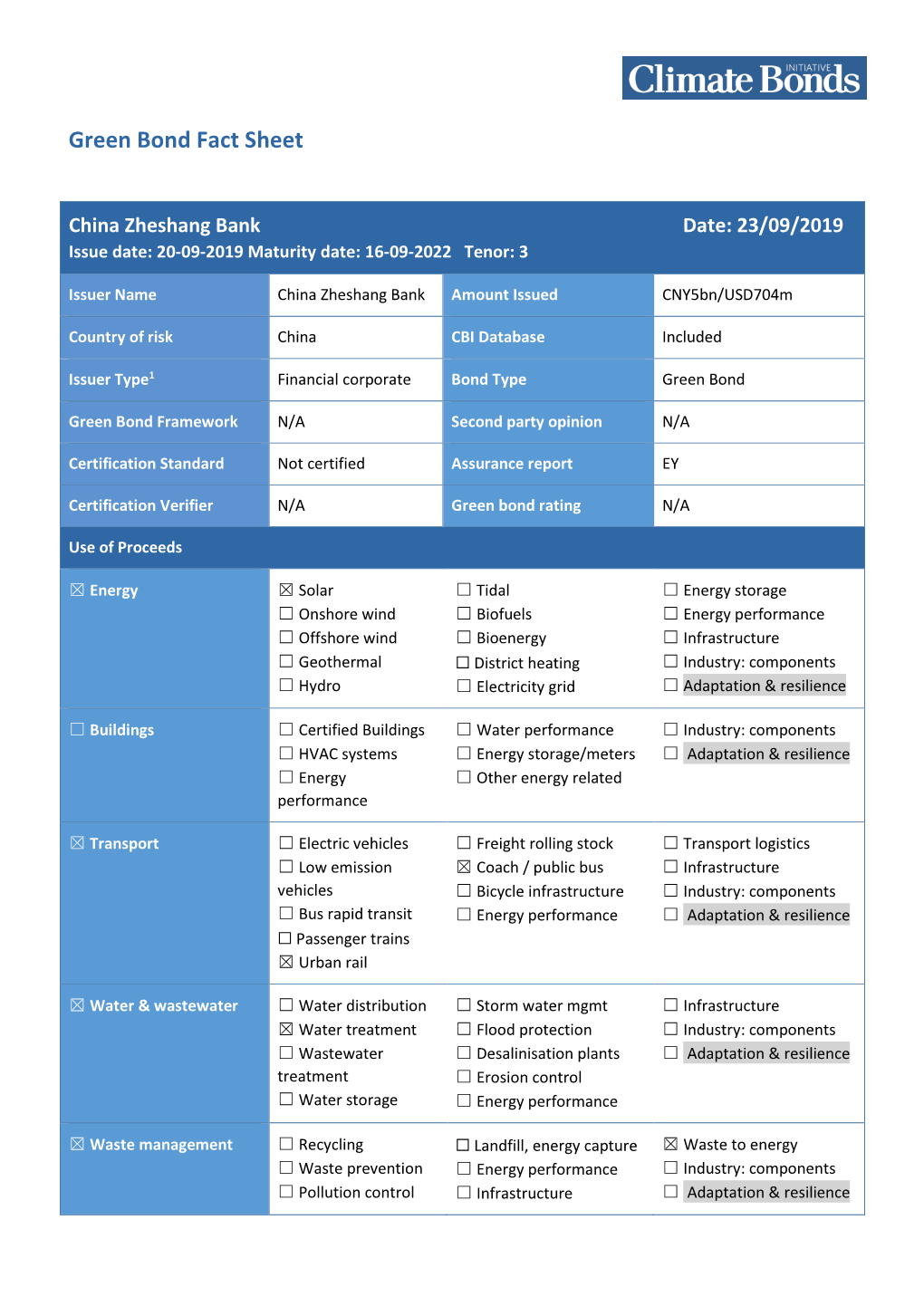

China Zheshang Bank Date: 23/09/2019 Issue Date: 20-09-2019 Maturity Date: 16-09-2022 Tenor: 3

