Introduction NYSE Euronext's IP Challenges

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Intraday Herding on a Cross-Border Exchange

CORE Metadata, citation and similar papers at core.ac.uk Provided by CURVE/open Intraday Herding on a Cross-Border Exchange Andrikopoulos, P, Kallinterakis, V, Pedro Leite Ferreira, M & Verousis, T Author post-print (accepted) deposited by Coventry University’s Repository Original citation & hyperlink: Andrikopoulos, P, Kallinterakis, V, Pedro Leite Ferreira, M & Verousis, T 2017, 'Intraday Herding on a Cross-Border Exchange' International Review of Financial Analysis, vol 53, pp. 25-36 https://dx.doi.org/10.1016/j.irfa.2017.08.010 DOI 10.1016/j.irfa.2017.08.010 ISSN 1057-5219 Publisher: Elsevier NOTICE: this is the author’s version of a work that was accepted for publication in International Review of Financial Analysis. Changes resulting from the publishing process, such as peer review, editing, corrections, structural formatting, and other quality control mechanisms may not be reflected in this document. Changes may have been made to this work since it was submitted for publication. A definitive version was subsequently published in International Review of Financial Analysis, [53, (2017)] DOI: 10.1016/j.irfa.2017.08.010 © 2017, Elsevier. Licensed under the Creative Commons Attribution- NonCommercial-NoDerivatives 4.0 International http://creativecommons.org/licenses/by-nc-nd/4.0/ Copyright © and Moral Rights are retained by the author(s) and/ or other copyright owners. A copy can be downloaded for personal non-commercial research or study, without prior permission or charge. This item cannot be reproduced or quoted extensively from without first obtaining permission in writing from the copyright holder(s). The content must not be changed in any way or sold commercially in any format or medium without the formal permission of the copyright holders. -

Filed by the NASDAQ OMX Group, Inc

Filed by The NASDAQ OMX Group, Inc. (Commission File No. 000-32651) Pursuant to Rule 425 under the Securities Act of 1933, as amended Subject Company: NYSE Euronext (Commission File No. 001-33392) NASDAQ OMX and ICE Issue Joint Statement on Superior Proposal New York, NY and Atlanta, GA (April 25, 2011) NASDAQ OMX (NDAQ) and IntercontinentalExchange (ICE) today issued a joint statement with regard to their superior proposal for NYSE Euronext: NYSE Euronext investors should be highly skeptical that after two years of exploratory merger discussions, including more than six months dedicated to finalizing the transaction, NYSE Euronext has suddenly found a reported €100 million in additional synergies. This increase appears not to be a matter of sharpening a pencil, but an unexplained shift in strategy. The discovery that initial synergies having been understated by one-third comes after receiving a superior proposal from NASDAQ OMX and ICE that achieves greater synergies. Importantly, if there are additional synergies to be found after the merger economics have been agreed, then it has to come at the expense of NYSE Euronext stockholders because there has been no increase in the price they are being offered. NYSE Euronext should describe these newly-found synergies in detail in order to support the credibility of these revised estimates, particularly in light of commitments to retain two technology platforms and two headquarters. Increasingly it appears that NYSE Euronext is more focused on protecting the transaction than its stockholders. NASDAQ OMX and ICE have described in detail our proven and focused long-term strategy from which stockholders would benefit and our companies demonstrated outperformance relative to their proposed strategy of creating a financial supermarket. -

