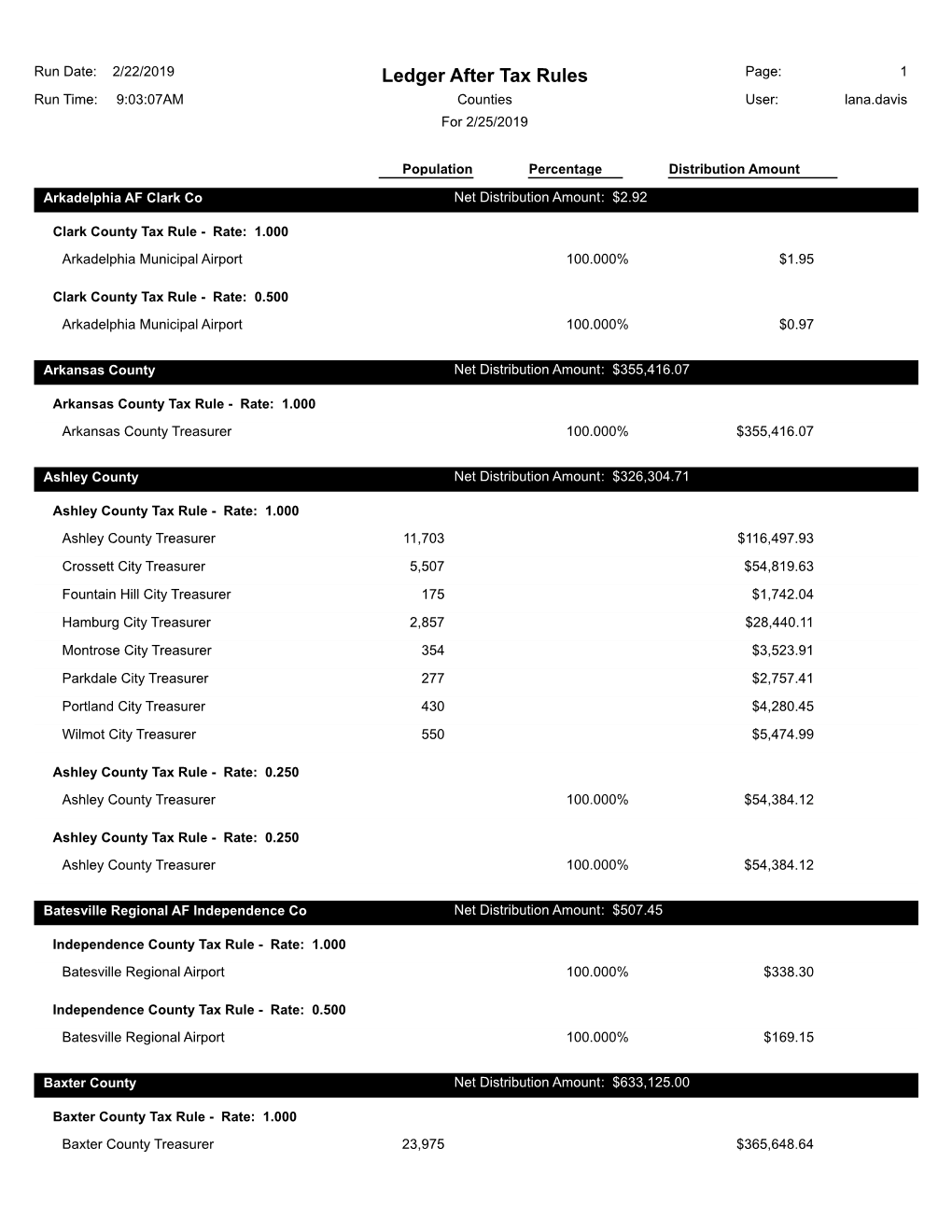

Ledger After Tax Rules Page: 1 Run Time: 9:03:07AM Counties User: Lana.Davis for 2/25/2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Airport Rates & Charges Survey

