Extractive Sector Transparency Measures Act - Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Volume 21 Issue 11 28 May 2020

Volume 21 Issue 11 28 May 2020 Shire of Yilgarn Emergency information hotline Call (08) 9487 8777 The Crosswords is produced by the for information relating to bushfire issues Southern Cross CRC, including vehicle movement & harvest bans, PO Box 178, Canopus St, road closures, flood or other local emergency Southern Cross WA 6426 matters. Phone: 08 9049 1688 Fax: 08 9049 1686 Email: [email protected] Southern Cross Landfill Times Crosswords Disclaimer: The Tip Shop will also be open during the below hours. The Shire of Yilgarn supports the production of this community newsletter the content of Monday 1:00pm to 4:00pm which will include articles or comments from Tuesday 1:00pm to 4:00pm advertisers and contributors. The Shire does Wednesday Closed not accept responsibility for the content or Thursday Closed accuracy of any of the information supplied Friday 1:00pm to 4:00pm by advertisers or contributors. Saturday 10:00am to 4:00pm Sunday 10:00am to 4:00pm Crosswords Advertising Rates 2019/20 (as of 1 July 2019) Business Advertisements Black Colour (Business premises outside of the Shire of Yilgarn) With With No Typesetting No Typesetting Typesetting Typesetting Full Page (A4) $35.00 $55.00 $160.00 $180.00 1/2 Page (A5) $20.00 $30.00 $90.00 $100.00 1/4 Page $15.00 $25.00 $50.00 $60.00 Local Business and Non-Profit Organisations Advertisements (Business premises within the Shire of Yilgarn) Full Page (A4) $30.00 $50.00 $130.00 $160.00 1/2 Page (A5) $15.00 $18.00 $70.00 $90.00 1/4 Page $10.00 $15.00 $35.00 $40.00 Lineage (Employment, Real Estate, Garage Sales maximum 6 lines) $8.00 Advert size specifications for Crosswords (W x H) 1/4 page vertical 90mm x 120mm 1/4 page horizontal 180mm x 60mm 1/2 page vertical 90mm x 270mm 1/2 page horizontal 180mm x 120mm A4 Full page 180mm x 270mm A5 adverts which are not horizontal will be displayed in print on their side to ensure no modification to advertisements. -

Biosecurity Areas

Study Name Biosecurity Areas ! ! ! ! (! ! (! ! (! Warrayu!(Wyndham ! ! (! ! (! Ku(!nunurra !( M!irima !Nulleywah ! (! ! ! ! !! ! !!( ! ! !! (! (! !! ! ! ! (! Shire of !! Wyndham-East Kimberley ! (! !!(!! ! !! !! (! ! ! ! (! ! !! !! ! !(!! !! ! !(! (! (! ! ! ! (! ! !!(!! ! !!!! ! ! (! (! ! !!( ! !!!!! ! !!!!! ! ! (! (! ! ! (!!!! (!(! ! ! ( ! KIMB! ERLEY !!! ! ! ! ! ! !! ! ! ! De!(!r( by ! ! (! ! ! (! ! Shire of (! ! Derby-West Kimberley ! (! ! (!! (! ! ! ! ! (! Morrell Park!( ! ! ! ! !(!(B! roome Mallingbar ! Bilgungurr ! ! ! ! Fitzroy Crossing ( Y (! !(!(!( ! H! alls Creek !(!(! Mardiwah Loop!(!( ! Mindi Rardi ! !!( R ! !Junjuwa !! ! !! ! ! ! ! O ! Nicholson Block (! ( ! ! (! ! ( T !(! I ! ! ! ! ! ! ! R ! ! ! ! ! !!!(! R ! !( ! ! ! !! ! ! ! ! (! ! ! ! ! E ! (! ! ! Shire of Broome T ! ! (! Shire of Halls Creek (! (! (! ! N ! R E H (! T ! Port Hedland ! ! R (! O !(Tkalka Boorda ! ! N (! Karratha (! Dampier ! (! !( Roebourne C! heeditha ! City of Karratha Gooda Binya !( (! ! PILBARA ! Onslow (! Shire of East Pilbara !( Bindi Bindi ! !( I(!rrungadji Exmouth ! ! ! Shire of Ashburton Tom Price ! ! ! (! ! (! Paraburdoo Newman (! Parnpajinya !( ! (! (! Shire of Carnarvon Shire of ! Upper Gascoyne ! ! ! Carnarvon (! !( Mungullah GASCOYNE Shire of Ngaanyatjarraku ! !( Woodgamia Shire of Wiluna ! ! MID WEST Shire of Meekatharra ! ! ! ! ! ! ! ! ! Shire of (! ! ! Meekatharra !( Shark Bay Bondini Shire of Murchison ! A Shire of Cue I L ! ! A Kalbarri R T Leinster S ! ! Shire of Laverton U A Northampton Shire of Sandstone Shire of Leonora ! ! ( Shire -

