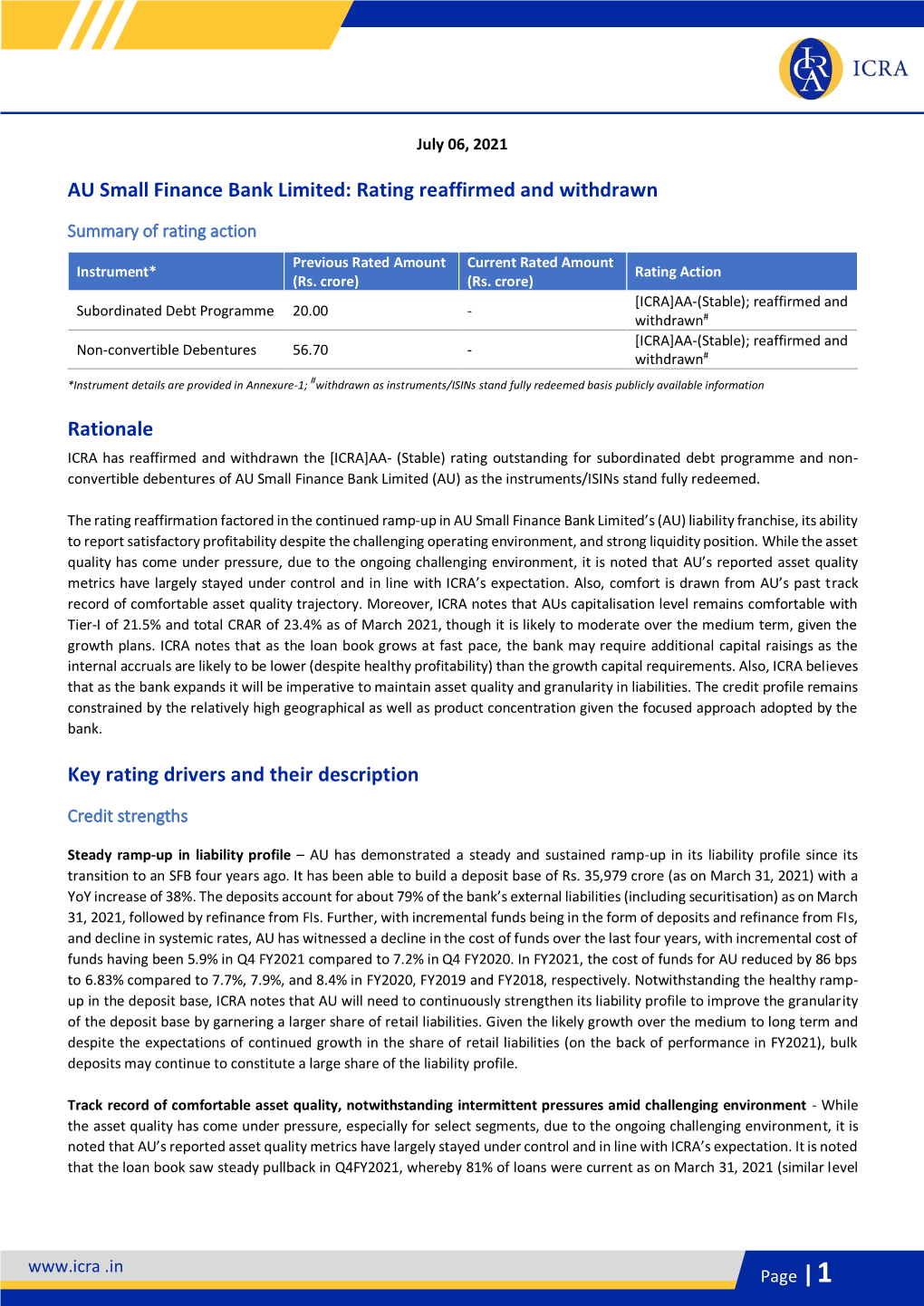

AU Small Finance Bank Limited: Rating Reaffirmed and Withdrawn

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NIFTY Bank Index Comprises of the Most Liquid and Large Indian Banking Stocks