AIRPORT RATES & CHARGES SURVEY 2021 Table of Contents About the Survey 2-5 Respondent Information 6-13 Regional Survey Results 14-22 Survey Results by State 23-41 1 2020 General Aviation Airports Rates & Charges Survey In 2020, KSA undertook a robust data collection effort for our Federal Aviation Administration (FAA) Southwest Region airport sponsors. The results of this survey are intended to be a resource for aviation professionals regarding general aviation airport rates and charges across all categories and provide a clearinghouse for regional comparisons. Rest assured, no individual airport data will be published. The airport data has been complied to create a composite of airport types for your reference and use. Each participating airport will receive a copy of the survey results. We are preparing this survey as a service to airports within our region. Thank you to those that participated. We believe this will benefit our colleagues and peers in the airport industry looking to benchmark their respective market areas and remain competitive in developing sustainable revenue sources at their facility. ABOUT US: Founded in 1978, KSA provides a broad range of consulting, management, engineering, architecture, planning, surveying, and construction services to our clients across the south-central United States. As a firm, KSA’s primary work portfolio includes non-hub commercial service and general airports in the Southwest Region. We have completed over a thousand projects at hundreds of aviation facilities including Commercial Service, Reliever, and General Aviation airports. More at www.ksaeng.com 2 Aviation Rates & Fee 2020 INTRO Welcome to KSA’s inaugural issue of the Aviation Rates & Fees for Southwest region General Aviation Airports. -

City & Town, July 2012 Vol. 68, No.07

JULY 2012 VOL. 68, NO. 07 THE OFFICIAL PUBLICATION OF THE ARKANSAS MUNICIPAL LEAGUE Mayor Jackie Crabtree Pea Ridge First Vice President Mayor Chris Claybaker Camden President New leaders named during 78th Convention Mayor Harold Perrin Mayor Michael Watson Jonesboro Maumelle Vice President, District 1 Vice President, District 2 Mayor Doug Sprouse Mayor Harry Brown Springdale Stephens Vice President, District 3 Vice President, District 4 BUILDING SOMETHING EVEN GREATER. TOGETHER.TOGETHER. Raymond James and Morgan committed to serving the needs Keegan. We’re two well of our clients. As Raymond respected firms, among James | Morgan Keegan, our the leading underwriters team of veteran bankers leads of municipal bonds in the one of the largest public finance industry and both known for practices in the country – one our fierce commitment to Expect red carpet capable of delivering innovative, treatment. clients. Individually, we’re Every time. comprehensive solutions to excellent companies, but help issuers meet often complex together, we’re even greater. Capitalizing financing goals. All with a powerful retail on more than 60 years of combined public distribution platform more than 6,500 finance experience, we’ve created a strong strong. In short, we’re now one firm with partnership even more capable of and one goal: To better serve our clients. Raymond James | Morgan Keegan is a proven public financing partner with a tradition in Arkansas going back to 1931. We pair our local team and deep resources to achieve success for our clients. Give us a call. Little Rock Public Finance 100 Morgan Keegan Drive, Suite 400 • Little Rock, AR 72202 • 501.671.1339 ©2012 Raymond James & Associates, Inc., member New York Stock Exchange/SIPC. -

Sales and Use Tax Distribution Page: 1 Run Time: 1:48:49PM 7/1/2014 to 6/30/2015 User: Rgraves

