Intercontinental Exchange Reports Ice and Nyse May Volume

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Intraday Herding on a Cross-Border Exchange

CORE Metadata, citation and similar papers at core.ac.uk Provided by CURVE/open Intraday Herding on a Cross-Border Exchange Andrikopoulos, P, Kallinterakis, V, Pedro Leite Ferreira, M & Verousis, T Author post-print (accepted) deposited by Coventry University’s Repository Original citation & hyperlink: Andrikopoulos, P, Kallinterakis, V, Pedro Leite Ferreira, M & Verousis, T 2017, 'Intraday Herding on a Cross-Border Exchange' International Review of Financial Analysis, vol 53, pp. 25-36 https://dx.doi.org/10.1016/j.irfa.2017.08.010 DOI 10.1016/j.irfa.2017.08.010 ISSN 1057-5219 Publisher: Elsevier NOTICE: this is the author’s version of a work that was accepted for publication in International Review of Financial Analysis. Changes resulting from the publishing process, such as peer review, editing, corrections, structural formatting, and other quality control mechanisms may not be reflected in this document. Changes may have been made to this work since it was submitted for publication. A definitive version was subsequently published in International Review of Financial Analysis, [53, (2017)] DOI: 10.1016/j.irfa.2017.08.010 © 2017, Elsevier. Licensed under the Creative Commons Attribution- NonCommercial-NoDerivatives 4.0 International http://creativecommons.org/licenses/by-nc-nd/4.0/ Copyright © and Moral Rights are retained by the author(s) and/ or other copyright owners. A copy can be downloaded for personal non-commercial research or study, without prior permission or charge. This item cannot be reproduced or quoted extensively from without first obtaining permission in writing from the copyright holder(s). The content must not be changed in any way or sold commercially in any format or medium without the formal permission of the copyright holders. -

Filed by the NASDAQ OMX Group, Inc

Filed by The NASDAQ OMX Group, Inc. (Commission File No. 000-32651) Pursuant to Rule 425 under the Securities Act of 1933, as amended Subject Company: NYSE Euronext (Commission File No. 001-33392) NASDAQ OMX and ICE Issue Joint Statement on Superior Proposal New York, NY and Atlanta, GA (April 25, 2011) NASDAQ OMX (NDAQ) and IntercontinentalExchange (ICE) today issued a joint statement with regard to their superior proposal for NYSE Euronext: NYSE Euronext investors should be highly skeptical that after two years of exploratory merger discussions, including more than six months dedicated to finalizing the transaction, NYSE Euronext has suddenly found a reported €100 million in additional synergies. This increase appears not to be a matter of sharpening a pencil, but an unexplained shift in strategy. The discovery that initial synergies having been understated by one-third comes after receiving a superior proposal from NASDAQ OMX and ICE that achieves greater synergies. Importantly, if there are additional synergies to be found after the merger economics have been agreed, then it has to come at the expense of NYSE Euronext stockholders because there has been no increase in the price they are being offered. NYSE Euronext should describe these newly-found synergies in detail in order to support the credibility of these revised estimates, particularly in light of commitments to retain two technology platforms and two headquarters. Increasingly it appears that NYSE Euronext is more focused on protecting the transaction than its stockholders. NASDAQ OMX and ICE have described in detail our proven and focused long-term strategy from which stockholders would benefit and our companies demonstrated outperformance relative to their proposed strategy of creating a financial supermarket. -

