Available CFA Resources NYS Consolidated Funding Application (CFA)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

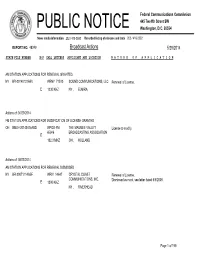

Broadcast Actions 5/29/2014

Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 48249 Broadcast Actions 5/29/2014 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N AM STATION APPLICATIONS FOR RENEWAL GRANTED NY BR-20140131ABV WENY 71510 SOUND COMMUNICATIONS, LLC Renewal of License. E 1230 KHZ NY ,ELMIRA Actions of: 04/29/2014 FM STATION APPLICATIONS FOR MODIFICATION OF LICENSE GRANTED OH BMLH-20140415ABD WPOS-FM THE MAUMEE VALLEY License to modify. 65946 BROADCASTING ASSOCIATION E 102.3 MHZ OH , HOLLAND Actions of: 05/23/2014 AM STATION APPLICATIONS FOR RENEWAL DISMISSED NY BR-20071114ABF WRIV 14647 CRYSTAL COAST Renewal of License. COMMUNICATIONS, INC. Dismissed as moot, see letter dated 5/5/2008. E 1390 KHZ NY , RIVERHEAD Page 1 of 199 Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 48249 Broadcast Actions 5/29/2014 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N Actions of: 05/23/2014 AM STATION APPLICATIONS FOR ASSIGNMENT OF LICENSE GRANTED NY BAL-20140212AEC WGGO 9409 PEMBROOK PINES, INC. Voluntary Assignment of License From: PEMBROOK PINES, INC. E 1590 KHZ NY , SALAMANCA To: SOUND COMMUNICATIONS, LLC Form 314 NY BAL-20140212AEE WOEN 19708 PEMBROOK PINES, INC. -

Spring Catalog 20082008 OLLI • Osher Lifelong Learning Institute at BERKSHIRE COMMUNITY COLLEGE Formerly Berkshire Institute for Lifetime Learning (BILL)

PARTNERS IN EDUCATION WITH WILLIAMS COLLEGE BARD COLLEGE AT SIMON’S ROCK MASSACHUSETTS COLLEGE OF LIBERAL ARTS AT BERKSHIRE COMMUNITY COLLEGE www.BerkshireOLLI.org • 413.236.2190 Spring Catalog 20082008 OLLI • Osher Lifelong Learning Institute AT BERKSHIRE COMMUNITY COLLEGE Formerly Berkshire Institute for Lifetime Learning (BILL) WELCOME TO OLLI AT BCC The Osher Lifelong Learning Institute (OLLI) at Berkshire Community College was established in 2007 following a grant from the Bernard Osher Foundation of San Francisco to the Berkshire Institute for Lifetime Learning (BILL). Founded in 1994 as a volunteer-run organization, BILL fostered lifelong learning opportunities for adults in the culture-rich Berkshire area. Building on this tradition, OLLI continues the classes, trips, special events and lectures that members value. As part of the nationwide OLLI network, members can enjoy educational resources, ideas and advanced technologies that offer an even wider range of learning. In addition to Berkshire Community College, OLLI is a partner in education with Williams College, Bard College at Simon’s Rock and Massachusetts College of Liberal Arts and has cultural partners including the Sterling and Francine Clark Art Institute. These institutions give generously of their faculty and facilities to enrich the lifetime learning of OLLI members. N Choose from among 50-plus (noncredit) courses in a variety of subject areas offered in the fall, winter, spring and summer semesters. N Attend distinguished speaker lectures and panel discussions that stimulate and inform. N Experience history and culture through special events and trips. N Network with other members to form groups of mutual interest. LEARN – EXPLORE – ENJOY JOIN OLLI UPCOMING EVENTS AND LECTURES March . -