Run Date: 10/9/2015 Sales and Use Tax Distribution Page: 1 Run Time: 1:48:49PM 7/1/2014 To 6/30/2015 User: rgraves County/City Amount Arkansas County Treasurer $1,235.80 Almyra AF Arkansas Co Total $1,235.80 Arkansas County Treasurer $3,560,383.83 Arkansas County Total $3,560,383.83 Ashley County Treasurer $2,758,204.95 Crossett City Treasurer $671,222.74 Fountain Hill City Treasurer $21,329.95 Hamburg City Treasurer $348,226.51 Montrose City Treasurer $43,147.43 Parkdale City Treasurer $33,762.24 Portland City Treasurer $52,410.70 Wilmot City Treasurer $67,036.93 Ashley County Total $3,995,341.45 Batesville Regional Airport $4,300.93 Independence County Treasurer $3,225.71 Batesville Regional AF Independence Co Total $7,526.64 Baxter County Treasurer $3,711,519.97 Big Flat City Treasurer $16,100.03 Briarcliff City Treasurer $36,534.66 Cotter City Treasurer $150,163.70 Gassville City Treasurer $321,690.85 Lakeview City Treasurer $114,712.67 Mountain Home City Treasurer $1,927,049.04 Norfork City Treasurer $79,106.84 Salesville City Treasurer $69,663.60 Baxter County Total $6,426,541.36 Avoca City Treasurer $89,046.44 Bella Vista City Treasurer $4,836,337.50 Benton County Treasurer $7,824,006.00 Bentonville City Treasurer $6,441,450.63 Bethel Heights City Treasurer $432,824.02 Cave Springs City Treasurer $343,264.07 Centerton City Treasurer $1,736,222.86 Decatur City Treasurer $310,020.26 Elm Springs City Treasurer $14,688.04 Garfield City Treasurer $91,601.04 Gateway City Treasurer $73,901.22 Gentry City Treasurer $576,247.16 Gravette -

Ledger After Tax Rules Page: 1 Run Time: 10:07:38AM Counties User: Lana.Davis for 5/25/2021

Run Date: 5/21/2021 Ledger After Tax Rules Page: 1 Run Time: 10:07:38AM Counties User: lana.davis For 5/25/2021 Population Percentage Distribution Amount Arkadelphia AF Clark Co Net Distribution Amount: $345.34 Clark County Tax Rule - Rate: 1.000 Arkadelphia Municipal Airport 100.000% $230.23 Clark County Tax Rule - Rate: 0.500 Arkadelphia Municipal Airport 100.000% $115.11 Arkansas County Net Distribution Amount: $367,126.17 Arkansas County Tax Rule - Rate: 1.000 Arkansas County Treasurer 100.000% $367,126.17 Ashley County Net Distribution Amount: $428,038.92 Ashley County Tax Rule - Rate: 1.000 Ashley County Treasurer 11,703 $152,819.28 Crossett City Treasurer 5,507 $71,911.11 Fountain Hill City Treasurer 175 $2,285.17 Hamburg City Treasurer 2,857 $37,307.07 Montrose City Treasurer 354 $4,622.58 Parkdale City Treasurer 277 $3,617.10 Portland City Treasurer 430 $5,615.00 Wilmot City Treasurer 550 $7,181.97 Ashley County Tax Rule - Rate: 0.250 Ashley County Treasurer 100.000% $71,339.82 Ashley County Tax Rule - Rate: 0.250 Ashley County Treasurer 100.000% $71,339.82 Batesville Regional AF Independence Co Net Distribution Amount: $537.42 Independence County Tax Rule - Rate: 1.000 Batesville Regional Airport 100.000% $358.28 Independence County Tax Rule - Rate: 0.500 Batesville Regional Airport 100.000% $179.14 Baxter County Net Distribution Amount: $1,047,483.13 Baxter County Tax Rule - Rate: 1.000 Baxter County Treasurer 23,975 $483,962.29 Run Date: 5/21/2021 Ledger After Tax Rules Page: 2 Run Time: 10:07:38AM Counties User: lana.davis -

Ledger After Tax Rules Page: 1 Run Time: 11:25:35AM Counties User: Lana.Davis for 8/23/2018

