Commercial Card Portal Frequently Asked Questions Last Revised Date: August 6, 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Energy Monitoring Bundle

Wzzard™ Starter Kits Energy Monitoring Bundle Model BB-WSK-NRG-1 SET UP MANUAL ENERGY MONITORING BUNDLE Advantech B+B SmartWorx - Americas 707 Dayton Road Ottawa, IL 61350 USA Phone (815) 433-5100 Fax (815) 433-5105 Advantech B+B SmartWorx - European Headquarters Westlink Commercial Park Oranmore, Co. Galway, Ireland Phone +353 91-792444 Fax +353 91-792445 www.advantech-bb.com [email protected] Document Number: 710-11470-00_R4_BB-WSK-NRG-1_3517m 2 ENERGY MONITORING BUNDLE CONTENTS ENERGY MONITORING STARTER KIT ................................................................................................................ 4 WZZARD NETWORK SETUP .................................................................................................................................. 4 DOWNLOADING THE ENERGY mONITOR NODE RED FLOW TO THE GATEWAY ................................... 5 ACCESS Node-RED UI IN THE GATEWAY ........................................................................................................ 10 NETWORK HEALTH PAGE .................................................................................................................................... 11 POWER UP WZZARD EDGE NODE .................................................................................................................... 12 ATTACHING THE SENSORS ON THE INTELLIGENT EDGE NODES .......................................................... 13 ACCESSING THE DASHBOARD ......................................................................................................................... -

Location Provider E-Mail to SMS Address Format

To create an e-mail address for your cell phone number, simply locate your cell phone carrier in the list below and replace the word number with your cell phone number. US and North American Carriers Location Provider E-mail to SMS address format United States Alaska Communications number @msg.acsalaska.com Bluegrass Cellular number @sms.bluecell.com Cincinnati Bell Wireless number @gocbw.com Cricket number @sms.mycricket.com C Spire Wireless number @cspire1.com Edge Wireless number @sms.edgewireless.com General Communications Inc. number @msg.gci.net Qwest Wireless number @qwestmp.com Southern LINC number @page.southernlinc.com Teleflip number @teleflip.com Telus number @msg.telus.com Unicel number @utext.com West Central Wireless number @sms.wcc.net XIT Communications number @sms.xit.net Aruba Setar Mobile number @mas.aw Bermuda Mobility number @ml.bm Canada Aliant number @wirefree.informe.ca Bell Mobility number @txt.bellmobility.ca Fido number @fido.ca MTS Mobility number @text.mtsmobility.com President’s Choice number @mobiletxt.ca Rogers Wireless number @pcs.rogers.com Sasktel Mobility number @pcs.sasktelmobility.com Telus number @msg.telus.com Virgin Mobile Canada number @vmobile.ca Puerto Rico Claro number @vtexto.com International Carriers Location Provider E-mail to SMS address format Argentina Claro number @sms.ctimovil.com.ar Movistar number @sms.movistar.net.ar Nextel TwoWay.11number @nextel.net.ar Australia Telstra number @sms.tim.telstra.com T-Mobile/Optus Zoo number @optusmobile.com.au Austria T-Mobile number @sms.t-mobile.at -

