Rating Rationale for JKCL

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

“Adani Enterprises Limited Q1 FY19 Earnings Conference Call”

“Adani Enterprises Limited Q1 FY19 Earnings Conference Call” August 07, 2018 MANAGEMENT: MR. PRANAV ADANI – DIRECTOR, ADANI ENTERPRISES LIMITED MR. RAJIV NAYAR – CFO, ADANI GROUP MR. VINAY PRAKASH – CEO, COAL AND MINING MR. RAMESH NAIR – CEO, MUNDRA SOLAR PV LIMITED MR. RAKESH SHAH – CFO, ADANI ENTERPRISES LIMITED MR. RAM PATODIA – CFO, MINING AND ICM MR. SHRIKANT KANHERE – CFO, ADANI WILMAR LIMITED MR. RAKESH TIWARY – CFO, MUNDRA SOLAR PV LIMITED MR. NARESH PODDAR – CFO, ADANI GAS LIMITED MR. PRAVEEN KHANDELWAL, CFO, MINING AUSTRALIA Page 1 of 9 Adani Enterprises Limited August 07, 2018 Moderator: Good day ladies and gentlemen and a very warm welcome to Adani Enterprises Limited Q1 FY19 earnings conference call. We have with us today on the call Mr. Pranav Adani – Director, Adani Enterprises Limited, Mr. Rajiv Nayar – CFO, Adani Group, Mr. Vinay Prakash – CEO, Coal and Mining, Mr. Ramesh Nair – CEO, Mundra Solar PV Ltd, Mr. Rakesh Shah – CFO, Adani Enterprises Ltd, Mr. Ram Patodia – CFO, Mining and ICM, Mr. Shrikant Kanhere – CFO, Adani Wilmar Limited, Mr. Rakesh Tiwary – CFO, Mundra Solar PV Ltd, Mr. Naresh Poddar – CFO, Adani Gas Limited, Mr. Praveen Khandelwal, CFO, Mining Australia. As a reminder all participant lines will be in the listen-only mode. There will be an opportunity for you to ask questions after the presentation concludes. Should you need assistance during the conference call please signal an operator by pressing ‘*’ then ‘0’ on your touchtone phone. Please note that this conference is being recorded. I am now glad to hand the conference over to Mr. Rakesh Shah, thank you and over to you sir. -

Adani Realty

POWERFUL REAL ESTATE dani Realty, one of the youngest arms of the A Adani Group, has delivered 13 lac sq. mtrs. of real estate and is on track to deliver an additional 13 lac sq. mtrs. In just 8 years since its inception, the realty group has won over 35 awards and ranks 7th in the list of top real estate brands – Prop Equity MAKINGADANI A SPLASH IN THE REALTY REAL ESTATE SECTOR survey 2017-18. MAGNIFICENT PROJECTS Adani Realty, the youngest arm of Ahmedabad-based the firm speaks a story of Adani Realty’s growth has Adani Group – a global integrated infrastructure and astounding success and been primarily due to their development conglomerate – is considered as one of the ingenious teamwork under relentless commitment to foremost construction companies in India and has some the guidance of its visionary establish trust by exceeding mesmerizing buildings representing both the flavour of leader. Some of the accolades delivery expectations luxury & affordable housing to its credit received by the company and crafting projects that include Best Golf Club in raise benchmarks. This Gujarat 2019, Best New commitment has seen the 9 Hole Golf Course 2019, group foray into major cities ‘Best Township Project of such as Mumbai, Gurgaon, and the airport. Thanks to that’ll be appreciated by India’ Award 2018, and Pune and Ahmedabad with the flyovers and its proximity connoisseurs of fine living. ‘Environment Friendly Project residential, commercial to the Western Express of the Year - Residential’. and social club projects. highway, its connectivity to AWARDS & ACCOLADES Adani Realty has armed Shantigram, Gujarat’s largest the rest of the city is second Under the leadership of MD itself with a skilled workforce integrated township spread to none. -

