Full Page Photo

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Declaration Under Sec 4(4)

KABLE FIRST INDIA PRIVATE LIMITED BANGALORE Declaration under Section 4(4) of the Telecommunication (Broadcasting and Cable) Services Interconnection (Addressable Systems) Regulations, 2017 (No. 1 of 2017) 4(4) a: Target Market : States/Parts of State covered as "Coverage Area" Bangalore 4(4) b: Total Channel carrying capacity Distribution Network Location / States / Parts of State covered Capacity in SD Headend as "Coverage Area" Terms Bangalore Bangalore 543 Kindly Note : 1. Local Channels considered as 1 SD; 2. Consideration in SD Terms is clarified as 1 SD = 1 SD; 1 HD = 2SD; 3. Number of channels will vary within the area serviced by a distribution network location depending upon available Bandwidth Capacity. 4(4) c: List of Channels available on the network: Distribution Network Location: Bangalore Sl. No Service Name COUNT IN SD TERMS SD/HD 1 DD CHANDANA 1 SD 2 ZEE KANNADA 1 SD 3 COLORS KANNADA 1 SD 4 NAPTOL KANNADA 1 SD 5 COLORS SUPER 1 SD 6 STAR SUVARNA 1 SD 7 UDAYA TV 1 SD 8 BHIMA TV 1 SD 9 EXPRESS TV 1 SD 10 ZEE PICTURE 1 SD 11 PUBLIC MOVIES 1 SD 12 COLORS KANNADA CINEMA 1 SD 13 SUVARNA PLUS 1 SD 14 SIRI KANNADA 1 SD 15 UDAYA COMEDY 1 SD 16 UDAYA MOVIES 1 SD 17 PUBLIC MUSIC 1 SD 18 RAJ MUSIX KANNADA 1 SD 19 UDAYA MUSIC 1 SD 20 SUVARNA NEWS 1 SD 21 B TV News 1 SD 22 TV 9 KANNADA 1 SD 23 DIG VIJAY 1 SD 24 PUBLIC TV 1 SD 25 POWER TV 1 SD 26 NEWS18 KANNADA 1 SD 27 PRAJA TV NEWS 1 SD 28 TV 5 KANNADA NEWS 1 SD 29 RAJ NEWS KANNADA 1 SD 30 AAYUSH TV 1 SD 31 CHINTU TV 1 SD 32 ETV BAL BHARAT 1 SD 33 SRI SANKARA 1 SD 34 DD PODHIGAI 1 -

EARNINGS RELEASE: Q4 and FY 2020-21

EARNINGS RELEASE: Q4 and FY 2020-21 Mumbai, 20th April, 2021 – Network18 Media & Investments Limited today announced its results for the quarter and financial year ended 31st March 2021. Consolidated EBITDA up 29% in COVID year; Highest ever EBITDA margins led by cost controls and innovative measures. PAT up by ~9x at Rs. 547 cr. Strong recovery in TV ad-growth to high single digits in Q4; Digital growing at fast clip TV News remains #1 on reach; margins expanded all through the year TV Entertainment grew viewership share by ~2% to 10.9%; full year margins highest ever Flagship GEC Colors returns to a strong #2 position during the year Entertainment OTT fastest to 1mn D2C subscribers within first year of launch Digital News breaks even for the full year; subscription the next engine of growth Summary Consolidated Financials Q4FY21 Q4FY20 Growth FY21 FY20 Growth Consolidated Operating Revenue (Rs Cr) 1,415 1,464 -3% 4,705 5,357 -12% Consolidated Operating EBITDA (Rs Cr) 279 225 24% 796 617 29% Operating EBITDA margin 19.7% 15.4% 16.9% 11.5% Highlights for Q4 Q4 Operating EBITDA up 24% YoY, Q4 Operating Margin expanded to highest ever ~20% Entertainment operating margins are at a healthy ~19% in Q4. News margins rose to highest ever levels of ~27% in Q4, led by 5% YoY revenue growth. Digital News maintained its break-even performance. Consolidated revenue ex-film production grew 2% YoY, despite deferral of award shows Highlights for FY2020-21 Consolidated Annual EBITDA margins rose to ~17%, the best ever inspite of COVID Group EBITDA up 29% YoY despite pandemic impact dragging revenue down 12% YoY. -

