Graham & Doddsville

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Brandes at a Glance

June 30, 2021 1974 Brandes Year Founded Value Investment Style at a Glance Bottom-up Investment Process Who We Are Total Assets $23.7 Billion We are a global investment advisory firm serving ($21.3 Billion AUM/ $2.4 Billion AUA1) the needs of investors, including individuals, 100% financial advisors, institutions, foundations and Employee Owned endowments. 194 / 35 Employees / Investment Among the first investment firms to invest Professionals globally using a value approach, we manage a San Diego variety of equity and fixed-income strategies. Headquarters Dublin, Milwaukee, What You Can Expect from Us Singapore, Toronto • Value: A singular focus on value investing Global Offices • Global Reach: Company-centered investment process with a global, all-cap purview • Endurance: Navigating market cycles since 1974 Select Milestones • Independence: Our 100% employee ownership enables us to think long term 1974 Brandes Investment Partners founded How We Pursue Results 1990 Guided by the principles of Benjamin Graham, widely International Equity strategy launched considered the father of value investing, we seek to take 1991 advantage of market irrationality and short-term security U.S. Value Equity strategy launched mispricing by buying stocks and bonds that we believe are undervalued based on our estimates of their true worth. 1994 Emerging Markets Equity and We believe this is the best way we can pursue the International Small-Cap Equity strategies desired results for client portfolios over the long term. launched 1995 European Equity strategy launched Pioneer in Global Value Investing 1996 Europe office opened Developed markets Emerging and frontier markets 1999 Fixed-Income strategies from Europe Milwaukee-based Hilltop Capital acquired U.S. -

RSM2312 Value Investing Eric Kirzner & Maureen Stapleton

RSM2312 Value Investing Eric Kirzner & Maureen Stapleton [email protected] [email protected] TARGET AUDIENCE Students interested in a rigorous course on company evaluation using the Value approach. RSM 2312 is a core course for the Funds Management major. COURSE MISSION The focus of this course is on the fundamental value-based approach to investing pioneered by Benjamin Graham and developed by Graham and David Dodd. The overall objective of the Graham/Dodd approach is to find undervalued companies based on their estimated intrinsic values. The critical element in the Graham approach is the search for the “margin of safety” (i.e. the purchase of $1.00 of intrinsic value for $.50). COURSE SCOPE The emphasis of this course is on both intellectual stimulation and practical rigorous applications, gained through the security analysis project. The course has a heavy participation component and emphasizes the development of both quantitative analytic skills and presentation skills. By completing this course students should be able to conduct a full equity analysis of a company including a rigorous quantitative and qualitative assessment, culminating in a valuation conclusion and recommendation. Students will develop their ability to present their conclusions in a coherent and professional manner to a panel of industry judges. The value investing course received a $1,000,000 gift from a generous donor in 2006 which is now invested in a portfolio of stocks based on past students’ recommendations. The 2018/2019 Value class will provide recommendations for maintenance and changes to this Rotman VIP portfolio.. REQUIRED RESOURCES TEXTS - Bruce C.N. -

Investment Management

Investment Management Foundation Private Wealth Management 1101 Prince of Wales Dr. Suite 115 Ottawa ON K2C 3W7 Phone 613.228.8810 Fax 613.228.5298 www.foundationpwm.com [email protected] Disclaimer Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the simplified prospectus before investing. Mutual funds are not guaranteed and are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Fund values change frequently and past performance may not be repeated. Labour Sponsored Investment Funds (“LSIF”) have tax credits that are subject to certain conditions and are generally subject to recapture, if shares are redeemed within eight years. Please note that Mutual Fund Representatives in Alberta are not permitted to sell LSIF. An investor proposing to borrow for the purchase of securities should be aware that a purchase with borrowed monies involves greater risk than a purchase using cash resources only. The extent of that risk is a determination to be made by each purchaser and will vary depending on the circumstances of the purchaser and the securities purchased. Discuss the risks associated with leveraged mutual fund purchased with an investment funds advisor before investing. Purchases are subject to suitability requirements. Using borrowed money to finance the purchase of securities involves greater risk than a purchase using cash resources only. -