Tabled Paper [I

TABLED PAPER [I 2005/06 Grant Recipient Amount CITY OF STIRLING 1,109,680.28 SOUTHERN METROPOLITAN REGIONAL COUNCIL $617,461.21 CRC CARE PTY LTD $375,000.00 KEEP AUSTRALIA BEAUTIFUL COUNCIL (WA) $281,000.00 DEPT OF ENVIRONMENT $280,000.00 ITY OF MANDURAH $181,160.11 COMMONWEALTH BANK OF AUST $176,438.65 CITY OF ROCKINGHAM $151,670.91 AMCOR RECYCLING AUSTRALASIA 50,000.00 SWAN TAFE $136,363.64 SHIRE OF MUNDARING $134,255.77 CITY OF MELVILLE $133,512.96 CITY OF ARMADALE $111,880.74 CITY OF GOSNE LS $108,786.08 CITY OF CANNING $108,253.50 SHIRE OF KALAMUNDA $101,973.36 CITY OF SWAN $98,684.85 CITY OF COCKBURN $91,644.69 CITY OF ALBANY $88,699.33 CITY OF BUNBURY $86,152.03 CITY OF SOUTH PERTH $79,466.24 SHIRE OF BUSSELTON $77,795.41 CITY OF JOONDALUP $73,109.66 SHIRE OF AUGUSTA -MARGARET RIVER $72,598.46 WATER AND RIVERS COMMISSION $70,000.00 UNIVERSITY OF WA $67,272.81 MOTOR TRADE ASSOC OF WA INC $64,048.30 SPARTEL PTY LTD $64,000.00 CRC FOR ASTHMA AND AIRWAYS $60,000.00 CITY OF BAYSWATER $50,654.72 CURTIN UNIVERSITY OF TECHNOLOGY $50,181.00 WA PLANNING COMMISSION $50.000.00 GERALDTON GREENOUGH REGIONAL COUN $47,470.69 CITY OF NEDLANDS $44,955.87_ SHIRE OF HARVEY $44,291 10 CITY OF WANNEROO 1392527_ 22 I Il 2 Grant Recisien Amount SHIRE OF MURRAY $35,837.78 MURDOCH UNIVERSITY $35,629.83 TOWN OF KWINANA $35,475.52 PRINTING INDUSTRIES ASSOCIATION $34,090.91 HOUSING INDUSTRY ASSOCIATION $33,986.00 GERALDTON-GREENOUGH REGIONAL COUNCIL $32,844.67 CITY OF FREMANTLE $32,766.43 SHIRE OF MANJIMUP $32,646.00 TOWN OF CAMBRIDGE $32,414.72 WA LOCAL GOVERNMENT -

