Form S-8 REGISTRATION STATEMENT UNDER the SECURITIES ACT of 1933

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Scholastic Corporation Notice Of

Scholastic 557 Broadway, New York, NY 10012-3999 (212) 343-6100 www.scholastic.com SCHOLASTIC CORPORATION NOTICE OF ANNUAL MEETING OF STOCKHOLDERS To Holders of Class A Stock and Common Stock: The Annual Meeting of Stockholders of Scholastic Corporation (the “Company”) will be held at the Company’s corporate headquarters located at 557 Broadway, New York, New York on Wednesday, September 21, 2016 at 9:00 a.m., local time, for the following purposes: Matters to be voted upon by holders of the Class A Stock 1. Electing seven directors to the Board of Directors Matters to be voted upon by holders of the Common Stock 1. Electing two directors to the Board of Directors and such other business as may properly come before the meeting and any adjournments thereof. A proxy statement describing the matters to be considered at the Annual Meeting of Stockholders is attached to this notice. Only stockholders of record of the Class A Stock and the Common Stock at the close of business on July 29, 2016 are entitled to notice of, and to vote at, the meeting and any adjournments thereof. We hope that you will be able to attend the meeting. Whether or not you plan to be present at the meeting, we urge you to vote your shares promptly. You can vote your shares in three ways: • via the Internet at the website indicated on your proxy card; • via telephone by calling the toll free number on your proxy card; or • by returning the enclosed proxy card. By order of the Board of Directors Andrew S. -

2018/2019 Annual Report

2018/2019 ANNUAL REPORT The central idea of Scholastic is to help every child develop the personal power to engage with issues, to understand themselves and become the best and most able person they can be, equipped with the thinking skills and the emotional resilience to navigate the mid-21st century world they will inherit. —Richard Robinson Chairman, President and Chief Executive Officer 557 Broadway, New York, NY 10012 • 212 343 6100 • scholastic.com Fellow Shareholders, As I write this, Scholastic author Dav Pilkey is embarking on a global “Do Good” tour encouraging young readers to make an impact in their communities, demonstrating the power of reading to inspire positive change. The tour reminds us that reading can inspire both action and reflection, which is central to our Scholastic mission–helping kids read so they can develop the thinking skills to understand how the world works and the inspiration to understand themselves and their place in that world. The stakes are certainly high. At best, only 30% of U.S. children read at grade level. As millions of students and teachers prepare to return to school this month, Scholastic will be there for them as we have been for generations, providing the support, educational materials and high-quality children’s books needed to help prepare students for success, now and in the future. As we remain dedicated to this mission, we are also taking actions that enable us to continue serving educators, families, and children for our next 100 years. In FY20, this includes improving operating profitability while preparing for longer term growth. -

Wahoo! Climb Aboard the Magic School Bus™ and Buckle-Up for a Wild Ride with Newa Ll-In-One Game!

Wahoo! Climb aboard The Magic School Bus™ and Buckle-Up For a Wild Ride with Newa ll-in-one Game! With “The Magic School Bus,” the interactive new feature-packed, multi-touch, multiplayer game for Intel® powered All-in-One PCs: • Two-four players join Ms. Frizzle and set out on an exciting series of extraordinary field trips all around the world and through space, time—and beyond • Players are encouraged to “take chances, make mistakes, and get messy!” as they work together to solve problems and make incredible discoveries • Kids play each game as their favorite character from The Magic School Bus TV series – with eight options to choose from • The iconic yellow bus transforms into a submarine, space shuttle and other vehicles needed to make the journey to each exotic field trip location • Families experience a unique combination of adventures every time they play the game. And when players revisit a location, they encounter different animals, new sets of clues and more! • Kids ages 7 and up will actively engage in science, learning core concepts and tons of amazing facts all along the way • Players must work together to complete each mission— from piecing together a dinosaur skeleton and planting flags on planets, to killing germs and catching prey—to collect cool virtual stamps to fill their team passports Travel in the Magic School Bus and play cooperative games in 8 exciting locations! • Amazon Rainforest • Outer Planets • Great Barrier Reef • African Savanna • Jurassic Period • Inside the Human Body • Inner Planets • Cretaceous Period -