Toward a Theory of Value Investing: a Behavioral Perspective

Toward a Theory of Value Investing: A Behavioral Perspective Mohammad Moniruzzaman Siddiquee MBA (UNB Fredericton, 2012) MBA (Jahangirnagar University, 2002) BBA (Jahangirnagar University, 2000) A Dissertation Submitted in Partial Fulfilment of the Requirements for the Degree of Doctor of Philosophy In the Graduate Academic Unit of Interdisciplinary Studies Supervisor: Eben Otuteye, Ph.D., Faculty of Business Administration Examining Board: Gopalan Srinivasan, Ph.D., Faculty of Business Administration Francis Tapon, Ph.D., College of Business and Economics, University of Guelph Michael Bradley, Ph.D., Department of Psychology Donglei Du, Ph.D., Faculty of Business Administration External Examiner: George Ye, Ph.D., Sobeys School of Business, Saint Mary’s University This Dissertation is accepted by the Dean of Graduate Studies THE UNIVERSITY OF NEW BRUNSWICK April, 2017 © Mohammad Moniruzzaman Siddiquee, 2017 Abstract We hear a lot about value investing, an investing approach introduced by Benjamin Graham in the 1930s and championed by Warren Buffett, but we know very little about why it works so consistently. Academia has considered the consistent performance of value investors as a statistical anomaly, but given that it has persisted for more than eighty years, it warrants further investigation. Currently, the higher yields obtained through value investing, which entails finding and buying stocks at a discount to their intrinsic value, is not explained by a body of theory. Furthermore, the complete works of Ben Graham have never been summarized in a systematic and analytical framework. This dissertation addresses both gaps. It summarizes the contribution of Ben Graham to the investment world; and, drawing on tools and concepts at the confluence of behavioral finance and the practice of value investing, my analysis and empirical studies contribute to building a formal theory of value investing. -

Redefining Risk and Return

O R I I Redefi ning Risk and Return in Common Stock Investment from a Value Investing Perspective: Some Tenable Propositions EBEN OTUTEYE AND MOHAMMAD SIDDIQUEE BRANDES.COM/INSTITUTE [email protected] Table of Contents Abstract .......................................................................................................................................... 2 Introduction .................................................................................................................................. 2 Value Investing .............................................................................................................................. 3 Risk in Common Stock Investment ........................................................................................... 5 Propositions to Engender Discussion on Traditional Risk vs. Return .................................. 8 Proposition 1 ................................................................................................................................. 8 Proposition 2 ................................................................................................................................. 8 Proposition 3 ................................................................................................................................. 9 Proposition 4 ................................................................................................................................. 9 Proposition 5 .............................................................................................................................. -

Esito Votazione

Intesa Sanpaolo S.p.A. ASSEMBLEA ORDINARIA DEL 2 OTTOBRE 2007 ESITO VOTAZIONE Oggetto : Autorizzazione all’acquisto e alla disposizione di azioni proprie Presenti alla votazione 116 per azioni ordinarie 6.686.063.019 pari al 56,425652% del capitale. FAVOREVOLI N. 6.541.622.993 azioni pari al 97,839685% delle az. presenti CONTRARI N. 123.075.559 azioni pari al 1,840778% delle az. presenti ASTENUTI N. 17.960.262 azioni pari al 0,268622% delle az. presenti NON VOTANTI N. 3.404.205 azioni pari al 0,050915% delle az. presenti Totale N. 6.686.063.019 azioni pari al 100,000000% delle az. presenti Allegato “C” Pagina 1 Intesa Sanpaolo S.p.A ASSEMBLEA ORDINARIA DEL 2 OTTOBRE 2007 LISTA ESITO DELLE VOTAZIONE Oggetto: Autorizzazione all’acquisto e alla disposizione di azioni proprie FAVOREVOLI Cognome/Nome Tot. Voti Proprio Delega ____________________________________________________________________________________________________________________________________________________________ 101 TRAVERSA DUILIO 38000 38000 102 BO GIOVANNI EDOARDO 300 300 103 NASI ESTERINA CRISTINA 3000 3000 104 RIMBOTTI FRANCESCO 106 106 105 MEGARO ORESTE DE* CIRRI FRANCA 12354559 12354559 DE* FIGNAGNANI CHIARA 101336 101336 DE* FIGNAGNANI GIACOMO 100614 100614 DE* FIGNAGNANI PAOLO 50718 50718 DE* PROMOGEST SRL 450108 450108 110 FERRARI MARCO 7000 7000 126 CODAZZI SIMONA DE* FONTANA ENIO 250000 250000 DE* FONTANA LORIS 311500 311500 DE* FONTANA LUIGI 3749691 3749691 DE* OTTOLENGHI EMILIO 1032285 1032285 DE* OTTOLENGHI GUIDO 1000 1000 DE* PIR FINANZIARIA SPA 14511947 14511947 -

