Property Times Baltic Retail Q4 2011 Continuously Improving

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

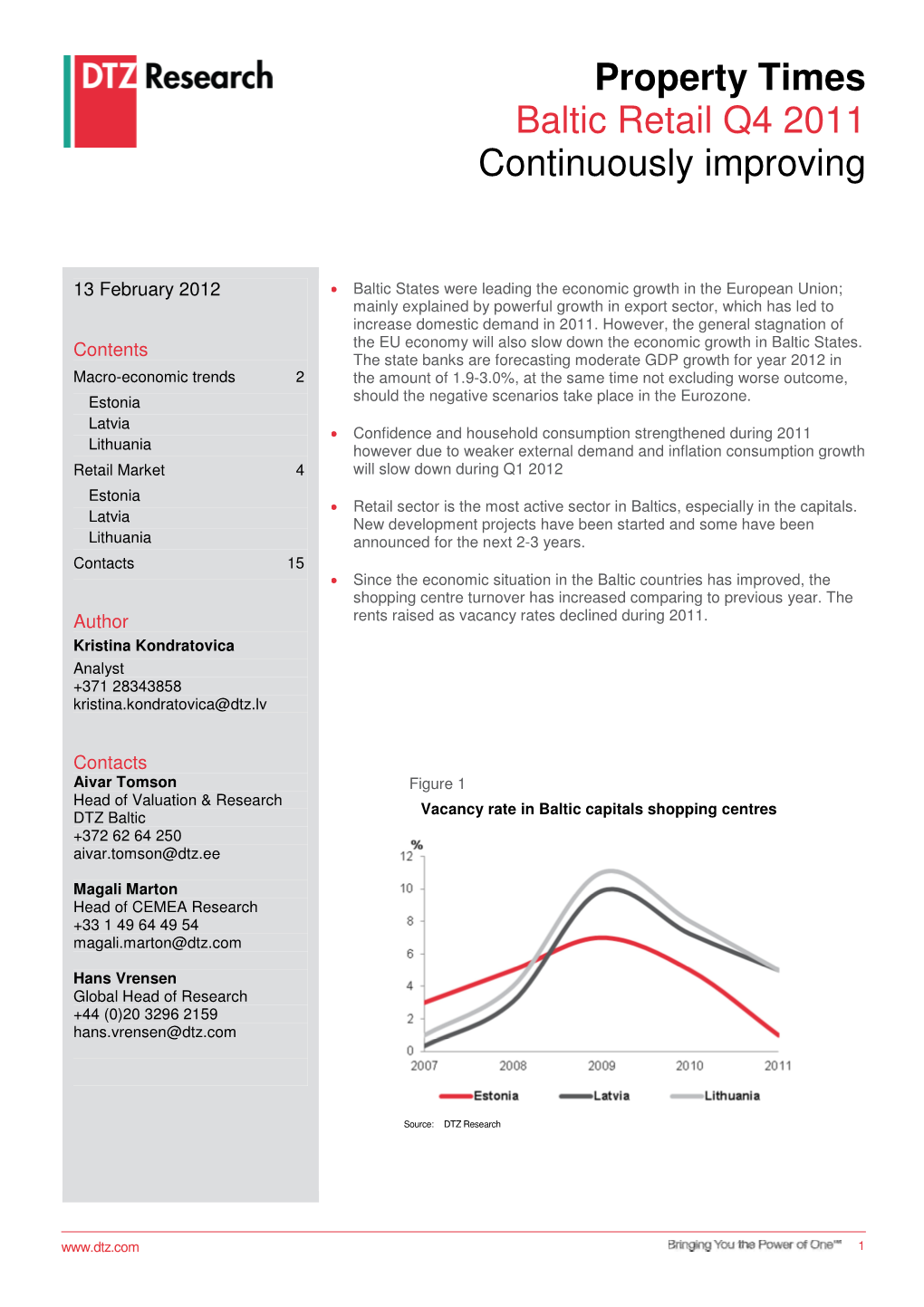

-

Baltic Property Fund Quarterly Report January — March 2019

Baltic Property Fund Quarterly Report January — March 2019 Bauhof DIY store in Pärnu Papiniidu centre. 1 Baltic Property Fund Quarterly Report January — March 2019 Macro overview across Estonia during the year. The opening of new-format smaller grocery stores is gaining momentum in Tallinn, with the Melon Rimi Year-on-year GDP growth in 4Q 2018 was 4.2% in Estonia, 5.7% Express store opening its doors in the CBD in March 2019, while in Latvia and 2.4% in Lithuania, driven mostly by growth in the Maxima announced the opening of its Maxima Express store in Old construction sector across the Baltic countries. Town for summer 2019. IKEA finally announced it was entering the The unemployment rate among the potential workforce aged Estonian market - an IKEA showroom and pick-up point with a total 15-74 continues to mostly decrease, and shrank to 4.4% in Estonia and area of ca 6,000 sqm will open in Tallinn at Peterburi tee 66 during 6.9% in Latvia. The unemployment rate slightly increased - up 0.1% - autumn 2019. to 6.6% in Lithuania. The Riga retail market remained active during 1Q 2019, preparing The harmonised index of consumer prices in Estonia increased to for the opening of the long-awaited Akropole shopping centre, which 3.7% in 4Q 2018, compared to 3.5% in the previous quarter. In Latvia, opened in April with more than 170 tenants, including many new it remained stable at 2.9% and in Lithuania it concluded at 2.3%. brands. Until the completion of the extension to the Alfa shopping centre, Akropole will be the largest shopping centre in Latvia. -

Soviet Housing Construction in Tartu: the Era of Mass Construction (1960 - 1991)

University of Tartu Faculty of Science and Technology Institute of Ecology and Earth Sciences Department of Geography Master thesis in human geography Soviet Housing Construction in Tartu: The Era of Mass Construction (1960 - 1991) Sille Sommer Supervisors: Michael Gentile, PhD Kadri Leetmaa, PhD Kaitsmisele lubatud: Juhendaja: /allkiri, kuupäev/ Juhendaja: /allkiri, kuupäev/ Osakonna juhataja: /allkiri, kuupäev/ Tartu 2012 Contents Introduction ......................................................................................................................................... 3 Literature review ................................................................................................................................. 