LAND REGISTRATION for the TWENTY-FIRST CENTURY a Conveyancing Revolution

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Property Law: Fourth Report on Land Registration Report

The Law Commission (LAW COM. No. 173) PROPERTY LAW FOURTH REPORT ON LAND REGISTRATION Laid before Parliament by the Lord High Chancellor pursuant to section 3(2) of the Law Commissions Act 1965 Ordered by The House of Commons to be printed 8 November 1988 LONDON HER MAJESTY’S STATIONERY OFFICE E 10.30 net HC 680 _I_. _I--.--- ._... .. .- The Law Commission was set up by section 1 of the Law Commissions Act 1965 for the purpose of promoting the reform of the law. The Commissioners are- The Honourable Mr. Justice Beldam, Chairman Mr. Trevor M. Aldridge Mr. Brian J. Davenport, Q.C. Professor Julian Farrand Professor Brenda Hoggett The Secretary of the Law Commission is Mr. Michael Collon and its offices are at Conquest House, 37-38 John Street, Theobalds Road, London WClN 2BQ. .. 11 PROPERTY LAW FOURTH REPORT ON LAND REGISTRATION CONTENTS Paragraph Page PART I: INTRODUCTION 1.1 1 PART II: THE LAND REGISTRATION ACT 1925 2.1 2 c Revising the Act 2.3 2 PART 111: THE THIRD REPORT ON LAND REGISTRATION 3.1 Overriding Interests 3.2 Rectification and Indemnity 3.6 Minor Interests 3.7 PART IV: CONCLUSION 4.1 8 APPENDIX LAND REGISTRATION BILL 9 Table of Derivations 9 Table of Destinations 14 Draft clauseskhedules and explanatory notes 24 ... 111 Land Registration THE LAW COMMISSION Item IX of the First Programme FOURTH REPORT ON LAND REGISTRATION To the Right Honourable the Lord Mackay of Clashfern, Lord High Chancellor of Great Britain PART I INTRODUCTION 1.1 In November 1987, you said that “the final results of the Law Commission’s work [on land registration] are eagerly awaited”.’ We are now pleased to be able to submit our fourth, and for the time being final, report on the subject of land registration. -

Mason's Minnesota Statutes 1927

1940 Supplement To Mason's Minnesota Statutes 1927 (1927 to 1940) (Superseding Mason s 1931, 1934, 1936 and 1938 Supplements) Containing the text of the acts of the 1929, 1931, 1933, 1935, 1937 and 1939 General Sessions, and the 1933-34,1935-36, 1936 and 1937 Special Sessions of the Legislature, both new and amendatory, and notes showing repeals, together with annotations from the various courts, state and federal, and the opinions of the Attorney General, construing the constitution, statutes, charters and court rules of Minnesota together with digest of all common law decisions. Edited by William H. Mason Assisted by The Publisher's Editorial Staff MASON PUBLISHING CO. SAINT PAUL, MINNESOTA 1940 CH. 64—PLATS §8249 street on a street plat made by and adopted by the plat, or any officer, department, board or bureau of commission. The city council may, however, accept the municipality, may present to the district court a any street not shown on or not corresponding with a petition, duly verified, setting forth that such decision street on an approved subdivision plat or an approved is illegal, in whole or in part, specifying the grounds street plat, provided the ordinance accepting such of the Illegality. Such petition must be presented to street be first submitted to the planning commission the court within thirty days after the filing of the deci- for its approval and, if approved by the commission, sion in the office of the planning commission. be enacted or passed by not less than a majority of Upon the presentation of such petition, the court the entire membership of the council, or, if disapproved may allow a writ of certiorari directed to the planning by the commission, be enacted or passed by not less commission to review such decision of the planning than two-thirds of the entire membership of the city commission and shall prescribe therein the time within council. -