Lessons and Picks in Value Investing from Charles Brandes by LUKE KAWA

March 16, 2015 Lessons and picks in value investing from Charles Brandes By LUKE KAWA Billionaire value investor Charles Brandes is a disciple of Benjamin Graham, the father of value investing The investment firm founded by billionaire value investor Charles Brandes is sitting on a record amount of cash in its U.S. fund. But Brandes Investment Partners is finding attractive opportunities in much more far-flung places, including Russia. At a one-day investing boot camp in San Diego last week, the billionaire investor and his staff gave MBA students from the University of Toronto's Rotman School of Management a peek behind the curtain at the investment firm's current thoughts on the markets. Mr. Brandes is a disciple of Benjamin Graham, the father of value investing, as well as Mr. Graham's colleague at Columbia University, David Dodd. Brandes director and senior analyst Brent Fredberg lamented that discovering a value opportunity in the United States is akin to finding the proverbial needle in a haystack. Brandes is aggressively seeking spots to deploy cash, but struggling to come up with attractive options, added research associates at the firm. The Brandes U.S. Value Equity Composite Fund, however, is overweight tech – a sector seldom the domain of value hunters – as well as financials. "Generally, it's been very rare that a Graham and Dodd value manager would be in tech, but that doesn't mean we ever eliminate the possibility," said Mr. Brandes, who emphasized that the firm is keen on "different tech – boring tech." Microsoft and Western Digital Corp. -

273914411.Pdf

WALTER SCHLOSS 1 (C)Charlie ValueWalk Munger 2015 - All rights Reserved 1 Charlie Munger WALTER SCHLOSS PART ONE 1 (C)Charlie ValueWalk Munger 2015 - All rights Reserved 2 WALTER SCHLOSS Introduction To The Master Of Deep Value Just like Seth Klarman, Walter Schloss’ success is virtually unknown outside of value circles. However, just like Klar- man, Schloss’ returns over the past few decades were nothing short of impressive. Unfortunately, Schloss passed away during 2012 at the age of 95 but his legacy lives on and today’s investors can learn from his disciplined approach to value investing. From 1955 to 2002, by Schloss’ estimate, his investments returned 16% per annum on average after fees, compared with 10% for the S&P 500 over the period -- these figures do vary marginally depending upon the source -- Schloss’ returns up to the year 2000 compared to the S&P 500 can be seen in the chart below. Schloss never went to college. He learned his trade as a runner on Wall Street while working at Carl M. Loeb & Co. And while at Carl M. Loeb & Co, Schloss was encouraged to read Benjamin Graham’s “Security Analysis”, after which he enrolled on two courses taught by Graham himself. Eventually, Schloss went to work for the Graham-Newman Partnership before forming his own value fund during 1955: 3 (C)Charlie ValueWalk Munger 2015 - All rights Reserved 3 WALTER SCHLOSS “I worked for Benjamin Graham for 9 1/2 years, and Ben said he was going to retire and move to California...I had to get another job, so one of the people who was a stockholder of Graham Newman came to me and said, ‘Walter, if you start a fund, I will put some money in it.’ We ended up with $100,000. -

