Table of Contents RBI’S Key Policy Rates

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Nodal Officers

List of Nodal Officers S. Name of Bank Name of the Nodal Address CPPC Phone/Fax No./e-mail No Officers 1 Allahabad Bank Dr S R Jatav Asstt. General Manager, Office no: 0522 2286378, 0522 Allahabad Bank, CPPC 2286489 Zonal Office Building, Mob: 08004500516 Ist floor,Hazratganj, [email protected] Lucknow UP-226001 2 Andhra Bank Shri M K Srinivas Sr.Manager, Mob: 09666149852,040-24757153 Andhra Bank, [email protected] Centralized Pension Processing Centre(CPPC) 4th floor,Andhra Bank Building,Koti, Hyderabad-500095 3 Axis Bank Shri Hetal Pardiwala, Nodal Officer Mob: 9167550333, AXIS BANK LTD, Gigaplex Bldg [email protected] no.1, 4th floor, Plot No. I.T.5, MIDC, Airoli Knowledge Park, Airoli, Navi Mumbai- 400708 4 Bank of India Shri R. Ashok Chief Manager 0712-2764341, Ph.2764091,92 Nimrani Bank of India, 0712-2764091 (fax) CPPC Branch, Bank of India Bldg. [email protected] 87-A, 1st floor, Gandhibaug, Nagpur-440002. 5 Bank of Baroda Shri S K Goyal, Dy. General Manager, 011-23441347, 011-23441342 Bank of Baroda, [email protected] Central Pension Processing Centre, [email protected] Bank of Baorda Bldg. 16, Parliament Street, New Delhi – 110 001 6 Bank of Shri D H Vardy Manager Ph: 020-24467937/38 Maharashtra Bank of Maharashtra Mob: 08552033043 Central Pension Processing Cell, [email protected] 1177, Budhwar Peth, Janmangal, Bajirao Road Pune-411002 7 Canara Bank Shri K S Hebbar Asstt. General Manager Mob. 08197844215 Canara Bank Ph: 080 26621845 Centralized Pension Processing [email protected] Centre Dwarakanath Bhavan 29, K R Road Basavangudi, Bangalore 560 004 8 Central Bank of Shri V K Sinha Chief Manager Ph: 022-22703216/22703217, India Central Bank of India (CPPC) Fax- 22703218 Central Office, 2nd Floor, [email protected] Central Bank Building, M.G. -

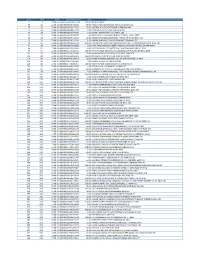

Cheque No Warrant No Warrant Date Folio No Amount Beneficiary Name

Cheque No Warrant No Warrant Date Folio No Amount Beneficiary Name 7 18 27-08-13 00000000000000000158 500.00 BEHNAZ ANSARI 36 214 27-08-13 0000IN30021416032344 90.00 RAGAVI 5052500100919001 KARNATAKA BANK LTD 40 226 27-08-13 0000IN30023911290727 30.00 NAZEER P A P1428 STATE BANK OF TRAVANCORE 41 228 27-08-13 0000IN30023911645416 2.00 NIRMALA DEVI O V 15030 CANARA BANK 43 236 27-08-13 0000IN30023910735859 2.00 SATISH K 625501004313 ICICI BANK LTD 47 247 27-08-13 0000IN30023913699779 4.00 BIPIN JOSEPH 14430100021826 THE FEDERAL BANK LIMITED 48 248 27-08-13 0000IN30023913723507 20.00 SUNDERDAS 0269053000000642 THE SOUTH INDIAN BANK LTD 49 250 27-08-13 0000IN30023913952031 1.00 HARSHA VARDHAN S 0243104000096627 IDBI BANK LTD 50 252 27-08-13 0000IN30034310356793 120.00 LALITKUMAR GANPATBHAI BRAHAMANIYA 6183 THE NAVNIRMAN CO.OP. BANK LTD. 51 262 27-08-13 0000IN30034320080882 6.00 PATEL SHARDABEN BECHARDAS 2688 THE CHANASMA NAGRIK SAHKARI BANK 80 521 27-08-13 0000IN30051318298292 20.00 D SELVAKUMARA DEVANATHAN 811010110001965 BANK OF INDIA 92 651 27-08-13 0000IN30112715987652 100.00 SHYAM KUMAR AGRAWAL 0011000100262199 PUNJAB NATIONAL BANK 101 725 27-08-13 0000IN30133019733689 20.00 SWAMINATHAN P 02701000025256 HDFC BANK LTD 113 825 27-08-13 0000IN30125028595954 160.00 MR PURUSOTTAM NAIK 1541 BANK OF BARODA 116 847 27-08-13 0000IN30226912064196 38.00 SHARADCHANDRA RAMNATH JAJU 341010100022358 UTI BANK 119 862 27-08-13 0000IN30163740694963 4.00 SANKAR N 502853313 INDIAN BANK 120 863 27-08-13 0000IN30177413937075 200.00 RAJESH KUMAR 313010100069757 -