Overview of Tax Legislation and Rates 19 March 2014

Overview of Tax Legislation and Rates 19 March 2014 Official versions of this document are printed on 100% recycled paper. When you have finished with it please recycle it again. If using an electronic version of the document, please consider the environment and only print the pages which you need and recycle them when you have finished. Contents Introduction Chapter 1 – Finance Bill 2014 Chapter 2 – Future Tax Changes Annex A – Tax Information and Impact Notes (TIINs) Annex B – Rates and Allowances 1 Introduction This document sets out the detail of each tax policy measure announced at Budget 2014. It is intended for tax practitioners and others with an interest in tax policy changes, especially those who will be involved in consultations both on the policy and on draft legislation. The information is set out as follows: Chapter 1 provides detail on all tax measures to be legislated in Finance Bill 2014, or that will otherwise come into effect in 2014-15. This includes confirmation of previously announced policy changes and explains where changes, if any, have been made following consultation on the draft legislation. It also sets out new measures announced at Budget 2014. Chapter 2 provides details of proposed tax changes announced at Budget 2014 to be legislated in Finance Bill 2015, other future finance bills, programme bills or secondary legislation. Annex A includes all Tax Information and Impact Notes published at Budget 2014. Annex B provides tables of tax rates and allowances. Finance Bill 2014 will be published on 27 March 2014. 2 1 Finance Bill 2014 1.1 This chapter summarises tax changes to be legislated in Finance Bill 2014 or other legislation, including secondary legislation having effect in 2014-15. -

Tax Credits Act 2002 (Commencement No 4, Transitional Provisions and Savings) Order 2003

2003/962 Tax Credits Act 2002 (Commencement No 4, Transitional Provisions and Savings) Order 2003 Made by the Treasury under TCA 2002 ss 61, 62(2) Made 31 March 2003 1 Citation and interpretation (1) This Order may be cited as the Tax Credits Act 2002 (Commencement No 4, Transitional Provisions and Savings) Order 2003. (2) In this Order— “the Act” means the Tax Credits Act 2002; “the 1999 Act” means the Tax Credits Act 1999; and “the superseded tax credits” means working families' tax credit and disabled person's tax credit. 2 Commencement of provisions of the Act (1) Subject to the provisions of articles 3 and 4 (savings and transitional provisions), the provisions of the Act specified in this article shall come into force in accordance with the following paragraphs of this article. (2) Section 47 (consequential amendments), so far as it relates to paragraphs 4 to 7 of Schedule 3, shall come into force on 1st April 2003. (3) The following provisions of the Act shall come into force on 6th April 2003— (a) section 1(3)(a) and (f) (abolition of children's tax credit under section 257AA of the Income and Corporation Taxes Act 1988 and employment credit); (b) section 47, so far as it relates to the provisions of Schedule 3 specified in sub-paragraph (d); (c) section 60 (repeals), so far as it relates to the provisions of Schedule 6 specified in sub-paragraph (e); (d) in Schedule 3 (consequential amendments)— (i) paragraphs 1 to 3, (ii) paragraphs 8 and 9, and (iii) paragraphs 13 to 59; and (e) in Schedule 6, the entries relating to the enactments specified in column 1 of Schedule 1 to this Order to the extent shown in column 2 of that Schedule. -

Adverse Possession and the Transmissibility of Possessory Rights – the Dark Side of Land Registration? Mark Pawlowski* *Barris

Adverse Possession and the Transmissibility of Possessory Rights – The Dark Side of Land Registration? Mark Pawlowski* *Barrister, Professor of Property Law, Scholl of Law, University of Greenwich James Brown** **Barrister, Senior Lecturer in Law, Aston University It is trite law that, if unregistered land is adversely possessed for a period of 12 years, the title of the paper owner is automatically barred under s.15 of the Limitation Act 1980. Where the land is registered, however, there is no automatic barring of title by adverse possession1 – instead, after being in adverse possession for a minimum of 10 years,2 the adverse possessor can apply to be registered as the proprietor in place of the registered proprietor of the land.3 Upon receipt of such an application, the Land Registry is obliged to notify various persons interested in the land, including the registered proprietor.4 Those persons then have 65 business days5 within which to object to the registration6 and, in the absence of any objection, the adverse possessor is entitled to be registered as the new proprietor of the land. 7 In these circumstances, the registered proprietor is assumed to have abandoned the land. If, on the other hand, there is an objection, the possessor will not be registered as the proprietor unless he falls within one of the three exceptional grounds listed in paragraph 5, Schedule 6 to the Land Registration Act 2002, where: (1) it would be unconscionable for the registered proprietor to object to the application; (2) the adverse possessor is otherwise entitled to the land; or (3) if the possessor is the owner of adjacent property and has been in adverse possession of the subject land under the mistaken, but reasonable belief, that he is its owner. -

