Advanced Logistics Systems Integration 888.725.3046 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

John Bean Technologies Corporation (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2016 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number: 1-34036 John Bean Technologies Corporation (Exact name of registrant as specified in its charter) Delaware 91-1650317 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification Number) 70 West Madison Street Chicago, IL 60602 (Address of principal executive offices) (312) 861-5900 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Exchange on Which Registered Common Stock, $0.01 par value New York Stock Exchange Preferred Share Purchase Rights New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Company Profile PT Jaya Teknik Indonesia View Compressed.Pdf

JAYA TEKNIK Quality and Reliability GOGREEN REFACE Associate with GE ission Enhanced Bioremediation p Associate with BioCleaner M Associate with Safegate tAtEmEnt Associate with Axa Power PT Jaya Teknik Indonesia has been in the contracting field, 2015 S doing the trading and services of the Mechanical, Electrical, Electronic (MEE) and Information Technology (IT) business for more than 45 years. Associate with Authorized distributor Mitsubishi Electric 2014 Flygt Pump The company has gone through some difficult situations during the oil, economic and financial crisis in 1976, 1997, 2007 and 2015. The good foundation of the company Associate with Gallagher 2013 coupled with a good team work between the management Associate with Synectics and employees have helped the company to work through the challenging condition. Authorized distributor Associate with AXIS 2012 SANEI Elevator & The company is growing stronger and more innovative to Escalator achieve the highest competence and performance to meet the growing expectation of our customers. Continual assessment Authorized distributor is performed to ensure that our engineers are updated and Associate with 2011 Rapiscan teltronic trained on the newest technology. PT Jaya Teknik Indonesia commit to deliver “Quality and Authorized distributor ” to our customers. 2010 Reliability Vanderlande Associate with 2009 Authorized distributor Microsoft Dynamic CRM VoiceCyber Subsidiary PT Jaya konstruksi MP 2007 The company Logo of Former logo of transformed into PT Teknik Indonesia PT Jaya Teknik Indonesia -

Download 2020 Annual Report Based on IFRS

Annual Report 2020 ’ASML ANNUAL2 REPORT 2020 01 Contents 2020 at a glance Leadership and governance 5 Interview with our CEO 106 Corporate governance 7 2020 Highlights 119 Message from the Chair of our Supervisory Board 8 Business as (un)usual 120 Supervisory Board report 135 Remuneration report Who we are and what we do 10 Our company 147 Directors’ Responsibility Statement 14 Our products and services 17 Our markets Consolidated Financial Statements 18 Semiconductor industry trends and opportunities 150 Consolidated Statement of Profit or Loss 22 How we create value 151 Consolidated Statement of Comprehensive Income 24 Our strategy 152 Consolidated Statement of Financial Position 153 Consolidated Statement of Changes in Equity What we achieved in 2020 154 Consolidated Statement of Cash Flows 27 Technology and innovation ecosystem 155 Notes to the Consolidated Financial Statements 39 Our people 53 Our supply chain Company Financial Statements 59 Circular economy 209 Company Balance Sheet 65 Climate and energy 210 Company Statement of Profit or Loss 211 Notes to the Company Financial Statements CFO financial review 74 Financial performance Other Information 81 Financing policy 217 Adoption of Financial Statements 83 Tax policy 218 Independent auditor’s report 85 Long-term growth opportunities Non-financial statements How we manage risk 225 Assurance Report of the Independent Auditor 87 How we manage risk 227 About the non-financial information 92 Risk factors 229 Non-financial indicators 100 Responsible business 244 Materiality: assessing our impact 247 Stakeholder engagement 250 Other appendices 253 Definitions A definition or explanation of abbreviations, technical terms and other terms used throughout this Annual Report can be found in the chapter Definitions. -

