Fidelity® Select Portfolio® Semiconductors Portfolio

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chapter 2 Hon Hai/Foxconn: Which Way Forward ?

Chapter 2 Hon Hai/Foxconn: which way forward ? Gijsbert van Liemt 1 1. Introduction Hon Hai/Foxconn, the world's leading contract manufacturer, assembles consumer electronics products for well-known brand-names. It is also a supplier of parts and components and has strategic alliances with many other such suppliers. Despite its size (over a million employees; ranked 32 in the Fortune Global 500) and client base (Apple, HP, Sony, Nokia), remarkably little information is publicly available on the company. The company does not seek the limelight, a trait that it shares with many others operating in this industry. Quoted on the Taiwan stock exchange, Hon Hai Precision Industry (HHPI) functions as an ‘anchor company’ for a conglomerate of companies. 2 As the case may be, HHPI is the sole, the majority or a minority shareholder in these companies and has full, partial or no control at all. Many subsidiaries use the trade name Foxconn and that is why this chapter refers to the company as Hon Hai/Foxconn. Among its many subsidiaries and affiliates are Ambit Microsystems, Cybermart, FIH Mobile, Fu Taihua Industrial, Hong Fujin Precision and Premier Image. After a near hundredfold increase in sales in the first decade of this century Hon Hai/Foxconn's sales growth slowed down drastically. The company is facing several challenges: slowing demand growth in its core (electronics) business; a weakening link with Apple, its main customer; rising labour costs and a more assertive labour force in China, its main production location; and pressure from its shareholders. 1. Copyright 2015 Gijsbert van Liemt. -

Outsourcing in Japan Outsourcing of Electronic Assemblies by Japanese DNA

Vol. 27, No. 5 May 2017 Outsourcing in Japan Outsourcing of electronic assemblies by Japanese DNA. There was also the issue of Foxconn is the largest supplier (see Table Japanese companies has always been quality. Japanese OEMs were known for their 2), with an estimated 2.5 million square feet considered one of the “final frontiers” for intense dedication to 100% total quality and of manufacturing capacity, followed by EMS suppliers. Japanese OEMs have didn’t trust any third-party suppliers to live up other Tier 1 EMS suppliers such as Delta, always considered manufacturing one of to their standards. And there were cultural Flex, Jabil, Pegatron, and Sanmina. But it their core competencies, and for a long issues that involved language and behaviors is the domestic suppliers that are of interest; time resisted engaging EMS companies. that were unique to the Japanese, resulting in these include Di-Nikko Engineering, SIIX, Additionally, the supply chain was well these OEMs simply being more comfortable UMC, and a recently discovered EMS established for the parts and mechanical working with Japan-based companies. company named Kaga Electronics. assemblies that are essential to Breaking into the Japanese EMS market was Kaga Electronics is a sizable $3 billion mechanical products like copiers, fax like trying to break into Fort Knox for many conglomerate consisting of the EMS machines, and other office automation Western EMS firms. division ($700 million); a parts, components, equipment. But a number of factors Yet today, EMS in Japan is quite pervasive, and power supply business named Taxan; conspired to bring the Japanese to the though it did not happen overnight. -

Abbott Laboratories Advanced Micro Devices, Inc

FORTUNE 1000 CUSTOMERS equipped with the power to save lives 3M (3 Com Corporation) Gannett Co, Inc. Pittston Co 3M (3M Company) General Electric Pratt & Whitney Abbott Laboratories Gencorp Praxair Advanced Micro Devices, Inc. General Dynamics Corporation Procter & Gamble Agilent Technologies, Inc. General Mills Progressive Insurance AK Steel General Motors Purolator Alcoa Gillette Quantum Corporation Allstate Gold Kist, Inc. Raytheon Amazon Goldman Sachs Group, Inc. Readers Digest Amerada Hess Corporation Goodyear Reebok American Express Great Lakes Chemical Corp Revlon, Inc. Anadarko Petroleum Corporation Guidant Corporation Rockwell International AON Corporation Halliburton Company Rohm and Haas Company Apache Corporation Harley-Davidson Safeco Corporation Applied Materials Harris Corporation Sentry Insurance Ashland, Inc. Heinz Sherwin-Williams AT&T Hercules Incorporated Sierra Pacific Resources Ball Corporation Hewlett Packard Sisco Bank of America Corporation Hilton Spartan Stores Bank of New York Company, Inc. Hon Industries, Inc. Sprint Bear Stearns Companies, Inc. Honeywell Solectron Corporation Bethlehem Steel Hubbell Corporation Solutia, Inc. Blockbuster IBM Southern Company Boeing Intel Southern Union Company, Inc. Bristol-Myers Squibb International Paper Standard Register Company Cabot ITT Industries, Inc. State Farm Calpine Corporation Jabil Circuit, Inc. Steelcase, Inc. Carrier Corporation John Deere Textron, Inc. Caterpillar Johnson & Johnson The Gap Charter Communications, Inc. Johnson Controls Timberland Company Chevron -