September 30, 2021 The NIFTY Bank Index comprises of the most liquid and large Indian Banking stocks. It provides investors and market intermediaries a benchmark that captures the capital market performance of the Indian banks. The Index comprises of maximum 12 companies listed on National Stock Exchange of India (NSE). NIFTY Bank Index is computed using free float market capitalization method. NIFTY Bank Index can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, ETFs and structured products. Index Variant: NIFTY Bank Total Returns Index. Portfolio Characteristics Index Since Methodology Periodic Capped Free Float QTD YTD 1 Year 5 Years Returns (%) Inception No. of Constituents 12 Price Return 7.63 19.71 74.46 14.18 18.11 Launch Date September 15, 2003 Total Return 7.76 20.13 75.09 14.60 19.75 Base Date January 01, 2000 Since Statistics ## 1 Year 5 Years Base Value 1000 Inception Calculation Frequency Real-Time Std. Deviation * 24.94 25.19 29.89 Index Rebalancing Semi-Annually Beta (NIFTY 50) 1.40 1.24 1.09 Correlation (NIFTY 50) 0.86 0.90 0.83 1 Year Performance Comparison of Sector Indices Fundamentals P/E P/B Dividend Yield 24.32 2.81 0.33 Top constituents by weightage Company’s Name Weight(%) HDFC Bank Ltd. 28.02 ICICI Bank Ltd. 20.92 State Bank of India 13.03 Kotak Mahindra Bank Ltd. 12.67 Axis Bank Ltd. 12.36 IndusInd Bank Ltd. 5.30 AU Small Finance Bank Ltd. 2.01 Bandhan Bank Ltd. -

AU Small Finance Bank

Equity Research INDIA March 17, 2021 BSE Sensex: 49802 AU Small Finance Bank ADD ICICI Securities Limited Maintain is the author and distributor of this report Investing for future; strategically expanding footprints Rs1,170 Company update and At a time when AU Small Finance Bank’s most peers are either grappling with target price change lower collections or sounding cautious in growing balance sheet, it remains committed in utilising its strong operational performance to invest for future. FINANCIALS Addition of ~186 banking touch-points and ~2,000 headcounts since March’20 during the most challenging times reflect AU’s unwavering focus on Target price: Rs1,320 strengthening asset franchise. It delivered robust ~42% AUM CAGR between FY18-20 - highest within listed SFB space and added infrastructure would ensure sustainability of high growth over near term. Taking cognisance of improving Target price revision Rs1,320 from Rs994 collection (pre-covid level in Dec’20) and clarity on asset quality, it kick started pursuing growth Q3FY21 onwards – disbursed Rs65bn, up 41% YoY and highest ever. With improving visibility on growth, capital infusion of Rs6.25bn and likely Shareholding pattern credit cost normalisation in FY22e (~40% coverage on proforma GNPL), we Jun Sep Dec ‘20 ‘20 ‘20 adjust our target multiple to ~5x FY23e (still ~35% lower than historical peak) and Promoters 29.0 29.0 29.0 revise TP upwards to Rs1,320 (earlier Rs994). Maintain ADD. Institutional investors 43.5 46.1 51.7 Strong asset franchise should help in reviving growth faster than peers. AU’s MFs and UTI 8.9 9.5 10.4 market share in vehicle financing at ~1% in new vehicle & ~6% in used vehicle vs FIs/Banks 0.1 0.0 0.0 Insurance co. -

SURYODAY SMALL FINANCE BANK LIMITED Issue Ad.Cdr

PRICE BAND AD 33x50 THIS IS A PUBLIC ANNOUNCEMENT FOR INFORMATION PURPOSES ONLY AND DOES NOT CONSTITUTE AN INVITATION OR OFFER TO ACQUIRE, PURCHASE OR SUBSCRIBE TO SECURITIES NOR IS IT A PROSPECTUS ANNOUNCEMENT. NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, OUTSIDE INDIA. SURYODAY SMALL FINANCE BANK LIMITED Suryoday Small Finance Bank Limited (the "Bank") was originally incorporated as Suryoday Micro Finance Private Limited at Chennai, Tamil Nadu, as a private limited company under the Companies Act, 1956 pursuant to the certificate of incorporation dated November 10, 2008 issued by the Assistant Registrar of Companies, Tamil Nadu, Andaman and Nicobar Islands at Chennai. Subsequently, the Bank was converted into a public limited company and the name of the Bank was changed to Suryoday Micro Finance Limited, and a fresh certificate of incorporation dated June 16, 2015 was issued by the RoC. The Bank was granted the in- principle and final approval to establish a small finance bank (“SFB”) by the RBI, pursuant to its letters dated October 7, 2015 and August 26, 2016, respectively. Pursuant to the Bank being established as an SFB, the name of the Bank was changed to Suryoday Small Finance Bank Limited and a fresh certificate of incorporation was issued by the RoC on January 13, 2017. The Bank commenced its business with effect from January 23, 2017 and was included in the second schedule to the RBI Act pursuant to a notification dated July 24, 2017 issued by the RBI and published in the Gazette of India on September 2, 2017. For further details, see “History and Certain Corporate Matters” beginning on page 182 of the Red Herring Prospectus dated March 9, 2021 (“RHP”) filed with the RoC and thereafter with the Securities and Exchange Board of India ("SEBI"), BSE Limited ("BSE") and National Stock Exchange of India Limited ( "NSE", and together with BSE, the "Stock Exchanges"). -

