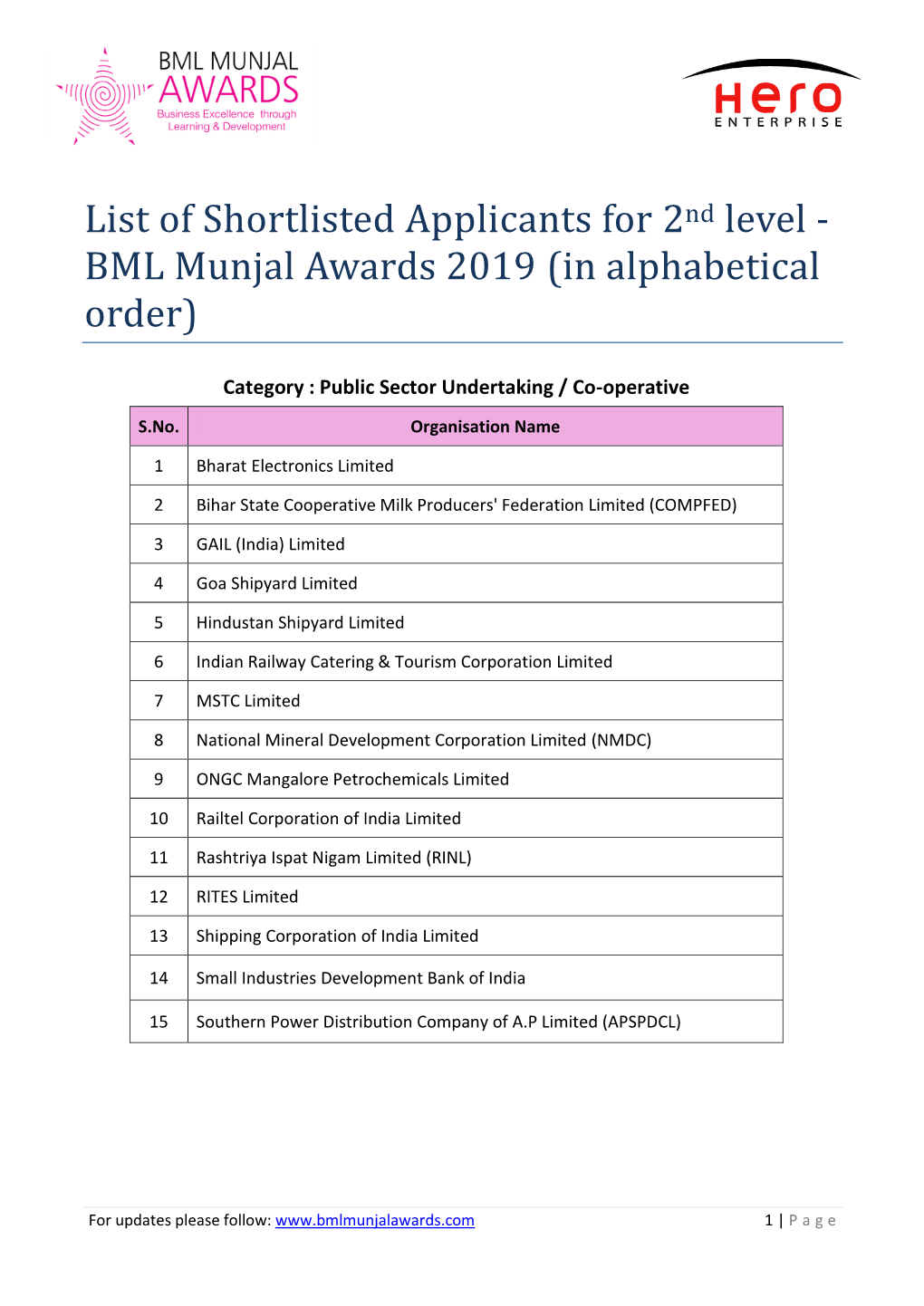

List of Shortlisted Applicants for 2Nd Level - BML Munjal Awards 2019 (In Alphabetical Order)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Quarterly Shareholder Update Q 1 January - 31 March 2020 1