Anthony Harris October 2014

Anthony Harris October 2014 Summary Understanding the financial relationships between Electronic Manufacturing Services (EMS) providers such as Flextronics, Foxconn and Jabil and the Brand Names of consumer electronics is crucial in all efforts to improve working conditions in the sector. According to Tony Harris, so far most efforts to improve workers conditions have been directed at tragedy event reaction, audits, naming and shaming and union representation yet all have fallen short of expectations. Tony Harris is retired after years of experience in the sector, and supporting the goals of the GoodElectronics Network and the makeITfair project, says whether we like it or not, money is the driving factor for all business decisions. Environmental concerns, compliance to health and safety and worker representation etc. are secondary or tertiary ‘add-on’s in the primary nature of business decision makers. Mr. Harris shows where the economic tension between EMS providers and the brands comes from and how these billion dollar tensions play out on the backs of impoverished workers who are willing to give up their night’s sleep for a few dollars more for basic cost coverage as well as remittance to feed their families. In the following back ground article he shows it is all about margins and explains the standard mark-up on the factory price, the technique of Purchase Price Variance (PVV) and the Profit Life Cycle of fast moving consumer electronics. In other words, how does a $100 electronic factory priced product become a $500 consumer product while the people making that product receive so little under marginalized operating conditions? About the author The author Anthony Harris worked from 1979–1993 for Philips Electronics as Senior consultant Video product safety and liability and Divisional Quality Manager for: Video recording, Passive components and medical systems. -

2019 Public Supplier List

2019 Public Supplier List The list of suppliers includes original design manufacturers (ODMs), final assembly, and direct material suppliers. The volume and nature of business conducted with suppliers shifts as business needs change. This list represents a snapshot covering at least 95% of Dell’s spend during fiscal year 2020. Corporate Profile Address Dell Products / Supplier Type Sustainability Site GRI Procurement Category Compal 58 First Avenue, Alienware Notebook Final Assembly and/ Compal YES Comprehensive Free Trade Latitude Notebook or Original Design Zone, Kunshan, Jiangsu, Latitude Tablet Manufacturers People’s Republic Of China Mobile Precision Notebook XPS Notebook Poweredge Server Compal 8 Nandong Road, Pingzhen IoT Desktop Final Assembly and/ Compal YES District, Taoyuan, Taiwan IoT Embedded PC or Original Design Latitude Notebook Manufacturers Latitude Tablet Mobile Precision Notebook Compal 88, Sec. 1, Zongbao Inspiron Notebook Final Assembly and/ Compal YES Avenue, Chengdu Hi-tech Vostro Notebook or Original Design Comprehensive Bonded Zone, Manufacturers Shuangliu County, Chengdu, Sichuan, People’s Republic of China Public Supplier List 2019 | Published November 2020 | 01 of 40 Corporate Profile Address Dell Products / Supplier Type Sustainability Site GRI Procurement Category Dell 2366-2388 Jinshang Road, Alienware Desktop Final Assembly and/ Dell YES Information Guangdian, Inspiron Desktop or Original Design Xiamen, Fujian, People’s Optiplex All in One Manufacturers Republic of China Optiplex Desktop Precision Desktop -

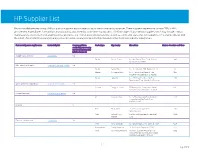

HP Supplier List

HP Supplier List Below is an alphabetized listing of HP production suppliers and information about their sustainability practices. These suppliers represent more than 95% of HP’s procurement expenditures for materials, manufacturing, and assembly at the time of publication. This list includes final assembly suppliers, which may include contract manufacturers, electronic manufacturing service providers, and original design manufacturers, as well as commodity and component suppliers. HP is sharing this list with the intent of promoting transparency and progress in raising social and environmental standards in the electronics industry supply chain. Final assembly parent supplier name Sustainability link Company publishes Product type City, Country Site address Number of workers on HP lines sustainability report using the Global Reporting (GRI) Initiative framework AU Optronics Corporation Sustainability Yes Display Suzhou, China No. 398, Suhong Zhong Road, Suzhou 890 Industrial Park, 215021 BOE Technology Group Co. Corporate Social Responsibility Yes Display Beijing, China No.118 Jinghaiyilu, BDA, Beijing, 100176 50 Display Chongqing, China No. 7, Yunhan Road, Shuitu Hi Tech 950 Industrial Park, Beibei District, 400700 Display Hefei, China No.2177, Great East Road, Xin Zhan 150 Development Zone, Hefei, An Hui Province Cheng Uei Precision Industry Co. Corporate Responsibility Yes Scanner Dongguan, China FIT Industry Park, Yinhe Industrial Area, 1013 Qingxi, Dongguan Guangdong Province Compal Electronics Sustainable Development Yes PC Kunshan, -

