30 Annual Global Tire Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Crystal Structure of (E)-2-((2-(O-Tolylcarbamothioyl

Z. Kristallogr. NCS 2018; 233(1): 137–138 Tai Xi-Shi*, Li Peng-Fei and Liu Qing-Yun The crystal structure of (E)-2-((2-(o-tolylcarba- mothioyl)hydrazono)methyl)benzoic acid, C16H15N3O2S Table 1: Data collection and handling. Crystal: Yellow block Size: 0.19 × 0.18 × 0.170 mm Wavelength: Mo Kα radiation (0.71073 Å) μ:0.22mm−1 Diffractometer, scan mode: Bruker, APEX2, ω and ϕ scans 2θmax, completeness: 27.5°, >99% N(hkl)measured, N(hkl)unique, Rint: 7428, 3461, 0.029 Criterion for Iobs, N(hkl)gt: Iobs > 2 σ(Iobs), 3139 N(param)refined: 200 Programs: Bruker programs [1], SHELX [2], https://doi.org/10.1515/ncrs-2017-0221 OLEX2 [3], DIAMOND [4] Received September 2, 2017; accepted November 24, 2017; available online December 14, 2017 Table 2: Fractional atomic coordinates and isotropic or equivalent isotropic displacement parameters (Å2). Abstract C16H15N3O2S, triclinic, P¯1(no.2),a = 7.6 3 9 4 ( 1 5 ) Å , b = Atom xyzUiso*/Ueq 9.2445(18) Å, c = 11.428(2) Å, α = 98.75(3)°, β = 106.34(3)°, 3 S1 0.48227(5) 0.73308(4) 0.15236(4) 0.04350(16) γ = 91.18(3)°, V = 763.7(3) Å , Z = 2, Rgt(F) = 0.0548, O1 1.18235(17) 0.35086(12) 0.03524(13) 0.0519(3) wR (F2) = 0.1411, T = 293(2) K. ref O2 1.37644(17) 0.17585(15) 0.05773(13) 0.0582(4) CCDC no.: 1587438 H2 1.4095 0.2088 0.0041 0.087* N1 0.69310(17) 0.51243(14) 0.14418(11) 0.0372(3) The crystal structure is shown in the figure. -

International Conference on Engineering and Business Management 2010

International Conference on Engineering and Business Management 2010 (EBM 2010) Chengdu, China 25 - 27 March 2011 Volume 1 of 4 Pages 1 - 740 ISBN: 978-1-61782-807-2 Printed from e-media with permission by: Curran Associates, Inc. 57 Morehouse Lane Red Hook, NY 12571 Some format issues inherent in the e-media version may also appear in this print version. Copyright© (2010) by the Scientific Research Publishing Inc. All rights reserved. Printed by Curran Associates, Inc. (2011) For permission requests, please contact the Scientific Research Publishing Inc. at the address below. Scientific Research Publishing Inc. P.O. Box 54821 Irvine, CA 92619-4821 Phone: (408) 329-4591 [email protected] Additional copies of this publication are available from: Curran Associates, Inc. 57 Morehouse Lane Red Hook, NY 12571 USA Phone: 845-758-0400 Fax: 845-758-2634 Email: [email protected] Web: www.proceedings.com Contents Volume 1 Entrepreneurship, Decision and Investment A Study of Corporate Information Disclosure in Social Responsibility Crisis Based on Subjective Game Yongsheng GE………………………………………………………………………………………………………………………(1) The Influence Degree of Management Active Behaviors on Financial Ratios Adjustment Jianguang Zhang, Valerie Zhu, Junrui Zhang, Linyan Sun, Donglin Liu…………………………………………………………(5) A Financial Warning Method for the Listed Companies of Information Industry Based on Bayesian Rough Set Zhang Hongmei, Tong Yuesong…………………………………………………………………………………………………(12) Research on relationship between top management team incentive, ownership -

