Downloads/Send/49-2013/ 216-Management-S-Discussion-And-Analysis-For-The-Three-And-Twelve-Months-Ended-December-31-2012 (Accessed on 18 November 2016)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mineral Profile

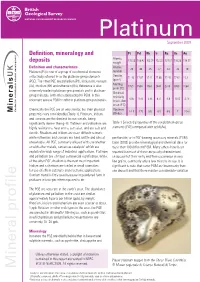

Platinum September 2009 Definition, mineralogy and Pt Pd Rh Ir Ru Os Au nt Atomic 195.08 106.42 102.91 192.22 101.07 190.23 196.97 deposits weight opme vel Atomic Definition and characteristics 78 46 45 77 44 76 79 de number l Platinum (Pt) is one of a group of six chemical elements ra UK collectively referred to as the platinum-group elements Density ne 21.45 12.02 12.41 22.65 12.45 22.61 19.3 (gcm-3) mi (PGE). The other PGE are palladium (Pd), iridium (Ir), osmium e Melting bl (Os), rhodium (Rh) and ruthenium (Ru). Reference is also 1769 1554 1960 2443 2310 3050 1064 na point (ºC) ai commonly made to platinum-group metals and to platinum- Electrical st group minerals, both often abbreviated to PGM. In this su resistivity r document we use PGM to refer to platinum-group minerals. 9.85 9.93 4.33 4.71 6.8 8.12 2.15 f o (micro-ohm re cm at 0º C) nt Chemically the PGE are all very similar, but their physical Hardness Ce Minerals 4-4.5 4.75 5.5 6.5 6.5 7 2.5-3 properties vary considerably (Table 1). Platinum, iridium (Mohs) and osmium are the densest known metals, being significantly denser than gold. Platinum and palladium are Table 1 Selected properties of the six platinum-group highly resistant to heat and to corrosion, and are soft and elements (PGE) compared with gold (Au). ductile. Rhodium and iridium are more difficult to work, while ruthenium and osmium are hard, brittle and almost pentlandite, or in PGE-bearing accessory minerals (PGM). -

Integrated Annual Report 2020

ANGLO AMERICAN PLATINUM LIMITED INTEGRATED ANNUAL REPORT 2020 REPORT ANNUAL INTEGRATED Integrated annual report 2020 Anglo American Platinum Limited Purpose: re-imagining mining to improve people’s lives We are grounded in our purpose to re-imagine mining to improve people’s lives. We are transforming the very nature of mining for a safer, cleaner, smarter future. We are using more precise technologies, less energy and less water; we are reducing our physical footprint for every ounce of PGM and base metal we produce. We are combining smart innovation with the utmost consideration for our people, their families, local communities, our customers, and the world at large – to better connect precious resources in the ground to all of us who need and value them. Our focus is on our four strategic priorities to deliver the next phase of value creation for stakeholders. – Stimulate new markets and leverage new capabilities – Embed anti-fragility across our business – Maximise value from our core – Be a leader in ESG Refers to other pages in this report Supporting documentation on the website Full annual financial statements (AFS) Full Ore Reserves and Mineral Resources report Environmental, social and governance (ESG) report Notice of annual general meeting www.angloamericanplatinum.com/investors/annual-reporting/2020 Contents 1 Our report 4 Strategy, PGM markets and 99 Our economic contribution in Zimbabwe business model in 2020 1 Approach to reporting 101 Mining and concentrator operations review 2 Reporting principles 38 Strategic priorities -

Heraeus Precious Appraisal I 1 Precious Metals Review

HERAEUS PRECIOUS Ed. 36 APPRAISAL th 14 October 2019 MARKET SPOTLIGHT Implats aligns its output more closely with future order books Impala Platinum (Implats) is acquiring North American Palladium (NAP) for ~$758 million. Implats will gain an existing mine, Lac des Iles, which is a primary palladium mine. It has very small amounts of platinum, gold and copper by-products. This will provide Implats with immediate low-cost palladium production at a time when palladium prices are very high and are expected to remain high. NAP reported all-in sustaining costs of $875/oz in H1’19, against an average palladium price of $1,411/oz. The acquisition reduces the combined company’s average cost of production. Lac des Iles is situated in Canada so this also provides geographic diversification of production and reduces the company’s exposure to high-cost, deep-level conventional mining. The acquisition does not add any extra palladium production to the market. Impala’s output moves closer to what the market requires. Based on 2018 production, the addition of Lac des Iles’ output to that of Implats increases attributable palladium output by 37% to 887 koz and Implats’ palladium output stays fairly stable going forward. This reduces the ratio of the company’s platinum to palladium production significantly from 1.71:1 to 1.27:1. The ratio of platinum to palladium demand globally (excl. investment) in 2018 was 0.70:1, and palladium demand is expected to grow faster than platinum demand. Implats has the potential to maintain or increase its palladium production. Lac des Iles’ life-of-mine could be extended beyond 2027. -