Title and Index.Pmd

RED HERRING PROSPECTUS Dated July 14, 2009 Please read Sections 60 and 60B of the Companies Act, 1956 100% Book Built Issue ADANI POWER LIMITED (Our Company was incorporated on August 22, 1996 as a public limited company under the Companies Act, 1956. For details of changes in the name and registered office of our Company, see “History and Certain Corporate Matters” on page 131 of this Red Herring Prospectus.) Registered Office: Shikhar, Near Adani House, Mithakhali Six Roads, Navrangpura, Ahmedabad 380 009. Tel: (91 79) 2656 5555; Fax: (91 79) 2656 5500 Contact Person: Mr. Rahul C. Shah, Company Secretary and Compliance Officer; Tel No: (91 79) 2555 5795; Fax: (91 79) 2555 5608 Email: [email protected]; Website: www.adanipower.com PUBLIC ISSUE OF 301,652,031 EQUITY SHARES OF Rs. 10 EACH OF ADANI POWER LIMITED (“APL” OR THE “COMPANY” OR THE “ISSUER”) FOR CASH AT A PRICE OF Rs. [] PER EQUITY SHARE (INCLUDING A SHARE PREMIUM OF Rs. [•] PER EQUITY SHARE) AGGREGATING TO Rs. [] MILLION (THE “ISSUE”). THE ISSUE INCLUDES A RESERVATION OF UP TO 8,000,000 EQUITY SHARES OF RS. 10 EACH FOR THE ELIGIBLE EMPLOYEES (THE “EMPLOYEE RESERVATION PORTION”). THE ISSUE LESS THE EMPLOYEE RESERVATION PORTION I.E. 293,652,031 EQUITY SHARES IS REFERRED TO AS THE “NET ISSUE”. THE ISSUE WILL CONSTITUTE 13.84% OF THE POST ISSUE PAID UP CAPITAL OF THE COMPANY AND THE NET ISSUE WILL CONSTITUTE 13.47% OF THE POST ISSUE PAID UP CAPITAL OF THE COMPANY. THE FACE VALUE OF THE EQUITY SHARES IS Rs. -

Enhancing Value. Building India. Inside the Report

Size: 8.25x10.75inch (wxh) Adani Enterprises Limited Annual Report 2018-19 Enhancing Value. Building India. Inside the Report Corporate Overview Financial Statements 002 About Adani Group 104 Independent Auditors Report 004 About Adani Enterprises Limited 114 Balance Sheet 006 Our Businesses 115 Statement of Profit and Loss “Our nation is expected to see 008 Chairman’s Message 117 Statement of Cash Flow an investment of a trillion dollars 010 Managing Director’s Message 119 Notes to Financial Statements in infrastructure, split evenly 012 Review by Chief Financial 186 Independent Auditor’s between public and private sector Officer Report on Consolidated resources and is on its way to Financial Statements becoming a five trillion dollar 013 Shaping a stronger AEL 194 Consolidated Balance Sheet economy over the next five years.’’ 014 Our Value Creation Story 195 Consolidated Statement of Gautam S Adani 016 Performance Highlights Chairman Profit and Loss 017 Our Core Competitiveness 199 Consolidated Statement 018 Profile of Board of Directors of Cash Flow 020 Adapting an Integrated 201 Notes to Consolidated Approach Financial Statements 025 Awards & Recognition 288 Salient Features of the Financial Statements of Subsidiaries / Associate / “The economy witnessed a growth Statutory Reports Joint Ventures of 6.8% during FY19 on the back of firm industrial development, 026 Corporate Information improvement in monetary and 027 Directors’ Report Notice fiscal policies, growth in private 059 Management Discussion and investments and stabilization in Analysis Report 298 Notice of the GST implementation.’’ 27th Annual General Meeting 072 Corporate Governance Report Rajesh S Adani Managing director 096 Business Responsibility Report The cover design is thoughtfully created to summarise all the businesses of Adani Enterprises. -