The Crystal Structure of Poly [Μ2-Aqua-(Μ2-2-Naphthylamine-1

Z. Kristallogr. NCS 2018; 233(4): 603–604 Feng Yi-Min, Guo Hong-Mei, Liu Qing-Yun and Tai Xi-Shi* The crystal structure of poly[µ2-aqua-(µ2-2- naphthylamine-1-sulfonato-κ3O,O′:O′′)sodium(I)], C10H10N1O4S1Na Table 1: Data collection and handling. Crystal: Yellow block Size: 0.21 × 0.20 × 0.18 mm Wavelength: Mo Kα radiation (0.71073 Å) µ: 0.32 mm−1 Diffractometer, scan mode: Bruker SMART, φ and ω-scans θmax, completeness: 25°, >99% N(hkl)measured, N(hkl)unique, Rint: 8472, 2023, 0.045 Criterion for Iobs, N(hkl)gt: Iobs > 2 σ(Iobs), 1903 N(param)refined: 154 Programs: Bruker programs [1], SHELX [2, 3], DIAMOND [4] https://doi.org/10.1515/ncrs-2017-0362 Received February 2, 2018; accepted May 3, 2018; available online May 18, 2018 Table 2: Fractional atomic coordinates and isotropic or equivalent isotropic displacement parameters (Å2). Abstract C10H10N1O4S1Na, monoclinic, P21/c, a = 16.737(3) Å, Atom x y z Uiso*/Ueq = = = b 6.6610(13) Å, c 10.427(2) Å, β 97.69(3)°, O1 0.37575(7) 0.24350(17) 0.25407(11) 0.0310(3) 3 2 V = 1152.0(4) Å , Z = 4, Rgt(F) = 0.0419, wRref(F ) = 0.1104, O1W 0.59036(8) 0.45177(18) 0.05298(12) 0.0362(3) T = 293(2) K. H1WB 0.6248 0.3834 0.0194 0.054* H1WA 0.6076 0.5225 0.1171 0.054* CCDC no.: 1577211 O2 0.40234(7) 0.43095(19) 0.45424(11) 0.0341(3) O3 0.44021(7) 0.56489(18) 0.25648(12) 0.0347(3) The crystal structure is shown in the figure. -

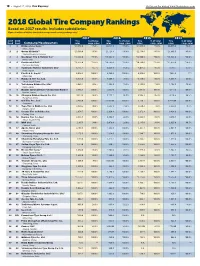

2018 Global Tire Company Rankings Based on 2017 Results

18 • August 27, 2018, TIRE BUSINESS Visit us on the web at www.tirebusiness.com 2018 Global Tire Company Rankings Based on 2017 results. Includes subsidiaries. (Figures in millions of dollars, translated at average annual currency exchange rates) 2017 2016 2015 2014 2017 2016 Tire % of total Tire % of total Tire % of total Tire % of total Rank Rank Company/Headquarters sales corp. sales sales corp. sales sales corp. sales sales corp. sales 1 1 Bridgestone Corp.# 1 *24,350.0 *75.0% 22,121.0 *75.0% *24,045.0 *75.0% *26,045.0 *75.0% Tokyo, Japan 2 2 Group Michelin#2 *23,560.0 *95.0% 21,129.4 *95.0% *22,130.0 *95.0% *24,668.5 *95.0% Clermont-Ferrand, France 3 3 Goodyear Tire & Rubber Co.# *14,300.0 *93.0% *13,645.0 *90.0% *14,800.0 *90.0% *16,355.0 *90.0% Akron, Ohio 4 4 Continental A.G.# *11,325.0 *28.5% *10,785.0 *25.0% *10,780.0 *25.0% *11,875.0 *24.8% Hanover, Germany 5 6 Sumitomo Rubber Industries Ltd.# 6,755.1 85.7% 6,029.9 85.6% 6,051.2 86.3% 6,917.7 87.3% Kobe, Japan 6 5 Pirelli & C. S.p.A.# 3 6,034.2 100.0% 6,380.0 100.0% 6,933.6 100.0% 7,992.2 ??? Milan, Italy 7 7 Hankook Tire Co. Ltd. *5,535.0 *92.0% 5,008.7 91.6% *5,320.0 *90.0% 5,595.4 88.0% Seoul, South Korea 8 8 Yokohama Rubber Co. -

