Business Review and Prospects

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Completed Properties 1. Westin Centre 2. Grand Palisades 3

Completed properties 1. Westin Centre 2. Grand Palisades 3. Central Park 4. Far East Finance Centre 5. Cambridge Plaza 6. Dynasty Heights 7. Island Resort 8. Greenfields 9. Majestic Park 10. Island Harbourview 11. Grand Dynasty View 12. Park Avenue 13. Belair Monte 14. Sky Horizon 15. Horizon Place 16. Grand Regentville 17. Lincoln Centre Properties under development 18. Kowloon Inland Lot No. 11158 19. Ocean View, Sha Tin Town Lot No. 481 20. The Cliveden, Lot No. 404 21. The Cairnhill, Lot No. 395 22. Anglers’ Bay, Lot No. 214 in DD387, Sham Tseng 23. Residence Oasis, Tseung Kwan O Town Lot No. 24, MTR Hang Hau Station Development 24. Skyline Tower, New Kowloon Inland Lot No. 5846 25. Embassy Lodge, Lot No. 2543 26. St Andrews Place, Lot No. 943 27. Parc Palais, Kowloon Inland Lot No. 11118 28. Oceania Heights, Tuen Mun Town Lot No. 432 29. Imperial Villas, Lot No. 2051 and 2052 30. The Beacon Hill, New Kowloon Inland Lot No. 6196 31. Piper’s Hill, New Kowloon Inland Lot No. 6378 32. Tsuen Wan Town Centre Redevelopment Investment properties 33. The Centrium 34. 148 Electric Road 35. Central Plaza 36. Conrad Hong Kong 37. Harbour Centre 38. Hollywood Centre 39. Marina House 40. One Capital Place 41. Pacific Palisades 42. Pacific Plaza 43. Island Resort Mall 44. 25/F United Centre 45. Olympian City 1 46. Olympian City 2 47. The Astrid 48. Cameron Plaza 49. China Hong Kong City 50. Corporation Square 51. Futura Plaza 52. Sunley Centre 53. Westley Square 54. Fullerton Centre 55. -

A/Tw/516 A-1

°Ñ¦Ò ø REFERENCE No. DRAWING A/TW/516 A-1 ¡]¨Ó·½¡ Ia¡ (Source : Appendix Ia) °Ñ¦Ò ø REFERENCE No. DRAWING A/TW/516 A-2 ¡]¨Ó·½¡ Ia¡ (Source : Appendix Ia) °Ñ¦Ò ø REFERENCE No. DRAWING A/TW/516 A-3 ¡]¨Ó·½¡ Ia¡ (Source : Appendix Ia) °Ñ¦Ò ø REFERENCE No. DRAWING A/TW/516 A-4 ¡]¨Ó·½¡ Ia¡ (Source : Appendix Ia) °Ñ¦Ò ø REFERENCE No. DRAWING A/TW/516 A-5 ¡]¨Ó·½¡ Ia¡ (Source : Appendix Ia) °Ñ¦Ò ø REFERENCE No. DRAWING A/TW/516 A-6 ¡]¨Ó·½¡ Ia¡ (Source : Appendix Ia) °Ñ¦Ò ø REFERENCE No. DRAWING A/TW/516 A-7 ¡]¨Ó·½¡ Ic¡ (Source : Appendix Ic) °Ñ¦Ò ø REFERENCE No. DRAWING A/TW/516 A-8 ¡]¨Ó·½¡ Ic¡ (Source : Appendix Ic) °Ñ¦Ò ø REFERENCE No. DRAWING A/TW/516 A-9 ¡]¨Ó·½¡ Ia¡ (Source : Appendix Ia) G/IC B R(A) G/IC(5) G GB V G/IC(8) 509 (13.12.19) 路口 (有待詳細設計) ROAD JUNCTION (SUBJECT TO DETAILED DESIGN) G/IC 508 (17.01.20) R(B)4 4 W an g L ung 514 (29.05.20) St ¥Ó½Ð ¹Ï LEGEND APPLICATION SITE Àò§å•ã ¥ý«e 505 (01.11.19) APPROVED APPLICATION PREVIOUS APPLICATION 505 (01.11.19) ³Q©Úµ´ 415 (05.08.11) 415 (05.08.11) REJECTED APPLICATION 505 (01.11.19) ·|ij DATE OF MEETING ¥Ó½Ð APPLICATION NUMBER ¹ê¦a·Ó¤ù 4 VIEWING POINT OF SITE OU PHOTO ¥Ó½Ð¦aÂI¬É½ APPLICATION SITE BOUNDARY R(A)8 美化市容地帶 FOR IDENTIFICATION PURPOSE ONLY AMENITY AREA ¦ì¸ LOCATION PLAN ³W¹ 擬議略為放寬地積比率限制 ¥»ºK•n¹Ï©ó2020¦~5¤ë29¤éÀ 以作准許的工業用途 ¬°©ó2017¦~4¤ë11¤é®Ö•ãªº¤ 荃灣灰窰角街24-32號 PLANNING DEPARTMENT S/TW/33 PROPOSED MINOR RELAXATION OF PLOT RATIO RESTRICTION EXTRACT PLAN PREPARED ON 29.5.2020 FOR PERMITTED INDUSTRIAL USE BASED ON OUTLINE ZONING PLAN No. -