Equity Markets USD 47 Tn

19 January 2012 2011 WFE Market Highlights 2011 equity volumes remained stable despite a fall in market capitalization. Derivatives, bonds, ETFs, and securitized derivatives continued to grow strongly. Total turnover value remained stable in 2011 at USD 63 tn despite a sharp decrease of the global market capitalization (-13.6% at USD 47 tn). High volatility and global uncertainty created from the sovereign debt crisis affected volumes all year through and made August 2011 the most active month in terms of trading value, a highly unusual annual peak for markets. Despite overall unfavorable conditions for primary markets in several regions, WFE members increased their total listings by 1.7% totaling 45 953 companies listed. Total number of trades decreased by 6.4% at 112 tn. This trend combined with the stability of turnover value led to a small increase in the average size of transaction which was USD 8 700 in 2011. The high volatility and lack of confidence that affected financial markets globally probably drove the needs of hedging as derivatives contracts traded grew by 8.9%. WFE members continued to diversify their products range as other products such as bonds, ETFs, and securitized derivatives all had solid growth in 2011. Equity Markets Market capitalization USD 47 tn -13.6% Domestic market capitalization declined significantly in 2011 to USD 47 401 bn roughly back to the same level of end 2009. The decline affected almost all WFE members, as there were only four exchanges ending 2011 with a higher market capitalization. The magnitude of the decline is quite similar among the three time zones: -15.9% in Asia-Pacific, -15.2% in EAME and -10.8% in the Americas. -

Bonds Denominated in USD to List for the First Time on NYSE Euronext Lisbon Market BPI Quotes 12 Million on 12Th of March

CONTACT | Media: CONTACT | Investor Relations: +31.20.550.4488 (Amsterdam), +32.2.509.1392 (Brussels) +1.212.656.5700 (New York) +351.217.900.029 (Lisbon), +44.20.7379.2789 (London) +33.1.49.27.58.60 (Paris) +1.212.656.2411 (New York), +33.1.49.27.11.33 (Paris) Bonds denominated in USD to list for the first time on NYSE Euronext Lisbon market BPI quotes 12 million on 12th of March March 11, 2010 – NYSE Euronext (NYX) is pleased to welcome Banco Português de Investimento as the first listed issuer of non-euro currency on Euronext Lisbon. Banco Português de Investimento, a company with a market capitalization of € 1.750 billion, will list two bond issues denominated in USD on the Lisbon market of NYSE Euronext on 12th March 2010: • an issue of USD 6 million of Index Linked Interested Notes “BPI AMERICAN OUTPERFORMANCE 2010-2013” and • an issue of USD 6 million of Index Linked Interest Notes “BPI JPYUSD 350% 2010- 2013”. Both bonds will be issued under the BPI’s Euro Medium Term Note Programme. The listing of these two new products will see the start of a service to trade non-Euro currency via NYSE Euronext in Lisbon. The non-Euro settlement service will be provided by Interbolsa using the non-Euro payment system operated by Caixa Geral de Depósitos. Trading member firms will need to have a clearing member firm (CMF) and a settlement agent (SA) with a settlement account at Interbolsa for the securities side and an account with Caixa Geral de Depósitos for the cash side of the settlement process. -

NZX Limited NZX Participant Rule Procedures

NZX Limited NZX Participant Rule Procedures Contents Section A: Interpretation and Construction ...................................................................... 3 A.1 Interpretation ................................................................................................................ 3 A.2 Construction ................................................................................................................. 3 Section 1: Error Trade Cancellation Procedure .............................................................. 4 1.1 Notice by Trading Participant ........................................................................................ 4 1.2 NZX Action ................................................................................................................... 4 1.3 Information to be provided to NZX ................................................................................ 5 1.4 Trading Error Register .................................................................................................. 5 Section 2: Capital Adequacy and Monthly Reporting ....................................................... 9 Capital Adequacy and Monthly Reporting Procedure ...................................................... Error! Bookm 2.1 Recognised Market Index ............................................................................................. 9 2.2 Recognised Market ..................................................................................................... 10 2.3 Monthly Reporting ........................................................ -

