Property Barometer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cape Town's Film Permit Guide

Location Filming In Cape Town a film permit guide THIS CITY WORKS FOR YOU MESSAGE FROM THE MAYOR We are exceptionally proud of this, the 1st edition of The Film Permit Guide. This book provides information to filmmakers on film permitting and filming, and also acts as an information source for communities impacted by film activities in Cape Town and the Western Cape and will supply our local and international visitors and filmmakers with vital guidelines on the film industry. Cape Town’s film industry is a perfect reflection of the South African success story. We have matured into a world class, globally competitive film environment. With its rich diversity of landscapes and architecture, sublime weather conditions, world-class crews and production houses, not to mention a very hospitable exchange rate, we give you the best of, well, all worlds. ALDERMAN NOMAINDIA MFEKETO Executive Mayor City of Cape Town MESSAGE FROM ALDERMAN SITONGA The City of Cape Town recognises the valuable contribution of filming to the economic and cultural environment of Cape Town. I am therefore, upbeat about the introduction of this Film Permit Guide and the manner in which it is presented. This guide will be a vitally important communication tool to continue the positive relationship between the film industry, the community and the City of Cape Town. Through this guide, I am looking forward to seeing the strengthening of our thriving relationship with all roleplayers in the industry. ALDERMAN CLIFFORD SITONGA Mayoral Committee Member for Economic, Social Development and Tourism City of Cape Town CONTENTS C. Page 1. -

South Africa, It Is Often Said, Is a World in One Said, Is a World It Is Often Africa, South Description Is This in No Other Arena Country

norway_sk 14/5/07 14:37 Page 452 452 south africa OBSERVATIONS FOR FILMMMAKERS www www. South Africa, it is often said, is a world in one . country. In no other arena is this description thelocationguide thelocationguide more apt than in the production of international commercials and films. Although in recent years, the enchanting Cape .com .com Town has become the centre of the international production industry, the city is also the perfect launch pad to a variety of exotic locations in Southern Africa and the Indian Ocean Islands, many of which enjoy an equable annual climate. Other areas of location production such as Gauteng and KwaZulu Natal offer wonderfully contrasting landscapes and have recently become quite an attraction for international commercial and film production. The high production values and developed film FILM COMMISSION, FILM BOARD or infrastructure on which Cape Town and the GOVERNMENT FILM LIAISON OFFICE Western Cape has built its reputation are National Film & Video Foundation complemented by spectacular locations, sunny Contact: Jackie Motsepe, Head of Marketing weather (in the Northern Hemisphere’s winter) & Public Affairs and 14-hour days of radiant light. E: [email protected] T: (27 11) 483 0880 W: www.nfvf.co.za The latest in equipment, post production and facilities are all available in South Africa, centred REGIONAL FILM OFFICES mainly around Cape Town and Gauteng Film Commission Gauteng. Its crews are Contact: Puisano Phatoli internationally renowned E: [email protected] for being the most cost T: (27 11) 833 0409 effective, talented and W: www.gautengfilm.org.za hard working English speaking crew Durban Film Office (Kwazulu Natal) available anywhere Contact: Toni Monti in the world. -

University of Cape Town

Town The copyright of this thesis rests with the University of Cape Town. No quotation from it or information derivedCape from it is to be published without full acknowledgement of theof source. The thesis is to be used for private study or non-commercial research purposes only. University An investigation into the geographical trends in the sectoral composition of the Cape Town economy By Netshikulwe Azwihangwisi NTSAZW002 Supervisor Professor Owen Crankshaw Town A minor dissertation submitted in partial fulfilment of the requirements for the degree of MastersCape of Social Science in Sociology in the DepartmentOf of Sociology Faculty of the Humanities University University of Cape Town March 2010 Plagiarism Declaration This work has not been previously submitted in whole, or part, for the award of any degree. It is my own work. Each significant contribution to, and quotes from people has been attributed, and has been cited and referenced. Signature Azwihangwisi Netshikulwe September 2009 Town Cape Of University I Acknowledgements I would like to acknowledge the financial contributions made by the following institutions towards my study: the National Research Foundation (NRF), the Harry Crossley Foundation, the KW Johnstone Research Scholarship and UCT Scholarship. To my supervisor, Professor Owen Crankshaw, your indefinite support and guidance have been a major determinant in my completing this degree. Thank you for assisting me throughout this journey and particularly in the theoretical component and for continuously providing me with data relevant to my study. Your support in my study has been immense and incalculable. I would also like to thank the City of Cape Town staff who provided me with the necessary data to conduct my research. -