The Condominium Act

REPUBLIC ACT NO. 4726 AN ACT TO DEFINE CONDOMINIM, ESTABLISH REQURIEMENTS FOR ITS CREATION, AND GOVERN ITS INCIDNETS SECTION 1. The short title of this Act shall be The Condominium Act. SECTION 2. A condominium is an interest in real property consisting of a separate interest in a unit in a residential, industrial or commercial building and an undivided interest in common directly or indirectly, in the land which it is located and in other common areas of the building. A condominium may include, in addition, a separate interest in other portions of such real property. Title to the common areas, including the land, or the appurtenant interests in such areas, may be held by a corporation specially formed for the purpose (hereinafter known as the condominium corporation) in which the holders of separate interests shall automatically be members or share−holders, to the exclusion of others, in proportion to the appurtenant interest of their respective units in the common areas. The interests in condominium may be ownership or any other interest in real property recognized by the law of property in the Civil Code and other pertinent laws. SECTION 3. As used in this Act, unless the context otherwise requires: a. Condominium means a condominium as defined in the next preceding section. b. Unit means a part of the condominium project intended for any type of independent use or ownership, including one or more rooms or spaces located in one or more floors (or part or parts of floors) in a building or buildings and such accessories as may be appended thereto. -

Land Registry Annual Report and Accounts 2005/6 Creating a Comprehensive Land Register Readers of This Report

Land Registry Annual Report and Accounts 2005/6 Creating a comprehensive Land Register Readers of this report Her Majesty’s Land Registry academics in the field (Land Registry), established the professional and in 1862, is a government national press department in its own right, other government an executive agency and a departments and trading fund that makes no agencies including HM call on monies voted by Treasury and the Cabinet Parliament. By statute, it is Office required to ensure that its land registries overseas income from fees covers all the United Nations, of its expenditure. European Union and World Bank Land Registry comprises the those individuals in Registration of Title institutions with a Department, dealing with its professional interest in main business, and the much public sector smaller Land Charges and management. Agricultural Credits Departments. This report For readers of this report who deals with the departments are not familiar with Land separately but the accounts Registry terms, a glossary are given for Land Registry as has been provided at a whole. Appendix 10. This report is available for online viewing The Secretary of State for on our website at Constitutional Affairs and www.landregistry.gov.uk Lord Chancellor is the Minister responsible for Land Registry. This is the Chief If you would like this Land Registrar’s formal Annual Report and account to the Minister of Land Registry’s performance Accounts in a different against each of the objectives format including audio and key performance targets set by -

Land Registration for the Twenty-First Century a Consultative Document

LAW COMMISSION H M LAND REGISTRY LAND REGISTRATION FOR THE TWENTY-FIRST CENTURY A CONSULTATIVE DOCUMENT CONTENTS Paragraph Page FOREWORD 1 PART I: INTRODUCTION 2 INTRODUCTION 1.1 2 The move to electronic conveyancing 1.2 2 The deficiencies of the present legislation 1.3 3 The need to develop principles appropriate to registered land 1.5 3 BACKGROUND 1.7 4 THE LAND REGISTRATION ACT 1997 1.10 5 THE CRITERIA FOR REFORM 1.11 6 The agreed objectives 1.12 6 CONSULTATION 1.15 7 THE EUROPEAN CONVENTION ON HUMAN RIGHTS 1.16 8 STRUCTURE OF THIS REPORT 1.17 8 ACKNOWLEDGEMENTS 1.19 9 PART II: LAND REGISTRATION TODAY – A CRITICAL OVERVIEW 10 INTRODUCTION 2.1 10 GENERAL PRINCIPLES: THE CONCEPT OF LAND REGISTRATION 2.2 10 Conveyancing in unregistered land 2.2 10 Registered land 2.4 11 The move towards total registration 2.8 12 THE LEGAL AND ADMINISTRATIVE FRAMEWORK 2.10 13 H M Land Registry 2.10 13 The register 2.11 13 INTERESTS IN REGISTERED LAND 2.13 14 Registrable interests 2.13 14 Overriding interests 2.16 15 Minor interests 2.19 16 MAKING DISPOSITIONS OF REGISTERED LAND 2.20 17 Introduction 2.20 17 Registered dispositions 2.21 17 Priority searches 2.24 18 Minor interests 2.25 19 RECTIFICATION AND INDEMNITY 2.36 22 Rectification 2.37 22 Indemnity 2.40 23 ADVERSE POSSESSION 2.43 24 v Paragraph Page CONVEYANCING ISSUES 2.45 25 The move to electronic conveyancing 2.45 25 Proof of title 2.49 26 PART III: DEFINITIONS AND CONCEPTS 27 INTRODUCTION 3.1 27 REGISTERED ESTATES 3.5 28 The present definition 3.5 28 Estates which may be registered 3.6 29 Registered -