DDC Location Plan Mar-2017 Mon Tue Wed Thu Fri Sat Sun 1 2 3

WWF - DDC Location Plan Mar-2017 Mon Tue Wed Thu Fri Sat Sun 1 2 3 4 5 Team A Lai King MTR Exit A Tai Wo Hau MTR Exit B apm apm apm CWB Yun Ping Road (Near Hang Team B Ma Tau Wai Road (near HSBC) Plaza Hollywood Plaza Hollywood Plaza Hollywood Seng Bank) Wing On Hse (Bank of China), Team C Bellagio, Sham Tseng Bellagio, Sham Tseng Wing On Hse (Bank of China), Central Wing On Hse (Bank of China), Central Central Team D iSquare, TST iSquare, TST Island Creast, Sai Wan Island Creast, Sai Wan Island Creast, Sai Wan Team E Heng Fa Chuen MTR Station Heng Fa Chuen MTR Station Fortress Hill MTR Station Exit B Fortress Hill MTR Station Exit B Fortress Hill MTR Station Exit B Team F Kwai Fong MTR Station Exit D Kwai Fong MTR Station Exit D Greenfield Gdn, Tsing Yi Greenfield Gdn, Tsing Yi Greenfield Gdn, Tsing Yi Team G Kwun Tong HSBC Kwun Tong HSBC Cheung Sha Wan Plaza Cheung Sha Wan Plaza Cheung Sha Wan Plaza Hang Hau Residence Oasis Tower Team H Hang Hau Residence Oasis Tower 1 On Ting Light Rail Station On Ting Light Rail Station On Ting Light Rail Station 1 Team I Tuen Mun Town Plaza Tuen Mun Town Plaza Tai Hang, CWB Tai Hang, CWB Tai Hang, CWB Chung Sing Path (Chung Sing Path Chung Sing Path (Chung Sing Path Chung Sing Path (Chung Sing Path Team J Wanchai HSBC Wanchai HSBC Playground) Playground) Playground) Team K Diamond Hill MTR Station Exit A1 Diamond Hill MTR Station Exit A1 Yau Ma Tei MTR Station Exit A2 Yau Ma Tei MTR Station Exit A2 Yau Ma Tei MTR Station Exit A2 Team L Wing On, Jordon Wing On, Jordon Tram Terminus, Kennedy Town Tram -

Egn20111550859.Ps, Page 3 @ Preflight ( EX-50-1833.Indd )