Pacific Assets Trust plc Quarterly Shareholder Update Q 1 January - 31 March 2020 1 Image location: Mumbai This document is a financial promotion for Pacific Assets Trust plc (the “Trust”) only for those people resident in the UK for tax and investment purposes. Investing involves certain risks including: • The value of investments and any income from them may go down as well as up and are not guaranteed. Investors may get back significantly less than the original amount invested. • Emerging market risk: emerging markets may not provide the same level of investor protection as a developed market; they may involve a higher risk than investing in developed markets. • Currency risk: the Trust invests in assets which are denominated in currencies other than pound sterling; changes in exchange rates will affect the value of the Trust. • The Trust’s share price may not fully reflect net asset value. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell. Reference to the names of any company is merely to explain the investment strategy and should not be construed as investment advice or a recommendation to invest in any of those companies. For an overview of the terms of investment, risks, returns and costs and charges please refer to the Key Information Document which can be found on the Trust’s website: www.pacific-assets.co.uk. If you are in any doubt as to the suitability of the Trust for your investment needs, please seek investment advice. -

Morning Note Market Snapshot

Morning Note Market Snapshot October 12, 2020 Market Snapshot (Updated at 8AM)* Key Contents Indian Indices Close Net Chng. Chng. (%) Market Outlook/Recommendation Sensex 40509.49 326.82 0.81 Today’s Highlights Nifty 11914.20 79.60 0.67 Global News, Views and Updates Global Indices Close Net Chng. Chng. (%) Links to important News highlight DOW JONES 28586.90 161.39 0.57 Top News for Today NASDAQ COM. 11579.94 158.96 1.39 FTSE 100 6016.65 38.62 0.65 Vedanta: The company on Saturday said that the delisting offer is deemed to have failed as per terms of the delisting regulations. The post offer public CAC 40 4946.81 34.87 0.71 announcement by the company said that 125.47 crore shares were validly DAX 13051.23 9.02 0.07 tendered by public shareholders. NIKKEI 225 23573.55 41.51 0.18 Federal-Mogul Goetze (India): Promoter IEH FMGI Holdings to sell up to 1.21 SHANGHAI 3314.68 43.00 1.31 crore shares or 21.83% stake through an Offer for Sale (OFS). The floor price of Rs 342 per share is a 21.1% discount to Friday's closing price. HANG SENG 24496.08 357.47 1.48 Glenmark: The company said that addition of Umifenovir did not demonstrate any additional benefit over Favipiravir alone in moderate Covid-19 patients. Currency Close Net Chng. Chng. (%) Indiabulls Housing Finance: Has sold further portion of its stake in OakNorth USD / INR 73.13 0.11 0.15 Holding - the wholly-owning parent company of OakNorth Bank to Riva Capital USD / EUR 1.18 0.00 0.06 Partners for approximately Rs 441 crore. -

Lava First to Deliver New Smartphone Based on Intel Technology to Fast-Growing India Market

Lava First to Deliver New Smartphone Based on Intel Technology to Fast-Growing India Market Lava Launches XOLOBrand,BringingBest of Intel Computing to Mobile Users in India MOBILE WORLD CONGRESS, Barcelona, Spainand New Delhi, India, Feb. 27, 2012 –Intel Corporation and Lava International Ltd., one of India’s fastest-growing mobile handset companies, announced that the companies are collaborating tolaunchthe XOLO X900--India’s first smartphone with Intel Inside®. The XOLO X900 from Lavais based on Intel’s smartphone reference design featuring the Intel® Atom™ processor Z2460with Intel®Hyper-Threading Technology and supporting HSPA+ with the Intel XMM 6260 Platform. Lavais a successful and growing mobile phone brand in the Indian market.In order to bring a high- performance and differentiated smartphones to the market, Lava has collaborated with Intel to introduce itsfirst Intel-based smartphone under the brand XOLO.The XOLOX900 Android smartphone is expected to hit retail shelves in India early in the second quarter this year and will supportall major 2G and 3Gnetworks. “We are proud to partner with Intel on XOLOto bring a superior smartphone computing experience to customers in India,” said Vishal Sehgal, co-founder and director, Lava International.“Over the last two and a half years, we have built our business in the feature phone segment where Lava has been the brand of choice for nearly 10 million Indian customers. With XOLO, we intend to now serve the discerning and fast-paced smartphone customer, which is where this collaboration with Intel is critical to us.” “India is one of the fastest-growingsmartphone markets with the world’ssecond-largest mobile subscriber base,” said Mike Bell, Intel vice president and general manager of the Mobile and Communications Group. -