Declaration Under Section 4 (4) of the Telecommunication (Broadcasting and Cable) Services Interconnection (Addressable System) Regulation, 2017 (No

Version 1.0/2019 Declaration Under Section 4 (4) of The Telecommunication (Broadcasting and Cable) Services Interconnection (Addressable System) Regulation, 2017 (No. 1 of 2017) 4(4)a: Target Market Distribution Network Location States/Parts of State covered as "Coverage Area" Bangalore Karnataka Bhopal Madhya Pradesh Delhi Delhi; Haryana; Rajasthan and Uttar Pradesh Hyderabad Telangana Kolkata Odisha; West Bengal; Sikkim Mumbai Maharashtra 4(4)b: Total Channel carrying capacity Distribution Network Location Capacity in SD Terms Bangalore 506 Bhopal 358 Delhi 384 Hyderabad 456 Kolkata 472 Mumbai 447 Kindly Note: 1. Local Channels considered as 1 SD; 2. Consideration in SD Terms is clarified as 1 SD = 1 SD; 1 HD = 2 SD; 3. Number of channels will vary within the area serviced by a distribution network location depending upon available Bandwidth capacity. 4(4)c: List of channels available on network List attached below in Annexure I 4(4)d: Number of channels which signals of television channels have been requested by the distributor from broadcasters and the interconnection agreements signed Nil Page 1 of 37 Version 1.0/2019 4(4)e: Spare channels capacity available on the network for the purpose of carrying signals of television channels Distribution Network Location Spare Channel Capacity in SD Terms Bangalore Nil Bhopal Nil Delhi Nil Hyderabad Nil Kolkata Nil Mumbai Nil 4(4)f: List of channels, in chronological order, for which requests have been received from broadcasters for distribution of their channels, the interconnection agreements -

Tata Consultancy Services Ltd. TV18 Broadcast Ltd

Tata Consultancy Services TV18 BroadcastLtd. Ltd. RESULT UPDATE 12th October, 2017 RESULT UPDATE 19th April2017 India Equity Institutional Research II Result Update – Q2FY18 II 12th October, 2017 Page 2 TV 18 Broadcast Ltd. Niche Channels Started Bearing Fruit !! CMP Target Potential Upside Market Cap (INR Mn) Recommendation Sector INR 40 INR 57 42.5% 69,174 BUY Media Result highlights •TV18 reported its Q2 FY18 results, where revenues fell below our estimates but margins have improved on yoy basis •Revenue stood at INR 2,272 Mn, up 4% qoq and down 5% yoy •EBITDA (under Ind AS consolidated) stood at INR (1) Mn in Q2 FY18, an improvement over INR (109 Mn) in Q2 FY17 •PAT was recorded at INR 75 Mn in Q2 FY18, versus INR 51 Mn in Q2 FY17, primarily due to improvement in performance of JVs and gaining operating efficiency MARKET DATA KEY FINANCIALS Shares outs (Mn) 1714 Particulars (INR Mn) FY17 FY18E FY19E EquityCap (INR Mn) 3429 Net Sales 9794 10083 10,890 Mkt Cap (INR Mn) 69174 EBITDA 313 445 2,178 52 Wk H/L (INR) 50/33 PAT 191 1520 3,267 EPS 0.11 0.89 1.91 Volume Avg (3m K) 6444.5 OPM 3.2% 4.4% 20.0% Face Value (INR) 2 NPM 2.0% 15.1% 30.0% Bloomberg Code TV18 IN Source: Company, KRChoksey Research SHARE PRICE PERFORMANCE Highlights of Q2 FY18 (i) Revenues in Q2 FY18 were largely subdued, as the market is reviving from GST implications, and traders are still cautious to increase their spending for advertisements. -

