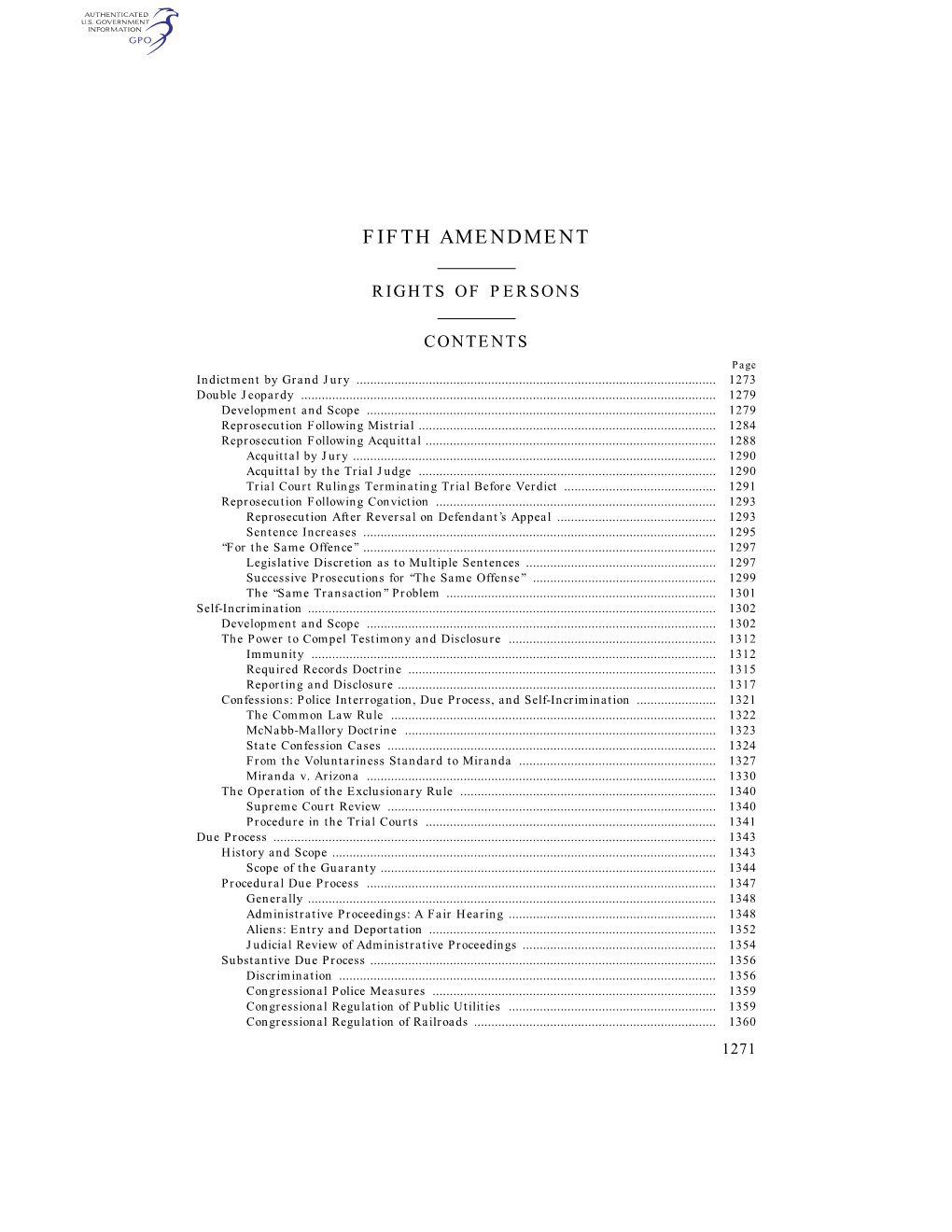

5Th Amendment US Constitution--Rights of Persons

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

—FOR PUBLICATION— in the UNITED STATES DISTRICT COURT for the EASTERN DISTRICT of PENNSYLVANIA THOMAS SKÖLD, Plaintiff, V

