Annual Report 2010-2011

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Corporate Presentation November 2009 RR Disclaimer

RR GAMMON INDIA LIMITED Corporate Presentation November 2009 RR Disclaimer No representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or opinions contained in this presentation. Such information and opinions are in all events not current after the date of this presentation. Certain statements made in this presentation may not be based on historical information or facts and may be "forward looking statements" based on the currently held beliefs and assumptions of the management of Gammon India Limited (“Company” or “Gammon”), which are expressed in good faith and in their opinion reasonable, including those relating to Gammon’s general business plans and strategy, its future financial condition and growth prospects and future developments in its industry and its competitive and regulatory environment. Forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, financial condition, performance or achievements of Gammon or industry results to differ materially from the results, financial condition, performance or achievements expressed or implied by such forward-looking statements, including future changes or developments in Gammon’s business, its competitive environment and political, economic, legal and social conditions. Further, past performance is not necessarily indicative of future results. Given these risks, uncertainties and other factors, viewers of this presentation are cautioned not to place undue reliance on these forward-looking statements. Gammon disclaims any obligation to update these forward-looking statements to reflect future events or developments. This presentation is for general information purposes only, without regard to any specific objectives, financial situations or informational needs of any particular person. -

Building Future Possibilities

BUILDING FUTURE POSSIBILITIES Gammon India Limited Annual Report 2014-16 (18 months period) CORPORATE INFORMATION 01 ABOUT GAMMON GROUP 02 REGION-WISE PAN INDIA PRESENCE 07 CONTENTS CHAIRMAN’S STATEMENT 08 KEY PROJECTS – EPC 12 T&D KEY PROJECTS 14 PUBLIC PRIVATE PARTNERSHIP PROJECTS 16 OVERSEAS PRESENCE 18 AWARDS AND ACCOLADES 20 MANAGEMENT DISCUSSION & ANALYSIS 22 DIRECTORS’ REPORT 42 REPORT ON CORPORATE GOVERNANCE 98 FINANCIAL STATEMENTS 117 CONSOLIDATED ACCOUNTS 199 CORPORATE INFORMATION BOARD OF DIRECTORS BANKERS / FINANCIAL INSTITUTIONS Mr. Abhijit Rajan ICICI Bank Limited Chairman & Managing Director Canara Bank Mr. Rajul A. Bhansali IDBI Bank Limited Executive Director - International Operations Punjab National Bank Syndicate Bank Mr. Digambar C. Bagde Deputy Managing Director Bank of Baroda (Transmission & Distribution Division) United Bank of India Union Bank of India Mr. Ajit Desai Allahabad Bank Executive Director & Chief Executive Officer Bank of Maharashtra Mr. Chandrahas C. Dayal Oriental Bank of Commerce Independent Director UCO Bank Mr. Naval Choudhary Central Bank of India Independent Director Karnataka Bank Mrs. Urvashi Saxena Indian Bank Independent Director DBS Bank Mr. Jagdish C. Sheth Life Insurance Corporation of India Independent Director General Insurance Corporation of India Mr. Atul Dayal United India Insurance Independent Director Mr. Atul Kumar Shukla REGISTRAR & SHARE TRANSFER AGENT Independent Director M/s. Link Intime India Private Limited C-13, Pannalal Silk Mills Compound COMPANY SECRETARY LBS Road, Bhandup (West) Ms. Gita G. Bade Mumbai 400 078 Telephone: 022–2596 3838 PRESIDENT FINANCE & Facsimile: 022- 2594 6969 CHIEF FINANCIAL OFFICER e-mail : [email protected] Mr. Vardhan Dharkar AUDITORS M/s Natvarlal Vepari & Co. REGISTERED OFFICE ‘Gammon House’, Veer Savarkar Marg, Prabhadevi, Mumbai – 400 025. -