Measuring the Effects of Political Reservations Thinking About Measurement and Outcomes

J-PAL Executive Education Course in Evaluating Social Programmes Course Material University of Cape Town 23 – 27 January 2012 J-PAL Executive Education Course in Evaluating Social Programmes Table of Contents Programme ................................................................................................................................ 3 Maps and Directions .................................................................................................................. 5 Course Objectives....................................................................................................................... 7 J-PAL Lecturers ......................................................................................................................... 9 List of Participants .................................................................................................................... 11 Group Assignment .................................................................................................................. 12 Case Studies ............................................................................................................................. 13 Case Study 2: Learn to Read Evaluations ............................................................................... 18 Case Study 3: Extra Teacher Program .................................................................................... 27 Case Study 4: Deworming in Kenya ....................................................................................... 31 Exercises -

Sunsquare City Bowl Fact Sheet 8.Indd

Opens September 2017 Lobby Group and conference fact sheet Standard room A city hotel for the new generation With so much to do and see in Cape Town, you need to stay somewhere central. Situated on the corner of Buitengracht and Strand Street, the bustling location of SunSquare Cape Town City Bowl inspires visitors to explore the hip surroundings and get to know the city. The bedrooms The hotel’s 202 rooms are divided into spacious standard rooms with queen The Deck Bar size beds, twin rooms each with 2 double beds, 5 executive rooms, 2 suites and 2 wheelchair accessible rooms. Local attractions Hotel services Long Street - 200 m • Rooftop pool with panoramic views of the V&A Waterfront and Signal Hill CTICC - 1 km • Fitness centre on the top fl oor with views of Table Mountain Artscape Theatre - 1 km • 500 MB free high-speed WiFi per room, per day V&A Waterfront - 2 km • Rewards cardholders get 2GB free WiFi per room, per day Cape Town Stadium - 2 km Two Oceans Aquarium - 2 km Table Mountain Cable Way - 5 km Other facilities • Vigour & Verve restaurant • Transfer services • Rooftop Deck Bar and Lounge • Shuttle service (on request) Contact us • Secure basement parking • Car rental 23 Buitengracht Street, • Airport handling service • Dry cleaning Cape Town City Centre, 8000 Telephone: +27 21 492 0404 Meeting spaces Email: capetown.reservations@ 5 conference rooms in total catering for up to 140 delegates. The venues can be tsogosun.com confi gured to host a range of occasions like intimate boardroom meetings, cocktail GPS Coordinates: -33.919122 S / 18.419020 E functions, workshops, seminars, training sessions, conferences as well as product launches. -