Central Hudson Gas & Electric

Central Hudson Gas & Electric Electric Emergency Plan April 1, 2013 Central Hudson Gas & Electric TABLE OF CONTENTS Section Page 1. Overview 1 1.1. Introduction 1 1.2. Safety 2 1.3. Annual Storm Drill 2 1.4. Training 3 1.5. Contact Lists 3 1.6. Emergency Materials 4 1.7. Customer Storm Preparedness Information 4 2. Incident Command System 5 2.1 Organization Charts 5 2.2 Position Descriptions 5 3. Pre-Event Planning 6 3.1 Command Staff Responsibilities 6 3.2 General Staff Responsibilities 6 4. During Event 8 4.1 Assessment 9 4.1.1 Helicopter Patrols 9 4.1.2 Rapid Assessment 10 4.1.3 Detailed Damage Assessment 10 4.2 Restoration 10 4.2.1 Restoration Priorities 11 4.2.2 Mutual Assistance 12 4.2.3 Logistics 13 4.2.4 Flooding of Customer or Company Equipment 16 4.3 Estimated Time of Restoration 16 4.4 De-mobilization 16 5. Post Event 17 6. Communication 18 6.1 Estimated Time of Restoration Guidelines 18 6.2 ETR Communication 18 6.3 IVR and Website Messages 18 6.4 PSC and SEMO Contacts/Reporting 19 6.5 Municipal Contacts/Conference Calls 20 6.6 Press Releases and Media Information 21 6.7 Social Media, Email and Text Messaging 22 6.8 Special Needs Customer Contacts 23 6.9 Customer Contact Process 23 7. Procedures 24 7.1 Estimated Time of Restoration Guidelines 25 7.2 ETR Procedure 29 7.3 LSA Contact Procedure 33 7.4 Wire Down Procedure 35 7.5 Damage Assessment Process 37 7.6 OMS Reliability Policy 39 7.7 Restoration of Flood Damaged Equipment 41 7.7.1 Pre-emptive System Shutdown 41 7.7.2 Restoration of Customer Electric Service 41 Electric Emergency Plan – Apr. -

Windham-Ashland-Jewett Central School Student Handbook 2019-2020

Windham-Ashland-Jewett Central School Student Handbook 2019-2020 available online at www.wajcs.org PO Box 429 5411 Main Street Windham, NY 12496 (518) 734-3400 www.wajcs.org Board of Education Drew Shuster, President Dr. Teri Martin, Vice-President Susan Simpfenderfer, Member Debra Bunce, Member Melissa Maldonado, Member Administrative Staff John Wiktorko - Superintendent Tammy Hebert - Assistant Superintendent David Donner – Building Principal Lara McAneny - Director of Student Services Megan Wilkey – School Psychologist Michelle Mattice – School Business Manager Wendy Oftedal – Director of Transportation John Mattice – Director of Building and Grounds AJ Savasta – Director of Technology Nicole Ray – Director of Instructional Technology Nicole Baldner - K-6 Guidance Counselor Mike Pellettier - 7-12 Guidance Counselor Joel Middleton – Athletic Director Diana Potter – Cafeteria Manager Alma Mater Nestled in the Cozy Catskills In Among The Hills Stands Our Dear Old Windham High School Sheltered From All Ills. Shout The Name ‘Tis Windham High School Loud Her Praises Sing With Her Glories All Unnumbered, Let The Dear Hills Ring. When Our High School Days Have Ended Armed With Precepts True, May We Give The World Such Service As We Honor You. Shout The Name ‘Tis Windham High School Loud Her Praises Sing With Her Glories All Unnumbered, Let The Dear Hills Ring. Mission Statement Windham-Ashland-Jewett Central School will provide the resources and environment that maximizes the opportunity for each and every student to reach his or her academic, -