APL-SOA-Equity Postal Ballot-62500

ADANI POWER LIMITED Registered office: ‘Shikhar’, Near Adani House, Mithakhali Six Roads, Navrangpura, Ahmedabad–380 009, Gujarat Phone No. +91-79-25557555 Fax No. +91-79-25557177 CIN: L40100GJ1996PLC030533 Website: www.adanipower.com POSTAL BALLOT NOTICE of ADANI POWER LIMITED CONTENTS PAGE NOS. Postal Ballot Notice of Adani Power Limited ……….............................................. 2 Explanatory Statement under Section 393 of the Companies Act, 1956 read with Section 102 of the Companies Act, 2013…………………....……………........... 7 Composite Scheme of Arrangement between Adani Enterprises Limited and Adani Ports and Special Economic Zone Limited and Adani Power Limited and Adani Transmission Limited and Adani Mining 39 Private Limited and their respective shareholders and creditors (“the Scheme”)……………………………………………………................................................................. Observation Letter dated 13th March 2015 from BSE Limited (“BSE”) conveying No Objection for filing the Scheme with the Hon'ble High Court.. 83 Observation Letter dated 13th March 2015 from the National Stock Exchange of India Limited (“NSE”) conveying No Objection for filing the 85 Scheme with the Hon'ble High Court …………......................................................... Complaints Report dated 28th February 2015 submitted by Adani Power Limited to BSE and NSE…...................................................................................... 87 1 ADANI POWER LIMITED Registered office: ‘Shikhar’, Near Adani House, Mithakhali Six Roads, Navrangpura, -

Gas Projects)

LNG News Weekly Date 27th NOVEMBER 20 SHELL POISED TO BOOST TALLY OF LNG NEWBUILDS AS IT SHEDS OLDER SHIPS Energy major Shell is moving to increase the number of LNG carrier newbuildings it has on order to 18 vessels by signing up shipowners to berths it has reserved in South Korea. TradeWinds understands that Shell may start by awarding time-charter contracts to back four more ships in the near term, on top of the 14 contracted by owners last year. In previous years, Shell has timed the conclusion of its LNG newbuilding charters for the year-end period. Sources following the business said talks are ongoing with owners, including new names for Shell. Longer term, the major is said to be keen to bring its total of new LNG carriers up to 22. [email protected] [email protected] (Sale and Purchase) (Gas projects) Talk of possible new fleet additions comes as the company moves to dispose of two 10-year-old, tri-fuel diesel-electric (TFDE) LNG vessels in what would be rare secondhand sales. Shell kicked off its LNG fleet expansion and renewal in December 2019 with eight vessels contracted at Hyundai Heavy Industries and affiliate Hyundai Samho Heavy Industries. In this first tranche, Shell Tankers (Singapore) signed time charters for four LNG newbuildings contracted by Norway’s Knutsen LNG, two for newbuildings ordered by Korea Line Corp and a further pair of vessels contracted by investors advised by JP Morgan Asset Management. The 174,000-cbm newbuildings are being built with dual-fuel X-DF engines, boil-off management plants, air lubrication systems and shaft generators for auxiliary power. -

Adani Enterprises Limited Investor Presentation Thinking Big Doing Better July 2018 Legal Disclaimer

Adani Enterprises Limited Investor Presentation Thinking big Doing better July 2018 Legal Disclaimer Certain statements made in this presentation may not be based on AEL assumes no responsibility to publicly amend, modify or revise any historical information or facts and may be “forward-looking forward looking statements, on the basis of any subsequent statements,” including those relating to general business plans and development, information or events, or otherwise. Unless otherwise strategy of Adani Enterprises Limited (“AEL”), its future outlook and stated in this document, the information contained herein is based on growth prospects, and future developments in its businesses and management information and estimates. The information contained competitive and regulatory environment, and statements which herein is subject to change without notice and past performance is contain words or phrases such as ‘will’, ‘expected to’, etc., or similar not indicative of future results. AEL may alter, modify or otherwise expressions or variations of such expressions. Actual results may differ change in any manner the content of this presentation, without materially from these forward-looking statements due to a number of obligation to notify any person of such revision or changes. factors, including future changes or developments in its business, its No person is authorized to give any information or to make competitive environment, its ability to implement its strategies and any representation not contained in and not consistent with this initiatives and respond to technological changes and political, presentation and, if given or made, such information economic, regulatory and social conditions in India. This presentation or representation must not be relied upon as having been authorized does not constitute a prospectus, offering circular or offering by or on behalf of AEL. -