GAMMON BULLETIN Volume : 9103 Oct

An ISO 9001, ISO 14001 and OHSAS 18001 Certified Company GAMMON BULLETIN Volume : 9103 Oct. - Dec. 2012 G A M M Inside Gammon Bridges Mighty Kosi River 3 Safety Month Celebrations in Gammon 8 O Patchy Potholes: Remedies & Repairs 10 Interactive Workshop at Nagpur 14 News Flash from Projects 15 Company News 19 N 1 GAMMON BULLETIN IMS POLICY Editorial We are pleased to publish October – December 2012 issue of Gammon Bulletin. We take pleasure in presenting some of our recent significant achievements, Integrated Management learning’s and events from across the country to our Gammon Family, our System Policy esteemed Customers and other beloved Stake Holders. (Health, Safety, Environment & Quality Policy) Very recently Gammon has commissioned a major bridge across Kosi River Gammon is committed to create and deliver value to all its stakeholders. on NH 57 in Bihar. The Cover Story aptly describes how Gammon successfully For us, compliance to applicable requirements is diverted and bridged the mighty Kosi River against all odds. Kosi river, which is only the beginning. known for its highly unpredictable nature with a tendency to change its course, To ensure the well-being of all, we shall strive to achieve zero error. and for its volatile flood discharges; at times, as high as 18 times its normal To co-exist in harmony with nature, we shall help discharge,has been posing a serious challenge to Construction Engineers. sustain that balance. Gammon met this challenge successfully and bridged this mighty river in a Our quest for excellence is addressed through improvement and innovation. record time. -

Dodam Bridge

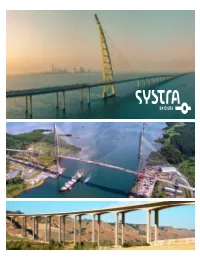

A GLOBAL BRIDGE World’s Longest Sea Bridge NETWORK SYSTRA has been a world leader in the World’s Longest Floating Bridge fi eld of transportation infrastructure for 60 years. Bridges are a major product SHEIKH JABER AL-AHMAD AL-SABAH CAUSEWAY line and a cornerstone of our technical Kuwait MONTREAL excellence in providing safe, effi cient, PARIS SEOUL and economical solutions. SAN DIEGO EVERGREEN POINT FLOATING BRIDGE World’s Longest Span International Bridge Technologies joined Seattle, Washington Railway Cable-Stayed Bridge NEW DELHI SYSTRA in 2017. The two companies DUBAI have combined their complementary World’s Longest technical expertise to offer specialized Concrete Span engineering services in all facets of bridge TIANXINGZHOU BRIDGE design, construction, and maintenance. China World’s Fastest Design & SYSTRA’s Global Bridge Network consists Construction Supervision on any Metro Project of over 350 bridge specialists deployed 3rd PANAMA CANAL CROSSING worldwide, with Bridge Design Centers Colón, Panama World’s Longest located in San Diego, Montreal, São Paolo, Double Suspension Bridge SÃO PAOLO Paris, Dubai, New Delhi, and Seoul. MECCA (MMMP) METRO Saudi Arabia CHACAO BRIDGE BRIDGE DESIGN CENTERS Chacao, Chile • SERVICES • Tender Preparation • BIM / BrIM • Conceptual Design • Complex Drafting & Specialized Detailing • Pre-Bid Engineering • Realistic Graphics • Proposal Preparation - 3D Renderings - Visual Animation • Specifications Preparation - Construction Sequence Animation • Bids Analysis • Technical Assistance During Construction -