Future Interests in Property in Minnesota Everett Rf Aser

University of Minnesota Law School Scholarship Repository Minnesota Law Review 1919 Future Interests in Property in Minnesota Everett rF aser Follow this and additional works at: https://scholarship.law.umn.edu/mlr Part of the Law Commons Recommended Citation Fraser, Everett, "Future Interests in Property in Minnesota" (1919). Minnesota Law Review. 1283. https://scholarship.law.umn.edu/mlr/1283 This Article is brought to you for free and open access by the University of Minnesota Law School. It has been accepted for inclusion in Minnesota Law Review collection by an authorized administrator of the Scholarship Repository. For more information, please contact [email protected]. MINNESOTA LAW REVIEW FUTURE INTERESTS IN PROPERTY IN MINNESOTA "ORIGINALLY the creation of future interests at law was greatly restricted, but now, either by the Statutes of Uses and of Wills, or by modern legislation, or by the gradual action of the courts, all restraints on the creation of future interests, except those arising from remoteness, have been done away. This practically reduces the law restricting the creation of future interests to the Rule against Perpetuities,"' Generally in common law jurisdictions today there is but one rule restricting the crea- tion of future interests, and that rule is uniform in its application to real property and to personal property, to legal and equitable interests therein, to interests created by way of trust, and to powers. In 1830 the New York Revised Statutes went into effect in New York state. The revision had been prepared by a commis- sion appointed for the purpose five years before. It contained a code of property law in which "the revisers undertook to re- write the whole law of future estates in land, uses and trusts .. -

Report at a Glance

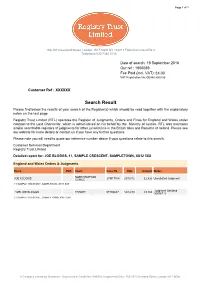

Page 1 of 2 153-157 Cleveland Street, London, W1T 6QW DX 134211 Tottenham Court Rd 2 Telephone 020 7380 0133 Date of search: 19 September 2016 Our ref : 1900089 Fee Paid (incl. VAT): £4.00 VAT Registration No: GB440 4009 96 Customer Ref : XXXXXX Search Result Please find below the results of your search of the Register(s) which should be read together with the explanatory notes on the last page. Registry Trust Limited (RTL) operates the Register of Judgments, Orders and Fines for England and Wales under contract to the Lord Chancellor, which is administered on his behalf by the Ministry of Justice. RTL also maintains similar searchable registers of judgments for other jurisdictions in the British Isles and Republic of Ireland. Please see our website for more details or contact us if you have any further questions. Please note you will need to quote our reference number above if your questions relate to this search. Customer Services Department Registry Trust Limited Detailed report for: JOE BLOGGS, 11, SAMPLE CRESCENT, SAMPLETOWN, XX12 5XX England and Wales Orders & Judgments Name DoB Court Case No. Date Amount Status NORTHAMPTON JOE CLOGGS CCMCC 2YM17104 25/10/12 £2,826 Unsatisfied Judgment 11 SAMPLE CRESCENT, SAMPLTOWN, XX11 5XX Judgment Satisfied * MR JOE BLOGGS THANET 0TT00657 14/12/10 £3,769 (30/06/11) 11 SAMPLE CRESCENT, SAMPLETOWN, XX12 5XX A Company Limited by Guarantee. Registered in Cardiff No 1896592. Registered Office: 153-157 Cleveland Street, London W1T 6QW Page 2 of 2 Explanatory notes on search results We use an automated system for providing search responses. -