G.N. (E.) 859 of 2011 ELECTORAL AFFAIRS COMMISSION (ELECTORAL PROCEDURE) (ELECTION COMMITTEE) REGULATION (Cap. 541, sub. leg. I) (Section 18 of the Regulation) NOTICE OF NOMINATIONS ELECTION COMMITTEE SUBSECTOR ELECTIONS NEW TERRITORIES DISTRICT COUNCILS SUBSECTOR Polling Date: 11 December 2011 The following candidates are validly nominated for the New Territories District Councils subsector : Particulars as shown on Nomination Form Candidate Number Name of Candidate Address 1 WONG CHAK PIU FLAT D 2/F BLOCK 2 SOUTH WAVE PHILIP COURT 3 SHUM WAN ROAD HONG KONG 2 LING MAN HOI 3/F, NO.5 WAN KING PATH, SAI KUNG, N.T. 3 LAM LAP CHI 2/F, NO. 7A, KAU WAH KENG VILLAGE, KWAI CHUNG, NEW TERRITORIES 4 TONG PO CHUN F30, 1/F, COMMERCIAL CENTRE, SADDLE RIDGE GARDEN, MA ON SHAN, SHATIN, N.T. 5 WONG CHEUK KIN SHOP NO. 121A, 1/F, CHUNG FU PLAZA (PHASE I), TIN SHUI WAI, NEW TERRITORIES, HONG KONG 6 KWU HON KEUNG 1/F, NO. 84, SAN WAI TSAI, SAN SIU STREET, TUEN MUN, N.T. 7 LAM FAAT KANG FLT 08 20/F BLK G LUK YEUNG SUN CHUEN TSUEN WAN N.T. 8 WONG PIK KIU 2/F, 97 KWONG FUK ROAD, TAI PO, N.T., HONG KONG 9 LEE CHI KEUNG FLAT A, 16/F, TOWER 1, TIERRA VERDE, ALAN TSING YI 10 CHAU CHUEN HEUNG ROOM 1810, HOR TUNG HOUSE, YU TUNG COURT, TUNG CHUNG, LANTAU ISLAND 11 WONG WANG TO FLAT K, 30/F, BLOCK 3, WING FAI CENTRE, FANLING 12 LEUNG CHI WAI RM. 1220, SUN WAI HOUSE, SUN CHUI ESTATE, SHATIN, N.T. -

M / SP / 14 / 173 Ser Res

¬½á W¤á 300 200 Sheung Fa Shan LIN FA SHAN Catchwater flW˘§⁄ł§¤‚˛†p›ˇ M / SP / 14 / 173 Ser Res 200 w 200 SEE PLAN REF. No. M / SP / 14 / 173 NEEDLE HILL 532 FOR TSUEN WAN VILLAGE CLUSTER BOUNDARIES 500 è¦K 45 Catchwater fih 400 Catchwater 400 2 _ij 100 flW˘§⁄ł§¤‚˛†p›ˇ M / SP / 14 / 172 The Cliveden The Cairnhill JUBILEE (SHING MUN) ROUTE RESERVOIR ê¶È¥ Catchwater «ø 314 Yuen Yuen 9 SEE PLAN REF. No. M / SP / 14 / 172 Institute M' y TWISK Wo Yi Hop 46 23 22 10 FOR TSUEN WAN VILLAGE CLUSTER BOUNDARIES Ser Res 11 SHING MUN ROAD 200 Catchwater 300 Ser Res 3.2.1 Á³z² GD„‹ HILLTOP ROAD ãÅF r ú¥OªÐ e flA Toll Gate t 474 a Kwong Pan Tin 12 w h San Tsuen D c ù t «ø“G a C ¥s 25 SHEK LUNG KUNG ƒ Po Kwong Yuen –‰ ú¥Oª LO WAI ROAD ¶´ú 5 Tso Kung Tam Kwong Pan Tin «ø Tsuen “T Fu Yung Shan ƒ SAMT¤¯· TUNG UK ROAD 5 Lo Wai 14 20 Sam Tung Uk fl” 22 ø–⁄ U¤á 315 24 Resite Village 300 Ha Fa Shan ROAD ¥—¥ H¶»H¶s s· CHUN Pak Tin Pa 8 Cheung Shan 100 fl” 19 San Tsuen YI PEI 400 fl´« TSUEN KING CIRCUIT San Tsuen 13 Estate 100 5 ROAD Allway Gardens flW˘ 100 3.2.2 fl”· SHAN 3 ROAD fi Tsuen Wan Centre FU YUNG SHING 25 ˦Lª MUN Ser Res 28 Chuk Lam Hoi Pa Resite Village ST Tsuen King Sim Yuen 252 ¤{ ON YIN Garden G¤@ G¤@« Ma Sim Pei Tsuen Łƒ… “T» Yi Pei Chun Lei Muk Shue 2 SHING MUN TUNNEL »» 26 Sai Lau Kok Ser Res Ser Res CHEUNG PEI SHAN ROAD Estate w ¥—¥ Tsuen Heung Fan Liu fl MEI WAN STREET 21 Pak Tin Pa M©y© ROAD «ø“ ·wƒ Tsuen 12 MA SIM PAI Lower Shing Mun Ser Res 18 Village «ø“ flw… 7 TSUEN KING CIRCUIT A ⁄· fi¯ł «ø“ƒ¤ Tsuen Tak ¤{ 200 ½ Shing Mun Valley W¤ª Garden -