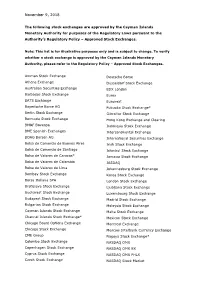

The List of Approved Stock Exchanges

November 9, 2018 The following stock exchanges are approved by the Cayman Islands Monetary Authority for purposes of the Regulatory Laws pursuant to the Authority’s Regulatory Policy – Approved Stock Exchanges. Note: This list is for illustrative purposes only and is subject to change. To verify whether a stock exchange is approved by the Cayman Islands Monetary Authority, please refer to the Regulatory Policy – Approved Stock Exchanges. Amman Stock Exchange Deutsche Borse Athens Exchange Dusseldorf Stock Exchange Australian Securities Exchange EDX London Barbados Stock Exchange Eurex BATS Exchange Euronext Bayerische Borse AG Fukuoka Stock Exchange* Berlin Stock Exchange Gibraltar Stock Exchange Bermuda Stock Exchange Hong Kong Exchange and Clearing BM&F Bovespa Indonesia Stock Exchange BME Spanish Exchanges Intercontinental Exchange BOAG Borsen AG International Securities Exchange Bolsa de Comercio de Buenos Aires Irish Stock Exchange Bolsa de Comercio de Santiago Istanbul Stock Exchange Bolsa de Valores de Caracas* Jamaica Stock Exchange Bolsa de Valores de Colombia JASDAQ Bolsa de Valores de Lima Johannesburg Stock Exchange Bombay Stock Exchange Korea Stock Exchange Borsa Italiana SPA London Stock Exchange Bratislava Stock Exchange Ljubljana Stock Exchange Bucharest Stock Exchange Luxembourg Stock Exchange Budapest Stock Exchange Madrid Stock Exchange Bulgarian Stock Exchange Malaysia Stock Exchange Cayman Islands Stock Exchange Malta Stock Exchange Channel Islands Stock Exchange* Mexican Stock Exchange Chicago Board Options Exchange -

The Dynamics of Stock Market Development in the United States of America

Risk governance & control: financial markets & institutions / Volume 3, Issue 1, 2013, Continued - 1 THE DYNAMICS OF STOCK MARKET DEVELOPMENT IN THE UNITED STATES OF AMERICA Sheilla Nyasha*, NM Odhiambo** Abstract This paper highlights the origin and development of the stock market in the United States of America. The country consists of several stock exchanges, with the three largest being the NYSE Euronext (NYX), National Association of Securities Dealers Automated Quotation (NASDAQ), and the Chicago Stock Exchange. Stock market reforms have been implemented since the stock market crash of 1929; and the exchanges responded positively to some of these reforms, but not so positively to some of the reforms. As a result of the reforms, the U.S. stock market has developed in terms of market capitalisation, the total value of stocks traded, and the turnover ratio. Although the U.S. stock market has developed over the years, its market still faces wide-ranging challenges. Keywords: United States of America, New York Stock Exchange Euronext, NASDAQ, Stock Market, Reforms *Department of Economics, University of South Africa, P.O Box 392, UNISA, 0003, Pretoria, South Africa Email: [email protected] **Corresponding author. Department of Economics, University of South Africa, P.O Box 392, UNISA, 0003, Pretoria, South Africa Email: [email protected], [email protected] 1 Introduction investors, but they also facilitate the inflow of foreign financial resources into the domestic economy; and Stock market development is an important component they promote risky, entrepreneurial investments of financial sector development, and it supplements through their risk-sharing and monitoring functions. the role of the banking system in economic Even the most recent studies have confirmed the vital development. -