Run Date: 8/22/2018 Ledger After Tax Rules Page: 1 Run Time: 11:25:35AM Counties User: lana.davis For 8/23/2018 Population Percentage Distribution Amount Almyra AF Arkansas Co Net Distribution Amount: $166.13 Arkansas County Tax Rule - Rate: 1.000 Arkansas County Treasurer 100.000% $166.13 Arkadelphia AF Clark Co Net Distribution Amount: $47.60 Clark County Tax Rule - Rate: 1.000 Arkadelphia Municipal Airport 100.000% $31.73 Clark County Tax Rule - Rate: 0.500 Arkadelphia Municipal Airport 100.000% $15.87 Arkansas County Net Distribution Amount: $293,469.57 Arkansas County Tax Rule - Rate: 1.000 Arkansas County Treasurer 100.000% $293,469.57 Ashley County Net Distribution Amount: $343,586.67 Ashley County Tax Rule - Rate: 1.000 Ashley County Treasurer 11,703 $122,667.97 Crossett City Treasurer 5,507 $57,723.02 Fountain Hill City Treasurer 175 $1,834.31 Hamburg City Treasurer 2,857 $29,946.37 Montrose City Treasurer 354 $3,710.54 Parkdale City Treasurer 277 $2,903.45 Portland City Treasurer 430 $4,507.15 Wilmot City Treasurer 550 $5,764.97 Ashley County Tax Rule - Rate: 0.250 Ashley County Treasurer 100.000% $57,264.45 Ashley County Tax Rule - Rate: 0.250 Ashley County Treasurer 100.000% $57,264.44 Batesville Regional AF Independence Co Net Distribution Amount: $435.24 Independence County Tax Rule - Rate: 1.000 Batesville Regional Airport 100.000% $290.16 Independence County Tax Rule - Rate: 0.500 Batesville Regional Airport 100.000% $145.08 Run Date: 8/22/2018 Ledger After Tax Rules Page: 2 Run Time: 11:25:35AM Counties User: lana.davis -

Ledger After Tax Rules Page: 1 Run Time: 10:41:46AM Counties User: Shyreen.Hightower for 3/23/2018

Run Date: 3/22/2018 Ledger After Tax Rules Page: 1 Run Time: 10:41:46AM Counties User: shyreen.hightower For 3/23/2018 Population Percentage Distribution Amount Arkadelphia AF Clark Co Net Distribution Amount: $598.98 Clark County Tax Rule - Rate: 1.000 Arkadelphia Municipal Airport 100.000% $399.32 Clark County Tax Rule - Rate: 0.500 Arkadelphia Municipal Airport 100.000% $199.66 Arkansas County Net Distribution Amount: $297,089.40 Arkansas County Tax Rule - Rate: 1.000 Arkansas County Treasurer 100.000% $297,089.40 Ashley County Net Distribution Amount: $306,145.86 Ashley County Tax Rule - Rate: 1.000 Ashley County Treasurer 11,703 $109,300.78 Crossett City Treasurer 5,507 $51,432.92 Fountain Hill City Treasurer 175 $1,634.42 Hamburg City Treasurer 2,857 $26,683.10 Montrose City Treasurer 354 $3,306.20 Parkdale City Treasurer 277 $2,587.06 Portland City Treasurer 430 $4,016.01 Wilmot City Treasurer 550 $5,136.75 Ashley County Tax Rule - Rate: 0.250 Ashley County Treasurer 100.000% $51,024.31 Ashley County Tax Rule - Rate: 0.250 Ashley County Treasurer 100.000% $51,024.31 Batesville Regional AF Independence Co Net Distribution Amount: $393.17 Independence County Tax Rule - Rate: 1.000 Batesville Regional Airport 100.000% $224.67 Independence County Tax Rule - Rate: 0.250 Batesville Regional Airport 100.000% $56.17 Independence County Tax Rule - Rate: 0.500 Batesville Regional Airport 100.000% $112.33 Baxter County Net Distribution Amount: $491,402.43 Run Date: 3/22/2018 Ledger After Tax Rules Page: 2 Run Time: 10:41:46AM Counties User: -