香港物業管理公司協會有限公司the Hong Kong Association of Property

香港物業管理公司協會有限公司 The Hong Kong Association of Property Management Companies Limited 會員轄下物業資料 Date : 05-14-2018 Members Portfolios Property Registers 會員編號 F-0073/01 公司名稱: 香港鐵路有限公司 Membership No.: Company Name: MTR Corporation Limited 總樓宇面積 單位面積 (平方呎) 類別 物業名稱及地點 物業地址 類別/座數 單位數目 Unit Size GFA 樓齡 管理年數 Type Properties Properties Address Type/No. of Blocks No. of Units Min/Max Sq. Ft. Age Yrs.Managed CAdmiralty Centre 18 Harcourt Road Admiralty HK Office/Shop CCitylink Plaza 1 Station Circuit Shatin NT Shop CElements 1 Austin Road West KLN Shop CFairmont House 8 Cotton Tree Drive Central HK Office CLuk Yeung Galleria Luk Yeung Sun Chuen KLN Shop CMaritime Square 33 Tsing King Road Tsing Yi NT Shop COcean Walk 168-236 Wu Chui Road Tuen Mun NT Shop CParadise Mall 100 Shing Tai Road Chai Wan HK Shop CPopCorn 9 Tong Yin Street Tseung Kwan O NT Shop CPopCorn2 9 Tong Chun Street Tseung Kwan O NT Shop CTelford Plaza 33 Wai Yip Street Kowloon Bay KLN Shop CTelford Plaza II 33 Wai Yip Street Kowloon Bay KLN Shop CThe Lane 15 Pui Shing Road Hang Hau NT Shop CTwo International Finance Centre 8 Finance Street Central HK Office CWorld-wide House 19 Des Voeux Road Central HK Office/Shop RCaribbean Coast 2 Kin Tung Road Tung Chung NT RCentral Park/Park Avenue 18 Hoi Ting Road RCentury Gateway I & II 83 Tuen Mun Heung Sze Wui Road Tuen Mun NT RCityPoint 48 Wing Shum Street Tsuen Wan NT RCoastal Skyline - Le Bleu (Ph. II) 12 Tung Chung Waterfront Road Tung Chung NT 香港物業管理公司協會有限公司 The Hong Kong Association of Property Management Companies Limited 會員轄下物業資料 Date : 05-14-2018 Members Portfolios Property Registers 會員編號 F-0073/01 公司名稱: 香港鐵路有限公司 Membership No.: Company Name: MTR Corporation Limited 總樓宇面積 單位面積 (平方呎) 類別 物業名稱及地點 物業地址 類別/座數 單位數目 Unit Size GFA 樓齡 管理年數 Type Properties Properties Address Type/No. -

Buildings Energy Efficiency Funding Schemes Under the Environment and Conservation Fund

ECPVSC Paper 18/2011-12 For Discussion Buildings Energy Efficiency Funding Schemes under the Environment and Conservation Fund Purpose This paper seeks – (a) Members’ agreement to approve 90 funding applications and not to accept eight funding applications for the Energy Efficiency Projects (EEP) of the Buildings Energy Efficiency Funding Schemes (BEEFS) under the Environment and Conservation Fund (ECF). (b) Members’ support to seek approval from the ECF Committee for three funding applications of values exceeding HK$2.0 million for the EEP of the BEEFS under the ECF. Summary 2. As at 3 January 2012, a total of 220 and 1,329 applications were received for Energy-cum-carbon Audit Projects (ECA) and EEP respectively. Since the Energy Conservation Projects Vetting Sub-committee (ECPVSC) meeting on 17 August 2011, 98 funding applications have been vetted. Out of these 98 applications, 90 funding applications are recommended for approval, six funding applications are recommended not to accept due to inadequate information received for assessment, one funding application is recommended not to accept due to ineligible applicant and one funding application is recommended not to accept due to works commenced before Energy Conservation Projects Vetting Subcommittee (ECPVSC) approval. 3. In addition to the above, 12 funding applications were withdrawn by the applicants which are listed below. Projects withdrawn by the Applicants Project No. Applicant Funding Sought Energy Efficiency Project - The Incorporated Owners of $45,340.00 Cheong Ming Building Cheong Ming Building (Ref. EEP-0236) - 1 - ECPVSC Paper 18/2011-12 For Discussion Project No. Applicant Funding Sought Energy Efficiency Project - Residence Oasis Residential $210,623.00 Residence Oasis Owners Sub-committee (Ref. -

