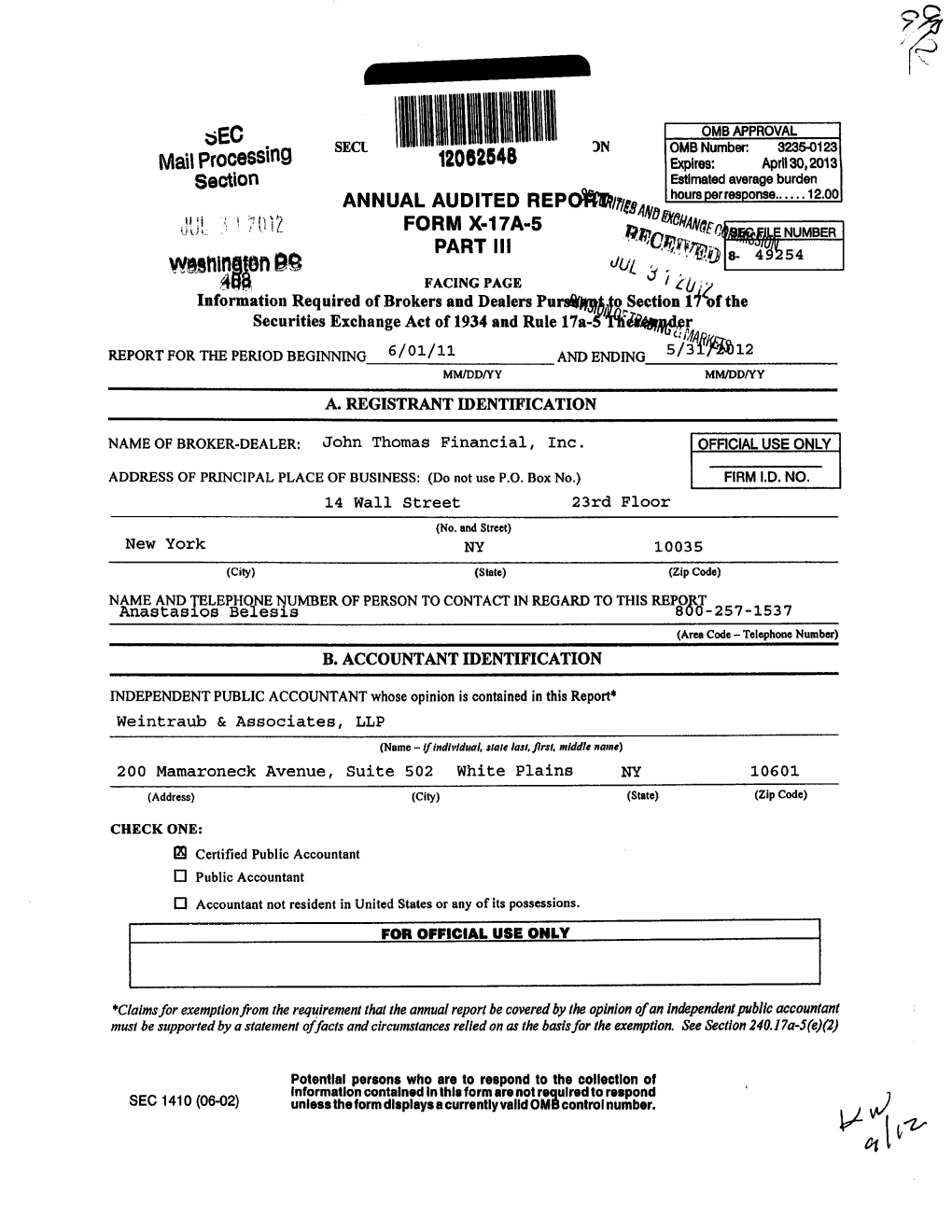

AN UAL AUDITED REPO PART III and ENDING__S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JOHN THOMAS FINANCIAL, INC., And