The Yangzhou Storytelling of Rogue Pi Wu

The Yangzhou Storytelling of Rogue Pi Wu A Case Study of Yang Mingkun and His Repertoire LIU LIU 劉 琉 Faculty of Arts and Social Science The University of Sydney A thesis submitted in fulfilment of the requirements for the degree of Doctor of Philosophy The Yangzhou Storytelling of Rogue Pi Wu Abstract Yangzhou pinghua is a genre of Chinese chantefables. It is a living tradition with a history of more than 300 years and is listed as China’s intangible cultural heritage. The present research project is designed primarily as a case study of the Yangzhou pinghua performance of Rogue Pi Wu by Yang Mingkun, the ninth-generation heir of the Pu School of Pi Wu. This study combines methods borrowed from anthropological, linguistic, and literary fields to examine the history and performance of the Yangzhou pinghua repertoire of Rogue Pi Wu. Through observing both the performance tradition of the Pu School and the repertoire of Rogue Pi Wu performed by Yang, this study finds that the Yangzhou dialect acts as a special channel through which Yang communicates with his audiences in a most effective and intimate way. This study also finds that Yang develops a powerful narrative strategy by skilfully integrating oral narrative with written narrative into a coherent whole. Based on these findings, among others, I argue that Yang acheives a special aesthetic effect for his version of Rogue Pi Wu by creatively preserving and developing the Pu School of Pi Wu. ii / 251 The Yangzhou Storytelling of Rogue Pi Wu Table of Contents Abstract ................................................................................................................................... ii List of Tables ......................................................................................................................... -

Profiles of Directors, Supervisors and Senior Management

!"#EF !"#$%&'( Report of The Supervisors (Cont’d) Profiles of Directors, Supervisors and Senior Management ! Suggestion N !"#$%&'() ! 1. When integrated to international standards, the Company should excel !"#$ !"#$%&' itself consistently, establish and perfect corporate governance structure both ! !"#$%&!"'( in the company and its subsidiaries in accordance with the requirements for !"#$%&'()*+ a global company so as to make it a modernized enterprise with harmonized Li Gui Rong Jin Zhi Guo !"#$% !" !" operation and effective control. !"# O !"#$%&'()*+ 2. Following the consistent expansion, the Company should reinforce the !"#$%&'() !" internal monitoring and management, branding consolidation, eliminate !"#$ !"#$ ! market conflicts, optimize market environment, financial management, pace !"#$ !"#$ up with capital recycling, enhance collection of payment and reduce !"#$ !"#$%& receivables against operational risks. = !" Liu Ying Di Sun Yu Guo Chu Zhen Gang Wang Li Jun Tan Li Ning P !"#$ !"#$%& 3. Enhanced enforcing force is guarantee for the Company's sound ! !"#$%&'()* development. The Company should establish and perfect its regulations to !"#$%&' ()* ! bring the management to legal track so that at every level, department and ! ! !"#$ even every staff both exercise rights and undertake obligations. In this case !"# !"#$ could we build our staff team into a well disciplined of diligence, professional, !"#$%&'()*+ fast responding and best practice. !" !" !" Wu Hai Hua Pan Gui Rong Wu Yu Ting Yu Jia -

Ming China' Anew: the Ethnocultural Space in a Diverse Empire-With Special Reference to the 'Miao Territory' Yonglin Jiang Bryn Mawr College, [email protected]

Bryn Mawr College Scholarship, Research, and Creative Work at Bryn Mawr College East Asian Studies Faculty Research and East Asian Studies Scholarship 2018 Thinking About the 'Ming China' Anew: The Ethnocultural Space In A Diverse Empire-With Special Reference to the 'Miao Territory' Yonglin Jiang Bryn Mawr College, [email protected] Let us know how access to this document benefits ouy . Follow this and additional works at: https://repository.brynmawr.edu/eastasian_pubs Part of the East Asian Languages and Societies Commons Custom Citation Jiang, Y. 2018. "Thinking About the 'Ming China' Anew: The thnocE ultural Space In A Diverse Empire-With Special Reference to the 'Miao Territory'." Journal of Chinese History 2.1: 27-78. This paper is posted at Scholarship, Research, and Creative Work at Bryn Mawr College. https://repository.brynmawr.edu/eastasian_pubs/2 For more information, please contact [email protected]. Journal of Chinese History 2 (2018), 27–78 doi:10.1017/jch.2017.27 . Jiang Yonglin THINKING ABOUT “MING CHINA” ANEW: THE ETHNOCULTURAL SPACE IN A DIVERSE https://www.cambridge.org/core/terms EMPIRE —WITH SPECIAL REFERENCE TO THE “MIAO TERRITORY”* Abstract By examining the cultural identity of China’s Ming dynasty, this essay challenges two prevalent perceptions of the Ming in existing literature: to presume a monolithic socio-ethno-cultural Chinese empire and to equate the Ming Empire with China (Zhongguo, the “middle kingdom”). It shows that the Ming constructed China as an ethnocultural space rather than a political entity. Bryn Mawr College, e-mail: [email protected]. , subject to the Cambridge Core terms of use, available at *The author is grateful to a large number of individuals and institutions for their insightful critiques and generous support for this project. -

Profiles of Directors, Supervisors and Senior Management (Cont’D) Profiles of Directors, Supervisors and Senior Management (Cont’D)

