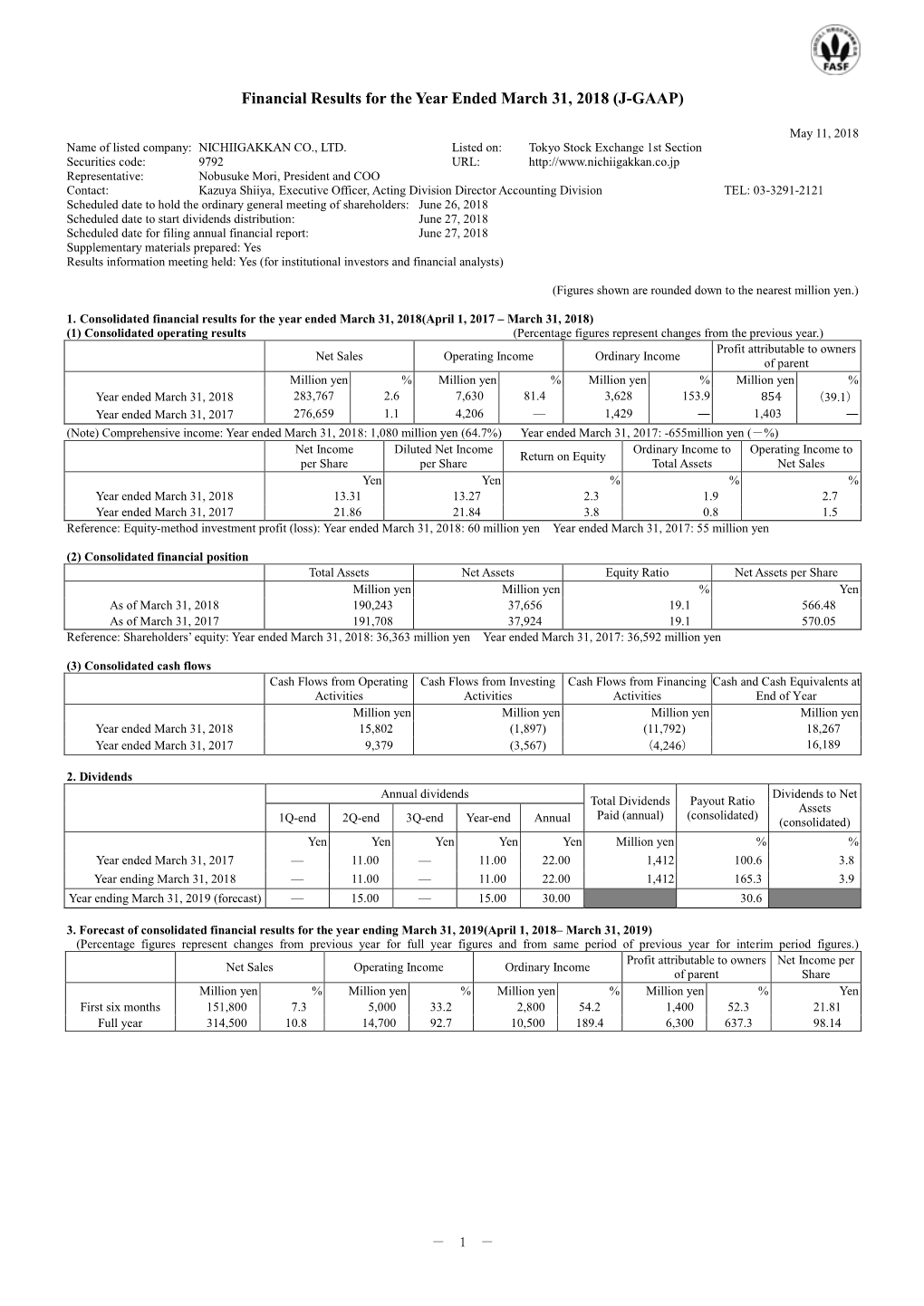

Financial Results for the Year Ended March 31, 2018 (J-GAAP)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AY2019 List of Major Employers (In Japanese Syllabary Order) Ritsumeikan Asia Pacific University, Career Office

