016 at 9:00 a.m., local time, for the following purposes: Matters to be voted upon by holders of the Class A Stock 1. Electing seven directors to the Board of Directors Matters to be voted upon by holders of the Common Stock 1. Electing two directors to the Board of Directors and such other business as may properly come before the meeting and any adjournments thereof. A proxy statement describing the matters to be considered at the Annual Meeting of Stockholders is attached to this notice. Only stockholders of record of the Class A Stock and the Common Stock at the close of business on July 29, 2016 are entitled to notice of, and to vote at, the meeting and any adjournments thereof. We hope that you will be able to attend the meeting. Whether or not you plan to be present at the meeting, we urge you to vote your shares promptly. You can vote your shares in three ways: • via the Internet at the website indicated on your proxy card; • via telephone by calling the toll free number on your proxy card; or • by returning the enclosed proxy card. By order of the Board of Directors Andrew S. -

Kids, Libraries, and LEGO® Great Programming, Great Collaborations

Children the journal of the Association for Library Service to Children Libraries & Volume 10 Number 3 Winter 2012 ISSN 1542-9806 Kids, Libraries, and LEGO® Great Programming, Great Collaborations Playing with Poetry PERMIT NO. 4 NO. PERMIT Change Service Requested Service Change HANOVER, PA HANOVER, Chicago, Illinois 60611 Illinois Chicago, PAID 50 East Huron Street Huron East 50 U.S. POSTAGE POSTAGE U.S. Association for Library Service to Children to Service Library for Association NONPROFIT ORG. NONPROFIT Table Contents● ofVolume 10, Number 3 Winter 2012 Notes 28 Louisa May Alcott The Author as Presented in 2 Editor’s Note Biographies for Children Sharon Verbeten Hilary S. Crew 36 More than Just Books Features Children’s Literacy in Today’s Digital Information World 3 Arbuthnot Honor Lecture Denise E. Agosto Reading in the Dark 41 Peter Sís From Board to Cloth and Back Again 9 C Is for Cooperation A Preliminary Exploration of Board Books Public and School Library Allison G. Kaplan Reciprocal Responsibility in Community Literacy Initiatives 45 Play to Learn Janet Amann and Sabrina Carnesi Free Tablet Apps and Recommended Toys for Ages 3-7 14 He Said, She Said Hayley Elece McEwing How the Storytime Princess and the Computer Dude Came Together to Create a Real-Life Fairytale Shawn D. Walsh and Melanie A. Lyttle Departments 17 The People on the Bus . 35 Author Guidelines Louisiana Program Targets Community Literacy 40 Call for Referees Jamie Gaines 52 Children and Technology 20 Brick by Brick Here to Stay ® LEGO -Inspired Programs in the Library Mobile Technology and Young Tess Prendergast Children in the Library Amy Graves 24 Carnegie Award Acceptance Speeches 55 School-Age Programs and Services Bringing Lucille to Life Kick Start Your Programming! Melissa Reilly Ellard and Paul R. -

2018/2019 Annual Report

2018/2019 ANNUAL REPORT The central idea of Scholastic is to help every child develop the personal power to engage with issues, to understand themselves and become the best and most able person they can be, equipped with the thinking skills and the emotional resilience to navigate the mid-21st century world they will inherit. —Richard Robinson Chairman, President and Chief Executive Officer 557 Broadway, New York, NY 10012 • 212 343 6100 • scholastic.com Fellow Shareholders, As I write this, Scholastic author Dav Pilkey is embarking on a global “Do Good” tour encouraging young readers to make an impact in their communities, demonstrating the power of reading to inspire positive change. The tour reminds us that reading can inspire both action and reflection, which is central to our Scholastic mission–helping kids read so they can develop the thinking skills to understand how the world works and the inspiration to understand themselves and their place in that world. The stakes are certainly high. At best, only 30% of U.S. children read at grade level. As millions of students and teachers prepare to return to school this month, Scholastic will be there for them as we have been for generations, providing the support, educational materials and high-quality children’s books needed to help prepare students for success, now and in the future. As we remain dedicated to this mission, we are also taking actions that enable us to continue serving educators, families, and children for our next 100 years. In FY20, this includes improving operating profitability while preparing for longer term growth. -