View Our 2020-2021 Chamber Directory Here

2020-2021 Member Directory Expanding Opportunities Throughout the Great Northern Catskills www.GreeneCountyChamber.com greenecountychamber.com • 1 2 • Greene County Chamber of Commerce 2020-2021 Directory Greene County Chamber of Commerce 327 Main Street, P.O. Box 248 Catskill, NY 12414 p: (518) 943-4222 f: (518) 751-2267 Welcome to Greene County, New York! Chamber Staff Jeff Friedman The Greene County Chamber of Commerce is pleased to pres- President/Executive Director ent this guide to the many fine members of the business commu- nity of Greene County and its surrounding area. Within this direc- Pamela Geskie tory you will find a wide array of quality businesses ready to meet Membership Director the needs of every resident and visitor alike. We hope that you Officers will find it useful throughout the year and share it with others. Nicole Bliss – Chair National Bank of Coxsackie Greene County’s unique blend of commerce ranges from a thriving tourism industry to quality manufacturers and top notch Joey LoBianco – Vice Chair service providers. Whether you are looking for a place to stay Rip Van Winkle Brewing Company and play, acquire a product you need, or just get some personal Ryan Hastie – Treasurer attention, it can all be found right here. The diverse cultural and Pardee’s Agency, Inc. historic heritage of the region is woven into the fabric of our Kathleen McQuaid Holdridge - Secretary community’s friendly, welcoming nature, making Greene County KathodeRay Media a special place to visit or just a great place to call home. Florence Ohle - Immediate Past Chair The Chamber of Commerce is committed to serving as a re- Community Action of Greene County source, advocate and promotional source for our business mem- 2021 Directors bers. -

MAY 2021 COMPLIMENTARY GUIDE Catskillregionguide.Com

Catskill Mountain Region MAY 2021 COMPLIMENTARY GUIDE catskillregionguide.com Home & Garden Landscape Design Home Improvement Banking & Real Estate Nurseries & Floral Design May 2021 • GUIDE 1 2 • www.catskillregionguide.com May 2021 • GUIDE 3 4 • www.catskillregionguide.com www.catskillregionguide.com VOLUME 36, NUMBER 5 May 2021 PUBLISHERS Peter Finn, Chairman, Catskill Mountain Foundation Sarah Finn, President, Catskill Mountain Foundation On the cover: Photo courtesy of Greene Bee EDITORIAL DIRECTOR, Greenhouse, Ltd. For more CATSKILL MOUNTAIN FOUNDATION information about Greene Bee, Sarah Taft please see the article on page 28 ADVERTISING SALES Barbara Cobb Steve Friedman CONTRIBUTING WRITERS Jeff Senterman, Sarah Taft, IN THIS ISSUE Margaret Donsbach Tomlinson & Robert Tomlinson ADMINISTRATION & FINANCE 6 WANDA’S VISIT: Christopher Durang’s classic one-act farce Candy McKee takes on new life in a production presented by the Catskill Justin McGowan & Hillary Morse Mountain Foundaiton PRINTING Catskill Mountain Printing Services 12 TODAY BUILDS TOMORROW: About Recycling… By Robert Tomlinson DISTRIBUTION Catskill Mountain Foundation 14 KERNS NURSERY EDITORIAL DEADLINE FOR NEXT ISSUE: May 10 16 SPECIAL SECTION: HOME & GARDEN The Catskill Mountain Region Guide is published 12 times a year by the Catskill Mountain Foundation, Inc., Main Street, PO Box 924, Hunter, NY 12442. If you have events or programs that you would like to have covered, please send them by e-mail to tafts@ 28 GREENE BEE GREENHOUSE, LTD.: Growing Responsibly catskillmtn.org. Please be sure to furnish a contact name and in- clude your address, telephone, fax, and e-mail information on all correspondence. For editorial and photo submission guidelines 29 A GREENE COUNTY GARDEN IN MAY send a request via e-mail to [email protected]. -

