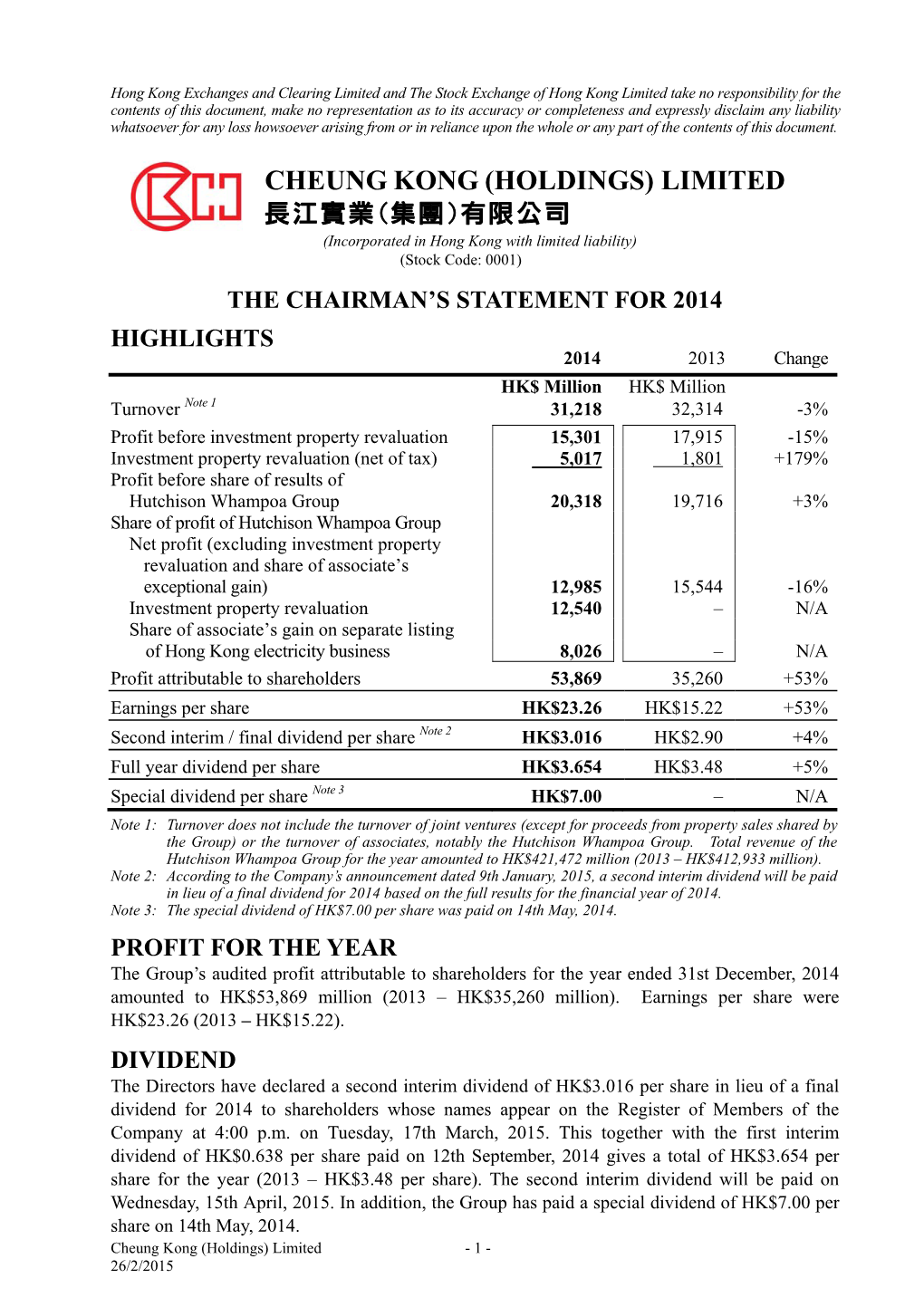

Cheung Kong (Holdings) Limited 長江實業(集團)有限公司

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Case No COMP/M.2951 - A.S

EN Case No COMP/M.2951 - A.S. WATSON / KRUIDVAT Only the English text is available and authentic. REGULATION (EEC) No 4064/89 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 27/09/2002 Also available in the CELEX database Document No 302M2951 Office for Official Publications of the European Communities L-2985 Luxembourg COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, 27.09.2002 SG (2002) D/231850 In the published version of this decision, some PUBLIC VERSION information has been omitted pursuant to Article 17(2) of Council Regulation (EEC) No 4064/89 concerning non-disclosure of business secrets and other confidential information. The omissions are MERGER PROCEDURE shown thus […]. Where possible the information ARTICLE 6(1)(b) DECISION omitted has been replaced by ranges of figures or a general description. To the notifying party Dear Sir/Madam, Subject: Case No COMP/M.2951 - A.S. Watson/Kruidvat Notification of 29.08.2002 pursuant to Article 4 of Council Regulation No 4064/891 1. On 29 August 2002, the Commission received a notification of a proposed concentration whereby A.S. Watson & Co., Limited (“A.S. Watson”), which belongs to the Hong Kong based group Hutchison Whampoa Limited (“Hutchison”), intends to acquire within the meaning of Article 3(1)(b) of the Council Regulation (EEC) No 4064/89 (“the Merger Regulation”) control over Dutch companies Kruidvat Holding B.V., and Kruidvat Superdrug B.V. (hereinafter ”Kruidvat”). The companies are presently controlled by Kruidvat Beheer B.V. (”Kruidvat Beheer”). 2. After examination of the notification, the Commission has concluded that the notified operation falls within the scope of the Merger Regulation and does not raise serious doubts as to its compatibility with the common market and the functioning of the EEA Agreement. -

This Document Is Important and Requires Your Immediate Attention

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in doubt as to any aspect of this circular or as to the action to be taken, you should consult a licensed securities dealer or registered institution in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in the Company, you should at once hand this circular and the accompanying form of proxy to the purchaser or the