Appendix a – Integrated Exchanges Integrated Exchanges

Appendix A – Integrated Exchanges Integrated exchanges The integrated exchange model exists in several market places BM&F TMX TMX ASX DB Bovespa (CURRENT) (Alpha+CDS) Trading Equities Exchange Fixed Income Exchange Derivatives Exchange ATS Clearing & Settlement Equities Fixed Income Derivatives Depository Equities Fixed Income Derivatives Source: Public filings ASX is fully integrated, offering multi-asset trading and post-trade operations Listed Derivatives/ Equities Fixed Income Energy OTC Derivatives ASX Ownership ASX Bilateral National Stock Exchange ASX Group Australia Financial SIM Venture Yieldbroker Security Exchange Institutions Independent Asia Pacific Exchange Trading FIIG Securities ASX Futures & Options Proposed build IMB ATS/ Multiple expected Liquidnet Australia Bloomberg BondTrader Chi-X Australia BGC Partners Chi-East LCH ASX Clear Clearing CME NYPC SFE Austraclear ASX Clear (Futures) ASX Settlement / Settlement ICE Clearing House Electronic Settlement System Others (CHESS)1 Depository Australian OTCD CCP Reserve Bank Information and Transfer System RITS RITS CLS RITS CLS Payment (RITS) 1. CHESS operated by ASX Settlement Note: ASX Clear, ASX Clear (Futures), ASX Settlement and Austraclear are all part of ASX Group Overview of Australian Securities Exchange The Australian Securities Exchange functions as a market operator, clearing house and payments system facilitator Business Overview Key Milestones 2002 – Sydney Futures Exchange demutualised in 2000 and listed on Listing – Offers both national and international -

If You Are in Any Doubt About the Contents of This

If you are in any doubt about the contents of this Prospectus, the risks involved in investing in the Company or the suitability for you of investment in the Company, you should consult your stock broker, bank manager, solicitor, accountant or other independent financial adviser. Prices of shares in the Company’s Sub-Funds may fall as well as rise. ___________________________ MORI UMBRELLA FUND PLC (An open-ended umbrella investment company with variable capital incorporated with limited liability in Ireland under the Companies Act 2014 with registration number 282792 and established as an undertaking for collective investment in transferable securities pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations, 2011, as amended and with segregated liability between Sub-Funds. ___________________________ Mori Eastern European Fund Mori Ottoman Fund Investment Manager MORI CAPITAL MANAGEMENT LIMITED Dated 22 December 2020 PRELIMINARY THIS PROSPECTUS MAY BE ISSUED WITH ONE OR MORE SUPPLEMENTS EACH CONTAINING SPECIFIC INFORMATION RELATING TO A PARTICULAR SUB-FUND. THIS PROSPECTUS AND ANY RELEVANT SUPPLEMENT SHOULD BE READ AND CONSTRUED AS ONE DOCUMENT. TO THE EXTENT THAT THERE IS ANY INCONSISTENCY BETWEEN THIS PROSPECTUS AND ANY SUPPLEMENT, THE RELEVANT SUPPLEMENT SHALL PREVAIL. This Prospectus does not constitute, and may not be used for the purposes of, an offer or solicitation to anyone in any jurisdiction in which such offer or solicitation is not authorised, or to any person to whom it is unlawful to make such offer or solicitation. The distribution of this Prospectus and the offering of Shares in certain jurisdictions may be restricted and, accordingly, persons into whose possession this Prospectus comes are required to inform themselves about, and to observe, such restrictions. -

NYSE Euronext Welcomes Teixeira Duarte to Its European Market

NYSE Euronext welcomes Teixeira Duarte to its European market Amsterdam, Brussels, Lisbon, London, Paris, 16 August 2010 - Teixeira Duarte SA, a company specializing in construction and public works, today celebrated its listing and first day of trading on NYSE Euronext in Lisbon following its corporate restructuring operation. It will trade under the ticker symbol « TDSA ». The admission of Teixeira Duarte SA was by the listing of 406,360,199 shares at an opening price of €0.96 per share. Market capitalization on the date of admission amounted to €390 million. “We are very pleased to welcome Teixeira Duarte SA on to NYSE Euronext in Lisbon and look forward to a beneficial and lasting partnership, providing the Company and its shareholders with the highest levels of service, liquidity and brand visibility associated with listing on NYSE Euronext markets”, commented Luis Laginha de Sousa, Chairman and CEO of NYSE Euronext Lisbon. “With the success of our listing, our Group realized another important step in its corporate restructuring process. Teixeira Duarte SA believes that this key step in its development will optimize its working process, and renew its commitment to the stock market”, said José Cobra Ferreira, Investor Relations of Teixeira Duarte SA. Contacts: NYSE Euronext (Lisbon): (+351) 964046778 Teixeira Duarte: (+351) 217912415 About Teixeira Duarte SA Teixeira Duarte Group currently has around 13,500 employees. Teixeira Duarte Group act within the core activity of construction but also in other sectors such as cements, concrete and aggregates, concessions and services, real estate, hotel services, food, fuel and vehicles’ trading in more than ten countries, including Portugal. -