AY2019 List of Major Employers (in Japanese syllabary order) Ritsumeikan Asia Pacific University, Career Office Dom. Int. Company / Organization Dom. Int. Company / Organization Dom. Int. Company / Organization ○ ○ RGF Professional Recruitment Japan ○ JFE Shoji Trade Corporation○HAKUHODO DY MEDIA PARTNERS INCORPORATED ○ ○ IHI Corporation ○ JFE LOGISTICS CORPORATION ○ HAKUHODO PRODUCT'S INC. ○ Aoyama Seisakusho Co., Ltd. ○ JK Holdings Co., Ltd. ○ Pasona Inc. ○ Akachan Honpo Co.,Ltd. ○ JTB Global Marketing & Travel Inc. ○ Pasona Group Inc. ○ ○ Accenture Japan Ltd ○ JTB Pte Ltd. ○ BANDAI NAMCO Entertainment Inc. ○ AsiaQuest Inc. ○ JTEKT CORPORATION ○ East Japan Railway Company ○ Ashimori Industry Co., Ltd. ○ J Trust Co.,Ltd. ○ HITACHI CHEMICAL CO., LTD. ○ Azbil Corporation ○ Citizen Watch Co., Ltd. ○ Hitachi High-Tech Solutions Corporation ○ Apple Japan GK ○ SHIMADZU CORPORATION ○ Hilton Tokyo ○ Adecco Ltd. ○ JAL SKY CO.,LTD. ○ Hilton NISEKO VILLAGE ○ Adways Inc. ○ JALSKY Kyushu Co.,Ltd. ○ FAST RETAILING CO., LTD. ○ ADVANTEC CO., LTD. ○ Singapore Airlines. ○ Foster Electric Company, Limited ○ ANABUKI KOSAN INC. ○ Swissotel Nankai Osaka ○ ○ THE BANK OF FUKUOKA, LTD. ○ APA GROUP ○ Skymark Airlines Inc. ○ THE FUKUOKA CHUO BANK, LTD. ○ Amano Enzyme Inc. ○ SUZUYO & CO., LTD. ○ Fuji Xerox Co., Ltd. ○ ULVAC, Inc. ○ State Street Trust and Banking Company, Ltd. ○ ○ FUJITSU LIMITED ○ Allegis Group Japan KK ○ Striders Corporation ○ FUJITSU FRONTECH LIMITED ○ Anchor Business Consulting Inc. ○ Sumisho Global Logistics Co., Ltd. ○ Fujitsu Marketing Limited ○ ANZEN MOTOR CAR CO.,LTD. ○ SUMITOMO DENSETSU CO.,LTD. ○ PLUS CORPORATION ○ AEON MALL Co., Ltd. ○ salesforce.com, inc. ○ ○ Freewill ○ Ishida Co., Ltd. ○ SEPTENI HOLDINGS CO.,LTD. ○ British American Tobacco Japan ○ IZUMI Co.,Ltd. ○ Seven-Eleven Japan Co.,Ltd. ○ Bloomberg L.P. ○ IDOM INC. ○ SENKO Co., Ltd. ○ The Howa Bank, Ltd. -

Commodity, Capital, and Commercial ELT: a Political Economy of Eikaiwa English Language Teaching

Commodity, Capital, and Commercial ELT: A Political Economy of Eikaiwa English Language Teaching Doctoral Thesis William Simpson IOE – UCL (Applied Linguistics) Word Count: 95,882 1 Signed Declaration: I, William Simpson, confirm that the work presented in this thesis is my own. Where information has been derived from other sources, I confirm that this has been indicated in the thesis. 2 Abstract: The aims of this research are threefold. Firstly, to understand how the drive for profit in commercial English language teaching (ELT) affects the manner in which language is taught. Secondly, to understand the how the various ways in which teachers are valued (monetarily in wages, valued as a ‘good’ teacher, and valued as an ‘authentic’ speaker of a language for example) interrelate with one another. Finally, the research aims to give an account of how teachers’ experiences of potential contradictions and tensions between commercial and pedagogic interests, and multiple forms of valuation, inform the way they understand themselves in relation to the economy and society more broadly. The research synthesises a body of research on political economy and language with Marxist political economy in order to understand commercial ELT through the moments of capital as value in motion: from the production and consumption of lessons, to the realisation of the lesson’s value in its sale, through to the distribution of this value in the form of wages. In focussing in on these moments throughout the circulation of capital, the research gives an account of the contradictory forces and interests at play within commercial eikaiwa – a form of ELT in Japan in which teachers are often precariously employed. -