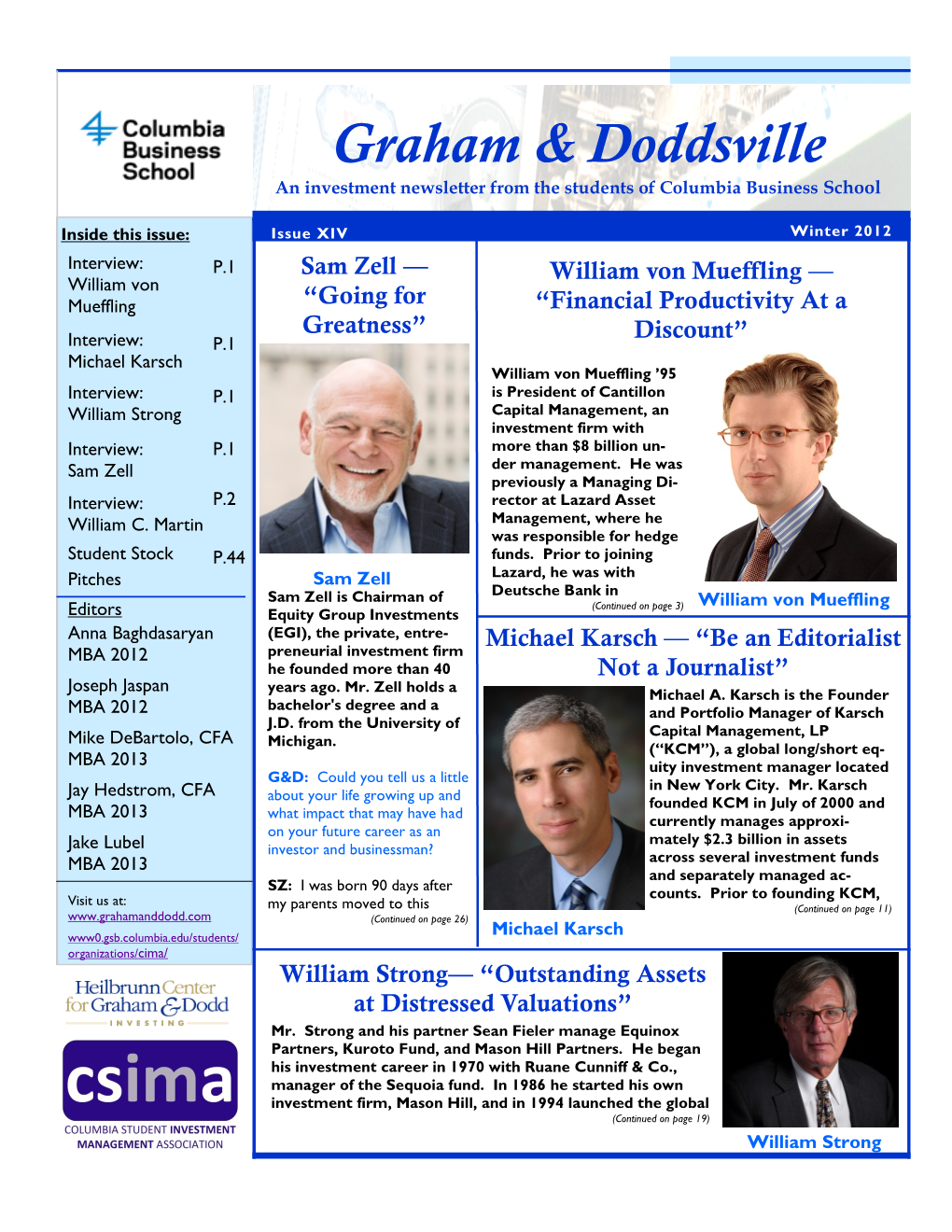

Graham & Doddsville

Graham & Doddsville An investment newsletter from the students of Columbia Business School Inside this issue: Issue XIII Fall 2011 Interview: p1 Lee Cooperman Mario Gabelli — “Think Like an Leon Cooperman — “Buying Owner” Interview: p1 Straw Hats in Mario Gabelli Mario Gabelli ’67, CFA, the Winter” started his career as an Interview: p1 automotive and farm Marty Whitman equipment analyst at Loeb Rhodes & Co. In Alumni Profile p25 1977 he founded GAMCO Investors Student Write- p29 (NYSE: GBL), where he is currently Chairman up: GLDD and CEO, as well as a portfolio manager and Student Write- p31 the company’s largest up: MSG shareholder. GAMCO now manages roughly Editors $36 billion dollars across open and closed-end mu- Anna Baghdasaryan tual funds, institutional Mario Gabelli MBA 2012 and private wealth man- sity and his M.B.A. from Joseph Jaspan Leon Cooperman agement, and invest- ment partnerships. Mr. Columbia Business School. MBA 2012 Leon “Lee” Cooperman ’67, Gabelli earned his B.S. (Continued on page 12) CFA, began his post- from Fordham Univer- Mike DeBartolo, CFA business school career in MBA 2013 1967 with Goldman Sachs. In addition to holding a Marty Whitman — “Business Skill Jay Hedstrom, CFA number of key positions MBA 2013 within the firm, Mr. Cooper- Critical to Investment Success” Jake Lubel man was founder, Chairman and Chief Executive Officer Mr. Whitman founded MBA 2013 of Goldman’s Asset Manage- the predecessor to the ment division. In 1991, he Third Avenue Funds in Visit us at: left the firm to launch 1986 and M.J. Whitman, a www.grahamanddodd.com Omega Advisors, Inc., a full service broker-dealer www0.gsb.columbia.edu/students/ value-oriented hedge fund affiliated with Third Ave- organizations/cima/ which now manages roughly nue in 1974. -