2020 Annual Report 2020 Annual Report

2020 ANNUAL REPORT 2020 ANNUAL REPORT 2020 ANNUAL REPORT 2020 ANNUAL REPORT CEO MESSAGE: BOARD OF DIRECTORS AND DEAR EMPLOYEES, PARTNERS SHAREHOLDER INFORMATION AND SHAREHOLDERS: In reflecting on the astonishing challenges the world faced during our fiscal year 2020, I’m inspired and humbled by the effort and fortitude put forth by so many, both within and beyond Jabil – What a year! By the time we completed our first fiscal quarter of 2020, we had what appeared to be the start of another solid year for Jabil, as evidenced by our record Q1 revenue of $7.5 billion. Then, out of nowhere, we abruptly learned firsthand of the novel coronavirus directly from our team in Wuhan, China. What followed would TIMOTHY L. THOMAS A. MARK T. ANOUSHEH MARTHA F. test and stress: (a) the fabric of our people; (b) the purpose in our approach; and (c) the resiliency of our MAIN SANSONE MONDELLO ANSARI BROOKS commercial portfolio. And I couldn’t be prouder of the results. Chairman of the Board Vice Chairman of Chief Executive Officer Director since 2016 Director since 2011 Director since 1999 the Board Director since 2013 Age 54 Age 61 Age 63 Director since 1983 Age 56 Age 71 We’re fundamentally in the “people business.” Our people are Jabil’s most important and valued differentiator, making us who we are today. CHRISTOPHER S. JOHN C. STEVEN A. DAVID M. KATHLEEN A. HOLLAND PLANT RAYMUND STOUT WALTERS – Mark T. Mondello Director since 2018 Director since 2016 Director since 1996 Director since 2009 Director since 2019 Age 54 Age 67 Age 65 Age 66 Age 69 Jabil’s Board of Directors has standing Audit, Compensation, Cybersecurity and Nominating & Corporate Governance Committees. -

Sanmina-Sci Corp

SANMINA-SCI CORP FORM 10-K (Annual Report) Filed 11/24/08 for the Period Ending 09/27/08 Address 2700 N FIRST ST SAN JOSE, CA 95134 Telephone 4089643500 CIK 0000897723 Symbol SANM SIC Code 3672 - Printed Circuit Boards Industry Electronic Instr. & Controls Sector Technology Fiscal Year 09/30 http://www.edgar-online.com © Copyright 2008, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. QuickLinks -- Click here to rapidly navigate through this document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended September 27, 2008 or TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number: 0-21272 Sanmina-SCI Corporation (Exact name of registrant as specified in its charter) Delaware 77 -0228183 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification Number) 2700 North First Street, San Jose, CA 95134 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (408) 964-3500 Securities registered pursuant to Section 12(b) of the Act: None Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.01 Par Value (Title of Class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

As filed with the Securities and Exchange Commission March 20, 2006 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F អ Registration statement pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934 or ፤ Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2005 or Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 or អ Shell company report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of event requiring this shell company report: Commission file number: 1-14832 CELESTICA INC. (Exact name of registrant as specified in its charter) Ontario, Canada (Jurisdiction of incorporation or organization) 1150 Eglinton Avenue East Toronto, Ontario, Canada M3C 1H7 (Address of principal executive offices) SECURITIES REGISTERED OR TO BE REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: Subordinate Voting Shares The Toronto Stock Exchange (Title of Class) New York Stock Exchange (Name of each Exchange on which Registered) SECURITIES REGISTERED OR TO BE REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: N/A SECURITIES FOR WHICH THERE IS A REPORTING OBLIGATION PURSUANT TO SECTION 15(d) OF THE ACT: N/A Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. 196,676,249 Subordinate Voting Shares 0 Preference Shares 29,637,316 Multiple Voting Shares Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Labour Conditions at Foreign Electronics Manufacturing Companies in Brazil Case Studies of Samsung, LGE and Foxconn