Intercontinental Exchange Reports Ice and Nyse May Volume

INVESTORS INTERCONTINENTAL EXCHANGE REPORTS ICE AND NYSE MAY VOLUME Released : 04 June 2014 ATLANTA--(BUSINESS WIRE)-- Intercontinental Exchange, Inc. (NYSE: ICE), the leading global network of exchanges and clearing houses, today reported exchange traded volumes for May 2014. ICE’s May average daily volume (ADV) was 5.4 million contracts, a decrease of 15% compared to May 2013. • Commodity futures and options ADV decreased 23% in May due primarily to continued low price volatility across most energy products. • Financial futures and options ADV decreased 9% in May due primarily to the low interest rate environment in Europe. This was partially offset by a 23% increase in equity derivatives ADV year to year, including a 32% increase in Liffe single stock futures. • NYSE cash equities ADV decreased 13% and Euronext cash equities ADV was flat compared to the prior May. NYSE equity options volume decreased 23% year to year. ICE Futures & Options ADV (contracts in 000s) ADV May ADV May Change ADV YTD ADV YTD Change May ’13 2014 2013 y/y May ‘14 y/y COMMODITIES Energy Brent 594 670 -11% 617 712 -13% Gasoil 214 266 -19% 220 272 -19% Other Oil (1) 248 244 2% 254 255 0% TOTAL OIL 1,055 1,179 -10% 1,092 1,239 -12% Natural Gas (2) 714 1,241 -42% 983 1,363 -28% Power (3) 131 141 -7% 130 144 -10% Emissions & Other (4) 32 30 6% 48 46 5% TOTAL ENERGY 1,932 2,591 -25% 2,252 2,792 -19% Agricultural Sugar (5) 115 113 1% 167 146 15% Other Ags & Metals (6) 156 162 -4% 192 188 2% TOTAL AGRICULTURAL & METALS 270 276 -2% 360 334 8% TOTAL COMMODITIES 2,203 2,867 -23% 2,612 3,125 -16% FINANCIALS Interest Rates Short-term Interest Rates (7) 1,729 2,213 -22% 1,761 2,312 -24% Medium & Long-term Interest Rates (8) 195 233 -16% 177 192 -8% TOTAL INTEREST RATES 1,924 2,445 -21% 1,938 2,504 -23% TOTAL EQUITY DERIVATIVES (9) 1,297 1,058 23% 1,051 1,170 -10% TOTAL FX (10) 20 43 -54% 24 38 -38% TOTAL FINANCIALS 3,241 3,547 -9% 3,012 3,712 -19% TOTAL FUTURES & OPTIONS 5,444 6,414 -15% 5,625 6,837 -18% Note: Figures may not foot due to rounding. -

Equity Markets USD 47 Tn

19 January 2012 2011 WFE Market Highlights 2011 equity volumes remained stable despite a fall in market capitalization. Derivatives, bonds, ETFs, and securitized derivatives continued to grow strongly. Total turnover value remained stable in 2011 at USD 63 tn despite a sharp decrease of the global market capitalization (-13.6% at USD 47 tn). High volatility and global uncertainty created from the sovereign debt crisis affected volumes all year through and made August 2011 the most active month in terms of trading value, a highly unusual annual peak for markets. Despite overall unfavorable conditions for primary markets in several regions, WFE members increased their total listings by 1.7% totaling 45 953 companies listed. Total number of trades decreased by 6.4% at 112 tn. This trend combined with the stability of turnover value led to a small increase in the average size of transaction which was USD 8 700 in 2011. The high volatility and lack of confidence that affected financial markets globally probably drove the needs of hedging as derivatives contracts traded grew by 8.9%. WFE members continued to diversify their products range as other products such as bonds, ETFs, and securitized derivatives all had solid growth in 2011. Equity Markets Market capitalization USD 47 tn -13.6% Domestic market capitalization declined significantly in 2011 to USD 47 401 bn roughly back to the same level of end 2009. The decline affected almost all WFE members, as there were only four exchanges ending 2011 with a higher market capitalization. The magnitude of the decline is quite similar among the three time zones: -15.9% in Asia-Pacific, -15.2% in EAME and -10.8% in the Americas. -

Bonds Denominated in USD to List for the First Time on NYSE Euronext Lisbon Market BPI Quotes 12 Million on 12Th of March

CONTACT | Media: CONTACT | Investor Relations: +31.20.550.4488 (Amsterdam), +32.2.509.1392 (Brussels) +1.212.656.5700 (New York) +351.217.900.029 (Lisbon), +44.20.7379.2789 (London) +33.1.49.27.58.60 (Paris) +1.212.656.2411 (New York), +33.1.49.27.11.33 (Paris) Bonds denominated in USD to list for the first time on NYSE Euronext Lisbon market BPI quotes 12 million on 12th of March March 11, 2010 – NYSE Euronext (NYX) is pleased to welcome Banco Português de Investimento as the first listed issuer of non-euro currency on Euronext Lisbon. Banco Português de Investimento, a company with a market capitalization of € 1.750 billion, will list two bond issues denominated in USD on the Lisbon market of NYSE Euronext on 12th March 2010: • an issue of USD 6 million of Index Linked Interested Notes “BPI AMERICAN OUTPERFORMANCE 2010-2013” and • an issue of USD 6 million of Index Linked Interest Notes “BPI JPYUSD 350% 2010- 2013”. Both bonds will be issued under the BPI’s Euro Medium Term Note Programme. The listing of these two new products will see the start of a service to trade non-Euro currency via NYSE Euronext in Lisbon. The non-Euro settlement service will be provided by Interbolsa using the non-Euro payment system operated by Caixa Geral de Depósitos. Trading member firms will need to have a clearing member firm (CMF) and a settlement agent (SA) with a settlement account at Interbolsa for the securities side and an account with Caixa Geral de Depósitos for the cash side of the settlement process. -

