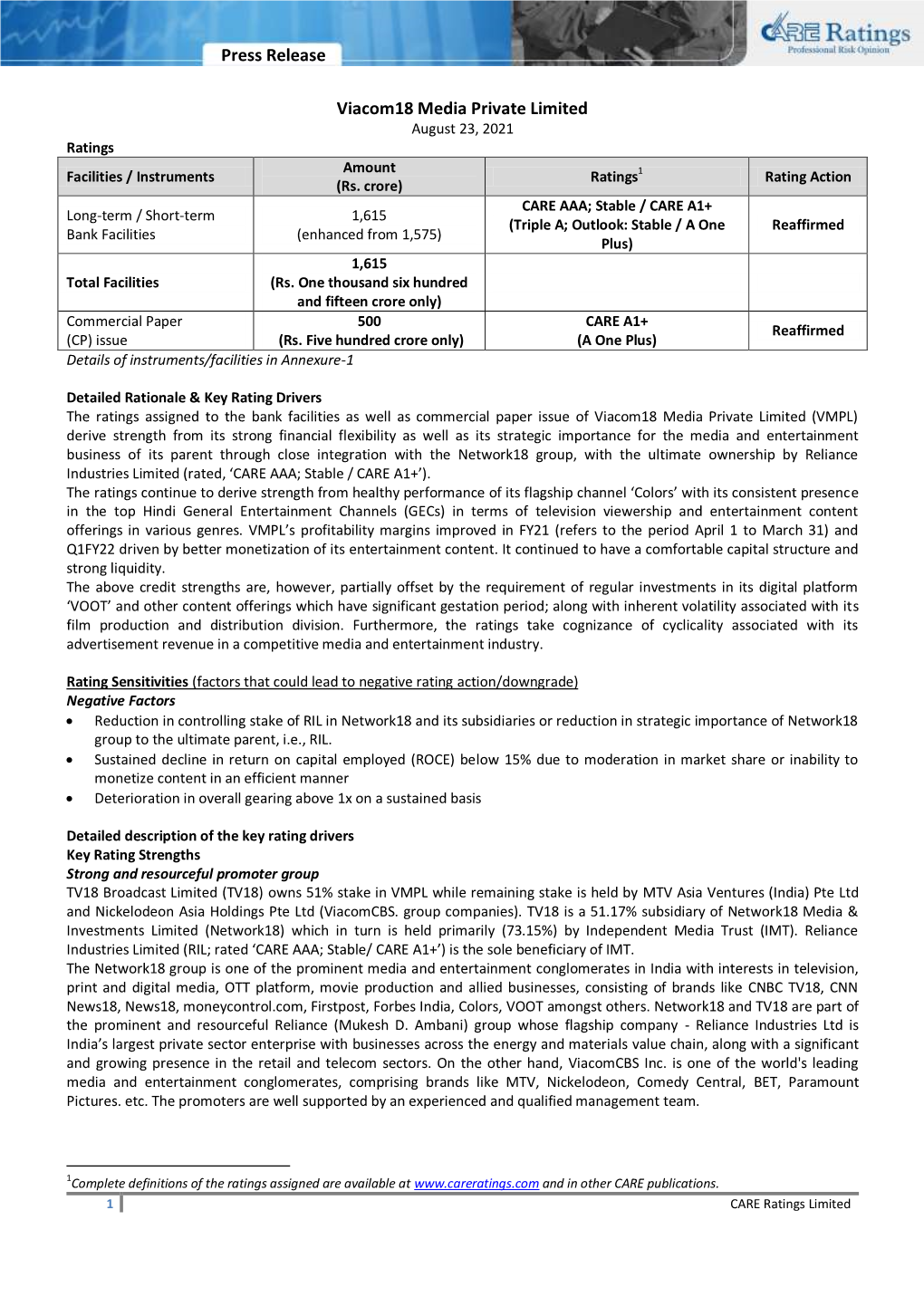

Press Release Viacom18 Media Private Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