-~;i;e:l: UNITED STATES OF AMERICA Before the I SECURITIES AND EXCHANGE COMMISSlON. y " . MA c:.8 2014 ~FFlCE otrH{SECRETARt In the Matter of JOHN THOMAS CAPITAL MANAGMENT GROUP LLC d/b/a PATRIOT28 LLC, File No. 3-15255 GEORGE R. JARKESY, JR., JOHN THOMAS FINANCIAL, INC., and ANASTASIOS "TOMMY" BELESIS, Respondents. RESPONDENTS' POST-HEARING MEMORANDUM OF LAW Karen Cook, Esq. S. Michael McColloch, Esq. Karen Cook, PLLC S. Michael McColloch, PLLC E-mail: [email protected] E-mail: [email protected] Phone: 214.593.6429 Phone: 214.593.6415 1717 McKinney A venue, Suite 700 171 7 McKinney A venue, Suite 700 Dallas, Texas 75202 Dallas, Texas 75202 Fax: 214.593.6410 Fax: 214.593.6410 Counsel for: John Thomas Capital Management Group d/b/a Patriot28 LLC and George Jarkesy, Jr. TABLE OF CONTENTS Preliminary Statement....................................................................................................... l The AP is Void Because the Commission Prejudged the Case Against Respondents ............................................................................................................ 2 The AP Should Be Dismissed Due to Improper Ex Parte Communications with the Division of Enforcement Prior to the Hearing ..................................... 8 The AP is Void Because the Commission Failed to Follow its Own Rules of Practice.................................................................................................................. ll Respondents' Constitutional Rights Were {and continue to be) Violated ................. -

Disciplinary and Other FINRA Actions

Disciplinary and Other FINRA Actions Firms Fined, Individuals Sanctioned Reported for Delaney Equity Group, LLC (CRD® #142285, Palm Beach Gardens, Florida) October 2013 and David Cameron Delaney (CRD #2447186, Registered Principal, West Palm Beach, Florida) submitted an Offer of Settlement in which the firm was censured and fined $215,000. The firm was prohibited from directly or FINRA has taken disciplinary actions indirectly receiving, in any manner, any penny stock in any form, and prohibited against the following firms and from selling, for the benefit of any customer or firm proprietary account, any individuals for violations of FINRA penny stock deposited with the firm (including through the firm’s clearing rules; federal securities laws, rules firm) by Automated Customer Account Transfer (ACAT) unless the stock has and regulations; and the rules of been held in the account for at least 180 days or has been beneficially owned the Municipal Securities Rulemaking by the accountholder, including the accountholders predecessors, if any, for Board (MSRB). the requisite statutory period not to be less than 180 days, and in amounts not to exceed the volume limitations prescribed by the applicable federal securities laws; or the stock is subject to an effective registration statement. The firm shall retain, within 60 days of the date of the Order Accepting Offer of Settlement, an independent consultant, to conduct a comprehensive review of the adequacy of the firm’s policies, systems and procedures (written and otherwise) and training relating to the compliance with Section 5 of the Securities Act of 1933, applicable rules and regulations with respect to the distribution of unregistered non-exempt securities, compliance with the requirements of the Bank Secrecy Act, and the regulations promulgated thereunder. -

Jonathan C. Rugg, CFA, President Cyrus M

Item 1. Cover Page PART 2B of FORM ADV Jonathan C. Rugg, CFA, President Cyrus M. Amini, Esq., CFA, CIO & CCO Shawn Hsieh, MBA, CFA, CFP Aaron Dejuan Morris, AIF Jamie N. Rugg, CFP David Fitzgerald, CIMA Thomas Murphy K. David Yoshioka Hugh A. Meyer, MBA David D. Hu, CLU, CFP Charlesworth & Rugg, Inc. 20750 Ventura Boulevard, Suite 420 Los Angeles, California 91364 Phone: (818) 340-0157 Facsimile: (818) 702-8851 Email: [email protected] March 31, 2019 This brochure supplement provides information about the qualifications of Charlesworth & Rugg, Inc. (C&R) supervised persons. If you have any questions about the contents of this brochure supplement, please contact us at (818) 340-0157. The information in this brochure supplement has not been approved or verified by the United States Securities and Exchange Commission or by any state securities authority. C&R is a registered investment adviser. However, being a registered investment adviser does not imply a certain level of skill or training and does not guarantee investment performance. Additional information about C&R is also available on the SEC’s website at www.adviserinfo.sec.gov. 1 Jonathan C. Rugg, CFA Item 2. Educational Background and Business Experience NAME: Jonathan Christopher Rugg YEAR OF BIRTH: 1983 FORMAL EDUCATION: B.S. with concentrations in Finance, Real Estate and Marketing at The University of Pennsylvania, Wharton School of Business, 2006 Chartered Financial Analyst (CFA) Charterholder, 2010 BUSINESS BACKGROUND: Firm Position Responsibilities Period C&R President Investment selection, asset 8/16 - Present allocation and business development Chief Develops, maintains, monitors, 8/16 – 3/19 Compliance and revises, compliance related Officer policies and procedures Vice Investment selection, asset 8/10 – 7/16 President allocation and business development Urdang Capital Associate, Analyzing investments, 7/06 - 6/10 Management Acquisitions underwriting, due diligence Item 3. -

