Record Sales and Earnings Financial Highlights

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hassinger & Courtney Auctioneers September 26, 2018 Knife List

Hassinger & Courtney Auctioneers September 26, 2018 Knife List 1. Buck Knives 2004 Limited Edition Buck Model 101 USA Knife #71 of 300, Gold Inlay Engraved Antelope. New in Original Box. A Beautiful Knife, Nice Scrimshaw Artwork!! 2. Unusual Klever “Kleever” with Walnut Handle. It’s a Kleever, Can Opener, Bottle Opener & Meat Tenderizer. A Great Find!! 3. Vintage Irish “Stag Brand” Fish Knife 4. Golden Mallard Key Chain Knife 5. Nascar Jeff Gordon #24 Signature Pocket Knife with Designer Case 6. PBR Western Folding Knife Set. Leather Handle 440 Steel. Includes Burl Maple Mini Knife. A Great Set Mfg. in 2008. New in Original Box. 7. Case Pennsylvania Trout 1988 Limited Edition Case XX Stag Handle Knife #400 of Only 500 Mfg. New in Original Box 8. Case XX 3” Finn Fixed Blade Knife with Sheath 9. J.F. Novelties, N.Y. N.Y. Whitetail Deer Pocket Knife. New Condition. 10. Rare Jigged Bone Handle Knife Marked “WS 131” Great Quality 11. Case Tested XX Bone Handle Pocket Knife. 2 Blades 12. Camillus New York USA 2 Blade Pocket Knife. Circa 1970’s. Brown Hardwood Laminate Handles. Orig. Box & Paperwork. #20 on Blade 13. Vintage Oyster Knife with Walnut Handle. Mfg. by William Johnson, Newark, NJ Circa 1940’s 14. Imperial Providence R.I. Pearl Handles 2 Blade Pocket Knife. Circa 1950’s 15. “Swissgear” Stainless Leatherman with Belt Sheath 16. Husky Loc-Back Box Cutter with Heavy Leather Sheath & Belt Clip, Like New. 17. Case XX 6265SAB, 2 Blade Red Bone Folding Hunter Circa 1940-64 18. NRA Folding Pocket Knife with Damascus Style Blade 19. -

Mail To: the Auction Exchange & Collectors News

THE AUCTION EXCHANGE ® nd COLLECTORS NEWS $150 AANTIQUES • COLLECTIBLES • ESTATES • FARM • REAL ESTATE • COMMERCIAL www.eauctionexchange.com January12, 2021 Vol. 44, No. 05 ACROSS THE AUCTION BLOCK Kubota loader hauls away $39,025 at Miedema auction By William tion, and heavy equip- OrbitBid which helps sell was in operating condi- Flood ment. commercial assets from tion with auxiliary Miedema started with company locations, Rang- hydraulics rated at 3,330- Miedema Auctioneer- live auctions in 1984, erBid which helps busi- lb capacity. Ten other ing, a specialist in catego- evolving into online auc- nesses sell items directly loaders were sold, includ- ries like commercial and tioning as early as 2000. to end-users, and Rep- ing a 2012 Case TR270 heavy machinery, held an The company soon oCast which helps sell Track skid steer loader online sale via their Rep- expanded its online foot- repossessed assets for with 66-inch bucket with ocast platform, featuring print to multiple special- banks, credit unions, and cutting edge, auxiliary snow removal, construc- ized divisions including trustees. hydraulics, and a cab At this sale, loaders with heat and stereo attracted several of the ($17,025); and, a 2014 auction’s highest bids. A Volvo MC95C skid steer 2018 Kubota SVL95-2S loader 84-inch bucket rubber track loader, in with cutting edge, and operating condition, with deluxe cab featuring heat 18-inch rubber tracks, and A/C, that had 112 Above: A dozen loaders of various types were available. auxiliary hydraulics, bidders take it to $16,660. One of the auction’s top bids - $39,025 - went to this 2018 80-inch bucket, and Other big wins were a Kubota rubber track loader. -