Clifford Moves Online: the History and Future of Scholastic Reading Club

Clifford Moves Online: The History and Future of Scholastic Reading Club By Natassja Barry B.A. English, Thompson Rivers University, 2016 Project submitted in partial fulfillment of the requirements for the degree of Master of Publishing In the Faculty of Communication, Art, and Technology ©Natassja Barry Simon Fraser University Fall 2017 This work is licensed under the Creative Commons Attribution 4.0 International (https://creativecommons.org/licenses/by/4.0/) Approval Name Natassja Barry Degree Master of Publishing Project Title Clifford Moves Online: The History and Future of Scholastic Reading Club Supervisory Committee _______________________________ Hannah McGregor Senior Supervisor Assistant Professor Publishing Program _______________________________ Leanne Johnson Supervisor Lecturer Publishing Program _______________________________ Sarah Maniscalco Industry Supervisor Senior Manager Reading Club Marketing Scholastic Canada Ltd. Toronto, Ontario Date Approved: December 20, 2017 ii Abstract Scholastic Canada has been running Reading Club in Canadian schools for half a century. Until 1998, teachers were only able to place student orders by mail or over the phone. Then, the first Canadian Reading Club website was created with a web form for teachers to submit orders online. The online form marked the start of a major change that has been brewing for Reading Club over the last two decades, but it wouldn’t be until 2016 that this simple form would be replaced by a fully- functioning e-commerce website. As Scholastic Canada moves Reading Club online, the company must maintain its valued relationship with teachers and protect its unique place in Canadian classrooms, while at the same time seeking out opportunities to grow in its new digital context. -

Scholastic Corporation (Exact Name of Registrant As Specified in Its Charter)

United States Securities and Exchange Commission Washington, D.C. 20549 Form 10-K Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended May 31, 2020 Commission File No. 000-19860 Scholastic Corporation (Exact name of Registrant as specified in its charter) Delaware 13-3385513 (State or other jurisdiction of incorporation or organization) (IRS Employer Identification No.) 557 Broadway New York, New York 10012 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (212) 343-6100 Securities Registered Pursuant to Section 12(b) of the Act: Title of Class Trading Symbol Name of Each Exchange on Which Registered Common Stock, $0.01 par value SCHL The NASDAQ Stock Market LLC Securities Registered Pursuant to Section 12(g) of the Act: NONE Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No o Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ☒ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No o Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit). -

Alaska Laborers Employers Retirement Fund, Et Al. V. Scholastic

UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK ALASKA LABORERS EMPLOYERS Civil Action No. 07-7402 RETIREMENT FUND, Individually and On Behalf of All Others Similarly Situated, CLASS ACTION COMPLAINT FOR VIOLATIONS OF Plaintiffs, FEDERAL SECURITIES LAWS vs. JURY TRIAL DEMANDED SCHOLASTIC CORP., RICHARD ROBINSON and MARY WINSTON, Defendant. Plaintiff has alleged the following based upon the investigation ofplaintiff's counsel, which included a review of United States Securities and Exchange Commission ("SEC ) filings by Scholastic Corp. ("Scholastic or the "Company ), as well as regulatory filings and reports, securities analysts' reports and advisories about the Company, press releases and other public statements issued by the Company, and media reports about the Company, and plaintiffbelieves that substantial additional evidentiary support will exist for the allegations set forth herein after a reasonable opportunity for discovery. NATURE OF THE ACTION 1. This is a federal securities class action on behalf ofpurchasers ofthe common stock of Scholastic between March 18, 2005 and March 23, 2006, inclusive (the "Class Period ), seeking to pursue remedies under the Securities Exchange Act of 1934 (the "Exchange Act ). JURISDICTION AND VENUE 2. The claims asserted herein arise under and pursuant to Sections 10(b) and 20(a) ofthe Exchange Act [15 U.S.C. §§78j(b) and 78t(a)] and Rule lOb-5 promulgated thereunder by the Securities and Exchange Commission ("SEC ) [17 C.F.R. §240. 1Ob-5]. 3. This Court has jurisdiction over the subject matter ofthis action pursuant to 28 U. S.C. §§1331 and Section 27 of the Exchange Act [15 U.S.C. -