Fundamentals Content Monthly Coverage Packet April 2009 - Worldscope

FUNDAMENTALS CONTENT MONTHLY COVERAGE PACKET APRIL 2009 - WORLDSCOPE A SERIES OF RESOURCE DOCUMENTS HIGHLIGHTING THE BREADTH AND DEPTH OF THOMSON REUTERS WORLDSCOPE FUNDAMENTALS CONTENT For further information or assistance, please contact your local Thomson Reuters customer service or account team. North America: +1 888.888.1082 [email protected] [email protected] Europe: +44 (0) 870 458.1052 [email protected] Asia: +63 2 878.5772 [email protected] 1 NOTICE This document contains confidential and proprietary information of Thomson Reuters and may be used only by a recipient designated by and for purposes specified by Thomson Reuters. Reproduction of, dissemination of, modifications to, or creation of derivative works from this document, by any means and in any form or manner, is expressly prohibited, except with the prior written permission of Thomson Reuters. Permitted copies of this document must retain all proprietary notices contained in the original. The information in this document is subject to change without prior notice. Always confirm with Thomson Reuters that you are using the most current version of this document. Thomson Reuters is free to modify any of its products and services, in any manner and at any time, notwithstanding the information contained in this document. Certain information, including images, graphics, numerical or textual data pertaining to assets or securities may be included in this document to illustrate different types of products and services of Thomson Reuters. Such information may be fictitious or incomplete and should not be relied upon or considered investment advice. THE CONTENTS OF THIS DOCUMENT SHALL NOT CONSTITUTE ANY WARRANTY OF ANY KIND, EITHER EXPRESSED OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE IMPLIED WARRANTIES OF MERCHANTABILITY AND/OR FITNESS FOR A PARTICULAR PURPOSE OR GIVE RISE TO ANY LIABILITY OF THOMSON REUTERS, ITS AFFILIATES OR ITS SUPPLIERS. -

Norman Rockwell

accent argot articulation brogue cant The communication conversation dialect diction Languagedictionary discourse doublespeak expression gibberish Teacher idiom <jalt-publications.org/tlt> interchange jargon lexicon lingua franca March / April 2011 Feature Article . palaver Volume 35, Number 2 9 David Ockert investigates student motivationparlance and pedagogical activity preferences patois ISSN 0289-7938 phraseology ¥950 Readers’ Forum . prose 19 Mark Fennelly and Robert Luxton address Englishsignal in The Japan Association elementary schools for Language Teaching slang 25 Joseph Falout provides an interview with Ema Ushioda sound My Share Activities Special Issue . speech THE JAPAN ASSOCIATION FOR LANGUAGE TEACHING 全 国 語 学 教 育 学 会 29 Classroom ideas from Catherine Cheetham, Bob Jones,style JALT2011 – Teaching Eoin Jordan, Dawn Kobayashi, Arthur Lauritsen, Mariotalk Leto, Leigh McDowell, Patrick Miller,terminology Robert Shoichi Learning Growing Murphy, Julian Pigott, James W. Porcaro, Mark Gerrard November 18-21, 2011 and Jack Ryan, Graham Taylor, and James Yorktongue National Olympics Memorial utterance Center, Yoyogi, Tokyo Book Reviews . verbalization TEAC HIN G 50 Kevin M. Maher reviews Impact Conversationvernacular 1 & 2 • L E A and Jodie Campbell evaluates Tell Me More: Effective R N vocabulary I N Communication Strategies for the Japanese Student G • G R vocalization O W I N G voice <jalt.org/conference> word wording JALT Publications } OuTrEACh Tim}Murphey}– Kanda University of JALT Publications Board Chair david McMurray International -