5 Housing development in the socialist states .................................................................................... 5 From World War I until the 1950s .............................................................................................. 5 From the 1950s until the collapse of the Soviet Union ............................................................... 6 Socio-economic differentiations in the socialist residential areas ................................................... 8 Different types of housing ......................................................................................................... 11 The housing estates in the socialist city .................................................................................... 13 Industrial control and priority sectors .......................................................................................... -

Tallinna Kaubamaja Grupp As

TALLINNA KAUBAMAJA GRUPP AS Consolidated Interim Report for the Fourth quarter and 12 months of 2016 (unaudited) Tallinna Kaubamaja Grupp AS Table of contents MANAGEMENT REPORT ............................................................................................................................................ 4 CONSOLIDATED FINANCIAL STATEMENTS ........................................................................................................... 12 MANAGEMENT BOARD’S CONFIRMATION TO THE CONSOLIDATED FINANCIAL STATEMENTS ....... 12 CONSOLIDATED STATEMENT OF FINANCIAL POSITION ....................................................................... 13 CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME ........ 14 CONSOLIDATED CASH FLOW STATEMENT ............................................................................................. 15 CONSOLIDATED STATEMENT OF CHANGES IN OWNERS’ EQUITY ...................................................... 16 NOTES TO THE CONSOLIDATED INTERIM ACCOUNTS ......................................................................... 17 Note 1. Accounting Principles Followed upon Preparation of the Consolidated Interim Accounts ........ 17 Note 2. Cash and cash equivalents ............................................................................................................... 18 Note 3. Trade and other receivables .............................................................................................................. 18 Note 4. Trade receivables .............................................................................................................................. -

