Before the Public Utilities Commission of the State of California

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Strong Office Investment Sale Activity

Research & Forecast Report SAN FRANCISCO | OFFICE MARKET Q2 | 2019 > VACANCY Overall vacancy rate grew during the second quarter by a Strong Office percentage point to 7.0 percent. This increase in vacancy is primarily attributed to new construction being delivered to the market as well as some tenants moving out of spaces that have already been leased. There are a number of Investment Sale Activity large occupancies expected during the second half of 2019 such as Facebook, Google, Dropbox, Twilio and Slack to name a few that will drive the vacancy rate Sony PlayStation down in San Francisco. secured 130,000 square feet at 303 > LEASING VOLUME The City experienced another strong quarter of 2nd Street leasing activity, which reflected approximately 2.3 million square feet of closed transactions. Demand remains very strong in the market with technology REDCO Development purchased 1 Montgomery companies leading the demand for space which translates in for 42 percent Street for $82 million, of the requirements. The second largest demand comes from coworking ($1,081 psf) companies which account for 12.4 percent of the requirements. Demand for space in the market shows no signs of declining. Four deals closed over 100,000 square feet this quarter and two of these deals were companies locking in expansion space. First Republic Bank leased 265,000 square feet at One Front Street, Sony PlayStation secured 130,000 square feet at 303 2nd Street COLUMBUS Segment.io renewed for over 88,000 and Autodesk leased nearly 118,000 square feet at 50 Beale Street. Year-to-date square feet at 100 ten leases over 100,000 square feet have been signed in San Francisco. -

Before the Public Utilities Commission of The

BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIA FILED 01/25/21 Order Instituting Rulemaking to Create a 04:59 PM Consistent Regulatory Framework for the Rulemaking 14-10-003 Guidance, Planning and Evaluation of Integrated (Filed October 2, 2014) Distributed Energy Resources. CERTIFICATE OF SERVICE I hereby certify that a copy of OPENING COMMENTS OF SAN DIEGO GAS & ELECTRIC COMPANY (U 902-E) ON THE PROPOSED DECISION ADOPTING TWO TARIFF PILOTS FOR PROCURING DISTRIBUTED ENERGY RESOURCES THAT AVOID OR DEFER UTILITY CAPITAL INVESTMENTS has been electronically mailed to each party of record of the service list in R.14-10-003. Due to the current Coronavirus (COVID-19) health crisis, our legal staff is working from home. Accordingly, the normal mailing of hard copies is not possible and hard copies will not be mailed to the Administrative Law Judge or to parties who are on the service list and have not provided an electronic mail address. Executed January 25, 2021 at San Diego, California. /s/ Tamara Grabowski Tamara Grabowski 1 / 15 CPUC - Service Lists - R1410003 CPUC Home CALIFORNIA PUBLIC UTILITIES COMMISSION Service Lists PROCEEDING: R1410003 - CPUC - OIR TO CREATE FILER: CPUC LIST NAME: LIST LAST CHANGED: JANUARY 5, 2021 Download the Comma-delimited File About Comma-delimited Files Back to Service Lists Index Parties CARMELITA L. MILLER DAMON FRANZ LEGAL COUNSEL DIR - POLICY & ELECTRICITY MARKETS THE GREENLINING INSTITUTE TESLA, INC. EMAIL ONLY EMAIL ONLY EMAIL ONLY, CA 00000 EMAIL ONLY, CA 00000 FOR: THE GREENLINING INSTITUTE FOR: TESLA, INC. (FORMERLY SOLARCITY CORPORATION) EVELYN KAHL MARC D JOSEPH GENERAL COUNSEL, CALCCA ATTORNEY CALIFORNIA COMMUNITY CHOICE ASSOCIATION ADAMS BROADWELL JOSEPH & CARDOZO, PC EMAIL ONLY EMAIL ONLY EMAIL ONLY, CA 00000 EMAIL ONLY, CA 00000 FOR: ENERGY PRODUCERS AND USERS FOR: COALITION OF CALIFORNIA UTILITY COALITION EMPLOYEES MERRIAN BORGESON DENISE GRAB SR. -