Miguel Ortiz January 4, 2017 New York, NY

BEFORE THE NATIONAL ADJUDICATORY COUNCIL FINANCIAL INDUSTRY REGULATORY AUTHORITY In the Matter of Department of Enforcement, DECISION Complainant, Complaint No. 2014041319201 vs. Miguel Ortiz January 4, 2017 New York, NY, Respondent. Respondent willfully made material misrepresentations to conceal losses in an account. Respondent also willfully failed to disclose on his Form U4 an unsatisfied judgment. Held, findings and sanctions affirmed. Appearances For the Complainant: Leo F. Orenstein, Esq., Jeffrey D. Pariser, Esq., Department of Enforcement, Financial Industry Regulatory Authority For the Respondent: Pro se Decision Miguel Ortiz appeals a November 6, 2015 Hearing Panel decision. The Hearing Panel found that Ortiz made materially false statements and omitted material facts concerning the composition, value, and performance of an investment account and concealed the losses incurred in that account. It further found that Ortiz willfully failed to disclose on his Uniform Application for Securities Industry Registration and Transfer (“Form U4”) an unsatisfied judgment against him. The Hearing Panel barred Ortiz for his material misrepresentations and omissions and did not impose additional sanctions for Ortiz’s remaining misconduct. On appeal, Ortiz concedes that he made material misrepresentations and omitted to disclose material facts, but argues that his motivation was not greed or his own monetary gain. Rather, Ortiz argues that he misrepresented the composition, value, and performance of the account in a misguided attempt to shield the account’s owners, his longtime friend and her partner, from the “unpleasant reality” of large losses while he purportedly tried to recover the losses. Ortiz urges us to reduce the bar imposed upon him for this misconduct. -

John Thomas Capital Management Group LLC, D/B/A Patriot28 LLC And

INITIAL DECISION RELEASE NO. 693 ADMINISTRATIVE PROCEEDING FILE NO. 3-15255 UNITED STATES OF AMERICA Before the SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 _____________________________________ In the Matter of : : JOHN THOMAS CAPITAL MANAGEMENT : INITIAL DECISION AS TO GROUP LLC, d/b/a PATRIOT28 LLC, : JOHN THOMAS CAPITAL MANAGEMENT GEORGE R. JARKESY, JR., : GROUP LLC, d/b/a PATRIOT28 LLC, and JOHN THOMAS FINANCIAL, INC., and : GEORGE R. JARKESY, JR1 ANASTASIOS “TOMMY” BELESIS : October 17, 2014 _______________________________________ APPEARANCES: Todd Brody and Alix Biel for the Division of Enforcement, Securities and Exchange Commission Karen Cook and S. Michael McColloch for Respondents John Thomas Capital Management Group LLC, d/b/a Patriot28 LLC, and George R. Jarkesy, Jr. BEFORE: Carol Fox Foelak, Administrative Law Judge SUMMARY This Initial Decision (ID) concludes that George R. Jarkesy, Jr. (Jarkesy) and John Thomas Capital Management Group LLC, d/b/a Patriot28 LLC (JTCM) (collectively, JTCM/Jarkesy or Respondents) violated the antifraud provisions of the federal securities laws. The ID orders Respondents to cease and desist from further violations and, jointly and severally, to disgorge $1,278,597 plus prejudgment interest and to pay a third-tier civil penalty of $450,000. I. INTRODUCTION A. Procedural Background The Securities and Exchange Commission (Commission) instituted this proceeding with an Order Instituting Proceedings (OIP) on March 22, 2013, pursuant to Section 8A of the Securities Act of 1933, Sections 15(b)(4), 15(b)(6), and 21C of the Securities Exchange Act of 1934, Sections 1 The proceeding has ended as to Respondents John Thomas Financial, Inc., and Anastasios “Tommy” Belesis, who settled the charges against them. -