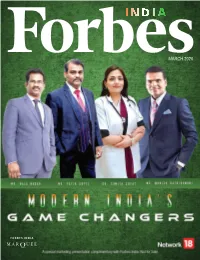

March 2020 from the Editor

MARCH 2020 FROM THE EDITOR: A visionary leader or a company that has contributed to or had a notable impact on the society is known as a game changer. India is a land of such game changers where a few modern Indians have had a major impact on India's development through their actions. These modern Indians have been behind creating a major impact on the nation's growth story. The ones, who make things happen, prove their mettle in current time and space and are highly SHILPA GUPTA skilled to face the adversities, are the true leaders. DIRECTOR, WBR Corp These Modern India's Game Changers and leaders have proactively contributed to their respective industries and society at large. While these game changers are creating new paradigms and opportunities for the growth of the nation, they often face a plethora of challenges like lack To read this issue online, visit: of funds and skilled resources, ineffective strategies, non- globalindianleadersandbrands.com acceptance, and so on. WBR Corp Locations Despite these challenges these leaders have moved beyond traditional models to find innovative solutions to UK solve the issues faced by them. Undoubtedly these Indian WBR CORP UK LIMITED 3rd Floor 207 Regent Street, maestros have touched the lives of millions of people London, Greater London, and have been forever keen on exploring beyond what United Kingdom, is possible and expected. These leaders understand and W1B 3HH address the unstated needs of the nation making them +44 - 7440 593451 the ultimate Modern India's Game Changers. They create better, faster and economical ways to do things and do INDIA them more effectively and this issue is a tribute to all the WBR CORP INDIA D142A Second Floor, contributors to the success of our great nation. -

Viacom18 Media Private Limited– Update on Material Event Rationale

April 29, 2021 Viacom18 Media Private Limited– Update on Material Event Summary of rating(s) outstanding Previous Rated Amount Current Rated Amount Instrument* Rating Outstanding (Rs. crore) (Rs. crore) Commercial Paper Programme 500.0 500.0 [ICRA]A1+ Short-term, Fund-based/Non 1,610.7 1,610.7 [ICRA]A1+ fund based Limits Total 2,110.7 2,110.7 *Instrument details are provided in Annexure-1 Rationale On February 17, 2020, Network18 intimated the stock exchanges regarding a scheme of amalgamation and arrangement amongst Network18, TV18, DEN Networks Limited (DEN) and Hathway Cable & Datacom Limited (Hathway). Under the scheme, DEN, Hathway and TV18 were to merge into Network18 with effect from February 1, 2020, subject to receipt of necessary approvals to consolidate Reliance Industries Limited’s (RIL, rated [ICRA]AAA (Stable) / [ICRA]A1+ and Baa2 Stable by Moody’s Investors Service) media and distribution business spread across multiple entities into Network18. The company again announced on April 20, 2021 that considering more than a year has passed from the time the Board considered the Scheme, the Board of the Company has decided not to proceed with the arrangement envisaged in the Scheme. ICRA has taken cognizance of the above and the rating remain unchanged at the earlier rating of [ICRA]A1+ as the parent company, TV18 would continue with the existing corporate structure. Please refer to the following link for the previous detailed rationale that captures Key rating drivers and their description, Liquidity position, Rating sensitivities,: Click here Analytical approach Analytical Approach Comments Corporate Credit Rating Methodology Applicable Rating Methodologies Rating Methodology for Media Broadcasting Industry Impact of Parent or Group Support on an Issuer’s Credit Rating Parent / Group Company: RIL Group. -

APNA CHOICE HINDI 225 225 ### (Pay Channels + Delhi FTA)