2019 Megabrands Table of Contents

2019 MEGABRANDS TABLE OF CONTENTS I. OOH Industry Revenue Overview II. 2019 Top 100 OOH Advertisers III. 2019 Top 100 Overall Advertisers IV. 2019 Agency List - Top 100 OOH Advertisers V. 2019 Agency List - Top 100 Overall Advertisers VI. OOH Agencies & Specialists Overview OOH INDUSTRY OVERVIEW Top 10 OOH Revenue Categories by Quarter and Full Year 2019 2019 January - March OOH Advertising Expenditures Ranked By Total Spending Category Growth Percentage Change Jan - Mar Percent of Jan - Mar Jan - Mar Jan - Mar 2019 Total 2018 '19 vs '18 '19 vs '18 Industry Categories ($m) Revenue Rank ($m) Rank ($m) (%) MISC LOCAL SERVICES & AMUSEMENTS 435,139.6 24.5% 1 403,806.8 1 31,332.8 7.8% RETAIL 174,055.8 9.8% 2 175,932.4 2 -1,876.6 -1.1% MEDIA & ADVERTISING 163,399.3 9.2% 3 144,097.0 3 19,302.3 13.4% PUBLIC TRANSPORT, HOTELS & RESORTS 124,325.6 7.0% 4 122,314.9 5 2,010.7 1.6% RESTAURANTS 115,445.2 6.5% 5 130,692.7 4 -15,247.5 -11.7% FINANCIAL 106,564.8 6.0% 6 100,532.8 6 6,032.0 6.0% INSURANCE & REAL ESTATE 103,012.6 5.8% 7 87,128.4 8 15,884.2 18.2% GOVERNMENT, POLITICS & ORGS 94,132.2 5.3% 8 92,155.1 7 1,977.1 2.1% AUTOMOTIVE DEALERS & SERVICES 74,595.4 4.2% 9 75,399.6 9 -804.2 -1.1% SCHOOLS, CAMPS & SEMINARS 69,267.1 3.9% 10 70,373.0 10 -1,105.9 -1.6% Total Top Ten Categories 1,459,937.6 82.2% 1,402,432.7 57,504.9 Total 2019 January - March OOH Expenditures $1,776,079,816 Overall Percentage Change January - March '19 vs '18 6.0% Source: Kantar Media, OAAA - May 2019 Prepared by the Out of Home Advertising Association of America 2019 April - -

Before the Public Utilities Commission of the State of California

BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIA Application of PacifiCorp (U 901 E) for Approval of its Application ____________ 2017 Transportation Electrification Programs CERTIFICATE OF SERVICE I, Rosa Gutierrez, certify that I have on this 30th day of June 2017 caused a copy of the foregoing APPLICATION OF PACIFICORP (U 901 E) FOR APPROVAL OF ITS 2017 TRANSPORTATION ELECTRIFICATION PROGRAMS to be served on all known parties to R.13-11-007 listed on the most recently updated service list available on the California Public Utilities Commission website, via email to those listed with email and via U.S. mail to those without email service. I also caused copies to be hand- delivered as follows: Commissioner Carla Peterman ALJ John S. Wong California Public Utilities Commission California Public Utilities Commission 505 Van Ness Avenue 505 Van Ness Avenue San Francisco, CA 94102 San Francisco, CA 94102 Amy Mesrobian Energy Division California Public Utilities Commission 505 Van Ness Avenue San Francisco, CA 94102 I declare under penalty of perjury that the foregoing is true and correct. Executed this 30th day of June 2017 at San Francisco, California. /s/ Rosa Gutierrez Rosa Gutierrez 3219/003/X192215.v1 CPUC - Service Lists - R1311007 Page 1 of 17 CPUC Home CALIFORNIA PUBLIC UTILITIES COMMISSION Service Lists PROCEEDING: R1311007 - CPUC - OIR TO CONSID FILER: CPUC LIST NAME: LIST LAST CHANGED: JUNE 27, 2017 Download the Comma-delimited File About Comma-delimited Files Back to Service Lists Index Parties CAMERON SEAN GRAY JEREMY WAEN ENERGY AND TRANSPORTATION MANAGER SR. REGULATORY ANALYST COMMUNITY ENVIRONMENTAL COUNCIL MARIN CLEAN ENERGY EMAIL ONLY EMAIL ONLY EMAIL ONLY, CA 00000 EMAIL ONLY, CA 00000 FOR: COMMUNITY ENVIRONMENTAL COUNCIL FOR: MARIN CLEAN ENERGY JOHN BOESEL JOHN W. -