Retail Trade in Growth

DTZ Research PROPERTY TIMES Retail Trade in Growth Baltic Retail Q3 2015 The retail trade has continued its growth in all three countries growing at constant prices in range 5-8% on annual basis. 29 October 2015 Prime shopping centres have low or nearly no vacancies, situation of less preferable locations including the street retail is various. Contents Rental levels have been stabilised during some last years and no remarkable changes are foreseen in 2016. Although there are some new developments in the pipeline their influence is still limited in short run. Tenant mix is a key question to all newcomers as position of existing shopping centres is strong and it is complicated to attract new brands. Macroeconomic Trends in the The retail market in general is the most attractive for investors. However, Baltic States ........................... 2 the number of investment deals is rather limited as usually there is a gap Estonian retail market ............ 4 between the yield expectations. Latvia retail market ................. 7 Lithuania retail market .......... 10 Figure 1 Total retail trade turnover € bln, current prices 10 000 8 000 6 000 Author 4 000 Aivar Tomson Baltic Head of Research 2 000 + 372 6 264 250 0 [email protected] Contacts Estonia Latvia Lithuania Magali Marton Head of EMEA Research Source: National Statistics + 33 (0)1 49 64 49 54 [email protected] www.dtz.com Property Times 1 Baltic Retail Q3 2015 Macroeconomic Trends in the Baltic States by the global prices and postponement electricity market liberalisation until 2015. It is expected that inflation will remain Estonia weak until the end of 2015 when impact of oil price decrease The annual GDP growth in 2014 was 1.8%. -

City Break 100 Free Offers & Discounts for Exploring Tallinn!

City Break 100 free offers & discounts for exploring Tallinn! Tallinn Card is your all-in-one ticket to the very best the city has to offer. Accepted in 100 locations, the card presents a simple, cost-effective way to explore Tallinn on your own, choosing the sights that interest you most. Tips to save money with Tallinn Card Sample visits with Normal 48 h 48 h Tallinn Card Adult Tallinn Price Card 48-hour Tallinn Card - €32 FREE 1st Day • Admission to 40 top city attractions, including: Sightseeing tour € 20 € 0 – Museums Seaplane Harbour (Lennusadam) € 10 € 0 – Churches, towers and town wall – Tallinn Zoo and Tallinn Botanic Garden Kiek in de Kök and Bastion Tunnels € 8,30 € 0 – Tallinn TV Tower and Seaplane Harbour National Opera Estonia -15% € 18 € 15,30 (Lennusadam) • Unlimited use of public transport 2nd Day • One city sightseeing tour of your choice Tallinn TV Tower € 7 € 0 • Ice skating in Old Town • Bicycle and boat rental Estonian Open Air Museum with free audioguide € 15,59 € 0 • Bowling or billiards Tallinn Zoo € 5,80 € 0 • Entrance to one of Tallinn’s most popular Public transport (Day card) € 3 € 0 nightclubs • All-inclusive guidebook with city maps Bowling € 18 € 0 Total cost € 105,69 € 47,30 DISCOUNTS ON *Additional discounts in restaurants, cafés and shops plus 130-page Tallinn Card guidebook • Sightseeing tours in Tallinn and on Tallinn Bay • Day trips to Lahemaa National Park, The Tallinn Card is sold at: the Tallinn Tourist Information Centre Naissaare and Prangli islands (Niguliste 2), hotels, the airport, the railway station, on Tallinn-Moscow • Food and drink in restaurants, bars and cafés and Tallinn-St. -

Best Clothing Shops in Tallinn"