—FOR PUBLICATION— IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF PENNSYLVANIA THOMAS SKÖLD, Plaintiff, v. CIVIL ACTION GALDERMA LABORATORIES, L.P.; NO. 14-5280 GALDERMA LABORATORIES, INC.; and GALDERMA S.A., Defendants. OPINION I. INTRODUCTION Before the Court are Defendants Galderma Laboratories, L.P. and Galderma Laboratories, Inc.’s Motion to Dismiss and Motion to Stay Pending the Outcome of the Administrative Proceeding, Plaintiff Thomas Sköld’s Response in Opposition thereto, and Galderma L.P. and Galderma Inc.’s Reply, as well as Defendant Galderma S.A.’s Motion to Dismiss and Motion to Stay Pending the Outcome of the Administrative Proceeding, the Plaintiff’s Response in Opposition thereto, and Galderma S.A.’s Reply.1 The Court held oral argument on all pending motions on March 19, 2015. For the reasons that follow, the motion to stay shall be denied as moot, the motions to dismiss for failure to state a claim shall be granted in part, and the motion to dismiss for lack of personal jurisdiction shall be denied. 1 Galderma S.A. was served after Galderma Laboratories, L.P. and Galderma Laboratories, Inc. had filed their motion to dismiss. Galderma S.A. then filed its own motion to dismiss, incorporating the arguments contained in L.P. and Inc.’s motion to dismiss Sköld’s state-law claims and also arguing separately that this Court cannot exercise either general or specific personal jurisdiction over it. See S.A. Mot. to Dismiss at 11. Hereinafter, any reference in this Opinion to an argument made by “the Defendants” collectively will be used in the context of an argument asserted by Galderma Laboratories, L.P. -

Compensation Chart by State

Updated 5/21/18 NQ COMPENSATION STATUTES: A NATIONAL OVERVIEW STATE STATUTE WHEN ELIGIBILITY STANDARD WHO TIME LIMITS MAXIMUM AWARDS OTHER FUTURE CONTRIBUTORY PASSED OF PROOF DECIDES FOR FILING AWARDS CIVIL PROVISIONS LITIGATION AL Ala.Code 1975 § 29-2- 2001 Conviction vacated Not specified State Division of 2 years after Minimum of $50,000 for Not specified Not specified A new felony 150, et seq. or reversed and the Risk Management exoneration or each year of incarceration, conviction will end a charges dismissed and the dismissal Committee on claimant’s right to on grounds Committee on Compensation for compensation consistent with Compensation Wrongful Incarceration can innocence for Wrongful recommend discretionary Incarceration amount in addition to base, but legislature must appropriate any funds CA Cal Penal Code §§ Amended 2000; Pardon for Not specified California Victim 2 years after $140 per day of The Department Not specified Requires the board to 4900 to 4906; § 2006; 2009; innocence or being Compensation judgment of incarceration of Corrections deny a claim if the 2013; 2015; “innocent”; and Government acquittal or and Rehabilitation board finds by a 2017 declaration of Claims Board discharge given, shall assist a preponderance of the factual innocence makes a or after pardon person who is evidence that a claimant recommendation granted, after exonerated as to a pled guilty with the to the legislature release from conviction for specific intent to imprisonment, which he or she is protect another from from release serving a state prosecution for the from custody prison sentence at underlying conviction the time of for which the claimant exoneration with is seeking transitional compensation. -