Predictability of Pothole Characteristics and Their Spatial Distribution At

79_Chitiyo:Template Journal 12/15/08 11:16 AM Page 733 Predictability of pothole characteristics J o and their spatial distribution at u Rustenburg Platinum Mine r n by G. Chitiyo*, J. Schweitzer*, S. de Waal*, P. Lambert*, and a P. Olgilvie* l P a p Synopsis thermo-chemical erosion of the cumulus floor by new influxes of superheated magma best explains the observed data. e Prediction of pothole characteristics is a challenging task, Partial to complete melting of the cumulate floor occurred in r confronting production geologists at the platinum mines of three phases. The first represents the emplacement of hot the Bushveld Complex. The frequency, distribution, size, magma. This magma, due to turbulent flow and high chemical shape, severity and relationship (FDS3R) of potholes has a and physical potential, aggressively attacks the existing floor huge impact on mine planning and scheduling, and (crystal mush on the magma/floor interface). Regional consequently cost. It is with this in mind that this study was erosion is manifested by large, often coalescing potholes. initiated. During the second phase, when the magma emplacement Quantitative analysis of potholes indicates that pothole process ceased and cooling in situ started, two distinct size (area covered) can be described by two partly periods of pothole formation ensued. The first is related to overlapping lognormal distributions. These are referred to as rapid cooling along the relatively steep part of the Newton Populations A (smaller) and B (larger). The range of Cooling Curve, when Population B potholes nucleated observed pothole sizes conforms to a simple double randomly and grew rapidly with concurrent convective exponential growth model based on Newton’s Cooling Curve. -

STRATIFORM and ALLUVIAL Plafl NUM MINERALIZATION in THE

LU3 The Canadian M iner alog is t Vol. 33,pp. 1023-lM5(1995) STRATIFORMAND ALLUVIALPLAfl NUM MINERALIZATION IN THENEW CALEDONIA OPHIOLITE COMPLEX THIERRY AUGE lNI PIERREMATIRZOT BRGM'Metallogeny and Geotynarnics", B.P. 6009, 45060 Orldans Cedex 2, France ABSTRA T An unusualtype offt mineralizationhas beenfound in the New Caledoniaophiolite complex, associatedwitl stratiform chromite-bearingrocks at the baseof the cumulateseries (close to the transition zone betweendunite and pyroxene-bearing rocks) and with cbromite-richpyroxenite dykes from the samezone. Two placer deposis, both enrichedin Fl also have been recognized one derived from the chromite-rich horizons and the other a cbromitiferous beach sand of unknown origin. Chromite-bearingrocks aremarked by a very strongenrichment in Pt relative to fhe other platinum-groupelements (PGE), $'ith a rrardmunconcentration of 11.5ppm (average3.9 ppm). The Pt enrichmenttakes the form of platinum-groupminerals (PGM) included in chromite crystals and is interpretedas being pdlrar'/. The following minerals have been identified: ft-Fe{u alloys (isoferroplatinum,tulame€nite, tetraferroplatinum and undeterminedphases), cooperite, laurite, bowieite, malanite, cuprorhodsite,unnamed PGE oxides, and base-metalsulfides with PGE in solid solution. The associatedplacers show a slightly different mineral association,with isoferroplatinum,tulameenite, and rare cooperite,sperrylite, Os-k-Ru alloys and PGE oxides. A more complex paragenesishas been identified in the beach san4 with isoferroplatinum,cooperite, laurite, erlichmanite, Os-Ir-Ru alloys, bowieite, ba$ite, hollingworthire, sperrylite, stibiopalladinite, and unnamed Rh sulfide, Pt-Ru-Rh alloy and PGE oxides. This type of mineralization, which differs markedly from the Os-Ru-h mineralization previously recognized in podiform cbromitite in New Caledonia, shows several analogies with Alaskan-type PGE mineralization.The host chromitite,with typical cumulustextwes, is markedby Ti and Feh emichmentdue to derivationfrom an evolved liquid. -