A DELHI / HARYANA /UTTAR PRADESH HATHWAY RECOMMENDED PACK DRP ₹ a (Excluding Tax) APNA CHOICE HINDI 225 225 ### (Pay Channels + Delhi FTA) SD 53 PAY CHANNELS HD 0 TOTAL: 53 LANGUAGE ~ GENRE CHANNEL NAME(S) CHANNEL TYPE ASSAMESE NEWS NEWS18 ASSAM/NE SD ENGLISH MUSIC VH1 SD ENGLISH NEWS CNBC TV18 SD CNN NEWS18 SD ET NOW SD INDIA TODAY SD MIRROR NOW SD NDTV 24X7 SD NDTV PROFIT SD TIMES NOW SD HINDI GEC COLORS SD COLORS RISHTEY SD SONY SD SONY PAL SD SONY SAB SD STAR BHARAT SD STAR PLUS SD STAR UTSAV SD ZOOM SD HINDI MOVIE COLORS CINEPLEX SD MOVIES OK SD SONY MAX SD SONY MAX 2 SD SONY WAH SD STAR GOLD SD STAR UTSAV MOVIES SD HINDI MUSIC MTV SD MTV BEATS SD SONY MIX SD HINDI NEWS AAJ TAK SD CNBC AWAAZ SD NDTV INDIA SD NEWS18 BR/JH SD NEWS18 INDIA SD NEWS18 MPCG SD NEWS18 RAJASTHAN SD NEWS18 UP/UK SD TEZ SD INFOTAINMENT FYI TV18 SD Page 1 of 186 HISTORY TV18 SD NAT GEO WILD SD NATIONAL GEOGRAPHIC SD NDTV GOODTIMES SD KIDS NICK SD NICK JR SD SONIC SD SONY YAY SD PUNJABI NEWS NEWS18 PB/HR/HP SD SPORTS STAR SPORTS 1 HINDI SD STAR SPORTS 2 SD STAR SPORTS 3 SD STAR SPORTS FIRST SD URDU NEWS NEWS18 URDU SD HATHWAY RECOMMENDED PACK DRP ₹ a (Excluding Tax) APNA CHOICE HINDI 275 275 ### (Pay Channels + Delhi FTA) SD 85 PAY CHANNELS HD 0 TOTAL: 85 LANGUAGE ~ GENRE CHANNEL NAME(S) CHANNEL TYPE ASSAMESE NEWS NEWS18 ASSAM/NE SD BHOJPURI GEC BIG GANGA SD ENGLISH MUSIC VH1 SD ENGLISH NEWS BBC WORLD NEWS SD CNBC TV18 SD CNN NEWS18 SD ET NOW SD INDIA TODAY SD MIRROR NOW SD NDTV 24X7 SD NDTV PROFIT SD TIMES NOW SD GUJARATI NEWS ZEE 24 KALAK SD HINDI GEC &TV -

Corporate Presentation Media & Investments

Media & Investments Corporate Presentation FY19-20 OVERVIEW 2 Key Strengths Leading Media company in India with largest bouquet of channels (56 domestic channels and 16 international beams), and a substantial digital presence Market-leader in multiple genres (Business News #1, Hindi General News & Entertainment #2 Urban, Kids #1, English #1) Key “Network effect” and play on Vernacular media growth - Benefits of Strengths Regional portfolio across News (14) and Entertainment (9) channels Marquee Digital properties (MoneyControl, BookMyShow) & OTT video (VOOT) provides future-proof growth and content synergy Experienced & Professional management team, Strong promoters 3 Network18 group : TV & Digital media, specialized Print & Ticketing ~75% held by Independent Media Trust, of which RIL is Network18 Strategic Investment the sole beneficiary Entertainment Ticketing & Live Network18 has ~39% stake Digital News Broadcasting Print + Digital Magazines Business Finance News Auto Entertainment News & Niche Opinions Infotainment All in standalone entity Network18 holds ~92% in Moneycontrol. Network18 holds ~51% of subsidiary TV18. Others are in standalone entity. TV18 in turn owns 51% in Viacom18 and 51% in AETN18 (see next page for details) TV18 group – Broadcasting pure-play, across News & Entertainment ENTITY GENRE CHANNELS Business News (4 channels, 1 portal) Standalone entity TV18 TV18 General News Group (Hindi & English) Regional News 50% JV with Lokmat group (14 geographies) IBN Lokmat AETN18 Infotainment (Factual & Lifestyle) 51% subsidiary -