!"#$%&'(EF !"#$%&'(EF Profiles of Directors, Supervisors and Senior Management (Cont’d) Profiles of Directors, Supervisors and Senior Management (Cont’d) !"# RP !"# Ms. Pan Gui Rong, aged 53, is an independent director of the Company. Ms. !"#$%&'())*+ Pan was the deputy Head of Qingdao Audit Firm, the Company’s supervisor, !"#$%&'(')* and now is the head of Shandong Tian Hua Accountants Firm. She is a !"#$%&'()*# senior auditor and chartered accountant. Ms. Pan has many years of !"# !"#$%&'( experience in corporate finance auditing. !" Supervisors !"# RT !"# Mr. Wu Yu Ting, aged 57, is the Chairman of the Supervisory Committee. Mr. !"#$%&'()*+ Wu has been involved in supervisory work and corporate accounting for many !"#$%&'()*+ years. He was the Head and the Deputy Head of Qingdao Discipline and !" !"#$# Inspection Commission and the Deputy Head of Supervisory Bureau. He ! !"#$%&'( joined the Company in April, 1998. Mr. Wu gained broad experience in law !"#$%&'()*+,-. knowledge and accounting supervisory. !" PR !"# Mr. Chen Jun, aged 35, is the Company’s supervisor and working as Deputy !"#QM !"# Mr. Yu Jia Ping, aged 40, is a Supervisor of the Company. Mr. Yu is now the !"#$%&'()*+ General Manager of CITIC Wantong Securities Company, with MBA’s degree. !"#$%&&'( !" director of Tsingtao Brewery. He was the Deputy General Manager of Tsingtao ! !"#$%&'()* He was division head of CITIC Securities Shandong Investment Bank, who !"#$%$&' !"! Brewery Malting Plant, Deputy General Manager of Tsingtao Brewery Facctory !"#$%&'()*+, has rich expierience in corporate investment & financing. !!"#$% !"#$ No. 1, General Manager of Tsingtao Brewery Factory No. 2. He has broad !"# !"#$%&'( experience in brewery management. !"# Senior Management !"#QM !"# Mr. Ren Zeng Gui, aged 40, is the Company’s supervisor. -

Top North American Retailers (2017 Retail Sales of Tires & Related Automotive Services) 80 Company / Chain Sales No

10 • February 18, 2019, TIRE BUSINESS Visit us on the web at www.tirebusiness.com New England East South Central Connecticut, Alabama Maine Kentucky Passenger 4% Massachusetts Passenger 6% Mississippi Tennessee Light Truck 3% New Hampshire Light Truck 6% 41% Rhode Island West North Central 42% Vermont Iowa Kansas Middle Atlantic Passenger 7% Minnesota Passenger 10% Pennsylvania Missouri New Jersey Light Truck 9% Nebraska National National Light Truck 8% New York North Dakota dealerships3 3 General South Dakota General dealerships South Atlantic merchandise 30 merchandise 30 West Virginia West South Central 4 distributors4 Delaware distributors Regional Arkansas Passenger 24% Maryland Passenger 13% Louisiana dealerships2 Washington D.C. Regional Tire makers’ Tire makers’ Light Truck 17% Virginia Light Truck 19% Oklahoma 5 Texas 2 13% outlets 5 North Carolina dealerships outlets South Carolina 20 Mountain 20 18% Georgia 12% Florida Arizona 11% Colorado 12% Idaho East North Central Passenger 5% Local Local Illinois Montana 1 1 2% dealerships dealerships 23% Passenger 16% Indiana Light Truck 9% Nevada Others6 6 Michigan New Mexico 14% Others Utah 7% 10 Light Truck 12% Ohio 4% 10 Wisconsin Wyoming Independents with fewer than 10 outlets Mass merchandisers, Pacic /RFDOGHDOHUVKLSV *HQHUDOPHUFKDQGLVHGLVWULEXWRUV Alaska in a single regional distribution area. wholesale clubs, etc. California Passenger 15% 5HJLRQDOGHDOHUVKLSV Independents with 10 to 40 outlets in 7LUHPDNHUV·RXWOHWV Those operated by the manufacturers Hawaii at least two regions. Light Truck 18% Oregon using various names and store formats. Washington Independents with more than 40 1DWLRQDOGHDOHUVKLSV 2WKHUV Service stations, garages, car dealerships, etc. *Percentage may not add to 100% due to rounding. -