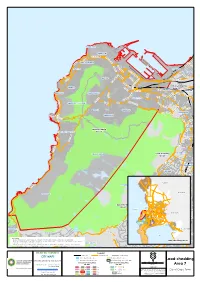

Load-Shedding Area 7

MOUILLE POINT GREEN POINT H N ELEN SUZMA H EL EN IN A SU M Z M A H N C THREE ANCHOR BAY E S A N E E I C B R TIO H A N S E M O L E M N E S SEA POINT R U S Z FORESHORE E M N T A N EL SO N PAARDEN EILAND M PA A A B N R N R D D S T I E E U H E LA N D R B H AN F C EE EIL A K ER T BO-KAAP R T D EN G ZO R G N G A KLERK E E N FW DE R IT R U A B S B TR A N N A D IA T ST S R I AN Load-shedding D D R FRESNAYE A H R EKKER L C Area 15 TR IN A OR G LBERT WOODSTOCK VO SIR LOWRY SALT RIVER O T R A N R LB BANTRY BAY A E TAMBOERSKLOOF E R A E T L V D N I R V R N I U M N CT LT AL A O R G E R A TA T E I E A S H E S ARL K S A R M E LIE DISTRICT SIX N IL F E V V O D I C O T L C N K A MIL PHILIP E O M L KG L SIGNAL HILL / LIONS HEAD P O SO R SAN I A A N M A ND G EL N ON A I ILT N N M TIO W STA O GARDENS VREDEHOEK R B PHILI P KGOSA OBSERVATORY NA F P O H CLIFTON O ORANJEZICHT IL L IP K K SANA R K LO GO E O SE F T W T L O E S L R ER S TL SET MOWBRAY ES D Load-shedding O RH CAMPS BAY / BAKOVEN Area 7 Y A ROSEBANK B L I S N WOO K P LSACK M A C S E D O RH A I R O T C I V RONDEBOSCH TABLE MOUNTAIN Load-shedding Area 5 KLIP PER N IO N S U D N A L RONDEBOSCH W E N D N U O R M G NEWLANDS IL L P M M A A A C R I Y N M L PA A R A P AD TE IS O E R P R I F 14 Swartland RIA O WYNBERG NU T C S I E V D CLAREMONT O H R D WOO BOW Drakenstein E OUDEKRAAL 14 D IN B U R G BISHOPSCOURT H RH T OD E ES N N A N Load-shedding 6 T KENILWORTH Area 11 Table Bay Atlantic 2 13 10 T Ocean R 1 O V 15 A Stellenbosch 7 9 T O 12 L 5 22 A WETTO W W N I 21 L 2S 3 A I A 11 M T E O R S L E N O D Hout Bay 16 4 O V 17 O A H 17 N I R N 17 A D 3 CONSTANTIA M E WYNBERG V R I S C LLANDUDNO T Theewaterskloof T E O 8 L Gordon's R CO L I N L A STA NT Bay I HOUT BAY IA H N ROCKLEY False E M H Bay P A L A I N MAI N IA Please Note: T IN N A G - Every effort has been made to ensure the accuracy of information in this map at the time of puMblication . -

Special Schools

Province District Name PrimaryDisability Postadd1 PhysAdd1 Telephone Numbers Fax Numbers Cell E_Mail No. of Learners No. of Educators Western Cape Metro South Education District Agape School For The CP CP & Physical disability P.O. Box23, Mitchells Plain, 7785 Cnr Sentinel and Yellowwood Tafelsig, Mitchells Plain 213924162 213925496 [email protected] 213 23 Western Cape Metro Central Education District Alpha School Autism Spectrum Dis order P.O Box 48, Woodstock, 7925 84 Palmerston Road Woodstock 214471213 214480405 [email protected] 64 12 Western Cape Metro East Education District Alta Du Toit School Intellectual disability Private Bag x10, Kuilsriver, 7579 Piet Fransman Street, Kuilsriver 7580 219034178 219036021 [email protected] 361 30 Western Cape Metro Central Education District Astra School For Physi Physical disability P O Box 21106, Durrheim, 7490 Palotti Road, Montana 7490 219340155 219340183 0835992523 [email protected] 321 35 Western Cape Metro North Education District # Athlone School For The Blind Visual Impairment Private BAG x1, Kasselsvlei Athlone Street Beroma, Bellville South 7533 219512234 219515118 0822953415 [email protected] 363 38 Western Cape Metro North Education District Atlantis School Of Skills MMH Private Bag X1, Dassenberg, Atlantis, 7350 Gouda Street Westfleur, Atlantis 7349 0215725022/3/4 215721538 [email protected] 227 15 Western Cape Metro Central Education District Batavia Special School MMH P.O Box 36357, Glosderry, 7702 Laurier Road Claremont 216715110 216834226 -