Exhibit 2181

Exhibit 2181 Case 1:18-cv-04420-LLS Document 131 Filed 03/23/20 Page 1 of 4 Electronically Filed Docket: 19-CRB-0005-WR (2021-2025) Filing Date: 08/24/2020 10:54:36 AM EDT NAB Trial Ex. 2181.1 Exhibit 2181 Case 1:18-cv-04420-LLS Document 131 Filed 03/23/20 Page 2 of 4 NAB Trial Ex. 2181.2 Exhibit 2181 Case 1:18-cv-04420-LLS Document 131 Filed 03/23/20 Page 3 of 4 NAB Trial Ex. 2181.3 Exhibit 2181 Case 1:18-cv-04420-LLS Document 131 Filed 03/23/20 Page 4 of 4 NAB Trial Ex. 2181.4 Exhibit 2181 Case 1:18-cv-04420-LLS Document 132 Filed 03/23/20 Page 1 of 1 NAB Trial Ex. 2181.5 Exhibit 2181 Case 1:18-cv-04420-LLS Document 133 Filed 04/15/20 Page 1 of 4 ATARA MILLER Partner 55 Hudson Yards | New York, NY 10001-2163 T: 212.530.5421 [email protected] | milbank.com April 15, 2020 VIA ECF Honorable Louis L. Stanton Daniel Patrick Moynihan United States Courthouse 500 Pearl St. New York, NY 10007-1312 Re: Radio Music License Comm., Inc. v. Broad. Music, Inc., 18 Civ. 4420 (LLS) Dear Judge Stanton: We write on behalf of Respondent Broadcast Music, Inc. (“BMI”) to update the Court on the status of BMI’s efforts to implement its agreement with the Radio Music License Committee, Inc. (“RMLC”) and to request that the Court unseal the Exhibits attached to the Order (see Dkt. -

Hadiotv EXPERIMENTER AUGUST -SEPTEMBER 75C

DXer's DREAM THAT ALMOST WAS SHASILAND HadioTV EXPERIMENTER AUGUST -SEPTEMBER 75c BUILD COLD QuA BREE ... a 2-FET metal moocher to end the gold drain and De Gaulle! PIUS Socket -2 -Me CB Skyhook No -Parts Slave Flash Patrol PA System IC Big Voice www.americanradiohistory.com EICO Makes It Possible Uncompromising engineering-for value does it! You save up to 50% with Eico Kits and Wired Equipment. (%1 eft ale( 7.111 e, si. a er. ortinastereo Engineering excellence, 100% capability, striking esthetics, the industry's only TOTAL PERFORMANCE STEREO at lowest cost. A Silicon Solid -State 70 -Watt Stereo Amplifier for $99.95 kit, $139.95 wired, including cabinet. Cortina 3070. A Solid -State FM Stereo Tuner for $99.95 kit. $139.95 wired, including cabinet. Cortina 3200. A 70 -Watt Solid -State FM Stereo Receiver for $169.95 kit, $259.95 wired, including cabinet. Cortina 3570. The newest excitement in kits. 100% solid-state and professional. Fun to build and use. Expandable, interconnectable. Great as "jiffy" projects and as introductions to electronics. No technical experience needed. Finest parts, pre -drilled etched printed circuit boards, step-by-step instructions. EICOGRAFT.4- Electronic Siren $4.95, Burglar Alarm $6.95, Fire Alarm $6.95, Intercom $3.95, Audio Power Amplifier $4.95, Metronome $3.95, Tremolo $8.95, Light Flasher $3.95, Electronic "Mystifier" $4.95, Photo Cell Nite Lite $4.95, Power Supply $7.95, Code Oscillator $2.50, «6 FM Wireless Mike $9.95, AM Wireless Mike $9.95, Electronic VOX $7.95, FM Radio $9.95, - AM Radio $7.95, Electronic Bongos $7.95. -