transferee or to the bank, licensed securities dealer, registered institution in securities or other agent through whom the sale or transfer was effected for transmission to the purchaser or the transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. This circular is for information purposes only and is being provided to you solely for the purpose of considering the resolutions to be voted upon at the SGM to be held on Tuesday, 24 November 2015. This circular does not constitute an offer to issue or sell or an invitation of an offer to acquire, purchase or subscribe for securities in Hong Kong, the United States or any other jurisdiction, nor is it intended to invite any such offer or invitation. Securities may not be offered or sold in the United States absent registration or an exemption from registration under the U.S. -

Hong Kong Office Marketview Q1 2013 CBRE Global Research and Consulting

Hong Kong Office MarketView Q1 2013 CBRE Global Research and Consulting OVERALL HONG KONG CENTRAL HONG KONG ISLAND KOWLOON Rents -0.2% q-o-q Rents -1.5% q-o-q Rents -0.6% q-o-q Rents +0.8% q-o-q NEW SUPPLY ON THE HORIZON COULD BE TOO LITTLE TOO LATE Hot Topics Current tight supply persist Three of the sites to be tendered in Oct 2013 - Mar 2014 are located in Occupiers continue to seek out cost Kowloon East, providing a possible 2.3 . There are early signs that activity effective space, but options are limited. million sq ft, although other in the CBD is slowly picking up The overall vacancy rate is just 3.3%, commercial uses or hotel development compared with previous quarters. or 2.2 million sq ft of available space, may reduce the office provision. This and over 30% of this is located in the should further consolidate the area as most expensive sub-market, Central. a key office hub. However, it may not . Decentralised districts on both Only 7% of all vacant space in Hong be until 2018, at the earliest, before Hong Kong Island and Kowloon Kong is located in decentralised Hong development is completed. continue to receive stronger Kong Island and Kowloon. interest. However, this does not A platform for rental growth always translate into new lettings Given the lack of new supply feeding as vacancy remains tight in these Government action on land into the market, we do not anticipate a areas. supply significant increase in vacancy in the The government recently announced short / medium term. -