APLNG Newsletter Spring 2017

Department of Applied Linguistics Spring 2017 The Pennsylvania State University D EAR M EMBERS AND F RIENDS OF A PPLIED L INGUISTICS rom my perspective, this STEM grad students (ITAs) who are L2 speak- tion! Who are the teachers in the time of year is marked by ers of English. videos? You guessed it. Our own F annual reviews, which gives grad students, members of the me the unique privilege of a 360 de- Now, if you have all those acronyms down, IECP faculty, and members of the gree view of the department, start- here’s the crisscrossing synergy. Over this ESL faculty. ing with each individual’s personal past summer, Stephen Looney worked with So from one point of view, the accomplishments, but ultimately faculty and grad students in the ITA program CEAPP project has triggered inno- encompassing the various criss- to develop video clips out of the database to vative pedagogical applications crossing synergies that make use in courses (ESL 115, ESL 117, and ESL 118) and cutting-edge research with APLNG sizzle all year. with the International Teaching Assistants video data. But from another per- here at Penn State. Then, along with two of spective (mine), it has also brought Let me talk about just one of these our graduate students, he used data from the together people in a collaborative that you might not know about. CEAPP database to publish an article in the community in ways that optimize Stephen Looney (Director of the Journal of Pragmatics about ITA instruction. their expertise, incites their creativ- International Teaching Assistant Finally, Stephen’s group is working with a col- ity, and foments their scholarship Program; ITA) and Joan Kelly Hall league at Cornell to revise and refine these and teaching. -

Supplement to the AUSTRALIAN OFFICIAL JOURNAL

Vol: 18, No: 30 5 August 2004 Supplement to the AUSTRALIAN OFFICIAL JOURNAL OF PATENTS The Australian Official Journal of Patents (Supplement) is part of the Official Journal issued by the Commissioner of Patents for the purpose of the Patents Act 1990, the Trade Marks Act 1995 and the Designs Act 2003. (ISSN 0819-1794) AUSTRALIAN OFFICIAL JOURNAL OF PATENTS (Supplement) 5 August 2004 Contents General Information & Notices Amendments, Section 104 Applications for Amendment ....................................................................................... 7994 Amendments Made ....................................................................................................... 7994 Applications Accepted Name Index .................................................................................................................... 8172 Numerical Index .............................................................................................................8175 IPC Index ........................................................................................................................ 8176 Applications Lapsed, Refused or Withdrawn, Patents Ceased or Expired ............................................................ 7990 Applications Open to Public Inspection Name Index .................................................................................................................... 7996 Numerical Index .............................................................................................................8137 IPC Index -

Clean Planet Inc. Quantum Hydrogen Energy (QHE)

A unicorn company contributing to the future Clean Planet Inc. May 19, 2021 Special Corporate Report: Developing “Quantum Hydrogen Energy”, a future energy for the earth Hideki Yoshino, the founder and president of Clean Planet Inc., established the company in 2012 with the aim of developing clean energy for the future society after the natural disasters caused by the Great East Japan Earthquake and the secondary damage caused by the nuclear power plant. In 2015, in collaboration with an industry-university research team led by Professor Yasuhiro Iwamura of Tohoku University, the company established a joint research division to create quantum hydrogen energy, a clean energy source. In Japan, the New Energy and Industrial Technology Development Organization (NEDO)’s advanced research program for energy and environmental technologies (FY2015 to FY2017) has conducted demonstration work on the basic technology for quantum hydrogen energy, and it was well-received. Overseas, competition for the development of quantum hydrogen energy is intensifying around the world, especially in Europe and the United States, and major companies representing various industries have recently begun to enter the race to develop quantum hydrogen energy. In this context, the company has been attracting attention as a world-leading developer of quantum hydrogen energy. Currently, the company is expanding from the stage of empirical research of basic technologies to the stage of starting practical experiments in collaboration with leading companies in various industries. At present, the company has applied for 17 families of patents, and is gradually expanding its business in Japan and 16 countries, and has received 6 patent decisions in Japan and 20 overseas so far. -