"Best Clothing Shops in Tallinn" Erstellt von : Cityseeker 5 Vorgemerkte Orte Kaubamaja "Giant Department Store & Mall" Tallinna Kaubamaja is located in the center of Tallinn. The mall has been around since 1960 but still manages to keep up with more modern shopping centers in the area. There are a large variety of clothing stores and gift boutiques to browse through. The center is also connected to the Viru Keskus. by love Maegan +372 667 3100 www.kaubamaja.ee/ [email protected] Gonsiori 2, Tallinn Sikupilli Kaubanduskeskus "Shop All Day" Housing a plethora of national and international brands, the Sikupilli Kaubanduskeskus is a one stop destination for buying anything and everything. The shopping center features such popular outlets as Prisma, Rosalind, Denim Dream among others. The Sikupilli shopping center also has a restaurant complex on-site that houses four eateries which take care by love Maegan of your gastronomic needs. So, next time you are out on a shopping spree in Tallinn, do pay a visit to the Sikupilli shopping center. +372 680 9500 www.sikupilli.ee/ [email protected] Tartu Maantee 87, Tallinn Kristiine Centre "Modern Mall Outside City Centre" Kristiine Centre or Kristiine Keskus is a large modern shopping center, housing many fashion boutiques, department stores, retail shops, sports and leisure stores and more. You can munch on some pizza if carrying the bags around gets exhausting. For more information, visit their website. by+372 Elvert 6 65Barnes 9100 www.kristiinekeskus.ee [email protected] Endla 45, Tallinn Ülemiste Keskus "Gigantic Mall" Ülemiste Center is located just next to Tallinn's Airport. -

Top Estonian Enterprises 2008

Top Estonian2008 Enterprises Entrepreneurship Award 2008 Competitiveness Ranking 2008 Estonian Chamber of Commerce and Industry www.nordecon.com Sky is the limit (OK, sometimes it’s the roof) Experts in construction and real estate development. Top Estonian Enterprises 2008 Entrepreneurship Award 2008 Competitiveness Ranking 2008 Estonian Chamber of Commerce and Industry TOP ESTONIAN ENTERPRISES 2008 Contents Entrepreneurship Award 2008 – summary 8 Estonian Companies’ Competitiveness Ranking 2008 - summary 9 Entrepreneurship Award 2008 – winners 10 Estonian Companies’ Competitiveness Ranking 2008 – winners 11 Entrepreneurship Award 2008 - methodology 13 Entrepreneurship Award 2008 - nominees and winners 14 The History of the Entrepreneurship Award 32 The History of the Estonian Companies’ Competitiveness Ranking 33 Estonian Companies’ Competitiveness Ranking 2008 - main chart 37 Estonian Companies’ Competitiveness Ranking 2008 - categories and winners 44 Swedbank’s Special Prize to the Most Successful Expander in the Baltics 94 Student Company 2008 95 European Enterprise Awards - "Recognise promoters of enterprise 2008" 96 “Financial Year 2007 - year of the cooling down of economy” 98 – Leev Kuum, Estonian Institute of Economic Research Enterprise Estonia 102 Estonian Chamber of Commerce and Industry 104 Estonian Employers’ Confederation 106 Review of the entrepreneurship contests’ ceremonial award-gala 2008 108 4 November 2008 TOP ESTONIAN ENTERPRISES 2008 Competitiveness to be made international! For the 13th year, the state is expressing recognition by nances, the number of exporting companies must in- awarding the Enterprise Award, and for the sixth time, we crease. Greater attention to be paid on innovations, wider are identifying the most competitive Estonian companies. use of Structural Funds for research and development ac- This way, we can have a chance to assess the performance tivities, constant increasing of the qualifications of em- of hundreds of companies. -

