Blackrock Hedge Fund Guided Portfolio Solution Class a Shares Class I Shares

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Notice of Filing and Immediate Effectiveness of Proposed Rule Change Amending the Fees for NYSE BBO and NYSE Trades by Modifying

SECURITIES AND EXCHANGE COMMISSION (Release No. 34-90407; File No. SR-NYSE-2020-91) November 12, 2020 Self-Regulatory Organizations; New York Stock Exchange LLC; Notice of Filing and Immediate Effectiveness of Proposed Rule Change Amending the Fees for NYSE BBO and NYSE Trades by Modifying the Application of the Access Fee and Amending the Fees for NYSE Trades by Adopting a Waiver Applicable to the Redistribution Fee Pursuant to Section 19(b)(1) of the Securities Exchange Act of 1934 (the “Act”),1 and Rule 19b-4 thereunder,2 notice is hereby given that on November 2, 2020, New York Stock Exchange LLC (“NYSE” or the “Exchange”) filed with the Securities and Exchange Commission (the “Commission”) the proposed rule change as described in Items I, II, and III below, which Items have been prepared by the Exchange. The Commission is publishing this notice to solicit comments on the proposed rule change from interested persons. I. Self-Regulatory Organization’s Statement of the Terms of Substance of the Proposed Rule Change The Exchange proposes to (1) amend the fees for NYSE BBO and NYSE Trades by modifying the application of the Access Fee; and (2) amend the fees for NYSE Trades by adopting a waiver applicable to the Redistribution Fee. The Exchange proposes to implement the proposed fee changes on January 1, 2021. The proposed rule change is available on the Exchange’s website at www.nyse.com, at the principal office of the Exchange, and at the Commission’s Public Reference Room. 1 15 U.S.C. 78s(b)(1). -

This Week in Wall Street Reform | Jan 5 - 11

This Week in Wall Street Reform | Jan 5 - 11 Please share this weekly compilation with friends and colleagues. To subscribe, email [email protected], with “This Week” in the subject line. TABLE OF CONTENTS - The Trump Administration, Congress, & Wall Street - Consumer Finance And The CFPB - Derivatives, Commodities, And The CFTC - Investor Protection, SEC, Capital Markets - Executive Compensation - Mortgages And Housing - Private Funds - Student Loans And For-Profit Schools - Systemic Risk - Taxes - Other Topics THE TRUMP ADMINISTRATION, CONGRESS & WALL STREET Ocasio-Cortez May Take On Wall Street, Fellow Democrats On Finance Panel | Politico Pro Rep. Alexandria Ocasio-Cortez is poised to win a seat on the powerful House Financial Services Committee, in what would be a victory for progressives fighting to curb Wall Street's clout in Washington and inside the Democratic Party itself. The assignment, which lawmakers say they expect her to receive, would pit the 29-year-old New Yorker not only against banks that make up a major local industry but also potentially against business-friendly Democrats who have backed financial deregulation. Some moderate Democrats have privately raised concerns that they'll be targeted by the former bartender-turned-progressive icon, whose willingness to challenge her party's establishment propelled her to Congress and the national spotlight. "When industry lobbyists or their shills in Congress throw shade at a new member, it probably reflects a genuine fear that the newcomers will become a force for fixing a broken system," said Porter McConnell, campaign director of the Take On Wall Street coalition. Progressives Fought For Key Committee Spots, But Centrist New Dems Came Out On Top | The Intercept 1 Rep. -