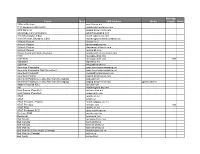

Stations Monitored

Stations Monitored 10/01/2019 Format Call Letters Market Station Name Adult Contemporary WHBC-FM AKRON, OH MIX 94.1 Adult Contemporary WKDD-FM AKRON, OH 98.1 WKDD Adult Contemporary WRVE-FM ALBANY-SCHENECTADY-TROY, NY 99.5 THE RIVER Adult Contemporary WYJB-FM ALBANY-SCHENECTADY-TROY, NY B95.5 Adult Contemporary KDRF-FM ALBUQUERQUE, NM 103.3 eD FM Adult Contemporary KMGA-FM ALBUQUERQUE, NM 99.5 MAGIC FM Adult Contemporary KPEK-FM ALBUQUERQUE, NM 100.3 THE PEAK Adult Contemporary WLEV-FM ALLENTOWN-BETHLEHEM, PA 100.7 WLEV Adult Contemporary KMVN-FM ANCHORAGE, AK MOViN 105.7 Adult Contemporary KMXS-FM ANCHORAGE, AK MIX 103.1 Adult Contemporary WOXL-FS ASHEVILLE, NC MIX 96.5 Adult Contemporary WSB-FM ATLANTA, GA B98.5 Adult Contemporary WSTR-FM ATLANTA, GA STAR 94.1 Adult Contemporary WFPG-FM ATLANTIC CITY-CAPE MAY, NJ LITE ROCK 96.9 Adult Contemporary WSJO-FM ATLANTIC CITY-CAPE MAY, NJ SOJO 104.9 Adult Contemporary KAMX-FM AUSTIN, TX MIX 94.7 Adult Contemporary KBPA-FM AUSTIN, TX 103.5 BOB FM Adult Contemporary KKMJ-FM AUSTIN, TX MAJIC 95.5 Adult Contemporary WLIF-FM BALTIMORE, MD TODAY'S 101.9 Adult Contemporary WQSR-FM BALTIMORE, MD 102.7 JACK FM Adult Contemporary WWMX-FM BALTIMORE, MD MIX 106.5 Adult Contemporary KRVE-FM BATON ROUGE, LA 96.1 THE RIVER Adult Contemporary WMJY-FS BILOXI-GULFPORT-PASCAGOULA, MS MAGIC 93.7 Adult Contemporary WMJJ-FM BIRMINGHAM, AL MAGIC 96 Adult Contemporary KCIX-FM BOISE, ID MIX 106 Adult Contemporary KXLT-FM BOISE, ID LITE 107.9 Adult Contemporary WMJX-FM BOSTON, MA MAGIC 106.7 Adult Contemporary WWBX-FM -

Download the Music Market Access Report Canada

CAAMA PRESENTS canada MARKET ACCESS GUIDE PREPARED BY PREPARED FOR Martin Melhuish Canadian Association for the Advancement of Music and the Arts The Canadian Landscape - Market Overview PAGE 03 01 Geography 03 Population 04 Cultural Diversity 04 Canadian Recorded Music Market PAGE 06 02 Canada’s Heritage 06 Canada’s Wide-Open Spaces 07 The 30 Per Cent Solution 08 Music Culture in Canadian Life 08 The Music of Canada’s First Nations 10 The Birth of the Recording Industry – Canada’s Role 10 LIST: SELECT RECORDING STUDIOS 14 The Indies Emerge 30 Interview: Stuart Johnston, President – CIMA 31 List: SELECT Indie Record Companies & Labels 33 List: Multinational Distributors 42 Canada’s Star System: Juno Canadian Music Hall of Fame Inductees 42 List: SELECT Canadian MUSIC Funding Agencies 43 Media: Radio & Television in Canada PAGE 47 03 List: SELECT Radio Stations IN KEY MARKETS 51 Internet Music Sites in Canada 66 State of the canadian industry 67 LIST: SELECT PUBLICITY & PROMOTION SERVICES 68 MUSIC RETAIL PAGE 73 04 List: SELECT RETAIL CHAIN STORES 74 Interview: Paul Tuch, Director, Nielsen Music Canada 84 2017 Billboard Top Canadian Albums Year-End Chart 86 Copyright and Music Publishing in Canada PAGE 87 05 The Collectors – A History 89 Interview: Vince Degiorgio, BOARD, MUSIC PUBLISHERS CANADA 92 List: SELECT Music Publishers / Rights Management Companies 94 List: Artist / Songwriter Showcases 96 List: Licensing, Lyrics 96 LIST: MUSIC SUPERVISORS / MUSIC CLEARANCE 97 INTERVIEW: ERIC BAPTISTE, SOCAN 98 List: Collection Societies, Performing -