In the High Court of South Africa Western Cape Division, Cape Town

SAFLII Note: Certain personal/private details of parties or witnesses have been redacted from this document in compliance with the law and SAFLII Policy IN THE HIGH COURT OF SOUTH AFRICA WESTERN CAPE DIVISION, CAPE TOWN REPORTABLE CASE NO: A 276/2017 In the matter between: FREDERICK WESTERHUIS First Appellant CATHERINE WESTERHUIS Second Appellant and JAN LAMBERTUS WESTERHUIS First Respondent JAN LAMBERTUS WESTERHUIS N.O. (In his capacity as the Executor in the Estate of the late John Westerhuis) Second Respondent DERICK ALEXANDER WESTERHUIS N.O. (In his capacity as the Executor in the Estate of the late John Westerhuis) Third Respondent JAN LAMBERTUS WESTERHUIS N.O. (In his capacity as the Executor in the 2 Estate of the late Hendrikus Westerhuis) Fourth Respondent PATRICIA WESTERHUIS Fifth Respondent MARELIZE VAN DER MESCHT Sixth Respondent Coram: Erasmus, Gamble and Parker JJ. Date of Hearing: 20 April 2018. Date of Judgment: 27 June 2018. JUDGMENT DELIVERED ON WEDNESDAY 27 JUNE 2018 ____________________________________________________________________ GAMBLE, J: INTRODUCTION [1] In the aftermath of the Second World War there was a large migration of European refugees to various parts of the world, including South Africa. Amongst that number were Mr. Hendrikus Westerhuis and his wife, Trish, her sister Ms. Jannetje Haasnoot and her husband who was known as “Hug” Haasnoot. The Westerhuis and Haasnoot families first shared a communal home in the Cape Town suburb of Claremont and later moved to Vredehoek on the slopes of Devil’s Peak where they lived in adjacent houses. The Haasnoots stayed at […]3 V. Avenue and the Westerhuis’ at number […]5. -

The Great Green Outdoors

MAMRE CITY OF CAPE TOWN WORLD DESIGN CAPITAL CAPE TOWN 2014 ATLANTIS World Design Capital (WDC) is a biannual honour awarded by the International Council for Societies of Industrial Design (ICSID), to one city across the globe, to show its commitment to using design as a social, cultural and economic development tool. THE GREAT Cape Town Green Map is proud to have been included in the WDC 2014 Bid Book, 2014 SILWERSTROOMSTRAND and played host to the International ICSID judges visiting the city. 01 Design-led thinking has the potential to improve life, which is why Cape WORLD DESIGN CAPITAL GREEN OUTDOORS R27 Town’s World Design Capital 2014’s over-arching theme is ‘Live Design. Transform Life.’ Cape Town is defi nitively Green by Design. Our city is one of a few Our particular focus has become ‘Green by Design’ - projects and in the world with a national park and two World Heritage Sites products where environmental, social and cultural impacts inform (Table Mountain National Park and Robben Island) contained within design and aim to transform life. KOEBERG NATURE its boundaries. The Mother City is located in a biodiversity hot Green Map System accepted Cape Town’s RESERVE spot‚ the Cape Floristic Region, and is recognised globally for its new category and icon, created by Design extraordinarily rich and diverse fauna and fl ora. Infestation – the fi rst addition since 2008 to their internationally recognised set of icons. N www.capetowngreenmap.co.za Discover and experience Cape Town’s natural beauty and enjoy its For an overview of Cape Town’s WDC 2014 projects go to www.capetowngreenmap.co.za/ great outdoor lifestyle choices. -

Applications

APPLICATIONS PUBLICATIONS AREAS BUSINESS NAMES AUGUST 2021 02 09 16 23 30 INC Observatory, Rondebosch East, Lansdowne, Newlands, Rondebosch, Rosebank, Mowbray, Bishopscourt, Southern Suburbs Tatler Claremont, Sybrand Park, Kenilworth, Pinelands, Kenwyn, BP Rosemead / PnP Express Rosemead Grocer's Wine 26 Salt River, Woodstock, University Estate, Walmer Estate, Fernwood, Harfield, Black River Park Hazendal, Kewtown, Bridgetown, Silvertown, Rylands, Newfields, Gatesville, Primrose Park, Surrey Estate, Heideveld, Athlone News Shoprite Liquorshop Vangate 25 Pinati, Athlone, Bonteheuwel, Lansdowne, Crawford, Sherwood Park, Bokmakierie, Manenberg, Hanover Park, Vanguard Deloitte Cape Town Bantry Bay, Camps Bay, Clifton, De Waterkant, Gardens, Green Point, Mouille Point, Oranjezicht, Schotsche Kloof, Cape Town Wine & Spirits Emporium Atlantic Sun 26 Sea Point, Tamboerskloof, Three Anchor Bay, Vredehoek, V & A Marina Accommodation Devilspeak, Zonnebloem, Fresnaye, Bakoven Truman and Orange Bergvliet, Diep River, Tokai, Meadowridge, Frogmore Estate, Southfield, Flintdale Estate, Plumstead, Constantia, Wynberg, Kirstenhof, Westlake, Steenberg Golf Estate, Constantia Village, Checkers Liquorshop Westlake Constantiaberg Bulletin 26 Silverhurst, Nova Constantia, Dreyersdal, Tussendal, John Collins Wines Kreupelbosch, Walloon Estate, Retreat, Orchard Village, Golf Links Estate Blouberg, Table View, Milnerton, Edgemead, Bothasig, Tygerhof, Sanddrift, Richwood, Blouberg Strand, Milnerton Ridge, Summer Greens, Melkbosstrand, Flamingo Vlei, TableTalk Duynefontein, -