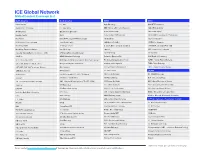

ICE Global Network Global Content Coverage List

ICE Global Network Global Content Coverage List North America North America EMEA APAC Activ Financial ICE TMC Aquis Exchange ASX (NTP Derivatives) Aequitas NEO Exchange ICE Swap Trade BME - Bolsas y Mercados Españoles CXA (CHI-X Australia) ATG Americas IEX (Investors Exchange) Borsa Italiana Group CXJ (CHI-X Japan) Barclays Capital IIROC Börse Stuttgart (SID platform) HKEX (OMD C Securities & D Derivatives) BGC Fenics Itiviti (NYFIX, ULLink PTRMS (Canada)) CBOE Europe ICE Clear Singapore BOX (Boston Stock Exchange) Jane Street Capital CME (BrokerTech EU) ICE Futures Singapore Broadridge (ADP) JP Morgan Chase Deutsche Börse Group (Xetra, Eurex) JPX (TSE Flex Standard/Full, OSE) Broadridge Financial Solutions Lime Brokerage Equiduct KRX - Korea Stock Exchange Canadian Imperial Bank of Commerce - CIBC LTSE (Long Term Stock Exchange) Euronext Group SBI Japanext CBOE US MEMX (Members Exchange) Fastmatch (Euronext FX) SGX (Equities, Derivatives) CBOE FX (Hotspot NY4) MIAX Options, MIAX Pearl Options, Miax Pearl Equities FIS Global (Sungard London-Paris) TAIFEX – Taiwan Futures Exchange CME (CME, NYMEX, COMEX, CBOT) Morgan Stanley Unicast Services Goldman Sachs Sigma-X TPEX – Taipei Exchange CME (BME, DME, MGEX, Indexes, Bitcoin) MSCI Indexes ICE Benchmark Administration TWSE - Taiwan Stock Exchange CME (BrokerTec US) MT Newswires ICE Clear Europe LATAM Credit Suisse NASDAQ Canada (CXC, CX2, CXD, Basic) ICE Clear Netherlands B3 - BM&F & Bovespa Creditex NASDAQ US (All Markets) ICE Futures Europe BCS - Bolsa de Santiago CSE - Canadian Securities -

Institutional Blackrock Cash Funds: Treasury 400 Howard Street, San Francisco, California 94105 • Phone No

STATEMENT OF ADDITIONAL INFORMATION BlackRock Funds III BlackRock Cash Funds: Institutional BlackRock Cash Funds: Treasury 400 Howard Street, San Francisco, California 94105 • Phone No. (800) 441-7450 This combined Statement of Additional Information (“SAI”) of BlackRock Funds III (the “Trust”) is not a prospectus and should be read in conjunction with the current prospectus of the Trust dated April 30, 2021, as it may from time to time be supplemented or revised, for SL Agency Shares of BlackRock Cash Funds: Institutional and BlackRock Cash Funds: Treasury (each, a “Fund” and collectively, the “Funds”). No investment in shares should be made without reading the prospectus. All terms used in this SAI that are defined in the prospectus have the meanings assigned in the prospectus. This SAI is incorporated by reference in its entirety into the prospectus for SL Agency Shares. Copies of the prospectus and Annual Report and Semi-Annual Report for each of the Funds may be obtained, without charge, by writing to State Street Bank and Trust Company, Institutional Transfer Agency, P.O. Box 5493, Boston, Massachusetts 02206, or by calling 1-888-204-3956 (toll free). The audited financial statements of each of the Funds are incorporated into this SAI by reference to the Funds’ Annual Report to Shareholders for the fiscal year ended December 31, 2020 (the “Annual Report”). References to the Investment Company Act of 1940, as amended (the “1940 Act”), or other applicable law, will include any rules promulgated thereunder and any guidance, interpretations or modifications by the Securities and Exchange Commission (the “SEC”), SEC staff or other authority with appropriate jurisdiction, including court interpretations, and exemptive, no-action or other relief or permission from the SEC, SEC staff or other authority. -

Blackrock Cash Funds: Treasury 400 Howard Street, San Francisco, California 94105 • Phone No

STATEMENT OF ADDITIONAL INFORMATION BlackRock Funds III BlackRock Cash Funds: Treasury 400 Howard Street, San Francisco, California 94105 • Phone No. (800) 441-7450 This Statement of Additional Information (“SAI”) of BlackRock Funds III (the “Trust”) is not a prospectus and should be read in conjunction with each of the current prospectuses of the Trust dated April 30, 2021, as they may from time to time be supplemented or revised, for Capital, Institutional, Premium, Select and Trust Shares of BlackRock Cash Funds: Treasury (the “Fund”). No investment in shares should be made without reading the appropriate prospectus. All terms used in this SAI that are defined in the prospectuses have the meanings assigned in the prospectuses. This SAI is incorporated by reference in its entirety into each prospectus for Capital, Institutional, Premium, Select and Trust Shares. Copies of the prospectuses and Annual Report and Semi-Annual Report for the Fund may be obtained, without charge, by writing to State Street Bank and Trust Company, Institutional Transfer Agency, P.O. Box 5493, Boston, Massachusetts 02206, or by calling 1-888-204-3956 (toll free). The audited financial statements of the Fund are incorporated into this SAI by reference to the Fund’s Annual Report to Shareholders for the fiscal year ended December 31, 2020 (the “Annual Report”). References to the Investment Company Act of 1940, as amended (the “1940 Act”), or other applicable law, will include any rules promulgated thereunder and any guidance, interpretations or modifications by the Securities and Exchange Commission (the “SEC”), SEC staff or other authority with appropriate jurisdiction, including court interpretations, and exemptive, no-action or other relief or permission from the SEC, SEC staff or other authority. -