EARNINGS RELEASE: Q4 and FY 2020-21

EARNINGS RELEASE: Q4 and FY 2020-21 Mumbai, 20th April, 2021 – Network18 Media & Investments Limited today announced its results for the quarter and financial year ended 31st March 2021. Consolidated EBITDA up 29% in COVID year; Highest ever EBITDA margins led by cost controls and innovative measures. PAT up by ~9x at Rs. 547 cr. Strong recovery in TV ad-growth to high single digits in Q4; Digital growing at fast clip TV News remains #1 on reach; margins expanded all through the year TV Entertainment grew viewership share by ~2% to 10.9%; full year margins highest ever Flagship GEC Colors returns to a strong #2 position during the year Entertainment OTT fastest to 1mn D2C subscribers within first year of launch Digital News breaks even for the full year; subscription the next engine of growth Summary Consolidated Financials Q4FY21 Q4FY20 Growth FY21 FY20 Growth Consolidated Operating Revenue (Rs Cr) 1,415 1,464 -3% 4,705 5,357 -12% Consolidated Operating EBITDA (Rs Cr) 279 225 24% 796 617 29% Operating EBITDA margin 19.7% 15.4% 16.9% 11.5% Highlights for Q4 Q4 Operating EBITDA up 24% YoY, Q4 Operating Margin expanded to highest ever ~20% Entertainment operating margins are at a healthy ~19% in Q4. News margins rose to highest ever levels of ~27% in Q4, led by 5% YoY revenue growth. Digital News maintained its break-even performance. Consolidated revenue ex-film production grew 2% YoY, despite deferral of award shows Highlights for FY2020-21 Consolidated Annual EBITDA margins rose to ~17%, the best ever inspite of COVID Group EBITDA up 29% YoY despite pandemic impact dragging revenue down 12% YoY. -

Viacom 18 Media Private Limited 1

VIACOM 18 MEDIA PRIVATE LIMITED 1 VIACOM 18 MEDIA PRIVATE LIMITED Financial Statements 2018-19 2 VIACOM 18 MEDIA PRIVATE LIMITED Independent Auditor’s Report To The Members of Viacom 18 Media Private Limited Report on the Audit of the Standalone Financial Statements Opinion We have audited the accompanying standalone Ind AS financial statements ofViacom 18 Media Private Limited (“the Company”), which comprise the Balance Sheet as at March 31, 2019, and the Statement of Profit and Loss (including Other Comprehensive Income), the Cash Flow Statement and the Statement of Changes in Equity for the year then ended, and a summary of significant accounting policies and other explanatory information. In our opinion and to the best of our information and according to the explanations given to us, the aforesaid standalone Ind AS financial statements give the information required by the Companies Act, 2013 (“the Act”) in the manner so required and give a true and fair view in conformity with the Indian Accounting Standards prescribed under section 133 of the Act read with the Companies (Indian Accounting Standards) Rules, 2015, as amended, (“Ind AS”) and other accounting principles generally accepted in India, of the state of affairs of the Company as at March 31, 2019, and its profit, total comprehensive income, its cash flows and the changes in equity for the year ended on that date. Basis for Opinion We conducted our audit of the standalone Ind AS financial statements in accordance with the Standards on Auditing specified under section 143(10) of the Act. Our responsibilities under those Standards are further described in the Auditor’s Responsibility for the Audit of the Standalone Ind AS Financial Statements section of our report. -