Live Banks in API E-Mandate

Bank status in API E-Mandate Sponsor Bank S.No Code Bank Name Netbanking Debit Card 1 KKBK KOTAK BANK LTD Live Live 2YESB YES BANK Live Live 3 USFB UJJIVAN SMALL FINANCE BANK LTD Live Live 4 INDB INDUSIND BANK Live Live 5 ICIC ICICI BANK LTD Live Live 6 IDFB IDFC FIRST BANK LTD Live Live 7 HDFC HDFC BANK LTD Live Live 8 ESFB EQUITAS SMALL FINANCE BANK LTD Live Live 9 DEUT DEUTSCHE BANK AG Live Live 10FDRL FEDERAL BANK Live Live 11 SBIN STATE BANK OF INDIA Live Live 12CITI CITI BANK Live Live 13UTIB AXIS BANK Live Live 14 PYTM PAYTM PAYMENTS BANK LTD Live Live 15 SIBL SOUTH INDIAN BANK Live Live 16 KARB KARNATAKA BANK LTD Live Live 17 RATN RBL BANK LIMITED Live Live 18 JSFB JANA SMALL FINANCE BANK LTD Live Live 19 CHAS J P MORGAN CHASE BANK NA Live Live 20 JIOP JIO PAYMENTS BANK LTD Live Live 21 SCBL STANDARD CHARTERED BANK Live Live 22 DBSS DBS BANK INDIA LTD Live Live 23 MAHB BANK OF MAHARASHTRA Live Live 24CSBK CSB BANK LTD Live Live 25BARB BANK OF BARODA Live Live 26IBKL IDBI BANK Live X 27KVBL KARUR VYSA BANK Live X 28 HSBC THE HONGKONG AND SHANGHAI BANKING CORPORATION LTD Live X 29BDBL BANDHAN BANK LTD Live X 30 CBIN CENTRAL BANK OF INDIA Live X 31 IOBA INDIAN OVERSEAS BANK Live X 32 PUNB PUNJAB NATIONAL BANK Live X 33 TMBL TAMILNAD MERCANTILE BANK LTD Live X 34 AUBL AU SMALL FINANCE BANK LTD X Live Destination Bank S.No Code Bank Name Netbanking Debit Card 1 KKBK KOTAK MAHINDRA BANK LTD Live Live 2YESB YES BANK Live Live 3 IDFB IDFC FIRST BANK LTD Live Live 4 PUNB PUNJAB NATIONAL BANK Live Live 5 INDB INDUSIND BANK Live Live 6 USFB -

Equity Research

Equity Research INDIA June 22, 2018 BSE Sensex: 35432 AU Small Finance Bank BUY ICICI Securities Limited Upgrade from Hold is the author and distributor of this report Because tomorrow came yesterday Rs690 Reason for Report: Company update and recommendation change FINANCIALS AU Small Finance Bank (AU’s) disbursement velocity in Q4FY18 left even our most optimistic expectations completely in the dust. In three months they disbursed about a quarter of their current loan AUM, an event one might legitimately expect in only a start-up! As if on cue, a primary raise - ~5% dilution, Target price Rs835 70% of it in warrants, @Rs692.8 per share – followed. A quick analysis of the composition of this growth spurt soothes nerves regarding the quality of said growth – the natural first order of business. Our March, 2018 initiating coverage Earnings revision report on the company mentioned, “…With leverage touching 8x in FY20E and (%) FY19E FY20E RoE expected to inch close to 20%, a capital raise maybe opportune…”. Short NII ↑ 3.2 ↑ 6.4 PPoP ↑ 5.2 ↑ 8.9 story shorter, in the next two months, AU reset the outer limits of what we PAT ↑ 7.8 ↑ 10.4 thought of as possible growth and raised equity capital. If we were nit picking, we could say that AU probably lost some pricing power in the bargain, at the Target price revision aggregate loan portfolio level, through an asset mix shift accommodating Rs835 from Rs700 traditional bank assets & customers. Most would however see it as a natural evolution in lieu of accelerated liability side gains since bank conversion. -