CK HUTCHISON HOLDINGS LIMITED (“CK Hutchison”) And

HUTCHISON WHAMPOA INTERNATIONAL (03/33) LIMITED (the “Issuer”) US$1,500,000,000 7.45% Guaranteed Notes due 2033 (the “Notes”) (ISIN: US44841SAC35/CUSIP: 44841SAC3/Common Code: 018124572 for Rule 144A Notes) (ISIN: USG4672CAC94/CUSIP: G4672CAC9/Common Code: 018124629 for Regulation S Notes) unconditionally and irrevocably guaranteed by CK HUTCHISON HOLDINGS LIMITED (“CK Hutchison”) and HUTCHISON WHAMPOA LIMITED In accordance with Regulation (EU) No. 596/2014 on market abuse and the law of 11 January 2008 on transparency requirements, as amended, the Issuer is filing with the Commission de Surveillance du Secteur Financier, storing with the Officially Appointed Mechanism and publishing the attached unaudited results for the six months ended 30 June 2019 of CK Hutchison, a guarantor of the Notes issued by the Issuer. The attached document was also published by CK Hutchison at 4:31 pm and 4:32 pm (Hong Kong time), 1 August 2019 on the websites of Hong Kong Exchanges and Clearing Limited and CK Hutchison, respectively. Hutchison Whampoa International (03/33) Limited Edith Shih Director and Company Secretary 1 August 2019 Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. UNAUDITED RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2019 HIGHLIGHTS -

Board and Senior Management (PDF)

BOARD AND SENIOR MANAGEMENT Executive Committee Front (from left to right) Andrew Hunter, H L Kam, Victor Li, Edmond Ip Back (from left to right) Joanna Chen, Pak Lam Lun, Lambert Leung, Dominic Chan, Ivan Chan, Victor Luk, Wendy Tong Barnes DIRECTORS’ BIOGRAPHICAL INFORMATION LI Tzar Kuoi, Victor aged 45, has been the Chairman of the Company since its incorporation in May 1996. He is the Chairman of the Remuneration Committee of the Company since March 2005. He is also the Managing Director and Deputy Chairman of Cheung Kong (Holdings) Limited, Deputy Chairman of Hutchison Whampoa Limited, the Chairman of CK Life Sciences Int’l., (Holdings) Inc., an Executive Director of Hongkong Electric Holdings Limited, Co-Chairman of Husky Energy Inc. and a Director of The Hongkong and Shanghai Banking Corporation Limited (“HSBC”). Except for HSBC, all the companies mentioned above are listed companies. Mr. Victor Li serves as a member of the Standing Committee of the 11th National Committee of the Chinese People’s Political Consultative Conference of the People’s Republic of China. He is also a member of the Commission on Strategic Development, the Greater Pearl River Delta Business Council and the Council for Sustainable Development of the Hong Kong Special Administrative Region, and Vice Chairman of the Hong Kong General Chamber of Commerce. Mr. Victor Li is also the Honorary Consul of Barbados in Hong Kong. He is a director of certain substantial shareholders of the Company within the meaning of Part XV of the Securities and Futures Ordinance (“SFO”). He also holds directorships in certain companies controlled by certain substantial shareholders of the Company. -