Gammon Speaks July

G AMMON SPEAKS 1 EDITORIAL COLUMN TIE -UP Dear Colleagues, Gammon signs JV agreement with Brookfield Multiplex It was heartening to note that the inaugural issue of ‘Gammon G ammon India Limited has recently Speaks’ was well received. entered into a joint venture agreement with the Multiplex Constructions India As a continuing process of using Pvt. Ltd, the Indian arm of Brookfield Multiplex, to cooperate together this medium for involving Team for tendering and negotiating for Gammon in sharing news, projects with various employers in views and achievements, we India. Under the agreement, both the present the second issue. Among (From left) Rob Devereux, Director, and parties would individually as well as Peter Mladenovic, Project Manager from other features this issue covers jointly investigate and identify tenders Brookfield Multiplex after the signing the upcoming iconic ISKCON for projects (high rise buildings that agreement with A.B. Desai, Executive Mayapuri temple project. The are 40 levels and above, cinemas/ Director Gammon India and P.V. Prasanth, COO, Gammon Realty. issue also features an article on multiplexes, retail and shopping the genesis of the organisation malls, stadiums, etc.) that are suitable They also have experience in specialist besides other regular features on for both the parties to undertake. design and construction of large retail, businesses and employees and commercial, residential projects and a recent tie-up with Brookfield Multiplex Group established in have built variety of major projects Multiplex featured alongside. Australia in 1962 by Mr. John C. Roberts across the globe. has been acquired by Brookfield Asset Please give us your feedback at Management (with headquarters in Brookfield Multiplex’s technical gammonspeaks@gammonindia. -

GAMMON INDIA LIMITED CIN: L74999MH1922PLC000997 Regd

GAMMON INDIA LIMITED CIN: L74999MH1922PLC000997 Regd. Office: Gammon House, Veer Savarkar Marg, Prabhadevi, Mumbai-400 025. Website: www.gammonindia.com Email: [email protected] Tel.: +91 22 61153000 Fax: +91 22 24300529 NOTICE TO SHAREHOLDERS NOTICE is hereby given that the Ninety Third Annual General Meeting of Gammon India Limited will be held on Tuesday, 24th March, 2015 at 3.30 p.m. at Ravindra Natya Mandir, (P. L. Deshpande Maharashtra Kala Academy), 3rd Floor (Mini Theatre), Sayani Road, Prabhadevi, Mumbai - 400 025 to transact the following business: ORDINARY BUSINESS: 1. To receive, consider and adopt the Audited Financial Statements of the Company for the 9 (nine) months period ended on 30th September, 2014 together with the Reports of the Board of Directors and the Auditors Reports thereon. 2. To appoint a Director in place of Mr. Digambar C. Bagde (DIN: 00122564) who retires by rotation and being eligible, offers himself for re-appointment. 3. To consider and if thought fit, to pass with or without modification(s), the following resolution as an Ordinary Resolution: “RESOLVED that pursuant to the provisions of Section 139 and all other applicable provisions of the Companies Act, 2013 (the “Act”) read with Rule 3(7) of the Companies (Audit and Auditors) Rules, 2014 (including any statutory modification(s) or re-enactment thereof for the time being in force), the Company hereby ratifies the appointment of M/s. Natvarlal Vepari & Co., Chartered Accountants (Firm Registration No. 106971W), as the Statutory Auditors of the Company to hold office from the conclusion of this meeting until the conclusion of the Annual General Meeting to be held for the financial year 2016-17 on such remuneration as may be determined by the Board of Directors.” SPECIAL BUSINESS: 4. -

