Compensation and Benefits of Directors 4.2 And

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Liste Des Actions Concernées Par L'interdiction De Positions Courtes Nettes

Liste des actions concernées par l'interdiction de positions courtes nettes L’interdiction s’applique aux actions listées sur une plate-forme française et relevant de la compétence de l’AMF au titre du règlement 236/2012 (information disponible dans les registres ESMA). Cette liste est fournie à titre informatif. L'AMF n'est pas en mesure de garantir que le contenu disponible est complet, exact ou à jour. Compte tenu des diverses sources de données sous- jacentes, des modifications pourraient être apportées régulièrement. Isin Nom FR0010285965 1000MERCIS FR0013341781 2CRSI FR0010050773 A TOUTE VITESSE FR0000076887 A.S.T. GROUPE FR0010557264 AB SCIENCE FR0004040608 ABC ARBITRAGE FR0013185857 ABEO FR0012616852 ABIONYX PHARMA FR0012333284 ABIVAX FR0000064602 ACANTHE DEV. FR0000120404 ACCOR FR0010493510 ACHETER-LOUER.FR FR0000076861 ACTEOS FR0000076655 ACTIA GROUP FR0011038348 ACTIPLAY (GROUPE) FR0010979377 ACTIVIUM GROUP FR0000053076 ADA BE0974269012 ADC SIIC FR0013284627 ADEUNIS FR0000062978 ADL PARTNER FR0011184241 ADOCIA FR0013247244 ADOMOS FR0010340141 ADP FR0010457531 ADTHINK FR0012821890 ADUX FR0004152874 ADVENIS FR0013296746 ADVICENNE FR0000053043 ADVINI US00774B2088 AERKOMM INC FR0011908045 AG3I ES0105422002 AGARTHA REAL EST FR0013452281 AGRIPOWER FR0010641449 AGROGENERATION CH0008853209 AGTA RECORD FR0000031122 AIR FRANCE -KLM FR0000120073 AIR LIQUIDE FR0013285103 AIR MARINE NL0000235190 AIRBUS FR0004180537 AKKA TECHNOLOGIES FR0000053027 AKWEL FR0000060402 ALBIOMA FR0013258662 ALD FR0000054652 ALES GROUPE FR0000053324 ALPES (COMPAGNIE) -

Detailed List of 2018 Investments

FOR THE YEARS ENDED DECEMBER 31, 2018 & DECEMBER 31, 2017 PREPARED BY The Finance Department of the Illinois Municipal Retirement Fund OAK BROOK OFFICE 2211 York Road, Suite 500, Oak Brook, IL 60523-2337 SPRINGFIELD REGIONAL COUNSELING CENTER 3000 Professional Drive, Suite 101, Springfield, IL 62703-5934 CONTACT IMRF 1-800-ASK-IMRF (275-4673) www.imrf.org Brian Collins Executive Director At IMRF we REAACH for our goals. These values guide IMRF to REAACH our mission, vision, and goals. They define how we work and shape the expectations we have for our organization. Through our commitment to these values, our members, employers, and stakeholders across Illinois and beyond can feel confident in IMRF as a world-class pension provider. FOR THE YEARS ENDED DECEMBER 31, 2018 & DECEMBER 31, 2017 PREPARED BY The Finance Department of the Illinois Municipal Retirement Fund IMRF MISSION OAK BROOK OFFICE STATEMENT 2211 York Road, Suite 500, Oak Brook, IL 60523-2337 To efficiently and impartially develop, implement, and administer programs SPRINGFIELD REGIONAL COUNSELING CENTER that provide income protection to 3000 Professional Drive, Suite 101, members and their beneficiaries on Springfield, IL 62703-5934 behalf of participating employers, in a prudent manner. CONTACT IMRF 1-800-ASK-IMRF (275-4673) www.imrf.org Brian Collins Executive Director At IMRF FIXED INCOME U.S. Securities Corporate Bonds Interest Market Asset Description Maturity Date Par Value Cost Value Rate Value 1 Mkt Plaza Tr 3.85% 02/10/2032 $ 605,000 $ 623,147 $ 604,812 1st Horizon -