Bart at Twenty: Land Use and Development Impacts

ffional Development BART@20: Land Use and Development Impacts Robert Cervero with research assistance by Carlos Castellanos, Wicaksono Sarosa, and Kenneth Rich July 1995 University of California at Berkeley - 1 BART@20: Land Use and Development Impacts Robert Cervero with Research Assistance by Carlos Castellanos, Wicaksono Sarosa, and Kenneth Rich This paper was produced with support provided by the U.S. Department of Transportation and the California State Department of Transportation (Caltrans) through the University of California Transportation Center. University of California at Berkeley Institute of Urban and Regional Development Table of Contents ONE: BART at 20: An Analysis of Land Use Impacts 1 1. INTRODUCTION 1 TWO: Research Approach and Data Sources 3 THREE: Employment and Population Changes in BART and Non-BART Areas 6 3.1. Population Changes 6 3.2. Employment Changes 3.3. Population Densities 15 3.4. Employment Densities 15 3.5. Summary 20 FOUR: Land Use Changes Over Time and by Corridor 21 4.1. General Land-Use Trends 23 4.2. Pre-BART versus Post-BART 25 4.3. Early versus Later BART 30 4.4. Trends in Non-Residential Densities 33 4.4. Summary 37 FIVE: Land-Use Changes by Station Classes 38 5.1. Grouping Variables 38 5.2. Classification 38 5.3. Station Classes 41 5.4. Trends in Residential and Non-Residential Growth Among Station Classes 44 5.5. Percent Growth in Early- versus Later-BART Years Among Station Classes 46 5.6. Trends in Non-Residential Densities Among Station Classes 46 SLX: Matched-Pair Comparisons of Land-Use Changes near BART Stations Versus Freeway Interchanges 51 6.1. -

Calcca and DACC Comments on Draft Resolution E-5131

March 30, 2021 CPUC Energy Division Attn: Tariff Unit and Edward Randolph, Director 505 Van Ness Avenue San Francisco, CA 94102 By email: [email protected] Re: California Community Choice Association and Direct Access Customer Coalition Comments on Draft Resolution E-5131, Concerning Joint IOU Advice Letters in response to Decision 20-03-019 (PCIA Bill Presentation) Dear Tariff Unit and Mr. Randolph: Pursuant to General Order 96-B, and the Comment Letter dated March 10, 2021, California Community Choice Association1 (CalCCA) and the Direct Access Customer Coalition2 (DACC) (Joint Parties) submit these comments on draft resolution E-5131 (Draft Resolution). The Draft Resolution approves with modifications Pacific Gas and Electric Company’s Advice Letter 4302-G/5932-E, Southern California Edison Company’s Advice Letter 4280-E, and San Diego Gas & Electric Company’s Advice Letter 3600-E (Advice Letters). 1. Summary of CalCCA Position Joint Parties support implementing the proposed changes in the Advice Letters, as modified in the Draft Resolution, as soon as possible. Joint Parties disagree with Finding 5 that “Further changes to bundled customer bills are 1 California Community Choice Association was formed in 2016 as a trade organization to facilitate joint participation in certain regulatory and legislative matters in which members share common interests. CalCCA’s voting membership includes community choice aggregators (CCAs) serving load and others in the process of implementing new service, including: Apple Valley Choice Energy, -

Before the Public Utilities Commission of the State of California Filed 08/18/21 04:59 Pm

BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIA FILED 08/18/21 04:59 PM Order Instituting Rulemaking to Create a Consistent Regulatory Framework for the Rulemaking 14-10-003 Guidance, Planning and Evaluation of (Filed October 2, 2014) Integrated Distributed Energy Resources. CERTIFICATE OF SERVICE I, Stephen Green, certify under penalty of perjury under the laws of the State of California that the following is true and correct: On August 18, 2021, I served a copy of: Intervenor Compensation Claim of The Utility Reform Network and Decision on Intervenor Compensation Claim of The Utility Reform Network on all eligible parties on the attached list R.14-10-003 by sending said document by electronic mail to each of the parties via electronic mail, as reflected on the attached Service List. For those parties without an email address of record on the official service list, service is completed by mailing via United States Postal mail a properly addressed copy with prepaid postage. Executed this Wednesday, August 18, 2021, at San Francisco, California. /s/ Stephen Green The Utility Reform Network Phone: (415) 929-8876 Email: [email protected] 1 / 21 8/17/2021 CPUC - Service Lists - R1410003 CPUC Home CALIFORNIA PUBLIC UTILITIES COMMISSION Service Lists PROCEEDING: R1410003 - CPUC - OIR TO CREATE FILER: CPUC LIST NAME: LIST LAST CHANGED: AUGUST 12, 2021 Download the Comma-delimited File About Comma-delimited Files Back to Service Lists Index Parties CARMELITA L. MILLER DAMON FRANZ LEGAL COUNSEL DIR - POLICY & ELECTRICITY MARKETS THE GREENLINING INSTITUTE TESLA, INC. EMAIL ONLY EMAIL ONLY EMAIL ONLY, CA 00000 EMAIL ONLY, CA 00000 FOR: THE GREENLINING INSTITUTE FOR: TESLA, INC. -

Company First Name Last Name #Smartcohort David Capelli #Smartcohort Carla Mays 10 Jennifer Walker 123 Contracting Michael Friedman 4083716800 Muhie Maaz A

Company First Name Last Name #SmartCohort David Capelli #SmartCohort Carla Mays 10 Jennifer Walker 123 Contracting Michael Friedman 4083716800 Muhie Maaz A. Esteban & Company, Inc Alfonso C. Esteban A3GEO, Inc. Dona Mann Abtahi Engineering ManagementAfshin Consulting Abtahi Abundance Worldwide EnterprisesDollene Jones ACCIONA Fernando Vara ACCIONA Jesús García Acciona Luis Palazzi Acciona Jesus Garcia Acciona Fernando Vara ACCIONA Luis Palazzi ACCIONA CONSTRUCTION FERNANDO VARA ORTIZ DE LA TORRE Acciona Infrastructure North AmericaRafael Sanchez Achievement Engineering Corp. Arash Firouzjaei ActiveWayz Engineering Constance Farris ActiveWayz Engineering Admas Zewdie Acumen Building Enterprise Inc. Gian Fiero Acumen Building Enterprise Inc. Robert Pilgrim ADA Takuya Nagai Adelaide Strategies marvin williams ADKO Engineering, Inc. President Kanaan Advantage Supply David Ibanez Doria AECOM Mel Sears AECOM nasri munfah AECOM Paul Nicholas AECOM Paul Boddie AECOM Emile Jilwan AECOM Russel Rudden AECOM Jon Porterfield AerialZeus, LLC Luis Robles Aero-Environmental Consulting, JorgeINC. Vizcaino All Trade Coordinators, Inc. Thelma King Ally Rail Consutling Douglas Deming Alpine Rail Group Buzz Berger ALSTOM Transportation Inc. Muriel LUO Anrak Corporation Mark Hamilton ANTHONIO, INC. TONY OGBEIDE Apadana Engineering, Inc. sopida siadat Aptim Environmental & Infrastructure,Rob LLC Delnagro Arad Adam Rad Arcadis U.S., Inc. Girish Kripalani Arora Engineers, Inc. Adam Oliver Arup Orion Fulton Arup North America LTD Luis Piek ASC Rahul Vaishnav ASC Henry Adley ASC Lorda Rumbaua ASC Dots Oyenuga ASC Dots Oyenuga Assurant Innovations Takeo Kimura Atkins Sergio Callen ATKINSON CONSTRUCTION ROHIT SHETTY Auriga Corporation Thomas Gibson Auriga Corporation Parkash Daryani Azad Engineering PC Mahsa Azad A-Zone Environmental Services, LLCMike Bruzzesi AZTEC/TYPSA Karim Dada AZTEC/TYPSA Carlos Tarazaga BabEng LLC Rene Reichl Badger Dalighting Inc. -