ECONOMIC GEOLOGY RESEARCH INSTITUTE HUGH ALLSOPP LABORATORY University of the Witwatersrand Johannesburg

ECONOMIC GEOLOGY RESEARCH INSTITUTE HUGH ALLSOPP LABORATORY University of the Witwatersrand Johannesburg CHROMITITES OF THE BUSHVELD COMPLEX- PROCESS OF FORMATION AND PGE ENRICHMENT J.A. KINNAIRD, F.J. KRUGER, P.A.M. NEX and R.G. CAWTHORN INFORMATION CIRCULAR No. 369 UNIVERSITY OF THE WITWATERSRAND JOHANNESBURG CHROMITITES OF THE BUSHVELD COMPLEX – PROCESSES OF FORMATION AND PGE ENRICHMENT by J. A. KINNAIRD, F. J. KRUGER, P.A. M. NEX AND R.G. CAWTHORN (Department of Geology, School of Geosciences, University of the Witwatersrand, Private Bag 3, P.O. WITS 2050, Johannesburg, South Africa) ECONOMIC GEOLOGY RESEARCH INSTITUTE INFORMATION CIRCULAR No. 369 December, 2002 CHROMITITES OF THE BUSHVELD COMPLEX – PROCESSES OF FORMATION AND PGE ENRICHMENT ABSTRACT The mafic layered suite of the 2.05 Ga old Bushveld Complex hosts a number of substantial PGE-bearing chromitite layers, including the UG2, within the Critical Zone, together with thin chromitite stringers of the platinum-bearing Merensky Reef. Until 1982, only the Merensky Reef was mined for platinum although it has long been known that chromitites also host platinum group minerals. Three groups of chromitites occur: a Lower Group of up to seven major layers hosted in feldspathic pyroxenite; a Middle Group with four layers hosted by feldspathic pyroxenite or norite; and an Upper Group usually of two chromitite packages, hosted in pyroxenite, norite or anorthosite. There is a systematic chemical variation from bottom to top chromitite layers, in terms of Cr : Fe ratios and the abundance and proportion of PGE’s. Although all the chromitites are enriched in PGE’s relative to the host rocks, the Upper Group 2 layer (UG2) shows the highest concentration. -

Impala Platinum Minpro Rustenburg, South Africa (2012)

CASE STUDY Impala Platinum Minpro Rustenburg, South Africa (2012) BACKGROUND Impala Platinum Holdings Limited (Implats) is in the business of mining, refining, and marketing of OWNER: platinum group metals, as well as nickel, copper and cobalt. Imapala is also the second largest producer Impala Platinum Mineral of platinum in the world. Processes The Impala Platinum slag granulation cooling tower in Rustenburg had several flaws that were causing ENGINEER: cracks and severe water leakage. Because of the nature of this process, the reservoir could not be G & H Consulting Engineers emptied for this repair process as not only would it stagnate their smelting process but it would incur enormous labour and operational costs. Therefore, repairs would have to be to the negative side. CONTRACTOR: Sanika Waterproofing Impala had numerous contractors come and do a test panel on the negative side of the structure to see if their solution would work for this extremely large 6m (20 ft) deep reservoir structure. APPLICATOR: Sanika Waterproofing Kryton was the only successful product on these test panels, as such, Sanika Waterproofing were DISTRIBUTOR: awarded the contract to repair and waterproof this structure using Kryton’s Crack Repair System. Sanika Waterproofing SOLUTION PRODUCTS: Sanika had to remove the unsuccessful membranes and other products from the structure to prepare Learn more at kryton.com it for the crack repair and waterproofing process. After preparing the surface Sanika had to act Krystol® Crack Repair System quickly with Krystol Plug as the water penetrating through the cracks was at a temp of over 80 C° (176 F°). After the Krystol Plug successfully stopped the flow of water Sanika employed the rest of the Krystol Crack Repair System followed by a coat of Krystol T1 & T2 to completely waterproof the reservoir. -

F Makwara (PDF)