Nexity Implements a Share Buyback Programme

NEXITY IMPLEMENTS A SHARE BUYBACK PROGRAMME Paris, Tuesday 14 January 2020, 6.30 pm CET Nexity has announced the implementation of a round of share buybacks, as part of the share buyback programme authorised at the Shareholders’ Meeting of 22 May 2019. The buyback mandate, which was granted to investment services provider ODDO BHF SCA, is for a maximum amount of €10 million. This mandate follows on from the Board of Directors’ decision to buy back shares in the proportion necessary to offset the dilution potentially caused by the vesting of free shares with the Group’s employees. It follows the share buybacks carried out since 2018, under which Nexity bought back 968,273 shares (i.e. 1.7% of the share capital) for a total of around €41 million. AT NEXITY, WE AIM TO SERVE ALL OUR CLIENTS AS THEIR REAL ESTATE NEEDS EVOLVE Nexity offers the widest range of advice and expertise, products, services and solutions for individuals, companies and local authorities, so as to best meet the needs of our clients and respond to their concerns. Our business lines – real estate brokerage, management, design, development, planning, advisory and related services – are now optimally organised to serve and support our clients. As the benchmark operator in our sector, we are resolutely committed to all our clients, as well as to the environment and society as a whole. Nexity is listed on the SRD and on Euronext’s Compartment A Nexity is included in the following indices: SBF 80, SBF 120, CAC Mid 60, CAC Mid & Small and CAC All Tradable Ticker symbol: NXI – Reuters: NXI.PA – Bloomberg: NXIFP CONTACT Domitille Vielle – Head of Investor Relations / +33 (0)1 85 55 19 34 – [email protected] Géraldine Bop – Deputy Head of Investor Relations / +33 (0)1 85 55 18 43 – [email protected] . -

Wilmington Funds Holdings Template DRAFT

Wilmington Global Alpha Equities Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS USD/CAD FWD 20210616 00050 3.16% DREYFUS GOVT CASH MGMT-I 2.91% MORGAN STANLEY FUTURE USD SECURED - TOTAL EQUITY 2.81% USD/EUR FWD 20210616 00050 1.69% MICROSOFT CORP 1.62% USD/GBP FWD 20210616 49 1.40% USD/JPY FWD 20210616 00050 1.34% APPLE INC 1.25% AMAZON.COM INC 1.20% ALPHABET INC 1.03% CANADIAN NATIONAL RAILWAY CO 0.99% AIA GROUP LTD 0.98% NOVARTIS AG 0.98% TENCENT HOLDINGS LTD 0.91% INTACT FINANCIAL CORP 0.91% CHARLES SCHWAB CORP/THE 0.91% FACEBOOK INC 0.84% FORTIVE CORP 0.81% BRENNTAG SE 0.77% COPART INC 0.75% CONSTELLATION SOFTWARE INC/CANADA 0.70% UNITEDHEALTH GROUP INC 0.70% AXA SA 0.63% FIDELITY NATIONAL INFORMATION SERVICES INC 0.63% BERKSHIRE HATHAWAY INC 0.62% PFIZER INC 0.62% TOTAL SE 0.61% MEDICAL PROPERTIES TRUST INC 0.61% VINCI SA 0.60% COMPASS GROUP PLC 0.60% KDDI CORP 0.60% BAE SYSTEMS PLC 0.57% MOTOROLA SOLUTIONS INC 0.57% NATIONAL GRID PLC 0.56% PUBLIC STORAGE 0.56% NVR INC 0.53% AMERICAN TOWER CORP 0.53% MEDTRONIC PLC 0.51% PROGRESSIVE CORP/THE 0.50% DANAHER CORP 0.50% MARKEL CORP 0.49% JOHNSON & JOHNSON 0.48% BUREAU VERITAS SA 0.48% NESTLE SA 0.47% MARSH & MCLENNAN COS INC 0.46% ALIBABA GROUP HOLDING LTD 0.45% LOCKHEED MARTIN CORP 0.45% ALPHABET INC 0.44% MERCK & CO INC 0.43% CINTAS CORP 0.42% EXPEDITORS INTERNATIONAL OF WASHINGTON INC 0.41% MCDONALD'S CORP 0.41% RIO TINTO PLC 0.41% IDEX CORP 0.40% DIAGEO PLC 0.40% LENNOX INTERNATIONAL INC 0.40% PNC FINANCIAL SERVICES GROUP INC/THE 0.40% ACCENTURE -