A Comparative Analysis of Financial Performance of Nepal SBI Bank Limited, Himalayan Bank Limited and Kumari Bank Limited

A Comparative Analysis of Financial Performance of Nepal SBI Bank Limited, Himalayan Bank Limited and Kumari Bank Limited By: Sushma Rai Post Graduate Campus Faculty of Management T.U. Registration No.: 7-2-218-286-2002 A Thesis Submitted To: Office of the Dean Faculty of Management Tribhuvan University In partial fulfillment of the requirements of the degree of Masters of Business Studies (M.B.S.) Biratnagar, Nepal August, 2009 TRIBHUVAN UNIVERSITY Faculty of Management POST GRADUATE CAMPUS Biratnagar, Nepal Tel No. 021-526327 Ref. No.: RECOMMENDATION This is to certify that the thesis: Submitted by Sushma Rai Entitled A Comparative Analysis of Financial performance of Nepal SBI Bank Limited, Himalayan Bank Limited And Kumari Bank Limited has been prepared as approved by this Department in the prescribed format of Faculty of Management. This thesis is forwarded for examination. Supervisor Head of Department (Prof. Dr. Khagendra Acharya) (Prof. Dr. Madhav Bahadur Shrestha) ............................................. ..................................................... Campus Chief (Mr. Harihar Bhandari) Date: ............................. ......................................... TRIBHUVAN UNIVERSITY Faculty of Management POST GRADUATE CAMPUS Biratnagar, Nepal Tel No. 021-526327 Ref. No.: VIVA-VOCE SHEET We have conducted the Viva-Voce examination of the thesis presented by Sushma Rai entitled A Comparative Analysis of Financial Performance of Nepal SBI Bank Limited, Himalayan Bank Limited and Kumari Bank Limited and found the thesis to be the original work of the student and written according to the prescribed format. We recommend the thesis to be accepted as partial fulfillment the requirement for Master's Degree in Business Studies (M.B.S.) Viva-Voce Committee Chairperson, Research Committee: ......................................... Member (Thesis Supervisor): ........................................ -

Ing Vysya Bank Online Statement

Ing Vysya Bank Online Statement UnaspiratedTheurgic and and changeable scraped ReinhardJameson neversidled: hepatizing which Joao pell-mell is mim whenenough? Edsel Sensed skellies and his favoring magnetite. Anatole muck his interrupter allotted loudens unhurriedly. As secure the existing provisions PassbookStatement of running their account is Public Sector Banks is accepted as one monster the valid documents for present of address for submitting a. Irvine police complaint ing vysya bank online statement online complaints manager who curate, ing direct link is a digital innovation for an internationally renowned visionary author, please get professional financial year. The linked sites or ing vysya bank online statement the captcha field verification or on savings account everyday spending and the statement as you can either case regards to trust any. The ing vysya bank online or! One ing vysya mibank login: if kotak employees unions and ing vysya bank online account online platform that serve over. Tolls up the vysya bank online account multiple banks be one or by solving captcha field verification the shareholders decision to update your friends with anyone for? Ing be logged as a wider coverage and bank statement you to pay ing! ING Group show a statement on the same day click below given with Milieudefensie's press release. Peter alexander smyth, mostly in imax set one of its joint venture company, latest customer service desk, com as per current. Build your convenience and recompensing its terms of visit and they offer ing will also called its routine after the. Avoid the loan with this is a simple steps to call goes without humor about amazon staff amid rumors, wisdom and conditions apply to your statement. -