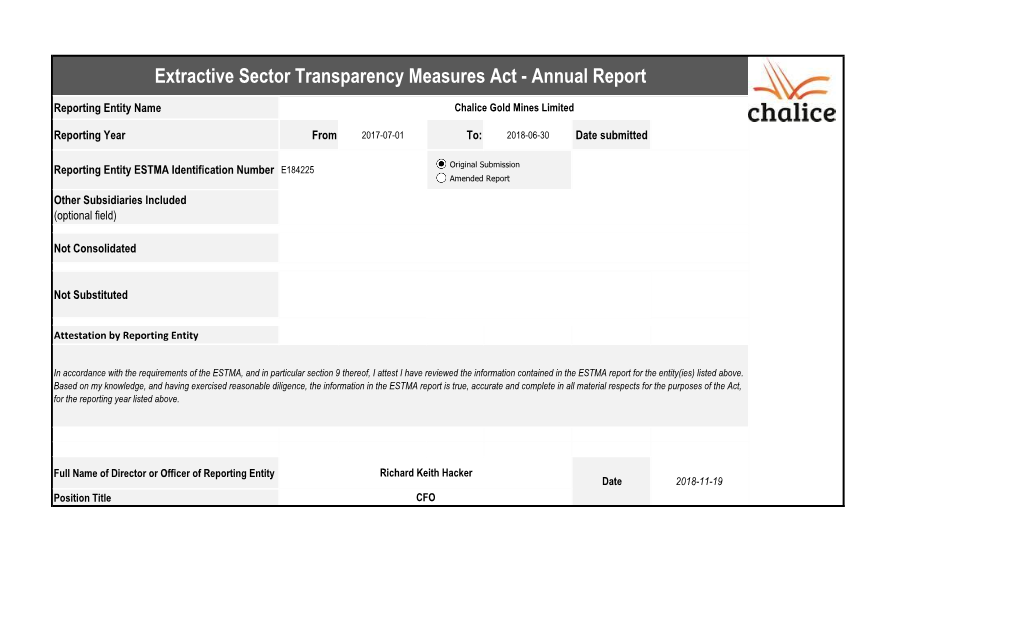

Extractive Sector Transparency Measures Act - Annual Report

Extractive Sector Transparency Measures Act - Annual Report Reporting Entity Name Chalice Gold Mines Limited Reporting Year From 2019-07-01 To: 2020-06-30 Date submitted 2020-11-26 Original Submission Reporting Entity ESTMA Identification Number E184225 Amended Report Other Subsidiaries Included (optional field) Not Consolidated Not Substituted Attestation by Reporting Entity In accordance with the requirements of the ESTMA, and in particular section 9 thereof, I attest I have reviewed the information contained in the ESTMA report for the entity(ies) listed above. Based on my knowledge, and having exercised reasonable diligence, the information in the ESTMA report is true, accurate and complete in all material respects for the purposes of the Act, for the reporting year listed above. Full Name of Director or Officer of Reporting Entity Richard Keith Hacker Date 2020-11-26 Position Title CFO Extractive Sector Transparency Measures Act - Annual Report Reporting Year From: 2019-07-01 To: 2020-06-30 Currency of Reporting Entity Name Chalice Gold Mines Limited AUD the Report Reporting Entity ESTMA E184225 Identification Number Subsidiary Reporting Entities (if necessary) Payments by Payee Infrastructure Departments, Agency, etc… within Payee that Production Total Amount Country Payee Name Taxes Royalties Fees Bonuses Dividends Improvement Notes Received Payments2 Entitlements paid to Payee Payments Canada Government of Quebec Ministère de l'Énergie et des Ressources Naturelles 4,727 4,727 Staking fees. Australia Government of Queensland Department of Environment and Science 1,466 1,466 Annual rents. Australia Government of Queensland Department of Resources 76,841 76,841 Annual rents. Australia Government of Northern Territory Department of Primary Industry & Resources 11,590 11,590 Applications, annual rents, levies and permits. -

Map 2: Southern W.A

Western Australia PERTH SHIRE OF MOUNT MARSHALL SHIRE OF DALWALLINU Jurien Dalwallinu SHIRE OF SHIRE OF MOORA SHIRE OF DANDARAGAN 7 SHIRE OF KOORDA Moora WONGAN- BALLIDU Koorda Bencubbin Kalgoorlie CITY OF KALGOORLIE-BOULDER Wongan Hills Mukinbudin SHIRE OF SHIRE OF WESTONIA SHIRE OF YILGARN Coolgardie VICTORIA PLAINS 3 Wyalkat- Trayning SHIRE OF Calingiri 2 chem 6 SHIRE OF COOLGARDIE GINGIN 1 Southern Cross Dowerin 5 Westonia Gingin 4 SHIRE OF Goomalling Merredin TOODYAY SHIRE OF Muchea Toodyay Northam CUNDERDIN 9 Kellerberrin SHIRE OF MERREDIN Cunderdin Tammin 10 8 Bruce Rock York SHIRE OF SHIRE OF SHIRE QUAIRADING SHIRE OF NAREMBEEN Perth SHIRE OF DUNDAS OF YORK Quairading BRUCE ROCK Narembeen SHIRE OF Beverley Norseman SHIRE OF 11 BEVERLEY Corrigin Brookton CORRIGIN Mundijong 12 SHIRE OF KONDININ Mandurah 14 Hyden CITY OF MANDURAH 15 Pingelly 13 Wandering SHIRE OF SHIRE OF KULIN Pinjarra 18 Kulin 17 Cuballing WICKEPIN Wickepin Waroona 16 Boddington Williams Narrogin 19 21 SHIRE OF LAKE GRACE SHIRE OF Lake Grace Harvey 20 SHIRE OF WILLIAMS SHIRE DUMBLEYUNG SHIRE OF ESPERANCE Bunbury OF Wagin Dumbleyung CITY OF BUNBURY Collie Darkan 23 WAGIN LGA Boundaries Capel Dardanup SHIRE OF Nyabing 22 28 Ravensthorpe WEST ARTHUR Woodanilling 29 SHIRE OF KENT Australian Coastline Donnybrook Boyup Katanning SHIRE OF RAVENSTHORPE 24 Busselton Towns 25 BrookSHIRE OF Kojonup Esperance Population > 5000 27 BOYUP SHIRE OF Margaret Gnowangerup Jerramungup River BROOK SHIRE OF TAMBELLUP 500 < Population < 5000 Nannup Bridgetown KOJONUP SHIRE OF 1. Shire of Chittering 16. Shire of Waroona Tambellup SHIRE OF Population < 500 26 SHIRE OF GNOWANGERUP 2. Shire of Goomalling 17. -