Labour conditions at foreign electronics manufacturing companies in Brazil Case studies of Samsung, LGE and Foxconn Authors: André Campos, Marcel Gomes, Irene Schipper December 2017 Colophon Labour conditions at foreign electronics manufacturing companies in Brazil Case studies of Samsung, LGE and Foxconn December 2017 Authors André Campos (Repórter Brasil), Marcel Gomes (Repórter Brasil), Irene Schipper (SOMO) Photo cover Irene Schipper Design Zeppa. – www.zeppa.nl Layout Frans Schupp – www.fransschupp.nl ISBN/EAN 978-94-6207-129-2 This publication was made possible with the financial assistance of the European Union. The content is the sole responsibility of SOMO, and can in no way be taken to reflect the views of the European Union. Repórter Brasil Stichting Onderzoek Multinationale Bruxelas Street 169, São Paulo, Brazil Ondernemingen (SOMO) T +55 11 250 66570 Centre for Research on [email protected] Multinational Corporations www.reporterbrasil.org.br Sarphatistraat 30, 1018 GL Amsterdam The Netherlands Repórter Brasil was founded in 2001 by T + 31 (20) 6391291 journalists, educators and social scientists. [email protected] - www.somo.nl Its mission is to identify and address public labour and human rights violations in Brazil, as The Centre for Research on Multinational well as other kinds of social and environmental Corporations (SOMO) is a critical, independent, crimes. Its news, investigations, researches not-for-profit knowledge centre on multina- and educational methodology are used by tionals. Since 1973 we have investigated multi- leaders in the government, companies and national corporations and the impact of their also civil society organizations as tools to activities on people and the environment. -

Electronics Manufacturing Services Malaysia’S EMS Advantage Gearing for Manufacturing Success

Electronics Manufacturing Services Malaysia’s EMS Advantage Gearing for Manufacturing Success Electronics manufacturing services Outsourcing to EMS providers also (EMS) providers are assuming an enables OEMs to gain access to the increasingly important role and making a latest equipment, process knowledge significant impact on manufacturing and manufacturing know-how without industries worldwide today. having to make substantial capital investments as capital risks are converted EMS companies function as strategic into variable costs. partners to larger original equipment manufacturers (OEMs) by providing The trend in manufacturing partnership them with a full range of services from has been growing steadily as OEMs strive contract design and manufacturing to to cut costs to maintain their competitive post-manufacturing services. By using advantage in the face of rapidly changing the services of EMS providers, OEMs can market conditions, technological concentrate on their core competencies advances and global competition. such as research and development, sales and marketing. 2 The Global Trend The EMS industry first appeared some 30 The Asian region (excluding Japan) is years ago and has flourished since. expected to be the fastest growing region Consolidation within the industry has led for EMS as an increasing number of to the emergence of a few well-known OEMs moves into the region to take multi-billion dollar ‘tier one’ companies advantage of the lower operating costs. with worldwide operations such as Solectron, Flextronics, Celestica, Jabil, Within the electronics industry, the Plexus and Sanmina-SCI. growing global consumption of optoelectronics components, which is In 1999, the EMS industry was estimated expected to reach an estimated US$1.12 to be worth US$75 billion with a compound billion in 2005 from US$407 in 2000, annual growth rate of 25%. -

View Annual Report

Innovating to grow Annual Report 2005 We are focusing our activities on the interlocking domains of healthcare, lifestyle and technology. Understanding the needs of our customers is our starting point as we pursue innovation in every aspect of our business. We believe that fresh new ideas based on the combination of consumer insight and technology leadership – like our award-winning Ambient Experience radiology suite – are key to creating new opportunities for growth. Our advanced technologies span the entire scope of healthcare – pre-screening patients for diseases like cancer, monitoring patients while in hospital, enabling people to monitor their health at home, or simply helping them to pursue a healthy, active lifestyle. New ideas, 2 Philips Annual Report 2005 Advanced but easy to use, our We believe simplicity is the products and solutions enrich key to successful technology. people’s daily lives by offering Accordingly, we design our them more enjoyable products, systems and services experiences wherever they around the people who will be are – at home or on the move. using them. So, no matter how sophisticated they are, they make sense and are user-friendly. new opportunities Philips Annual Report 2005 Contents Financial highlights Group financial statements �2 Consolidated statements of income Message from the President �2 Consolidated balance sheets 128 Consolidated statements of cash flows � Our company �0 Consolidated statements of stockholders’ e�uity �� Information by sectors and main countries Information on the Philips