ENT Catalogue

ENT serving healthcare worldwide ENT HISTORY Mit Blick in die Zukunft RUDOLF Medical GmbH + Co. KG wurde als Firma 1950 gegründet. Heute ist bereits die dritte Rudolf- Generation an der Leitung des Unternehmens und RUDOLF Medical zählt weltweit zu den führenden Herstellern von chirurgischen Instrumenten und Geräten. Focused on the Future RUDOLF Medical GmbH + Co. KG was established as a company in 1950. Today the 3rd Rudolf generation is at the steering wheel of the company and RUDOLF Medical ranks among the leading manufacturers of surgical instruments and equipment worldwide. MANUFACTURING Handarbeit und Hightech Das Geheimnis der Herstellung der RUDOLF Medical Produkte liegt einerseits in der Verwendung hoch- wertiger Werkstoffe andererseits in der harmonischen Verschmelzung von langjähriger Handwerks- kunst, speziellen Herstellungsverfahren und neuesten Technologien. Die Automatisierung spielt eine wichtige Rolle in der Fertigung der Firma RUDOLF Medical. Wann immer möglich, ersetzen CNC-Roboter die Handarbeit, um während des Herstellungsprozesses hohe Präzision und immer gleich bleibende Instrumentenmodelle zu gewährleisten. Am Ende ist es jedoch immer noch die Hand des Meisters, die den Instrumenten den letzten Schliff verleiht. Handicraft and High Tech RUDOLF Medical products prove that the secret of manufacturing high quality instruments lies in the employment of exquisite materials as well as in the perfect merging of long handicraft experience, special manufacturing techniques and state-of-the-art technologies. Automation plays a main role in RUDOLF Medical´s production. Whenever it is possible CNC robots replace handicraft to ensure high precision during the manufacturing process and to guarantee instrument pattern consistency. Nevertheless it is still the master craftsman’s hand that gives the instruments the fi nal, “human” touch. -

Health Industry Business Communications Council

Health Industry Business Communications Council Registered Labelers: Accredited Auto-ID Labeling Standards Argentina New MedTek Devices Pty Ltd Oxavita SRL Norseld Pty Ltd. Novadien Healthcare Pty Ltd The following companies Odontit S.A. (and/or their subsidiaries/ PAMPAMED S.R.L. Numedico Technologies Pty Ltd divisions) have applied PATEJIM SRL Opto Global Pty. Ltd. for a Labeler Identification Orthocell Limited Code (LIC) assignment with Austria Prolotus Technologies Pty Ltd HIBCC*. By doing so, they afreeze GmbH Red Milawa Pty Ltd dba Magic Mobility have demonstrated their AMI GmbH SDI Limited commitment to patient safety Bender Medsystems GmbH Signostics Ltd. and logistical efficiency for BHS Technologies GmbH Sirtex Medical Pty Ltd their customers, the industry Metasys Medizintechnik GmbH Smith & Nephew Surgical Pty. Ltd. and the public at large. PAA Laboratories GmbH Staminalift International Limited Safersonic Medizinprodukte Handels The Pipette Company Pty. Ltd. Any organization that is GmbH Thermo Electron Corporation interested in using the HIBC W & H Dentalwerk Burmoos GmbH Vush Pty Ltd uniform labeling system may apply for the assignment of VUSH STIMULATION Australia one or more LICs. William A Cook Australia Pty. Ltd. Adv. Surgical Design & Manufacture, Ltd. Last updated 9-21-2021 AirPhysio Pty Ltd Belgium Annalise-AI Pty Ltd 3M Europe Apollo Medical Imaging Technology Pty Advanced Medical Diagnostics SA/NV Ltd Analis SA/NV Benra Pty Ltd dba Gelflex Laboratories Baxter World Trade Bioclone Australia Pty. Ltd. Bio-Rad RSL Candelis, Inc. Bio-Rad Lab Inc Clinical Diag. Group DePuy Australia Pty. Ltd. Biosource Europe SA For more information, please dorsaVi Ltd Cilag NV contact the HIBCC office at: EC Certification Service GmbH Coris Bioconcept Fink Engineering Pty Ltd Fuji Hunt Photographic Chemicals NV 2525 E. -

Acme United Corp. (ACU)

Acme United Corp. (ACU) Acme United Corporation is an innovative supplier of cutting devices, measuring instruments and safety products for school, home, office, industrial and hardware use. The company has facilities in the United States, Canada, Germany, Hong Kong and China. Acme United’s products are organized under four global brands: Westcott, Clauss, Camillus and PhysiciansCare, all of which serve a growing customer base that includes the world’s premier retailers and merchandisers. Update Report – May 26, 2011 Investment Highlights Symbol: ACU Industry: Office Supplies 9 Acme United acquired The Pac-Kit Safety Market: NYSE Amex Equipment Company late February 2011, a leading Recent Price: $9.40 manufacturer of first aid kits for the industrial, safety, transportation and marine markets. Pac-Kit is expected 52-Week Price Range: $6.53 - $13.04 to contribute between $4 and $4.5 million in sales and Market Cap: approx. $29.19 million between $100,000 and $150,000 in earnings for fiscal year 2011. Acme United Corp. 60 Round Hill Road 9 For the first quarter of 2011, ended March 31, Acme reported sales of $14.4 million, compared to Fairfield, CT 06824 $13.1 million in the first quarter of 2010, an increase of Phone: (203) 254-6060 10%. Every business unit had sales growth in Q1. Net http://www.acmeunited.com income was $120,000 or $.04 per diluted share for the quarter ended March 31, 2011 compared to $214,000 or $.07 per diluted share for the comparable period last year. This decline is both the result of lower gross margins and the one-time Pac-Kit acquisition costs. -