Democracy Wall Prisoners

March 28, 1993 Vol.5, No.6 DEMOCRACY WALL PRISONERS Xu Wenli, Wei Jingsheng and Other Jailed Pioneers of the Chinese ProPro----DemocracyDemocracy Movement Introduction.................................................................................................................................................................................................. 2 Releases in the 1980s............................................................................................................................................................................ 3 Rearrests Since June 1989.................................................................................................................................................................. 4 News About Wei Jingsheng................................................................................................................................................................. 5 The Case of Xu Wenli................................................................................................................................................................................ 7 April 5th Forum........................................................................................................................................................................... 7 "People's capitalism" ......................................................................................................................................................... 10 The "League of Communists".......................................................................................................................................... -

Tire Market Data Book.PDF

2016 Market Data Book table of contents 17 pages Chart Title Page Table of Contents 1 U.S. replacement passenger tire shipments from manufacturers 2 Manufacturers’ shipments of U.S. replacement light truck tires 2 Tire Shipments by U.S. region 2 Top North American retailers 2 U.S. replacement market brand shares 2 Vehicle mileage/costs 2 N. American market leaders 3 North American tire sales 3 Replacement passenger tires 3 Original equipment passenger‐LT tire market 3 Replacement market shares – U.S. & Canada 3 U.S. tire shipments 3 Canadian tire shipments 3 Tire Market Facts by region 4 Daily tire production by states/provinces 5 Vehicles per tire outlet 5 North American tire production facilities 5 Passenger tire sizes 6 Light truck tire sizes 6 Medium truck tire sizes 6 Retreading Systems – U.S. Canada 6 Tire makers’ DOT codes expanded 7‐10 Top Selling Cars/Light Trucks 2015 11 Top Nameplates 2015 11 Sales by country of origin 11 U.S. high‐performance tire trends 11 2015 Tire Imports 11 Scrappage rates 11 Size of the U.S. motor vehicle aftermarket 12 2014 Most Popular Vehicles By State 12 U.S. tire imports 12 Tire maker profitability 12 E‐tailing in the automotive aftermarket 12 Scrap tire/rubber recycling at a glance 12 Global tire sales 12 Automotive aftermarket employment trends 13 Growth rate of U.S. motor vehicle aftermarket auto care industry 13 Technicians’ wages 13 Auto care services sales to end users by distribution channel 13 Top five issues facing automotive aftermarket 13 General repair shop sales 13 2014 automotive aftermarket sales 13 Global Tire Company Rankings 14 N. -

The Crystal Structure of Phthalazin-1 (2H)-One, C8H6N2O1

Z. Kristallogr. NCS 2018; 233(4): 605–606 Zhang Yun-Chena, Guo Hong-Meia, Li Peng-Fei, Liu Qing-Yun and Tai Xi-Shi* The crystal structure of phthalazin-1(2H)-one, C8H6N2O1 Table 1: Data collection and handling. Crystal: Yellow block Size: 0.18 × 0.17 × 0.16 mm Wavelength: Mo Kα radiation (0.71073 Å) µ: 0.10 mm−1 Diffractometer, scan mode: Bruker CCD, ω-scans θmax, completeness: 27.5°, >99% N(hkl)measured, N(hkl)unique, Rint: 13032, 3138, 0.037 Criterion for Iobs, N(hkl)gt: Iobs > 2 σ(Iobs), 2245 N(param)refined: 199 Programs: CrysAlisPRO [1], SHELX [2], DIAMOND [3] https://doi.org/10.1515/ncrs-2017-0363 Received January 8, 2018; accepted April 4, 2018; available online April 18, 2018 hexahydrate (0.5 mmol, 0.216 g) were dissolved in 20 mL H2O/CH3CH2OH (v:v = 1:3). The mixture was stirred for 5 h at Abstract 70 °C. Then the solution is quietly placed. The yellow crystal of C8H6N2O1, monoclinic, P21/c (no. 14), a = 8.6277(17) Å, b = phthalazin-1(2H)-one was obtained after 3 weeks. Yield: 71%. 3 13.134(3) Å, c = 13.062(5) Å, β = 110.54(3)°, V = 1386.0(7) Å , MS (FAB): 147 (M + 1). 2 Z = 8, Rgt(F) = 0.0512, wRref(F ) = 0.1581, T = 293(2) K. Experimental details CCDC no.: 1834694 Coordinates of hydrogen atoms were refined without any The asymmetric unit, containing two independent molecules, constraints or restraints. Their Uiso values were set to 1.2Ueq of the title crystal structure is shown in the figure.