IN THIS ISSUE SEC Announces 2021 Examination Priorities

April 1, 2021 For more information please contact [email protected] IN THIS ISSUE SEC Announces 2021 Examination Priorities ............................................................................................... 2 SEC Acting Chair Addresses Importance of Fund Voting & Disclosure ........................................................ 2 SEC Adopts Uniform and Secure Amendments to EDGAR Access .............................................................. 2 FINRA Extends Pilot Program Related to FINRA Rule 11892 ....................................................................... 3 FINRA Amends Rule to Permit Firms to File Electronically Signed Form U4 ............................................... 3 FINRA Proposes to Adopt Rules 4111 (Restricted Firm Obligations) and 9561 (Procedures for Regulating Activities Under Rule 4111) ......................................................................................................................... 3 SEC Delays Action on Nasdaq Proposal to Amend Listing Rules Applicable to Special Purpose Acquisition Companies ................................................................................................................................................... 4 SEC Designates Longer Period for Action on Nasdaq Board Diversity and Recruiting Solution Proposals . 4 Nasdaq Revalues and Expands its Complimentary Services for Listed Companies .................................... 5 Nasdaq Amends its Transaction Credits at Equity 7, Section 118(A) ......................................................... -

Blackrock Exchange Portfolio of Blackrock Fundssm Blackrock Advisors, LLC — Manager Blackrock Investments, LLC — Distributor

BlackRock Advantage Global Fund, Inc. BlackRock LifePath® Dynamic 2040 Fund BlackRock LifePath® Dynamic 2045 Fund BlackRock Allocation Target Shares BlackRock LifePath® Dynamic 2050 Fund BATS: Series C Portfolio BlackRock LifePath® Dynamic 2055 Fund BATS: Series S Portfolio BlackRock LifePath® Dynamic 2060 Fund BlackRock LifePath® Dynamic 2065 Fund BlackRock Balanced Capital Fund, Inc. BlackRock LifePath® ESG Index Retirement Fund BlackRock Bond Fund, Inc. BlackRock LifePath® ESG Index 2025 Fund BlackRock Total Return Fund BlackRock LifePath® ESG Index 2030 Fund BlackRock LifePath® ESG Index 2035 Fund BlackRock Emerging Markets Fund, Inc. BlackRock LifePath® ESG Index 2040 Fund BlackRock LifePath® ESG Index 2045 Fund BlackRock Equity Dividend Fund BlackRock LifePath® ESG Index 2050 Fund BlackRock LifePath® ESG Index 2055 Fund BlackRock FundsSM BlackRock LifePath® ESG Index 2060 Fund BlackRock Advantage Emerging Markets Fund BlackRock LifePath® ESG Index 2065 Fund BlackRock Advantage ESG Emerging Markets BlackRock LifePath® Index Retirement Fund Equity Fund BlackRock LifePath® Index 2025 Fund BlackRock Advantage ESG International Equity BlackRock LifePath® Index 2030 Fund Fund BlackRock LifePath® Index 2035 Fund BlackRock China A Opportunities Fund BlackRock LifePath® Index 2040 Fund BlackRock Defensive Advantage Emerging BlackRock LifePath® Index 2045 Fund Markets Fund BlackRock LifePath® Index 2050 Fund BlackRock Defensive Advantage International BlackRock LifePath® Index 2055 Fund Fund BlackRock LifePath® Index 2060 Fund BlackRock Defensive -