(ACU) Company Report – November 14, 2015 Acme United Corporation Is a Worldwide Supplier of Cutting Devices

Smallcaps Investment Research Acme United Corp. (ACU) Company Report – November 14, 2015 Acme United Corporation is a worldwide supplier of cutting devices, measuring instruments and first-aid products for school, home, office, industrial and hardware use. In the third quarter, ended September 30, 2015, Acme United achieved record back-to- school sales and record earnings. In addition, the Company is on course for a new annual sales and earnings record in 2015. Also 2016 looks very promising. The full optimization of the Company’s three first aid brands, will lead to cost savings of up to $1 million in 2016 and beyond. We also foresee plenty of growth for Acme’s other brands. Camillus, for example, is gaining market share with its knives, and camping & hunting gear. At Clauss, a number of market tests with large retail chains are ongoing with strong results so far. As for Westcott, we should start to see the full impact of the large Office Depot/Office Max scissors account for North America that Acme picked up a couple of months ago. Based on our outlook and calculations, we reiterate our buy recommendation for Acme United Corp. with a price target of $28.67, which is 68% above today’s stock price. The decline of the Canadian dollar and euro versus the U.S. dollar has stopped in recent months. Both segments are reducing costs with suppliers, trimming expenses, and increasing their selling prices to somewhat regain their margins. All these efforts should start to have a positive impact. The Cuda fishing tools brand has launched an entire line for fresh water fishing. -

KINF-AR-2013-Digital.Pdf

COVER Programs of the Kids In Need Foundation Kids In Need National Network of Resource Centers Sponsored by Free stores for teachers in 32 cities nationwide provide free school supplies for the neediest students in the school districts they serve. They are the affiliates of the Kids In Need National Network. With the generous donations of many companies, Kids In Need was able to distribute more than $70 million worth of product to the National Network in 2013, providing supplies to nearly 120,000 teachers and 3.6 million kids. Teacher Grants Sponsored by The original Kids In Need Teacher Grants program and the Elmer’s Teacher Tool Kit grants awarded a combined total of more than $202,200 to 505 teachers across the country so they could conduct classroom projects that helped make learning interesting and fun. Approximately 40,500 students were the recipients of these unique experiences in 2013. School Ready Supplies Sponsored by Local Community Organizations & Corporations School Ready Supplies helps to provide school supplies to students in communities not served by Resource Centers. Through events sponsored by local organizations or national corporations, students are given free backpacks and supplies. In 2013, 26,685 kids found that being well equipped made going back to school pretty exciting and even fun! Second Responder® A national program that provides backpacks and school supplies to students who have been affected by natural disasters, Second Responder® was announced as a new official program of the Kids In Need Foundation in 2013. Kids In Need has provided this type of assistance to communities in the past, most notably after Hurricane Katrina. -

Innovation That Sells

Acme United Corporation innovation that sells Acme United Corporation | 2007 Annual Report 2007 Annual Report Acme United Corporation | 60 Round Hill Road, Fairfield, CT 06824 U.S.A. | 203.254.6060 | www.acmeunited.com Officers Walter C. Johnsen Paul G. Driscoll James A. Benkovic Chairman of the Board and Vice President, Chief Financial Officer, Senior Vice President of Global Sales Chief Executive Officer Secretary and Treasurer Brian S. Olschan Larry H. Buchtmann President and Chief Operating Officer Vice President of Technology International Key Management Harry G. Wanless Dennis Liang Willi Engelsberg General Manager General Manager Managing Director Acme United Limited Acme United (Asia Pacific) Limited Acme United Europe, GmbH (Canada) (Hong Kong) (Germany) Directors Rex L. Davidson Susan H. Murphy Stephen Spinelli, Jr. President and Chief Executive Officer Vice President for Student President Goodwill Industries of and Academic Services Philadelphia University Greater New York and New Jersey Cornell University Stevenson E. Ward III Richmond Y. Holden, Jr. Brian S. Olschan Vice President and Chief Financial Officer President President and Chief Operating Officer Triton Thalassic Technologies, Inc. Educators Publishing Service Acme United Corporation Walter C. Johnsen Gary D. Penisten Chairman and Chief Executive Officer Chairman of the Board Emeritus Acme United Corporation Acme United Corporation Corporate Offices Stock Listing Annual Meeting Acme United Corporation The stock of Acme United Corporation will be held at 11 a.m. on 60 Round Hill Road is traded on the American Stock Monday, April 21, 2008 at Fairfield, CT 06824 Exchange under the symbol ACU. The American Stock Exchange, 86 Trinity Place, New York, NY 10006 Transfer Agents Counsel Auditors American Stock Transfer Company Brody, Wilkinson and Ober, P.C. -