Sustainability Report FY2018 Vanderlande Industries Holding B.V

Sustainability Report FY2018 Vanderlande Industries Holding B.V. Financial Year 2018 MOVING YOUR BUSINESS FORWARD Contents About this report 3 Highlights 4 Foreword from the CEO 5 Company profile 6 Core and brand values 7 Company locations 8 Sustainable ambition 10 Stakeholder inclusiveness 12 Materiality assessment 13 Health and safety at work 15 Design safety and ergonomics 18 Employee development and training 20 Employee engagement 22 Energy use (products and systems) 26 Sustainable product design 28 Responsible sourcing 30 Circular solutions 32 Corporate governance 35 GRI content index 38 2 About this report This report addresses the sustainability approach, position Vanderlande is not obligated by legislation to report on and performance of Vanderlande Industries Holding B.V., a sustainability. However, the company believes in transparency fully owned subsidiary of Toyota Industries Corporation (TICO). and has chosen to voluntarily publish this Sustainability It has been prepared in accordance with the GRI standard: Report. For this reason, it has not been externally assured. core option. Vanderlande acts in a practical way to apply the precautionary This is Vanderlande’s first report in accordance with the GRI principle in its approach while maintaining its competitive standards. For this reason, it should be as a new baseline and position in the market. The company takes account of scientific not compared with the previous report in respect to material evidence and global trends to reduce carbon emissions and to topics and their respective boundaries. act responsibly. All data refers to Vanderlande’s financial year 2018 (1 January For more information on Vanderlande and its reports, please 2017 to 31 March 2018) and represents every employee refer to www.vanderlande.com. -

Electronic Transmission Disclaimer

ELECTRONIC TRANSMISSION DISCLAIMER IMPORTANT: You must read the following disclaimer before continuing. The disclaimer applies to the document (including the documents incorporated by reference therein) following this disclaimer (the ‘‘Document’’) and you are advised to read this disclaimer carefully before reading, accessing or making any other use of the Document. In accessing this electronic transmission and the Document, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from Sif Holding N.V. (the ‘‘Company’’), ABN AMRO Bank N.V., HSBC Bank plc, ING Bank N.V. or Coo¨peratieve Rabobank U.A (together, the ‘‘Underwriters’’) as a result of such access. You acknowledge that the delivery of this electronic transmission and the Document is confidential and intended for you only and you agree you will not forward, reproduce or publish this electronic transmission or the Document to any other person. IF YOU ARE NOT THE INTENDED RECIPIENT OF THIS ELECTRONIC TRANSMISSION AND THE DOCUMENT, DO NOT DISTRIBUTE OR COPY THE INFORMATION CONTAINED IN THIS ELECTRONIC TRANSMISSION AND THE DOCUMENT AND DELETE AND DESTROY ALL COPIES OF THIS ELECTRONIC TRANSMISSION AND THE DOCUMENT. IF YOU ARE IN ANY DOUBT AS TO WHAT ACTION YOU SHOULD TAKE, YOU ARE RECOMMENDED TO SEEK YOUR OWN PERSONAL FINANCIAL ADVICE IMMEDIATELY FROM YOUR STOCKBROKER, BANK MANAGER, SOLICITOR, ACCOUNTANT, FUND MANAGER OR OTHER APPROPRIATELY AUTHORISED INDEPENDENT FINANCIAL ADVISER. NOTHING IN THIS ELECTRONIC TRANSMISSION AND THE DOCUMENT CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. -

NAG Segmentbijeenkomsten Introductie Vanderlande

Cover slide NAG segmentbijeenkomsten Introductie Vanderlande Mark Lakerveld Director Strategy & Markets Airports 13 February 2020 Text (Only) About Vanderlande: Company profile 2 13 February 2020 NAG Segmentbijeenkomsten Text (Only) About Vanderlande: History Sustainable profitable growth with attractive outlook 2.500 Services, partnership and major customers Currently one of the most important suppliers of automated material handling systems in the world: > More than 6,500 employees 2.000 > Present in more than 105 countries > Executing over 260 projects at the same time 1.500 Engineering and integrator Europe > IT Revenue (€m) Revenue > Project management 1.000 Systems (equipment and engineering) > Supply chain Europe > Focus on material handling in EU > Offices in FR, BE, ES, DE and EN (1964-77) 500 Machinery and construction company The Netherlands > Founded 1949 0 1950 1975 1980 1985 1990 1995 2000 2005 2010 2015 2021 3 13 February 2020 NAG Segmentbijeenkomsten Text (Only) About Vanderlande: Core business Industry segments Geographic market ➔ Airports (global market leader) ➔ Worldwide ➔ Warehousing (leading supplier) ➔ Focus on developed countries, ➔ Parcel (global market leader) spin-off to developing countries Logistic process automation ➔ Innovative systems ➔ Intelligent software ➔ Life-cycle services Innovative systems Intelligent software Life-cycle services ➔ System and process scope ➔ Complete and modular ➔ Asset services ➔ Entire material handling systems ➔ Low-level and high-level controls ➔ Logistic services ➔ Process -