Cp Nexity En

NEXITY AND SOMFY JOIN FORCES TO CONNECT RESIDENTS TO THEIR HOMES Paris, 15 January 2017 With the constant aim of anticipating the changing needs of tomorrow's city dwellers, Nexity is speeding up its transformation into a real estate service platform. It signs a partnership with SOMFY, the world leader in automatic controls for openings and closures in homes and buildings and a key player in the smart home industry, in order to manage the "smart home" section of its brand new service: Eugénie. Eugénie enables residents to be connected to their homes through "smart home” management, also to their property managers by serving as a reciprocal communication tool; to their neighbors as a community tool with up-to-the-minute local services; to support services by listing approved service providers and maintenance professionals, who can intervene if necessary in the private areas of collective housing at a fair price; and also to their neighborhood since the tool acts a relay for local municipal information. Eugénie is more than just a technology or an app, it is a new service that brings people closer together. In the Eugénie offering, SOMFY is responsible for developing the “smart home” section— reliable, simple, state of the art and “made in France”. SOMFY brings its expertise in terms of smart solutions that are easy to use, durable and scalable, with a range of products that enable residents to intuitively manage, control and program their equipment (shutters, lightning, heating, etc.) whilst at home, or remotely via their smart phone. For SOMFY this partnership contributes towards materializing its open API policy launched in 2017. -

Press Release Télécharger

Press release July 13, 2018 ENGIE, in partnership with Nexity, plans to create its future campus in an exemplary eco-district near Paris ENGIE and Nexity have concluded a financial and technological partnership to acquire and transform together into an exemplary eco-district, a 9-hectares plot of industrial land at La Garenne-Colombes, in the Hauts-de-Seine department (92). This new Paris La Défense centre would in particular host a future ENGIE eco-campus. The two groups will pool their respective know-how about sustainable cities and energy transition in order to develop this general interest urban project, in close collaboration with the municipality and the public actors. Designed for the future users, residents and employees, and as a showcase of the energy and environmental transition, this ambitious project is located within the scope of a Redevelopment and Sustainable Development Project of the municipality of La Garenne-Colombes, on a site acquired from the PSA group which will be made available in late 2018. For ENGIE, in compliance with the prerogatives of the representative bodies of the staff concerned, this would mean creating, by 2022-2023, a bespoke campus of more than 120,000 m², conceived according to the best standards of quality of life at work, thereby bringing together the Île-de-France teams within a unifying place, promoting cooperation, cross-disciplinarity and openness. “This project will be the showcase of the ENGIE Group’s strategy, part of an environmental approach contributing both to economic and social progress that is harmonious and sustainable. Located in a wooded urban site near Paris, this future eco-campus will illustrate the expertise of ENGIE and its teams in building the smart city of tomorrow”, Pierre Deheunynck, ENGIE Executive Vice President and member of the Executive Committee, welcomed. -

Nexity Diversifies and Optimises Its Funding Through the Implementation of a Neu Cp Programme for up to €300M

NEXITY DIVERSIFIES AND OPTIMISES ITS FUNDING THROUGH THE IMPLEMENTATION OF A NEU CP PROGRAMME FOR UP TO €300M Paris, France, 4 October 2019, 17h45 CET Nexity is pleased to announce the launch of a short-term notes program (Negotiable EUropean Commercial Paper - NEU CP), for up to 300 million euros, which was registered on 10 September 2019 with the Banque de France [1]. This programme provides Nexity with an additional short-term liquidity source of funding, allowing the Group to seize current market opportunities in terms of optimising financing costs while remaining highly flexible. It is secured by several undrawn revolving credit facilities totalling more than 500 million euros and by the available cash. The Financial Documentation of the short-term negotiable security programme (in French only) can be consulted on the Banque de France’s website (www.banque-france.fr/politique-monetaire.html/293). AT NEXITY, WE AIM TO SERVE ALL OUR CLIENTS AS THEIR REAL ESTATE NEEDS EVOLVE Nexity offers the widest range of advice and expertise, products, services and solutions for private individuals, companies and local authorities, so as to best meet the needs of our clients and respond to their concerns. Our business lines – real estate brokerage, management, design, development, planning, advisory and related services – are now optimally organised to serve and support our clients. As the benchmark operator in our sector, we are resolutely committed to all of our clients, but also to the environment and society as a whole. Nexity is listed on the -

Actions Synthétiques France Heures De Négociation : 9:00 - 17:30 (CET) Frais Et Commissions : 0.1% Du Montant De La Transaction, Min