Before the Public Utilities Commission of the State of California

BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIA Order Instituting Rulemaking to Consider Alternative-Fueled Vehicle Programs, Tariffs, and Rulemaking 13-11-007 Policies. (Filed November 14, 2013) CERTIFICATE OF SERVICE I hereby certify that SAN DIEGO GAS & ELECTRIC COMPANY (U902E) NOTICE OF AVAILABILITY OF ELECTRIC VEHICLE-GRID INTEGRATION PILOT PROGRAM (“POWER YOUR DRIVE”) SEMI-ANNUAL REPORT has been electronically mailed to each party of record on the service list in R.13-11-007. SDG&E is unable to serve the report to A.14- 04-014 because that service list has been closed. Any party on the service list who has not provided an electronic mail address was served by placing a copy in a properly addressed and sealed envelope and depositing such envelope in the United States Mail with first-class postage prepaid. A copy was also sent via Federal Express to the Assigned Administrative Law Judge in this proceeding. Executed this 6th day of September 2016 at San Diego, California /s/ Tamara Grabowski Tamara Grabowski CPUC - Service Lists - R1311007 Page 1 of 15 CPUC Home CALIFORNIA PUBLIC UTILITIES COMMISSION Service Lists PROCEEDING: R1311007 - CPUC - OIR TO CONSID FILER: CPUC LIST NAME: LIST LAST CHANGED: AUGUST 19, 2016 Download the Comma-delimited File About Comma-delimited Files Back to Service Lists Index Parties CAMERON SEAN GRAY JEREMY WAEN ENERGY AND TRANSPORTATION MANAGER SR. REGULATORY ANALYST COMMUNITY ENVIRONMENTAL COUNCIL MARIN CLEAN ENERGY EMAIL ONLY EMAIL ONLY EMAIL ONLY, CA 00000 EMAIL ONLY, CA 00000 FOR: COMMUNITY ENVIRONMENTAL COUNCIL FOR: MARIN CLEAN ENERGY JOHN BOESEL JOHN W. -

San Francisco Office Market

RESEARCH 2Q 2020 SAN FRANCISCO OFFICE MARKET DROP IN ABSORPTION CURRENT CONDITIONS San Francisco experienced the largest drop in absorption in nearly two decades, at negative 3.1 million square feet. While 1/3 of that is Overall vacancy increased by 360 basis points to 7.6%, and Class A attributed to the delivery of the Uber campus at Mission Bay, which is vacancy increased 430 basis points to 7.4%. not yet occupied, the remaining 2.1 million square feet of negative Availability increased by more than 1.5 million square feet for the absorption is the greatest single-quarter drop since the beginning of third quarter in a row, increasing from 9.5 million square feet last 2001. As a result, vacancy jumped 360 basis points to 7.6% and quarter to 12.1 million square feet. availability increased 290 basis points to 14.2%. Nearly 65% of the Class A direct average asking rates fell slightly to $90.31/SF, and increase in availability in the second quarter came from sublease overall direct asking rates decreased to $84.39/SF. space, which grew by 1.7 million square feet, or 46.9%. At 5,214,633 square feet, sublease availability has more than tripled over the last year and is expected to increase further. MARKET ANALYSIS Asking Rent and Vacancy The increase in available space came with only a small decrease in overall asking rents, which ended the quarter at $84.39/SF, a drop of $100 10.0% 2.4% since last quarter and just 0.6% less than year ago. -