Nyse Euronext Announces Implementation Team for New European Clearing Houses

CONTACT - Media: CONTACT - Investor Relations: nyx.com Amsterdam +31.20.550.4488 Brussels +32.2.509.1392 New York +1.212.656.5700 Please follow us at: Lisbon +351.217.900.029 London +44.20.7379.2789 Paris +33.1.49.27.58.60 Exchanges blog New York +1.212.656.2411 Paris +33.1.49.27.11.33 Facebook Twitter NYSE EURONEXT ANNOUNCES IMPLEMENTATION TEAM FOR NEW EUROPEAN CLEARING HOUSES LONDON, PARIS Wednesday 17 November 2010. Following its May announcement that it plans to launch two purpose-built clearing houses in London and Paris before the end of 2012, NYSE Euronext (NYX) today announced the leadership team which will be engaging with our customers and partners on the delivery of the project. Mark Ibbotson, formerly the Chief Operating Officer of NYSE Euronext’s Global Derivatives segment, will lead the implementation team as Executive Vice President, Global Clearing, reporting to Duncan Niederauer, the Group Chief Executive Officer. Reporting to Mr. Ibbotson will be Declan Ward, Executive Director of NYSE Liffe Clearing in London, and Michel Favreau, the Company’s Clearing Project Director in Paris. Mr. Niederauer said : “Our new European Clearing Houses will be central to our strategy of expanding our community, delivering value to customers and diversifying the business mix of NYSE Euronext. This initiative will substantially extend our post-trade capabilities and build on our existing London NYSE Liffe Clearing operations as well as our launch of NYPC in the U.S. early next year. Mark Ibbotson and his team have an exciting task ahead to develop new and innovative clearing solutions for our customers which will enable further growth in our trading franchises and open up new opportunities in clearing.” Mark Ibbotson added: “This is a very exciting opportunity to work with our customers and the wider community to develop purpose-built clearing houses in London and Paris which will deliver genuine added value to the marketplace. -

NZX Limited NZX Participant Rule Procedures

NZX Limited NZX Participant Rule Procedures Contents Section A: Interpretation and Construction ...................................................................... 3 A.1 Interpretation ................................................................................................................ 3 A.2 Construction ................................................................................................................. 3 Section 1: Error Trade Cancellation Procedure .............................................................. 4 1.1 Notice by Trading Participant ........................................................................................ 4 1.2 NZX Action ................................................................................................................... 4 1.3 Information to be provided to NZX ................................................................................ 5 1.4 Trading Error Register .................................................................................................. 5 Section 2: Capital Adequacy and Monthly Reporting ....................................................... 9 Capital Adequacy and Monthly Reporting Procedure ...................................................... Error! Bookm 2.1 Recognised Market Index ............................................................................................. 9 2.2 Recognised Market ..................................................................................................... 10 2.3 Monthly Reporting ........................................................ -