Disciplinary and Other FINRA Actions Reported for September 2013

Disciplinary and Other FINRA Actions Firm Expelled, Individual Sanctioned Reported for Thornes & Associates, Inc. Investment Securities (CRD® #40868, Redlands, September 2013 California) and John Thomas Thornes (CRD #2097878, Registered Principal, Redlands, California) submitted an Offer of Settlement in which the firm was expelled from FINRA® membership and Thornes was barred from association FINRA has taken disciplinary actions with any FINRA member in any capacity. Without admitting or denying the against the following firms and allegations, the firm and Thornes consented to the described sanctions and to individuals for violations of FINRA the entry of findings that the firm, by and through Thornes, as its president, rules; federal securities laws, rules and Thornes individually, and as broker of record, converted and improperly and regulations; and the rules of used a total of $4,189,770.90 that belonged to two trust accounts, one of the Municipal Securities Rulemaking which was for the benefit of an elderly widow and the other for awarding Board (MSRB). educational scholarships. Thornes falsely characterized the transfers of funds from the accounts of both trusts as loans to friends. The purported loans have never been repaid and Thornes did not have any reasonable expectation that the funds would be repaid. The findings stated that Thornes placed his own interests and the interests of his friend, and other third parties on his friend’s behalf, ahead of the trust by utilizing high margin and causing the trust brokerage account to make risky unsecured and undocumented fictitious loans to his personal friends. Thornes’ actions enabled him to use, control and dissipate the assets of the trusts in a manner that harmed the trusts. -

GAO-14-213R, Financial Audit

On December 23, 2013, the enclosure was replaced to reflect SEC’s correction of certain unaudited information in its agency financial report, as discussed on page 1 of the enclosure. 441 G St. N.W. Washington, DC 20548 December 16, 2013 The Honorable Mary Jo White Chair United States Securities and Exchange Commission Financial Audit: Securities and Exchange Commission’s Fiscal Years 2013 and 2012 Financial Statements Dear Ms. White: This report transmits the GAO auditor’s report on the results of our audits of the fiscal years 2013 and 2012 financial statements of the United States Securities and Exchange Commission (SEC) and its Investor Protection Fund (IPF),1 which is incorporated in the enclosed U.S. Securities and Exchange Commission Fiscal Year 2013 Agency Financial Report. As discussed more fully in the auditor’s report that begins on page 54 of the enclosed agency financial report, we found • the financial statements are presented fairly, in all material respects, in accordance with U.S. generally accepted accounting principles; • SEC maintained, in all material respects, effective internal control over financial reporting as of September 30, 2013, although internal control deficiencies regarding information security exist that merit attention by those charged with governance; and • no reportable noncompliance in fiscal year 2013 with provisions of applicable laws, regulations, contracts, and grant agreements we tested. The Accountability of Tax Dollars Act of 2002 requires that SEC annually prepare and submit audited financial statements to Congress and the Office of Management and Budget.2 The Securities Exchange Act of 1934, as amended in 2010 by the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act), requires SEC to annually prepare and submit a complete set of audited financial statements for IPF to Congress.3 We agreed, under our audit authority, to audit SEC’s and IPF’s financial statements. -