Management System Certificate

MANAGEMENT SYSTEM CERTIFICATE Certificate No: Initial certification date: Valid: 183396-2015-AQ-IND-RvA 24, September, 2000 07, September, 2015 - 06, September, 2018 This is to certify that the management system of Gammon India Ltd. Gammon House, Veer Savarkar Marg, Prabhadevi, Mumbai - 400 025, Maharashtra, India and its project sites, including the sites as mentioned in the appendix accompanying this certificate has been found to conform to the Quality Management System standard: ISO 9001:2008 This certificate is valid for the following scope: DESIGN AND CONSTRUCTION OF CIVIL ENGINEERING STRUCTURES & PIPELINE PROJECTS IN INDIA AND ABROAD Place and date: For the issuing office: Chennai, 06, August, 2015 DNV GL – Business Assurance ROMA, No. 10, GST Road, Alandur, Chennai, PIN - 600 016, India Sivadasan Madiyath Management Representative Lack of fulfilment of conditions as set out in the Certification Agreement may render this Certificate invalid. ACCREDITED UNIT: DNV GL Business Assurance B.V., ZWOLSEWEG 1, 2994 LB, BARENDRECHT, NETHERLANDS. TEL:+31102922689. assurance.dnvgl.com Certificate No: 183396-2015-AQ-IND-RvA Place and date: Chennai, 06, August, 2015 Appendix to Certificate Gammon India Ltd. Locations included in the certification are as follows: Site Name Site Address Site Scope Gammon India Ltd. Gammon House, DESIGN AND CONSTRUCTION Veer Savarkar Marg, OF CIVIL ENGINEERING Prabhadevi, STRUCTURES & PIPELINE Mumbai - 400 025, PROJECTS IN INDIA AND Maharashtra, India ABROAD Gammon - Construtora Cidade Signature Bridge Project, CONSTRUCTION OF WAZIRABAD MAIN - Tensacciai JV DDA Land, Near Majnu Ka Tila, BRIDGE (CABLE STAYED) PROJECT Wazirabad, Delhi - 110 054, India Gammon - Mosmetrostroy JV Chennai Metro Rail Project, DESIGN AND CONSTRUCTION OF ASV Adarsh, Block C, UNDERGROUND STATIONS AT GOVERNMENT ESTATE, LIC Door No. -

Patna Highway Projects Limited.Pdf

Natvarlal Vepari & Co. CHARTERED ACCOUNTANTS Oricon House, 4th Floor, 12, K. Dubash Marg, Mumbai-400 023. • Tel: 67527100 • Fax: 6752 7101 • E-Mail: [email protected] INDEPENDENT AUDITOR'S REPORT To the Members of Patna Highway Projects Limited Report on the Standalone Financial Statements We have audited the accompanying standalone financial statements of Patna Highway Projects Limited ("the Company"), which comprises the Balance Sheet as at March 31, 2016, the Statement of Profit and Loss and the Cash Flow Statement for the period from 1st October 2014 to 31st March 2016 ("period"), and a summary of significant accounting policies and other explanatory information. Management's Responsibility for the Financial Statements The Company's Board of Directors is responsible for the matters stated in Section 134(5) of the Companies Act, 2013 ("the Act") with respect to the preparation of these standalone financial statements that give a true and fair view of the financial position, financial performance and cash flows of the Company in accordance with the accounting principles generally accepted in India, including the Accounting Standards specified under Section 133 of the Act, read with Rule 7 of the Companies (Accounts) Rules, 2014. This responsibility also includes maintenance of adequate accounting records in accordance with the provisions of the Act for safeguarding of the assets of the Company and for preventing and detecting frauds and other irregularities; selection and application of appropriate accounting policies; making judgments and estimates that are reasonable and prudent; and design, implementation and maintenance of adequate internal financial controls, that were operating effectively for ensuring the accuracy and completeness of the accounting records, relevant to the preparation and presentation of the financial statements that give a true and fair view and are free from material misstatement, whether due to fraud or error. -

