Frozen Food Products Marketing and Distribution Challenges in a Developing Country

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FIRMS in AOR of RD PUNJAB Ser Name of Firm Chemical RD

Appendix-A FIRMS IN AOR OF RD PUNJAB Ser Name of Firm Chemical RD 1 M/s A.A Textile Processing Industries, Faisalabad Hydrochloric Acid Punjab 2 M/s A.B Exports (Pvt) Ltd, Faisalabad Hydrochloric Acid Punjab 3 M/s A.M Associates, Lahore Hydrochloric Acid Punjab 4 M/s A.M Knit Wear, Faisalabad Hydrochloric Acid Punjab 5 M/s A.S Chemical, Multan Hydrochloric Acid Punjab 6 M/s A.T Impex, Lahore Hydrochloric Acid Punjab 7 M/s AA Brothers Chemical Traders, Sialkot Hydrochloric Acid Punjab 8 M/s AA Fabrics, Faisalabad Hydrochloric Acid Punjab 9 M/s AA Spinning Mills Ltd, Faisalabad Hydrochloric Acid Punjab 10 M/s Aala Production Industries (Pvt) Ltd, Faisalabad Hydrochloric Acid Punjab 11 M/s Aamir Chemical Store, Multan Hydrochloric Acid Punjab 12 M/s Abbas Chemicals, Lahore Hydrochloric Acid Punjab M/s Abdul Razaq & Sons Tezab and Spray Centre, 13 Hydrochloric Acid Punjab Toba Tek Singh 14 M/s Abubakar Anees Textiles, Faisalabad Hydrochloric Acid Punjab 15 M/s Acro Chemicals, Lahore Toluene & MEK Punjab 16 M/s Agritech Ltd, Lahore Hydrochloric Acid Punjab 17 M/s Ahmad Chemical Traders, Muridke Hydrochloric Acid Punjab 18 M/s Ahmad Chemmicals, Lahore Hydrochloric Acid Punjab 19 M/s Ahmad Industries (Pvt) Ltd, Khanewal Hydrochloric Acid Punjab 20 M/s Ahmed Chemical Traders, Faisalabad Hydrochloric Acid Punjab 21 M/s AHN Steel, Lahore Hydrochloric Acid Punjab 22 M/s Ajmal Industries, Kamoke Hydrochloric Acid Punjab 23 M/s Ajmer Engineering Electric Works, Lahore Hydrochloric Acid Punjab Hydrochloric Acid & Sulphuric 24 M/s Akbari Chemical Company, -

S# BRANCH CODE BRANCH NAME CITY ADDRESS 1 24 Abbottabad

BRANCH S# BRANCH NAME CITY ADDRESS CODE 1 24 Abbottabad Abbottabad Mansera Road Abbottabad 2 312 Sarwar Mall Abbottabad Sarwar Mall, Mansehra Road Abbottabad 3 345 Jinnahabad Abbottabad PMA Link Road, Jinnahabad Abbottabad 4 131 Kamra Attock Cantonment Board Mini Plaza G. T. Road Kamra. 5 197 Attock City Branch Attock Ahmad Plaza Opposite Railway Park Pleader Lane Attock City 6 25 Bahawalpur Bahawalpur 1 - Noor Mahal Road Bahawalpur 7 261 Bahawalpur Cantt Bahawalpur Al-Mohafiz Shopping Complex, Pelican Road, Opposite CMH, Bahawalpur Cantt 8 251 Bhakkar Bhakkar Al-Qaim Plaza, Chisti Chowk, Jhang Road, Bhakkar 9 161 D.G Khan Dera Ghazi Khan Jampur Road Dera Ghazi Khan 10 69 D.I.Khan Dera Ismail Khan Kaif Gulbahar Building A. Q. Khan. Chowk Circular Road D. I. Khan 11 9 Faisalabad Main Faisalabad Mezan Executive Tower 4 Liaqat Road Faisalabad 12 50 Peoples Colony Faisalabad Peoples Colony Faisalabad 13 142 Satyana Road Faisalabad 585-I Block B People's Colony #1 Satayana Road Faisalabad 14 244 Susan Road Faisalabad Plot # 291, East Susan Road, Faisalabad 15 241 Ghari Habibullah Ghari Habibullah Kashmir Road, Ghari Habibullah, Tehsil Balakot, District Mansehra 16 12 G.T. Road Gujranwala Opposite General Bus Stand G.T. Road Gujranwala 17 172 Gujranwala Cantt Gujranwala Kent Plaza Quide-e-Azam Avenue Gujranwala Cantt. 18 123 Kharian Gujrat Raza Building Main G.T. Road Kharian 19 125 Haripur Haripur G. T. Road Shahrah-e-Hazara Haripur 20 344 Hassan abdal Hassan Abdal Near Lari Adda, Hassanabdal, District Attock 21 216 Hattar Hattar -