2019 Attending Firms (By Firm Type)

2019 Market Structure Conference Diverse Audience of Industry Professionals Session Highlights 62 presenters across 18 sessions 18 Principal SEC Commissioner Hester M. Peirce 13 Trading Addressed all-things crypto following ATS Firm a new Digital Assets panel 64 NYSE President Stacey Cunningham 14 Broker Dealer & Yext CFO Steve Cakebread Exchange Discussed public markets and issuer participants Jim Ross, SSGA & Chris Concannon, MarketAxess Fireside chat on fixed income and ETFs 264 SEC Director, Trading & Markets Firms Attended Retail Order Division Brett Redfearn Addressed 50 Entry 11 key SEC initiatives Buy Side 4th Annual STA Women in Finance Law Firm/ Symposium Incorporated into the Consultant Gov’t/ main program with keynote from Steph Davis, Climb2Fly Regulator/ 17 SRO Press Leaders from Exchanges & Liquidity Providers Discussed important topics across our industry 7 Vendor 15 Buy-Side Panel Discussions On 38 innovation, rules, regulations and more Dictum Meum Pactum Award Presented to Peggy Bowie, Canadian STA Attendance Continues to Climb Diverse Line-Up of Speakers Save the Date 81% 35% Growth rate over Speaker diversity October 7-9 2020 the 7-year period 751 across gender and 2012-2019 ethnicity 87th Annual Market Structure Conference 2019 662 JW Marriott, Washington DC Attendees Got More Social 2017 More than 624 For more information on STA and the STA Market Structure 2014 150,000 Conference, including sponsorship impressions @STA_National 415 opportunities, contact STA at on tweets sent during the [email protected] or conference 2012 646.699.5996. 2019 Attending Firms (by firm type) ATS BUY SIDE FOUNDATION/ACADEMIA RETAIL ORDER ENTRY BIDS Trading* Acta Strategies, LLC Autism Science Foundation Ameriprise Financial Canadian Securities Exchange* AJO Partners Babson College Cetera Financial Group CODA Markets* Alliance Bernstein Foundation for Women Warriors Charles Schwab & Co. -

October 9, 2020

October 9, 2020 Financial Engineering with Options Welcome to Financial Agenda Engineering with Options. As proud sponsors of “Financial Engineering 10:00 – 10:10 a.m. with Options”, The Options Industry Council OCC Welcome Remarks (OIC) and Barron’s Group would like to thank John Davidson, Chief Executive Officer, OCC you for joining us for this options/financial education workshop. We would also like to 10:10 – 10:30 a.m. thank our partners, The University of Chicago, and its Financial Mathematics Department. Options Industry Overview Guest speakers include Representatives Denise Knabjian, Senior Vice President, Investor from OCC, OIC, Cboe, Fidelity, NYSE, E*TRADE, Education, OCC University of Chicago and Barron’s Group. 10:30 – 11:15 a.m. Today, you will hear firsthand from active Technology, Innovation and Opportunity options market participants regarding the Moderator: opportunities and challenges facing investors Geralyn Endo, Head of Client Engagement, Cboe and traders. You will learn about developments Panelists: in the FinTech space and the new job Greg Stevens, Vice President, Independent opportunities being created. You will hear Investing Options Experience, Fidelity Investments valuable commentary from knowledgeable Meaghan Dugan, Head of Product and Competitive professionals on today’s top issues facing the Strategy, NYSE Chris Larkin, Managing Director of Trading and financial markets. At the end of the workshop, Investing Product, E*TRADE you will have a better understanding of how options markets are being impacted by massive 11:15 – 11:45 a.m. shifts in demographics, technology and wealth. Break This forum will certainly increase your awareness of a constantly changing environment within 11:45 a.m. -