Listing in Africa

LISTING IN AFRICA 2014/2015 kpmg.com/Africa Contents Introduction 04 Key De nitions 08 Summary of Listing Criteria 12 Botswana 24 Kenya 44 Mauritius 68 Namibia 88 Nigeria 114 South Africa 132 Zambia 160 Zimbabwe 186 Key sources 210 Contributors 211 Introduction Purpose of this publication There is an increasing interest in Africa as a potential investment destination due to the fact that the developed markets are not expected to grow as they have done previously. In addition, Africa is seen to be becoming more politically mature and easier to access and this, together with its growing population and rise in consumption, is adding to its attractiveness for foreign investors. Africa also has vast tracts of unutilised land and signicant mineral and other resources. The purpose of this document is to provide an overview of the considerations for listing, listing criteria, processes, documentation requirements and continuing obligations relating to certain African stock exchanges, as well as an overview of the composition and liquidity of the equity markets in these countries. This information will give potential investors and applicant issuers’ valuable insights into listing in these environments. Advantages and disadvantages of an equity listing Some of the advantages of listing equity on any stock exchange are set out below: › Enables the company to raise equity capital to fund existing projects and acquisition opportunities and/or to reduce current gearing levels in the company; › Provides a future and current exit route for the existing -

SIX Swiss Exchange Mitteilung Nr. XX/2012

SIX Swiss Exchange message no. 35/2012 Title SIX Swiss Exchange Liquidnet Service (SLS) expands market coverage Category Trading and Products Authorised by Martin Schönenberger, Head Member Relations Adrian Isler, Head Market Operations Pages 2 Date 13.07.2012 Information SIX Swiss Exchange successfully launched the SIX Swiss Exchange Liquidnet Service (SLS) in July 2011. SLS offers trading participants access to the top-class non-displayed liquidity pool of Liquidnet, in which block orders can be executed efficiently at the mid-point price. At present, more than 2,500 equities from five European markets (Switzerland, Germany, France, the Netherlands and the UK) can be traded via this liquidity pool. The market coverage offered by SLS is now being expanded further in response to market demand, thereby broadening the range of services provided by SIX Swiss Exchange. As of 30 July 2012, it will be possible to trade an additional 1,200 equities from the following six markets. Trading Market Reference exchange Currency SLS trading hours Austria Wiener Börse AG (XWBO) EUR – euro 08:55 – 17:30 CET Belgium NYSE Euronext – Brussels (XBRU) EUR – euro 09:00 – 17:30 CET Denmark OMX Nordic Exchange – Copenhagen A/S (XCSE) DKK – Danish krone 09:00 – 16:55 CET Finland OMX Nordic Exchange – Helsinki OY (XHEL) EUR – euro 09:00 – 17:25 CET Portugal NYSE Euronext – Lisbon (XLIS) EUR – euro 09:00 – 17:30 CET Sweden OMX Nordic Exchange – Stockholm AB (XXXX) SEK – Swedish krona 09:00 – 17:25 CET Clearing and settlement Trades in the new markets will be automatically cleared by one of our approved CCPs and settlement will occur in the domestic central securities depository (CSD) of the underlying product.