CHROMITE GEOLOGY OF ZIMBABWE AND RELATED MINING CHALLENGES PRESENTATION GREAT DYKE : MUTORASHANGA AUGUST 2017 2 WORLD CHROME RESOURCE Estimate World Chromite Resource : +-12 Billion Tonnes • South Africa : 72% of world Resource - Stratiform • Zimbabwe: 12% -Stratiform & podiform • Kazakhstan: 4% - Podiform • Finland : 2% -Podiform • India : 1% -Podiform • Turkey and others : 9% -Largely podiform But Zimbabwe companies producing at full capacity is not in the top 5 producing companies . STRATIFORM & PODIFORM GEOLOGY LOCATION GEOLOGY MAP - ZIMBABWE MASHONALAND CENTRAL MASHONALAND WEST CHIRUMANZU MIDLANDS MASVINGO MBERENGWA 5 LOCATION OF STRATIFORM CHROMITE RESOURCE • Mashonaland Central: North Dyke Tengenenge Impinge Birkdale Mutorashanga • Mashonaland West: Middle Dyke Ngezi Darwendale Maryland Lembe/Mapinga Mutorashanga • Midlands: South Dyke Lalapanzi Mapanzure Bannockburn CSC LOCATION OF PODIFORM CHROMITE RESOURCES • Midlands: Valley Nhema Chirumanzu Mberengwa • Masvingo: Mashava THE GREAT DYKE AND PODIFORMS GEOLOGY • THE GREAT DYKE • Tengenenge to Mberengwa, Location • Stretches for 550km and is 4-11km wide. • PODIFORM • Isolated chrome resources in Shurugwi,Mashava ,Nhema ,Valley, Chirumanzu and Mberengwa • THE DYKE : STRATIFORM • Chromite hosts rocks are :Harzburgite, dunite, serpentinite and pyroxenite Host Rock • PODIFORM • Chromite host rocks are: Serpentinite ,Silicified Talc Carbonate and Talc Carbonate • 10 known seams, The 11 th seam is poorly exposed in the North Dyke • 8cm to 40cm thickness Chrome Seams • Average vertical spacing of seams is 30-40m • Geotechnical Parameters considered fore seams are: Seam Widths, quality, dip, friability, & continuity • Platinum Group Metals Known Minerals in • Chrome the Dyke • Asbestos • Nickel 8 CHROMITE RESOURCES • The dyke intruded as an ultramafic sill ,estimated age 2.7 Ga . STRATIFORM • 11 seams are known to exist on the Great Dyke, but not evenly distributed through out the dyke. -

Mining Within Zimbabwe's Great Dyke: Extent , Impacts & Opportunities

Mining Within Zimbabwe’s Great Dyke: Extent , Impacts & Opportunities Authors: Gilbert Makore & Veronica Zano Published by: Zimbabwe Environmental Law Association (ZELA) Sponsored by: International Alliance on Natural Resource in Africa (IANRA) Authors: Gilbert Makore and Veronica Zano Editor: Muduso Dhliwayo Copyright: 2012. Zimbabwe Environmental Law Association (ZELA) This publication may be reproduced in whole or in part and in any form for educational or non-profit uses, without special permission from the copyright holder, provided full acknowledgement of the source is made. No use of this publication may be made for resale or other commercial purposes without the prior written permission of ZELA. Year of Publication: 2012 Available from: Zimbabwe Environmental Law Association (ZELA), No. 6 London Derry Road, Eastlea, Harare, Zimbabwe: Tel: 253381; 252093, Email: , Website: www.zela.org Zimbabwe Environmental Law Association International Alliance on Natural Resource in Africa International Alliance on Natural Resources in Africa MINING WITHIN ZIMBABWE’S GREAT DYKE: EXTENT , IMPACTS AND OPPORTUNITIES I Table of Contents Executive Summary: 1 The Great Dyke Mineral Belt: 2 Mining and Mining Development Contribution to Economic Growth: 5 Companies operating in the Great Dyke: 10 Communities along the Great Dyke: 12 Impacts of Mining on the Great Dyke Communities: 14 Recommendations: 19 Conclusion: 20 MINING WITHIN ZIMBABWE’S GREAT DYKE: EXTENT , IMPACTS AND OPPORTUNITIES ii Executive Summary The Great Dyke is a seam of ore-bearing rock that goes from the north to the south of Zimbabwe. The Dyke spans a total length of 550kms and has a maximum width of 11kms. This geological feature represents an important resource for Zimbabwe's national economy and the local communities' livelihoods. -