For the Quarter / Nine Months Ended December 31, 2019 – Media

-· Reliance Industries Limited January 17, 2020 BSE Limited National Stock Exchange of India Limited Phiroze Jeejeebhoy Towers Exchange Plaza Dalal Street Plot No. Cl1, G Block Mumbai 400 001 Bandra-Kurla Complex Sandra (East) Mumbai 400 051 Scrip Code: 500325 Trading Symbol: RELIANCE Dear Sirs, Sub: Media Release - Standalone and Consolidated Unaudited Financial Results for the quarter I nine-months ended December 31, 2019 In continuation of our letter of today's date on the Standalone and Consolidated Unaudited Financial Results for the quarter I nine months ended December 31, 2019, we send herewith a copy of Media Release issued by the Company in this regard. The Standalone and Consolidated Unaudited Financial Results for the quarter I nine months ended December 31, 2019 approved by the Board of Directors and the Media Release in this connection will also be available on the Company's website, 'www.ril.com'. Kindly acknowledge receipt. Thanking you, Yours faithfully, For Reliance Industries Limited joPl{ Savithri Parekh Joint Company Secretary and Compliance Officer Encl.: As above Copy to: The Luxembourg Stock Singapore Stock Taipei Stock Exchange Exchange Exchange 15F, No.100, Sec. 2, Societe de Ia Bourse de 2 Shenton Way, #19- 00 Roosevolt Road, Luxembourg SGX Centre 1, Taipei, Taiwan, 10084 35A boulevard Joseph II Singapore 068804 8 P 165, L-2011 Luxembourg Registered Office: Maker Chambers IV, 3rd Floor, 222, Nariman Point, Post Box: 11717, Mumbai- 400 021. India. Phones:+ 91-22-3555 5000. Telefax: +91-22-2204 2268, 2285 2214. -

February 17, 2020

February 17, 2020 The Manager, Listing Department The General Manager The National Stock Exchange of India Ltd. The Bombay Stock Exchange Limited Exchange Plaza Listing Department Bandra Kurla Complex 15th Floor, P J Towers Bandra (E) Mumbai-400 051 Dalal Street, Mumbai-400 001 NSE Trading Symbol- DEN BSE Scrip Code- 533137 Dear Sirs, Sub.: Media Release titled “Scheme of Amalgamation and Arrangement amongst Network18, TV18, Den & Hathway” Dear Sirs, Attached is the Media Release being issued by the Company titled “Scheme of amalgamation and Arrangement amongst Network18, TV18, Den & Hathway”. You are requested to take the above on record. Thanking You, FCS No. :6887 MEDIA RELEASE Scheme of Amalgamation and Arrangement amongst Network18, TV18, Den & Hathway Consolidates media and distribution businesses of Reliance Creates Media & Distribution platform comparable with global standards of reach, scale and integration News Broadcasting business of TV18 to be housed in Network18 Cable and Broadband businesses of Den and Hathway to be housed in two separate wholly-owned subsidiaries of Network18 February 17, 2020: Reliance Industries (NSE: RELIANCE) announced a consolidation of its media and distribution businesses spread across multiple entities into Network18. Under the Scheme of Arrangement, TV18 Broadcast (NSE: TV18), Hathway Cable & Datacom (NSE: HATHWAY) and Den Networks (NSE: DEN) will merge into Network18 Media & Investments (NSE: NETWORK18). The Appointed Date for the merger shall be February 1, 2020. The Board of Directors of the respective companies approved the Scheme of Amalgamation and Arrangement at their meetings held today. The broadcasting business will be housed in Network18 and the cable and ISP businesses in two separate wholly owned subsidiaries of Network18. -

Network18 Media & Investments Limited – Update on Material Event Rationale

April 29, 2021 Network18 Media & Investments Limited – Update on Material Event Summary of rating(s) outstanding Previous Rated Amount Current Rated Amount Instrument* Rating Outstanding (Rs. crore) (Rs. crore) Commercial Paper Programme 1,500.0 1,500.0 [ICRA]A1+ Overdraft / Working Capital 30.0 30.0 [ICRA]A1+ Demand Loan Short-term Unallocated Limits 470.0 470.0 [ICRA]A1+ Total 2,000.00 2,000.00 *Instrument details are provided in Annexure-1 Rationale On February 17, 2020, Network18 intimated the stock exchanges regarding a scheme of amalgamation and arrangement amongst Network18, TV18, DEN Networks Limited (DEN) and Hathway Cable & Datacom Limited (Hathway). Under the scheme, DEN, Hathway and TV18 were to merge into Network18 with effect from February 1, 2020, subject to receipt of necessary approvals; to consolidate Reliance Industries Limited’s (RIL, rated [ICRA]AAA (Stable) / [ICRA]A1+ and Baa2 Stable by Moody’s Investors Service) media and distribution business spread across multiple entities into Network18. The company again announced on April 20, 2021 that considering more than a year has passed from the time the Board considered the Scheme, the Board of the Company has decided not to proceed with the arrangement envisaged in the Scheme. ICRA has taken cognizance of the above and the rating remains unchanged at the earlier rating of [ICRA]A1+ as the company would continue with the existing corporate structure. Please refer to the following link for the previous detailed rationale that captures Key rating drivers and their description, Liquidity position, Rating sensitivities,: Click here Analytical approach Analytical Approach Comments Corporate Credit Rating Methodology Applicable Rating Methodologies Rating Methodology for Media Broadcasting Industry Impact of Parent or Group Support on an Issuer’s Credit Rating Parent / Group Company: RIL Group. -