Consolidated List of HBL and Bank Alfalah Branches for Ehsaas Emergency Cash Payments

Consolidated list of HBL and Bank Alfalah Branches for Ehsaas Emergency Cash Payments List of HBL Branches for payments in Punjab, Sindh and Balochistan ranch Cod Branch Name Branch Address Cluster District Tehsil 0662 ATTOCK-CITY 22 & 23 A-BLOCK CHOWK BAZAR ATTOCK CITY Cluster-2 ATTOCK ATTOCK BADIN-QUAID-I-AZAM PLOT NO. A-121 & 122 QUAID-E-AZAM ROAD, FRUIT 1261 ROAD CHOWK, BADIN, DISTT. BADIN Cluster-3 Badin Badin PLOT #.508, SHAHI BAZAR TANDO GHULAM ALI TEHSIL TANDO GHULAM ALI 1661 MALTI, DISTT BADIN Cluster-3 Badin Badin PLOT #.508, SHAHI BAZAR TANDO GHULAM ALI TEHSIL MALTI, 1661 TANDO GHULAM ALI Cluster-3 Badin Badin DISTT BADIN CHISHTIAN-GHALLA SHOP NO. 38/B, KHEWAT NO. 165/165, KHATOONI NO. 115, MANDI VILLAGE & TEHSIL CHISHTIAN, DISTRICT BAHAWALNAGAR. 0105 Cluster-2 BAHAWAL NAGAR BAHAWAL NAGAR KHEWAT,NO.6-KHATOONI NO.40/41-DUNGA BONGA DONGA BONGA HIGHWAY ROAD DISTT.BWN 1626 Cluster-2 BAHAWAL NAGAR BAHAWAL NAGAR BAHAWAL NAGAR-TEHSIL 0677 442-Chowk Rafique shah TEHSIL BAZAR BAHAWALNAGAR Cluster-2 BAHAWAL NAGAR BAHAWAL NAGAR BAZAR BAHAWALPUR-GHALLA HOUSE # B-1, MODEL TOWN-B, GHALLA MANDI, TEHSIL & 0870 MANDI DISTRICT BAHAWALPUR. Cluster-2 BAHAWALPUR BAHAWALPUR Khewat #33 Khatooni #133 Hasilpur Road, opposite Bus KHAIRPUR TAMEWALI 1379 Stand, Khairpur Tamewali Distt Bahawalpur Cluster-2 BAHAWALPUR BAHAWALPUR KHEWAT 12, KHATOONI 31-23/21, CHAK NO.56/DB YAZMAN YAZMAN-MAIN BRANCH 0468 DISTT. BAHAWALPUR. Cluster-2 BAHAWALPUR BAHAWALPUR BAHAWALPUR-SATELLITE Plot # 55/C Mouza Hamiaytian taxation # VIII-790 Satellite Town 1172 Cluster-2 BAHAWALPUR BAHAWALPUR TOWN Bahawalpur 0297 HAIDERABAD THALL VILL: & P.O.HAIDERABAD THAL-K/5950 BHAKKAR Cluster-2 BHAKKAR BHAKKAR KHASRA # 1113/187, KHEWAT # 159-2, KHATOONI # 503, DARYA KHAN HASHMI CHOWK, POST OFFICE, TEHSIL DARYA KHAN, 1326 DISTRICT BHAKKAR. -