Media Release 23 September 2014 Letter to the Editor

Lonmin Plc 4 Grosvenor Place London SW1X 7YL United Kingdom T: +44 (0)20 7201 6000 F: +44 (0)20 7201 6100 Media Release www.lonmin.com 23 September 2014 Letter to the Editor - Mail and Guardian The M&G's story on Lonmin's historic tax affairs published on Friday 19 September 2014 contained significant inaccuracies and material omissions. Disappointingly, the lengthy answers provided to the M&G’s detailed questions were not reported. Any suggestion of potential illegality around Lonmin’s historic tax affairs is seriously damaging to the Company's reputation, not least because such allegations are wholly and absolutely false. The following facts and context, missing from the published article, are vital in judging its accuracy. 1. The Western Metal Sales (WMS) structure referred to was a structure not uncommon to old world conglomerates. The structure was in no way illegal and did not benefit Lonmin from a tax perspective as Lonmin remained liable for the payment of taxes in the UK arising from legitimate and reasonable commissions paid to Western Metal Sales. 2. This structure was changed in 2007 when Lonmin took a decision to move its marketing services to South Africa. 3. The move was based on cost concerns (having a company registered in Bermuda and operating out of London was expensive) and resulted in marketing personnel being based closer to Lonmin’s operations. 4. A transitional arrangement was put in place for 18 months and thereafter, from 1 October 2008, the marketing commission paid to Lonmin Management Services (LMS) was entirely taxable in South Africa. -

Implats Front to CP.Qxp

ANNUAL REPORT 2004 IMPALA PLATINUM HOLDINGS LIMITED IMPALA PLATINUM HOLDINGS LIMITED ANNUAL REPORT 2004 WWW.IMPLATS.CO.ZA Report profile This annual report covers the period 1 July 2003 to 30 June 2004. Information has been provided for comparative purposes for five years (FY2000 to FY2004). Additional statistics going back to FY1997 are provided on the company’s website at www.implats.co.za. Information relating to the market has been provided per calendar year. The report has been prepared in accordance with South African Statements of Generally Accepted Accounting Practice, International Financial Reporting Standards and in the manner required by the South African Companies Act and in line with the regulations of the JSE Securities Exchange South Africa (JSE). It has also taken into account the guidelines of the King Report 2002, the JSE Social Responsibility Index and the Global Reporting Initiative (GRI), particularly those applicable to Implats’ direct economic impact, environmental and human capital performance. No significant changes have occurred in terms of the size, structure and operation of the group during the year under review,other than the sale of 83.2% stake in Barplats Investments Limited. The transaction for the sale of a significant strategic interest (Implats’ stake in Western Platinum Limited and Eastern Platinum Limited) is nearing finalisation and is reported on fully in this document. Reporting of reserves and resources is in accordance with each company’s listing requirements. Mineral Reserves and Mineral Resources for Implats’South African operations are reported in accordance with the principles and guidelines of the South African Code for Reporting of Minerals Reserves and Mineral Resources (SAMREC Code). -

Indian Gold Book:Indian Gold Book

AN INTRODUCTION TO THE INDIAN GOLD MARKET MAJOR SPONSOR WORLD GOLD COUNCIL CORPORATE SPONSOR RAND REFINERY LIMITED Published by Virtual Metals Research & Consulting Ltd and Grendon International Research Pty Ltd AN INTRODUCTION TO THE INDIAN GOLD MARKET INDUSTRY COMMENTS Comments in letters, faxes and emails include: Reserve Bank of India (“an excellent work”), State Bank of India (“excellent coverage”) and The Gem & Jewellery Export Promotion Council (“a wonderful, educative, informative book”). “This volume is an absolute boon … The resulting accumulation of facts and data is of fantastic value to anyone who wants to understand the history and nature of the world’s most important market for gold.” London Bullion Market Association “It has provided an excellent basis for the Council and its members to learn about the complex dynamics of the market, and also is a strong foundation for us to review our operational business plans and strategies for the Indian market … it has added significant value to our operations there.” World Gold Council “It is necessary to understand the intricacy of market structures and the historical sequence of events (of the Indian gold market). The book by Nigel Desebrock … provides a veritable gold mine of authentic information”. S.S. Tarapore (former Deputy Governor, Reserve Bank of India), Financial Express (India) PHONE AND FAX NUMBERS IN INDIA In October 2002, Mumbai telephone exchanges either prefixed a “2” to the local number, or replaced the first digit with “56”. Since then, exchanges in other cities have also made changes. In this publication, while the listed Mumbai numbers take the changes into account, numbers for other parts of the country do not.