Children's Catalog

PBS KIDS MAKES AN IMPACT! Emotions & Social Skills Character Self-Awareness Literacy Math Science Source: Marketing & Research Resources, Inc. (M&RR,) January 2019 2 A Word From Linda Simensky, Head of Content at PBS KIDS “PBS KIDS characters are curious about the world and genuinely excited about discovery new things. They are positive role models that ask questions, investigate, and experience the fun of learning something new. Our stories engage kids with humor, surprise, and authentic situations that they find in their everyday lives. Interwoven are themes of inclusion, diversity, kindness, and exploration.” 3 Seven in ten children Research shows ages 2-8 watch PBS that PBS KIDS makes an in the U.S. – that’s impact on early † childhood 19 million children learning** * Source: Nielsen NPower, 1/1/2018--12/30/2018, L+7 M-Su 6A-6A TP reach, 50% unif., 1-min, LOH18-49w/c<6, LOH18-49w/C<6 Hispanic Origin. All PBS Stations, children’s cable TV networks ** Source: Hurwitz, L. B. (2018). Getting a Read on Ready to Learn Media: A Meta-Analytic Review of Effects on Literacy. Child Development. Dol:10.1111/cdev/f3043 † Source: Marketing & Research Resources, Inc. (M&RR), January 2019 4 Exploring Nature’s Ingenious Inventions This funny and engaging show follows a curious bunny named Facts: Elinor as she asks the questions in • Co-created by Jorge Cham and every child’s mind and discovers Daniel Whiteson, authors of We the wonders of the world around Have No Idea: A Guide to the her. Each episode encourages Unknown Universe and creators of children to follow their curiosity the podcast Daniel & Jorge Explain the Universe. -

Wahoo! Climb Aboard the Magic School Bus™ and Buckle-Up for a Wild Ride with Newa Ll-In-One Game!

Wahoo! Climb aboard The Magic School Bus™ and Buckle-Up For a Wild Ride with Newa ll-in-one Game! With “The Magic School Bus,” the interactive new feature-packed, multi-touch, multiplayer game for Intel® powered All-in-One PCs: • Two-four players join Ms. Frizzle and set out on an exciting series of extraordinary field trips all around the world and through space, time—and beyond • Players are encouraged to “take chances, make mistakes, and get messy!” as they work together to solve problems and make incredible discoveries • Kids play each game as their favorite character from The Magic School Bus TV series – with eight options to choose from • The iconic yellow bus transforms into a submarine, space shuttle and other vehicles needed to make the journey to each exotic field trip location • Families experience a unique combination of adventures every time they play the game. And when players revisit a location, they encounter different animals, new sets of clues and more! • Kids ages 7 and up will actively engage in science, learning core concepts and tons of amazing facts all along the way • Players must work together to complete each mission— from piecing together a dinosaur skeleton and planting flags on planets, to killing germs and catching prey—to collect cool virtual stamps to fill their team passports Travel in the Magic School Bus and play cooperative games in 8 exciting locations! • Amazon Rainforest • Outer Planets • Great Barrier Reef • African Savanna • Jurassic Period • Inside the Human Body • Inner Planets • Cretaceous Period -