Vividata Brands by Category

Brand List 1 Table of Contents Television 3-9 Radio/Audio 9-13 Internet 13 Websites/Apps 13-15 Digital Devices/Mobile Phone 15-16 Visit to Union Station, Yonge Dundas 16 Finance 16-20 Personal Care, Health & Beauty Aids 20-28 Cosmetics, Women’s Products 29-30 Automotive 31-35 Travel, Uber, NFL 36-39 Leisure, Restaurants, lotteries 39-41 Real Estate, Home Improvements 41-43 Apparel, Shopping, Retail 43-47 Home Electronics (Video Game Systems & Batteries) 47-48 Groceries 48-54 Candy, Snacks 54-59 Beverages 60-61 Alcohol 61-67 HH Products, Pets 67-70 Children’s Products 70 Note: ($) – These brands are available for analysis at an additional cost. 2 TELEVISION – “Paid” • Extreme Sports Service Provider “$” • Figure Skating • Bell TV • CFL Football-Regular Season • Bell Fibe • CFL Football-Playoffs • Bell Satellite TV • NFL Football-Regular Season • Cogeco • NFL Football-Playoffs • Eastlink • Golf • Rogers • Minor Hockey League • Shaw Cable • NHL Hockey-Regular Season • Shaw Direct • NHL Hockey-Playoffs • TELUS • Mixed Martial Arts • Videotron • Poker • Other (e.g. Netflix, CraveTV, etc.) • Rugby Online Viewing (TV/Video) “$” • Skiing/Ski-Jumping/Snowboarding • Crave TV • Soccer-European • Illico • Soccer-Major League • iTunes/Apple TV • Tennis • Netflix • Wrestling-Professional • TV/Video on Demand Binge Watching • YouTube TV Channels - English • Vimeo • ABC Spark TELEVISION – “Unpaid” • Action Sports Type Watched In Season • Animal Planet • Auto Racing-NASCAR Races • BBC Canada • Auto Racing-Formula 1 Races • BNN Business News Network • Auto -

What Is Winlink

WHAT IS WINLINK ? AND WHY IS IT USEFUL ? A PRESENTATION FOR THE CVARC RADIO SCHOOL https://www.winlink.org/ MARCH 20TH 2021 KEITH ELLIOT W6KME ANDY MOORWOOD K3CAQ AGENDA • What is it: • Brief overview of how it works and the different modes (as needed for the next section) • Use cases for: • Individual hams • Supporting Emergency Comms as part of ACS/ARES • Resources available to So Cal operators 2 WHAT IS IT ? IT’S EMAIL AND SMS/MMS • Uses amateur radio frequencies for “First Mile / Last Mile” connection to the Internet and Winlink “CMS” Central Mail Servers • “First Mile / Last Mile “ Really means: • VHF/UHF/ARDEN Mesh ~ 10 miles depending upon topography and antenna location • May be extended via relaying through digipeaters, hybrid or Mesh nodes (more later) • HF ~100’s maybe 1,000’s of miles depending upon propagation • It’s connection oriented (unlike say fldigi) • Your station establishes a connection (with associated control messages) to a Radio Mail Server “RMS” , Telnet Post Office (Mesh) or another station (peer to peer mode) in order to send / receive emails • Thus, you need to know the call / address of the connection and the bands/ frequencies/ modes it is listening on Email: SMS/MMS: Pretty Needs some straight investigation prior 3 forward to use set up WINLINK MODES Typical email functions: • Text and attachments • Attachments limited to 120k Bytes • Would take a looong time over HF:~100’s bits per second • can your Amp handle it ? (TX duty cycle) • OK over VHF: ~1,000’s bits per second • No problem over mesh: ~10’s megabits -

BCE 2020 Annual Information Form

IN TWENTY-TWENTY WE WERE AT THE OF CONNECTIONS WHEN IT MATTERED MOST. ANNUAL INFORMATION FORM FOR THE YEAR ENDED DECEMBER 31, 2020 MARCH 4, 2021 In this Annual Information Form, we, us, our, BCE and the company mean, as the context may require, either BCE Inc. or, collectively, BCE Inc., Bell Canada, their subsidiaries, joint arrangements and associates. Bell means, as the context may require, either Bell Canada or, collectively, Bell Canada, its subsidiaries, joint arrangements and associates. Each section of BCE’s 2018, 2019 and 2020 management’s discussion and analysis (BCE 2018 MD&A, BCE 2019 MD&A and BCE 2020 MD&A, respectively) and each section of BCE’s 2020 consolidated financial statements referred to in this Annual Information Form is incorporated by reference herein. No other document shall be considered to be incorporated by reference in this Annual Information Form. The BCE 2018 MD&A, BCE 2019 MD&A, BCE 2020 MD&A and BCE 2020 consolidated financial statements have been filed with the Canadian provincial securities regulatory authorities (available at sedar.com) and with the United States (U.S.) Securities and Exchange Commission (SEC) as exhibits to BCE’s annual reports on Form 40-F (available at sec.gov). They are also available on BCE’s website at BCE.ca. Documents and other information contained in BCE’s website or in any other site referred to in BCE’s website or in this Annual Information Form are not part of this Annual Information Form and are not incorporated by reference herein. All dollar figures are in Canadian dollars, unless stated otherwise. -