Final Report

FINAL REPORT JANUARY 15, 2021 This Study was prepared under contract with White & Smith, LLC, with financial support from the Office of Local Defense Community Cooperation (OLDCC), Department of Defense (DoD). The content reflects the views of White & Smith and its subconsultants Benchmark Planning and Marstel-Day, and the input of the local steering committees and does not necessarily reflect the views of the OLDCC or the DoD. Little Rock AFB Compatible Use Study Acknowledgments CUS Policy Committee Col. Robert Ator (USAF Ret.), Director, Military Affairs Judge Barry Hyde, Pulaski County Arkansas Economic Development Commission Mr. Michael Johnson, Entergy Judge Jim Baker, Faulkner County Mayor Robert Johnson, City of Jacksonville Mr. Robert Birch, Workforce Development & Education Director CUS Authorizing Official City of North Little Rock Mr. Efrem Jones, Lonoke City Council Mayor Bernie Chamberlain, City of Austin Mayor Ken Kincade, City of Cabot Mr. Tommy Bond, Bond Consulting Engineers, Inc. Judge Michael Lincoln, White County Mr. Don Crabbe, President and Chief Executive Officer Col Tina Lipscomb, Commander, 189th Mission Support Group First Electric Cooperative Corporation, Inc. Little Rock AFB, Arkansas Air National Guard Ms. Annabelle Davis, Executive Secretary Mr. Nicholas Lynch, Deputy Director, 19th Mission Support Group Little Rock AFB Community Council Little Rock AFB Ms. Courtney Dunn, City of Jacksonville Chamber of Commerce Mr. Brad McCaleb, Director of System Information & Research Judge Doug Erwin, Lonoke County Arkansas Department of Transportation Mr. Gary Fletcher, former Mayor, City of Jacksonville Mayor Caleb Norris, City of Maumelle Col. Derrick J. Floyd, Commander Dr. Bob Price, CUS Project Director 19th Mission Support Group Little Rock AFB Jacksonville Economic Development and Cultural Alliance Mayor Charles Gastineau, City of Ward Mayor Trae Reed, City of Lonoke Mr. -

May 2021 EAA CHAPTER 377

May 2021 EAA CHAPTER 377 EAA—Our mission: To grow participation in aviation by sharing the spirit of aviation. LAST MONTH THIS MONTH From Bill Cotter The fly- in in Elkhart in April was well attended. We had about 22 planes. The day of the fly-in was beautiful and couldn’t have been any better. Thank you to Den- nis Tevebaugh for the delicious hamburgers and many member brought in many tasty desserts. You can see by the photos that everyone enjoyed themselves. We had a business meeting to discuss the next fly-in. A lot of fun was had by everyone who attended. One of the members said these fly-in are fun and well worth coming. REMEMBER---if you plan to FLY in to 36K, CHECK NOTAMS! The airport will be CLOSED during the air- show. For the VERY LATEST information, call Flight Service at 800-WX Brief (800-992-7433) Photo by Randal Loder With the state of Covid19 stuff, family. Plains, KS. 620-629-3604 who knows what will happen PLEASE NOTE THIS IS NOT OUR F.Y.I. on a day to day basis. Presi- “NORMAL 2ND SATURDAY.” Chapter 377 normally meets on the dent Bill Cotter has organized 11 December—Christmas Party. second Saturday of each month. this list for 2021; please con- “Meetings” are normally fly-ins to ANOTHER different member airports, with a firm times/locations as some potluck at noon and short meeting changes may occur. Sure hope following. December is the Club to see you on the ramp some ISSUE THANKS TO: Ben McNary, Bill Christmas Party. -