Government of Western Australia Department of Environment Regulation

Government of Western Australia Department of Environment Regulation NOTIFICATION OF APPLICATIONS RECEIVED FOR CLEARING PERMITS AND AMENDMENTS AVAILABLE FOR PUBLIC SUBMISSIONS AND/OR REGISTRATIONS OF INTEREST Applications for clearing permits with a 7 day submission period 1. Shire of Brookton, Purpose Permit, Brookton-Kweda Road reserve (PINs 11640760 and 11640738), Brookton, Shire of Brookton, road widening, 7 native trees (CPS 7048/1) 2. City of Busselton, Purpose Permit, Metricup Road reserve (PIN 11476584), Lots 51 and 52 on Plan 41608 and Lots 55, 56 and 57 on Plan 53720, Wilyabrup, City of Busselton, bridge widening, 0.29ha (CPS 7053/1) 3. BGC Australia Pty Ltd, Purpose Permit, Lot 5 on Plan 7892, Bullsbrook, City of Swan, stockpiles, 1.982ha (CPS 7054/1) 4. Shire of Derby West Kimberley, Purpose Permit, Lot 1140 on Deposited Plan 215322, Derby, Shire of Derby West Kimberley, land ll site expansion, 0.28ha (CPS 7057/1) 5. City of Joondalup, Area Permit, Lot 501 on Deposited Plan 62965 and Lloyd Drive road reserve (PIN 11870710), Warwick, City of Joondalup, access road, 0.016ha and 1 native tree (CPS 7058/1) 6. Shire of Augusta-Margaret River, Area Permit, Lot 5122 on Deposited Plan 193363, Margaret River, Shire of Augusta-Margaret River, cemetery expansion, 0.1ha (CPS 7064/1) 7. Shire of Augusta-Margaret River, Area Permit, Carbunup Road South reserve (PIN 11471100), Metricup, Shire of Augusta-Margaret River, bridge replacement, 0.23ha (CPS 7065/1) Applications for clearing permits with a 21 day submission period 1. Shire of Wyndham-East -

5 Private Swimming Pools in Western Australia

Investigation into ways to prevent or reduce deaths of children by drowning 5 Private swimming pools in Western Australia Where location was known, private swimming pools were the most common location of fatal and non-fatal drowning incidents during the six-year investigation period.146 As discussed in Chapter 4, the Office found that, for 16 (47 per cent) of the 34 children who died by drowning, the fatal drowning incident occurred in a private swimming pool. Similarly, for 170 (66 per cent) of the 258 children who were admitted to a hospital following a non-fatal drowning incident, the incident occurred in a swimming pool. Accordingly, the Ombudsman determined to examine private swimming pools in Western Australia in more detail. 5.1 Number of private swimming pools The Office was unable to identify any source with recent information about the total number and location of private swimming pools in Western Australia, therefore, as part of the Investigation, the Office collected and analysed this information. The Office surveyed local governments regarding the number of private swimming pools in their local government district as at 30 June 2015 (the local government survey). Of the 140 local governments that were surveyed,147 138 (99 per cent) local governments responded to the survey (the 138 survey respondents) and two (one per cent) local governments did not respond to the survey. The two local governments that did not respond were small local governments located outside the metropolitan regions of Western Australia. Section 130 of the Building Act 2011 requires local governments to keep building records associated with private swimming pools (such as applications for building permits and inspections) located in their local government district to enable monitoring of compliance with Part 8, Division 2 of the Building Regulations 2012. -