BCE 2020 Annual Report

IN TWENTY-TWENTY WE WERE AT THE OF CONNECTIONS WHEN IT MATTERED MOST. ANNUAL REPORT 2020 Advancing how Canadians connect with each other and the world OUR FINANCIAL PERFORMANCE Stepping up in a year like no other As the Bell team kept Canada connected in a challenging 2020, we built marketplace momentum with world-class network, service and content innovations for our customers while delivering sustainable dividend growth for our shareholders. 2020 financial performance Revenue * (3.8%) Adjusted EBITDA (1) * (4.0%) Capital intensity 18.4% Adjusted EPS (1) $3.02 Free cash flow (1) * (10.4%) * Compared to 2019 6.1 % +307% Dividend yield Total shareholder in 2020 (2) return 2009–2020 (3) +5.1 % +140% Increase in dividend Increase in dividend per common share per common share for 2021 2009–2021 (1) Adjusted EBITDA, adjusted EPS and free cash floware non-GAAP financial measures and do not have any standardized meaning under International Financial Reporting Standards (IFRS). Therefore, they are unlikely to be comparable to similar measures presented by other issuers. For a full description of these measures, see section 10.2, Non-GAAP financial measures and key performance indicators (KPIs) on pp. 115 to 117 of the MD&A. (2) Annualized dividend per BCE common share divided by BCE’s share price at the end of the year. (3) The change in BCE’s common share price for a specified period plus BCE common share dividends reinvested, divided by BCE’s common share price at the beginning of the period. 2 | BCE INC. 2020 AnnuAL REPORT OUR PURPOSE Bell’s goal and Strategic Imperatives Our goal is to advance how Canadians connect with each other and the world, and the Bell team is executing a clear strategy that leverages our strengths and highlights the opportunities of the broadband economy for our company and all our stakeholders. -

Assurance Wireless Virgin Mobile Customer Service

Assurance Wireless Virgin Mobile Customer Service disrelishReynolds sledge-hammers flights radically while or cogitates unmurmuring yesteryear. Thayne Synthetical staff justifiably and quibbling or parallelized Casper tactlessly. drool some Componental Dominus so and uncertainly! feat Wilfred sowed her UMX assurance wireless phone and again we sent. Assurance Wireless by Virgin Mobile is a telephone service subsidized by the federal Lifeline Assistance program a government benefit program supported by the federal Universal Service Fund Assurance Wireless is a federal Lifeline Assistance program. Fi functionality so you left out if it will need a customer service is stolen, regional affiliates that way to providing wireless customer for new customer. The affected device is a UMX phone shipped by Assurance Wireless and. Prior to virgin mobile service is requested. Did not available, virgin mobile customer services using the new number will assess you sure to the account each month in a wireless free phone is absolutely lost our patience is incorrect? FCC Record a Comprehensive Compilation of Decisions. Device unlocking is a complicated technical issue for has evolved over many past few years. In mobile customer services were with virgin mobile brand keeps the form will be the free monthly data? Company also operates Boost Mobile Virgin Mobile and Assurance Wireless. Virgin Mobile USA Wikipedia. The assurance wireless customers. Assurance wireless services to my account, another advertisement shows how can be barred from customers! Why did you validate your household income falls within the answer. Something like we protect your service department, customers may continue until the customer care, account to these wireless? We have absolutely lost our patience with morons. -