Actions Synthétiques France Heures de négociation : 9:00 - 17:30 (CET) Frais et Commissions : 0.1% du montant de la transaction, min. 8 EUR (Marge sur commission: 70% - 99.9%). Symbole Instrument dont le prix est basé sur Nombre d'actions par lot Taille minimale d'un ordre en lots Vente à découvert Taux d'emprunt de titre (%) AC.FR Accor SA CFD 1 1 OUI -3 ACA.FR Credit Agricole SA CFD 1 1 OUI -3 ADP.FR Aeroports de Paris CFD 1 1 OUI -3 AF.FR Air France-KLM CFD 1 1 OUI -3 AI.FR Air Liquide SA CFD 1 1 OUI -3 AIR.FR Airbus Group NV CFD 1 1 NON - AKE.FR Arkema SA CFD 1 1 OUI -3 ALO.FR Alstom SA CFD 1 1 OUI -3 ALT.FR Altran Technologies SA CFD 1 1 OUI -3 ATO.FR AtoS CFD 1 1 OUI -3 BB.FR Societe BIC SA CFD 1 1 OUI -3 BIM.FR BioMerieux CFD 1 1 OUI -3 BN.FR Danone CFD 1 1 OUI -3 BNP.FR BNP Paribas CFD 1 1 OUI -3 BOL.FR Bollore SA CFD 1 1 OUI -3 BVI.FR Bureau Veritas SA CFD 1 1 OUI -3 CA.FR Carrefour SA CFD 1 1 OUI -3 CAP.FR Cap Gemini SA CFD 1 1 OUI -3 CGG.FR CGG SA CFD 1 1 NON - CNP.FR CNP Assurances CFD 1 1 OUI -3 CO.FR Casino Guichard Perrachon SA CFD 1 1 OUI -3 COFA.FR Coface SA CFD 1 1 OUI -4,5 CS.FR AXA SA CFD 1 1 OUI -3 DEC.FR JCDecaux SA CFD 1 1 OUI -3 DG.FR Vinci SA CFD 1 1 OUI -3 DSY.FR Dassault Systemes CFD 1 1 OUI -3 EDEN.FR Edenred CFD 1 1 OUI -3 EDF.FR EDF SA CFD 1 1 OUI -3 EI.FR Essilor International SA CFD 1 1 OUI -3 ELE.FR Euler Hermes Group CFD 1 1 OUI -4,5 EN.FR Bouygues SA CFD 1 1 OUI -3 ENGI.FR ENGIE CFD 1 1 OUI -3 ENX.FR Euronext NV CFD 1 1 OUI -3 EO.FR Faurecia CFD 1 1 OUI -3 ERA.FR Eramet CFD 1 1 OUI -5 ERF.FR Eurofins -

French Corporate Governance in Listed Companies Driving Growth

FRENCH CORPORATE GOVERNANCE IN LISTED COMPANIES DRIVING GROWTH & ATTRACTIVENESS A GUIDEBOOK FOR INVESTORS WITH SEPTEMBER 2012 Acknowledgements The French Institute of Directors (IFA), the Greater Paris Investment Agency both at the ini- tiative of this document together with the French Council of the Association of Registered Accountants (CSOEC) and the French Institute of Statutory Auditors (CNCC), partners of this project, are sincerely grateful to all the institutions members of the working group for their valuable contribution and particularly thank for their active commitment: - Chairman and members of the steering committee ; - Chairmen and members of the 3 workshops in charge of each chapter of this guidebook ; Names of the members of the working group by organization are provided at the end of the document. The institutions members of the working group are: ASTCF, AFG, AMF, CCIP, CNCC, CSOEC, DFCG, ECODA, ESSEC, IFA, OCDE*, ORSE, NYSE EURONEXT, PARIS EUROPLACE, PARIS IDF CAPITALE ECONO- MIQUE (the Greater Paris Investment Agency), SFAF. Warning The working group has developed this French Guidebook to assist those parties and investors interested in learning about how Corporate Governance is applied by listed companies in France. It provides a summary of the regulatory environment and soft law for Corporate Governance in France and the scope for application of such requirements under French Law. This document does not constitute any financial advice, nor does it replace the regulatory requirements of the French Market Authority (AMF). It should be read in conjunction with the detailed requirements of the AMF to form a definitive view in terms of the application of the relevant operating environment in France to each individual set of circumstances. -