Corporate Presentation Media & Investments

Media & Investments Corporate Presentation FY18-19 OVERVIEW 2 Key Strengths Leading Media company in India with largest bouquet of channels (55 domestic channels and 16 international beams), and a substantial digital presence Market-leader in multiple genres (Business News #1, Hindi General News & Entertainment #2 Urban, Kids #1, English #1) Key “Network effect” and play on Vernacular media growth - Benefits of Strengths Regional portfolio across News (14) and Entertainment (8) channels Marquee Digital properties (MoneyControl, BookMyShow) & OTT video (VOOT) provides future-proof growth and content synergy Experienced & Professional management team, Strong promoters 3 Building India’s leading media company 2016+ • OTT video platform, revamp of portals Filling whitespaces, umbrella branding, • Hindi Movie and Music channels thrust on digital • News (TV+Digital) expanded and relaunched • ETV acquisition (Regional News +Entertainment) 2012-2015 • Indiacast setup for distribution of TV bouquet Regional entry to tap vernacular market • NW18 acquired by RIL, corporatization thrust • JVs with Viacom & A+E networks, Forbes 2005-2011 • Invest in Home shopping, Online Ticketing Entry into Entertainment and Digital • News, Opinions & Info portals 1999-2005 • Business News (CNBC cluster) Built core platforms and launched • General News (IBN cluster) flagships • Finance portal (MoneyControl) 4 Network18 group : TV & Digital media, specialized Print & Ticketing ~75% held by Independent Media Trust, of which RIL is Network18 Strategic Investment the sole beneficiary Entertainment Ticketing Network18 has ~39% stake Digital News Broadcasting Print + Digital Magazines Business Finance News Auto Entertainment News & Niche Opinions Infotainment All in standalone entity Infotainment Network18 holds ~51% of subsidiary TV18. TV18 in turn owns 51% in Viacom18 and 51% in AETN18 (see next page for details) Network18 holds ~92% in Moneycontrol. -

New Dpo Packs Upload on Website

DELHI / HARYANA / UTTAR PRADESH HINDI SUPER SAVER PACK 297.00 88 PAY CHANNELS + DELHI FTA PACK Excluding Tax Pay Channel Count SD 88 HD 0 Total: 88 LANG-GENRE CHANNEL_NAME CHANNEL TYPE Bhojpuri - Gec BIG GANGA SD Hindi - Gec COLORS SD Hindi - Gec COLORS RISHTEY SD Hindi - Gec BINDASS SD Hindi - Gec SONY TV SD Hindi - Gec SONY PAL SD Hindi - Gec SONY SAB SD Hindi - Gec BINDASS SD Hindi - Gec STAR BHARAT SD Hindi - Gec STAR PLUS SD Hindi - Gec STAR UTSAV SD Hindi - Gec &TV SD Hindi - Gec BIG MAGIC SD Hindi - Gec ZEE ANMOL SD Hindi - Gec ZEE TV SD Marathi - Gec SONY MARATHI SD English - Infotainment FYI TV18 SD Hindi - Infotainment HISTORY TV18 SD Hindi - Infotainment FOOD FOOD SD Multi Audio - Infotainment ANIMAL PLANET SD Multi Audio - Infotainment DISCOVERY CHANNEL SD Multi Audio - Infotainment TLC SD Multi Audio - Infotainment SONY BBC EARTH SD Multi Audio - Infotainment NAT GEO WILD SD Multi Audio - Infotainment NATIONAL GEOGRAPHIC SD Multi Audio - Infotainment LIVING FOODZ SD English - Kids NICK JR SD Hindi - Kids NICK SD Hindi - Kids SONIC SD Hindi - Kids CARTOON NETWORK SD Hindi - Kids POGO SD Multi Audio - Kids DISCOVERY KIDS SD Multi Audio - Kids DISNEY CHANNEL SD Multi Audio - Kids DISNEY JUNIOR SD Multi Audio - Kids HUNGAMA TV SD Multi Audio - Kids MARVEL HQ SD Multi Audio - Kids SONY YAY SD Hindi - Movie COLORS CINEPLEX SD Hindi - Movie UTV ACTION SD Hindi - Movie UTV MOVIES SD Hindi - Movie SONY MAX SD Hindi - Movie SONY MAX 2 SD Hindi - Movie SONY WAH SD Hindi - Movie MOVIES OK SD Hindi - Movie STAR GOLD SD Hindi - Movie STAR -