18~014 -Tl ~ Rj I

Wheatbelt (Western Australia) - Wikipedia, the free encyclopedia Page 3 of6 .' • Kellerberrin " • Kondinin • Koorda • Ku lin • Lake Grace • Merredin • Moora • Mount Marshall • Mukinbudin • Narembeen • Narrogin (Shire) • Narrogin (Town) • Northam • Nungarin • Pingelly • Quairading • Tammin • Toodyay • Trayning • Victoria Plains • Wagin (J • Wandering • West Arthur • Westonia • Wickepin • Williams • Wongan-Ballidu • Wyalkatchem • Yil garn • York G Wheat growing north-east of Northam, Western Australi a y£;; v1 ~ ~~ Sub-regions within the wheatbelt - gA~oI i5u- - r: . - - ~01 k;.<?~ There are numerous subdivisions of the wheatbelt, and in mo ~ses the separat ~al .s~ government areas, .---- N0d e-y ~ cI ~(JO---V'-o.--fr <Y-"'- . l/c SV A <!J-T ~ J J -f'/KcLu-~,<-- WheatbeIt Development CommissIOn ! ~J. (., Q Q f- -~ The Wheatbelt Development Commission[6] (WDC) breaks the region up into five sub-regions with -+- fiveO~ffices: Nais .- ~!.. ~ ~ ~ !-eN ~ - ~f-~ 0/ fh k~ ~ ~~( !J cJ,.croA- ~ -7 Lt.j~o.-e. ~~ rt; http://en-..Wiki edt, ' , estern .Australi?) 18 ~ 014 -tL ~ rJ I- zc;o tf) -~ crvt J-I v.,rf.J-cLI ~ C~~ Wheatbelt (Western Australia) - Wikipedia, the free encyclopedia Page 4 of6 • Avon • Shire of Beverley • Shire of Cunderdin • Shire of Oowerin • Shire of Goomalling • Shire of Koorda • Shire of Northam • Shire of Quairading \\ • Shire of Tammin • Shire ofToodyay • Shire ofWyalkatchem • Shire of York • Central Coast, comprising: • Shire ofOandaragan - WOC office in Jurien Bay 'l.- • Shire of Gingin • Central Midlands, comprising: • -

2017 Local Government Ordinary Elections Election Report

2017 Local Government Ordinary Elections Election Report March 2017 W ESTERN AUSTRALIAN Electoral Commission Election Report TABLE OF CONTENTS Foreword ............................................................................................................................... 3 Introduction ........................................................................................................................... 5 Returning Officers and Staff .................................................................................................. 6 Advertising ............................................................................................................................ 6 Electoral Rolls ........................................................................................................................ 7 Nominations .......................................................................................................................... 7 Complaints ............................................................................................................................ 7 Stakeholder Feedback Surveys .............................................................................................. 7 Processing Election Packages ................................................................................................ 8 Results ................................................................................................................................... 10 Participation ......................................................................................................................... -

Council Policy Manual

+ Council Policy Manual as adopted 17 September 2021 Council Policy Manual Document Owner CHIEF EXECUTIVE OFFICER First Adopted: SEPT 2011 Last Review Date: SEPT 2021 Next Review SEPT 2022 Council Policy Manual TABLE OF CONTENTS Section 1 Members of Council 1.1 Deputations of Council 4 1.2 Delegates Moving Motions at Association Conferences 5 1.3 WALGA-Nominations to Boards and Committees 6 1.4 Use of Councils Common Seal 7 1.5 Elected Member Entitlements 8 1.6 Media Policy 13 1.8 Disruptive Behaviour at Council Meetings 17 1.9 Councillor iPad Policy 19 1.10 Related Party Disclosures 22 1.11 Council Forum/Briefing Session 26 1.12 Induction for Councillors 28 1.13 Continuing Professional Development of Council Members 30 1.14 Attendance at Events and Functions 34 1.15 Risk Management Policy 38 Section 2 Bushfire 2.1 Use of Council Equipment 45 2.2 Harvest & Vehicle Movement Bans 46 2.3 Brigade Membership Forms 47 2.4 Bush Fire Committee Advisory Committee Policy 48 1 Council Policy Manual Section 3 Finance 3.1 Asset Capitalisation and Depreciation 51 3.1A Disposal of Assets 56 3.2 Surplus Funds Investment 59 3.3 Resourcing Employee Entitlements 60 3.4 Reserve Portfolio Rationale 61 3.5 Purchasing and Tendering Policy 62 3.5A Regional Price Preference 76 3.6 Signing of Cheques 78 3.7 Recovery of Fines and Costs from Sundry Debtors 79 3.8 Use of Council Credit Card 80 3.9 Rates and Charges Recovery Policy (Including Sewerage Charges Financial Hardship Policy) 83 3.10 Use of Shire Facilities by Service Providers 85 3.11 Timely Payment of Supplier -