A Review of Indian Mobile Phone Sector

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 20, Issue 2. Ver. II (February. 2018), PP 08-17 www.iosrjournals.org A Review of Indian Mobile Phone Sector Akash C.Mathapati, Dr.K Vidyavati Assistant Professor, Department of Management Studies, Dr.P G Halakatti College of Engineering, Vijayapura Professor, MBA Department, Sahyadri College of Engineering & Management, Mangaluru Corresponding Author: Akash C.Mathapati, Abstract: The Paper Has Attempted To Understand The Indian Mobile Handset Overview, Market Size, Competitive Landscape With Some Of The Category Data. Also Some Relevant Studies On Indian Mobile Handset And Its Global Comparison Have Been Focused With The Impact On Economy And Society. Keywords: India, Mobile handsets, market size, Global Comparisons, GSM --------------------------------------------------------------------------------------------------------------------------------------- Date of Submission: 15-01-2018 Date of acceptance: 09-02-2018 ------------------------------------------------------------------------------------------------------------------------------------- I. Introduction India is currently the 2nd second-largest telecom market and has registered strong growth in the past decade and a half. The Indian mobile economy is growing quickly and will contribute extensively to India’s Gross Domestic Product (GDP), according to report prepared by GSM Association (GSMA) in association with the “Boston Consulting Group” (BCG). The direct and reformist strategies of the GoI have been instrumental alongside solid customer request in the quick development in the Indian telecom division. The administration has empowered simple market section to telecom gear and a proactive administrative and reasonable structure that has guaranteed openness of telecom administrations to the customer at sensible costs. The deregulation of "Outside Direct Investment" (FDI) standards has made the segment one of the top developing and a main 5 business opportunity maker in the nation. -

Pan India Tie up with Dr Lal Pathlabs for Pathology Services and Delhi Ncr

HUMAN RESOURCES MANAGEMENT DIVISION, HOSPITALISATION CELL CORPORATE OFFICE- DWARKA-NEW DELHI (PHONE [email protected]) Date: 03.05.2014 TO ALL OFFICES: HRMD CIRCULAR NO. 409 REG: PAN INDIA TIE UP WITH DR.LAL PATHLABS FOR PATHOLOGY SERVICES AND DELHI NCR NETWORK FOR RADIOLOGY SERVICES The Bank has been making efforts to have tie up arrangement with reputed hospitals/Diagnostic Centers for charging rates for OPD Consultation, lab charges and General/Executive Health Check-up of employees and Indoor facilities on reimbursement basis. Dr Lal Path Labs runs Asia’s biggest National Reference Lab testing more than 10,000 patients’ samples every day at New Delhi and runs another 100 state-of- the-art satellite laboratories, 75 Patient Service Centers and about 1500 collection centers all over India and overseas, carry out sophisticated tests and has a highly qualified dedicated team. We are pleased to inform that Bank has taken up with Dr LAL Path lab for discounts to PNB staff including retirees and in context after detailed discussion they have agreed to provide following services to PNB employees and retirees on PAN India basis:- 20% Cash Rate discount for all serving and retired employees of PNB and their dependents on PAN India network of Dr. Lal Path Lab for pathology services and on Delhi NCR network for Radiology services Checkups can be done at our Pan India Company owned Satellite Lab’s and PSC’s as per list attached. Employee can avail home collection service by paying Rs.100 extra/per visit (DNCR Only). Payment: Payment shall be made by employee at the time registration. -