List of Participants As of 30 April 2013

World Economic Forum on India List of Participants As of 30 April 2013 National Capital Region, Gurgaon, India, 6-8 November 2012 Zoher Abdoolcarim Asia Editor Time International Hong Kong SAR Asanga Executive Director Lakshman Kadirgamar Sri Lanka Abeyagoonasekera Institute for International Relations and Strategic Studies Anoka Abeyrathne Co-Founder and Volunteer GreentheClimate.org Sri Lanka Reuben Abraham Executive Director, Centre for Emerging Indian School of Business India Markets Solutions Pranav Adani Managing Director, Agro and Oil & Gas Adani Group India Philippe Advani Vice-President, Global Sourcing Network EADS Germany Vineet Agarwal Joint Managing Director Transport Corporation of India India Ltd Bina Agarwal Professor of Development Economics University of Manchester United Kingdom Manoj Kumar Chief Executive Officer, Indian Karuturi Global Limited India Agarwal Operations Nirmal Kumar Director Adhunik Metaliks Limited India Agarwal (AML) Aakarsh Agarwal Director Adhunik Metaliks Limited India (AML) Anup Agarwalla Managing Director B L A Industries Pvt. Ltd India Manish Agrawal Director MSP Steel & Power Ltd India Nisha Agrawal Chief Executive Officer Oxfam India India Saurabh Agrawal Regional Head, Corporate Finance, Standard Chartered Bank India South Asia Montek Singh Deputy Chairman, Planning Ahluwalia Commission, India Richie Ahuja Asia Regional Director Environmental Defense Fund USA Joiel Akilan Executive Director and Chief BBVA India India Representative Satohiro Akimoto General Manager, Global Intelligence, Mitsubishi Corporation Japan Global Strategy and Business Development Vikram K. Akula Social Entrepreneur, India Muhammad Ali Chairman Securities and Exchange Pakistan Commission of Pakistan (SECP) Michael W. Allworth Global Chairman, Cities Centre of KPMG Australia Excellence Shubhendu Amitabh Group Executive President The Aditya Birla Group India World Economic Forum on India 1/16 Manu Anand Chairman and Chief Executive Officer PepsiCo India Holdings Pvt. -

About Adani Enterprises

Adani Enterprises Limited Annual Report 2019-20 Committed to Value Creation Enabling a Sustainable Future Read Inside Corporate Overview 002 Profile of Adani Group 004 About Adani Enterprises 006 Our Businesses 012 Chairman’s Message 016 Managing Director’s Message 018 Message from the Chief Financial Officer 019 Shaping a stronger AEL 020 Investing in Growth 022 Financials - Measuring Growth 023 How we add value 024 Profile of Board of Directors 026 Corporate Social Responsibility 033 Awards and Recognition Statutory Reports 035 Directors’ Report 067 Management Discussion and Analysis Report 084 Corporate Governance Report 106 Business Responsibility Report “We continue to draw inspiration from our Financial Statements vision ‘Growth with Goodness’, to be a 120 Independent Auditor’s Report world class leader in 130 Balance Sheet businesses that enrich lives and contribute to 131 Statement of Profit and Loss nation building.’’ 133 Statement of Cash Flow Gautam S Adani 135 Notes to Financial Chairman Statements 202 Independent Auditor’s Report on Consolidated Financial Statements 210 Consolidated Balance Sheet 211 Consolidated Statement of Profit and Loss 215 Consolidated Statement “Defying unprecedented www.adanienterprises.com of Cash Flow challenges and a complicated external 217 Notes to Consolidated environment, AEL Financial Statements recorded a strong 308 Salient Features of the performance during the Financial Statements of year with a singular focus Subsidiaries / Associate / on creating value for our Joint Ventures stakeholders.” Scan this code with a QR reader app on your 317 Notice Rajesh S Adani smartphone or tablet and Managing Director know more about us Business begins with value creation. It lays the foundation for a sustainable future, nurturing and enabling lives as well as livelihoods. -