Investor Presentation Creating a Diversified Media and Distribution Powerhouse Synopsis of Transaction

TV Investor Presentation Creating a Diversified Media and Distribution Powerhouse Synopsis of transaction Merging of RIL’s media & distribution businesses into Network18 Listed entities TV18, Den and Hathway to be merged into Network18 Network18 shares to be issued to shareholders of all of the above in swap-ratio as determined by valuers Ring-fencing of businesses by placing in wholly owned subsidiaries (WOS) Cable Distribution, Internet Service Provider (ISP) and Digital businesses and investments to be placed under separate WOS’s of Network18 – Cable Co, ISP Co & Digital Co Resultant: Diversified business, with better visibility and control Network18 standalone = News Broadcasting business of TV18 Cable Co = Combined Cable business of Den and Hathway + stake in GTPL ISP Co = Combined ISP business of Den and Hathway Digital Co = Digital News business (New18.com, FirstPost, MoneyControl) Unique combination of content & distribution across linear and digital Net debt free company. Mid-cap stock with ~2000 Cr market-cap Flagship Media & Distribution entity of Reliance group 2 Simplification of the listed media & distribution businesses of the group Current Structure Reliance Industries Ltd Sole (“RIL”) Sole Beneficiary Beneficiary Digital Media Independent Distribution Media Trust Trust Erstwhile Erstwhile RIL RIL RIL Public Public Den Public Hathway Companies Companies Promoters Companies Promoters 78.7% 13.4% 7.9% 72.0% 5.9% 22.1% 75.0% 25.0% NW18 (Listed) DEN Hathway 39.6% (Listed) (Listed) 51.2% TV18 IMT + RIL (Listed) Cos: -

BEST U.S. COLLEGES–AND the ONES to AVOID/Pg.82 RNI REG

BEST U.S. COLLEGES–AND THE ONES TO AVOID/Pg.82 RNI REG. NO. MAHENG/2009/28102 INDIA PRICEPRICE RSRS. 100100. AUGUST 2323, 2013 FORBES INDIA INDEPENDENCESpecial Issue Day VOLUME 5 ISSUE 17 TIME TO Pg.37 INDIA AUGUST 23, 2013 BRE A K INDEPENDENCE DAY SPECIAL FREThe boundaries of E economic, political and individual freedom need to be extended www.forbesindia.com LETTER FROM THE EDITOR-IN-CHIEF Towards Greater Freedom or a country that became politically free in 1947 and took a stab at economic freedom in 1991, the script in 2013 could not have been worse: An economy going downhill, a currency into free fall, and a widespread Ffeeling of despondency and frustration. A more full-blooded embrace of markets should have brought corruption down and increased competition for the benefi t of customers and citizens alike. But that was not the path we took over the last decade. An expanding pie should have provided adequate resources for off ering safety nets to the really poor even while leaving enough with the exchequer to fund public goods. But India is currently eating the seedcorn of future growth with mindless social spending. Corruption has scaled new heights, politicians have been found hand-in-glove with businessmen to hijack state resources for private ends, and a weakened state is opting for even harsher laws and an INDIA ever-expanding system of unaff ordable doles to maintain itself in power. Politicians have raided the treasury for private purposes, and businessmen fi nd more profi t in rent-seeking behaviour than in competing fairly in the marketplace. -