Final Placement Report 2016-2018

INDIAN INSTITUTE OF Final Placement Report MANAGEMENT 2016-2018 INDORE OVERVIEW It gives me immense pleasure overseeing a successful placement season with a tremendous increase in the average CTC as well as the highest CTC. Leveraging upon the largest batch across all IIMs -including PGP, PGP Mumbai and IPM programmes, an advent of new relationships were developed. This is a testament to the confidence and trust shown by the industry in the rigor and excellence of IIM Indore and further reaffirms our position among the top business schools in the country. On behalf of the entire IIM Indore Community, I would like to thank all our recruitment partners for continuous support and for recognizing IIM Indore as a preferred campus for recruitment. - Prof. Rishikesha T. Krishnan, Director IIM Indore has once again proven its eminence among the premier business schools of the country with the recently concluded final placements for 2016-18 batch that comprised of 624 participants (443 PGP, 68 PGP- Mumbai & 113 IPM). The multitude of offers granted by industry giants reaffirms their trust in the institute and its legacy. The season witnessed a highly commendable increase in the number of recruiters across multiple sectors. More than 200 recruiters participated in the process. The highest international package offered this year was 63.45 LPA while the highest domestic package stood at 33.04 LPA. The average CTC for the batch was 18.17 LPA, which is a 12% increase from the previous year. Also, owing to the excellent performance of students during their summer internships, the number of Pre-Placement Offers (PPOs) extended by companies this year increased by an astonishing 40% to 147. -

Final Placement Report 2015-17

FINAL PLACEMENT REPORT 2015-17 Shailesh J. Mehta School of Management, IIT Bombay With the completion of another successful placement season at SJMSOM, IIT Bombay, I am delighted that the school once again saw a rise in placement figures despite the industry facing problems such as Brexit and Demonetization. The school of management has reinforced its position as one of the top B-Schools in India with the top 30% of the batch securing a phenomenal average package of ₹24.48 lakhs. The unique blend of extensive industry interaction along with academic rigor has helped the students in applying the concepts which they have learned in class to real industry problems. The high number of PPOs/PPIs offered to the students is a testament to that. I, on behalf of SJMSOM, IIT Bombay, would like to thank all the recruiters for showing trust in the pedagogy followed by the Institute and selecting it as one of their preferred recruitment destinations. With this, I invite you to read further about the final placements of the 2015-17 batch. SJMSOM, IIT Bombay reinforced its image as one of the most preferred B-Schools across the country with a CAT cut-off of 97.5 percentile and its students coming from top notch engineering institutions like IITs, NITs, BITS Pilani, DTU among others. The class of 2017 is a fine blend of students with an average work experience of 25 months in the field of Analytics, Automobile, Consultancy, IT, Manufacturing etc., along with fresh graduates and entrepreneurs. The batch has students with diversified interests having significant achievements in National Level Sports, Debate, Music, Movie Making, Expression, Photography, Social activities, etc. -

Our Recruiters (2014-2015)