DTZ Research

Property Times Baltic Retail H2 2012 New projects in the pipeline 8 February 2013 Consumer confidence strengthened and household consumption expanded during 2012. The turnover of retail trade is expected to continue its growth also in 2013. Contents Macro-economic trends in Baltics 2 Most of the development projects completed in 2012 were medium-scale Retail Market in Estonia 4 (mainly hyper- and supermarkets); several large-scale retail projects are in the pipeline for the upcoming years, but only a few of them have the construction Retail Market in Latvia 8 process already initiated. Retail Market in Lithuania 12 Vacancy rate is close to 0% in the shopping centres with successful Author management. However, shopping centres with ineffective organisation or less favourable locations still struggle over their occupancy rates. Aivar Tomson Baltic Head of Research Improving retail trade turnover and increased occupancy has upward pressure + 372 6 264 250 on rents in prime shopping schemes. There are no notable rental rate changes [email protected] in secondary cities and secondary locations in capital cities. Cont acts The retail investment market saw an increased interest from foreign property investors. Several investment transactions in retail segment were in process in Magali Marton 2012, with two of them being closed by the end of the year ( Gedimino 9 SC in Head of CEMEA Research Vilnius and Mustika SC in Tallinn). Retail investment prospects for 2013 are + 33 (0)1 49 64 49 54 also promising. [email protected] Figure 1 Retail confidence index Hans Vrensen Global Head of Research + 44 (0)20 3296 2159 [email protected] Source: National Statistics, Estonian Institute of Economic Research DTZ Research Baltic Retail H2 2012 Macroeconomic Trends in the Baltic States Annual inflation meanwhile has reached its historical minimum ever since autumn 2010, and averaged at about Estonia 1.6% at the end of 2012, coming primarily from globally Estonian economy is in quite a good health, with evident increase in fuel and food prices. -

Gentrification in a Post-Socialist Town: the Case of the Supilinn District, Tartu, Estonia

GENTRIFICATION IN A POST-SOCIALIST TOWN: THE CASE OF THE SUPILINN DISTRICT, TARTU, ESTONIA Nele NUTT Mart HIOB Sulev NURME Sirle SALMISTU Abstract This article deals with the changes that Nele NUTT (corresponding author) have taken place in the Supilinn district in Tartu, Estonia due to the gentrification process. The Lecturer, Department of Landscape Architecture, Tallinn gentrification process affects the cultural, social, University of Technology, Tartu College, Estonia economic, and physical environment of the area. Tel.: 0037-2-501.4767 People have been interested in this topic since E-mail: [email protected] the 1960s. Nowadays, there is also reason to discuss this issue in the context of Estonia and Mart HIOB of the Supilinn district. Studying and understand- Lecturer, Department of Landscape Architecture, Tallinn ing the processes that take place in the living University of Technology, Tartu College, Estonia environment, provides an opportunity to be more aware about them and to influence the develop- Sulev NURME ment of these processes. This article provides Lecturer, Department of Landscape Architecture, Tallinn an analysis of the conditions necessary for gen- trification in the Supilinn district, describes the University of Technology, Tartu College, Estonia process of gentrification, and tries to assess the current developmental stage of the gentrification Sirle SALMISTU process. Lecturer, Department of Landscape Architecture, Tallinn Cities are shaped by their people. Every area University of Technology, Tartu College, Estonia has a unique look that is shaped not only by the physical environment, but also by the principles, values, and wishes of its residents. Local resi- dents influence the image of the mental and the physical space of the area. -

Tallinna Kaubamaja Grupp As

TALLINNA KAUBAMAJA GRUPP AS Consolidated Interim Report for the Third quarter and first 9 months of 2017 (unaudited) Tallinna Kaubamaja Grupp AS Table of contents MANAGEMENT REPORT ............................................................................................................................................. 4 CONSOLIDATED FINANCIAL STATEMENTS ........................................................................................................... 12 MANAGEMENT BOARD’S CONFIRMATION TO THE CONSOLIDATED FINANCIAL STATEMENTS ....... 12 CONSOLIDATED STATEMENT OF FINANCIAL POSITION ....................................................................... 13 CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME .......... 14 CONSOLIDATED CASH FLOW STATEMENT .............................................................................................. 15 CONSOLIDATED STATEMENT OF CHANGES IN OWNERS’ EQUITY....................................................... 16 NOTES TO THE CONSOLIDATED INTERIM ACCOUNTS .......................................................................... 17 Note 1. Accounting Principles Followed upon Preparation of the Consolidated Interim Accounts ......... 17 Note 2. Cash and cash equivalents ............................................................................................................... 18 Note 3. Trade and other receivables ............................................................................................................. 18 Note 4. Trade receivables .............................................................................................................................. -