Why the Proposed Maryland Constitution Was Not Approved

William & Mary Law Review Volume 10 (1968-1969) Issue 2 Article 6 December 1968 Why the Proposed Maryland Constitution Was Not Approved Thomas G. Pullen Jr. Follow this and additional works at: https://scholarship.law.wm.edu/wmlr Part of the Constitutional Law Commons Repository Citation Thomas G. Pullen Jr., Why the Proposed Maryland Constitution Was Not Approved, 10 Wm. & Mary L. Rev. 378 (1968), https://scholarship.law.wm.edu/wmlr/vol10/iss2/6 Copyright c 1968 by the authors. This article is brought to you by the William & Mary Law School Scholarship Repository. https://scholarship.law.wm.edu/wmlr WHY THE PROPOSED MARYLAND CONSTITUTION WAS NOT APPROVED THOMAS G. PULLEN, JR.* The people of Maryland simply did not want a new constitution so they went to the polls on May 14, 1968, and turned down the proposed constitution by a majority of more than 80,000. The apathy of the voters toward a new constitution was really expressed in the election held on September 13, 1966, when they approved the calling of a con- stitutional convention by a vote of 166,617 "for" and 31,692 "against," while in a concurrent primary election the vote was 609,747 of a total voter registration of 1,396,060. Obviously, interest in a new constitution was relatively slight. One of the most serious mistakes made by the proponents of a new constitution was to hold the vote on calling a constitutional convention at the same time as a primary election. The proponents probably thought the people would vote in greater numbers for the constitutional conven- tion if they were at the polls in a popular election; however, the converse was true. -

In the United States District Court for the District of Puerto Rico

Case 3:13-cr-00731-DRD-MEL Document 187 Filed 02/10/17 Page 1 of 15 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF PUERTO RICO UNITED STATES OF AMERICA Plaintiff v. Criminal No. 13-731 (DRD) William Rosado-Cancel (1) Juan Antonio Rosario-Cintron (2) Defendants OPINION & ORDER Defendants William Rosado-Cancel1 and Juan Antonio Rosario-Cintrón (“Defendants”) move the Court to dismiss the two-count indictment on double jeopardy and/or issue preclusion grounds in light of the Supreme Court’s landmark Sanchez Valle decision. See Puerto Rico v. Sanchez Valle, 136 S. Ct. 1863 (2016). However, it is a “fundamental principle that an accused must suffer jeopardy before he can suffer double jeopardy.” Serfass v. United States, 420 U.S. 377, 393 (1975). Until now, despite being charged in commonwealth court, Defendants have yet to suffer jeopardy. Defendants’ issue preclusion argument also falters for several reasons: (1) jeopardy did not attach to the commonwealth pretrial proceedings, (2) the argument was untimely, and/or (3) there was no privity between the federal and Puerto Rico prosecutors. For the reasons set forth below, the Court hereby ADOPTS Magistrate Judge Marcos E. López’s reasoning and DENIES each Defendant’s motion to dismiss.2 1 The Court notes that this defendant has already pled guilty in this case. See Docket No. 142. 2 Both defendants use the same arguments, challenge the same charges, and are part of the same nucleus of facts. As such, the Court addresses both motions jointly in the instant opinion and order. Case 3:13-cr-00731-DRD-MEL Document 187 Filed 02/10/17 Page 2 of 15 I. -

The 14Th Amendment and Due Process

The 14th Amendment and Due Process The 14th Amendment to the United States Constitution Section 1. No State shall make or enforce any law which shall abridge the privileges or immunities of citizens of the United States; nor shall any State deprive any person of life, liberty, or property, without due process of law; nor deny to any person within its jurisdiction the equal protection of the laws. Within months of the end of the Civil War, former rebellious Confederate states began passing Black Codes. These laws were designed to restrict the civil rights of recently freed African Americans. Though the 13th Amendment had ended slavery, it did not specifically assure the rights of citizenship. Congress soon passed a Civil Rights Act to assure equal civic participation and protection for black people. But President Andrew Johnson vetoed it. He believed that Congress lacked the constitutional authority to enact the law. Congress overrode the veto, but a new constitutional amendment was needed to make sure that civil rights legislation would be constitutional. This was the 14th Amendment. To rejoin the Union, all rebel Southern states had to ratify the new amendment. Dred Scott (Library of Congress) Declared adopted on July 28, 1868, the amendment nullified (voided) the Supreme Court’s decision in Dred Scott which denied citizenship for black Americans. It also provided a constitutional basis for civil rights legislation. Ultimately the new amendment changed our constitution. The Constitution, in its original form, served only as a restriction on the power of the federal government. The rights and protections against government power in the Bill of Rights did not apply to the actions of state governments. -