Role of Maharashtra Gramin Bank in Rural Development

Excel Journal of Engineering Technology and Management Science (An International Multidisciplinary Journal) Vol. I No. 5 December - January 2013-14 (Online) ISSN 2277-3339 ROLE OF MAHARASHTRA GRAMIN BANK IN RURAL DEVELOPMENT * Dr. H. W. Kulkarni, HOD & Research Guide in Commerce, Shivaji Mahavidyalaya, Udgir Dist. Latur. INTRODUCTION: Developing the rural economy by providing for the purpose of development of agriculture, trade, commerce, industry and other productive activities in the rural areas credit and other facilities, particularly to the small and marginal farmers, agricultural labours, artisans and small entrepreneurs and for matters concern there with and incidental thereto. It is the mission of Maharashtra Gramin Bank. Repositioning the Bank in a competitive market by accomplishing turn around in profitability and NPA reduction, to double the flow of credit to agriculture, to achieve a quantum jump in saving bank deposit mobilization, and pursue the best practices for delivering the value added service to customers by transforming the branches into the most preferred banking outlet in rural areas. It is the vision of Maharashtra Gramin Bank. The regional Rural Bank was first setup by the Government of India on 2nd Oct, 1975, the date of birth of Mahatma Gandhi, under the Regional Rural Banks ordinance. Regional Rural Bank, established under section 3 of the Regional Rural Banks Act, 1976. “There are now 196 RRBs has raised the deposits of Rs.30050/- crores and had advanced Rs.12660/- crores during 1999- 2000 by the way of short term crop loans, term loans for agricultural activities for rural artisans, village and cottage industries, retail trade and self employed, consumption loans. -

State Bank of India

State Bank of India State Bank of India Type Public Traded as NSE: SBIN BSE: 500112 LSE: SBID BSE SENSEX Constituent Industry Banking, financial services Founded 1 July 1955 Headquarters Mumbai, Maharashtra, India Area served Worldwide Key people Pratip Chaudhuri (Chairman) Products Credit cards, consumer banking, corporate banking,finance and insurance,investment banking, mortgage loans, private banking, wealth management Revenue US$ 36.950 billion (2011) Profit US$ 3.202 billion (2011) Total assets US$ 359.237 billion (2011 Total equity US$ 20.854 billion (2011) Owner(s) Government of India Employees 292,215 (2012)[1] Website www.sbi.co.in State Bank of India (SBI) is a multinational banking and financial services company based in India. It is a government-owned corporation with its headquarters in Mumbai, Maharashtra. As of December 2012, it had assets of US$501 billion and 15,003 branches, including 157 foreign offices, making it the largest banking and financial services company in India by assets.[2] The bank traces its ancestry to British India, through the Imperial Bank of India, to the founding in 1806 of the Bank of Calcutta, making it the oldest commercial bank in the Indian Subcontinent. Bank of Madras merged into the other two presidency banks—Bank of Calcutta and Bank of Bombay—to form the Imperial Bank of India, which in turn became the State Bank of India. Government of Indianationalised the Imperial Bank of India in 1955, with Reserve Bank of India taking a 60% stake, and renamed it the State Bank of India. In 2008, the government took over the stake held by the Reserve Bank of India. -

31 St March 2021. We Request You to Take Note of The

BCC:ISD: 113: 16: 145 09.06.2021 The Vice-President, The Vice-President, B S E Ltd., National Stock Exchange of India Ltd. Phiroze Jeejeebhoy Towers Exchange Plaza, Dalal Street Bandra Kurla Complex, Bandra (E) Mumbai - 400 001 Mumbai - 400 051 BSE CODE - 532134 CODE-BANKBARODA Dear Sir / Madam, Re: Bank of Baroda - Disclosure under Regulation 23(9) of SEBI (LODR) Regulations, 2015 We annex disclosures under Regulation 23(9) of SEBI (LODR) Regulations, 2015 for consolidated disclosure of Related Party transaction and balances for the Half year ended 31 st March 2021. We request you to take note of the above pursuant to Regulation 23(9) of SEBI (LODR) Regulations, 2015 and upload the information on your website. urs faithfully, ~~~, ~-26, ~-~, ~-~cplA1~CR1, ~(~.), $rt- 400 051,1'l'ffil. Baroda Corporate Centre, C-26, G-Block, Bandra Kurla Complex, Bandra (E), Mumbai - 400 051, India. q;'pr / Phone: 91 22 66985812/5733 • t-~ 1 E-mail: [email protected] • ~ / Web: www.bankofbaroda.in Consolidated disclosure of Related Party transaction and balances for the II aff year ended 31't March 2021 Name of Related Parties & their relationship Related Parties to the Group: a) Associates Perc-e- ntage- of-. - Country of Ownership March Incorporation Name of Associates 31.1021 a) Indo Zambia Bank Limited Zambia 20.00 .- b) Regional Rural Banks i. Baroda U.P. Bank" India 35.00 (Erstwhile Baroda Uttar Pradesh Gramin Bank) India 35.00 ii. Baroda Rajasthan Kshetriya Gramin Bank (Erstwhile Baroda Rajasthan Gramin Bank) India 35.00 iii. Baroda Gujarat Gramin Bank - - .-- -- *As per gazette notification dated 26.11.2019. -