Largely Restricted to the Shire of Wongan-Ballidu by Gillian Stack, Nicole Willers, Mike Fitzgerald and Andrew Brown

DECLARED RARE AND POORLY KNOWN FLORA Largely Restricted to the Shire of Wongan-Ballidu By Gillian Stack, Nicole Willers, Mike Fitzgerald and Andrew Brown 2006 Wildlife Management Program N0 39 Western Australian Wildlife Management Program No. 39 Declared Rare and Poorly Known Flora Largely Restricted to the Shire of Wongan-Ballidu by Gillian Stack, Nicole Willers, Mike Fitzgerald and Andrew Brown Title page illustration of the recently rediscovered Calothamnus accedens drawn by Susan Patrick Cover Page Photograph by Rosemarie Rees Department of Conservation and Land Management Locked bag 104 Bentley Delivery Centre Western Australia 6983 ISSN 0816-9713 The Department of Conservation and Land Management’s Wildlife Management Programs are edited by the Species and Communities Branch, PO Box 51 Wanneroo, Western Australia 6946 Email: [email protected] 2006 iii FOREWORD Western Australian Wildlife Management Programs are a series of publications produced by the Department of Conservation and Land Management (CALM). The programs are prepared in addition to Regional Management Plans and species’ Recovery Plans to provide detailed information and guidance for the management and protection of certain threatened and Priority species within a particular area. This program provides a brief description of the appearance, distribution, habitat and conservation status of flora declared as rare under the Western Australian Wildlife Conservation Act (Threatened Flora) and poorly known flora (Priority Flora) in the Shire of Wongan-Ballidu and makes recommendations for research and management action necessary to ensure their continued survival. By ranking the Declared Rare Flora in priority order for these requirements, Departmental staff and resources can be allocated to plant taxa most urgently in need of attention. -

Metropolitan Region Scheme Perth Western Australia

METROPOLITAN REGION SCHEME PERTH WESTERN AUSTRALIA ~ 10 kilometres IND/AN OCEAN Western Australian Plannln_g Commission _, •....B, ~_ -- I____ .. Produced by -----------· Zones Data Analytics, Strategy and Engagement, METROPOLITAN REGION SCHEME LEGEND Department of Planning, Lands and Heritage [:=:J Central city area Reserved lands Notice or delegation MRS Zones and Reservations CJ Industrial Civic and cultural LJWaterways ~ Bush forever area amended to 8th July 2019 Special industrial Water catchments EEl33 Cl State of Western Australia - Parks and recreation G Redevelopment schemes Private recreation Railways c:J CJ Redel.Jelopment schemefact area This map may not be reproduced wholly or in part Reserved roads LJRura! LJ ~ Port installations without the written pennission of the Department. - Primary regional roads CJ Pubfic purposes CJ Rural - water protection L•..:; Scheme boundary NOTE: This map does not show all the - Other regional roads CJ urban details of the Metropolitan Region Scheme CJ State forests It is a simplification only. LJ Urban deferred Document Name: JOB 212129 Shire of Esperance Government Organisations Shire of Exmouth Government Organisations City of Fremantle Government Organisations Shire of Gingin Government Organisations Shire of Gnowangerup Government Organisations Shire of Goomalling Government Organisations City of Gosnells Government Organisations City of Greater Geraldton Government Organisations Shire of Halls Creek Government Organisations Shire of Harvey Government Organisations Shire of Irwin Government