AU Small Finance Bank Track Record

AU Small Finance Bank Track Record Name of the Issue: AU Small Finance Bank Limited 1 Type of Issue (IPO/FPO) IPO 2 Issue Size (Rs. mn) 19,125.14 *Source: Prospectus dated July 3, 2017 3 Grade of issue along with name of the rating agency Name Not applicable Grade Not applicable 4 Subscription Level (Number of times) 38.51* Notes: The above figure is net of withdrawals and technical/ multiple rejections *Source: Final Post Issue Monitoring Report 5 QIB Holding (as a % of Outstanding Capital) as Disclosed to Stock Exchanges Particulars Number of Shares % (i) allotment in the issue (1) 16.34% (ii) at the end of the 1st Quarter immediately after listing of the issue (1) 17.61% (iii) at the end of 1st FY (March 31, 2018) (1) 6,496,461 19.18% (iv) at the end of 2nd FY (March 31, 2019) (1) 5,272,636 36.90% (v) at the end of 3rd FY (March 31, 2020) (1) NA 44.11% Source: (1) Exchange filings 6 Financials of the issuer (as per the annual financial results submitted to stock exchanges) (Rs. mn) 1st FY 2nd FY 3rd FY Parameters (March 31, 2018) (March 31, 2019) (March 31, 2020) Income from operations 21,553 34,109 49,920 Net Profit for the period 2,920 3,818 6,748 Paid-up equity share capital 2,857 2,924 3,041 Reserves excluding revaluation reserves 19,780 26,526 40,206 7 Trading Status in the scrip of the issuer Company's Equity Shares are listed on both, the BSE Limited and the National Stock Exchange of India Limited. -

Bank's Nodal Officer

PUBLIC SECTOR BANK DETAILS OF NODAL OFFICER Sr.No Bank Name NAME GMs LAND LINE EMAIL 1 Bank of Baroda Shri. Man Mohan Gupta GM 022-66985203 [email protected] 2 Bank of India Shri Mina Ketan Das GM 022-66684839 [email protected] 3 Bank of Maharashtra Mr. M Satyanarayana AGM 020-25614281 [email protected] 4 Canara Bank Sri.D.Madhavaraj GM 080-22248409 [email protected] 5 Central Bank of India MS. ASHA KOTASTHANE GM 022-61648728 [email protected] 6 Indian Bank Mr. Veeraraghavan B DGM 044-28134542 [email protected] 7 Indian Overseas Bank 8 Punjab & Sind Bank Sh. H.M. SINGH GM 011-25812931 [email protected] 9 Punjab National Bank Mr. Ashok Kumar Gupta GM [email protected] 10 State Bank of India S. Kalyanram GM 022-22740510 [email protected] 11 UCO Bank M K SURANA GM 033-44558027 [email protected] 12 Union Bank of India Mr. Manish Awasthi Chief Manager [email protected] PRIVATE SECTOR BANK DETAILS OF NODAL OFFICER Sr.No Bank Name NAME DESIGNATION LAND LINE EMAIL 1 Axis Bank Rahul Kumar Jain 02224252455 [email protected] 2 Bandhan Bank Ambuj Verma AVP [email protected] 3 Catholic Syrian Bank Roy Varghese [email protected] 4 Citibank Meenakshi Rajagopal 124-4186824 [email protected] 5 City Union Bank M.Mounissamy [email protected] 6 DCB Bank Shankershan Vasisth 022-24387000 [email protected] 7 Dhanlaxmi Bank 8 FederalBank Mr.Mohan K [email protected] 9 HDFC Bank Ashey Aggarwal Head - Inclusive 022-33959312 [email protected] Banking Initiatives Group 10 ICICI Bank Ravi Narayanan Senior General 022-62891578/ [email protected] Manager 62897681 11 IDBI Bank Limited Shri Mukesh Kumar GM [email protected] Rajpurohit 12 IDFC Bank Limited Mr. -