Fourteenth Report: Draft Statute Law Repeals Bill

The Law Commission and The Scottish Law Commission (LAW COM. No. 211) (SCOT. LAW COM. No. 140) STATUTE LAW REVISION: FOURTEENTH REPORT DRAFT STATUTE LAW (REPEALS) BILL Presented to Parliament by the Lord High Chancellor and the Lord Advocate by Command of Her Majesty April 1993 LONDON: HMSO E17.85 net Cm 2176 The Law Commission and the Scottish Law Commission were set up by the Law Commissions Act 1965 for the purpose of promoting the reform of the Law. The Law Commissioners are- The Honourable Mr. Justice Brooke, Chairman Mr Trevor M. Aldridge, Q.C. Mr Jack Beatson Mr Richard Buxton, Q.C. Professor Brenda Hoggett, Q.C. The Secretary of the Law Commission is Mr Michael Collon. Its offices are at Conquest House, 37-38 John Street, Theobalds Road, London WClN 2BQ. The Scottish Law Commissioners are- The Honourable Lord Davidson, Chairman .. Dr E.M. Clive Professor P.N. Love, C.B.E. Sheriff I.D.Macphail, Q.C. Mr W.A. Nimmo Smith, Q.C. The Secretary of the Scottish Law Commission is Mr K.F. Barclay. Its offices are at 140 Causewayside, Edinburgh EH9 1PR. .. 11 THE LAW COMMISSION AND THE SCOTTISH LAW COMMISSION STATUTE LAW REVISION: FOURTEENTH REPORT Draft Statute Law (Repeals) Bill To the Right Honourable the Lord Mackay of Clashfern, Lord High Chancellor of Great Britain, and the Right Honourable the Lord Rodger of Earlsferry, Q.C., Her Majesty's Advocate. In pursuance of section 3(l)(d) of the Law Commissions Act 1965, we have prepared the draft Bill which is Appendix 1 and recommend that effect be given to the proposals contained in it. -

Kew Gardens (Leases) (No

KEW GARDENS (LEASES) (NO. 3) BILL [HL] EXPLANATORY NOTES What these notes do These Explanatory Notes relate to the Kew Gardens (Leases) (No. 3) Bill [HL] as introduced in the House of Lords on 25 April 2019 (HL Bill 174). • These Explanatory Notes have been prepared by the Department for Environment, Food and Rural Affairs in order to assist the reader of the Bill and to help inform debate on it. They do not form part of the Bill and have not been endorsed by Parliament. • These Explanatory Notes explain what each part of the Bill will mean in practice; provide background information on the development of policy; and provide additional information on how the Bill will affect existing legislation in this area. • These Explanatory Notes might best be read alongside the Bill. They are not, and are not intended to be, a comprehensive description of the Bill. HL Bill 174–EN 57/1 Table of Contents Subject Page of these Notes Overview of the Bill 2 Policy background 2 Legal background 2 Territorial extent and application 2 Commentary on provisions of Bill 3 Clause 1: Power to grant a lease in respect of land at Kew Gardens 3 Clause 2: Extent, commencement and short title 3 Commencement 3 Financial implications of the Bill 3 Compatibility with the European Convention on Human Rights 3 Annex A – Territorial extent and application in the United Kingdom 4 Subject matter and legislative competence of devolved legislatures 4 These Explanatory Notes relate to the Kew Gardens (Leases) (No. 3) Bill [HL] as introduced in the House of Lords on 25 April 2019 (HL Bill 174) 1 1 Overview of the Bill 1 This Bill provides that the Secretary of State's powers of management in relation to the Royal Botanic Gardens, Kew (Kew) include powers to grant a lease over land at Kew for a term of up to 150 years.