Page 1 BOSTON • NEW YORK • LONDON • HONG KONG

R E D L I N E G L O B A L T R A D I N G V E N U E S S U P P O R T MARKET DATA FEED HANDLERS - AMERICAS EQUITIES MARKET DATA FEED/ REGION CO PROVIDER TRADING VENUE MIC STATUS PROTOCOL Cboe Global Markets Cboe BYX Exchange BATY ✓ Cboe BZX Exchange BATS ✓ Multicast PITCH Cboe EDGA Equities Exchange EDGA ✓ Cboe EDGX Equities Exchange EDGX ✓ Citadel Execution Services Citadel Indication of Interest (IOI) FIX 4.x CDED ✓ Hudson River Trading (HRT) HRT Indication of Interest (IOI) FIX 4.x HRTF ✓ IEX Group IEX Investors Exchange Top of Book (TOPS v1.6) ✓ IEXG IEX Deep ✓ IMC Financial Markets IMC Financial (IOI) FIX 4.x IMCS ✓ Intercontinental Exchange NYSE NYSE Integrated Feed XDP XNYS ✓ NYSE NYSE OpenBook Ultra XNYS ✓ NYSE NYSE Order Imbalance XNYS ✓ NYSE NYSE Trades XDP XNYS ✓ NYSE American NYSE Amer. Integrated Feed XDP XASE ✓ NYSE American NYSE American OpenBook Ultra XASE ✓ NYSE American NYSE American Order Imbalance XASE ✓ NYSE American NYSE American Trades XDP XASE ✓ NYSE Arca ARCA Integrated XDP ARCX ✓ US NYSE Arca ARCA Trades XDP ARCX ✓ AMERICAS NYSE Arca ArcaBook XDP ARCX ✓ NYSE Chicago NYSE Chicago Integrated Feed XDP XCHI ✓ NYSE National NYSE National Integrated Feed XDP XCIS ✓ NYSE National NYSE National Trades XDP XCIS ✓ All protected U.S. venues CTA - CQS Binary Pillar ✓ All protected U.S. venues CTA - CTS Binary Pillar ✓ Jane Street’s Executive JX Indication of Interest (IOI) FIX 4.x JSES ✓ Services Jump Trading Jump Indication of Interest (IOI) FIX 4.x JLQD ✓ Members Exchange MEMX Memoir Depth MEMX ✓ Miami International Holdings MIAX Equities MIAX Pearl EPRL ✓ Nasdaq OMX Nasdaq Stock Market TotalView ITCH XNAS ✓ Nasdaq BX BX TotalView ITCH XBOS ✓ Nasdaq PSX PSX TotalView ITCH XPHL ✓ All protected U.S. -

The Rise of Wealthtech

WWW.DRAKESTAR.COM JULY 2020 Sector Report THE RISE OF WEALTHTECH Julian Ostertag, Managing Partner and Christophe Morvan, Managing Partner Member of the Executive Committee [email protected] [email protected] +33 1700 876 10 +49 89 1490 265 20 Michael Metzger, Partner Antonia Georgieva, Partner [email protected] [email protected] +1 310 696 4011 +1 917 755 5518 Kasper Kruse Petersen, Partner [email protected] +44 203 2057 360 In the USA, all securities transacted through Drake Star Securities LLC. In the USA, Drake Star Securities LLC. Is regulated by FINRA and is a member of SIPC Drake Star Partners is the marketing name for the global investment bank Drake Star Partners Limited and its subsidiaries and affiliates. In the USA, all securities are transacted through Drake Star Securities LLC. In the USA, Drake Star Securities LLC is regulated by FINRA and is a member of SIPC. © 2020 Drake Star Partners. This report is published solely for informational purposes and is not to be construed as an offer to sell or the solicitation of an offer to buy any security. The information herein is based on sources we believe to be reliable but is not guaranteed by us and we assume no liability for its use. Any opinions expressed herein are statements of our judgment on this date and are subject to change without notice. Citations and sources are available upon request through https://www.drakestar.com/contact. Interviews were conducted by Drake Star Partners via email correspondence between March and May 2020. -

Notice of Filing and Immediate Effectiveness of Proposed Rule Change Amending the Fees for NYSE Arca BBO and NYSE Arca Trades By

SECURITIES AND EXCHANGE COMMISSION (Release No. 34-90409; File No. SR-NYSEArca-2020-95) November 12, 2020 Self-Regulatory Organizations; NYSE Arca, Inc.; Notice of Filing and Immediate Effectiveness of Proposed Rule Change Amending the Fees for NYSE Arca BBO and NYSE Arca Trades by Modifying the Application of the Access Fee and Amending the Fees for NYSE Arca Trades by Adopting a Waiver Applicable to the Redistribution Fee Pursuant to Section 19(b)(1) of the Securities Exchange Act of 1934 (the “Act”),1 and Rule 19b-4 thereunder,2 notice is hereby given that on November 2, 2020, NYSE Arca, Inc. (“NYSE Arca” or the “Exchange”) filed with the Securities and Exchange Commission (the “Commission”) the proposed rule change as described in Items I, II, and III below, which Items have been prepared by the Exchange. The Commission is publishing this notice to solicit comments on the proposed rule change from interested persons. I. Self-Regulatory Organization’s Statement of the Terms of Substance of the Proposed Rule Change The Exchange proposes to (1) amend the fees for NYSE Arca BBO and NYSE Arca Trades by modifying the application of the Access Fee; and (2) amend the fees for NYSE Arca Trades by adopting a waiver applicable to the Redistribution Fee. The Exchange proposes to implement the proposed fee changes on January 1, 2021. The proposed rule change is available on the Exchange’s website at www.nyse.com, at the principal office of the Exchange, and at the Commission’s Public Reference Room. 1 15 U.S.C.