2011 Census Suburb Woodstock July 2013

City of Cape Town – 2011 Census Suburb Woodstock July 2013 Compiled by Strategic Development Information and GIS Department (SDI&GIS), City of Cape Town 2011 Census data supplied by Statistics South Africa (Based on information available at the time of compilation as released by Statistics South Africa) The 2011 Census suburbs (190) have been created by SDI&GIS grouping the 2011 Census sub-places using GIS and December 2011 aerial photography. A sub-place is defined by Statistics South Africa “is the second (lowest) level of the place name category, namely a suburb, section or zone of an (apartheid) township, smallholdings, village, sub- village, ward or informal settlement.” Suburb Overview, Demographic Profile, Economic Profile, Dwelling Profile, Household Services Profile 2011 Census Suburb Description 2011 Census suburb Woodstock includes the following sub-places: University Estate, Walmer Estate, Woodstock. 1 Data Notes: The following databases from Statistics South Africa (SSA) software were used to extract the data for the profiles: Demographic Profile – Descriptive and Education databases Economic Profile – Labour Force and Head of Household databases Dwelling Profile – Dwellings database Household Services Profile – Household Services database In some Census suburbs there may be no data for households, or a very low number, as the Census suburb has population mainly living in collective living quarters (e.g. hotels, hostels, students’ residences, hospitals, prisons and other institutions) or is an industrial or commercial area. In these instances the number of households is not applicable. All tables have the data included, even if at times they are “0”, for completeness. The tables relating to population, age and labour force indicators would include the population living in these collective living quarters. -

PENINSULA MAP Visitor Information Centres Police Station WITSAND

MAMRE PELLA ATLANTIS Cape Town Tourism PENINSULA MAP Visitor Information Centres Police Station WITSAND R27 Transport Information Centre 0800 656 463 CAPE TOWN TOURISM SERVICES GENERAL TRAVEL INFORMATION: Champagne All you need to know about Cape Town P hila W d el Adam Tas e ph and travelling within the City. s i t a C Wellington o R302 a PHILADELPHIA s R304 t k KOEBERG M c RESERVATIONS: e You can do all your bookings via Cape Town Tourism a e l b m e i e R s Visitor Information Centres, online and via our Call Centre. b u an r V y n y a r J u Silwerstroom b SANPARKS BOOKINGS/SERVICES: s R304 Reservations, Activity Cards, Green e Main Beach lm a Cards & Permits at designated Visitor Information Centres. M ld DUYNEFONTEIN O R45 COMPUTICKET BOOKINGS: Book your Theatre, Events or Music Shows R312 at designated Visitor Information Centres. M19 Melkbosstrand N7 MELKBOSSTRAND R44 WEBTICKETS ONLINE BOOKINGS: Langenh Robben Island Trips, Kirstenbosch oven Concerts, Table Mountain Cable Car Trip at all Cape Town Tourism R304 PAARL M14 Visitor Information Centres. Suid Agter Paarl R302 R27 M58 CITY SIGHTSEEING HOP ON HOP OFF BUS TICKETS: Purchase your tickets Main West Coast at designated Visitor Information Centres. Otto Du Plessis l BLAAUWBERG e Lichtenberg w u e h p li Visse Adderley MYCITI BUS ROUTE SERVICE: Purchase and load your MyConnect Card rshok K N1 Big Bay BLOUBERGSTRAND at Cape Town International Airport and City Centre. Big Bay i le v West Coast M48 s on Marine m PARKLANDS Si m ROBBEN ISLAND a Wellington d ts o R302 KLAPMUTS TABLE