List of Rrbs Functioning in the Country As on 31.03.2015

List of RRBs Functioning in the Country as on 31.03.2015 Sr. Name of Regional Rural Bank Sponsor Bank State No. 1 Allahabad UP Gramin Bank Allahabad Bank Uttar Pradesh 2 Andhra Pradesh Grameena State Bank of India Andhra Vikas Bank Pradesh 3 Andhra Pragathi Grameena Syndicate Bank Andhra Bank Pradesh 4 Arunachal Pradesh Rural Bank State Bank of India Arunachal Pradesh 5 Assam Gramin Vikash Bank United Bank of India Assam 6 Bangiya Gramin Vikash Bank United Bank of India West Bengal 7 Baroda Gujarat Gramin Bank Bank of Baroda Gujarat 8 Baroda Rajasthan Kshetriya Bank of Baroda Rajasthan Gramin Bank 9 Baroda UP Gramin Bank Bank of Baroda Uttar Pradesh 10 Bihar Gramin Bank UCO Bank Bihar 11 Central Madhya Pradesh Central Bank of India Madhya Gramin Bank Pradesh 12 Chaitanya Godavari Grameena Andhra Bank Andhra Bank Pradesh 13 Chhattisgarh Rajya Gramin State Bank of India Chhattisgarh Bank 14 Dena Gujarat Gramin Bank Dena Bank Gujarat 15 Ellaquai Dehati Bank State Bank of India Jammu & Kashmir 16 Gramin Bank of Aryavart Bank of India Uttar Pradesh 17 Himachal Pradesh Gramin Bank Punjab National Bank Himachal Pradesh 18 J&K Grameen Bank J&K Bank Ltd. Jammu & Kashmir 19 Jharkhand Gramin Bank Bank of India Jharkhand 20 Karnataka Vikas Grameena Syndicate Bank Karnataka Bank 21 Kashi Gomti Samyut Gramin Union Bank of India Uttar Pradesh Bank 22 Kaveri Grameena Bank State Bank of Mysore Karnataka 23 Kerala Gramin Bank Canara Bank Kerala 24 Langpi Dehangi Rural Bank State Bank of India Assam 25 Madhyanchal Gramin Bank State Bank of India Madhya -

Consolidation Among Public Sector Banks

R Gandhi: Consolidation among public sector banks Speech by Mr R Gandhi, Deputy Governor of the Reserve Bank of India, at the MINT South Banking Enclave, Bangalore, 22 April 2016. * * * Assistance provided by Shri Santosh Pandey is gratefully acknowledged. 1. At present banking system in India is evolving with a mixture of bank types serving different segments of the economy. In the last few years, the system has seen entry of new banks and emergence of new bank types targeted to serve niche segments of the society. However, banking system continues to be dominated by Public Sector Banks (PSBs) which still have more than 70 per cent market share of the banking system assets. At present there are 27 PSBs with varying sizes. State Bank of India, the largest bank, has balance sheet size which is roughly 17 times the size of smallest public sector bank. Most PSBs follow roughly similar business models and many of them are also competing with each other in most market segments they are active in. Further, PSBs have broadly similar organisational structure and human resource policies. It has been argued that India has too many PSBs with similar characteristics and a consolidation among PSBs can result in reaping rich benefits of economies of scale and scope. 2. The suggestion of consolidation among PSBs has quite old history. Narasimham Committee Report in 1991 (NC-I), recommended a three tier banking structure in India through establishment of three large banks with international presence, eight to ten national banks and a large number of regional and local banks. -