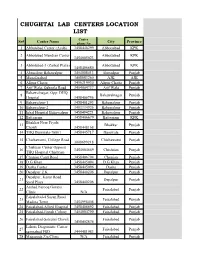

Chughtai Lab Centers Location List

CHUGHTAI LAB CENTERS LOCATION LIST Center Sr# Center Name City Province phone No 1 Abbotabad Center (Ayub) 3458448299 Abbottabad KPK 2 Abbotabad Mandian Center Abbottabad KPK 3454005023 3 Abbotabad-3 (Zarbat Plaza) Abbottabad KPK 3458406680 4 Ahmedpur Bahawalpur 3454008413 Ahmedpur Punjab 5 Muzafarabad 3408883260 AJK AJK 6 Alipur Chatta 3456219930 Alipur Chatta Punjab 7 Arif Wala, Qaboola Road 3454004737 Arif Wala Punjab Bahawalnagar, Opp: DHQ 8 Bahawalnagar Punjab Hospital 3458406756 9 Bahawalpur-1 3458401293 Bahawalpur Punjab 10 Bahawalpur-2 3403334926 Bahawalpur Punjab 11 Iqbal Hospital Bahawalpur 3458494221 Bahawalpur Punjab 12 Battgaram 3458406679 Battgaram KPK Bhakhar Near Piyala 13 Bhakkar Punjab Chowk 3458448168 14 THQ Burewala-76001 3458445717 Burewala Punjab 15 Chichawatni, College Road Chichawatni Punjab 3008699218 Chishtian Center Opposit 16 3454004669 Chishtian Punjab THQ Hospital Chishtian 17 Chunian Cantt Road 3458406794 Chunian Punjab 18 D.G Khan 3458445094 D.G Khan Punjab 19 Daska Center 3458445096 Daska Punjab 20 Depalpur Z.K 3458440206 Depalpur Punjab Depalpur, Kasur Road 21 Depalpur Punjab Syed Plaza 3458440206 Arshad Farooq Goraya 22 Faisalabad Punjab Clinic N/A Faisalabad-4 Susan Road 23 Faisalabad Punjab Madina Town 3454998408 24 Faisalabad-Allied Hospital 3458406692 Faisalabad Punjab 25 Faisalabad-Jinnah Colony 3454004790 Faisalabad Punjab 26 Faisalabad-Saleemi Chowk Faisalabad Punjab 3458402874 Lahore Diagonistic Center 27 Faisalabad Punjab samnabad FSD 3444481983 28 Maqsooda Zia Clinic N/A Faisalabad Punjab Farooqabad, -

Festiwal Chlebów Świata, 21-23. Marca 2014 Roku

FESTIWAL CHLEBÓW ŚWIATA, 21-23. MARCA 2014 ROKU Stowarzyszenie Polskich Mediów, Warszawska Izba Turystyki wraz z Zespołem Szkół nr 11 im. Władysława Grabskiego w Warszawie realizuje projekt FESTIWAL CHLEBÓW ŚWIATA 21 - 23 marca 2014 r. Celem tej inicjatywy jest promocja chleba, pokazania jego powszechności, ale i równocześnie różnorodności. Zaplanowaliśmy, że będzie się ona składała się z dwóch segmentów: pierwszy to prezentacja wypieków pieczywa według receptur kultywowanych w różnych częściach świata, drugi to ekspozycja producentów pieczywa oraz związanych z piekarnictwem produktów. Do udziału w żywej prezentacji chlebów świata zaprosiliśmy: Casa Artusi (Dom Ojca Kuchni Włoskiej) z prezentacją piady, producenci pity, macy oraz opłatka wigilijnego, Muzeum Żywego Piernika w Toruniu, Muzeum Rolnictwa w Ciechanowcu z wypiekiem chleba na zakwasie, przedstawiciele ambasad ze wszystkich kontynentów z pokazem własnej tradycji wypieku chleba. Dodatkowym atutem będzie prezentacja chleba astronautów wraz osobistym świadectwem Polskiego Kosmonauty Mirosława Hermaszewskiego. Nie zabraknie też pokazu rodzajów ziarna oraz mąki. Realizacją projektu będzie bezprecedensowa ekspozycja chlebów świata, pozwalająca poznać nie tylko dzieje chleba, ale też wszelkie jego odmiany występujące w różnych regionach świata. Taka prezentacja to podkreślenie uniwersalnego charakteru chleba jako pożywienia, który w znanej czy nieznanej nam dotychczas innej formie można znaleźć w każdym zakątku kuli ziemskiej zamieszkałym przez ludzi. Odkąd istnieje pismo, wzmiankowano na temat chleba, toteż, dodatkowo, jego kultowa i kulturowo – symboliczna wartość jest nie do przecenienia. Inauguracja FESTIWALU CHLEBÓW ŚWIATA planowana jest w piątek, w dniu 21 marca 2014 roku, pierwszym dniu wiosny a potrwa ona do niedzieli tj. do 23.03. 2014 r.. Uczniowie wówczas szukają pomysłów na nieodbywanie typowych zajęć lekcyjnych. My proponujemy bardzo celowe „vagari”- zapraszając uczniów wszystkich typów i poziomów szkoły z opiekunami do spotkania się na Festiwalu. -