KODY LOTNISK ICAO Niniejsze Zestawienie Zawiera 8372 Kody Lotnisk

KODY LOTNISK ICAO Niniejsze zestawienie zawiera 8372 kody lotnisk. Zestawienie uszeregowano: Kod ICAO = Nazwa portu lotniczego = Lokalizacja portu lotniczego AGAF=Afutara Airport=Afutara AGAR=Ulawa Airport=Arona, Ulawa Island AGAT=Uru Harbour=Atoifi, Malaita AGBA=Barakoma Airport=Barakoma AGBT=Batuna Airport=Batuna AGEV=Geva Airport=Geva AGGA=Auki Airport=Auki AGGB=Bellona/Anua Airport=Bellona/Anua AGGC=Choiseul Bay Airport=Choiseul Bay, Taro Island AGGD=Mbambanakira Airport=Mbambanakira AGGE=Balalae Airport=Shortland Island AGGF=Fera/Maringe Airport=Fera Island, Santa Isabel Island AGGG=Honiara FIR=Honiara, Guadalcanal AGGH=Honiara International Airport=Honiara, Guadalcanal AGGI=Babanakira Airport=Babanakira AGGJ=Avu Avu Airport=Avu Avu AGGK=Kirakira Airport=Kirakira AGGL=Santa Cruz/Graciosa Bay/Luova Airport=Santa Cruz/Graciosa Bay/Luova, Santa Cruz Island AGGM=Munda Airport=Munda, New Georgia Island AGGN=Nusatupe Airport=Gizo Island AGGO=Mono Airport=Mono Island AGGP=Marau Sound Airport=Marau Sound AGGQ=Ontong Java Airport=Ontong Java AGGR=Rennell/Tingoa Airport=Rennell/Tingoa, Rennell Island AGGS=Seghe Airport=Seghe AGGT=Santa Anna Airport=Santa Anna AGGU=Marau Airport=Marau AGGV=Suavanao Airport=Suavanao AGGY=Yandina Airport=Yandina AGIN=Isuna Heliport=Isuna AGKG=Kaghau Airport=Kaghau AGKU=Kukudu Airport=Kukudu AGOK=Gatokae Aerodrome=Gatokae AGRC=Ringi Cove Airport=Ringi Cove AGRM=Ramata Airport=Ramata ANYN=Nauru International Airport=Yaren (ICAO code formerly ANAU) AYBK=Buka Airport=Buka AYCH=Chimbu Airport=Kundiawa AYDU=Daru Airport=Daru -

City & Town, September 2014 Vol. 70, No. 09

SEPTEMBER 2014 VOL. 70, NO. 09 THE OFFICIAL PUBLICATION OF THE ARKANSAS MUNICIPAL LEAGUE Jonesboro Hosts League’s Annual Planning Meeting Download our free mobile app for locations throughout the Natural State. 1 Bentonville Mountain Home Rogers 1 Rector 1 2 1 Springdale Highland 1 1 Paragould Tontitown Mountain View 2 3 2 2 Siloam Fayetteville Monette Springs Batesville 1 Heber Springs 2 7 Van Buren 1 1 Clarksville Jonesboro 1 1 Greenbrier Russellville 1 Quitman 3 Atkins Searcy 3 1 Morrilton 3 Fort 1 1 Smith 1 7 1 2 Dardanelle Pottsville Beebe Conway Vilonia 1 Ward 1 5 Mayflower 3 Cabot Jacksonville 1 1 Maumelle Sherwood 5 North Little Rock 8 Bryant Little Rock 1 Fordyce 1 FOR ALL YOUR BANKING NEEDS, INCLUDING: BUSINESS & INVESTMENT INSURANCE PERSONAL LOANS SERVICES SERVICES MY100BANK.COM 888-372-9788 A Home BancShares Company SEPTEMBER 2014 VOL. 70, NO. 09 OFFICIAL PUBLICATION OF THE ARKANSAS MUNICIPAL LEAGUE FEATURES Governing body sets order of business for coming year 6City officials comprising the League’s governing body met to set the priorities of the coming year in motion. The upcoming legislative session was an important topic at this meeting and the League’s membership is 100 percent for the eleventh year in a ON THE COVER—Looking out from ASU’s row. Cooper Alumnae Center includes a view of Lake Terrace and the Red Wolves' Stadium. LR Port Authority unveils new HQ In this issue, read about the 2014-2015 The Little Rock Port Authority has unveiled its new Planning Meeting, get acquainted with headquarters, which overlooks the Arkansas River and promises District 1 Vice President and Blytheville 9 to invite more business through the port and beyond. -

Ledger After Tax Rules Page: 1 Run Time: 8:05:18AM Counties User: Shyreen.Hightower for 6/25/2018