2016-07 Cgcc Fall2016news Web.Pdf

ECRWSS Non-Profit Org. CREDIT AND NONCREDIT CLASSES // FALL CLASS SCHEDULES // 2016 U.S. Postage PAID Columbia-Greene 4400 Route 23 Community College Hudson, New York 12534 (518) 828-4181 www.mycommunitycollege.com Columbia TTY: (518) 828-1399 Greene POSTAL CUSTOMER Community College NEWS & CLASS SCHEDULE Our mailing lists come from several sources. If you receive more than one of these announcements, please pass the extra copy on to a friend or family member. To correct your name or address on our list, send the entire address panel and mailing label to: Evening Division, COLUMBIA-GREENE COMMUNITY COLLEGE, 4400 Route 23, Hudson, NY 12534 INSIDE College News P1-15 50th Anniversary Gemini Series P8-9 Credit Course Listing P16-23 REGISTER NOW Credit Registration Info for Fall Credit Classes P1 & 24 3rd Annual Noncredit Courses Join the Year-Long Celebration P25-34 Scholars Ball ALSO INSIDE: P1 Noncredit Calendar of Events P9 Online Classes P5 Registration Info Founding a Dream P3 P4 & 5 P35 New Program Options See pages 1 and 24 for information. Online Business Degree P1 Noncredit Program P4 2016 NEWS NEWS P1-15 CREDIT CLASSES P16-24 FALL NONCREDIT CLASSES & CLASS SCHEDULE P25-35 COLUMBIA-GREENE COMMUNITY COLLEGE CREDIT AND NONCREDIT CLASSES Invest in Futures in Our Community The Columbia-Greene Community Foundation 3rd Annual Scholars Ball And 50th Anniversary Celebration Saturday, September 10 A reproduction of the college's latest billboard. Save the Date! Once again, join special friends, enjoy great food and dance into the late summer evening to live music on the beautiful campus of Columbia-Greene C-GCC President: ‘Be Part of Community College. -

JANUARY 2021 COMPLIMENTARY GUIDE Catskillregionguide.Com

Catskill Mountain Region JANUARY 2021 COMPLIMENTARY GUIDE catskillregionguide.com Winter in the Mountains On and Off the Slopes January 2021 • GUIDE 1 2 • www.catskillregionguide.com January 2021 • GUIDE 3 Catskill Mountain Foundation’s Piano Performance Museum presents ACADEMY OF FORTEPIANO PERFORMANCE INTERNATIONAL ORTEPIANO Connecting fortepiano lovers from Salon Series all around the world via Zoom SALON #1: “MEET MY PIANO” FORTEPIANOS IN OUR LIVING ROOMS & MUSEUMS Saturday, January 30, 2021 @ 8 pm EST (5 pm PST, 9 am China) Hosted from the New York Catskills by AFP faculty members Maria Rose and Yi-heng Yang Informal online performances and discussions with fortepi ano students and professionals anywhere, hosted by AFP faculty and guest artists around the world. Interested in performing or presenting your own piano? Please apply to [email protected] with a brief bio and description of the music and piano to be presented. FREE! REGISTER AT www.catskillmtn.org MORE INFORMATION: www.catskillmtn.org This event is made possible in part through the support of the Jarvis and Constance Doctorow Family Foundation, www.academyfortepiano.org Greene 4County • www.catskillregionguide.com Council on the Arts, d/b/a/ CREATE, and Stewarts Shops. IN THIS www.catskillregionguide.com VOLUME 36, NUMBER 1 January 2021 ISSUE PUBLISHERS Peter Finn, Chairman, Catskill Mountain Foundation Sarah Finn, President, Catskill Mountain Foundation On the cover: Winter is in full swing in the Catskill Mountains! To see everything the region has to offer, -