Tsuen Wan(Revised After

District : Tsuen Wan Provisional District Council Constituency Areas +/- % of Population Estimated Quota Code Proposed Name Boundary Description Major Estates/Areas Population (16,964) K01 Tak Wah 21,075 +24.23 N Tai Ho Road North, Sai Lau Kok Road 1. CHUNG ON BUILDING 2. CITY LANDMARK I NE Sai Lau Kok Road 3. FOU WAH CENTRE E Sai Lau Kok Road, Shing Mun Road 4. HO FAI GARDEN 5. TAK YAN BUILDING (PART) : Kwan Mun Hau Street Stage 2 SE Kwan Mun Hau Street, Sha Tsui Road Stage 4 S Sha Tsui Road, Chuen Lung Street Stage 6 Stage 7 Ho Pui Street, Chung On Street Stage 8 SW Yeung Uk Road 6. THE BLUE YARD 7. TSUEN CHEONG CENTRE W Tai Ho Road 8. TSUEN WAN TOWN SQUARE NW Tai Ho Road, Tai Ho Road North 9. VISION CITY 10. WAH SHING BUILDING K1 District : Tsuen Wan Provisional District Council Constituency Areas +/- % of Population Estimated Quota Code Proposed Name Boundary Description Major Estates/Areas Population (16,964) K02 Yeung Uk Road 19,935 +17.51 N Sha Tsui Road, Kwan Mun Hau Street 1. BO SHEK MANSION 2. CHELSEA COURT Castle Peak Road - Tsuen Wan 3. EAST ASIA GARDENS NE Castle Peak Road - Tsuen Wan 4. HARMONY GARDEN 5. INDI HOME Texaco Road Flyover, Texaco Interchange 6. NEW HAVEN Texaco Road 7. TSUEN WAN GARDEN E Texaco Road, Texaco Road Flyover 8. WEALTHY GARDEN SE Texaco Road S Texaco Road, Tsuen Tsing Interchange Tsuen Wan Road SW Tsuen Wan Road, Texaco Road W Texaco Road, Ma Tau Pa Road Yeung Uk Road, Chung On Street Ho Pui Street NW Chuen Lung Street K2 District : Tsuen Wan Provisional District Council Constituency Areas +/- % of Population Estimated Quota Code Proposed Name Boundary Description Major Estates/Areas Population (16,964) K03 Hoi Bun 19,641 +15.78 N 1. -

M / SP / 14 / 172 San Tsuen �¥S SHEK LUNG KUNG �–‰ Ú¥Oª SEE PLAN REF

200 451 è¦K Catchwater 400 303 fih 100 The Cairnhill 100 ROUTE 314 TWISK 80 200 Ser Res 80 100 Catchwater Ser Res TAI LAM CHUNG RESERVOIR ú¥OªÐ 474 flA Kwong Pan Tin flW˘§⁄ł§¤‚˛†p›ˇ M / SP / 14 / 172 San Tsuen ¥s SHEK LUNG KUNG –‰ ú¥Oª SEE PLAN REF. No. M / SP / 14 / 172 Tso Kung Tam Kwong Pan Tin Tsuen “T FOR TSUEN WAN VILLAGE CLUSTER BOUNDARIES Fu Yung Shan fl” U¤á 315 80 j¤VÆ 300 Ha Fa Shan ¥—¥ flW˘ fl´« Pak Tin Pa TSUEN KING CIRCUIT San Tsuen 400 Allway Gardens 100 100 Tsuen Wan Centre fl”· 200 Tsuen King Garden ¤{ Ma Sim Pei Tsuen “T» ¥—¥ Pak Tin Pa fl Tsuen ·wƒ TSUEN KING CIRCUIT Adventist Hospital flw… A A ⁄· Tsuen Tak Garden Kam Fung r´º´s ½ Muk Min Ha Tsuen 200 259 Garden 200 Discovery Park ROUTE TWISK 300 A» 200 Summit C«s⁄‰⁄‚ CASTLE Terrace ã®W PEAK ROAD - TSUEN WAN CHAI WAN KOK _ b¥s D e NORTH Pun Shan Tsuen j ROAD HO ã®WÆ TAI C«fi Catchwater TSUEN WAN F¨L fi WAN ” fl CHAI WAN KOK STREET Fuk Loi Estate ñº¨· Tsuen Wan LineLuk Yeung 226 Catchwater HOI PA STREET Sun Chuen 3.3.5 TAI CHUNG ROAD TUEN MUN ROAD ¡º 200 SHA TSUI ROAD j¤ 300 oªa¬ Yau Kom Tau HOI SHING ROAD ½ CASTLE PEAK ROAD - TSUEN j¤e Village R˜« 8 HOI HING ROAD j¤VÆk¤ Ser Res ù Belvedere Garden flW Tai Lam Centre SAI LAU KOK j¤VÆg Ser Res for Women 100 flW˘ C Tai Lam Correctional 344 3.3.4 j¤F Institution M†§ s TAI HO ROAD ½ Tsing Fai Tong o“a‹Y New Village 1 fi‡ SHAM TSENG Yau Kom Tau ROAD flW˘ t¤s TSUEN WAN ê¶ `² w SETTLEMENT Treatment Works fl fi– Tsuen Wan HOI ON ROAD Yuen Tun Catchwater BASIN SHAM TSENG RÄ£³ A» Plaza W ³²w w… Lindo Green Greenview Court TSUEN WAN è¬w¼L MARKET -