Guantanamo, Boumediene, and Jurisdiction-Stripping: the Mpei Rial President Meets the Imperial Court" (2009)

University of Minnesota Law School Scholarship Repository Constitutional Commentary 2009 Guantanamo, Boumediene, and Jurisdiction- Stripping: The mpI erial President Meets the Imperial Court Martin J. Katz Follow this and additional works at: https://scholarship.law.umn.edu/concomm Part of the Law Commons Recommended Citation Katz, Martin J., "Guantanamo, Boumediene, and Jurisdiction-Stripping: The mpeI rial President Meets the Imperial Court" (2009). Constitutional Commentary. 699. https://scholarship.law.umn.edu/concomm/699 This Article is brought to you for free and open access by the University of Minnesota Law School. It has been accepted for inclusion in Constitutional Commentary collection by an authorized administrator of the Scholarship Repository. For more information, please contact [email protected]. Article GUANTANAMO, BOUMEDIENE, AND JURISDICTION-STRIPPING: THE IMPERIAL PRESIDENT MEETS THE IMPERIAL COURT Martin J. Katz* INTRODUCTION In Boumediene v. Bush,1 the Supreme Court struck down a major pillar of President Bush's war on terror: the indefinite de tention of terror suspects in Guantanamo Bay, Cuba. The Court held that even non-citizen prisoners held by the United States government on foreign soil could challenge their confinement by seeking a writ of habeas corpus in federal court, and that the procedures the government had provided for such challenges were not an adequate substitute for the writ." As a habeas corpus case, Boumediene may well be revolu tionary.3 However, Boumediene is more than merely a habeas * Interim Dean and Associate Professor of Law. University of Denver College of Law; Yale Law School. J.D. 1991: Harvard College. A.B. 1987. Thanks to Alan Chen. -

15-108 Puerto Rico V. Sanchez Valle (06/09/2016)

(Slip Opinion) OCTOBER TERM, 2015 1 Syllabus NOTE: Where it is feasible, a syllabus (headnote) will be released, as is being done in connection with this case, at the time the opinion is issued. The syllabus constitutes no part of the opinion of the Court but has been prepared by the Reporter of Decisions for the convenience of the reader. See United States v. Detroit Timber & Lumber Co., 200 U. S. 321, 337. SUPREME COURT OF THE UNITED STATES Syllabus COMMONWEALTH OF PUERTO RICO v. SANCHEZ VALLE ET AL. CERTIORARI TO THE SUPREME COURT OF PUERTO RICO No. 15–108. Argued January 13, 2016—Decided June 9, 2016 Respondents Luis Sánchez Valle and Jaime Gómez Vázquez each sold a gun to an undercover police officer. Puerto Rican prosecutors indict ed them for illegally selling firearms in violation of the Puerto Rico Arms Act of 2000. While those charges were pending, federal grand juries also indicted them, based on the same transactions, for viola tions of analogous U. S. gun trafficking statutes. Both defendants pleaded guilty to the federal charges and moved to dismiss the pend ing Commonwealth charges on double jeopardy grounds. The trial court in each case dismissed the charges, rejecting prosecutors’ ar guments that Puerto Rico and the United States are separate sover eigns for double jeopardy purposes and so could bring successive prosecutions against each defendant. The Puerto Rico Court of Ap peals consolidated the cases and reversed. The Supreme Court of Puerto Rico granted review and held, in line with the trial court, that Puerto Rico’s gun sale prosecutions violated the Double Jeopardy Clause. -

Introductory Handbook on the Prevention of Recidivism and the Social Reintegration of Offenders