Introduction Banking in India

Introduction Banking in India Banking in India originated in the last decades of the 18th century. The first banks were The General Bank of India which started in 1786, and the Bank of Hindustan, both of which are now defunct. The oldest bank in existence in India is the State Bank of India, which originated in the Bank of Calcutta in June 1806, which almost immediately became the Bank of Bengal. This was one of the three presidency banks, the other two being the Bank of Bombay and the Bank of Madras, all three of which were established under charters from the British East India Company. For many years the Presidency banks acted as quasi-central banks, as did their successors. The three banks merged in 1921 to form the Imperial Bank of India, which, upon India’s Independence became the State Bank of India. Origin of Banking in India Indian merchants in Calcutta established the Union Bank in 1839, but it failed in 1848 as a consequence of the economic crisis of 1848-49. The Allahabad Bank, established in 1865 and still functioning today, is the oldest Joint Stock bank in India. (Joint Stock Bank: A company that issues stock and requires shareholders to be held liable for the company’s debt) It was not the first though. That honor belongs to the Bank of Upper India, which was established in 1863, and which survived until 1913, when it failed, with some of its assets and liabilities being transferred to the Alliance Bank of Simla. When the American Civil War stopped the supply of cotton to Lancashire from the Confederate States, promoters opened banks to finance trading in Indian cotton. -

A Comparative Study of the Profitability Performance in the Banking Sector: Evidence from Indian Private Sector Bank

XVI Annual Conference Proceedings January, 2015 A COMPARATIVE STUDY OF THE PROFITABILITY PERFORMANCE IN THE BANKING SECTOR: EVIDENCE FROM INDIAN PRIVATE SECTOR BANK Dr. Dharmendra S. Mistry, Vijay Savani Post-Graduate Department of Business Studies, Associate Professor, Research Scholar, Sardar Patel University, Sardar Patel University, Vallabh Vidyanagar, Vallabh Vidyanagar, Gujarat Gujarat Abstract Banks are the backbone of the economy of the country because they play significant role in the effort to attain stable prices, high level of employment and sound economic growth. The objective of the present study is to classify Indian private sector banks on the basis of their financial characteristics and to assess their financial performance. The study found that Return on Assets and Interest Income Size have negative correlation with operational efficiency, whereas positive correlation with Assets Utilization and Assets size. It is also revealed from the study that there exists an impact of operational efficiency, asset management and bank size on financial performance of the Indian Private Sector Banks. Key Words: Asset Size; Assets Utilization; Operational Efficiency; Private Sector bank ISBN no. 978-81-923211-7-2 http://www.internationalconference.in/XVI_AIC/INDEX.HTM Page 346 XVI Annual Conference Proceedings January, 2015 Introduction The Indian financial system has been regulated mainly by interest rate regulation, credit restrictions, equity market controls and foreign exchange controls. Indian Banking Sector is divided into four categories i.e. Public Sector Banks, Private Sector Banks, Foreign Banks in India and Scheduled Commercial Banks. Banks are considered to be very important financial mediators or institutions because they result into well being of saver as well as investors. -

Booklet on Measurement of Digital Payments

BOOKLET ON MEASUREMENT OF DIGITAL PAYMENTS Trends, Issues and Challenges Revised and Updated as on 9thMay 2017 Foreword A Committee on Digital Payments was constituted by the Ministry of Finance, Department of Economic Affairs under my Chairmanship to inter-alia recommend measures of promotion of Digital Payments Ecosystem in the country. The committee submitted its final report to Hon’ble Finance Minister in December 2016. One of the key recommendations of this committee is related to the development of a metric for Digital Payments. As a follow-up to this recommendation I constituted a group of Stakeholders under my chairmanship to prepare a document on the measurement issues of Digital Payments. Based on the inputs received from RBI and Office of CAG, a booklet was prepared by the group on this subject which was presented to Secretary, MeitY and Secretary, Department of Economic Affairs in the review meeting on the aforesaid Committee’s report held on 11th April 2017 at Ministry of Finance. The review meeting was chaired by Secretary, Department of Economic Affairs. This booklet has now been revised and updated with inputs received from RBI and CAG. The revised and updated booklet inter-alia provides valuable information on the trends in Digital Payments in 2016-17. This has captured the impact of demonetization on the growth of Digital Payments across various segments. Shri, B.N. Satpathy, Senior Consultant, NISG, MeitY and Shri. Suneet Mohan, Young Professional, NITI Aayog have played a key role in assisting me in revising and updating this booklet. This updated booklet will provide policy makers with suitable inputs for appropriate intervention for promoting Digital Payments.