ACME UNITED CORPORATION Exact Name of Registrant As Specified in Its Charter

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D. C. 20549 FORM 10-K [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2016 OR [_] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 01-07698 ACME UNITED CORPORATION Exact name of registrant as specified in its charter Connecticut 06-0236700 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 55 Walls Drive Fairfield, Connecticut 06824 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code (203) 254-6060 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered $2.50 par value Common Stock NYSE MKT Securities registered pursuant to Section 12 (g) of the Act: None Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES [_] NO [X] Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES [_] NO [X] Indicate by check mark whether the registrant (l) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. -

(NAARS): Official Listing of the Corporations Comprising the 1972 Annual Report File

University of Mississippi eGrove American Institute of Certified Public Guides, Handbooks and Manuals Accountants (AICPA) Historical Collection 1972 National Automated Accounting Research System (NAARS): Official Listing of the Corporations Comprising the 1972 Annual Report File American Institute of Certified Public Accountants (AICPA) Follow this and additional works at: https://egrove.olemiss.edu/aicpa_guides Part of the Accounting Commons, and the Taxation Commons Recommended Citation American Institute of Certified Public Accountants (AICPA), "National Automated Accounting Research System (NAARS): Official Listing of the Corporations Comprising the 1972 Annual Report File" (1972). Guides, Handbooks and Manuals. 703. https://egrove.olemiss.edu/aicpa_guides/703 This Book is brought to you for free and open access by the American Institute of Certified Public Accountants (AICPA) Historical Collection at eGrove. It has been accepted for inclusion in Guides, Handbooks and Manuals by an authorized administrator of eGrove. For more information, please contact [email protected]. THE NATIONAL AUTOMATED ACCOUNTING RESEARCH SYSTEM NAARS OFFICIAL LISTING OF THE CORPORATIONS COMPRISING THE 1972 ANNUAL REPORT FILE PAGE 1 1972 ANNUAL REPORT FILE ALPHABETICAL LISTING COMPANY NAME SIC S EX B S DATE AUDITOR A & E PLASTIK PAK CO., INC. 309 ASE 12-31-72 PMM A.B. DICK COMPANY 508 OTC 12-31-72 AA A.E. STALEY MANUFACTURING COMPANY 204 NySE 09-30-72 HS a.g. Edwards & sons inc 621 ASE 02-28-73 TR a.h. rOBins company, incorporated 283 NYSE 12-31-72 a.m. pullen & company a.M. castle & co. 509 ASE 12-31-72 AA a.o. smith corporation 371 NYSE 12-31-72 ay a.p.s. -