75 Watson Cover

th Anniversary Quarter 2 • 2008 A.S. Watson quarterly75 family magazine "PARIS", the backbone of ICI PARIS XL's philosophy Marionnaud to change Hong Kong beauty retail Shining stars at Drogas Student fever Light the Passion & Share the Dream Relief forces mobilise Wats Our Aroundthe world Focusstory Home Ourcommunity Hutchstory tents With a history dating back to 1828, the A.S. Watson Group (ASW) has evolved into an international retail and manufacturing businessn with operations in 36 Co Record year of profit for "PARIS" the backbone of Light the Passion & Share Relief forces Li Ka Shing Center for markets worldwide. Today, the Group owns more than 8,000 retail stores ASW...... ICI PARIS XL's philosophy ...... the Dream...... mobilise...... Learning & Knowledge...... running the gamut from health & beauty chains, luxury perfumeries & cosmetics to food, electronics, fine wine and airport retail arms. An established player 19 33 in the beverage industry, ASW provides a full range of beverages from bottled water, fruit juices, soft drinks and tea products to the world's finest wine labels 28 40 via its international wine wholesaler and distributor. 05 ASW employs over 80,000 staff and is a member of the world renowned Hong Kong-based conglomerate Hutchison Whampoa Limited, which has five core businesses - ports and related services; property and hotels; retail; energy, About A.S. Watson Group About A.S. Watson infrastructure, investments and others; and telecommunications in 57 countries. Editorial committee Published by • Adviser : Dominic Lai • Members : A.S. Watson & Co., Limited Wats On is the quarterly family magazine of the A.S. -

Annual Report 2006 Annual Report2006

(incorporated in the Cayman Islands with limited liability) (Stock Code: 8222) Better Health Better Life Annual Report 2006 Annual Report2006 2 Dai Fu Street, Tai Po Industrial Estate, Hong Kong Tel: (852) 2126 1212 Fax: (852) 2126 1211 www.ck-lifesciences.com Characteristics of the Growth Enterprise Market (”GEM”) of The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) GEM has been established as a market designed to accommodate companies to which a high investment risk may be attached. In particular, companies may list on GEM with neither a track record of profi tability nor any obligation to forecast future profi tability. Furthermore, there may be risks arising out of the emerging nature of companies listed on GEM and the business sectors or countries in which the companies operate. Prospective investors should be aware of the potential risks of investing in such companies and should make the This annual report (“Annual Report”) is available in both decision to invest only after due and careful consideration. English and Chinese. Shareholders who have received either The greater risk profi le and other characteristics of GEM the English or the Chinese version of the Annual Report mean that it is a market more suited to professional and other may request a copy in the language different from that has sophisticated investors. been received by writing to: Computershare Hong Kong Investor Services Limited, 46th Floor, Hopewell Centre, 183 Given the emerging nature of companies listed on GEM, there Queen’s Road East, Hong Kong. is a risk that securities traded on GEM may be more susceptible to high market volatility than securities traded on the Main The Annual Report (in both English and Chinese versions) Board and no assurance is given that there will be a liquid has been posted on the Company’s website at market in the securities traded on GEM. -

CK Hutchison Highlights of the Unaudited Results for the Six Months Ended 30 June 2015

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. Highlights of the Unaudited Results for the six months ended 30 June 2015 CKHH six months statutory results (1) For the six months ended 30 June 2015 HK$ millions Total Revenue 117,250 Profit attributable to ordinary shareholders from continuing business 21,477 Profit attributable to ordinary shareholders from discontinued business 80,381 Profit attributable to ordinary shareholders 101,858 Earnings per share – statutory (2) HK$39.87 CKHH six months management pro forma results (3) (compared to HWL results for businesses continued by CKHH) CKHH Results HWL Results for the six for the six months ended months ended 30 June 2015 30 June 2014 HK$ millions HK$ millions Change Total Revenue (4) 197,019 196,671 - Total EBITDA (4) 46,165 42,587 +8% Total EBIT (4) 30,677 26,815 +14% Profit attributable to ordinary shareholders before profits on disposal of investments & others (5) 14,938 10,220 +46% Profits on disposal of investments & others (482) 14,921 -103% Total profit attributable to ordinary shareholders (6) 14,456 25,141 -43% Recurring earnings per share – pro forma (7) HK$3.87 For the six months ended 30 June 2015 Interim dividend per share HK$0.70 CKHH 2015 Interim Results Page 1 of 98 Note (1) Statutory results of CK Hutchison Holdings Limited (“CKHH” or the “Group”) for the six months ended 30 June 2015 include the one-time effects of the Reorganisation that occurred on 3 June 2015. -