Scholastic Corporation

United States Securities and Exchange Commission Washington, D.C. 20549 Form 10-K Annual Report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended May 31, 2004 | Commission File No. 000-19860 Scholastic Corporation (Exact name of Registrant as specified in its charter) Delaware 13-3385513 (State or other jurisdiction of (IRS Employer Identification No.) incorporation or organization) 557 Broadway, New York, New York 10012 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (212) 343-6100 Securities Registered Pursuant to Section 12(b) of the Act: NONE Securities Registered Pursuant to Section 12(g) of the Act: Title of class Name of Each Exchange on Which Registered Common Stock, $0.01 par value The NASDAQ Stock Market Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No _ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. X Indicate by check mark whether the Registrant is an accelerated filer (as defined in Exchange Act Rule 12b-2). -

Stifel Nicolaus Investor Meeting

Confidential ADD COVER IMAGE HERE Stifel Nicolaus Investor Meeting Wednesday, February 5, 2020 Art © Dav Pilkey. DOG MAN ™/® Dav Pilkey Forward-Looking Statements This presentation contains certain forward-looking statements. Such forward-looking statements are subject to various risks and uncertainties, including the conditions of the children’s book and educational materials markets and acceptance of the Company’s products in those markets, as well as other risks and factors identified from time to time in the Company’s filings with the Securities and Exchange Commission. Actual results could differ materially from those currently anticipated. 2 Investment Thesis Scholastic is the top children’s book publisher and distributor in the world. Children’s books seen as most stable and growing part of the market. Proprietary distribution channels to schools with clubs and fairs. New Scholastic Literacy comprehensive curriculum and component digital subscription products now in the market. English language learning materials market growing in China and Korea. Increased activity in the film and TV market as over‐the‐top subscription services compete for new children’s content. 3 Investment Thesis Strong balance sheet with ≈ $250 million in cash and trivial amounts of debt outside the U.S. Valuable company‐owned real estate unencumbered by liens or other collateral arrangements. Scholastic 2020 process improvement and cost savings initiatives gaining traction. New enterprise‐wide technology platforms and data‐ analytics capabilities informing new marketing strategies. Building remodel produced additional high value retail to drive incremental rental income in future periods. Higher levels of capital investment in technology, facilities and new products tapering off. -

Scholastic Corporation (Nasdaq: SCHL) to Ring the Nasdaq Stock Market Opening Bell with Clifford the Big Red Dog® in Celebration of Valentine's Day

February 11, 2016 Scholastic Corporation (Nasdaq: SCHL) to Ring The Nasdaq Stock Market Opening Bell With Clifford The Big Red Dog® in Celebration of Valentine's Day ADVISORY, Feb. 11, 2016 (GLOBE NEWSWIRE) -- What: Scholastic Corporation (Nasdaq:SCHL), the global children's publishing, education and media company, will visit the Nasdaq MarketSite in Times Square. In honor of Valentine's Day, Maureen O'Connell, EVP, CAO and CFO, Scholastic, will be joined by Clifford The Big Red Dog, to ring the Opening Bell. Clifford is a beloved literary icon, who, for more than 50 years, has added joy to the lives of millions of children all around the world. Clifford has grown from a beloved book series by the late, great Norman Bridwell into an iconic global brand. Today, there are more than 130 million Clifford books in print -- plus Clifford TV series, toys, games, ebooks and interactive products, and now Clifford is available on Netflix and through iTunes and Google Play, so that children can interact with Clifford wherever and whenever they like. Where: Nasdaq MarketSite - 4 Times Square - 43rd & Broadway - Broadcast Studio When: Friday, February 12, 2016 - 9:15 a.m. to 9:30 a.m. ET Scholastic Media Contact: Kyle Good 212-343-4563 [email protected] Nasdaq MarketSite: Emily Pan (646) 441-5120 [email protected] Feed Information: Fiber Line (Encompass Waterfront): 4463 Gal 3C/06C 95.05 degrees West 18 mhz Lower DL 3811 Vertical FEC 3/4 SR 13.235 DR 18.295411 MOD 4:2:0 DVBS QPSK Social Media: For multimedia features such as exclusive content, photo postings, status updates and video of bell ceremonies please visit our Facebook page at: http://www.facebook.com/NASDAQ. -

