Comer Westfield, NJ

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

アーティスト 商品名 品番 ジャンル名 定価 URL 100% (Korea) RE

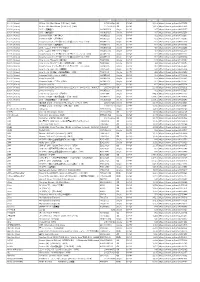

アーティスト 商品名 品番 ジャンル名 定価 URL 100% (Korea) RE:tro: 6th Mini Album (HIP Ver.)(KOR) 1072528598 K-POP 2,290 https://tower.jp/item/4875651 100% (Korea) RE:tro: 6th Mini Album (NEW Ver.)(KOR) 1072528759 K-POP 2,290 https://tower.jp/item/4875653 100% (Korea) 28℃ <通常盤C> OKCK05028 K-POP 1,296 https://tower.jp/item/4825257 100% (Korea) 28℃ <通常盤B> OKCK05027 K-POP 1,296 https://tower.jp/item/4825256 100% (Korea) 28℃ <ユニット別ジャケット盤B> OKCK05030 K-POP 648 https://tower.jp/item/4825260 100% (Korea) 28℃ <ユニット別ジャケット盤A> OKCK05029 K-POP 648 https://tower.jp/item/4825259 100% (Korea) How to cry (Type-A) <通常盤> TS1P5002 K-POP 1,204 https://tower.jp/item/4415939 100% (Korea) How to cry (Type-B) <通常盤> TS1P5003 K-POP 1,204 https://tower.jp/item/4415954 100% (Korea) How to cry (ミヌ盤) <初回限定盤>(LTD) TS1P5005 K-POP 602 https://tower.jp/item/4415958 100% (Korea) How to cry (ロクヒョン盤) <初回限定盤>(LTD) TS1P5006 K-POP 602 https://tower.jp/item/4415970 100% (Korea) How to cry (ジョンファン盤) <初回限定盤>(LTD) TS1P5007 K-POP 602 https://tower.jp/item/4415972 100% (Korea) How to cry (チャンヨン盤) <初回限定盤>(LTD) TS1P5008 K-POP 602 https://tower.jp/item/4415974 100% (Korea) How to cry (ヒョクジン盤) <初回限定盤>(LTD) TS1P5009 K-POP 602 https://tower.jp/item/4415976 100% (Korea) Song for you (A) OKCK5011 K-POP 1,204 https://tower.jp/item/4655024 100% (Korea) Song for you (B) OKCK5012 K-POP 1,204 https://tower.jp/item/4655026 100% (Korea) Song for you (C) OKCK5013 K-POP 1,204 https://tower.jp/item/4655027 100% (Korea) Song for you メンバー別ジャケット盤 (ロクヒョン)(LTD) OKCK5015 K-POP 602 https://tower.jp/item/4655029 100% (Korea) -

URL 100% (Korea)

アーティスト 商品名 オーダー品番 フォーマッ ジャンル名 定価(税抜) URL 100% (Korea) RE:tro: 6th Mini Album (HIP Ver.)(KOR) 1072528598 CD K-POP 1,603 https://tower.jp/item/4875651 100% (Korea) RE:tro: 6th Mini Album (NEW Ver.)(KOR) 1072528759 CD K-POP 1,603 https://tower.jp/item/4875653 100% (Korea) 28℃ <通常盤C> OKCK05028 Single K-POP 907 https://tower.jp/item/4825257 100% (Korea) 28℃ <通常盤B> OKCK05027 Single K-POP 907 https://tower.jp/item/4825256 100% (Korea) Summer Night <通常盤C> OKCK5022 Single K-POP 602 https://tower.jp/item/4732096 100% (Korea) Summer Night <通常盤B> OKCK5021 Single K-POP 602 https://tower.jp/item/4732095 100% (Korea) Song for you メンバー別ジャケット盤 (チャンヨン)(LTD) OKCK5017 Single K-POP 301 https://tower.jp/item/4655033 100% (Korea) Summer Night <通常盤A> OKCK5020 Single K-POP 602 https://tower.jp/item/4732093 100% (Korea) 28℃ <ユニット別ジャケット盤A> OKCK05029 Single K-POP 454 https://tower.jp/item/4825259 100% (Korea) 28℃ <ユニット別ジャケット盤B> OKCK05030 Single K-POP 454 https://tower.jp/item/4825260 100% (Korea) Song for you メンバー別ジャケット盤 (ジョンファン)(LTD) OKCK5016 Single K-POP 301 https://tower.jp/item/4655032 100% (Korea) Song for you メンバー別ジャケット盤 (ヒョクジン)(LTD) OKCK5018 Single K-POP 301 https://tower.jp/item/4655034 100% (Korea) How to cry (Type-A) <通常盤> TS1P5002 Single K-POP 843 https://tower.jp/item/4415939 100% (Korea) How to cry (ヒョクジン盤) <初回限定盤>(LTD) TS1P5009 Single K-POP 421 https://tower.jp/item/4415976 100% (Korea) Song for you メンバー別ジャケット盤 (ロクヒョン)(LTD) OKCK5015 Single K-POP 301 https://tower.jp/item/4655029 100% (Korea) How to cry (Type-B) <通常盤> TS1P5003 Single K-POP 843 https://tower.jp/item/4415954 -