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of CMU Members 2021-08-18

List of CMU Members 2021-09-23 Member Bond Code Member Name Bank Repo CMUBID Connect ABCI ABCI SECURITIES COMPANY LIMITED - Y Y ABNA ABN AMRO BANK N.V. - Y - ABOC AGRICULTURAL BANK OF CHINA LIMITED - Y Y AIAT AIA COMPANY (TRUSTEE) LIMITED - - - ASBK AIRSTAR BANK LIMITED - Y - ACRL ALLIED BANKING CORPORATION (HONG KONG) LIMITED - Y - ANTB ANT BANK (HONG KONG) LIMITED - - - ANZH AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED - - Y AMCM AUTORIDADE MONETARIA DE MACAU - Y - BEXH BANCO BILBAO VIZCAYA ARGENTARIA, S.A. - Y - BSHK BANCO SANTANDER S.A. - Y Y BBLH BANGKOK BANK PUBLIC COMPANY LIMITED - - - BCTC BANK CONSORTIUM TRUST COMPANY LIMITED - - - SARA BANK J. SAFRA SARASIN LTD - Y - JBHK BANK JULIUS BAER AND CO. LTD. - Y - BAHK BANK OF AMERICA, NATIONAL ASSOCIATION - Y Y BCHK BANK OF CHINA (HONG KONG) LIMITED - Y Y CDFC BANK OF CHINA INTERNATIONAL LIMITED - Y - BCHB BANK OF CHINA LIMITED, HONG KONG BRANCH - Y - CHLU BANK OF CHINA LIMITED, LUXEMBOURG BRANCH - - Y BMHK BANK OF COMMUNICATIONS (HONG KONG) LIMITED - Y - BCMK BANK OF COMMUNICATIONS CO., LTD. - Y - BCTL BANK OF COMMUNICATIONS TRUSTEE LIMITED - - Y DGCB BANK OF DONGGUAN CO., LTD. - - - BEAT BANK OF EAST ASIA (TRUSTEES) LIMITED - - - BEAH BANK OF EAST ASIA, LIMITED (THE) - Y Y BOIH BANK OF INDIA - - - BOFM BANK OF MONTREAL - - - BNYH BANK OF NEW YORK MELLON - - - BNSH BANK OF NOVA SCOTIA (THE) - - - BOSH BANK OF SHANGHAI (HONG KONG) LIMITED - Y Y BTWH BANK OF TAIWAN - Y - SINO BANK SINOPAC, HONG KONG BRANCH - - Y BPSA BANQUE PICTET AND CIE SA - - - BBID BARCLAYS BANK PLC - Y - EQUI BDO UNIBANK, INC. -

Primary Dealers (With Effect from 1 October 2021)

HONG KONG SPECIAL ADMINISTRATIVE REGION OF THE PEOPLE’S REPUBLIC OF CHINA GOVERNMENT BOND PROGRAMME List of Primary Dealers (with effect from 1 October 2021) 1. Bank of China (Hong Kong) Limited 2. Bank of Communications Company, Limited 3. BNP Paribas, Hong Kong 4. Citibank N.A. 5. Crédit Agricole Corporate and Investment Bank 6. DBS Bank (Hong Kong) Limited 7. Hang Seng Bank Limited 8. Hongkong and Shanghai Banking Corporation Limited, The 9. Societe Generale 10. Standard Chartered Bank (Hong Kong) Limited List of Recognized Dealers (with effect from 30 September 2021) 1. ABN AMRO Bank N.V. 2. Agricultural Bank of China Limited 3. Airstar Bank Limited 4. Allied Banking Corporation (Hong Kong) Limited 5. Ant Bank (Hong Kong) Limited 6. Australia and New Zealand Banking Group Limited 7. Banco Bilbao Vizcaya Argentaria, S.A. 8. Banco Santander, S.A. 9. Bangkok Bank Public Company Limited 10. Bank Julius Baer & Co. Ltd. 11. Bank of America, National Association 12. Bank of China (Hong Kong) Limited 13. Bank of China International Limited 14. Bank of Communications Company, Limited 15. Bank of Communications (Hong Kong) Limited 16. Bank of Dongguan Co., Ltd. 17. Bank of East Asia, Limited (The) 18. Bank of India 19. Bank of Montreal 20. Bank of Nova Scotia (The) 21. Bank of Taiwan 22. Bank SinoPac, Hong Kong Branch 23. Banque Pictet & Cie SA 24. Barclays Bank plc 25. BDO Unibank, Inc. 26. BNP Paribas, Hong Kong 27. BNP Paribas Securities Services 28. Cathay Bank 29. Cathay United Bank Company, Limited 30. Chang Hwa Commercial Bank, Limited 31. -