Catalogue of Pakistani Vegetables and Fruits

CATALOGUE OF PAKISTANI VEGETABLES AND FRUITS © 2019 The Employers’ Federation of Pakistan (EFP) Head Office, 2nd Floor, State Life Building No. 2, Wallace Road, off I.I Chundrigar Road Karachi, 74000 Telephone: (+92)-21-32439347 Website: www.efp.org.pk The work produced is a product of Economic Council Secretariat and fully reflects the views of stakeholders and association of chambers and industries of the federation. Legal Rights The EC Secretariat has no objection to dissemination of information contained in this document for commercial or academic purposes as long as full reference is provided. All queries concerning legalities should be forwarded to the EC Secretariat, 10 Banglalore Town, Shahra-e-Faisal, Karachi, Pakistan; fax: (+92)-21-34310037; email: [email protected]. 2 Project BreXport Authorized by: Ismail Suttar, Chairman Asif Aziz Zuberi, Co-Chairman Authored by: Abdullah Ali Khan, Coordinator Muhammad Junaid Hanif, Industrial Research Analyst Research & Development, EFP-EC 3 TABLE OF CONTENTS EMPLOYERS’ FEDERATION OF PAKISTAN – ECONOMIC COUNCIL ............................................................ i PREFACE ....................................................................................................................................................................... ii PAKISTAN – UK TRADE: HS CODES ...................................................................................................................... iii DESCRIPTION OF VEGETABLES INCLUDED ...................................................................................................... -

Amunowruz-Magazine-No1-Sep2018

AMU NOWRUZ E-MAGAZINE | NO. 1 | SEPTEMBER 2018 27SEP. HAPPY WORLD TOURISM DAY Taste Persia! One of the world's most ancient and important culinary schools belongs to Iran People of the world; Iran! Includes 22 historical sites and a natural one. They 're just one small portion from Iran's historical and natural resources Autumn, one name and a thousand significations About Persia • History [1] Contents AMU NOWRUZ E-MAGAZINE | NO. 1 | SEPTEMBER 2018 27SEP. HAPPY WORLD TOURISM DAY Taste Persia! One of the world's most ancient and important culinary schools belongs to Iran Editorial 06 People of the world; Iran! Includes 22 historical sites and a natural one. They 're just one small portion from Iran's historical and natural resources Autumn, one name and a thousand significations Tourism and the Digital Transformation 08 AMU NOWRUZ E-MAGAZINE NO.1 SEPTEMBER 2018 10 About Persia History 10 A History that Builds Civilization Editorial Department Farshid Karimi, Ramin Nouri, Samira Mohebali UNESCO Heritages Editor In Chief Samira Mohebali 14 People of the world; Iran! Authors Kimia Ajayebi, Katherin Azami, Elnaz Darvishi, Fereshteh Derakhshesh, Elham Fazeli, Parto Hasanizadeh, Maryam Hesaraki, Saba Karkheiran, Art & Culture Arvin Moazenzadeh, Homeira Mohebali, Bashir Momeni, Shirin Najvan 22 Tourism with Ethnic Groups in Iran Editor Shekufe Ranjbar 26 Religions in Iran 28 Farsi; a Language Rooted in History Translation Group Shekufe Ranjbar, Somayeh Shirizadeh 30 Taste Persia! Photographers Hessam Mirrahimi, Saeid Zohari, Reza Nouri, Payam Moein, -