Songliste Koreanisch (Juli 2018) Sortiert Nach Interpreten

Songliste Koreanisch (Juli 2018) Sortiert nach Interpreten SONGCODETITEL Interpret 534916 그저 널 바라본것 뿐 1730 534541 널 바라본것 뿐 1730 533552 MY WAY - 533564 기도 - 534823 사과배 따는 처녀 - 533613 사랑 - 533630 안녕 - 533554 애모 - 533928 그의 비밀 015B 534619 수필과 자동차 015B 534622 신인류의 사랑 015B 533643 연인 015B 975331 나 같은 놈 100% 533674 착각 11월 975481 LOVE IS OVER 1AGAIN 980998 WHAT TO DO 1N1 974208 LOVE IS OVER 1SAGAIN 970863기억을 지워주는 병원2 1SAGAIN/FATDOO 979496 HEY YOU 24K 972702 I WONDER IF YOU HURT LIKE ME 2AM 975815 ONE SPRING DAY 2AM 575030 죽어도 못 보내 2AM 974209 24 HOUR 2BIC 97530224소시간 2BIC 970865 2LOVE 2BORAM 980594 COME BACK HOME 2NE1 980780 DO YOU LOVE ME 2NE1 975116 DON'T STOP THE MUSIC 2NE1 575031 FIRE 2NE1 980915 HAPPY 2NE1 980593 HELLO BITCHES 2NE1 575032 I DON'T CARE 2NE1 973123 I LOVE YOU 2NE1 975236 I LOVE YOU 2NE1 980779 MISSING YOU 2NE1 976267 UGLY 2NE1 575632 날 따라 해봐요 2NE1 972369 AGAIN & AGAIN 2PM Seite 1 von 58 SONGCODETITEL Interpret 972191 GIVE IT TO ME 2PM 970151 HANDS UP 2PM 575395 HEARTBEAT 2PM 972192 HOT 2PM 972193 I'LL BE BACK 2PM 972194 MY COLOR 2PM 972368 NORI FOR U 2PM 972364 TAKE OFF 2PM 972366 THANK YOU 2PM 980781 WINTER GAMES 2PM 972365 CABI SONG 2PM/GIRLS GENERATION 972367 CANDIES NEAR MY EAR 2PM/백지영 980782 24 7 2YOON 970868 LOVE TONIGHT 4MEN 980913 YOU'R MY HOME 4MEN 975105 너의 웃음 고마워 4MEN 974215 안녕 나야 4MEN 970867 그 남자 그 여자 4MEN/MI 980342 COLD RAIN 4MINUTE 980341 CRAZY 4MINUTE 981005 HATE 4MINUTE 970870 HEART TO HEART 4MINUTE 977178 IS IT POPPIN 4MINUTE 975346 LOVE TENSION 4MINUTE 575399 MUZIK 4MINUTE 972705 VOLUME UP 4MINUTE 975332 WELCOME -

Une Discographie De Robert Wyatt

Une discographie de Robert Wyatt Discographie au 1er mars 2021 ARCHIVE 1 Une discographie de Robert Wyatt Ce présent document PDF est une copie au 1er mars 2021 de la rubrique « Discographie » du site dédié à Robert Wyatt disco-robertwyatt.com. Il est mis à la libre disposition de tous ceux qui souhaitent conserver une trace de ce travail sur leur propre ordinateur. Ce fichier sera périodiquement mis à jour pour tenir compte des nouvelles entrées. La rubrique « Interviews et articles » fera également l’objet d’une prochaine archive au format PDF. _________________________________________________________________ La photo de couverture est d’Alessandro Achilli et l’illustration d’Alfreda Benge. HOME INDEX POCHETTES ABECEDAIRE Les années Before | Soft Machine | Matching Mole | Solo | With Friends | Samples | Compilations | V.A. | Bootlegs | Reprises | The Wilde Flowers - Impotence (69) [H. Hopper/R. Wyatt] - Robert Wyatt - drums and - Those Words They Say (66) voice [H. Hopper] - Memories (66) [H. Hopper] - Hugh Hopper - bass guitar - Don't Try To Change Me (65) - Pye Hastings - guitar [H. Hopper + G. Flight & R. Wyatt - Brian Hopper guitar, voice, (words - second and third verses)] alto saxophone - Parchman Farm (65) [B. White] - Richard Coughlan - drums - Almost Grown (65) [C. Berry] - Graham Flight - voice - She's Gone (65) [K. Ayers] - Richard Sinclair - guitar - Slow Walkin' Talk (65) [B. Hopper] - Kevin Ayers - voice - He's Bad For You (65) [R. Wyatt] > Zoom - Dave Lawrence - voice, guitar, - It's What I Feel (A Certain Kind) (65) bass guitar [H. Hopper] - Bob Gilleson - drums - Memories (Instrumental) (66) - Mike Ratledge - piano, organ, [H. Hopper] flute. - Never Leave Me (66) [H. -