Annual Report 2018 Sif Holding N.V

Annual Report 2018 Sif Holding N.V. Sif Annual Report 2018 Key figures 2014 – 2018 X € 1,000 2018 2017 2016 2015 2014 Definition of non-IFRS measures Revenue 235,140 327,180 400,318 321,343 262,523 Contribution 74,336 135,634 129,480 100,536 83,594 Total revenue minus cost of raw materials, subcontracted work and other external charges and logistic and other project related expenses EBITDA 12,550 54,592 58,616 55,252 45,741 Earnings before net finance costs, tax, depreciation and amortization Normalized EBITDA 13,258 57,118 65,395 57,815 46,238 EBITDA corrected for incidental IPO related expenses or income Net earnings -2,051 30,760 37,365 35,628 27,995 Profit attributable to the shareholders Net cash from operating activities 5,548 53,886 52,887 25,421 33,570 Net increase/(decrease) in cash -372 573 -28,429 3,740 -10,954 and cash equivalents Net cash from investing activities -3.218 -27.587 -67.962 -16.421 -39.523 Depreciation and amortization 13,682 13,153 8,684 6,986 7,391 Net debt 30,377 25,107 41,969 26,894 11,434 Gross debt (loans and borrowings) minus cash and cash equivalents IN KTON Production 138 232 191 150 133 PER SHARE X € Earnings -0.08 1.21 1.47 1.40 1.10 Profit attributable to the shareholders divided by the average number of shares outstanding during the year under review Dividend* 0.10 0.30 0.37 0.94 1.28 RATIOS % ROCE -1.0 25.8 32.7 39.5 30.5 Earnings before Interest & Tax as a % of equity plus loans and borrowings Solvency 43.6 45.6 34.8 16.2 43.6 Equity/balance sheet total COVENANT RATIO’S Net debt/normalized EBITDA 2.33 0.4 0.7 0.5 0.2 Cash flow cover 3.02 29.4 3 10.3 4.2 Number of shares issued 25,501,356 25,501,356 25,501,356 25,501,356 25,501,356 Contribution is an important KPI since it excludes pass-through expenses. -

Productizing Material Handling Solutions Flexibility from a System Integrator Perspective

COVER SLIDE Productizing Material Handling Solutions Flexibility from a System Integrator perspective 06/05/2021 Remko van der Zee Director Systems Integration Vanderlande TEXT + IMAGE (M) Introduction › Remko van der Zee › Vanderlande since Nov 2004 › Director Systems Integration (since 2018) Responsible for corporate strategy on systems integration. System Integration in Vanderlande covers the design and delivery of customer solutions by executing projects in the Warehousing and Airports domain. 2 06/05/2021 TABLE OF CONTENTS Outline › Introduction › Vanderlande › Material Handling Solutions › Products as part of Solutions › Considerations and learnings 3 06/05/2021 IMAGE ONLY TEXT About Vanderlande: Company profile 5 06/05/2021 TEXT About Vanderlande: Roots in Veghel, The Netherlands 6 06/05/2021 TEXT About Vanderlande: Local and global presence UK NL (HQ) Norway Canada Russia South Korea Poland USA China Germany Mexico Switzerland Bulgaria Malaysia Colombia Romania India Italy United Arab Emirates Singapore Brazil Oman Australia Spain France Saudi Arabia Chile Argentina Customer centres and offices Software houses > Delivered in more than 100 countries Manufacturing sites > Located in 28 countries 7 06/05/2021 CHART About Vanderlande: Revenue FY2020 25% 30% 11% Airports Warehousing Parcel 34% Life-cycle services 8 06/05/2021 CHART About Vanderlande: Core business Industry segments Focus areas ➔ Airports (global market leader) Baggage, Passenger ➔ Warehousing (leading supplier) Food, General Merchandise, Fashion ➔ Parcel (global market -

Robotics, Automation, and AI: [email protected]

Equity Research Global Industrial Infrastructure | Multi-industry March 6, 2020 Industry Report Nicholas Heymann +1 212 237 2740 [email protected] Ross Sparenblek, CFA +1 212 237 2752 Robotics, Automation, and AI: [email protected] Explosion of New Markets Across Tanner James +1 212 237 2748 Broad Segments of the Economy [email protected] Please refer to important disclosures on pages 81 and 82. Analyst certification is on page 81. William Blair or an affiliate does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. This report is not intended to provide personal investment advice. The opinions and recommendations here- in do not take into account individual client circumstances, objectives, or needs and are not intended as recommen- dations of particular securities, financial instruments, or strategies to particular clients. The recipient of this report must make its own independent decisions regarding any securities or financial instruments mentioned herein. William Blair Contents Investment Overview .........................................................................................................3 Risks ................................................................................................................................10 Defining RAAI Applications and Their Commercialization ............................................12 Rise of RAAI Applications -

Vanderlande Warehousing Platform “New Paradigm Ahead”

Cover slide Vanderlande Warehousing Platform “new paradigm ahead” 07 June 2018 Bruno van wijngaarden| ‘s Hertogenbosch Dutch system Architecting Conference Table of contents - White logo Contents > Introduction Vanderlande > “New Paradigm ahead” > The current paradigm > The new paradigm > The challenge > The approach 2 07 June 2018 Dutch System Architecting Conference Text (Only) 3 07 June 2018 Dutch System Architecting Conference Text (Only) About Vanderlande: Company profile 4 07 June 2018 Dutch System Architecting Conference Text (Only) About Vanderlande: Local and global presence UK NL (HQ) Norway Canada South Korea Poland USA China Germany Mexico Hong Kong Switzerland Bulgaria Romania India Italy Colombia United Arab Emirates Brazil Oman Australia Spain France Saudi Arabia Chile Argentina Customer centres and offices Software houses > Delivered in 105 countries Manufacturing sites > Located in 29 countries 5 07 June 2018 Dutch System Architecting Conference Table of contents - White logo 6 07 June 2018 Dutch System Architecting Conference Table of contents - White logo Contents > Introduction Vanderlande > “New Paradigm ahead” > The current paradigm > The new paradigm > The challenge > The approach 7 07 June 2018 Dutch System Architecting Conference Text (Only) Project engineering: system stack Material handling equipment 1949 8 07 June 2018 Dutch System Architecting Conference Text (Only) Project engineering: system stack Machine control (PLC) Sensors and actuators Material handling equipment 1963 9 07 June 2018 Dutch System Architecting Conference Text (Only) Project engineering: system stack System Process control (WMS/WCS) GBam it GmbH R Material Flow Control (MFC) Machine control (PLC) Sensors and actuators 1997 Material handling equipment 10 07TNO/ESI June 2018 Symposium 2017 Dutch System Architecting Conference Text (Only) Project Engineering Integration…. -

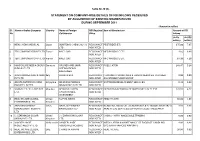

STATEMENT on COMPANY-WISE DETAILS of FDI INFLOWS RECEIEVED by ACQUISITION of EXISTING SHARES ROUTE DURING SEPTEMBER 2011 (Amount in Million) Sl

Table No.18 (b). STATEMENT ON COMPANY-WISE DETAILS OF FDI INFLOWS RECEIEVED BY ACQUISITION OF EXISTING SHARES ROUTE DURING SEPTEMBER 2011 (Amount in million) Sl. Name of Indian Company Country Name of Foreign RBI Regional Item of Manufacture Amount of FDI No Collaborator Office Inflows (In Rs (In US$ million) million) 1 NEW CHEMI CHEMICAL Japan SUMITOMO CHEMICAL CO REGION NOT PESTISIDES ETC 375.00 7.87 LTD INDICATED 2 TEK COMPONENTS PVT LTD France MAEC SAS REGION NOT MFG PRODUCE ETC 3.02 0.06 INDICATED 3 TEK COMPONENTS PVT LTD France MAEC SAS REGION NOT MFG PRODUCE ETC 61.30 1.29 INDICATED 4 MAXPOSURE MEDIA GROUP Germany GRUNER AND JAHR REGION NOT PUBLICATION 249.47 5.24 INDIA PVT LTD INTERNATIONAL INDICATED MAGAZINES 5 AGUSTWAWESTLAN D INDIA Italy AGUSTA SPA REGION NOT PROVIDING PROMOTIONA & LIAISON SERVICES TO OTHER 0.00 0.00 PVT LTD INDICATED AGUSTAWESTLAND GROUP 6 ARISTA NETWORKS INDIA Singapore ARISTA NETWORKS REGION NOT SOFTWARE DEVELOPMENT SERVICES 0.10 0.00 PRIVATE LIMITED SINGAPORE PVT LTD INDICATED 7 VASNA HEALTH CARE PVT Mauritius SEQUOIA CAPITAL REGION NOT OPERATING NETWORK OF SUPER SPECIALTY EYE 225.00 4.72 LTD. GROWTH INDIA INDICATED INVESTMENT 8 HEALTHCARE GLOBAL United RUPIKA SINGH REGION NOT HEALTHCARE 50.00 1.05 ENTERPRISES LTD. Kingdom INDICATED 9 ARGA INVESTMENT U.S.A ARGA INVESTMENT REGION NOT BUSINESS, FINANCIAL, QUANTITATIVE & ECONOMIC RESEARCH 0.00 0.00 MANAGEMENT INDIA PVT MANAGEMENT LP INDICATED ANALYTICAL SERVICES SUPPORTING EQUIT RESEARCH LTD 10 C.CZARNIKOW SUGAR United C.CZARNIKOW SUGAR REGION NOT CASH & CARRY WHOLESALE TRADING 0.00 0.00 (INDIA) PVT. -

State of the Art Survey of Baggage Handling Systems Control and Automated Equipment

FACULTY MECHANICAL, MARITIME AND MATERIALS ENGINEERING Delft University of Technology Department Maritime and Transport Technology Mekelweg 2 2628 CD Delft the Netherlands Phone +31 (0)15-2782889 Fax +31 (0)15-2781397 www.mtt.tudelft.nl Specialization: Transport Engineering and Logistics Report number: 2015.TEL.7978 Title: State of the art survey of baggage handling systems control and automated equipment Author: L.L.P. van Rijen (4036670) Title (in Dutch) Voortgang en huidige stand van techniek in de automatiserings en besturingstechnologien voor baggagesystemen. Assignment: literature Confidential: no Initiator (university): dr.ir. Y. Pang Supervisor: dr.ir. Y. Pang Date: 26-01-2016 This report consists of 68 pages and 1 appendices. It may only be reproduced literally and as a whole. For commercial purposes only with written authorization of Delft University of Technology. Requests for consult are only taken into consideration under the condition that the applicant denies all legal rights on liabilities concerning the contents of the advice. FACULTY OF MECHANICAL, MARITIME AND TU Delft mKammy] t.;liVi.-,i:i(W::^|r!lüïK|i,Vi Delft University of Technology Department of Marine and Transport Teclinology Mekelweg 2 2628 CD Delft the Netherlands Phone +31 (0)15-2782889 Fax +31 (0)15-2781397 www.mtt.tudelft.nl Student: L. L. P. van Rijen Assignment type: Literature Supervisor: Y. Pang Report number: 2015.TEL.7978 Specialization: TEL Confidential: No Creditpoints (EC): 10 Subject: State of the art of automation and system control in baggage handling Modern airport baggage handling concerns improving the processes from check-in through screening until departure, arrival and claims.