Clifford Moves Online: the History and Future of Scholastic Reading Club

Clifford Moves Online: The History and Future of Scholastic Reading Club By Natassja Barry B.A. English, Thompson Rivers University, 2016 Project submitted in partial fulfillment of the requirements for the degree of Master of Publishing In the Faculty of Communication, Art, and Technology ©Natassja Barry Simon Fraser University Fall 2017 This work is licensed under the Creative Commons Attribution 4.0 International (https://creativecommons.org/licenses/by/4.0/) Approval Name Natassja Barry Degree Master of Publishing Project Title Clifford Moves Online: The History and Future of Scholastic Reading Club Supervisory Committee _______________________________ Hannah McGregor Senior Supervisor Assistant Professor Publishing Program _______________________________ Leanne Johnson Supervisor Lecturer Publishing Program _______________________________ Sarah Maniscalco Industry Supervisor Senior Manager Reading Club Marketing Scholastic Canada Ltd. Toronto, Ontario Date Approved: December 20, 2017 ii Abstract Scholastic Canada has been running Reading Club in Canadian schools for half a century. Until 1998, teachers were only able to place student orders by mail or over the phone. Then, the first Canadian Reading Club website was created with a web form for teachers to submit orders online. The online form marked the start of a major change that has been brewing for Reading Club over the last two decades, but it wouldn’t be until 2016 that this simple form would be replaced by a fully- functioning e-commerce website. As Scholastic Canada moves Reading Club online, the company must maintain its valued relationship with teachers and protect its unique place in Canadian classrooms, while at the same time seeking out opportunities to grow in its new digital context. -

Scholastic Corporation (Exact Name of Registrant As Specified in Its Charter)

United States Securities and Exchange Commission Washington, D.C. 20549 Form 10-K Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended May 31, 2020 Commission File No. 000-19860 Scholastic Corporation (Exact name of Registrant as specified in its charter) Delaware 13-3385513 (State or other jurisdiction of incorporation or organization) (IRS Employer Identification No.) 557 Broadway New York, New York 10012 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (212) 343-6100 Securities Registered Pursuant to Section 12(b) of the Act: Title of Class Trading Symbol Name of Each Exchange on Which Registered Common Stock, $0.01 par value SCHL The NASDAQ Stock Market LLC Securities Registered Pursuant to Section 12(g) of the Act: NONE Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No o Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ☒ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No o Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit). -

Alaska Laborers Employers Retirement Fund, Et Al. V. Scholastic

UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK ALASKA LABORERS EMPLOYERS Civil Action No. 07-7402 RETIREMENT FUND, Individually and On Behalf of All Others Similarly Situated, CLASS ACTION COMPLAINT FOR VIOLATIONS OF Plaintiffs, FEDERAL SECURITIES LAWS vs. JURY TRIAL DEMANDED SCHOLASTIC CORP., RICHARD ROBINSON and MARY WINSTON, Defendant. Plaintiff has alleged the following based upon the investigation ofplaintiff's counsel, which included a review of United States Securities and Exchange Commission ("SEC ) filings by Scholastic Corp. ("Scholastic or the "Company ), as well as regulatory filings and reports, securities analysts' reports and advisories about the Company, press releases and other public statements issued by the Company, and media reports about the Company, and plaintiffbelieves that substantial additional evidentiary support will exist for the allegations set forth herein after a reasonable opportunity for discovery. NATURE OF THE ACTION 1. This is a federal securities class action on behalf ofpurchasers ofthe common stock of Scholastic between March 18, 2005 and March 23, 2006, inclusive (the "Class Period ), seeking to pursue remedies under the Securities Exchange Act of 1934 (the "Exchange Act ). JURISDICTION AND VENUE 2. The claims asserted herein arise under and pursuant to Sections 10(b) and 20(a) ofthe Exchange Act [15 U.S.C. §§78j(b) and 78t(a)] and Rule lOb-5 promulgated thereunder by the Securities and Exchange Commission ("SEC ) [17 C.F.R. §240. 1Ob-5]. 3. This Court has jurisdiction over the subject matter ofthis action pursuant to 28 U. S.C. §§1331 and Section 27 of the Exchange Act [15 U.S.C. -