Recommended District Council Constituency Areas

District : Tsuen Wan Recommended District Council Constituency Areas +/- % of Population Estimated Quota Code Recommended Name Boundary Description Major Estates/Areas Population (17,282) K01 Tak Wah 20,527 +18.78 N Tai Ho Road North, Sai Lau Kok Road 1. CHUNG ON BUILDING 2. CITY LANDMARK I NE Sai Lau Kok Road 3. FOU WAH CENTRE E Sai Lau Kok Road, Shing Mun Road 4. HO FAI GARDEN 5. TAK YAN BUILDING (PART) : Kwan Mun Hau Street, Sha Tsui Road Stage 2 Chuen Lung Street, Ho Pui Street Stage 4 Chung On Street, Yeung Uk Road Stage 6 Stage 7 SE Ma Tau Pa Road, Texaco Road Stage 8 S Texaco Road, Tsuen Wan Road 6. THE BLUE YARD 7. THE DYNASTY SW Tsuen Wan Road, Tai Ho Road 8. TSUEN CHEONG CENTRE W Tai Ho Road 9. TSUEN WAN TOWN SQUARE NW Tai Ho Road, Tai Ho Road North 10. VISION CITY 11. WAH SHING BUILDING K1 District : Tsuen Wan Recommended District Council Constituency Areas +/- % of Population Estimated Quota Code Recommended Name Boundary Description Major Estates/Areas Population (17,282) K02 Yeung Uk Road 19,327 +11.83 N Sha Tsui Road, Kwan Mun Hau Street 1. BO SHEK MANSION 2. CHELSEA COURT Castle Peak Road - Tsuen Wan 3. EAST ASIA GARDENS NE Castle Peak Road - Tsuen Wan 4. HARMONY GARDEN 5. INDI HOME Texaco Road Flyover, Texaco Interchange 6. NEW HAVEN Texaco Road 7. TSUEN WAN GARDEN E Texaco Road, Texaco Road Flyover 8. WEALTHY GARDEN SE Texaco Road S Texaco Road, Tsuen Tsing Interchange Tsuen Wan Road SW Tsuen Tsing Interchange, Tsuen Wan Road W Texaco Road, Ma Tau Pa Road Yeung Uk Road, Chung On Street Ho Pui Street NW Chuen Lung Street K2 District : Tsuen Wan Recommended District Council Constituency Areas +/- % of Population Estimated Quota Code Recommended Name Boundary Description Major Estates/Areas Population (17,282) K03 Hoi Bun 18,826 +8.93 N Tai Ho Road, Tsuen Wan Road 1. -