Curriculum Vitae

………………………….. Curriculum Vitae Name : Dr.Muhammad Tahir Nawaz E-mail: [email protected] [email protected] Distinctions Relevant Clusters CLUSTER CODE STATUS Management MM YES Engineering Management EM YES Project Management PM YES Human Resource Management HRM YES Technology Management TM YES Industrial Engineering and YES Management IEM Manufacturing Management MFM YES Telecom Management TEM NO Software Management SM NO Construction Management CM NO Quality Management QM YES Publications and Research Experience o National Publications (Conference): S.N PUBLICATI TITLE OF PAPER COMPLETE NAME HEC VOL NO. ISSUE NO. PAGE NO. O. ON DATE OF THE JOURNAL & CATEGORY FROM TO ADDRESS (W,X,Y,Z) / IMPACT FACTOR 1 JULY 2007 COMPETITVE STUDY ANNALS OF PUNJAB X 1 2 26 31 OF SOME MEDICAL COLLEGE, INTERESTING DATA FAISALABAD, OF MENTALLY PAKISTAN RETARTED CHILDRED FROM FAISALABAD & ISLAMABAD AND ITS MANAGEMENT 2 JUNE 2010 ROLE OF FEMALE PAKISTAN JOURNAL X 1 (PJS-09-1212) - - EMPLYEES IN OF SCIENCE, FIRST APPAREL INDUSTRY FLOOR, SHADMAN OF PAKISTAN PLAZA, SHADMAN MARKET LAHORE, PAKISTAN 3 NOV 2010 MEASURING FEMALE PAKISTAN JOURNAL X II PJS-09-1215 - - EMPLOYEE’S OF SCIENCE, FIRST EMPOWERMENT IN FLOOR, SHADMAN APPAREL INDUSTRY PLAZA, SHADMAN OF PAKISTAN MARKET, LAHORE PAKISTAN o International Publications (Conferences): PAPER TITLE: Topic: Auth: o Journal Publications: PAPER TITLE: Global Journals INC.(US) Topic: Globalization and right adoption of technology in Pakistan Auth: GJCST Volume 13, Issue 1, version 1.0 Jan 15 o Research Papers -

Ethnic and Traditional Iranian Breads: Different Types, and Historical and Cultural Aspects

J Ethn Foods - (2017) 1e7 Contents lists available at ScienceDirect Journal of Ethnic Foods journal homepage: http://journalofethnicfoods.net Original article Ethnic and traditional Iranian breads: different types, and historical and cultural aspects * Vahid Mohammadpour Karizaki Chemical Engineering Department, Quchan University of Advanced Technology, Quchan, Iran article info abstract Article history: Background: Bread making has a long history in Iran. Because of the inseparable relationship between Received 21 December 2016 Iranian people and bread, an increasingly wide variety of this healthy and nutritious food is prepared and Received in revised form consumed throughout the country. The present work aims at documenting and providing information 14 January 2017 about breads of Iranian cuisine. Accepted 20 January 2017 Methods: The required information was obtained via a direct face-to-face questionnaire-based survey Available online xxx among housewives, domestic people, and Iranian bakers. The statistical society was selected by random sampling among people from the top eight most populous cities in the country. Keywords: bread Results: More than 30 types of ethnic and traditional bread of Iranian cuisine are introduced in two main fi ethnic food categories: the rst group includes breads that are consumed all around the country, and the second Iran group consists of those that are prepared in special regions, or by ethnic groups. Conclusion: The historical and cultural aspects of the Iranian foods showed that bread is the most common and popular food in the country. © 2017 Korea Food Research Institute. Published by Elsevier B.V. This is an open access article under the CC BY-NC-ND license (http://creativecommons.org/licenses/by-nc-nd/4.0/). -

Landscape Analysis of the Family Planning Situation in Pakistan—District Profile: Faisalabad

LANDSCAPE ANALYSIS OF THE FAMILY PLANNING SITUATION IN PAKISTAN May 2016 DISTRICT PROFILE: FAISALABAD Figure 1: Map of Faisalabad District Background Faisalabad District is situated in central Punjab Province. It Map of Punjab Province Map of Faisalabad District has an estimated population of 7.4 million1. The district consists of eight administrative strata, or towns. Table 1 presents key demographic facts about the district. Less than half (42%) of the population is urban.2 Of the estimated 1.9 million women of reproductive age (MWRA) in the district, 1.15 million lives in urban areas. At 3.4, Faisalabad’s total fertility rate (TFR) is below Punjab’s average of 3.5.3 Table 1: Demographics of Faisalabad Faisalabad Demographics Urban Rural Overall Total population 3,142,000 4,216,000 7,358,000 Women 15-49 875,000 1,038,000 1,913,000 MWRA 489,000 663,000 1,152,000 Literacy rate (10 77% 61% 69% years and above) * IMR** - - 69 TFR** - - 3.4 Source: Punjab Development Statistics 2015, * Pakistan Social and Living Standards Measurement Survey (PSLMS) 2014-15, **Multiple Indicator Cluster Survey Punjab (MICS) 2014 Use of Antenatal and Delivery Care Services In both urban and rural areas, private facilities are the most common places of The majority of women in Faisalabad sought antenatal care from a skilled delivery. In urban areas, 64 percent of women delivered in private health provider during their last pregnancy, A higher percentage of urban than rural institutions compared to 12 percent in public facilities. In rural areas, 48 women sought antenatal care (81% and 70% respectively).4 percent of women delivered in private facilities, compared to 5 percent who delivered in public facilities. -