UNITED STATES of AMERICA Before the SECURITIES and EXCHANGE COMMISSION

UNITED STATES OF AMERICA Before the SECURITIES AND EXCHANGE COMMISSION ADMINISTRATIVE PROCEEDING File No. 3-15255 In the Matter of JOHN THOMAS CAPITAL MANAGEMENT GROUP, LLC, d/b/a PATRIOT28, LLC, GEORGE R. JARKESY JR., JOHN THOMAS FINANCIAL, INC., ANASTASIOS "TOMMY' BELESIS, Respondents. THE DIVISION'S RESPONSE TO RESPONDENTS' OBJECTIONS The Division of Enforcement("Division") submits the followingresponse to the Objections to Administrative Proceedings ("Objections") filedby Respondents George R. Jarkesy Jr. and John Thomas Capital Management Group, LLC d/b/a/ Patriot 28, LLC (collectively "Respondents"). The Division fullyincorporates its previously filedsubmissions as referencedherein and this document provides only a summary of its response. As a preliminary matter, however, the Division notes that many of Respondents' objections were previously addressed and rejected by the Commission in its orders dated February 20, 2015 (Denying Motion to Stay Administrative Proceedings), October 16, 2014 (denying interlocutory review with respect to Respondents' motion fororder directing alternativeprocedure forfiling, service and publication of initial decision), January 28, 2014 (denying petition forinterlocutory review) and December 6, 2013 ( denying petition forinterlocutory review). While the Commission may have vacated all prior orders in this matter, there is nothing in the Objections that lead to the conclusion that the Commission's prior rulings were in error. Second, many of the "objections" asserted by Respondents do not relate at all to the currentproceeding that is scheduled to commence on March 25, 2019, but rather relate to rulings previously made by ALJ Foelak, including the initial decision dated October 17, 2014. As the Commission'sAugust 22, 2018 Order (In re: Pending Administrative Proceedings) explicitly states, going forwardthe ALJ "shall not give weight to or otherwise presume the correctnessof any prior opinions, orders, or rulings in this matter". -

SEC Enforcement Year in Review: Actions and Issues from 2013

Electronically reprinted from SEC Enforcement Year in Review: Actions and Issues From 2013 By Daniel Marx and Lisa Wood ot since the Great Depression has so While recent years have been defined by much changed so fast. In 2008 and these new securities laws and the unprec- 2009, the global financial crisis dev- edented levels of enforcement activity, the astated securities markets and the past year in particular has featured many financialN services industry. In 2010, Congress new faces in the senior leadership at the SEC responded by enacting the Dodd-Frank Wall and its Enforcement Division. Most notably, Street Reform and Consumer Protection Act in April 2013, Mary Jo White became the (Dodd-Frank Act).1 Since then, the Securities new Chairman of the SEC, replacing for- and Exchange Commission (SEC) has pro- mer Chairman Elisse B. Walter.5 Chairman mulgated a vast array of new securities regula- White brings many years of experience as a tions,2 including regulations to enhance the federal prosecutor, having served as the US oversight of investment advisers.3 In addition, Attorney in Manhattan (from 1993 to 2002) in 2011 and 2012, the Enforcement Division of and Brooklyn (on an acting basis, from 1992 to the SEC brought new enforcement actions at a 1993). The nomination of a long-time prosecu- record-breaking pace, both in administrative tor, who spent much of her career prosecuting proceedings and also in federal court.4 Many high-profile criminal cases from international of these actions targeted investment advisers, terrorism to insider trading, sends a strong sig- from massive firms like The Galleon Group, nal to the investment community that aggres- run by Raj Rajarantam, to much smaller, sive enforcement will remain a central concern, unregistered advisers. -

A Non-Linear Analysis of Operational Risk and Operational Risk Management in Banking Industry

University of Wollongong Research Online University of Wollongong Thesis Collection 2017+ University of Wollongong Thesis Collections 2017 A non-linear analysis of operational risk and operational risk management in banking industry Yifei Li University of Wollongong Follow this and additional works at: https://ro.uow.edu.au/theses1 University of Wollongong Copyright Warning You may print or download ONE copy of this document for the purpose of your own research or study. The University does not authorise you to copy, communicate or otherwise make available electronically to any other person any copyright material contained on this site. You are reminded of the following: This work is copyright. Apart from any use permitted under the Copyright Act 1968, no part of this work may be reproduced by any process, nor may any other exclusive right be exercised, without the permission of the author. Copyright owners are entitled to take legal action against persons who infringe their copyright. A reproduction of material that is protected by copyright may be a copyright infringement. A court may impose penalties and award damages in relation to offences and infringements relating to copyright material. Higher penalties may apply, and higher damages may be awarded, for offences and infringements involving the conversion of material into digital or electronic form. Unless otherwise indicated, the views expressed in this thesis are those of the author and do not necessarily represent the views of the University of Wollongong. Recommended Citation Li, Yifei, A non-linear analysis of operational risk and operational risk management in banking industry, Doctor of Philosophy thesis, School of Accounting, Economics and Finance, University of Wollongong, 2017. -