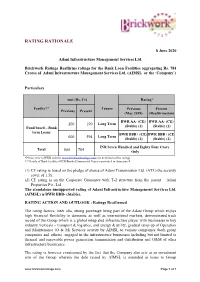

Rating Rationale

RATING RATIONALE 8 June 2020 Adani Infrastructure Management Services Ltd. Brickwork Ratings Reaffirms ratings for the Bank Loan Facilities aggregating Rs. 784 Crores of Adani Infrastructure Management Services Ltd. (AIMSL or the ‘Company’) Particulars Amt (Rs. Cr) Rating* Facility** Tenure Previous Present Previous Present (May 2019) (Reaffirmation) BWR AA- (CE) BWR AA- (CE) 200 190 Long Term Fund based – Bank (Stable) (1) (Stable) (1) term Loans BWR BBB+ (CE) BWR BBB+ (CE 600 594 Long Term (Stable) (2) (Stable) (2) INR Seven Hundred and Eighty Four Crore Total 800 784 Only *Please refer to BWR website www.brickworkratings.com/ for definition of the ratings ** Details of Bank facilities/NCD/Bonds/Commercial Paper is provided in Annexure-I (1) CE rating is based on the pledge of shares of Adani Transmission Ltd. (ATL) the security cover of 1.5x. (2) CE rating is on the Corporate Guarantee with T-2 structure from the parent – Adani Properties Pvt. Ltd. The standalone unsupported rating of Adani Infrastructure Management Services Ltd. (AIMSL) is BWR BBB- (Stable). RATING ACTION AND OUTLOOK : Ratings Reaffirmed The rating factors, inter alia, strong parentage being part of the Adani Group which enjoys high financial flexibility in domestic as well as international markets, demonstrated track record of the Group which is a global integrated infrastructure player with businesses in key industry verticals – transport & logistics, and energy & utility, gradual ramp-up of Operation and Maintenance (O & M) Services activity by AIMSL to various companies (both group companies and others) engaged in the infrastructure businesses including but not limited to thermal and renewable power generation, transmission and distribution and O&M of other infrastructure businesses. -

FY 2020-21 Is Expected to Remain Planning to Bring Nearly 50 Contracts for 9 Coal Blocks Subdued

3rd June, 2020 BSE Limited National Stock Exchange of India Limited P J Towers, Exchange plaza, Dalal Street, Bandra-Kurla Complex, Mumbai – 400001 Bandra (E), Mumbai – 400051 Scrip Code: 512599 Scrip Code: ADANIENT Sub: Notice of the 28th Annual General Meeting alongwith Annual Report of the Company for the financial year 2019-20 Dear Sir(s), The 28th Annual General Meeting (“AGM”) of the Company will be held on Friday, 26th June, 2020 at 1.00 p.m. IST through Video Conferencing / Other Audio Visual Means. Pursuant to Regulation 34(1) of Securities Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“SEBI Listing Regulations”), we are submitting herewith the Annual Report of the Company along with the Notice of AGM for the financial year 2019-20 which is being sent through electronic mode to the Members. The Annual Report containing the Notice is also uploaded on the Company’s website www.adanienterprises.com Kindly take the same on your record. Thanking you, Yours faithfully, Adani Enterprises Ltd Tel + 91 79 2656 5555 Adani House, Fax + 91 79 2555 5500 Nr Mithakhali Circle, Navrangpura [email protected] Ahmedabad 380 009 www.adani.com Gujarat, India CIN: L51100GJ1993PLC019067 Registered Office : Adani House, Nr. Mithakhali Circle, Navrangpura, Ahmedabad 380 009, Gujarat, India Adani Enterprises Limited Annual Report 2019-20 Committed to Value Creation Enabling a Sustainable Future Read Inside Corporate Overview 002 Profle of Adani Group 004 About Adani Enterprises 006 Our Businesses 012 Chairman’s -

Engineered for The

Engineered for the Adani Enterprises Limited Annual Report 2015-16 88 412 3 381 Coal handled Installed capacity of Volume of edible Volume of city (traded and mined) renewable energy in oil sold in 2015-16 gas distributed in in 2015-16 (MMT) 2015-16 (MW) (MMT) 2015-16 (MMSCM) 45,148 3,114 1,041 Revenue in 2015-16 EBIDTA in 2015-16 (Rs crore) (Rs crore) 2015-16 (Rs crore) 9.47 122 7 8 Earnings per share Book value per share EBIDTA margin in Return on Assets in in 2015-16 (Rs) as on March 31, 2015-16 (%) 2015-16 (%) 2016 (Rs crore) India is among the fastest growing • In just 16 years, the Company economies in the world. The country’s emerged as the largest port company growth could be faster if larger in India.* investments were to be made in coal • In just seven years, the Company access and mining, energy generation, emerged as one of the largest power port infrastructure creation, food generating companies in India.* security and renewable energy. • Over the years, Adani Enterprises emerged as one of the largest Limited responded proactively to renewable power generating these national priorities. The Company companies in India. entered these spaces with a singular objective: to plug evident gaps and • In just nine years, the Company catalyse national progress. emerged as one of the largest providers of agri-storage solutions in India. These have been the results of the company’s nation-strengthening Demonstrating that when it comes to objective: servicing core national needs, Adani Enterprises possesses energy, expertise • In just 10 years, Adani Enterprises and enthusiasm.