Company Directory

Media, Entertainment, and Journalism Company Directory Paid Internships in LA The Emmy Foundation (Academy of Television Arts and Sciences) – 31 categories of paid internships in LA – place students at various companies www.emmys.com/foundation/programs/internship/categories Motion Picture Production & Distribution Pixar Animation Studios www.pixar.com Walt Disney Pictures www.disney.com Warner Bros. Pictures www.warnerbros.com Paramount Pictures www.paramount.com Dreamworks Animation www.dreamworksanimation.com Dreamworks SKG www.dreamworks.com Twentieth Century-Fox Film Corporation www.fox.com Marvel Studios www.marvel.com Universal Pictures www.universalstudios.com Summit Entertainment www.summit-ent.com Columbia Pictures www.sonypictures.com Metro-Goldwyn-Mayer www.MGM.com New Line Cinema www.newline.com 1 Media, Entertainment, and Journalism Blue Sky Studios www.blueskystudios.com Lions Gate Films www.lionsgate.com Dimension Films www.weinsteinco.com The Weinstein Company www.weinsteinco.com Focus Features www.focusfeatures.com United Artists www.unitedartists.com GAMING Electronic Arts www.ea.com Activision Blizzard www.activisionblizzard.com Take-Two Interactive www.take2games.com THQ www.thq.com Midway Games www.midway.com Rockstar Games www.rockstargames.com Microsoft Game Studios www.microsoft.com/games MTV Games www.mtv.com/games/video_games 2 Media, Entertainment, and Journalism TV NETWORKS American Broadcasting Company (ABC) www.abc.com Fox Television Network www.fox.com CBS Television Network -

Scholastic Corporation (Exact Name of Registrant As Specified in Its Charter)