March 2020 from the Editor

MARCH 2020 FROM THE EDITOR: A visionary leader or a company that has contributed to or had a notable impact on the society is known as a game changer. India is a land of such game changers where a few modern Indians have had a major impact on India's development through their actions. These modern Indians have been behind creating a major impact on the nation's growth story. The ones, who make things happen, prove their mettle in current time and space and are highly SHILPA GUPTA skilled to face the adversities, are the true leaders. DIRECTOR, WBR Corp These Modern India's Game Changers and leaders have proactively contributed to their respective industries and society at large. While these game changers are creating new paradigms and opportunities for the growth of the nation, they often face a plethora of challenges like lack To read this issue online, visit: of funds and skilled resources, ineffective strategies, non- globalindianleadersandbrands.com acceptance, and so on. WBR Corp Locations Despite these challenges these leaders have moved beyond traditional models to find innovative solutions to UK solve the issues faced by them. Undoubtedly these Indian WBR CORP UK LIMITED 3rd Floor 207 Regent Street, maestros have touched the lives of millions of people London, Greater London, and have been forever keen on exploring beyond what United Kingdom, is possible and expected. These leaders understand and W1B 3HH address the unstated needs of the nation making them +44 - 7440 593451 the ultimate Modern India's Game Changers. They create better, faster and economical ways to do things and do INDIA them more effectively and this issue is a tribute to all the WBR CORP INDIA D142A Second Floor, contributors to the success of our great nation. -

Viacom18 Media Private Limited– Update on Material Event Rationale

April 29, 2021 Viacom18 Media Private Limited– Update on Material Event Summary of rating(s) outstanding Previous Rated Amount Current Rated Amount Instrument* Rating Outstanding (Rs. crore) (Rs. crore) Commercial Paper Programme 500.0 500.0 [ICRA]A1+ Short-term, Fund-based/Non 1,610.7 1,610.7 [ICRA]A1+ fund based Limits Total 2,110.7 2,110.7 *Instrument details are provided in Annexure-1 Rationale On February 17, 2020, Network18 intimated the stock exchanges regarding a scheme of amalgamation and arrangement amongst Network18, TV18, DEN Networks Limited (DEN) and Hathway Cable & Datacom Limited (Hathway). Under the scheme, DEN, Hathway and TV18 were to merge into Network18 with effect from February 1, 2020, subject to receipt of necessary approvals to consolidate Reliance Industries Limited’s (RIL, rated [ICRA]AAA (Stable) / [ICRA]A1+ and Baa2 Stable by Moody’s Investors Service) media and distribution business spread across multiple entities into Network18. The company again announced on April 20, 2021 that considering more than a year has passed from the time the Board considered the Scheme, the Board of the Company has decided not to proceed with the arrangement envisaged in the Scheme. ICRA has taken cognizance of the above and the rating remain unchanged at the earlier rating of [ICRA]A1+ as the parent company, TV18 would continue with the existing corporate structure. Please refer to the following link for the previous detailed rationale that captures Key rating drivers and their description, Liquidity position, Rating sensitivities,: Click here Analytical approach Analytical Approach Comments Corporate Credit Rating Methodology Applicable Rating Methodologies Rating Methodology for Media Broadcasting Industry Impact of Parent or Group Support on an Issuer’s Credit Rating Parent / Group Company: RIL Group. -

Meals. Movies. Masti at Bookmyshow.Com ~ Buy a Mcdonald’S Meal and Win FREE YEAR LONG MOVIE TICKETS ~