Introductory Handbook on The Prevention of Recidivism and the Social Reintegration of Offenders CRIMINAL JUSTICE HANDBOOK SERIES Cover photo: © Rafael Olivares, Dirección General de Centros Penales de El Salvador. UNITED NATIONS OFFICE ON DRUGS AND CRIME Vienna Introductory Handbook on the Prevention of Recidivism and the Social Reintegration of Offenders CRIMINAL JUSTICE HANDBOOK SERIES UNITED NATIONS Vienna, 2018 © United Nations, December 2018. All rights reserved. The designations employed and the presentation of material in this publication do not imply the expression of any opinion whatsoever on the part of the Secretariat of the United Nations concerning the legal status of any country, territory, city or area, or of its authorities, or concerning the delimitation of its frontiers or boundaries. Publishing production: English, Publishing and Library Section, United Nations Office at Vienna. Preface The first version of the Introductory Handbook on the Prevention of Recidivism and the Social Reintegration of Offenders, published in 2012, was prepared for the United Nations Office on Drugs and Crime (UNODC) by Vivienne Chin, Associate of the International Centre for Criminal Law Reform and Criminal Justice Policy, Canada, and Yvon Dandurand, crimi- nologist at the University of the Fraser Valley, Canada. The initial draft of the first version of the Handbook was reviewed and discussed during an expert group meeting held in Vienna on 16 and 17 November 2011.Valuable suggestions and contributions were made by the following experts at that meeting: Charles Robert Allen, Ibrahim Hasan Almarooqi, Sultan Mohamed Alniyadi, Tomris Atabay, Karin Bruckmüller, Elias Carranza, Elinor Wanyama Chemonges, Kimmett Edgar, Aida Escobar, Angela Evans, José Filho, Isabel Hight, Andrea King-Wessels, Rita Susana Maxera, Marina Menezes, Hugo Morales, Omar Nashabe, Michael Platzer, Roberto Santana, Guy Schmit, Victoria Sergeyeva, Zhang Xiaohua and Zhao Linna. -

Studying the Exclusionary Rule in Search and Seizure Dallin H

If you have issues viewing or accessing this file contact us at NCJRS.gov. Reprinted for private circulation from THE UNIVERSITY OF CHICAGO LAW REVIEW Vol. 37, No.4, Summer 1970 Copyright 1970 by the University of Chicago l'RINTED IN U .soA. Studying the Exclusionary Rule in Search and Seizure Dallin H. OakS;- The exclusionary rule makes evidence inadmissible in court if law enforcement officers obtained it by means forbidden by the Constitu tion, by statute or by court rules. The United States Supreme Court currently enforces an exclusionary rule in state and federal criminal, proceedings as to four major types of violations: searches and seizures that violate the fourth amendment, confessions obtained in violation of the fifth and' sixth amendments, identification testimony obtained in violation of these amendments, and evidence obtained by methods so shocking that its use would violate the due process clause.1 The ex clusionary rule is the Supreme Court's sole technique for enforcing t Professor of Law, The University of Chicago; Executive Director-Designate, The American Bar Foundation. This study was financed by a three-month grant from the National Institute of Law Enforcement and Criminal Justice of the Law Enforcement Assistance Administration of the United States Department of Justice. The fact that the National Institute fur nished financial support to this study does not necessarily indicate the concurrence of the Institute in the statements or conclusions in this article_ Many individuals assisted the author in this study. Colleagues Hans Zeisel and Franklin Zimring gave valuable guidance on analysis, methodology and presentation. Colleagues Walter J. -

Toward a Revitalization of the Contract Clause Richard A

The University of Chicago Law Review VOLUME 51 NUMBER 3 SUMMER 1984 0 1984 by The University of Chicago Toward a Revitalization of the Contract Clause Richard A. Epsteint The protection of economic liberties under the United States Constitution has been one of the most debated issues in our consti- tutional history.' Today the general view is that constitutional pro- tection is afforded to economic liberties only in the few cases of government action so egregious and outrageous as to transgress the narrow prohibitions of substantive due process.2 The current atti- tude took its definitive shape in the great constitutional battles over the New Deal, culminating in several important cases that sustained major legislative interference with contractual and prop- erty rights.3 The occasional Supreme Court decision hints at re- newed judicial enforcement of limitations on the legislative regula- t James Parker Hall Professor of Law, University of Chicago. This paper was originally prepared for a conference on "Economic Liberties and the Constitution," organized at the University of San Diego Law School in December, 1983, under the direction of Professors Larry Alexander and Bernard Siegan. I also presented it as a workshop paper at Boston University Law School in February, 1984. I wish to thank all the participants for their valu- able comments and criticisms. I also wish to thank David Currie, Geoffrey Miller, Geoffrey Stone, and Cass Sunstein for their helpful comments on an earlier draft of this article. The classic work on the subject is C. BEARD, AN EcONOPEC INTERPRETATION OF THE CONsTrruTiON OF THE UNrTED STATES (1913). -