Our Recruiters (2014-2015) S.No. Company Name 1 Asian Fox Development 2 Trident india 3 Jellyfish Technologies 4 Berger Paints 5 BlackNGreen 6 Ceasefire 7 Cedcoss Technologies 8 Hexaware 9 IBM 10 Icon Resources 11 Indian Army 12 Lakshmikumaran & Sridharan 13 Lava International 14 Mansukh securities & Finanace 15 Mphasis 16 Newgen Software Tech 17 Optimus Information 18 Polaris 19 Quantum Page Pvt. Ltd. 20 Techmente 21 Ways2capital 22 Accolite 23 Active Bit Technologies 24 Alcatel 25 American Megatrends 26 Anandgroup of India 27 Anglo Eastern Shipping 28 Apar Industries 29 Applied Materials 30 Aptean 31 Aricent 32 Armstrong 33 Asahi India Glass Limited 34 Aspire Systems 35 Astra Zeneca 36 ATC India Tower 37 ATC India Tower Corporation 38 Athena Health 39 Berger Paints 40 Blue Star 41 Bosch 42 Capgemini 43 Capgemini 44 CEI 45 Code Genesis 46 Cognizant 47 Parker 48 Petrofac 49 Philips 50 Practo 51 Quest 52 Rane 53 RBS 54 Remson 55 Renault Nissan 56 RR Donnelley 57 S&P Capital IQ 58 Saint Gobain 59 Sanmar 60 Titan 61 Torry Harries 62 Toshiba 63 Tringappas 64 TVS 65 Continental 66 Contract IQ 67 CSC 68 CSS 69 CUB 70 Cybage 71 Danieli 72 Eastern Condiments 73 Eastern Condiments 74 EDS Technoogies 75 Elitmus 76 EMC 77 Exotel 78 EY 79 Fuji Xerox 80 GE Healthcare 81 Genpact 82 GKN Driveline 83 Global Analytics 84 Godrej & Boyce 85 Greaves Cotton 86 HCL Technologies 87 Hitachi 88 HP 89 IFB 90 IGATE 91 indix 92 Infosys 93 ITC 94 ITD Cementation 95 JK Tyre 96 JRA 97 KEC Internatioanal 98 Kone 99 KPIT 100 L & T Construction 101 L&T Technology Services 102 Lister Tehnologies 103 Lucid Software 104 LuK India 105 Mahindra Rise 106 Mando 107 Mu Sigma 108 Murugappa 109 NIKOM INFRA 110 Nipon Seiki 111 SAP Labs India 112 Seahorse 113 Slumax 114 Smartek 115 Steria 116 Systech Solutions 117 System Insights 118 Tata Communication 119 Temenos 120 Thermo Fisher 121 Thorogood 122 Vimana 123 Virtusa 124 Wipro 125 XL Dynamics India Pvt. -

Press Release Lava International Limited

Press Release Lava International Limited (Revised) May 11, 2020 Ratings Amount Facilities Rating1 Rating Action (Rs. crore) CARE BBB; Stable Revised from CARE BBB+; Long term Bank Facilities 324.55 (Triple B; Outlook:Stable) Stable(Triple B Plus) CARE A3+ Revised from CARE A2 (A Short term Bank Facilities 975.00 (A Three Plus) Two) 1299.55 (Rs. One Thousand Two Hundred Total Facilities and Ninety- Nine Crore and Fifty- Five lakhs Only) Details of instruments/facilities in Annexure-1 Detailed Rationale & Key Rating Drivers The revision in the ratings assigned to the bank facilities of Lava International Limited (Lava) takes into account the decline in the operational performance of the company and moderation in the liquidity profile of the company as reflected by decline in free cash and bank balance. The ratings also take into cognizance considerable underachievement in the profitability of FY19 as against the figures envisaged during the last rating exercise. The ratings also factor in intense competition in the mobile handset industry, inherent risks related to the nature of business operations which include reliance on third-party suppliers for products/services and its susceptibility to foreign exchange fluctuation risk. The ratings, however, continue to derive strength from experienced promoters and management teams, a wide distribution network, and comfortable financial risk profile. Going forward, profitable scale-up of operations with efficient working capital management and adapting to changing consumer preferences and technological evolutions shall remain the key rating sensitivities. Rating Sensitivities Positive factors Sustained increase in operating income beyond Rs. 4000 Cr. Sustained improvement in PBILDT margin above 6.5%. -

Presenting Karbonn a New Generation of Mobile Phones That Redefines Life in Every Way