Investment Sales Activity on the Rise

Research & Forecast Report SAN FRANCISCO | OFFICE MARKET Q2 | 2018 Investment Sales Activity > VACANCY The overall vacancy rate shed 40 basis points to 6.1 percent and continues to reflect historic lows for San Francisco. In the City Class A assets continue to drive market absorption with over 2.8 million square feet year-to- on the Rise date. This has translated into the Class A vacancy rate dropping 40 basis points to 6.0 percent. Vacant sublease space remained flat during the past three months at 0.8 percent. The key driver for the vacancy shrinking during the first half of Cruise Automation snaps this year was the South Financial District which has posted 2.3 million square up the Dropbox sublease feet of net absorption which saw its vacancy rate drop 270 basis points since the Northwood Investors space at 333 & 345 beginning of the year to 4.6 percent. purchased 123 Mission Brannan Street as well as Street for $290 million 301 Brannan Street ($839 psf) > LEASING VOLUME San Francisco experienced a surge of leasing activity during the second quarter of the year which translated into nearly 2.8 million square feet of transactions closing. Technology companies continue to gobble up space in the City and their appetite for space doesn’t seem to be quenched. Four deals closed over 100,000 square feet this quarter and all these deals were companies securing expansion space. The market experienced the largest lease Facebook secures the largest lease in ever signed in San Francisco when Facebook leased all 773,000 square feet at the City’s history, 250 Howard Street (Park Tower). -

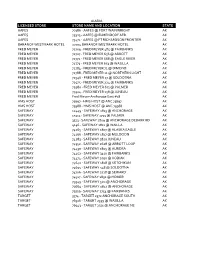

Licensed Store Store Name and Location State

ALASKA LICENSED STORE STORE NAME AND LOCATION STATE AAFES 70386 - AAFES @ FORT WAINWRIGHT AK AAFES 75323 - AAFES @ ELMENDORF AFB AK AAFES 75471 - AAFES @ FT RICHARDSON FRONTIER AK BARANOF WESTMARK HOTEL 22704 BARANOF WESTMARK HOTEL AK FRED MEYER 72709 - FRED MEYER 485 @ FAIRBANKS AK FRED MEYER 72727 - FRED MEYER 656 @ ABBOTT AK FRED MEYER 72772 - FRED MEYER 668 @ EAGLE RIVER AK FRED MEYER 72773 - FRED MEYER 653 @ WASILLA AK FRED MEYER 72784 - FRED MEYER 71 @ DIMOND AK FRED MEYER 72788 - FRED MEYER 11 @ NORTHERN LIGHT AK FRED MEYER 72946 - FRED MEYER 17 @ SOLDOTNA AK FRED MEYER 72975 - FRED MEYER 224 @ FAIRBANKS AK FRED MEYER 72980 - FRED MEYER 671 @ PALMER AK FRED MEYER 79324 - FRED MEYER 158 @ JUNEAU AK FRED MEYER Fred Meyer-Anchorage East #18 AK HMS HOST 75697 - HMS HOST @ ANC 75697 AK HMS HOST 75988 - HMS HOST @ ANC 75988 AK SAFEWAY 12449 - SAFEWAY 1813 @ ANCHORAGE AK SAFEWAY 15313 - SAFEWAY 1739 @ PALMER AK SAFEWAY 3513 - SAFEWAY 1809 @ ANCHORAGE DEBARR RD AK SAFEWAY 4146 - SAFEWAY 1811 @ WAILLA AK SAFEWAY 74265 - SAFEWAY 1807 @ ALASKA EAGLE AK SAFEWAY 74266 - SAFEWAY 1817 @ MULDOON AK SAFEWAY 74283 - SAFEWAY 1820 JUNEAU AK SAFEWAY 74352 - SAFEWAY 2628 @ ABBOTT LOOP AK SAFEWAY 74430 - SAFEWAY 1805 @ AURORA AK SAFEWAY 74452 - SAFEWAY 3410 @ FAIRBANKS AK SAFEWAY 74474 - SAFEWAY 1090 @ KODIAK AK SAFEWAY 74640 - SAFEWAY 1818 @ KETCHIKAN AK SAFEWAY 74695 - SAFEWAY 548 @ SOLDOTNA AK SAFEWAY 74706 - SAFEWAY 2728 @ SEWARD AK SAFEWAY 74917 - SAFEWAY 1832 @ HOMER AK SAFEWAY 79549 - SAFEWAY 520 @ ANCHORAGE AK SAFEWAY 79664 - SAFEWAY 1812 @ ANCHORAGE