Regional Company Focus

Regional Company Focus Kakao Bloomberg: 035720 KS, Reuters: 035720.KS Refer to important disclosures at the end of this report DBS Group Research . Equity 16 Aug 2018 BUY, KRW128,000 KOSPI: 2,282.8 Close to long-awaited turnaround (Closing price as of 10/8/18) Revenue growth continues for Kakao Ads, high Price Target 12-mth: KRW150,000 (prev. KRW130,000) hopes for Kakao M’s new businesses Reason for Report: Rating upgrade Kakao Page seeing higher gross merchandise value Potential catalyst: Advance towards music/video production industry and user traffic; Kakao Pay set to launch new Where we differ: We are more positive than the market on Kakao Pay’s new financial services financial services Upgrade to BUY, TP lifted to KRW150,000 Analyst Regional Research Team [email protected] Earnings turnaround soon. We upgrade our rating from HOLD to BUY as signs of earnings turnaround should be seen for Kakao going forward. From as early as 4Q18, Kakao’s quarterly earnings Price Relative are likely to return to growth (y-o-y). Top line is expanding and 200,000 110 2H18 advertising / labour costs are expected to be similar to 1H18 100 150,000 levels, backed by efficient cost management. 90 80 Finally, new businesses to yield results. Furthermore, new 100,000 70 businesses should start to bear fruit soon, with Kakao Bank 50,000 60 projected to reach its breakeven point in 2H18. The likely shift 50 by the government towards a more relaxed separation 0 40 Aug-14 Mar-15 Oct-15 May-16 Dec-16 Jul-17 Feb-18 between banking and commerce is also a positive. -

Rules Introduced Before the Two Municipal Facilities Signup Opens on Jiine 25 USDA Choice: California Nectarines Kraft Select Cheddarchunks -A

-—-V—rr. \. • . \ '•V Pa* » CRANFORD (N.J.) CHRONICLE niunday, JUM 7,1(5*4 SERVING CRANFORD, GARWOOD and KENIL WORTH 92 No. 24 PuWished-Every Thursday'.— Thursday, June 14,1984 USPS136 8C^> Second Class Postage Paid Cranford, N. J. 25 CENTS In Brief even on s revamp JjvC ,<\ v / Fire al house If you've never treated your family, and guests to the delicious pleasures of Soft- deep fry it, dr broil it. Arid speaking of broiling, you carl broil it on your charcoal Shell Crab, now's the time to do it. ' • ^ grill for a superbly elegant cookout. i : -A fire started by a paint remov- ing torch ignited a home on North exit Soft-Shell Crabs are not only ia plentiful supply, we have the biggest and the Arid when we say we have vthe biggest and freshest of all Spft-Shell Crabs, we Union Avenue Wednesday after- freshest of them "all Plus four free recipes that will show you how delectable and mean exactly that. The. few* is; the Chesapeake Bay's finest sheU-fishennen reserve^ noon, the two occupants escaped without injury, but the house suf- versatile -.-Soft-Shell Crab can be. - _ _:, .2: i , L; c ^^ .:, : v _,- :-:-^—,: their prize catches for usv Then, they'r^iced and rushed j&us—alive and kicking. fered about $40,000 in damages. How delectable is Soft-Shell Crab? It's so tender, you can eatjt shell and all, T ^ Ne^er and safer ways of getting on with a request for a traffic light it's sq tastyryou can ~enjcynf& aMhe old^time^ to our Seafood Corneh r this week and pick out=pne<or two or five, or and off the Garden State Parkway study, said the concept will include fishermen did for lunch: fry a Soft-Shell Crab in a little butter, pop if-onto a bun ten of our Jumbo Spft-Shell Crabs.