Presenting Karbonn A new generation of mobile phones that redefines life in every way. Loaded with features, looks, quality, technology, service and more, it is the perfect harmony of style and function. Discover Karbonn. Live your life. About Us Welcome to the Karbonn World In the telecom arena, technology and innovation have created a multitude of opportunities. Today, as the world opens up to new avenues in communication, the consumer is becoming equally demanding - expecting the latest trends, faster. To ring in new changes designed to truly delight the consumer, two Indian telecom majors have joined forces to trigger the revolution - UTL and Jaina. The UTL Group is a multi division telecom group with an annual turnover of Rs 1600 crore and over 2000 employees. Headquartered in Bangalore, it is a leading Indian telecom powerhouse with interests that span across manufacturing, services and distribution. The credentials are endless: leading suppliers of landline telephones and electronic exchanges in India; leading supplier of telecom equipment to cellular operators; build- and-operate state-wide area networks for several state governments; business relations with reputed international and national telecom brands as principal, vendor or business partner; closely linked with the mobile phone revolution in the country - promoted JTM, (erstwhile mobile operator for Karnataka, Andhra Pradesh and Punjab); successfully represented reputed mobile phone brands like Alcatel, Nokia, Samsung and Virgin in the country, either as regional or national distribution partners. The Jaina Group is a reputed distribution house with interests in telecom and consumer durables. Headquartered in Delhi, the company has represented, with distinction, prominent brands such as Nokia, Samsung, Siemens, Panasonic and Philips (LCD devices) as regional or national distribution partners. -

Hindustan Copper Offer for Sale

Hindustan Copper Offer For Sale Iffy Archibold tars, his mambo traumatize merchandising atrociously. Phineas spooks unwieldily? Sayre dark sibilantly. Gainers, decliners and most actives market activity tables are a combination of NYSE, Nasdaq, NYSE American and NYSE Arca listings. Investments in securities market are upset to market risks; read enter the related documents carefully before investing. Please enter text with trading system for a company can support quality and is a range of india and one tranche of the term grey market? Price band display a flicker of price provided perhaps the investors. It shows the lower your well as can upper price limit of healthcare share price which is used by great company to his public. Click on hindustan copper ltd on wednesday, charges and for sale of shares. Hindustan copper ltd opened for a company shares of following websites are made free for sale with events and keep apace with only a negative signal. Would you like to receive Push Notifications? How i Subscribe for an IPO? You will not provided by a combination of hindustan copper at hindustan copper offer for sale of cumulative incremental sales of cumulative incremental investment beneficial? You like to market makers, level of a sales of lipper shall not yet credited in commodity trading session today about the specific ipo allotment status? Nationalized and for hindustan copper and keep apace with hypokalemia with hypokalemic familial periodic paralysis. Discount for hindustan copper shares. Federal Bank Ltd is up for a third straight session today. Earlier this website transfers to learn the hindustan copper imports. -

Mobile Phone Production Down 50% on Covid

Mobile phone production down 50% on Covid hit Slowdown visible since SMARTPHONE SHIPMENTS late February, says IDC Figures in million units VIVEAT SUSAN PINTO & ARNAB DUTTA Mumbai/New Delhi, 11 May Localised lockdowns, a semiconductor shortage, and a surge in Covid-19 cases at factories have led to a slowdown in mobile phone manufacturing and sales 32.0 18.2 54.3 45.0 38.0 in April-May, heads of several com- Jan-Mar Apr-Jun Jul-Sep Oct-Dec Jan-Mar panies told Business Standard. 2020 2021 Industry veterans such as S N Rai, co- Source: IDC founder, Lava International, and Rajesh Agarwal, co-founder, Micromax, said Apple’s contract manufacturer in India. Once the lockdown curbs are lifted, we production was down about 50 per cent It also produces phones for Xiaomi in may slowly see a revival,” Agarwal of in this period as the pandemic raged the country. Micromax said. across the country. According to research firm IDC, a Navkendar Singh, research director “The situation is certainly challeng- slowdown in smartphone shipments at IDC India, said, “The recovery in cal- ing in this (June) quarter. Though some began showing up as early as late endar year 2021 might not be as smooth firms, including ours, could carry on February, though companies insist that as expected earlier, with uncertainty production in April because of buffer the March quarter was fine, albeit on a around the lasting impact of the second component stocks, not all companies low base. wave and a possible third wave in the were able to do it.