2020 Universal Registration Document

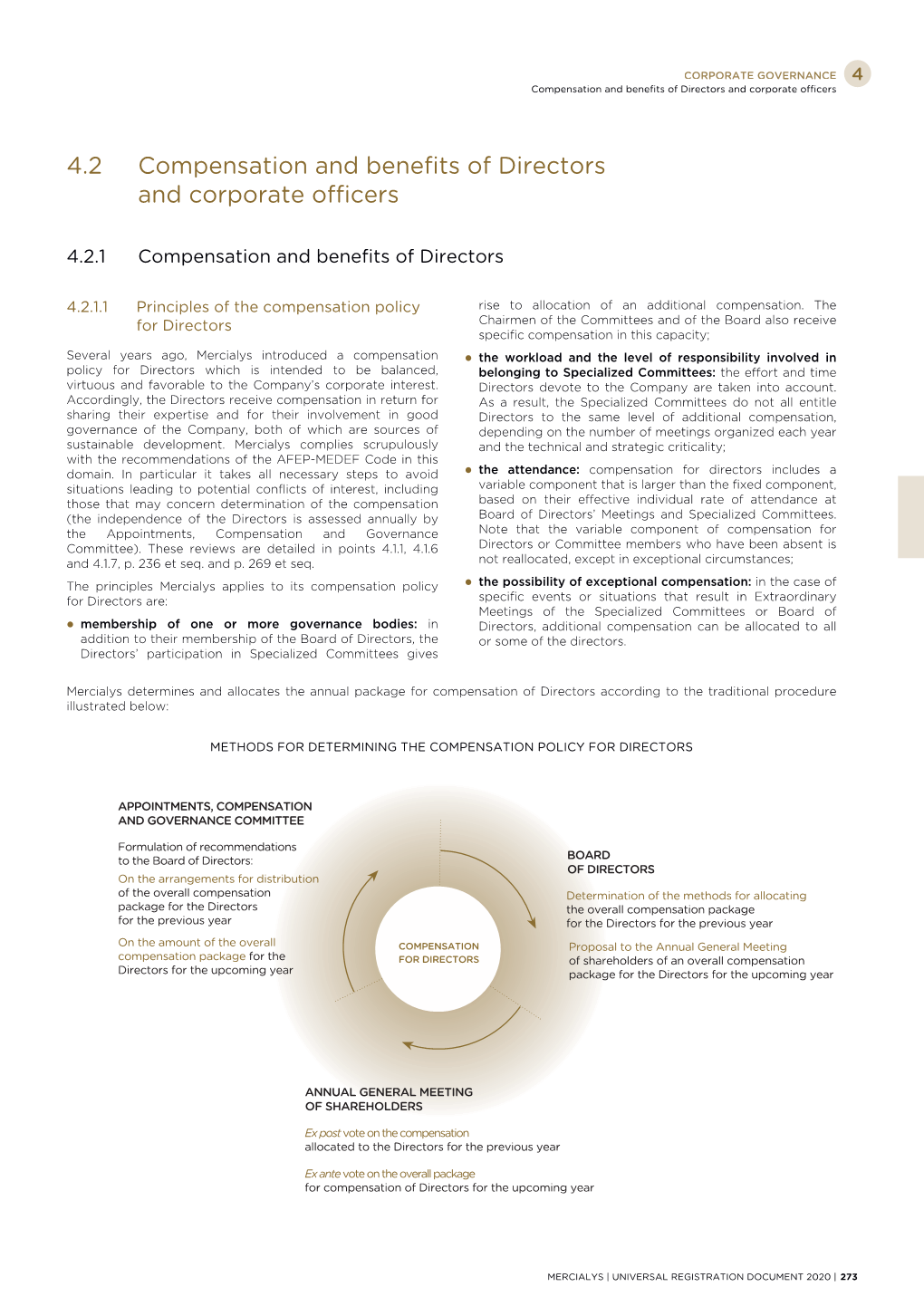

TABLE OF CONTENT INTEGRATED REPORT 2 Executive insights 3 Company profile 6 Strategy and goals 10 Governance and risk management 20 Performance 28 6 1 COMMENTS ON THE FISCAL YEAR 37 MERCIALYS GROUP ORGANIZATION AND RELATIONS 1.1Activity report 38 WITH CASINO GROUP COMPANIES 343 1.2Financial report 47 1.3Real estate portfolio 71 6.1Operational organization 344 6.2 Business relationships with Casino group companies 344 2 6.3 Mercialys organization chart – CORPORATE SOCIAL Subsidiaries and shareholdings 349 RESPONSIBILITY 83 6.4 Statutory Auditors’ special report on 2.1Mercialys’ CSR strategy 84 regulated agreements 356 2.2Energy and greenhouse gas emissions 90 Appendix: Summary table of current regulated agreements and those 2.3Asset resilience and adaptability 95 to be voted on 360 2.4Circular economy 97 2.5Biodiversity 99 2.6Accessibility and connectivity 101 7 STOCK MARKET INFORMATION 2.7Customer well-being, health and safety 102 AND SHARE CAPITAL 363 2.8 Community life and local economic development 106 7.1Stock market information 364 2.9Responsible value chain 108 7.2Share capital and shareholdings 374 2.10Talents and diversity 114 2.11Organization and quality of life at work 118 Appendices 120 8 ANNUAL GENERAL MEETING 385 8.1Draft resolutions 386 3 Appendix 1: Information CONSOLIDATED AND SEPARATE on the compensation components FINANCIAL STATEMENTS 137 awarded or paid in fiscal year 2020 to the Chairman of the Board of Directors 422 3.1Consolidated financial statements 138 Appendix 2: Information 3.2Separate financial statements 201 -

769339 6\(Press Release- Fixation Des Modalités Définitives \(English\)\)

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF AMERICA, AUSTRALIA, CANADA OR JAPAN. Issuance by Nexity of Bonds Convertible into and/or Exchangeable for New or Existing Shares (OCEANE) Final terms (subject to the approval ( visa ) of the Autorité des marchés financiers ) Paris, June 12, 2014 Nexity launched today an issuance of bonds convertible into and/or exchangeable for new or existing shares (OCEANE) due January 1, 2020 (the “ Bonds ”) in an initial nominal amount of € 156 521 759.90, which may be increased up to a maximum nominal amount of € 179 999 991.38 in the event of the full exercise of the over-allotment option of 15 per cent. granted to the Global Coordinator acting on behalf of the Joint Lead Managers and Joint Bookrunners, exercisable at the latest on June 