Real Estate Market Overview Annual Review

Research & Forecast Report Latvia | Lithuania | Estonia 2017 Real Estate Market Overview Annual Review Accelerating success. Real Estate is a location business. That’s why we do business where you do business. When you partner with Colliers professionals, you tap into an integrated team of experts. Together, we offer insight from 554 world markets, eight service lines and countless specializations, all with a common goal - accelerating your success. Contents LATVIA MARKET OVERVIEW 4 Economic Overview 5 Investment Market 6 Office Market 8 Retail Market 12 Industrial Market 16 Hotel Market 20 Legal Overview 23 Tax Summary 27 LITHUANIA MARKET OVERVIEW 29 Economic Overview 30 Investment Market 31 Office Market 33 Retail Market 37 Industrial Market 41 Hotel Market 44 Legal Overview 47 Tax Summary 51 ESTONIA MARKET OVERVIEW 53 Economic Overview 54 Investment Market 55 Office Market 58 Retail Market 62 Industrial Market 66 Hotel Market 70 Legal Overview 74 Tax Summary 78 Real Estate Market Overview | 2017 | Colliers International | Sorainen | Ernst & Young 3 Latvia Market Overview Dear Reader, We are delighted to present the Colliers International Real Estate Market Review for Latvia, Lithuania and Estonia, wherein you will find much useful information about market trends and forecasts, the latest statistics and market insights. We are grateful to our partners - Sorainen and EY - for contributing to preparation of our Deniss Kairans real estate legal and tax reviews. Partner | Managing Director It was an interesting year in the region, with activity staying high in most segments. Investment volumes for [email protected] the 2nd year in a row reached more than EUR 1 billion of investments in commercial real estate in the Baltic capital cities. -

Vastandumised / Confrontations 19.06.-25.07.2010 Vastandumised / Confrontations Vastandumised

EKL 10. AASTANÄITUS / 10TH ANNUAL EXHIBITION OF ESTONIAN ARTISTS’ ASSOCIATION VASTANDUMISED / CONFRONTATIONS 19.06.-25.07.2010 VASTANDUMISED / CONFRONTATIONS VASTANDUMISED Koostaja-toimetaja / Compiled and edited by Elin Kard Tõlge / Translation: Elin Kard, Maris Karjatse Tõlke toimetaja / Proof-reading: Maris Karjatse Fotod / Photos: Stanislav Stepashko Kujundus / Graphic design by Maris Lindoja Trükk / Printed by Printon Kaanel / On the cover: Evi Tihemets PURSE / ERUPTION Söövitus, kuivnõel / Etching, drypoint 2010 Väljaandja Eesti Kunstnike Liit / Published by Estonian Artists’ Association © autorid / authors Kataloogi väljaandmist on toetanud Eesti Kultuurkapital The publication of the catalogue was supported by the Cultural Endowment of Estonia ISBN: 9789949215799 © Eesti Kunstnike Liit / Estonian Artists’ Association, 2010 EKL 10. AASTANÄITUS / 10TH ANNUAL EXHIBITION OF ESTONIAN ARTISTS’ ASSOCIATION VASTANDUMISED / CONFRONTATIONS 19.06.-25.07.2010 TALLINNA KUNSTIHOONE / TALLINN ART HALL KURAATOR / CURATED BY ENN PÕLDROOS KUJUNDUS / DESIGN BY JAAN ELKEN EESTI KUNSTNIKE LIIDU AASTANÄITUSED 2000-2010 2000 MEHITAMINE / MANNING Kuraatorid ja kujundus / Curated and design by DÉJA VU EHK EESTI KUNSTI LÜHIAJALUGU / Jaak Soans, Hanno Soans DÉJA VU OR SHORT HISTORY OF ESTONIAN ART Eesti Arhitektuurimuuseum, Tallinn / Kuraator / Curated by Toomas Vint The Museum of Estonian Architecture, Tallinn Kujundus / Design by Aili Vint Tallinna Kunstihoone / Tallinn Art Hall KOHASPETSIIFILISED INSTALLATSIOONID JA AKTSIOONID TALLINNA LINNARUUMIS / AIDS