For Immediate Release: Meals. Movies. Masti at Bookmyshow.com ~ Buy a McDonald’s meal and win FREE YEAR LONG MOVIE TICKETS ~ Mumbai, 2nd February 2011: A hearty meal should always be followed by a good movie! Those who believe in this mantra, here is an offer you can‟t resist! For all film fanatics and foodies, Bookmyshow.com, India‟s fastest growing and largest entertainment ticketing website, and McDonald‟s India, in association with VISA bring an irresistible, wallet-friendly offer - Meals. Movies. Masti; eat to your heart‟s content, treat yourself to Movies and have lots of Masti! All you have to do is grab your favourite McDonald‟s meal (Except Breakfast Meal) and you get a chance to win free movie tickets for the Whole Year, by using your VISA Debit or Credit Card! Buy a McDonald‟s meal to get an „offer coupon‟, which also entitles you to an assured discount of Rs. 100 on your next purchase of two or more movie tickets on Bookmyshow.com, by using your VISA Debit or Credit Card. To avail this offer, one has to SMS the code mentioned on the „offer coupon‟ to 51818. A 16 digit unique “WINPIN code” will be sent as response via an SMS. This WINPIN, when entered on the payment page of the website under the “Exciting Offers” section, will entitle a customer to avail a discount of Rs. 100/- on the purchase of two or more movie tickets using the Visa Debit or Credit Card. That‟s not all… 1500 lucky winners chosen by Bookmyshow.com will stand a chance to win 24 movie tickets FREE for an entire year! Commenting on the promotion, Mr. -

Corporate Presentation Media & Investments

Media & Investments Corporate Presentation FY19-20 OVERVIEW 2 Key Strengths Leading Media company in India with largest bouquet of channels (56 domestic channels and 16 international beams), and a substantial digital presence Market-leader in multiple genres (Business News #1, Hindi General News & Entertainment #2 Urban, Kids #1, English #1) Key “Network effect” and play on Vernacular media growth - Benefits of Strengths Regional portfolio across News (14) and Entertainment (9) channels Marquee Digital properties (MoneyControl, BookMyShow) & OTT video (VOOT) provides future-proof growth and content synergy Experienced & Professional management team, Strong promoters 3 Network18 group : TV & Digital media, specialized Print & Ticketing ~75% held by Independent Media Trust, of which RIL is Network18 Strategic Investment the sole beneficiary Entertainment Ticketing & Live Network18 has ~39% stake Digital News Broadcasting Print + Digital Magazines Business Finance News Auto Entertainment News & Niche Opinions Infotainment All in standalone entity Network18 holds ~92% in Moneycontrol. Network18 holds ~51% of subsidiary TV18. Others are in standalone entity. TV18 in turn owns 51% in Viacom18 and 51% in AETN18 (see next page for details) TV18 group – Broadcasting pure-play, across News & Entertainment ENTITY GENRE CHANNELS Business News (4 channels, 1 portal) Standalone entity TV18 TV18 General News Group (Hindi & English) Regional News 50% JV with Lokmat group (14 geographies) IBN Lokmat AETN18 Infotainment (Factual & Lifestyle) 51% subsidiary -

Federal Communications Commission Record FCC 94-54

9 FCC Red No. 7 Federal Communications Commission Record FCC 94-54 action, as well as further comments, and Viacom responded Before the only to the QVC comments. Shortly after more than 50.1 Federal Communications Commission percent of Paramount shareholders tendered their stock to Washington, D.C. 20554 Viacom on February 14, 1993, QVC terminated its tender offer, requested that the Commission dismiss its pending long-form applications, and indicated that it would not In re Applications of pursue its opposition to Viacom©s application.3 VIACOM INC. File Nos. BTCCT-930921KG BACKGROUND through KM 2. Revised several times since the Commission granted an STA to trustee Robinson, Viacom©s tender offer for For Commission Consent to purchase of 50.1 percent of Paramount common stock at the Transfer of Control of $107 per share constitutes the first step in a two-tiered Paramount Communications Inc. process for acquiring the entire common stock interest in Paramount. The "second step merger" involves the conver sion of the remaining 49.9 percent of Paramount common MEMORANDUM OPINION AND ORDER stock issued and outstanding into the right to receive a package of Viacom securities.4 Upon completion of the Adopted: March 8, 1994; Released: March 8, 1994 merger, National Amusements, Inc. (NAI), which currently is the single majority shareholder of Viacom, will hold 62 By the Commission: percent of the merged entity©s voting stock.5 NAI, in turn, is, and will continue to be, controlled by Sumner M. 1. On November 23, 1993, the Commission granted a Redstone, in his capacity as trustee of the Sumner M.