A.V.V a Ju Earth Music & Ecology Earth Music

a.v.v A Ju earth music & ecology earth music & ecology natural store earth music & ecology premium store Arnold Palmer Rccat R.P AVENUE AOKI aqui agora pedido GRANCH axes femme az AZUL by MOUSSY AVAN Abientot avion AFRICA TARO apres les cours AMERICAN HOLIC AMOR AMO STYLE Alice ARGOS GARDEN ARGOS garden,t ALGY arudi Alphabet's alphabet A*R*R*O*W ensoleille and quarter ANNE VENTI UNO Anne Dear court e.r.g* EAST BOY COMET E hyphen world gallery ikka 1 / 29 ページ INGNI ing bu HIRO in the groove. in MY PLACE VANITY FACE Vin LASUD WEGO VITA RICCO WISH & BRAVE Will Wilkes Bushford by wing uno piu Eimy Pearl eur3 AIGLE Echo71 ESCAPADA ESPRIT D'OR HVC any SiS any SiS Feroux any FAM F.O.KIDS EPOCH GATE m.f.editorial MK MICHEL KLEN Emsexcite M.deux M2 EMUNI MB mint breeze aimerfeel L.L.Bean ELVENCE DEUX LUCA element of SIMPLE LIFE OZOC Oggi OFUON oblate OPAQUE.CLIP ORIHICA 2 / 29 ページ ORBENE ONLY OUTLET CABANA kid's-plus KiNu GATHER GAP Factory Store Quatre by puppy Quatre melange camelot GAL FIT/Re-J CURA coote Gready Brilliant Cour Carre an GootSin GLAMOUR green parks topic Green Parks fuuwa Gready Brilliant GLOBAL WORK CLOVE grove glory crew Crocodile KP BY KNIT PLANNER gameness Kese-moi coen Golden Bear koguma COSTA COURT cobato COMME CA ISM Confirm ILL'S CONRAD 3 / 29 ページ THE SHOP TK THE SHOP TK MIXPICE the PARK SM2 keittio ZARA salire 3can4on SIENA JEANASiS g by GORGE GU G-LAND the dan JEANS SANSHIN JEANS Mate J.PRESS JENNI sierra JACK Jantzen SHOO-LA-RUE sud et nord SHOT Sweet As SUIT SELECT SCOTCLUB suzutan SUZUTAN/Re-J SUZUYA family studio -

Third Quarter Financial Report for the Fiscal Year Ending March 31, 2019

Third Quarter Financial Report for the Fiscal Year Ending March 31, 2019 [Japan GAAP] (Consolidated) February 6, 2019 Name of listed Listed on: Tokyo Stock NICHIIGAKKAN CO., LTD. company: Exchange 1st Section Securities code: 9792 URL: http://www.nichiigakkan.co.jp Representative: (Title) President and COO (Name) Nobusuke Mori Executive Officer, Acting Division Contact: (Title) (Name) Kazuya Shiiya TEL: 03-3291-2121 Director Accounting Division Scheduled date for filing the Scheduled date to start February 8, 2019 - quarterly financial report: dividends distribution: Supplementary quarterly materials prepared: Yes Quarterly results information meeting held: Yes (for institutional investors and financial analysts) (Figures shown are rounded down to the nearest million yen.) 1. Consolidated financial results for the third quarter ended December 31, 2018 (April 1, 2018 – December 31, 2018) (1) Consolidated operating results (Percentage figures represent changes from same period of previous year.) Profit attributable to Net sales Operating income Ordinary income owners of parent Million yen % Million yen % Million yen % Million yen % Nine months ended 215,723 1.3 7,336 23.0 4,043 34.1 2,107 23.7 December 31, 2018 Nine months ended 212,914 2.7 5,963 184.4 3,014 ― 1,704 ― December 31, 2017 (Note) Comprehensive income: Nine months ended December 31, 2018 2,208million yen(31.3%) Nine months ended December 31, 2017 1,681million yen(-%) Net income per share Diluted net income per share Yen Yen Nine months ended 32.79 32.71 December 31, 2018 Nine months ended 26.55 26.49 December 31, 2017 (2) Consolidated financial position Total assets Net assets Equity ratio Million yen Million yen % As of December 31, 2018 189,124 37,076 19.0 As of March 2018 190,239 37,656 19.1 (Reference) Shareholders’ equity: As of December 31, 2018 36,001 million yen As of March 31, 2018 36,363million yen 2. -

An English Market in Japan: a Brief Psychology and History of Big Four Development