Double Jeopardy

The Law Commission Consultation Paper No 156 DOUBLE JEOPARDY A Consultation Paper The Law Commission was set up by section 1 of the Law Commissions Act 1965 for the purpose of promoting the reform of the law. The Law Commissioners are: The Honourable Mr Justice Carnwath CVO, Chairman Miss Diana Faber Mr Charles Harpum Mr Stephen Silber, QC When this consultation paper was completed on 6 September 1999, Professor Andrew Burrows was also a Commissioner. The Secretary of the Law Commission is Mr Michael Sayers and its offices are at Conquest House, 37-38 John Street, Theobalds Road, London WC1N 2BQ. This consultation paper is circulated for comment and criticism only. It does not represent the final views of the Law Commission. The Law Commission would be grateful for comments on this consultation paper before 31 January 2000. All correspondence should be addressed to: Mr R Percival Law Commission Conquest House 37-38 John Street Theobalds Road London WC1N 2BQ Tel: (020) 7453-1232 Fax: (020) 7453-1297 It may be helpful for the Law Commission, either in discussion with others concerned or in any subsequent recommendations, to be able to refer to and attribute comments submitted in response to this consultation paper. Any request to treat all, or part, of a response in confidence will, of course, be respected, but if no such request is made the Law Commission will assume that the response is not intended to be confidential. The text of this consultation paper is available on the Internet at: http://www.open.gov.uk/lawcomm/ Comments can be sent by e-mail to: [email protected] 17-24-01 THE LAW COMMISSION DOUBLE JEOPARDY CONTENTS [PLEASE NOTE: The pagination in this Internet version varies slightly from the hard copy published version. -

A Critique of Two Arguments Against the Exclusionary Rule: the Historical Error and the Comparative Myth, 32 Wash

Washington and Lee Law Review Volume 32 | Issue 4 Article 4 Fall 9-1-1975 A Critique Of Two Arguments Against The Exclusionary Rule: The iH storical Error And The Comparative Myth Donald E. Wilkes, Jr. Follow this and additional works at: https://scholarlycommons.law.wlu.edu/wlulr Part of the Comparative and Foreign Law Commons, and the Legal History Commons Recommended Citation Donald E. Wilkes, Jr., A Critique Of Two Arguments Against The Exclusionary Rule: The Historical Error And The Comparative Myth, 32 Wash. & Lee L. Rev. 881 (1975), https://scholarlycommons.law.wlu.edu/wlulr/vol32/iss4/4 This Article is brought to you for free and open access by the Washington and Lee Law Review at Washington & Lee University School of Law Scholarly Commons. It has been accepted for inclusion in Washington and Lee Law Review by an authorized editor of Washington & Lee University School of Law Scholarly Commons. For more information, please contact [email protected]. A Critique of Two Arguments Against the Exclusionary Rule: The Historical Error and The Comparative Myth DONALD E. WILKES, JR.* Introduction "The great body of the law of evidence consists of rules that oper- ate to exclude relevant evidence."' The most controversial of these rules are those which prevent the admission of probative evidence because of the irregular manner in which the evidence was obtained. Depending on whether the method of obtaining violated a provision of positive law, irregularly obtained evidence' may be separated into two classes. Evidence obtained by methods which meet legal requirements but contravene some moral or ethical principle is un- fairly obtained evidence.