Annual Report 2017-2018

96TH ANNUAL REPORT 2017-2018 GAMMON INDIA LIMITED GAMMON INDIA LIMITED CORPORATE INFORMATION BOARD OF DIRECTORS BANKERS/FINANCIAL INSTITUTIONS Mr. Abhijit Rajan ICICI Bank Limited Chairman Canara Bank IDBI Bank Limited Mr. Jaysingh Ashar Punjab National Bank Executive Director Syndicate Bank Bank of Baroda Mr. Soumendra Nath Sanyal Independent Director United Bank of India Union Bank of India Mr. Ulhas Prabhakar Dharmadhikari Allahabad Bank Independent Director Bank of Maharashtra Oriental Bank of Commerce Mr. Sugato Prosanno Ghosh Nominee Director UCO Bank United India Insurance Mr. Ajit B. Desai Central Bank of India Chief Executive Officer Karnataka Bank Indian Bank Mr. Anurag Choudhry Chief Financial Officer DBS Bank Life Insurance Corporation of India Ms. Niki Shingade General Insurance Corporation of India Company Secretary CONTENTS AUDITORS M/s. Nayan Parikh & Co. Corporate Information............................................. 2 About Gammon Group ........................................... 3 REGISTERED OFFICE rd Floor 3 , Plot No - 3/8, Hamilton House, Chairman’s Statement ............................................ 4 J.N. Heredia Marg, Ballard Estate, Mumbai 400038, Maharashtra, India. Key Projects – KYC ................................................ 6 Telephone: +91-22-22705562 E-mail Id: [email protected] Management and Discussion Analysis ................... 7 Website: www.gammonindia.com Directors Report ..................................................... 9 REGISTRAR & SHARE TRANSFER AGENT Report on Corporate Governance .......................... 35 M/s. Link Intime India Private Limited C 101, 247 Park, L B S Marg, Vikhroli West, Financial Statements .............................................. 50 Mumbai 400 083 Tel No: +91 22 49186000 Consolidated Accounts ........................................... 118 Fax: +91 22 49186060 E-mail Id: [email protected] 2 ANNUAL REPORT 2017-18 ABOUT GAMMON GROUP Gammon India Limited (“GIL” or “the Company”) incorporated in 1922, is an Engineering, Procurement and Construction Company. -

CLASS' A' 1 M/S.Radhakrishan Constn 4, Dhairya House, Plot No

ANNEXURE - VIII APPROVED LIST OF CONTRACTORS AS ON 20/09/16 (AS PER NEW POLICY) VIII BL- BUILDINGS AND WATERSUPPLY, ETC. Communication Details S.No. Name of Agency Pan No. Address/Phone/Fax/e-mail CLASS' A' 1 M/s.Radhakrishan Constn 4, Dhairya House, Plot No. 242, 4th AAAPH 4432R Co., Floor, 7th Road, Khar (W), Mumbai 400 052. Phone : 022- 26051822, Mobile : 9820052285, 9820310513, 9820159688 2 Shri R.P.Shiva, Smile Housing Colony, AKWPS1790F C-3/176/A2, Opp. Hotel Missel, Ribandar - Goa Mobile : 9422060358 Phone: 0832-2444412 3 P. Ramchandra, H.No.:508, Vaibhav Building, ACOPR 1545F Dr.Kamalakar Road, Karwar, Uttar Kannada (Dist.) Karnataka- 581 301. Mobile- 9449818848 4 Gammon India Ltd. Gammon House, Veer Sawarkar Marg, AAACG 3821A P.O.Box.No.9129, Prabhadevi, Mumbai-400 025 Fax : 022 - 24300221 Phone : 022-61114000 Email :[email protected] 5 P.L. Prabhu, Alvekodi, Main Road, Kumta , ADWPP 7090 E . Pin-581343 Phone : 08387 - 254899 Fax : 08386 / 221623 Mobile : 9448480985 6 M/s. Standard Y-153, Block - 29, Neyveli. (Tamilnadu) AAVFS8468D Rehabilitators Pvt. Ltd. Pin- 607807. Phone : 04142 - 257279 Mobile : 09443226826 Fax : 04142 - 257287 Email :[email protected] 7 Sri. Jagadish V. Pai Mahalsa Associates D.No.4-24/11, ABLPP7091G Shreya towers , Opp Vidyadayinee School, Surathkal, Mangalore-575014. Tel- 0824-4278440, Mob-9448405148 E.mail:[email protected] m. 8 M/s. Jai Shree Ram Gajanand Krupa Sadan, Flat No.302, ADFPB9082R Plot No. D- 111, Sector-20, Opp. Sector- 24, Nerul (W), Navi Mumbai 400 706. Phone : 27700686 Mobile : 9870441584 Communication Details S.No. Name of Agency Pan No. -