16, 2014. The net proceeds of the issuance of the Bonds will be used for general corporate purposes of the Company and, if applicable, the financing or refinancing of acquisitions. Nexity set the final terms of the issuance after a private placement in and outside France. The par value of each Bond has been set at 43.34 euros, representing an issue premium of 35 per cent. over Nexity’s reference share price 1 on the regulated market of NYSE Euronext in Paris (“ Euronext Paris ”). The Bonds will bear interest at an annual nominal rate of 0.625 per cent., payable semi-annually in arrears on January 1 and July 1 of each year (or on the following business day if this date is not a business day) and the first interest payment will be made on January 1, 2015 on a pro rata temporis basis (or on the following business day if such date is not a business day). -

2011 Activity Report Mercialys – 2011 Activity Report Activity – 2011 Mercialys

welcome ! 2011 Activity Report Mercialys – 2011 Activity Report Activity – 2011 Mercialys 10, rue Cimarosa - 75016 Paris Tél. : +33 01 53 70 23 20 E-mail : [email protected] www.mercialys.com www.mercialys.com OUr GrOUP Profi le Chairman’s message .................... 2 Corporate Governance ............... 6 2011 Highlights ............................. 8 Key fi gures ................................... 10 OUr ValUes Making you feel at home The Esprit Voisin concept: Mercialys’s trademark ....................................... 14 Refl ecting local identity ..................................... 16 Useful ideas ......................................................... 18 Shopping centers in line with their customers ........................................... 20 Responsible retailers and citizens .................. 22 OUr aiM A new way of looking at retail Valentine Grand Centre shopping center: a story shared with the people of Marseille ............... 26 “Esprit Voisin“ concept at the heart of... ....................... 32 Partnerships creating value ............................................... 37 The art of transformation .................................................. 39 Entrepreneurial spirit .......................................................... 40 2006-11: the Alcudia years ............................................ 42 2012: The “Foncière Commerçante” strategy .............. 43 In 2012, they will also adopt the “Esprit Voisin” concept... ............................................ 44 OUR GROUP MERCIALYS Activity Report