Brandes at a Glance

June 30, 2021 1974 Brandes Year Founded Value at a Glance Investment Style Bottom-up Investment Process Who We Are Total Assets $23.7 Billion We are a global investment advisory firm serving ($21.3 Billion AUM/ $2.4 Billion AUA1) the needs of investors, including individuals, 100% financial advisors, institutions, foundations and Employee Owned endowments. 194 / 35 Among the first investment firms to invest Employees / Investment Professionals globally using a value approach, we manage a San Diego variety of equity and fixed-income strategies. Headquarters What You Can Expect from Us Dublin, Milwaukee, Singapore, Toronto • Value: A singular focus on value investing Global Offices • Global Reach: Company-centered investment process with a global, all-cap purview • Endurance: Navigating market cycles since 1974 Select Milestones • Independence: Our 100% employee ownership enables us to think long term 1974 Brandes Investment Partners founded How We Pursue Results 1990 Guided by the principles of Benjamin Graham, widely International Equity strategy launched considered the father of value investing, we seek to take 1991 advantage of market irrationality and short-term security U.S. Value Equity strategy launched mispricing by buying stocks and bonds that we believe are undervalued based on our estimates of their true worth. 1994 Emerging Markets Equity and We believe this is the best way we can pursue the International Small-Cap Equity strategies desired results for client portfolios over the long term. launched 1995 European Equity strategy launched Pioneer in Global Value Investing 1996 Europe office opened Developed markets Emerging and frontier markets 1999 Fixed-Income strategies from Europe Milwaukee-based Hilltop Capital acquired U.S. -

Strategic Investment Symposium Spring 2017

The Third Annual April 7, 2017 Time Activity Location 8:00 AM – 9:00 AM Registration / Meet and Greet Tate Gallery 9:00 AM – 10:30 AM Global Markets Outlook Wells Fargo Auditorium 11:00 AM – 12:30 PM Value Investing Wells Fargo Auditorium 12:30 PM – 2:00 PM Keynote Luncheon Address Tate 202 2:00 PM – 3:30 PM Breakout Session 1 Session 1A: Value Strategies Beatty 220 Session 1B: Private Equity Investment Tate 207 Session 1C: Fixed Income Investment Tate 202 3:45 PM – 5:15 PM Breakout Session 2 Session 2A: Real Estate Investing Tate 207 Session 2B: Financial Technology Tate 202 5:15 PM – 6:30 PM Cocktail Reception Tate Gallery 5 Liberty Street, Charleston, SC Global Markets Outlook Panel 8:00 AM – 9:30 AM – Wells Fargo Auditorium Jay Tucker – Chief Operating Officer – George Weiss & Associates – New York, NY Mr. Tucker joined George Weiss in 2008. He began his tenure with the firm as a Portfolio Manager for the Rates/FX strategy. Previously, in 2003, he opened the macro fund, East Wind Capital Partners, LP, as well as East Wind Capital International, Ltd. Prior to that, Mr. Tucker spent a year’s managing a macro fund for Troubh Partners. Between 1997 and 1999, he managed $75 million for Caxton in a macro/emerging markets portfolio. He spent 11 years at Credit Suisse First Boston beginning in 1985, managing foreign exchange and local emerging markets trading. Mr. Tucker also worked at Dean Witter trading currencies and began his career in 1980 at Mocatta Metals trading gold and foreign exchange. -

Investor Relations

Notes from Omaha Reflections from Berkshire Hathaway & the 8th Annual Value Investor Conference Omaha, Nebraska 28 – 30 April 2011 Quotes It is not what happens to people that is significant but what they think happens to them Robert Hagstrom Legg Mason Growth Trust Everyday I am lucky if I have learnt something – I am doubly lucky if it hasn’t cost me anything Chuck Akre CEO Akre Capital The meek shall inherit the earth – but will they stay that way? Warren Buffett CEO Berkshire Hathaway Why do we look for new ways to lose money when the old ones were working pretty well John Stumpf CEO Wells Fargo 8th Annual Value Investor Conference 2011 University of Nebraska at Omaha, College of Business Thursday, 28 April and Friday 29 April Tom Gayner President and CIO, Markel Corporation Charles Brandes Brandes Investment Partners Bill Child Chairman, R C Wiley Home Furnishings Robert Hagstrom Portfolio Manager, Legg Mason Trust Chuck Akre CEO Akre Capital Pat Dorsey Director of Research, Sanibel Captiva Trust Tom Russo Partner, Gardner Russo and Gardner Robert Cialdini New York Times best selling author Berkshire Hathaway Annual Shareholders’ Meeting Qwest Center, Omaha, Nebraska Saturday 30 April 2011 “We’re the perfect pair, I can see and Charlie can hear” Warren Buffett Charlie Munger CEO Director Berkshire Hathaway Berkshire Hathaway Warren Buffett 80 year old CEO of Berkshire Hathaway (b 30 Aug 1930) Investor, businessman and philanthropist Estimated net worth around $50bn – currently third wealthiest man in the world In 2006 made commitment