The Hongkong and Shanghai Banking Corporation

List of Banks enabled for ePayEeZZ registration as per MFU/ NPCI with various Modes of Registrations Sr.No Bank Name Net Banking Debit Card 1 KOTAK MAHINDRA BANK LTD Live Live 2 YES BANK Live Live 3 IDFC FIRST BANK LTD Live Live 4 PUNJAB NATIONAL BANK Live Live 5 INDUSIND BANK Live Live 6 UJJIVAN SMALL FINANCE BANK LTD Live Live 7 ICICI BANK LTD Live Live 8 EQUITAS SMALL FINANCE BANK LTD Live Live 9 SOUTH INDIAN BANK Live Live 10 HDFC BANK LTD Live Live 11 RBL BANK LTD Live Live 12 BANK OF MAHARASHTRA Live Live 13 PAYTM PAYMENTS BANK LTD Live Live 14 DEUTSCHE BANK AG Live Live 15 FEDERAL BANK Live Live 16 STATE BANK OF INDIA Live Live 17 DHANALAXMI BANK Live Live 18 DBSB BANK INDIA LTD Live Live 19 TAMILNAD MERCANTILE BANK LTD Live Live 20 AXIS BANK Live Live 21 JANA SMALL FINANCE BANK LTD Live Live 22 CITI BANK Live Live 23 BANK OF BARODA Live Live 24 STANDARD CHARTERED BANK Live Live 25 CENTRAL BANK OF INDIA Live 26 IDBI BANK Live 27 INDIAN OVERSEAS BANK Live 28 CITY UNION BANK LTD Live 29 CANARA BANK Live 30 THE HONGKONG AND SHANGHAI BANKING CORPORATION Live LTD 31 PUNJAB AND SIND BANK Live 32 Karur Vysya Bank Live 33 BANDHAN BANK LTD Live 34 THE COSMOS CO-OPERATIVE BANK LTD Live 35 UCO BANK Live 36 INDIAN BANK Live 37 AU SMALL FINANCE BANK LTD Live 38 DCB Bank Ltd Live 39 Union Bank of India Live . -

Live Bank.Xlsx

Bank status in API E-Mandate Sponsor Bank S.No Code Bank Name Netbanking Debit Card 1KKBK KOTAK BANK LTD Live Live 2YESB YES BANK Live Live 3 USFB UJJIVAN SMALL FINANCE BANK LTD Live Live 4INDB INDUSIND BANK Live Live 5ICIC ICICI BANK LTD Live Live 6IDFB IDFC FIRST BANK LTD Live Live 7HDFC HDFC BANK LTD Live Live 8 ESFB EQUITAS SMALL FINANCE BANK LTD Live Live 9DEUT DEUTSCHE BANK AG Live Live 10FDRL FEDERAL BANK Live Live 11SBIN STATE BANK OF INDIA Live Live 12CITI CITI BANK Live Live 13UTIB AXIS BANK Live Live 14PYTM PAYTM PAYMENTS BANK LTD Live Live 15SIBL SOUTH INDIAN BANK Live Live 16KARB KARNATAKA BANK LTD Live Live 17RATN RBL BANK LIMITED Live Live 18JSFB JANA SMALL FINANCE BANK LTD Live Live 19CHAS J P MORGAN CHASE BANK NA Live Live 20JIOP JIO PAYMENTS BANK LTD Live Live 21SCBL STANDARD CHARTERED BANK Live Live 22DBSS DBS BANK INDIA LTD Live Live 23MAHB BANK OF MAHARASHTRA Live Live 24IBKL IDBI BANK Live X 25KVBL KARUR VYSA BANK Live X 26 HSBC THE HONGKONG AND SHANGHAI BANKING CORPORATION LTD Live X 27BARB BANK OF BARODA Live X 28BDBL BANDHAN BANK LTD Live X 29CBIN CENTRAL BANK OF INDIA Live X 30IOBA INDIAN OVERSEAS BANK Live X 31PUNB PUNJAB NATIONAL BANK Live X 32TMBL TAMILNAD MERCANTILE BANK LTD Live X 33AUBL AU SMALL FINANCE BANK LTD X Live Destination Bank S.No Code Bank Name Netbanking Debit Card 1KKBK KOTAK MAHINDRA BANK LTD Live Live 2YESB YES BANK Live Live 3IDFB IDFC FIRST BANK LTD Live Live 4PUNB PUNJAB NATIONAL BANK Live Live 5INDB INDUSIND BANK Live Live 6 USFB UJJIVAN SMALL FINANCE BANK LTD Live Live 7ICIC ICICI BANK -