Run Date: 6/25/2018 Ledger After Tax Rules Page: 1 Run Time: 8:05:18AM Counties User: shyreen.hightower For 6/25/2018 Population Percentage Distribution Amount Arkadelphia AF Clark Co Net Distribution Amount: $96.10 Clark County Tax Rule - Rate: 1.000 Arkadelphia Municipal Airport 100.000% $64.07 Clark County Tax Rule - Rate: 0.500 Arkadelphia Municipal Airport 100.000% $32.03 Arkansas County Net Distribution Amount: $270,691.37 Arkansas County Tax Rule - Rate: 1.000 Arkansas County Treasurer 100.000% $270,691.37 Ashley County Net Distribution Amount: $320,451.69 Ashley County Tax Rule - Rate: 1.000 Ashley County Treasurer 11,703 $114,408.28 Crossett City Treasurer 5,507 $53,836.31 Fountain Hill City Treasurer 175 $1,710.80 Hamburg City Treasurer 2,857 $27,929.97 Montrose City Treasurer 354 $3,460.70 Parkdale City Treasurer 277 $2,707.95 Portland City Treasurer 430 $4,203.67 Wilmot City Treasurer 550 $5,376.78 Ashley County Tax Rule - Rate: 0.250 Ashley County Treasurer 100.000% $53,408.62 Ashley County Tax Rule - Rate: 0.250 Ashley County Treasurer 100.000% $53,408.61 Batesville Regional AF Independence Co Net Distribution Amount: $574.64 Independence County Tax Rule - Rate: 1.000 Batesville Regional Airport 100.000% $383.09 Independence County Tax Rule - Rate: 0.500 Batesville Regional Airport 100.000% $191.55 Baxter County Net Distribution Amount: $1,082,277.09 Baxter County Tax Rule - Rate: 1.000 Baxter County Treasurer 23,975 $312,523.71 Run Date: 6/25/2018 Ledger After Tax Rules Page: 2 Run Time: 8:05:18AM Counties User: shyreen.hightower -

Ledger After Tax Rules Page: 1 Run Time: 12:23:09PM Counties User: Shyreen.Hightower for 1/25/2018

Run Date: 1/24/2018 Ledger After Tax Rules Page: 1 Run Time: 12:23:09PM Counties User: shyreen.hightower For 1/25/2018 Population Percentage Distribution Amount Almyra AF Arkansas Co Net Distribution Amount: $23.29 Arkansas County Tax Rule - Rate: 1.000 Arkansas County Treasurer 100.000% $23.29 Arkadelphia AF Clark Co Net Distribution Amount: $19.41 Clark County Tax Rule - Rate: 1.000 Arkadelphia Municipal Airport 100.000% $12.94 Clark County Tax Rule - Rate: 0.500 Arkadelphia Municipal Airport 100.000% $6.47 Arkansas County Net Distribution Amount: $327,204.07 Arkansas County Tax Rule - Rate: 1.000 Arkansas County Treasurer 100.000% $327,204.07 Ashley County Net Distribution Amount: $329,924.00 Ashley County Tax Rule - Rate: 1.000 Ashley County Treasurer 11,703 $117,790.10 Crossett City Treasurer 5,507 $55,427.67 Fountain Hill City Treasurer 175 $1,761.37 Hamburg City Treasurer 2,857 $28,755.56 Montrose City Treasurer 354 $3,562.99 Parkdale City Treasurer 277 $2,787.99 Portland City Treasurer 430 $4,327.93 Wilmot City Treasurer 550 $5,535.72 Ashley County Tax Rule - Rate: 0.250 Ashley County Treasurer 100.000% $54,987.33 Ashley County Tax Rule - Rate: 0.250 Ashley County Treasurer 100.000% $54,987.34 Batesville Regional AF Independence Co Net Distribution Amount: $692.04 Independence County Tax Rule - Rate: 1.000 Batesville Regional Airport 100.000% $395.45 Independence County Tax Rule - Rate: 0.250 Batesville Regional Airport 100.000% $98.86 Run Date: 1/24/2018 Ledger After Tax Rules Page: 2 Run Time: 12:23:09PM Counties User: shyreen.hightower