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by KANAGAWA University Repository Article An English Market in Japan: A Brief Psychology and History of Big Four Development Theron E. Fairchild Abstract The Big Four, in corporate English school history in Japan, set the standards for language communication as a commodity, as well as drove and dominated a market that annually generated billions in Japanese yen and reached hundreds of thousands in student-customers. The paper addresses the historical rise, decline, and resiliency of this industry, from the perspectives of management, marketing, and its underlying consumer psychology. The paper begins with critiques on the Japanese system of English education and the need for communicative training, followed by recent research from social, educational, and language psychology, as well as neuroscience, which collectively support why the need for such communication was desired in Japan. The paper next explores how that desire was commodified and marketed, how the student became a customer, and how the role of teacher became a sales asset. The focus on the Big Four schools presents a brief history of how two of them survived, how two failed, and how the market for private English has changed, from its rocketing beginning during the Japanese bubble economy of the 1980s, through the changes and downturns that occurred up to the present. keywords: EFL history, eikaiwa, English conversation school, English in Japan, English language business, English school history, language learning market Introduction In February 2006, the Japanese Ministry of Economy, Trade and Industry was reporting 826,000 enrollments in private English-conversation (eikaiwa: 英 会 話 ) schools in Japan, generating a monthly sales figure for the industry of ¥17.2 billion (apx. -

Language Learning Technologies and Learner Autonomy

language learning technologies and learner autonomy 6—7 June Table of Contents Welcome! 2 Sponsors 4 Conference Team 5 Announcements 6 Featured Speakers 8 Presentation Abstracts Paper Presentations 11 Show & Tell Presentations 34 Workshops 65 Poster Presentations 54 LD SIG Forum Presentations 69 Sponsored Presentations 71 Presenter Index 74 Schedule 76 Floor Plans 78 1 Welcome! From the site chair Welcome to the Language Education and Research Center (LERC) at Kyushu Sangyo University. Our curriculum cen- ters on a two-year compulsory English language program that serves 5,500 students in seven university departments. E-learning forms a crucial component of this program, with over 650 online activities developed in-house by LERC facul- ty. Recent initiatives have explored the use of tablet devices for the purpose of supporting a flipped classroom approach, and also as a tool for measuring student perceptions. Thus, we always seek to make use of technology in a manner that enhances both autonomy support and student accountabil- ity – never technology for technology’s sake. We sincerely hope you find the LERC facilities to be com- fortable and conducive for learning over these three days. If you have any questions or concerns, feel free to ask at any time. H. Nicholas Bovee Site Chair 2 Welcome! From the conference co-chairs Welcome to the 22nd Annual JALTCALL SIG Conference at Kyushu Sangyo University! It is our great honor, on behalf of the conference team and CALL SIG officers, to welcome all the presenters, delegates, and sponsors to JALTCALL 2015 “Language Learning Technologies and Learner Autonomy.” There will be presenters and attendees coming from across Asia and around the world, and we hope that you will enjoy Douglas the many presentations that showcase the future of educa- tional technology. -

DAIWA Earnings Analysis of Major Banks–I

DAIWA DAIWA INSTITUTE OF RESEARCH LTD. 4 June 2007 (No of pages: 18) Earnings Analysis of Major Banks–I —FY06 Earnings Summary and Operating Environment— (Sumitomo Mitsui Banking Corp is affiliated with Daiwa Securities SMBC. See disclaimer below.) Equity Research Dept Akira Takai • Major banks’ aggregate FY06 real net business profit on a parent basis (total sum of their group banks) declined 9.5% y/y to Y3,451.8 billion. Mainstay lending operations fell short of the bank projections in terms of both volume and spread, while a rise in interest rates eroded treasury income in domestic and foreign operations. Additionally, non-personnel costs significantly lifted overhead above the year- earlier level, weighing on profit. • Aggregate credit costs net of recoveries reached only Y167.3 billion, as credit costs for newly-emerged non-performing assets tended to be low, except for those related to some non-banks, and banks continued to record loan-loss reserve releases and write-off recoveries. A number of banks also continued to see lower income tax payments, a benefit of deferred tax assets. As a result, aggregate consolidated net income hit Y2,824.8 billion, the second-highest level in history, despite dropping 9.5% below the year-earlier level. Establishment of solid profitability in recent years prompted the majority of major banks to raise common dividends in FY06. • At its 21 February monetary policy meeting, the BOJ lifted the unsecured overnight call rate to 0.50%, the second hike since 14 July, when the BOJ rescinded its zero interest-rate policy and lifted the call rate to 0.25%.