Improvement of Flat Bread Processing and Properties by Enzymes

Improvement of flatbread processing and quality by enzymes Lutz Popper, Head R & D Flatbread feeds the world Bagebröd, Sweden; Bannock, Scotland; Bolo do caco, Madeira, Portugal; Borlengo, Italy; Farl, Ireland and Scotland; Flatbrød, Norway ; Flatkaka, Iceland; Focaccia, Italy; Ftira, Malta; Lagana, Greece; Lefse, Norway; Lepinja, Croatia, Serbia; Lepyoshka, Russia; Pita, Hungary; Flatbrød, Norway; Podpłomyk, Poland; Pane carasau, Sardinia; Piadina, Italy; Pita, Greece; Pită/Lipie/Turtă, Romania; Pissaladière, France; Pizza, Italy; Podpłomyk, Poland; Posúch, Slovakia; Părlenka, Bulgaria; Rieska, Finland; Somun, Lepina, Bosnia and Herzegovina; Spianata sarda, Sardinia; Staffordshire oatcake, England; Tigella, Italy; Torta, Spain; Torta al testo, Umbria, Italy; Torta de Gazpacho, Spain; Tunnbröd, Sweden; Yemeni lahoh; Barbari, Iran; Bataw, Egypt; Bazlama, Turkey; Gurassa, Sudan; Harsha, Morocco; Khebz, Levant; Khubz, Arabian Peninsula; Lahoh, Northern Somalia, Djibouti, Yemen; Lebanese Bread, Lebanon; Muufo, Somalia; Malooga, Yemen; M'lawi, Tunisia; Chapati, Swahili coast, Uganda; Markook, Levant; Matzo, Israel; Murr, Israel; Pita, Eastern Mediterranean, Turkey and Middle East; Sangak, Iran; Taftan, Iran; Khubz, Arabian Peninsula; Yufka, Dürüm, Turkey; Lavash, Armenia; Matnakash, Armenia; Pogača, Balkans and Turkey; Shotis Puri, Georgia; Tonis Puri, Georgia; Afghan bread or Nan, Afghanistan; Aloo paratha, India and Pakistan; Akki rotti, India; Aparon, Philippines; Bánh, Vietnam; Bakarkhani, Indian subcontinent; Bhatura, Indian subcontinent; -

Cotton Processing and Spinning Industry in Pakistan: a Case Study of Lyallpur City Hamid Iqbal 1 Dr

Pakistan Social Sciences Review P-ISSN 2664-0422 December 2018, Vol. 2, No. 2 [01-19] O-ISSN 2664-0430 RESEARCH PAPER Cotton Processing and Spinning Industry in Pakistan: A Case Study of Lyallpur City Hamid Iqbal 1 Dr. Abdul Qadir Mushtaq 2 Robina Khan 3 1. M. Phil Scholar, Department of History & Pakistan Studies, Govt. College University Faisalabad, Punjab, Pakistan 2. Assistant Professor, Department of History & Pakistan Studies, Govt. College University Faisalabad, Punjab, Pakistan 3. Ph. D Scholar Department of Political Science & IR Govt. College University Faisalabad, Punjab, Pakistan PAPER INFO ABSTRACT Received: This study explores the growth of cotton processing and May 14, 2018 spinning industry in Lyallpur. Cotton industry was established Accepted: by British government especially in Lyallpur which was August 31, 2018 renowned as the greatest industry of Pakistan. Cotton the white Online: gold enhanced the position of spindles and spinning industry. December 30, 2018 These industries played important role in the economy of Keywords: Pakistan generally and especially in Lyallpur, a city of Punjab. Cotton, Spinning, Library research has been used to analyze the growth of cotton Economy, processing and spinning industry in Lyallpur. Primary and Development, secondary sources were used to draw a rational conclusion. This Industry study observed that due to vague strategy of governments the Corresponding cotton industry faced problems in growth. Heavy taxes were Author: imposed on production of cotton industry and many taxes were robinakhan101@o also imposed on the imports of industrial machinery. This study utlook.com recommends that government should reserve a special budget for industry. Machinery and industry must be given rebate on imports and exclusion of taxable income.