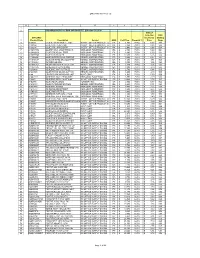

Office Max Net Pricer.Xls

Office Max Net Pricer.xls AB C D EF G H I 1 2 OfficeMax Net Pricer MAC 043 RS900707 Effective 01-21-08 State of Ohio Net 2008 OfficeMax (Contract) Catalog 3 Product Code Description Vendor UOM List Price Discount % Price Page 4 A100151 GLUESTICK,REMVBLE,.29OZ AVERY - OFFICE PRODUCT G EA$ 1.750 70.0%$ 0.53 564 5 A100164 GLUE STIC 26 OZ.3 PK AVERY - OFFICE PRODUCT G PK$ 2.940 70.0%$ 0.88 564 6 A100214 GLUE STIC 3PK DISAPP AVERY - OFFICE PRODUCT G PK$ 2.940 70.0%$ 0.88 564 7 A10M97373 GLUESTICK,1.23OZ,PERM,CR 0900 OMAX POWERMAX EA$ 2.190 70.0%$ 0.66 564 8 A10M99339 GLUE STICKS 3+1 FREE 0900 OMAX POWERMAX PK$ 2.990 70.0%$ 0.90 564 9 A10M99340 GLUE STICKS 24 PK 0900 OMAX POWERMAX PK$ 17.500 70.0%$ 5.25 564 10 A11046426 GLUE,SUPER,RD,ALL PURPSE HENKEL CORPORATION EA$ 2.890 70.0%$ 0.87 565 11 A11046437 GLUE,GN WING,GN,GOOF PRF HENKEL CORPORATION EA$ 4.690 70.0%$ 1.41 565 12 A11046464 SUPERGLUE GEL HENKEL CORPORATION EA$ 5.190 70.0%$ 1.56 565 13 A11046702 BRUSH-ON SUPER GLUE 5GR HENKEL CORPORATION EA$ 5.190 70.0%$ 1.56 565 14 A11051685 GLUE,LOCTITE,YW,SUMO HENKEL CORPORATION EA$ 8.990 70.0%$ 2.70 565 15 A1230890 ADHESIVE,MNT PUTTY,BE HENKEL CORPORATION EA$ 2.790 70.0%$ 0.84 565 16 A1234998 GLUE,PRCSN MX,CR,SUP 10G HENKEL CORPORATION EA$ 6.990 70.0%$ 2.10 565 17 A144 CEMENT,RBR,REMOVABL,4OZ HUNT CORP EA$ 1.980 70.0%$ 0.59 566 18 A1442219 ADHESIVE,ROLL PERM,DISP 0900 OMAX POWERMAX EA$ 6.990 70.0%$ 2.10 566 19 A16065 ADHESIVE,SPRY,10.25FL OZ 3M OFFICE SUPPLY DIVISIO EA$ 19.200 70.0%$ 5.76 565 20 A162180 GLUE,AQUA,LIQUID TOMBOW INC. -

SATS Replacement Catalog

HOW TO ORDER KipperTool® is dedicated to getting you the tools you need with several ordering options How to order directly from KipperTool®: 2375 Murphy Blvd., Gainesville, GA 30504 Sales: 1-800-295-9595 Fax: 1-800-295-9596 [email protected] www.kippertool.com SUPPORTING Simplifed Ordering Procedures For Federal Buyers: GSA SCHEDULE CONTRACT NUMBER GS-06F-0018L DOD EMALL CONTRACT SPM7W1-10-D-E008 (A Blanket Purchase Agreement (BPA) Against Our GSA Contract GS-06F-0018L) Order directly from GSA For help, contact GSA Global Orders can be placed through Advantage! or DOD Emall using Supply at 1-800-525-8027. FEDSTRIP or MILSTRIP the NSN, or the Part Number. DSN 465-7315 SATS REPLACEMENT CONTRACT NUMBER GS-06F-DA197 KipperTool® Company’s Strategic Distributors Divine Imaging, Inc. [email protected] | KIPPERTOOL.COM KIPPERTOOL® SUPPLIERS LIST ABRASIVES, BRUSHES & BROOMS DML APEX TOOL GROUP: 3M ESAB NICHOLSON ANDERSON GALAXY GROBET ARC ABRASIVES IRWIN INDUSTRIAL SIMONDS CAMEL GRINDING WHEELS LENOX SAW WARRENSVILLE FILE & KNIFE DIAMOND PRODUCTS MAGNA HAND TOOLS FALCON ABRASIVES MONSTER CARBIDE ALLEN KEIFER BRUSHES MORSE CUTTING TOOLS APEX TOOL GROUP: MERIT ABRASIVES OLDHAM APEX NORTON ABRASIVES PRECISION TWIST DRILL CRESCENT ADHESIVES, CHEMICALS, PRIMARK COOPER TOOLS SEALANTS, PAINT & LUBRICANTS QUALITY CARBIDE H.K. PORTER 3M ROCKY MOUNTAIN TWIST DRILL LUFKIN ACCU-FORM POLYMERS OF WARSAW LTD SIMONDS NICHOLSON ALBION DISPENSING SOLUTIONS STARRETT PLUMB GLIDDEN SUPER TOOL UTICA GROVER TITAN, USA WELLER J & S CHEMICAL DIGITAL TRACKING (RFID) WISS KRYLON IDZ XCELITE PLEWS / EDLEMANN LUBRICATION EQUIPMENT OMNI-ID ARMSTRONG AIR TOOLS & ACCESSORIES WINWARE/CRIBMASTER BAHCO AJAX DISTRIBUTORS BARCO ATP / THOR ARMYPROPERTY.COM BLACKHAWK CLECO DIVINE IMAGING C.S.