1 Abundant Glory Limited British Virgin Islands Executive

Appendix B Present Directorships of Edith SHIH as at effective date of appointment Role Name of Company Place of Incorporation (Executive / Non-Executive) 1 Abundant Glory Limited British Virgin Islands Executive 2 Actionfirm Limited British Virgin Islands Executive 3 AICT Advisory Limited British Virgin Islands Executive Alexandria International Container Terminals 4 Egypt Executive Company S.A.E. 5 Alpha Metrics Limited British Virgin Islands Executive 6 Americas Intermodal Services SA/NV Belgium Executive 7 Americas Shipyard SA/NV Belgium Executive 8 Amsterdam Container Terminals B.V. Netherlands Executive 9 Amsterdam Marine Terminals B.V. Netherlands Executive 10 Amsterdam Port Holdings B.V. Netherlands Executive 11 Anovio Holdings Limited Cyprus Executive 12 APM Terminals Dachan Company Limited Hong Kong Executive 13 Aqaba Terminal Services Limited British Virgin Islands Executive 14 Asia Pacific Honour Holdings Limited British Virgin Islands Executive 15 Bajacorp, S.A. de C.V. Mexico Executive 16 Barcelona Europe South Terminal, S.A. Spain Executive 17 Best Fortune S.a r.l. Luxembourg Executive 18 Best Month Profits Limited British Virgin Islands Executive 19 Best Oasis Holdings Limited British Virgin Islands Executive 20 Best People Resources Limited British Virgin Islands Executive 21 Beyond Excel Investments Limited British Virgin Islands Executive 22 Brightease Profits Limited British Virgin Islands Executive 23 Brisbane Container Terminals Pty Limited Australia Executive Appendix B 24 Buenos Aires Container Terminal Services S.A. Argentina Alternate Director 25 Cape Fortune B.V. Netherlands Executive 26 Central America Shipyard SA/NV Belgium Executive 27 China Terminal Services Holding Company Limited Bermuda Executive 28 Clivedon Limited British Virgin Islands Executive 29 CLK Limited British Virgin Islands Executive 30 Coastal Work Logistics Limited British Virgin Islands Executive 31 Container Security Inc. -

CK Hutchison Holding(1

Equity Market Hong Kong Equity Morning note Martin Ma (SFC CE:BOB758) (852) 3519 1055 Friday, September 25,2020 Market Wrap HSI▼1.82% HSCEI▼1.96% Turnover HK$117.16 bn ▼9% (30-day average) SSE Composite▼1.72% SZSE Component ▼2.24% Sector tracking Stock tracking 1D ▲% 1Y ▲% 1D ▲% 1Q ▲% Utilities 0.5 Automobiles 88.6 SOLARGIGA ENERGY(757) 38.0 NEXION TECHNOLOG(8420) 339.6 Real Estate 1.0 Durable & Tech 54.9 GOLDWAY EDUCATIO(8160) 21.4 HAINAN MEILAN IN(357) 286.2 GOLDWAY EDUCATIO HAINAN MEILAN IN Consumer Goods Health Care IN TECHNICAL PRO(8446) 1.4 49.8 CORNERSTONE FINA(8112) 20.0 227.1 CORNERSTONE FINA IN TECHNICAL PRO Capital Goods 1.4 Consumer Goods 29.2 CHINA ALUMINUM C(6898) 19.5 KNK HOLDINGS LTD(8039) 222.8 Telecom Services 1.6 Materials 25.6 ROYALCHINA CENTURY ALUMINUM RE(8125) C 18.2 YTOKNK EXPRESS HOLDINGS HOLD LTD(6123) 220.9 MarketROYAL CENTURY Highlight RE YTO EXPRESS HOLD Hong Kong Utilities Series 4 – CKGOLDWAY Hutchison EDUCATIO Holding(1 HK): CORNERSTONE FINA CK Hutchison Holding Limited is a CHINA ALUMINUM C Hutchison Telecommunications HK Holding multinational conglomerate that ROYAL CENTURY RE (0215 HK) operate variety sector of business in around 50 countries and have over CK Infrastructure Holding 300,000 employees around the world. (01038 HK) The business involve including Ports and related services, retail, infrastructure, Energy and Li Ka-shing Telecommunications. CK Hutchison Holding For the year 20201H, Hutchison Group (0001 HK) reported HK$ 189,942 million revenue, with YoY changes of -12%, HK$28,619 of total EBIT, with YoY changes of -21%. -