China Zheshang Bank Co., Ltd. 浙 商 銀 行 股 份 有 限

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. CHINA ZHESHANG BANK CO., LTD. 浙商銀行股份有限公司 (A joint-stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2016) (Stock Code of Preference Shares: 4610) 2018 ANNUAL RESULTS ANNOUNCEMENT The board of directors (the “Board”) of China Zheshang Bank Co., Ltd. (the “Bank”) hereby announces the audited results of the Bank for the year ended December 31, 2018. This announcement, containing the full text of the 2018 annual report of the Bank, complies with the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) in relation to information to accompany preliminary announcements of annual results. Publication OF Annual Results ANNOUNCEMENT AND Annual Report Both the Chinese and English versions of this results announcement are available on the websites of the Bank (www.czbank.com) and the Stock Exchange (www.hkex.com.hk). In the event of any discrepancies in interpretations between the English and Chinese text, the Chinese version shall prevail. The printed version of the 2018 annual report of the Bank will in due course be delivered to the H shareholders of the Bank and available for viewing on the websites of the Bank (www.czbank.com) and the Stock Exchange (www.hkex.com.hk). -

Market Overview

China Green Bond Market Newsletter Q3 2019 中国绿色债券市场季报 2019 第三季度 July-September 2019/2019 年 7 月- 9 月 Market overview Green bond market increase in Q3 2019 Both global and Chinese green bonds issuance have increased At a glance significantly in Q3 compared to the same quarter of 2018, although the total amount of global green bonds that are aligned with Total Q3 Chinese issuance: USD14.5bn/CNY104.3bn international definitions decreased from last quarter. Onshore issuance: USD13.9bn/CNY100.2bn 80 Offshore issuance: USD600m/CNY4.1bn 60 Issuance that meets international definitions: USD5.8bn/CNY40.3bn 40 Largest issuer: Industrial Bank Co., Ltd at USD2.9bn 20 Largest issuing sector: Low Carbon Transport USD Billions 0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Greater levels of alignment might be achieved if Chinese issuers 2018 2019 provide more clarity on the use of proceeds for working capital. Pending Tightening NDRC regulations, which allow up to 50% of green bond China issuance not aligned with international definitions proceeds to be allocated to working capital, and Shanghai Stock China issuance aligned with international definitions Exchange rules, which allows 30% for bonds listed on it, would help. Global issuance aligned with international definitions (excl. China) Despite the surge from the same period last year, the USD14.5bn 2% worth of green bonds dropped by 2% from Q2. Only 40% (or Working capital/General needs USD5.8bn) of the Q3 volume from Chinese issuers is in line with 35% international green bond definitions. Another 45% is aligned with Not aligned 63% China’s domestic green bond definitions only Insufficient information There are 15 deals on the Pending list, all from onshore issuers. -

China Zheshang Bank Co., Ltd. 浙 商 銀 行 股 份 有 限

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. CHINA ZHESHANG BANK CO., LTD. 浙商銀行股份有限公司* (A joint-stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2016) 2016 ANNUAL RESULTS ANNOUNCEMENT The board of directors (the “Board”) of China Zheshang Bank Co., Ltd. (the “Bank”) hereby announces the audited results of the Bank for the year ended December 31, 2016. This announcement, containing the full text of the 2016 annual report of the Bank, complies with the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) in relation to information to accompany preliminary announcements of annual results. Publication of Annual Results Announcement and Annual Report Both the Chinese and English versions of this results announcement are available on the websites of the Bank (www.czbank.com) and the Stock Exchange (www.hkex.com.hk). In the event of any discrepancies in interpretations between the English and Chinese text, the Chinese version shall prevail. Printed version of the 2016 annual report of the Bank will in due course be delivered to the H shareholders of the Bank and available for viewing on the websites of the Bank (www.czbank.com) and the Stock Exchange (www.hkex.com.hk). -

Banking Newsletter

September 2017 Banking Newsletter Review and Outlook of China’s Banking Industry for the First Half of 2017 www.pwccn.com Editorial Team Editor-in-Chief:Vivian Ma Deputy Editor-in-Chief:Haiping Tang, Carly Guan Members of the editorial team: Cynthia Chen, Jeff Deng, Carly Guan, Tina Lu, Haiping Tang (in alphabetical order of last names) Advisory Board Jimmy Leung, Margarita Ho, Richard Zhu, David Wu, Yuqing Guo, Jianping Wang, William Yung, Mary Wong, Michael Hu, James Tam, Raymond Poon About this newsletter The Banking Newsletter, PwC’s analysis of China’s listed banks and the wider industry, is now in its 32nd edition. Over the past one year there have been several IPOs for small-and-medium-sized banks, increasing the universe of listed banks in China. This analysis covers 39 A-share and/or H-share listed banks that have released their 2017 first half results. Those banks are categorized into four groups as defined by the China Banking Regulatory Commission (CBRC): Large Commercial Joint-Stock Commercial City Commercial Banks Rural Commercial Banks Banks (6) Banks (9) (16) (8) Industrial and Commercial Chongqing Rural Commercial Bank Bank of China (ICBC) China Industrial Bank (CIB) Bank of Beijing (Beijing) (CQRCB) China Construction Bank China Merchants Bank (CMB) Bank of Shanghai (Shanghai) (CCB) Guangzhou Rural Commercial Bank SPD Bank (SPDB) Bank of Hangzhou (Hangzhou) Agricultural Bank of China (GZRCB) (ABC) China Minsheng Bank Corporation Bank of Jiangsu (Jiangsu) (CMBC) Jiutai Rural Commercial Bank Bank of China (BOC) Bank of -

BANK of NINGBO CO., LTD. 2020 Annual Report

BANK OF NINGBO CO., LTD. (Stock Code: 002142) 2020 Annual Report Full Text of 2020 Annual Report of Bank of Ningbo Co., Ltd. Chapter One Important Notes, Content and Interpretation The Board of Directors, Board of Supervisors, directors, supervisors and senior management of the Company ensure the authenticity, accuracy and completeness of contents, and guarantee no frauds, misleading statements or major omissions in this report. They are willing to burden any individual and joint legal responsibilities. The 6th meeting of the 7th Board of Directors of the Company deliberated on and approved the text and abstract of 2020 Annual Report. 13 directors in person out of the total of 13 required directors attended the meeting, and part of supervisors attended as a nonvoting delegates. The Chairman of the Company, Mr. Lu Huayu, the President, Mr. Luo Mengbo, the person in charge of accounting, Mr. Zhuang Lingjun, and the general manager of financial department, Ms. Sun Hongbo hereby declare to guarantee the authenticity, accuracy and completeness of financial statements in the annual report. Financial data and indicators included in this annual report are following the criteria of Chinese Accounting Standard for Business Enterprises. Unless otherwise stated, all data in the consolidated financial statements of Bank of Ningbo Co., Ltd. and its holding subsidiary, Maxwealth Fund Management Co., Ltd., its wholly-owned subsidiaries, Maxwealth Financial Leasing Co., Ltd. and Ningyin Finance Co., Ltd., are subject to the unit of RMB. Ernst & Young Hua Ming LLP audited the 2020 Financial Statements of the Company in accordance with domestic accounting principles and published unqualified opinion. -

List of Banks in Hong Kong

LIST OF BANKS IN HONG KONG IN THE CATEGORY UPON LICENSED BANKS, RESTRICTED BANKS & DEPOSIT-TAKING COMPANIES (Update of April 2020 from the HKMA) LICENSED BANKS NO. Incorporated in Hong Kong 1 AIRSTAR BANK LIMITED 2 ANT BANK (HONG KONG) LIMITED 3 BANK OF CHINA (HONG KONG) LIMITED 4 BANK OF COMMUNICATIONS (HONG KONG) LIMITED 5 BANK OF EAST ASIA, LIMITED (THE) 6 CHINA CITIC BANK INTERNATIONAL LIMITED 7 CHINA CONSTRUCTION BANK (ASIA) CORPORATION LIMITED 8 CHIYU BANKING CORPORATION LIMITED 9 CHONG HING BANK LIMITED 10 CITIBANK (HONG KONG) LIMITED 11 CMB WING LUNG BANK LIMITED 12 DAH SING BANK, LIMITED 13 DBS BANK (HONG KONG) LIMITED 14 FUBON BANK (HONG KONG) LIMITED 15 FUSION BANK LIMITED 16 HANG SENG BANK, LIMITED 17 HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED (THE) 18 INDUSTRIAL AND COMMERCIAL BANK OF CHINA (ASIA) LIMITED 19 LIVI VB LIMITED 20 NANYANG COMMERCIAL BANK, LIMITED 21 OCBC WING HANG BANK LIMITED 22 PING AN ONECONNECT BANK (HONG KONG) LIMITED 23 PUBLIC BANK (HONG KONG) LIMITED 24 SC DIGITAL SOLUTIONS LIMITED 25 SHANGHAI COMMERCIAL BANK LIMITED 1 26 STANDARD CHARTERED BANK (HONG KONG) LIMITED 27 TAI SANG BANK LIMITED 28 TAI YAU BANK, LIMITED 29 WELAB DIGITAL LIMITED 30 ZA BANK LIMITED NO. Incorporated outside Hong Kong 1 ABN AMRO BANK N.V. NETHERLANDS 2 AGRICULTURAL BANK OF CHINA LIMITED CHINA 3 ALLAHABAD BANK INDIA 4 AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED AUSTRALIA 5 AXIS BANK LIMITED INDIA 6 BANCA MONTE DEI PASCHI DI SIENA S.P.A. ITALY 7 BANCO BILBAO VIZCAYA ARGENTARIA S.A. SPAIN 8 ABN AMRO BANK N.V. -

Bank Code List

Bank Code List (sorted by bank code) Bank Code Bank Name in English 003 STANDARD CHARTERED BANK (HONG KONG) LIMITED 004 THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED 005 CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK 006 CITIBANK, N.A. 007 JPMORGAN CHASE BANK, N.A. 008 NATWEST MARTETS PLC 009 CHINA CONSTRUCTION BANK (ASIA) CORPORATION LIMITED 012 BANK OF CHINA (HONG KONG) LIMITED 015 THE BANK OF EAST ASIA, LIMITED 016 DBS BANK (HONG KONG) LIMITED 018 CHINA CITIC BANK INTERNATIONAL LIMITED 020 CMB WING LUNG BANK LIMITED. 022 OVERSEA-CHINESE BANKING CORPORATION LTD. 024 HANG SENG BANK LTD. 025 SHANGHAI COMMERCIAL BANK LTD. 027 BANK OF COMMUNICATIONS CO., LTD 028 PUBLIC BANK (HONG KONG) LIMITED 035 OCBC WING HANG BANK LIMITED 038 TAI YAU BANK LTD. 039 CHIYU BANKING CORPORATION LTD. 040 DAH SING BANK, LTD. 041 CHONG HING BANK LIMITED 043 NANYANG COMMERCIAL BANK, LTD. 045 UCO BANK 046 KEB HANA BANK 047 MUFG BANK, LTD. 049 BANGKOK BANK PUBLIC COMPANY LIMITED 050 INDIAN OVERSEAS BANK 054 DEUTSCHE BANK AG 055 BANK OF AMERICA, N.A. 056 BNP PARIBAS 058 BANK OF INDIA 060 NATIONAL BANK OF PAKISTAN 061 TAI SANG BANK LIMITED 063 MALAYAN BANKING BERHAD (MAYBANK) 065 SUMITOMO MITSUI BANKING CORPORATION 066 PT. BANK NEGARA INDONESIA (PERSERO) TBK. 067 BDO UNIBANK, INC. 071 UNITED OVERSEAS BANK LTD. 072 INDUSTRIAL AND COMMERCIAL BANK OF CHINA (ASIA) LIMITED 074 BARCLAYS BANK PLC. 076 THE BANK OF NOVA SCOTIA 080 ROYAL BANK OF CANADA 081 SOCIETE GENERALE 082 STATE BANK OF INDIA Bank Code List (sorted by bank code) Bank Code Bank Name in English 085 THE TORONTO-DOMINION BANK 086 BANK OF MONTREAL 092 CANADIAN IMPERIAL BANK OF COMMERCE 097 COMMERZBANK AG 103 UBS AG, HONG KONG 106 HSBC BANK USA, N.A. -

UFJ China Correspondents.Xlsx

Bank of Tokyo-Mitsubishi UFJ; Overseas Correspondents (CHINA, TAIWAN, HONG KONG) City Bank Name ANQING BANK OF COMMUNICATIONS CO., LTD. ANSHAN BANK OF CHINA LIMITED BANK OF COMMUNICATIONS CO., LTD. INDUSTRIAL AND COMMERCIAL BANK OF CHINA LIMITED BAODING INDUSTRIAL AND COMMERCIAL BANK OF CHINA LIMITED BAOTOU BANK OF CHINA LIMITED BANK OF COMMUNICATIONS CO., LTD. BEIHAI BANK OF CHINA LIMITED BANK OF COMMUNICATIONS CO., LTD. BEIJING AGRICULTURAL BANK OF CHINA LIMITED AGRICULTURAL DEVELOPMENT BANK OF CHINA AUSTRALIA AND NEW ZEALAND BANK (CHINA) COMPANY LIMITED BANK OF AMERICA N.A. BANK OF BEIJING CO., LTD BANK OF CHINA LIMITED BANK OF COMMUNICATIONS CO., LTD. BANK OF MONTREAL (CHINA) CO. LTD. BANK OF TOKYO-MITSUBISHI UFJ (CHINA), LTD. BNP PARIBAS (CHINA) LIMITED CHINA CITIC BANK CHINA CONSTRUCTION BANK CORPORATION CHINA DEVELOPMENT BANK CORPORATION CHINA EVERBRIGHT BANK CHINA MERCHANTS BANK CO. LTD. CHINA MINSHENG BANKING CORPORATION LTD CITIBANK (CHINA) CO., LTD. DBS BANK (CHINA) LIMTIED GUANGDONG DEVELOPMENT BANK HANA BANK (CHINA) COMPANY LIMITED HSBC BANK (CHINA) COMPANY LIMITED HUA XIA BANK INDUSTRIAL AND COMMERCIAL BANK OF CHINA LIMITED INDUSTRIAL BANK CO., LTD. JPMORGAN CHASE BANK (CHINA) COMPANY LIMITED KEB BANK (CHINA) CO., LTD. MIZUHO CORPORATE BANK (CHINA), LIMITED PEOPLE'S BANK OF CHINA/STATE ADMINISTRATION OF FOREIGN EXCHANGE RAIFFEISEN BANK INTERNATIONAL AG ROAYL BANK OF CANADA SHANGHAI PUDONG DEVELOPMENT BANK SHENZHEN DEVELOPMENT BANK CO. LTD. SHINHAN BANK (CHINA) LIMITED SOCIETE GENERALE (CHINA) LIMITED STANDARD CHARTERED BANK (CHINA) LIMITED STANDARD CHARTERED BANK (CHINA) LIMITED SUMITOMO MITSUI BANKING CORPORATION (CHINA) LIMITED THE BANK OF EAST ASIA (CHINA) LIMITED THE EXPORT-IMPORT BANK OF CHINA THE KOREA DEVELOPMENT BANK THE ROYAL BANK OF SCOTLAND (CHINA) CO., LTD. -

China Zheshang Bank Co., Ltd. 浙 商 銀 行 股 份 有 限

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. CHINA ZHESHANG BANK CO., LTD. 浙商銀行股份有限公司 (A joint-stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2016) (Stock Code of Preference Shares: 4610) 2017 ANNUAL RESULTS ANNOUNCEMENT The board of directors (the “Board”) of China Zheshang Bank Co., Ltd. (the “Bank”) hereby announces the audited results of the Bank for the year ended December 31, 2017. This announcement, containing the full text of the 2017 annual report of the Bank, complies with the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) in relation to information to accompany preliminary announcements of annual results. Publication of Annual Results Announcement and Annual Report Both the Chinese and English versions of this results announcement are available on the websites of the Bank (www.czbank.com) and the Stock Exchange (www.hkex.com.hk). In the event of any discrepancies in interpretations between the English and Chinese text, the Chinese version shall prevail. Printed version of the 2017 annual report of the Bank will in due course be delivered to the H shareholders of the Bank and available for viewing on the websites of the Bank (www.czbank.com) and the Stock Exchange (www.hkex.com.hk). -

2020 Annual Results Announcement

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. CHINA ZHESHANG BANK CO., LTD. 浙商銀行股份有限公司 (A joint-stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2016) (Stock Code of Preference Shares: 4610) 2020 ANNUAL RESULTS ANNOUNCEMENT The board of directors (the “Board”) of China Zheshang Bank Co., Ltd. (the “Bank”) hereby announces the audited results of the Bank for the year ended December 31, 2020. This announcement, containing the full text of the 2020 annual report of the Bank, complies with the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) in relation to information to accompany preliminary announcements of annual results. PUBLICATION OF ANNUAL RESULTS ANNOUNCEMENT AND ANNUAL REPORT Both the Chinese and English versions of this results announcement are available on the websites of the Bank (www.czbank.com) and the Stock Exchange (www.hkex.com.hk). In the event of any discrepancies in interpretations between the English and Chinese text, the Chinese version shall prevail. The printed version of the 2020 annual report of the Bank will in due course be delivered to the H shareholders of the Bank and available for viewing on the websites of the Bank (www.czbank.com) and the Stock Exchange (www.hkex.com.hk).