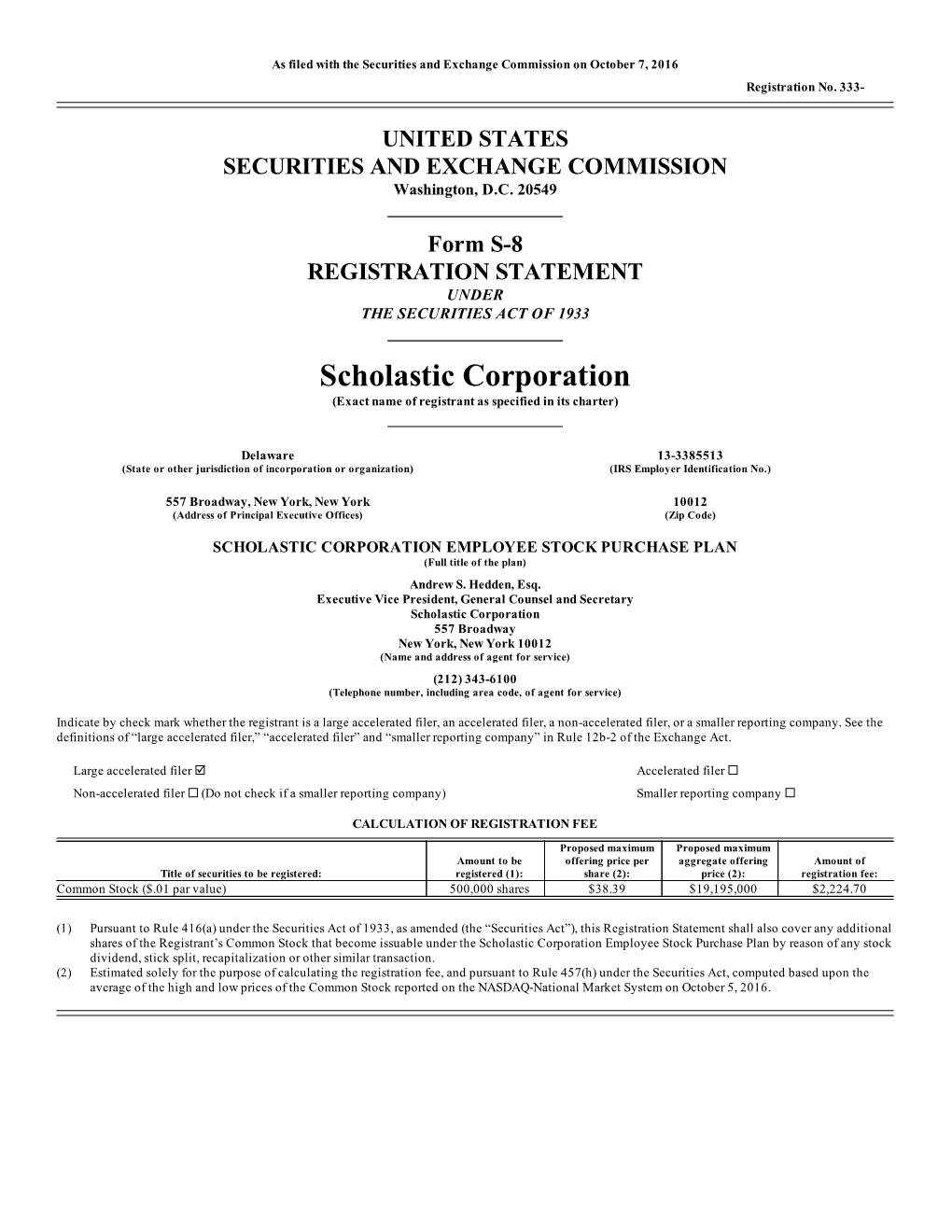

As filed with the Securities and Exchange Commission on November 30, 2011 Registration No. 333- UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form S-8 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 Scholastic Corporation (Exact name of registrant as specified in its charter) Delaware 13-3385513 (State or other jurisdiction of (IRS Employer Identification No.) incorporation or organization) 557 Broadway, New York, New York 10012 (Address of Principal Executive Offices) (Zip Code) SCHOLASTIC CORPORATION MANAGEMENT STOCK PURCHASE PLAN (Full title of the plan) Andrew S. Hedden, Esq. Senior Vice President, General Counsel and Secretary Scholastic Corporation 557 Broadway New York, New York 10012 (Name and address of agent for service) (212) 343-6100 (Telephone number, including area code, of agent for service) Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Large accelerated filer þ Accelerated filer o Non-accelerated filer o (Do not check if a smaller reporting company) Smaller reporting company o CALCULATION OF REGISTRATION FEE Proposed Proposed maximum maximum Title of securities Amount to be offering price per aggregate Amount of to be registered: registered (1): share (2): offering price (2): registration fee: Common Stock 300,000 shares $24.38 $7,314,000 $838.18 ($.01 par value) (1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional shares of the Registrant’s Common Stock that become issuable under the Scholastic Corporation Management Stock Purchase Plan by reason of any stock dividend, stick split, recapitalization or other similar transaction. -

Scholastic Corporation (Nasdaq: SCHL) to Ring the Nasdaq Stock Market Closing Bell on Halloween in Celebration of Goosebumps(TM)

Scholastic Corporation (Nasdaq: SCHL) to Ring The Nasdaq Stock Market Closing Bell on Halloween in Celebration of Goosebumps(TM) ADVISORY, Oct. 30, 2014 (GLOBE NEWSWIRE) -- What: Scholastic Corporation (Nasdaq:SCHL), the global children's publishing, education and media company, will visit the Nasdaq MarketSite in Times Square on October 31st in celebration of Goosebumps™. In honor of the occasion, Deborah Forte, EVP Scholastic and President Scholastic Media and Goosebumps author, R.L. Stine will ring the Closing Bell. Goosebumps™ has a LOT to scream about this year-- it remains one of the best-selling children's series of all-time with more than 350 million English language books in print, plus international editions in 32 languages as well as an incredibly popular TV series viewed by kids and young adults too! All 74 episodes of the Goosebumps® TV series are being streamed to Netflix subscribers in the United States, Canada, UK and Ireland and are also available for download through iTunes. In August 2015, the first ever Goosebumps feature film starring Jack Black will be released by Sony Pictures Entertainment. For more information about Scholastic visit mediaroom.scholastic.com. Where: Nasdaq MarketSite - 4 Times Square - 43rd & Broadway - Broadcast Studio When: Friday, October 31, 2014 - 3:45 p.m. to 4:00 p.m. ET Scholastic Corporation Media Contact: Kyle Good (212) 343-4563 [email protected] Nasdaq MarketSite: Christine Barna (646) 441-5310 [email protected] Feed Information: Fiber Line (Encompass Waterfront): 4463 Gal 3C/06C 95.05 degrees West 18 mhz Lower DL 3811 Vertical FEC 3/4 SR 13.235 DR 18.295411 MOD 4:2:0 DVBS QPSK Social Media: For multimedia features such as exclusive content, photo postings, status updates and video of bell ceremonies please visit our Facebook page at: http://www.facebook.com/NASDAQ.