73 Watson Cover

Quarter 3 & 4 • 2007 A.S. Watson quarterly73 family magazine Superdurg thinks pink Fresh look • innovative concept On tour with Marionnaud PARKnSHOP shares Olympic spirit Watsons invests in people Wats Our Aroundthe world Focusstory Home Ourcommunity Hutchstory tents With a history dating back to 1828, the A.S. Watson Group (ASW) has evolved into an international retail and manufacturing businessn with operations in 36 th Co Fresh look innovative Superdrug thinks pink ...... Reaching the 300 Small bears for big Li's donation a tribute to markets worldwide. Today, the Group owns more than 7,800 retail stores concept...... milestone...... benefits...... those who choose to running the gamut from health & beauty chains, luxury perfumeries & cosmetics serve...... to food, electronics, fine wine and airport retail arms. An established player 21 34 in the beverage industry, ASW provides a full range of beverages from bottled water, fruit juices, soft drinks and tea products to the world’s finest wine labels 27 38 via its international wine wholesaler and distributor. 05 ASW employs over 98,000 staff and is a member of the world renowned Hong Kong-based conglomerate Hutchison Whampoa Limited, which has five core businesses - ports and related services; property and hotels; retail; energy, About A.S. Watson Group About A.S. Watson infrastructure, investments and others; and telecommunications in 55 countries. Editorial committee Published by • Adviser : Dominic Lai • Members : A.S. Watson & Co., Limited Wats On is the quarterly family magazine of the A.S. Watson Group. • Editor : Malina Ngai Group Office – Anna Tam, Jenny Cabrol, Anthea Chau Watson House, 1-5 Wo Liu Hang Road, Fotan, Hong Kong Health & Beauty – Nuanphan Pat Jayanama, Rita Wong, Jessin Yeung Email: [email protected] Materials from this publication may only be reprinted with full © Copyright A.S. -

Jefferies 4Th Annual ASIA EXPERT Summit Agenda & Biographies

THE GLOBAL INVESTMENT BANKING FIRM Jefferies 4th Annual ASIA EXPERT Summit Island Shangri-La, Hong Kong February 4 – 5, 2015 (Wednesday & Thursday) Agenda & Biographies Subject to change Equities | Fixed Income | Commodities | Investment Banking | Wealth & Asset Management As of Feb 5, 2015 Jefferies 4th Annual ASIA EXPERT Summit Island Shangri-La, Hong Kong, Level 39 The Atrium February 4 – 5, 2015 (Wednesday & Thursday) Wednesday, February 4, 2015 Thursday, February 5, 2015 9:00am China Unconventional Oilfield Services Update – Impact of Oil Price Drop and Future How Internet is Changing the Financial Services Industry in Asia Forecasts Alister Musgrave, MD of Moneyhero.com.hk Robert Liou, China Country Manager, PacWest Consulting Partners James Lloyd, Head of Strategy & Corporate Development, Advanced Merchant Payments (AMP) 10:00am Who Wins As China’s Cement Demand Slows? (Mandarin) Panel Debate: The Sword of Damocles: Tech IP Wars in China Zuoyi Liu, Founder of Cement Geography Panelists: IPR and Competition Partners from Bird and Bird • Hank Leung, Managing Associate, Bird & Bird • Zhaofeng Zhao, Partner, Bird & Bird • Moderator: Conor O’Mara, Asian Tech Specialist Sales 11:00am China Insurance Industry Development and Pension Fund Reform (Mandarin) How Mobile Internet is Revolutionizing The Retail Industry Jinlong Guo, Director of Insurance Division, Institute of Finance and Banking, Chinese Jason Chiu, Chief Executive Officer of Cherrypicks Academy of Social Sciences 12:30pm Keynote Presentation & Panel: Shanghai HK Stock Connect: