PRE FEASIBILITY REPORT M/S. AARADHYA INDUSTRIES

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

B-1 B. Rajkot-Jamnagar-Vadinar

Draft Final Report B. RAJKOT- JAMNAGAR-VADINAR Revalidation Study and Overall Appraisal of the Project for Four-Laning of Selected Road Corridors in the State of Gujarat CORRIDOR B. RAJKOT-JAMNAGAR-VADINAR CORRIDOR B.3 REVIEW OF PRE-FEASIBILITY STUDIES B.3.1 Submittal Referred To 1. The study on ‘Preparation of Pre-feasibility Study and Bidding Documents for Four Laning and Strengthening of Rajkot - Jamnagar – Vadinar Road was given to two consultants. 2. The report made available on Rajkot – Jamnagar, is the Interim Report, submitted in 2001. Therefore, review of this report has been made. However in case of Jamnagar – Vadinar the report made available and reviewed was Draft Final Report. B.3.2 Traffic Studies and Forecast B.3.2.1 Base Year Traffic Volumes 3. On Jamnagar – Vadinar section, the traffic volume surveys have been conducted at 7 locations. The base year traffic volumes have been established as given in Table B.3-1. Table B.3-1: Base Year Traffic Volume on Jamnagar–Vadinar Corridor Location ADT in Vehicles ADT in PCUs Hotel Regal Palace 10612 19383 Vadinar Junction 5208 9063 Near Sikka Junction 5808 7968 Jhakar Village 1907 2725 Shree Parotha House 4426 12378 Lalpur Junction 5341 10345 Kalavad Junction 4046 10177 4. On Rajkot – Jamnagar corridor, traffic levels recorded at three locations are as given below: Average Daily Traffic Commercial Vehicles Location Chainage Vehicles PCU PCU % Dhrol Km 49.2 4616 8296 6246 75 Phalla Km 63.3 5184 9180 7016 76 Khijadia Km 78.3 8301 13870 10000 72 B.3.2.2 Projected Traffic 5. -

Various En+Oute Villages / Industries In.Condal, Ofrorali, Upleta,,J;Sla'nit

g/Land/ No. c/T l?a -77 Da16.17 office of the Deputy Conservator of Forest, Rajkot Foresi Division, Rajkot, Date'2J06/20'16 To, The Officer (RoU) Gujarat Gas Limited, grh Floor, Avdhesh House Opp. Shrl Govind Gurudwara, S.G Highway, Ahmedabad-380 054 sub r Diversion of 4 6632 Hect prorected of Forest rand r e road srde sirip pranra.on decrared as protected forest for tayina of 20115 Cm dia Steet & 9 Cm of [/DpE naturat g; irpei,n.." io srppty n"turat gas to various en+oute villages / industries in.condal, Ofrorali, Upleta,,J;sla'nit.otia sanagni, ,amtnOorna, Lodhika, Paddhari Taluka tn Rajkot Dislrict, Guja"t Stir" ii f"uou, oi6rjarJdas limiteO Refr of Gujaral, 1.g9lel1Telt Forest & Environment Department Letter No FCA /101S / 1013/15/SF-83F, Dt.04.02.2016. 2 G-ov'amment of cujarat, Forest & Environrneni Depa(menl Letter No. FcA / 1015/.1013/15/sF-83F, Dt.03.05.2016. 3. Gujarat Gas letter No. GUJARAT GAS /Ralkoucondal, Dhorajl, Upteta & Jasdan Suroundings / PF/2015 dtd 30 10 2015 Sr, I am directed to invlte a reference your to etter no GU,IAMT GAS /RajkoUGondal, Dhorajl, Upleta & Jasdan suroundings/PF/20i5 did. 30 10.2015 on lhe above mentroned subleciseeking prior approvar of the Government under section-2 of the forest (conservation) Act, r oao as p".n,inexuil-A aflached herewith. Govemment of Gurarat' Forest & Environment Depa(ment, Gandhlnagar vide its circurar mentioned under reference has powers delegated under "Generar Approvar" ro the conclrned divisionar forest officer to grant approval under forest (conservation) acl, i9B0 for laylng of underground opiical fiber cables, telephone iines, drlnking waier, electric llnes, piperine petroleum cNG/pNG and pip-e ine along the roads wthin existing right oi way not fa ling in National Parks and wid ife sanctuanes, without feiling of liees, where the maxlmum size of the lrench is noi more than 2 0O meter depth and 1.00 meter width subje;t to certain condiUons. -

Bank of Baroda

Bank of Baorda Actual disbursement of subsidy to Units will be done by banks after fulfillment of stipulated terms & conditions Date of issue 27/04/2017 vide sanction order No. 22/CLTUC/RF-14/All Banks/General/2016-17 (Amount in Rs.) Name of the unit Address Amount sanctioned Sl.No for subsidy 1 HARVI ENGINEERING R S NO 19P PLOT NO 5 NR RELIANCE TOWER PERFECT SHOWROOM GONDAL ROAD VAVDI RAJKOT 363234 2 V L ELECTRICALS 4 MAHADEVADI STATION ROAD VILLAGE GONDAL RAJKOT 666297 3 DHARTI OIL INDUSTRIES SURVEY NO 154 HIRAPAR TANKARA MORBI 225675 4 BALAJI INDUSTRIES SR NO 46/1 PLOT NO 48 NR BHAGWATI ENGINEERING B/H VICAS CORPORATION VAVDI RAJKOT 589148 5 SHREE PACKAGING PLOT NOG/828 GIDC METODA ALMIGHTY GATE KALAWAD ROAD RAJKOT 192937 6 Shreeji Agro Products bistan road, Khargone 686176 7 MARUTI PACKAGING PLOT NO 39, SURVEY NO 340P, JASDAN ROAD, B/H JALARAM TIMBER, RAJKOT 489600 8 SHK POLYMERS MANUFACTURING CO PLOT NO 139/1 OPP PATEL ALLOYS STEEL LTD PHASE1, GIDC ESTATE,VATVA,AHMEDABAD 1249171 9 JAY AMBE ENTERPRISE 131, 2ND FLOOR, MAHESHWARI INDUSTRIAL ESTATE, MAHESHWARI COMPOUND, SHAHIBAUG, AHMEDABAD 287448 10 ALPESH INDUSTRIES 9, CHANDUJI MADHAJIESTATE, MAHESHVARI MILL ROAD, TAVDIPURA, AHMEDABAD 389812 11 SANTKRUPA INDUSTRIES SANTKRUPA INDUSTRIES, BAGASARA ROAD, BORDI SAMADHIYALA, JETPUR 1500000 12 R R STEEL INDUSTRIES 1 AMARNAGAR MAIN ROAD NEAR RAJPAN MAVDI PLOT RAJKOT 360004 230343 13 CABILEX CABLES PVT LTD SURVEY NO 307 MORBI RAJKOT HIGHWAY LAJAI TANKARA MORBI 1475685 14 JAYHIND FOUNDRY NEAR JAYHIND WEIGHBRIDGE, OPP WATER TANK, ANIL STARCH MILL ROAD, NARODA ROAD 258187 15 ARROW PLAST INDUSTRIES PLOT NO 19 SURVEY NO 275P39 TIRUPATI IND PARK NR PATEL PROTEINS HADAMTALA KOTDA SANGANI 402097 16 KEYA ENGINEERING 42B JINTAN UDHYOGNAGAR SURENDRANAGAR 284006 17 Ornamac Engineering Co. -

Gujarat Council of Primary Education DPEP - SSA * Gandhinagar - Gujarat

♦ V V V V V V V V V V V V SorVQ Shiksha A b h i y O f | | «klk O f^ » «»fiaicfi ca£k ^ Annual Work Plan and V** Budget Year 2005-06 Dist. Rajkot Gujarat Council of Primary Education DPEP - SSA * Gandhinagar - Gujarat <* • > < « < ♦ < » *1* «♦» <♦ <♦ ♦♦♦ *> < ♦ *1* K* Index District - Rajkot Chapter Description Page. No. No. Chapter 1 Introduction 1 Chapter 2 Process of Plan Formulation 5 Chapter 3 District Profile 6 Chapter 4 Educational Scenario 10 Chapter 5 Progress Made so far 26 Chapter 6 Problems and Issues 31 Chapter 7 Strategies and Interventions 33 Chapter 8 Civil Works 36 Chapter 9 Girls Education 59 Chapter 10 Special Focus Group 63 Chapter 11 Management Information System 65 Chapter 12 Convergence and Linkages 66 Budget 68 INTRODUCTION GENERAL The state of Gujarat comprises of 25 districts. Prior to independence, tiie state comprised of 222 small and big kingdoms. After independence, kings were ruling over various princely states. Late Shri Vallabhbhai Patel, the than Honorable Home Minister of Government of India united all these small kingdoms into Gujarat-Bombay state (Bilingual State) during 1956. In accordance with the provision of the above-mentioned Act, the state of Gujarat was formed on 1 of May, 1960. Rajkot remained the capital of Saurashtra during 1948 to 1956. This city is known as industrial capital of Saurashtra and Kutch region. Rajkot district can be divided into three revenue regions with reference to geography of the district as follow: GUJARAT, k o t ¥ (1) Rajkot Region:- Rajkot, Kotda, Sangani, Jasdan and Lodhika blocks. -

District Census Handbook, Rajkot, Part X-C-II, Series-5

CENSUS 1971 PART X-C-II (with oft PliRts of Part X-C-I) ANALYTICAL REPORT ON CENSUS AND RELATED STATISTICS SOCIO-ECONOMIC & SERIES - 5 CULTURAL TABLES GUJARAT (RURAL AREAS) AND HOUSING TABLES DISTRICT RAJKOT CENSUS DISTRICT HANDBOOK C. c. DOCTOR of the Indian Administrative Service Director of Census Operations Gujarat . Y-331(}..(ij CENSUS OF INDIA, 1971 LIST OF PUBLICATIONS Census of India 1971-Series-5-Gujarat is being published in the follow ing parts: Central Government Publications Subject covered Part Number I-A General Report I-B Detailed Analysis of the Demographic, Social, Cultural and Migra tion Patterns I-C Subsidiary Tables II-A General Population Tables ('A' Series) II-B Economic Tables ('B' Series) II-C (i) Distribution of Population, Mother Tongue and Religion, Sche duled Castes and Scheduled Tribes I1-C (ii) Other Social and Cultural Tables and Fertility Tables, Tables on Household Composition, Single Year Age, Marital Status, Educational Levels, Scheduled Castes and Scheduled Tribes, etc., Bilingualism III Establishments Report and Tables ('E' Series) IV-A Housing Report and Housing Subsidiary Tables IV-B Housing Tables V Special Tables and Ethnographic Notes on Scheduled Castes and} Scheduled Tribes VI-A Town Directory VI-B ~pecial Survey Report on Selected Towns VI-C Survey Report on Selected Villages VII Special Report on Graduate and Technical Personnel I VIII-A Administration R~port-Enumeration 1For Official use only. VIII-B Administration Report-Tabulation J IX Census Atlas State Government Publications DISTRICT CENSUS HANDBOOK X-A Town and Village Directory X-B Village and Townwise Primary Census Abstract X-C-I Departmental Statistics and Full Count Census Tables X-C-II Analytical Report on Census and Related Statistics, Socio Econo mic and Cultural Tables (Rural Areas) and Housing Tables X-C-II (Supplement) Urban sample tables II CONTENTS PAGES PREFAOE i - ii I A~ALYTICAL REPORT ON CENSUS AND RELATED STATISTICS A. -

Annexure-V State/Circle Wise List of Post Offices Modernised/Upgraded

State/Circle wise list of Post Offices modernised/upgraded for Automatic Teller Machine (ATM) Annexure-V Sl No. State/UT Circle Office Regional Office Divisional Office Name of Operational Post Office ATMs Pin 1 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA PRAKASAM Addanki SO 523201 2 Andhra Pradesh ANDHRA PRADESH KURNOOL KURNOOL Adoni H.O 518301 3 Andhra Pradesh ANDHRA PRADESH VISAKHAPATNAM AMALAPURAM Amalapuram H.O 533201 4 Andhra Pradesh ANDHRA PRADESH KURNOOL ANANTAPUR Anantapur H.O 515001 5 Andhra Pradesh ANDHRA PRADESH Vijayawada Machilipatnam Avanigadda H.O 521121 6 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA TENALI Bapatla H.O 522101 7 Andhra Pradesh ANDHRA PRADESH Vijayawada Bhimavaram Bhimavaram H.O 534201 8 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA VIJAYAWADA Buckinghampet H.O 520002 9 Andhra Pradesh ANDHRA PRADESH KURNOOL TIRUPATI Chandragiri H.O 517101 10 Andhra Pradesh ANDHRA PRADESH Vijayawada Prakasam Chirala H.O 523155 11 Andhra Pradesh ANDHRA PRADESH KURNOOL CHITTOOR Chittoor H.O 517001 12 Andhra Pradesh ANDHRA PRADESH KURNOOL CUDDAPAH Cuddapah H.O 516001 13 Andhra Pradesh ANDHRA PRADESH VISAKHAPATNAM VISAKHAPATNAM Dabagardens S.O 530020 14 Andhra Pradesh ANDHRA PRADESH KURNOOL HINDUPUR Dharmavaram H.O 515671 15 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA ELURU Eluru H.O 534001 16 Andhra Pradesh ANDHRA PRADESH Vijayawada Gudivada Gudivada H.O 521301 17 Andhra Pradesh ANDHRA PRADESH Vijayawada Gudur Gudur H.O 524101 18 Andhra Pradesh ANDHRA PRADESH KURNOOL ANANTAPUR Guntakal H.O 515801 19 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA -

Morbi District Is Located in the Saurashtra Region of Indian State of Gujarat

Morbi District is located in the Saurashtra region of Indian state of Gujarat. It was formed on August 15, 2013, on the 67th Independence Day of India. The district has 5 talukas - Morbi, Maliya, Tankara, Wankaner and Halvad. This district is surrounded by Kutch district to the north, Surendranagar district to the east, Rajkot district to the south and Jamnagar district to the west. Morbi, also known as Morvi is the administrative headquarters of Morbi district, which literally means City of Peacocks. The town of Morbi is endowed not only with great natural beauty, but it is also famous for its colorful history and rich cultural heritage. The town of Morbi is situated on the bank of Machchhu River, 35 km from the sea and 60 km from Rajkot. The city-state of Morbi and much of the building heritage and town planning, are attributed to the administration of Sir Lakhdhiraji Waghji, who ruled from 1922 to 1948. The Machchhu dam failure or Morbi disaster was a dam-related flood disaster which occurred on 11 August 1979. Morbi has long been a center for trade and industry. In the beginning, the economy of the town was mainly dependent on ceramic and clock manufacturing industry. Today, the area has also become a growing hub for paper mills and other ancillary industries such as packaging industry, export houses etc. Together, they have created a vibrant and sustainable economy in this region. After the bifurcation from Rajkot District Court, Morbi District Court started its functioning from 02/10/2016 and presently, there are 2 Appellate Courts, 1 Family Court, 1 Labour Court, 5 Senior Division Courts/Chief Courts & 7 Junior Division Courts, are functioning in Morbi District. -

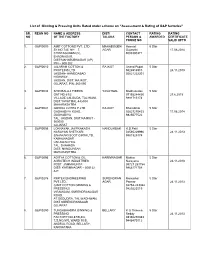

List of Ginning & Pressing Units Rated Under Scheme on “Assessment

List of Ginning & Pressing Units Rated under scheme on “Assessment & Rating of G&P factories” SR. REGN NO NAME & ADDRESS DIST/ CONTACT RATING RATING NO OF THE FACTORY TALUKA PERSON & AWARDED CERTIFICATE PHONE NO VALID UPTO 1. G&P/0009 AMIT COTTONS PVT. LTD MAHABOOBN Hemant 5 Star SY.NO.745, NH – 7, AGAR Gujarathi 17.08.2014 CHINTAGUDEM (V), 9000300371 EHADNAGAR, DIST:MAHABUBNAGAR (AP) PIN – 509 202 2. G&P/0010 JALARAM COTTON & RAJKOT Anand Popat 5 Star PROTEINS LTD 9426914910 24.11.2013 JASDAN- AHMEDABAD 02821222201 HIGHWAY, JASDAN, DIST: RAJKOT, GUJARAT, PIN: 360 050 3. G&P/0034 SHRI BALAJI FIBERS YAVATMAL Madhusudan 5 Star GAT NO:61/2 07153244430 27.6.2015 VILLAGE LALGUDA, TAL:WANI, 9881715174 DIST:YAVATMAL-445304 MAHARASHTRA 4. G&P/0041 GIRIRAJ COTEX P.LTD RAJKOT Bharatbhai 5 Star GADHADIYA ROAD, 02827270453 17.08.2014 GADHADIYA 9825077522 TAL: JASDAN, DIST;RAJKOT - 360050 GUJARAT 5. G&P/0056 LOKNAYAK JAYPRAKASH NANDURBAR R.D.Patil 5 Star NARAYAN SHETKARI 02565229996 24.11.2013 SAHAKARI SOOT GIRNI LTD, 9881925174 KAMALNAGAR UNTAWAD HOL TAL. SHAHADA DIST: NANDURBAR MAHARASHTRA 6. G&P/0096 ADITYA COTTON & OIL KARIMNAGAR Mukka 5 Star AGROTECH INDUSTRIES Narayana 24.11.2013 POST: JAMMIKUNTA 08727 253754 DIST: KARIMNAGAR – 505122 9866171754 A.P. 7. G&P/027 6 RIMTEX ENGINEERING SURENDRAN Manubhai 5 Star PVT.LTD., AGAR Parmar 24.11.2013 (UNIT COTTON GINNING & 02752-243322 PRESSING) 9825223519 VIRAMGAM, SURENDRANAGAR ROAD, AT.DEDUDRA, TAL.WADHWAN, DIST SURENDRANAGAR GUJARAT 8. G&P/0290 TUNGABHADRA GINNING & BELLARY K G Thimma 5 Star PRESSING Reddy 24.11.2013 FACTORY,NO.87/B,3/4, 08392250383 T.S.NO.970, WARD 10 B, 9448470112 ANDRAL ROAD, BELLARY, KARNATAKA 9. -

Econol\HC GEOLOGY and ~HNERAL. RESOURCES of SAURASHTRA

·I THE- . ECONOl\HC GEOLOGY AND ~HNERAL. RESOURCES OF SAURASHTRA (With a Mineral Map of Saurashtra) BY. B. C. ROY, D.I.C., M.Sc. (London), Dr.-lng. (Freiberg), Superintending Geologist-in-charge, Western Circle,. Geological Survey of India. Published by Government of Saurashtra, Department of Industry and Supply, RA.JKOT Price: Rs. 10/- 1953 THE ECONOMIC GEOLOGY AND MINERAL RESOURCES OF SAURASHTRA I THE ECONOMIC GEOLOGY AND 1\IINERAL RESOURCES OF SAURASHTRA (With a Mineral Map of Saurashtra) BY B. C. ROY, D.i.C., M.Sc. (London), Dr.-Ing, (Freiberg), Superintending Geologist-ifr,.charge, Western. Circle, Geological Survey of India Published by Government of Saurashtra, Department of. Industry and Supply, RA.JKOT Price: Rs. 10.'- 1953 Printed by G. G. Pathare at the Popular Press (Bombay) Ltd., 35, Tardeo Road, Bombay 7, for the Popular Book Depot., and published by Government of Saurashtra, Department of Industry and Supply. CONTENTS PART I.-ECONOMIC ASPECTS OF GEOLOGY IN SAURASHTRA 11,\(;r. CHAPTER I. -INTRODUCTION 1 CHAPTER II. -MINERAL PRODUCTION 5 CHAPTER III. -PHYSIOGRAPHY 8 Hills 8 Climate 10 Rainfall 11 Rivers 11 Lakes 12 Islands 12 Salt wastes 12 CRAPTER IV. -GENERAL GEOLOGY 14 Umia beds 14 W adhwan sandstones 15 Trappean grits 16 Deccan traps 16 Inter-trappeans 19 Trap-dykes 19 Lateritic rocks 21 Gaj beds. 21 Dwarka beds 2.'1 Miliolite series 24 Alluvium 25 CHAPTER v. -GEOLOGY IN ENGINEERING AND AGRICULTURE .. 27 General .. 27 Underground water supply 27 Dam sites and reservoirs .. 28 Road and railway alignments 30 Tunnelling 30 Airports .. 31 Docks and harbours 31 Bridge foundations 31 Building foundations 32 Construction materials 33 Soils 34 CHAPTER VI. -

VG-2017 MSME - Approved Investment Intentions District : Morbi Sr.No

VG-2017 MSME - Approved Investment Intentions District : Morbi Sr.No. Name of Company Registered Office Address 1 A one Industries rafaleshwar,,Makansar-363642,Morvi,Morbi 2 Aaaran Minerals 50,51 rafaleshwar GIDC,,Morvi-Morvi,Morbi 3 Aai krupa cotton thoriyali road,tankara,,Tankara-363650,Tankara,Morbi 4 aarav halvad,,Halvad-363330,Halvad,Morbi 5 AaRAV Flour Mill Ratabhe,,Ratabhe-363330,Halvad,Morbi 6 airson poly industries surve no 258/p1 maruti plsatic,,Hadmatiya-363650,Tankara,Morbi 7 ajana govindbhai tankara,,Nana Khijadiya-363650,Tankara,Morbi 8 ajnata oil mill ghuntu,,Ghuntu-363642,Morvi,Morbi 9 Alfa Industries near maruti cold storage,chhattar,,Chhattar-363650,Tankara,Morbi 10 Altimo Industries 30 , rafaleshwar GIDC estate,,Morvi-Morvi,Morbi 11 Altra Pack Ind. Ghuntu,,Ghuntu-363642,Morvi,Morbi 12 ambidhara oil industries dulkot,,Morvi-363642,Morvi,Morbi 13 Amerys special refactory vaghasia,,Vaghasia-363621,Wankaner,Morbi 14 AMRUT CERA COAT PLOT NO 151 RAFALESHWAR GIDC ESTATE,RAFALESHWAR,Morvi-360641,Morvi,Morbi 15 AMRUT CERA COTE PLOT NO.151,RAFALESHWAR GIDC ESTATE,Morvi-Morvi,Morbi 16 amul oil industriel kadiyana,,Kadiyana-363330,Halvad,Morbi 17 ANAND K VAGHELA PLOT NO.39,VAGHASIYA GIDC ESTATE,Vaghasia-Wankaner,Morbi 18 ANAND MINERALS PLOT NO.45,RAFALESHWAR GIDC ESTATE,Morvi-Morvi,Morbi 19 ANGEL PLASTIC INDUSTRIES K-1-GIDC,SANALA ROAD MORBI,,Morvi-Morvi,Morbi 20 antique cottex hirapar,latipar highway road,,Hirapar-363650,Tankara,Morbi 21 antique designer tiles plot no 2 rafaleshwar gidc estate,rafaleshwar,Morvi-360641,Morvi,Morbi 22 ANTIQUE PVC PIPE PLOT NO.146,RAFALESHWAR GIDC ESTATE,Morvi-Morvi,Morbi Page 1 of 19 VG-2017 MSME - Approved Investment Intentions District : Morbi Sr.No. -

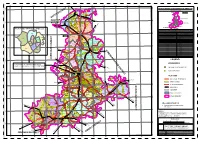

Rajkot District.Pdf

69°50'0"E 70°0'0"E 70°10'0"E 70°20'0"E 70°30'0"E 70°40'0"E 70°50'0"E 71°0'0"E 71°10'0"E 71°20'0"E 71°30'0"E 71°40'0"E 71°50'0"E T o w a rd s B h 23°10'0"N T a MANDARKI RAJKOT DISTRICT GEOGRAPHICAL AREA (1/2) c h a # IC u VENASAR 23°10'0"N (GUJRAT STATE) # MALIYA# GHANTILA CHIKHLI # TR KAJARDA # #KUMBHARIYA HARIPAR/" # IS # KUTCH KEY MAP MALIYA 21 CA-16 D NH-8A SH 3 £¤ VARDUSAR # H JAJASAR KHIRAI KHAKHRECHIVEJALPAR # CA-16 # # CA-17 C SULTANPUR # SONGADH # T # FATTEPAR VADHARVA MANABA NANI BARARRASANGPAR# U # # # # SH BHAVPAR 7 CA-19 K BAGASARA VIRVADARKA CA-18 # SOKHDA ROHISHALA # JASAPAR # RAPAR ANIYARI SURENDRANAGAR # NAVAGAM # PILUDI# # T # # # ow VAVANIYA BAHADURGADH ar MOTI BARAR # d CA-20 # MOTA BHELA# NAVA NAGDAVAS s CA-14 # # Dh CA-12 F MEGHPAR JETPAR r ULF O a CA-01TO CA-11 G g CA-13 CHAMANPAR # # h NANA BHELA VAGHPAR n 23°0'0"N #LAXMIVAS # # # dh JUNA NAGDAVAS ra CA-21 CA-15 SARVAD # CHAKAMPAR JAMNAGAR VARSAMEDI ± CA-24 # # CA-22 23°0'0"N UTCH # DERALA GALA CA-22 BHAVNAGAR K # # CA-23 SAPAR#JASMATGADH d MOTA DAHISARATARGHARI GUNGAN # a # # HARIPAR CA-25RAJKOTCA-23 # MAHENDRAGADH # ZINKIYALI w NAVLAKHI CHANCHAVADARDA # NARANKA JIVAPAR CHAKAMPAR# l # KHIRSARA # PIPALIYA # # NAVA SADULKA # a CA-27 LAVANPURBODKI # # CA-26 # # DAHISARA NANA KERALA H AMRELI # # CA-28 MANSAR RAVAPAR NADI s LUTAVADAR KHEVALIYA# # d PORBANDAR # # RANGPAR KHAREDA r £NH-8A # # a KUNTASI VIRPARDA ¤ # # BELA RANGPAR w JUNAGADH MODPAR BARVALA JUNA SADULKA # RAJKOT GEOGRAPHICAL AREA (2/2) 1 # # VANALIYA # VANKDA o S 2 # T H KHAKHRALA# 3 # SANALA (TALAVIYA) ANDARNA 24 # # HAJNALI BILIYA SH Total Population within the Geographical Area as per Census 2001 # # GOR KHIJADIA PIPALI #CA-17# # # KANTIPUR MORVI JEPUR NICHI MANDAL 31.12 Lacs(Approx.) # # GHUNTU # H 22 UNCHI MANDAL #BAGATHALA AMRELI (PART) #S # CA-03 # #MAHENDRANAGAR (PART) Total Geographical Area (Sq.KMs) No. -

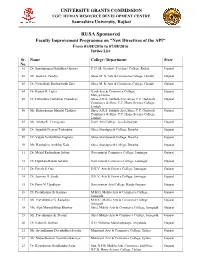

RUSA Sponsored Faculty Improvement Programme on "New Directives of the API" from 01/08/2016 to 07/08/2016 Invites List

UNIVERSITY GRANTS COMMISSION UGC: HUMAN RESOURCE DEVELOPMENT CENTRE Saurashtra University, Rajkot RUSA Sponsored Faculty Improvement Programme on "New Directives of the API" From 01/08/2016 to 07/08/2016 Invites List Sr. Name College / Department State No. 01 Dr. Sandipkumar Muljibhai Ghetiya P. D. M. Graduate Teachers' College, Rajkot Gujarat 02 Mr. Ketan S. Pandya Shree M. B. Arts & Commerce College, Gondal Gujarat 03 Dr. Nirmalsinh Dashrathsinh Zala Shree M. B. Arts & Commerce College, Gondal Gujarat 04 Dr. Rajesh R. Ladva Gardi Arts & Commerce College, Gujarat Maliya-Hatina 05 Dr. Dahyabhai Hathibhai Chaudhari Shree A.R.S. Sakhida Arts, Shree C.C. Gediwala Gujarat Commerce & Shree C.C. Home Science College, Limbdi 06 Mr. Kishorkumar Manilal Thakkar Shree A.R.S. Sakhida Arts, Shree C.C. Gediwala Gujarat Commerce & Shree C.C. Home Science College, Limbdi 07 Mr. Aditya R. Viramgama Govt. Arts College, Jam-Kalyanpur Gujarat 08 Dr. Jagadish Premaji Tankodara Shree Shardapeeth College, Dwarka Gujarat 09 Dr. Vipula Vallabhbhai Vaghela Shree Shardapeeth College, Dwarka Gujarat 10 Ms. Harshaben Arsibhai Vala Shree Shardapeeth College, Dwarka Gujarat 11 Dr. Mehul Rashmikant Solani Government Commerce College, Jamnagar Gujarat 12 Dr. Diptibala Ratilal Solanki Government Commerce College, Jamnagar Gujarat 13 Dr. Paresh S. Oza D.K.V. Arts & Science College, Jamnagar Gujarat 14 Dr. Jasmina H. Sarda D.K.V. Arts & Science College, Jamnagar Gujarat 15 Dr. Purvi N. Upadhyay Government Arts College, Kotda Sangani Gujarat 16 Dr. Prafulkumar B. Kanjiya M.M.G. Mahila Arts & Commerce College, Gujarat Junagadh 17 Mr. Pravinkumar G. Radadiya M.M.G. Mahila Arts & Commerce College, Gujarat Junagadh 18 Ms.