List of Bouquet Available on Dishtv Platform

List of Bouquet available on DishTV Platform Bouquet Broadcaster Bouquet Name Options Channel Price (Rs.) Discovery Communications India SD Bouquet 2 –INFOTAINMENT + SPORTS PACK Animal Planet 7 Discovery Channel Discovery Kids DSPORT TLC SD Bouquet 3 – INFOTAINMENT PACK Animal Planet 7 Discovery Channel Discovery Science Discovery Turbo Jeet Prime TLC SD Bouquet 7 – INFOTAINMENT (TAMIL) PACK Animal Planet 7 Discovery Channel Discovery Science Discovery Tamil Discovery Turbo Jeet Prime TLC HD Bouquet 1 – BASIC INFOTAINMENT HIGH DEFINITION PACK Animal Planet HD World 10 Discovery HD World Discovery Kids Discovery Science Discovery Turbo DSPORT Jeet Prime TLC HD WORLD HD Bouquet 2 – INFOTAINMENT + SPORTS HIGH DEFINITION PACK Animal Planet HD World 9 Discovery HD World Discovery Kids DSPORT TLC HD WORLD HD Bouquet 3 – INFOTAINMENT HIGH DEFINITION PACK Animal Planet HD World 9 Discovery HD World Discovery Science Discovery Turbo Jeet Prime TLC HD WORLD HD Bouquet 4 – KIDS INFOTAINMENT HIGH DEFINITION PACK Animal Planet HD World 8 Discovery HD World Discovery Kids TLC HD WORLD SD Bouquet 1 – BASIC INFOTAINMENT PACK Animal Planet 8 Discovery Channel Discovery Kids Discovery Science Discovery Turbo DSPORT Jeet Prime TLC SD Bouquet 4 – KIDS INFOTAINMENT PACK Animal Planet 6 Discovery Channel Discovery Kids TLC SD Bouquet 5 – BASIC INFOTAINMENT (TAMIL) PACK Animal Planet 8 Discovery Channel Discovery Kids Discovery Science Discovery Tamil Discovery Turbo DSPORT Jeet Prime TLC SD Bouquet 6 – INFOTAINMENT + SPORTS (TAMIL) PACK Animal Planet 7 Discovery Channel Discovery Kids Discovery Tamil DSPORT TLC SD Bouquet 8 – KIDS INFOTAINMENT (TAMIL) PACK Animal Planet 6 Discovery Channel Discovery Kids Discovery Tamil TLC Disney Broadcating (India) limited Kids Bouquet Disney Channel 12 Disney Junior Hungama tv MARVEL HQ Universal Bouquet Bindass 10 Disney Channel Disney Junior Hungama tv *GST Extra. -

Nifty Highlights

Result Update November 5, 2018 Rating matrix Rating : Hold Sun TV (SUNTV) | 629 Target : | 675 Target Period : 12-15 months Market share loss visible… Potential Upside : 6% Revenues came in at | 749.6 crore (up 10.9% YoY), lower than our What’s changed? estimate of | 763 crore. The miss was owing to advertisement Target Changed from | 920 to | 675 revenues, which witnessed 3.7% YoY growth vs. our estimate of 14% EPS FY19E Changed from | 35.9 to | 35.8 YoY growth). Subscription revenues came in at | 339.79 crore (21.3% EPS FY20E Changed from | 41.8 to | 37.5 YoY growth), much ahead of our estimate of 15.3% YoY growth, on Rating Changed from Buy to Hold account of continued benefits of Tamil Nadu digitisation EBITDA came in at | 554.3 crore, up 11.7% YoY, marginally below our Quarterly performance expectations of | 561.4 crore largely owing to lower topline. Margins Q2FY19 Q2FY18 YoY (%) Q1FY19 QoQ (%) at 73.9% were higher than our estimate of 73.5% Revenue 749.6 675.9 10.9 1,120.4 -33.1 The company reported profit of | 351.3 crore (vs. | 303.1 crore) on EBITDA 554.0 496.1 11.7 734.7 -24.6 account of lower depreciation and higher other income EBITDA (%) 73.9 73.4 51 bps 65.6 833 bps PAT 351.3 284.7 23.4 409.1 -14.1 The company has declared an interim dividend of | 2.5 per share, in addition to | 5 per share interim dividend declared during Q1FY19 Key financials Aims to wrest back market share loss; may result in higher content cost | Crore FY17 FY18 FY19E FY20E Sun TV’s Q2FY19 muted ad growth was reflective of its market share loss Net Sales 2,646 2,963 3,547 3,956 in the key Tamil market as it conceded that its ER was impacted owing to EBITDA 1,770 2,004 2,417 2,628 Net Profit 1,030 1,135 1,412 1,479 competitive pressure, resulting in impact on advertisements.