John Thomas Financial Crd# 40982

BrokerCheck Report JOHN THOMAS FINANCIAL CRD# 40982 Section Title Page(s) Report Summary 1 Registration and Withdrawal 2 Firm Profile 3 - 5 Firm History 6 Firm Operations 7 - 12 Disclosure Events 13 i Please be aware that fraudsters may link to BrokerCheck from phishing and similar scam websites, trying to steal your personal information or your money. Make sure you know who you’re dealing with when investing, and contact FINRA with any concerns. For more information read our investor alert on imposters. About BrokerCheck® BrokerCheck offers information on all current, and many former, registered securities brokers, and all current and former registered securities firms. FINRA strongly encourages investors to use BrokerCheck to check the background of securities brokers and brokerage firms before deciding to conduct, or continue to conduct, business with them. · What is included in a BrokerCheck report? · BrokerCheck reports for individual brokers include information such as employment history, professional qualifications, disciplinary actions, criminal convictions, civil judgments and arbitration awards. BrokerCheck reports for brokerage firms include information on a firm’s profile, history, and operations, as well as many of the Using this site/information means same disclosure events mentioned above. that you accept the FINRA · Please note that the information contained in a BrokerCheck report may include pending actions or BrokerCheck Terms and allegations that may be contested, unresolved or unproven. In the end, these actions or allegations may be Conditions. A complete list of resolved in favor of the broker or brokerage firm, or concluded through a negotiated settlement with no Terms and Conditions can be admission or finding of wrongdoing. -

John Thomas Capital Management Group LLC, D/B/Apatriot28 LLC

HARD COPY RECEIVED UNITED STATES OF AMERICA JAN 2 2 t:018 Beforethe OFFICE OF THE SECRETARY SECURITIES AND EXCHANGE COMMISSION ADMINISTRATIVEPROCEEDING File No. 3-15255 In the Matter of JOHN THOMAS CAPITAL MANAGEMENT GROUP, LLC, d/b/aPATRIOT28, LLC, GEORGE R. JARKESYJR., JOHN THOMAS FINANCIAL, INC., ANASTASIOS "TOMMY' BELESIS, Respondents. THE DIVISION OF ENFORCEMENT'S OPPOSITION TO RESPONDENTS' JANUARY 5, 2018 SUBMISSION OPPOSING RATIFICATION Todd D. Brody Senior Trial Counsel Alix Biel Senior Attorney Division of Enforcement New York Regional Office 200 Vesey Street, 4th Floor New York, NY 10281 TABLE OF CONTENTS Preliminary Statement 1 Argument 3 I. The Commission's RatificationOrder and Remand Order is Valid and has EffectivelyRemedied Respondents' Alleged Injury 3 A. None of Respondents' Challenges to the November 30 Order Have Merit 3 B. The Reconsideration Procedures Provide a Remedy For all Alleged Harm 5 C. Respondents' Prematurity Argument is not Properly Directed to theALJ 6 II. Respondents' Challenges to the Disgorgment Order are Without Merit 6 A. There Is No Monetary Limiton Disgorgement 6 B. The Potential StatutoryPenalty Amount Is Sufficientto Encompass both the Disgorgement and Penalty Amountin theInitial Decision 7 C. Respondents Have Not Met Their Burden to DemonstrateOffset 9 III. Respondents' Purported "Defects"in the ProceedingHave Already been Rejected 11 A. Respondents' Constitutional Rights Were Not Violated 12 1 The Selection of the AP Forum Raised no Equal Protection Violation 12 2. There No Right to a Juryin the AP Forum 13 3. Respondents Were Not Denied Due Process by theDiscovery Provided 13 B. The Commission Did Not Prejudge theMatter by Accepting Other Settlements 14 C.