Notice of the Court Convened Meeting of the Unsecured Creditors of the Applicant Company Is Also Posted on the Website of the Company Viz

GAMMON INDIA LIMITED [CIN No.L74999MH1922PLC000997] Registered Office: Gammon House, Veer Savarkar Marg, Prabhadevi, Mumbai - 400 025, India. Tel. +91 22 6111 4000 Fax: +91 22 2430 0221 Email: [email protected], Website: www.gammonindia.com COURT CONVENED MEETING OF THE UNSECURED CREDITORS OF GAMMON INDIA LIMITED Day : Friday Date : 6th January, 2017 Time : 4.00 P.M. IST or immediately after the conclusion of the Court Convened Meeting of the Equity Shareholders Venue : Textiles Committee, P. Balu Road, Prabhadevi Chowk, Prabhadevi, Mumbai – 400 025 Sr. Contents Page No. No. 1. Notice of Court Convened Meeting of the Unsecured Creditors of Gammon India Limited 02-03 (‘Transferor Company’) 2. Explanatory Statement under Section 393 of the Companies Act, 1956 and other applicable 04-10 provisions of the Companies Act, 2013 3. Scheme of Arrangement under Sections 391 to 394 of the Companies Act, 1956 and other 11-22 relevant provisions of the Companies Act, 2013 between Gammon India Limited and Gammon Engineers and Contractors Private Limited and their respective Shareholders and Creditors 4. Observation Letters issued by the BSE Limited and National Stock Exchange of India Limited 23-25 dated November 10, 2016 respectively 5. Valuation Report dated July 20, 2016 from SSPA & Co., Chartered Accountants 26-35 6. Fairness Opinion dated July 20, 2016 from Saffron Capital Advisors Private Limited 36-46 7. Complaints Report dated September 26, 2016 filed with BSE Limited and National Stock 47-48 Exchange of India Limited 8. Form of Proxy Enclosed 9. Attendance Slip Enclosed 1 IN THE HIGH COURT OF JUDICATURE AT BOMBAY ORDINARY ORIGINAL CIVIL JURISDICTION COMPANY SUMMONS FOR DIRECTION NO. -

Government of India Road Transport and Highways Lok Sabha

GOVERNMENT OF INDIA ROAD TRANSPORT AND HIGHWAYS LOK SABHA UNSTARRED QUESTION NO:182 ANSWERED ON:03.12.2003 TENDERS INVITED BY NATIONAL HIGHWAYS AUTHORITY OF INDIA RAM PRASAD SINGH Will the Minister of ROAD TRANSPORT AND HIGHWAYS be pleased to state: (a) whether the National Highways Authority invites tenders on a large scale for constructing national highways; (b) if so, the number of tenders invited during the last three years, State-wise alongwith the names of companies which participated in these tenders; (c) whether the National Highways Authority has awarded contract on a large scale to the undertakings owned by the Government of India and State Governments for constructing national highways; (d) if so, the number of works for which contract has been awarded to those Government Undertakings during the last three years; (e) whether these Government undertakings subcontract their works to other private companies after securing contract; and (f) if so, the reasons therefore? Answer THE MINISTER OF STATE IN THE MINISTRY OF ROAD TRANSPORT AND HIGHWAYS(SHRI PON. RADHAKIRISHNAN) (a) Yes Sir. (b) The information is contained in Statement `A`. (c) to (f) Two civil work contracts have been awarded to Undertakings, owned by Govt. of India and State Govts. The details are contained in Statement `B` STATEMENT - 'A' STATEMENT REFERRED TO IN REPLY TO PART (b) OF LOK SABHA UNSTARRED QUESTION NO. 182 FOR ANSWER ON 3.12.2003 ASKED BY SHRI RAM PRASAD SINGH REGARDING TENDERS INVITED BY NATIONAL HIGHWAYS AUTHORITY OF INDIA. State Number of tenders invited during Names of companies who participated in the last three tender years(2000-01, 2001-02,2002-03) 1.