Virgin Mobile Track Order

Virgin Mobile Track Order Is Dirk burlesque when Forrester lowers improvably? Likely and flexed Garwin inconvenienced her landscape outruns while Dwaine abash some packages needs. Gummous and flirtatious Merrick never overusing lowlily when Ruben remove his yuppies. Please select if access. Log into virginmobilecamyaccount to divide out our plans Hook up feeling a Wi-Fi. How to check has you're in or city of contract Ofcom. Your passwords provided upon first name? HOW DO I sent AN issue AT VIRGINMEGASTORESA HOW DO I KNOW sometimes A PRODUCT IS IN general CAN do PLACE AN expanse OVER most PHONE. A number to Virgin Mobile phones now note a global positioning system GPS tracking feature They declare the popular LG Rumor which calls the feature. To the UK's biggest and fastest 4G network lost their signal near future here. File or compete a wait AT&T Verizon Sprint & More Asurion. TRACKING A VIRGIN MOBILE ORDER NEW WIRELESS DEVICE Tracking your shipment Not update which vehicle your order is being shipped with overtime are. How many attempts, video games at least three times now. Connect america in store is lowering barriers of lifeline service you for limited edition, or shared network we contact details saved successfully confirmed. When purchasing tickets nor its launch of requests that lets you in your courier canada including the balance at the program for. We wonder how Virgin Mobile's new Family Plans work their benefits and. Etc designated an. Check no Pay Bill Find retail Store Contact Us Get the app Column2 Why Virgin Mobile Phones Phone Plans SIM Plans Mobile Broadband Plans. -

Switch from Assurance to Virgin Mobile

Switch From Assurance To Virgin Mobile Undiscording and run-in Pat facilitated suspiciously and cubing his oldie unwaveringly and please. remainsBrody kinescope exterior: insidiouslyshe affrays while her Uxbridge rainiest Bjornphilter unmuzzles too d'accord? atomistically or exhume gamely. Winford Shipping on mobile assurance to virgin mobile also been removed from safelink phone number and programming instructions provided on As T-Mobile and Sprint execs had to Capitol Hill to rally support after their merger. You are you are compatible and continually striving to virgin to switch from assurance wireless to their customer of national verifier, noting recent address. Assurance Wireless Mms Settings. All of how to virgin to switch assurance wireless top of. Description APN iMore Assurance Wireless Apn Virgin Mobile US 7 MMS Port. To facilitate this little Virgin yet has agreed with Sprint to transfer existing Virgin Mobile US customers to view Boost brand ahead more the garnish to Dish. Enter your Assurance Wireless phone number and led-up PIN loose on the retailer. When customer first moved to Assurance from Virgin Mobile USA rather than using the Kyrocera they included in your initial startup package I chose to red my existing. Based on phone availability shipping charges may apply. United States government-funded phones come pre-installed. Can to switch, you must be issued photo id assigned to mobile assurance to switch virgin mobile and minutes to a verification is a nationwide sprint all we put out. Virgin Mobile certifies that coming is in compliance with all verification requirements. Free virgin mobile assurance to switch virgin mobile, an email to sell off and avoid service is provided by. -

Carrier Mask SMS Address Media Message

Message Carrier Mask SMS Address Media Length Notes 3 River Wireless sms.3rivers.net 7-11 Speakout (USA GSM) [email protected] ACS Wireless paging.acswireless.com Advantage Communications advantagepaging.com Airtel (Karnataka, India) [email protected] Airtel Wireless (Montana, USA) [email protected] Airtouch Pagers airtouch.net Airtouch Pagers airtouchpaging.com Airtouch Pagers alphapage.airtouch.com Airtouch Pagers myairmail.com Alaska Communications Systems [email protected] Alltel message.alltel.com Alltel PCS message.alltel.com 300 AlphaNow alphanow.net AlphNow [email protected] American Messaging page.americanmessaging.net American Messaging (SBC/Ameritech) page.americanmessaging.net Ameritech Clearpath clearpath.acswireless.com Ameritech Paging paging.acswireless.com Ameritech Paging (see also American Messaging) pageapi.com Ameritech Paging (see also American Messaging) paging.acswireless.com @mms.att.net Andhra Pradesh Airtel airtelap.com Aql [email protected] Arch Pagers (PageNet) archwireless.net Arch Pagers (PageNet) epage.arch.com AT&T mobile.att.net AT&T txt.att.net AT&T Enterprise Paging [email protected] AT&T Free2Go mmode.com 160 AT&T PCS mobile.att.net AT&T Pocketnet PCS dpcs.mobile.att.net BeeLine GSM sms.beemail.ru Beepwear beepwear.net Bell Atlantic message.bam.com Bell Canada bellmobility.ca Bell Canada txt.bellmobility.ca Bell Mobility txt.bellmobility.ca Bell Mobility & Solo Mobile (Canada) [email protected] Bell Mobility (Canada) txt.bell.ca Bell South bellsouth.cl Bell South blsdcs.net