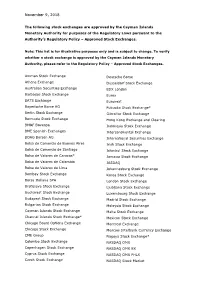

The List of Approved Stock Exchanges

November 9, 2018 The following stock exchanges are approved by the Cayman Islands Monetary Authority for purposes of the Regulatory Laws pursuant to the Authority’s Regulatory Policy – Approved Stock Exchanges. Note: This list is for illustrative purposes only and is subject to change. To verify whether a stock exchange is approved by the Cayman Islands Monetary Authority, please refer to the Regulatory Policy – Approved Stock Exchanges. Amman Stock Exchange Deutsche Borse Athens Exchange Dusseldorf Stock Exchange Australian Securities Exchange EDX London Barbados Stock Exchange Eurex BATS Exchange Euronext Bayerische Borse AG Fukuoka Stock Exchange* Berlin Stock Exchange Gibraltar Stock Exchange Bermuda Stock Exchange Hong Kong Exchange and Clearing BM&F Bovespa Indonesia Stock Exchange BME Spanish Exchanges Intercontinental Exchange BOAG Borsen AG International Securities Exchange Bolsa de Comercio de Buenos Aires Irish Stock Exchange Bolsa de Comercio de Santiago Istanbul Stock Exchange Bolsa de Valores de Caracas* Jamaica Stock Exchange Bolsa de Valores de Colombia JASDAQ Bolsa de Valores de Lima Johannesburg Stock Exchange Bombay Stock Exchange Korea Stock Exchange Borsa Italiana SPA London Stock Exchange Bratislava Stock Exchange Ljubljana Stock Exchange Bucharest Stock Exchange Luxembourg Stock Exchange Budapest Stock Exchange Madrid Stock Exchange Bulgarian Stock Exchange Malaysia Stock Exchange Cayman Islands Stock Exchange Malta Stock Exchange Channel Islands Stock Exchange* Mexican Stock Exchange Chicago Board Options Exchange -

The Dynamics of Stock Market Development in the United States of America

Risk governance & control: financial markets & institutions / Volume 3, Issue 1, 2013, Continued - 1 THE DYNAMICS OF STOCK MARKET DEVELOPMENT IN THE UNITED STATES OF AMERICA Sheilla Nyasha*, NM Odhiambo** Abstract This paper highlights the origin and development of the stock market in the United States of America. The country consists of several stock exchanges, with the three largest being the NYSE Euronext (NYX), National Association of Securities Dealers Automated Quotation (NASDAQ), and the Chicago Stock Exchange. Stock market reforms have been implemented since the stock market crash of 1929; and the exchanges responded positively to some of these reforms, but not so positively to some of the reforms. As a result of the reforms, the U.S. stock market has developed in terms of market capitalisation, the total value of stocks traded, and the turnover ratio. Although the U.S. stock market has developed over the years, its market still faces wide-ranging challenges. Keywords: United States of America, New York Stock Exchange Euronext, NASDAQ, Stock Market, Reforms *Department of Economics, University of South Africa, P.O Box 392, UNISA, 0003, Pretoria, South Africa Email: [email protected] **Corresponding author. Department of Economics, University of South Africa, P.O Box 392, UNISA, 0003, Pretoria, South Africa Email: [email protected], [email protected] 1 Introduction investors, but they also facilitate the inflow of foreign financial resources into the domestic economy; and Stock market development is an important component they promote risky, entrepreneurial investments of financial sector development, and it supplements through their risk-sharing and monitoring functions. the role of the banking system in economic Even the most recent studies have confirmed the vital development. -

Monthly Short Sales Client Specification

Document title MONTHLY SHORT SALES CLIENT SPECIFICATION NYSE MONTHLY SHORT SALES NYSE AMERICAN MONTHLY SHORT SALES NYSE ARCA MONTHLY SHORT SALES NYSE NATIONAL MONTHLY SHORT SALES (April 30, 2018) Version Date 1.2b February 5, 2018 © Copyright 2017 Intercontinental Exchange, Inc. ALL RIGHTS RESERVED. INTERCONTINENTAL EXCHANGE, INC. AND ITS AFFILIATES WHICH INCLUDE THE NEW YORK STOCK EXCHANGE, (“ICE” AND “NYSE”) MAKE NO WARRANTY WHATSOEVER AS TO THE PRODUCT DESCRIBED IN THESE MATERIALS EXPRESS OR IMPLIED, AND THE PRODUCT IS PROVIDED ON AN “AS IS” BASIS. ICE AND NYSE EXPRESSLY DISCLAIM ANY IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. NEITHER ICE, NYSE NOR THEIR RESPECTIVE DIRECTORS, MANAGERS, OFFICERS, AFFILIATES, SUBSIDIARIES, SHAREHOLDERS, EMPLOYEES OR AGENTS MAKE ANY WARRANTY WITH RESPECT TO, AND NO SUCH PARTY SHALL HAVE ANY LIABILITY FOR (i) THE ACCURACY, TIMELINESS, COMPLETENESS, RELIABILITY, PERFORMANCE OR CONTINUED AVAILABILITY OF PRODUCT, OR (ii) DELAYS, OMISSIONS OR INTERRUPTIONS THEREIN. ICE AND NYSE DO NOT, AND SHALL HAVE NO DUTY OR OBLIGATION TO, VERIFY, MONITOR, CONTROL OR REVIEW ANY INFORMATION IN RELATION TO THE PRODUCT. ICE/NYSE MONTHLY SHORT SALES CLIENT SPECIFICATION V1.2B PREFACE DOCUMENT HISTORY The following table provides a description of all changes to this document. VERSION DATE CHANGE DESCRIPTION NO. 1.0 01/02/2012 Approved version for release 1.1 6/13/2012 Updated references to NYSE MKT 08/03/2012 Document rebranded with new NYSE Technologies template 1.2 02/24/2017 Rebranded to ICE -