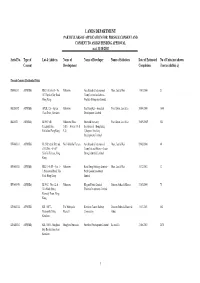

LANDS DEPARTMENT PARTICULARS of APPLICATION for PRESALE CONSENT and CONSENT to ASSIGN PENDING APPROVAL As at 31/10/2002

LANDS DEPARTMENT PARTICULARS OF APPLICATION FOR PRESALE CONSENT AND CONSENT TO ASSIGN PENDING APPROVAL as at 31/10/2002 Serial No. Type of Lot & Address Name of Name of Developer Name of Solicitors Date of Estimated No of Units (not shown Consent Development Completion if not available) @ Pre-sale Consent (Residential Units) HS000333 ASP(RES) RBL 168 sA ss1 – No. Unknown Asia Standard International Chan, Lau & Wai 31/03/2004 21 117 Repulse Bay Road, Group Limited and others – Hong Kong Weststar Enterprises Limited HSLS0502 ASP(RES) APLIL 128 – Ap Lei Unknown Sun Hung Kai – Annadale Woo, Kwan, Lee & Lo 30/04/2004 1040 Chau Drive, Aberdeen Development Limited HSLS531 ASP(RES) IL 8969 s.B – Unknown (Phase Financial Secretary Woo, Kwan, Lee & Lo 30/09/2004* 544 Telegraph Bay, 1(R1) – Towers 1-3 & Incorporated – Hong Kong Pokfulam, Hong Kong 5-8) Cyberport (Ancillary Development) Limited HW000331 ASP(RES) IL 2302 s.Q & Ext. and No. 8 Shiu Fai Terrace Asia Standard International Chan, Lau & Wai 29/02/2004 48 s.R & Ext. – 8A-8F Group Ltd and Others – Ocean Shiu Fai Terrace, Hong Strong Industrial Limited Kong HW000338 ASP(RES) RBL 1146 RP – Nos. 1- Unknown Kwai Hung Holdings Limited – Chan, Lau & Wai 31/12/2002 12 3 Homestead Road, The Profit Leader Investment Peak, Hong Kong Limited HW000340 ASP(RES) IL 8962 – Nos. 12 & Unknown Elegant Florist Limited – Johnson Stokes & Master 31/03/2004 75 12A North Street, Wealrise Investments Limited Kennedy Town, Hong Kong KW000334 ASP(RES) KIL 11077 – The Metropolis Kowloon-Canton Railway Johnson Stokes -

D3518 2020 年第22 期憲報第4 號特別副刊s. S. No. 4 to Gazette No

D3518 2020 年第 22 期憲報第 4 號特別副刊 S. S. NO. 4 TO GAZETTE NO. 22/2020 ENGLISH AUTHOR INDEX, 2019 009 6495 Arthur, Gordon 11381-11392 1957 & Co. (Hospitality) Arts Optical International Holdings Limited 2, 6496-6498 Limited 3328, 6583 51 Credit Card Inc 3284, 10675 Ascent International Holdings Limited 10714 9mouth 10676 Asia Cement (China) Holdings A-Living Services Co., Ltd 3285, 6524 Corporation 3329, 6584 A8 New Media Group Limited 3286, 6525 Asia Grocery Distribution Limited AAC Technologies Holdings Inc 3287 55, 6585-6586, 10715 AAG Energy Holdings Limited 3288, 6526 Asia Investment Finance Group Limited 3330 AB Builders Group Limited 3289, 10677 Asia-Pac Financial Investment Company abc Multiactive Limited 3290, 6527, 10678 Limited 6590 Aberdeen Kai-fong Welfare Association Social Asia Pioneer Entertainment Holdings Service 3291 Limited 3331 Able Engineering Holdings Limited 8, 6528 Asia Television Holdings Limited 3332, 10716 Ackland, Nick 3293-3304 Asiasec Properties Limited 3333, 10718 Adams, Penny 10685-10687 Atlinks Group Limited 3337, 6592-6593 Affluent Foundation Holdings Au, Louise 6615 Limited 19, 6551 Au, Man Hin 7568-7573, 11681-11682 Against Child Abuse Limited 10690-10691 Au, Rico Ka Man 10981 Agile Group Holdings Limited 3307, 6552 Au Yeung, Chi Kong 452 Agricultural Bank of China Aulas, Fred 11475-11476 Limited 3308, 10692 Aurum Pacific (China) Group AGTech Holdings Limited 20, 3309-3311, 6553 Limited 3338-3339, 6594 Ahsay Backup Software Development Austen, Jane 6595 Company Limited 3312, 6554, 10693 Ausupreme International Holdings AK Medical Holdings Limited 6555, 10694 Limited 6596 Al-Barghouti, Tamim 10695 Auto Italia Holdings Limited 3340-3341, 6597 AL Group Limited 3313-3314, 6556, 10696 Automated Systems Holdings Limited 3342, Alco Holdings Limited 22, 6557 10725 Alexander, L.