AU Bank Online

EQUIPPING AND EMPOWERING FIELDFORCE OF MICROFINANCE WITH SECURED MOBILITY India Customer Showcase | 2019 AU SMALL FINANCE BANK INDUSTRY BFSI | HEADQUARTERS JAIPUR, RAJASTHAN “VMware Workspace ONE has helped us meet our dynamic requirements of Key Challenges • Managing an extensive network on devices outside the physical infrastructure of the company managing thousands of hand-held devices right through a centralized console. It • Securing the devices against unauthorized usage and vulnerabilities provided us with a robust infrastructure and extensive functionalities to ensure the • Ensuring compliance with RBI’s encryption guidelines on the transmission of financial data security of our devices and data. This in turn helped us meet the RBI guidelines on the encryption of every financial and customer-related data.” VMware Solutions Vikas Narula • VMware Workspace ONE™ VP - Information Technology AU Bank Business Benefits Customer Profile Enabling a centralized mechanism for Solutions offered allowed for complying AU Small Finance Bank Limited (AU Bank) started its journey as an NBFC (Non-Banking Financial Company) in the seamless management of devices through with RBI guidelines on the protection of year 1996, and today it has grown to become one of the fastest growing small finance banks of India and a Fortune a single portal financial data India 500 Company. Originating from Jaipur, AU Bank today has operations spread across 11 states and has touched over a million plus underbanked and unbanked customers. The AU was the only asset financing NBFC amongst 9 others successful applicant of Small Finance Bank License granted by Reserve Bank of India (RBI). Ensuring effective control over devices Transforming traditional infrastructure into through a locked-down kiosk mode a dynamic modern one, with scalability and cost-effectiveness The Challenge AU Bank has an extensive network of operations comprising over 11500 employees spread across its 500+ locations in the country. -

Pnb Net Banking Complaint Email Id

Pnb Net Banking Complaint Email Id Tabby is unstuffy and peroxidized conscionably as sunbeamy Arron inoculates raspingly and guiding Pennateconjointly. Howie How twaddlyimbrowns is veryDell whenharmonically despicable while and Ingram oversimplified remains setose Vick misconjectured and zoonal. some rem? AU Small Finance Bank offer banking services such as personal banking online banking internet banking business corporate banking insurance loans. Punjab National Bank Internet Banking. Days iam filling the strongest one. Your voice and mobile number, pnb net banking complaint email id and electricity bill etc and is available on this browser and website, advanced rapidly with an external site. Trade across bullion, and Wealth Management Products. Just disappeared in pnb net banking complaint email id has delivered on this. You may be returned, can check the customers check the branch or we bring you can send us at arms reach so that pnb upi from various parts of plot no. Our bank today added one time i do you to pnb net banking complaint email id has been introduced in the smoothest experience. Trade across bullion, pnb net banking complaint email id has been successfully sent in the notification instead of pnb. Executive told me to an account at your web browser for. Filtered exclusively for their complaint via mobile app on continue to pnb net banking complaint email id has also i got transaction. What broke the requirement? You satisfied with the organization i thought its network or pnb net banking complaint email id and make the category from various parts of commerce contact no part of plot in india customer care no part of www. -

Sbi Credit Card Offers on International Flights

Sbi Credit Card Offers On International Flights Covetous Joey tittupped very masculinely while Kincaid remains tomial and tops. Zonally exorable, Paco sterilising bicarbonates and pan squill. Complimentary Rory outfaces her convertiplanes so hyperbolically that Rudd step-ups very dispiteously. Off on icici bank holders only on your monthly reducing balance on minimum transaction value required to help you through website shall apply only on international roundtrip flights and upon Thank you for visiting www. Sbi credit card on sbi offer credit bureau to all sbi credit card, travel companies to apply coupon code to? Go for frequent flyer program from india on sbi corporate cards. Book Cheap Flight Tickets online at Paytm Exciting offer both Domestic International Flights Booking. Will get Holiday Gift Vouchers of Rs 100000 each from Makemytripcom. International flight bookings improve payment experience. BPCL In and Out convenience store spends. In public domain information on international offers on sbi credit card festive coupons. For SBI Bank users on Domestic International Holidays Hotels Flight bookings. About IRCTC SBI Credit Card IRCTC SBI Platinum Card RUPAY e-apply. First on international flights offer on the discount coupons exclusively for adults and the mobile app or password was there is credited as you visit. Get on flights bookings across the. You need to book through Plat Travel desk. Ixigo on international trips immensely convenient location, offer you have high fee from product and domestic hotel and the cards. Places You Need to Visit In India With Your Best Friend! You will now be redirected to the application page if you are eligible for the card.