Appendix a – Integrated Exchanges Integrated Exchanges

Appendix A – Integrated Exchanges Integrated exchanges The integrated exchange model exists in several market places BM&F TMX TMX ASX DB Bovespa (CURRENT) (Alpha+CDS) Trading Equities Exchange Fixed Income Exchange Derivatives Exchange ATS Clearing & Settlement Equities Fixed Income Derivatives Depository Equities Fixed Income Derivatives Source: Public filings ASX is fully integrated, offering multi-asset trading and post-trade operations Listed Derivatives/ Equities Fixed Income Energy OTC Derivatives ASX Ownership ASX Bilateral National Stock Exchange ASX Group Australia Financial SIM Venture Yieldbroker Security Exchange Institutions Independent Asia Pacific Exchange Trading FIIG Securities ASX Futures & Options Proposed build IMB ATS/ Multiple expected Liquidnet Australia Bloomberg BondTrader Chi-X Australia BGC Partners Chi-East LCH ASX Clear Clearing CME NYPC SFE Austraclear ASX Clear (Futures) ASX Settlement / Settlement ICE Clearing House Electronic Settlement System Others (CHESS)1 Depository Australian OTCD CCP Reserve Bank Information and Transfer System RITS RITS CLS RITS CLS Payment (RITS) 1. CHESS operated by ASX Settlement Note: ASX Clear, ASX Clear (Futures), ASX Settlement and Austraclear are all part of ASX Group Overview of Australian Securities Exchange The Australian Securities Exchange functions as a market operator, clearing house and payments system facilitator Business Overview Key Milestones 2002 – Sydney Futures Exchange demutualised in 2000 and listed on Listing – Offers both national and international -

NYSE Euronext and APX to Establish NYSE Bluetm, a Joint Venture Targeting Global Environmental Markets

NYSE Euronext and APX to Establish NYSE BlueTM, a Joint Venture Targeting Global Environmental Markets • NYSE Euronext will contribute its ownership in BlueNext in return for a majority interest in the joint venture; • APX, a leading provider of operational infrastructure and services for the environmental and energy markets, will contribute its business in return for a minority interest in the venture; • NYSE Blue will focus on environmental and sustainable energy initiatives, and will further NYSE Euronext’s efforts to increase its presence in environmental markets globally while attracting new partners and customers. New York, September 7, 2010 -- NYSE Euronext (NYX) today announced plans to create NYSE BlueTM, a joint venture that will focus exclusively on environmental and sustainable energy markets. NYSE Blue will include NYSE Euronext’s existing investment in BlueNext, the world’s leading spot market in carbon credits, and APX, Inc., a leading provider of regulatory infrastructure and services for the environmental and sustainable energy markets. NYSE Euronext will be a majority owner of NYSE Blue and will consolidate its results. Shareholders of APX, which include Goldman Sachs, MissionPoint Capital Partners, and ONSET Ventures, will take a minority stake in NYSE Blue in return for their shares in APX. Subject to customary closing conditions, including APX shareholder approval and regulatory approvals, the APX transaction is expected to close by the end of 2010. NYSE Blue will provide a broad offering of services and solutions including integrated pre-trade and post-trade platforms, environmental registry services, a front-end solution for accessing the markets and managing environmental portfolios, environmental markets reference data, and the BlueNext trading platform.