Capital District

NY STATE EAS MONITORING ASSIGNMENTS - REGION 13 - CAPITAL DISTRICT Region 13 - Capital District Counties of: Albany, Columbia, Fulton, Greene, Montgomery, Rensselaer, Saratoga, Schenectady, Schoharie, Warren, Washington Callsign Frequency City of License Monitor 1 Monitor 2 SR/LP1/BS WROW 590 kHz. Albany WAMCFM WGY PP SR/LP1/BS WGY 810 kHz. Schenectady WFLY WAMCFM PP SR/LP1 WAMCFM 90.3 mHz. Albany WGY WPDH SR/LP1 WYJB 95.5 mHz. Albany WAMCFM WGY SR/LP1 WCKMFM 98.5 mHz. Lake George WFFGFM WYJB SR/LP1 WRGB 6 Schenectady WGY WYJB SR/LP1 WFLY 92.3 mHz. Troy WAMCFM WGY LP1 WFFGFM 107.1mHz Corinth WCKMFM WYJB LP1 WCQL 95.9 mHz. Glens Falls WFFGFM WYJB LP1 WWSC 1450 kHz. Glens Falls WFFGFM WYJB LP1 WIZR 930 kHz. Johnstown WRVE WAMCFM LP1 WRVE 99.5 mHz. Schenectady WFLY WAMCFM LP2 WBUGFM 101.1 mHz. Fort Plain WGY WLZW PN WAJZ 96.3 mHz. Voorheesville WAMCFM WGY PN WABY 1160 kHz. Mechanicville WGY WYJB PN WAMC 1400 kHz. Albany WGY WPDH PN WAMQ 105.1 mHz. Great Barrington, WYJB WFLY PN WBARFM 94.7 mHz. Lake Luzerne WGY WYJB PN WBLNLP 104.9 MHz Glens Falls WCKMFM WFFGFM PN WCAN 93.3 mHz. Canajoharie WAMCFM WFLY PN WCDB 90.9 mHz. Albany WGY WROW PN WCKL 560 kHz. Catskill WAMCFMWRVE PN WCSQLP 105.9 MHz Cobleskill WAMCFM WYJB PN WCSS 1490 kHz. -

Who Pays Soundexchange: Q3 2018

Payments received through 9/30/2018 Who Pays SoundExchange: Q3 2018 Entity Name License Type 101 Smooth Jazz Webcasting 102.7 FM KPGZ-lp Webcasting 3ABNRADIO (Christian Music) Webcasting 3Abnradio (Religious) Webcasting 999HANKFM - WANK Webcasting A-1 Communications Webcasting ABERCROMBIE.COM Webcasting Abundant Radio Webcasting ACAVILLE.COM Webcasting ACCURADIO.COM Webcasting ACRN.COM Webcasting Ad Astra Radio Webcasting AD VENTURE MARKETING DBA TOWN TALK RADIO Webcasting Adams Radio Group Webcasting ADDICTEDTORADIO.COM Webcasting Adoration Webcasting AGM Bakersfield Webcasting Agm California - San Luis Obispo Webcasting AGM Nevada, LLC Webcasting Agm Santa Maria, L.P. Webcasting Aibonz Webcasting AIR1.COM Webcasting AIR1.COM (Christmas) Webcasting Airlessradio - Green Machine Webcasting Airlessradio - Mind And Body Bath Webcasting Airlessradio - Piano Bar Webcasting Airlessradio - Smooth Grooves Webcasting Airlessradio - Snazzy Jazzy Webcasting Airlessradio - Strumtastic Webcasting Airlessradio - The Word Webcasting AJG Corporation Webcasting ALLWORSHIP.COM Webcasting ALLWORSHIP.COM (CONTEMPORARY) Webcasting ALLWORSHIP.COM (INSTRUMENTAL) Webcasting ALLWORSHIP.COM (SPANISH) Webcasting Aloha Station Trust Webcasting Alpha Media - Alaska Webcasting Alpha Media - Amarillo Webcasting Alpha Media - Aurora Webcasting Alpha Media - Austin-Albert Lea Webcasting Alpha Media - Bakersfield Webcasting Alpha Media - Biloxi - Gulfport, MS Webcasting Alpha Media - Bluefield, WV Webcasting Alpha Media - Brookings Webcasting Alpha Media - Cameron - Bethany