Scholastic Corporation

United States Securities and Exchange Commission Washington, D.C. 20549 Form 10-K Annual Report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended May 31, 2004 | Commission File No. 000-19860 Scholastic Corporation (Exact name of Registrant as specified in its charter) Delaware 13-3385513 (State or other jurisdiction of (IRS Employer Identification No.) incorporation or organization) 557 Broadway, New York, New York 10012 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (212) 343-6100 Securities Registered Pursuant to Section 12(b) of the Act: NONE Securities Registered Pursuant to Section 12(g) of the Act: Title of class Name of Each Exchange on Which Registered Common Stock, $0.01 par value The NASDAQ Stock Market Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No _ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. X Indicate by check mark whether the Registrant is an accelerated filer (as defined in Exchange Act Rule 12b-2). -

Stifel Nicolaus Investor Meeting

Confidential ADD COVER IMAGE HERE Stifel Nicolaus Investor Meeting Wednesday, February 5, 2020 Art © Dav Pilkey. DOG MAN ™/® Dav Pilkey Forward-Looking Statements This presentation contains certain forward-looking statements. Such forward-looking statements are subject to various risks and uncertainties, including the conditions of the children’s book and educational materials markets and acceptance of the Company’s products in those markets, as well as other risks and factors identified from time to time in the Company’s filings with the Securities and Exchange Commission. Actual results could differ materially from those currently anticipated. 2 Investment Thesis Scholastic is the top children’s book publisher and distributor in the world. Children’s books seen as most stable and growing part of the market. Proprietary distribution channels to schools with clubs and fairs. New Scholastic Literacy comprehensive curriculum and component digital subscription products now in the market. English language learning materials market growing in China and Korea. Increased activity in the film and TV market as over‐the‐top subscription services compete for new children’s content. 3 Investment Thesis Strong balance sheet with ≈ $250 million in cash and trivial amounts of debt outside the U.S. Valuable company‐owned real estate unencumbered by liens or other collateral arrangements. Scholastic 2020 process improvement and cost savings initiatives gaining traction. New enterprise‐wide technology platforms and data‐ analytics capabilities informing new marketing strategies. Building remodel produced additional high value retail to drive incremental rental income in future periods. Higher levels of capital investment in technology, facilities and new products tapering off. -

Download Add-Ons, Check out the Author’S Other Work, and Look at Other Books That You Might Like If You Enjoyed the Hunger Games

When Books Meet Movies: The Interplay Between Entertainment Companies and Education 2 TABLE OF CONTENTS Chapter 1: Problem Statement and Significance 3 Chapter 2: Book-to-Film Adaptations 6 i. What is Children’s Literature? 6 ii. What is Film Adaptation? 8 iii. Trends in Book-to-Film Adaptations 13 Chapter 3: Case Studies 23 iv. Harry Potter 23 v. Hunger Games 31 Chapter 4: Company Portfolios 39 vi. Scholastic 39 vii. Walden Media 44 Chapter 5: Theories 50 viii. Child Development Theories 50 ix. Media Theories 54 Chapter 6: Media Literacy 58 x. What is Media Literacy? 58 xi. Generation Z (M) 60 xii. Current Debate in the United States about Media Literacy 62 xiii. Current Media Literacy Awareness and Education in the U.S. 64 Chapter 7: Methodology 68 xiv. Research Methods 68 xv. Creative Methods 71 Chapter 8: Findings 88 Chapter 9: Creative (separate document) xvi. Pitch Book xvii. Education Guide xviii. PowerPoint Slides Chapter 10: Conclusion/Self-Reflective Statement/Acknowledgments 95 Acknowledgments 97 Appendixes 98 Bibliography 99 3 CHAPTER 1: Problem Statement and Significance It’s hard for me to think about Harry Potter without picturing Daniel Radcliffe, in fact, it is impossible. This association, though almost unconscious, has changed the educational landscape, particularly as it pertains to book-to-film adaptations. In the family genre alone, 73 book-to-film titles have come out since 1982 grossing over $7,526,815,755 dollars cumulatively (“Family-Children's Book Adaptation,” 2013, 1). Harry Potter and its subsequent sequels have each grossed upwards of $900,00,000 each with historical opening weekends that are unparalleled in worldwide and international box office (“All Time Box Office Records,” 2013, 1).